QNBFS Daily Market Report June 10, 2018

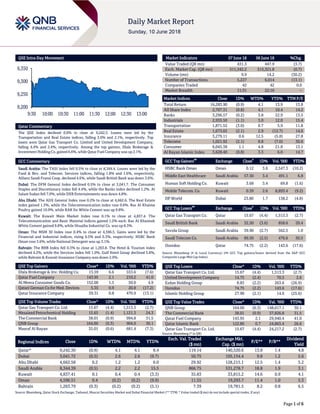

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.9% to close at 9,242.3. Losses were led by the Transportation and Real Estate indices, falling 3.0% and 2.1%, respectively. Top losers were Qatar Gas Transport Co. Limited and United Development Company, falling 4.4% and 2.4%, respectively. Among the top gainers, Dlala Brokerage & Investment Holding Co. gained 6.6%, while Qatar Fuel Company was up 2.1%. GCC Commentary Saudi Arabia: The TASI Index fell 0.5% to close at 8,344.4. Losses were led by the Food & Bev. and Telecom. Services indices, falling 1.8% and 1.6%, respectively. Allianz Saudi Fransi Coop. declined 4.6%, while Saudi British Bank was down 3.6%. Dubai: The DFM General Index declined 0.5% to close at 3,041.7. The Consumer Staples and Discretionary index fell 4.4%, while the Banks index declined 1.2%. Al Salam Sudan fell 7.0%, while DXB Entertainments was down 4.8%. Abu Dhabi: The ADX General Index rose 0.2% to close at 4,662.6. The Real Estate index gained 1.3%, while the Telecommunication index rose 0.6%. Ras Al Khaima Poultry gained 10.9%, while RAK for White Cement was up 9.8%. Kuwait: The Kuwait Main Market Index rose 0.1% to close at 4,837.4. The Telecommunication and Basic Material indices gained 1.2% each. Ras Al Khaimah White Cement gained 9.8%, while Shuaiba Industrial Co. was up 8.3%. Oman: The MSM 30 Index rose 0.4% to close at 4,596.5. Gains were led by the Financial and Industrial indices, rising 0.5% and 0.3%, respectively. HSBC Bank Oman rose 3.6%, while National Detergent was up 3.1%. Bahrain: The BHB Index fell 0.3% to close at 1,263.8. The Hotel & Tourism index declined 4.2%, while the Services index fell 1.0%. Gulf Hotel Group declined 5.8%, while Bahrain & Kuwait Insurance Company was down 2.9%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding Co. 13.59 6.6 553.6 (7.6) Qatar Fuel Company 143.95 2.1 210.2 41.0 Al Meera Consumer Goods Co. 152.00 1.5 50.0 4.9 Qatari German Co for Med. Devices 5.35 0.9 20.8 (17.2) Qatar Insurance Company 39.31 0.8 470.9 (13.1) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. Ltd. 15.67 (4.4) 1,513.3 (2.7) Mesaieed Petrochemical Holding 15.65 (1.4) 1,121.3 24.3 The Commercial Bank 38.01 (0.9) 994.8 31.5 QNB Group 164.00 (0.3) 904.9 30.1 Masraf Al Rayan 35.01 (0.6) 681.4 (7.3) Market Indicators 07 June 18 06 June 18 %Chg. Value Traded (QR mn) 431.3 447.9 (3.7) Exch. Market Cap. (QR mn) 511,542.2 515,321.8 (0.7) Volume (mn) 9.9 14.2 (30.2) Number of Transactions 5,227 6,014 (13.1) Companies Traded 42 42 0.0 Market Breadth 11:31 22:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,283.90 (0.9) 4.1 13.9 13.8 All Share Index 2,707.31 (0.8) 4.1 10.4 14.2 Banks 3,296.57 (0.2) 3.8 22.9 13.5 Industrials 2,935.50 (1.1) 3.0 12.0 15.4 Transportation 1,871.52 (3.0) 0.7 5.9 11.8 Real Estate 1,673.02 (2.1) 2.9 (12.7) 14.6 Insurance 3,279.11 0.6 12.5 (5.8) 27.8 Telecoms 1,021.92 (2.1) 8.8 (7.0) 30.6 Consumer 6,045.38 1.1 4.8 21.8 13.1 Al Rayan Islamic Index 3,628.40 (0.8) 3.3 6.0 14.7 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% HSBC Bank Oman Oman 0.12 3.6 2,547.3 (10.2) Middle East Healthcare Saudi Arabia 57.50 3.4 491.1 6.8 Human Soft Holding Co. Kuwait 3.68 3.4 69.8 (1.6) Mobile Telecom. Co. Kuwait 0.39 2.6 8,893.4 (9.2) DP World Dubai 23.80 1.7 138.2 (4.8) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. Qatar 15.67 (4.4) 1,513.3 (2.7) Saudi British Bank Saudi Arabia 32.50 (3.6) 858.6 20.4 Savola Group Saudi Arabia 39.90 (2.7) 562.5 1.0 Saudi Telecom Co. Saudi Arabia 89.50 (2.5) 476.6 30.5 Ooredoo Qatar 74.75 (2.2) 143.6 (17.6) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. Ltd. 15.67 (4.4) 1,513.3 (2.7) United Development Company 14.75 (2.4) 70.5 2.6 Ezdan Holding Group 8.83 (2.2) 263.6 (26.9) Ooredoo 74.75 (2.2) 143.6 (17.6) Islamic Holding Group 27.90 (2.1) 14.0 (25.6) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 164.00 (0.3) 148,617.1 30.1 The Commercial Bank 38.01 (0.9) 37,826.8 31.5 Qatar Fuel Company 143.95 2.1 29,940.4 41.0 Qatar Islamic Bank 122.80 0.7 24,863.4 26.6 Qatar Gas Transport Co. Ltd. 15.67 (4.4) 24,217.2 (2.7) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,242.30 (0.9) 4.1 4.1 8.4 119.14 140,520.6 13.8 1.4 4.8 Dubai 3,041.72 (0.5) 2.6 2.6 (9.7) 50.75 105,154.4 9.8 1.2 5.6 Abu Dhabi 4,662.58 0.2 1.2 1.2 6.0 29.92 128,215.1 12.5 1.4 5.2 Saudi Arabia 8,344.39 (0.5) 2.2 2.2 15.5 866.75 531,278.7 18.8 1.9 3.1 Kuwait 4,837.41 0.1 0.4 0.4 (3.3) 35.83 33,815.2 14.6 0.9 4.1 Oman 4,596.51 0.4 (0.2) (0.2) (9.9) 11.55 19,293.7 11.4 1.0 5.3 Bahrain 1,263.79 (0.3) (0.2) (0.2) (5.1) 7.39 19,781.5 8.2 0.8 6.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,200 9,250 9,300 9,350 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.9% to close at 9,242.3. The Transportation and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from GCC and non-Qatari shareholders. Qatar Gas Transport Company Limited and United Development Company were the top losers, falling 4.4% and 2.4%, respectively. Among the top gainers, Dlala Brokerage & Investment Holding Company gained 6.6%, while Qatar Fuel Company was up 2.1%. Volume of shares traded on Thursday fell by 30.2% to 9.9mn from 14.2mn on Wednesday. Further, as compared to the 30-day moving average of 11.8mn, volume for the day was 15.8% lower. Qatar Gas Transport Company Limited and Mesaieed Petrochemical Holding Company were the most active stocks, contributing 15.3% and 11.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Mashreqbank S&P Dubai LT-LIC/LT-FIC BBB+/BBB+ A-/A- Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FIC – Foreign Issuer Credit, LIC – Local Issuer Credit, IDR – Issuer Default Rating, SR – Support Rating) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 06/07 US Department of Labor Initial Jobless Claims 2-June 222k 220k 223k 06/07 US Department of Labor Continuing Claims 26-May 1,741k 1,735k 1,720k 06/08 Germany German Federal Statistical Office Trade Balance April 20.4bn 20.2bn 24.7bn 06/08 Germany German Federal Statistical Office Current Account Balance April 22.7bn 20.0bn 29.6bn 06/07 France Ministry of the Economy, France Trade Balance April -4,954mn -5,100mn -5,014mn 06/07 France Banque De France Current Account Balance April -1.1bn – -0.6bn 06/08 France INSEE National Statistics Office Industrial Production MoM April -0.5% 0.3% -0.4% 06/08 France INSEE National Statistics Office Industrial Production YoY April 2.1% 2.9% 1.9% 06/08 France INSEE National Statistics Office Manufacturing Production MoM April 0.4% 1.3% 0.3% 06/08 France INSEE National Statistics Office Manufacturing Production YoY April 3.0% 3.7% 0.5% 06/07 China National Bureau of Statistics Foreign Reserves May $3,110.62bn $3,106.50bn $3,124.85bn 06/08 China National Bureau of Statistics Trade Balance May $24.92bn $33.25bn $28.30bn 06/08 China National Bureau of Statistics Exports YoY May 12.6% 11.1% 12.6% 06/08 China National Bureau of Statistics Imports YoY May 26.0% 18.0% 21.5% 06/09 China National Bureau of Statistics PPI YoY May 4.1% 3.9% 3.4% 06/09 China National Bureau of Statistics CPI YoY May 1.8% 1.8% 1.8% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QFMA to split nominal value of QSE listed firms’ shares – Qatar Financial Markets Authority (QFMA) announced that regarding the split of the shares’ nominal value of QSE listed companies to become QR1 per share (from the present face value of QR10), the QFMA is working in developing the procedures and the appropriate mechanisms to regulate the process. This step comes as a part of performing the QFMA’s regulatory and supervisory role over the capital market in the State. Through this step, the QFMA seeks to increase the prospects for investment in the financial market, expand the shareholders base, attract more small investors, give more choice opportunities for all participants dealing in the QSE, and increase the liquidity and turnover ratio of shares listed on the market. The QFMA is exerting more efforts to achieve its mission that aims to regulate and develop the capital market in line with the QFMA’s strategic plan, which is in harmony with the financial sector plan in Qatar. (QSE, Gulf-Times.com) BRES’ EGM declares the increase of non-Qatari shareholding percentage to 49% and approves the amendment to the Articles of Association – Barwa Real Estate Company (BRES) held the company’s Extraordinary General Assembly meeting (EGM) on June 6, 2018. The EGM endorsed all proposals and recommendations made by the board members regarding the following: 1) The approval to increase the shareholding percentage of non-Qataris in the shares of the company from 25% to 49% of the total shares of the company. 2) The approval to amend the company’s Articles of Association to be in Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 20.09% 34.56% (62,406,666.30) Qatari Institutions 10.52% 19.80% (39,996,382.34) Qatari 30.61% 54.36% (102,403,048.64) GCC Individuals 0.25% 0.24% 52,683.68 GCC Institutions 9.80% 5.20% 19,860,446.64 GCC 10.05% 5.44% 19,913,130.32 Non-Qatari Individuals 4.58% 6.37% (7,719,268.53) Non-Qatari Institutions 54.76% 33.84% 90,209,186.85 Non-Qatari 59.34% 40.21% 82,489,918.32

- 3. Page 3 of 6 accordance with the amendments of non-Qatari ownership percentages. All necessary measures are to be taken in accordance with the relevant laws and procedures to implement the said decision, after obtaining the approval from the Ministry of Economy. (QSE) Mannai Corporation announces the result of its board meeting – Mannai Corporation announced the result of its board of directors’ meeting, which was held on June 6, 2018 and discussed administrative and operational matters of the company. (QSE) MRDS’ EGM endorses items on its agenda – Mazaya Qatar Real Estate Development (MRDS) announced the results of the Extraordinary General Assembly Meeting (EGM), which was held on June 6, 2018 and its agenda has been discussed and approved. One of the item of agenda is to amend the relevant Article of Association of the company to reflect the trade name after approval by the authorities on the new name, and authorize the Chairman to complete the necessary procedures. (QSE) Investment Holding Group to hold its board meeting on June 13 – Investment Holding Group announced that its board of directors will be holding a meeting on June 13, 2018 to discuss the following agenda: 1) Review Audit and Risk Committee report. 2) Discuss and approve the Organizational Structure. 3) Discuss and approve the Authority Matrix. 4) Discuss and approve the Salary Scale. 5) Discuss the acquisition of 39.6 % of the shares of Consolidated Engineering Systems. (QSE) QEWS signs deal with Marubeni – Qatar Electricity & Water Company (QEWS) signed an agreement with Japanese company Marubeni to facilitate visits by Qatari engineers, employees and joint venture companies to Marubeni plants and projects in various locations in Japan, the Philippines and Oman. Qatari engineers will be briefed on Marubeni’s practices in management, operation, maintenance, risk management, quality management and planning. (Peninsula Qatar) QCB sells QR1.2bn of Treasury bills at a monthly auction – Qatar Central Bank (QCB) sold QR1.2bn of Treasury bills at a monthly auction, with yields falling and the curve steepening compared to last month. It sold QR700mn of three-month bills at 2.38%, QR300mn of six-month at 2.63% and QR200mn of nine-month at 2.83%. Last month, it sold QR900mn riyals of three-month at 2.49%, QR400mn of six-month at 2.69% and QR200mn of nine-month at 2.84%. (Zawya) More opportunities for Qatar, Sri Lanka in investments, says Doha Bank’s CEO – Positive prospects abound for Qatar and Sri Lanka to strengthen bilateral relationships and to explore investment opportunities in sectors such as tourism, according to Doha Bank’s CEO, R Seetharaman. Speaking at a forum after the recent opening of Doha Bank’s representative office in Sri Lanka, the bank has further strengthened its presence in the Indian subcontinent, Seetharaman said that bilateral relationships can be explored in the fruits and vegetables, spices, cereals, rice, boat building, fabrics, construction services, garments, and IT segments. Sri Lanka could support Qatar in the food sector, citing LuLu Group, which has already started resourcing a number of food products from the Asian country for its hypermarkets in Qatar. He noted that Qatari corporates can also explore opportunities in Sri Lanka’s infrastructure and energy sector. (Gulf-Times.com, Qatar Tribune) Total 1,958 new companies registered in Qatar in May – Qatar witnessed the registration of 1,958 new companies in May this year with limited liability companies constituting the majority of them, according to the Ministry of Economy and Commerce. Limited liability companies accounted for 62% of new commercial records, followed by limited liability companies in the category of single-person companies at 27%, while 10% of new companies were registered in the category of individual corporations. A total of 8,283 commercial licenses were issued, amended or renewed in May. Some 1,620 new commercial licenses were issued, 946 were modified and 5,717 commercial licenses were renewed, the report stated, adding a total of 271 companies closed in May, representing 13.8% of newly registered companies. (Gulf-Times.com) Qatar’s rise boosts investors’ trust – Qatari economy’s steadfastness and rise in the face of the blockade has boosted investor confidence, opening up wider horizons for openness and attracting more foreign investments to the different sectors, a recent study by Qatar University showed. Prepared by Qatar University’s Dean of the College of Business and Economics, Khalid Al Abdulqader, ‘Foreign Investment Openness in the State of Qatar and Its Interaction in Development of Qatari Economy’ argues that the steadfastness of the Qatari economy against the siege thwarted the plans and expectations of the siege countries who had expected the Qatari economy to collapse once they imposed it, QNA reported. The study pointed out that the presence of major foreign companies that continued to operate in Qatar despite the siege indicates the strength of the Qatari economy, which is an indicator of investor confidence in the ability of Qatar to face the siege. Another proof of the strength of Qatar’s economy is that its credit rating is in the highest range for global rating agencies such as Standard and Poor’s, Fitch, Moody’s and Capital Intelligence, the study says. In the same context, the International Monetary Fund puts Qatar’s projected economic growth in 2018 at the higher level in the Gulf region despite the siege. (Peninsula Qatar) AmCham Qatar working to boost economic ties with the US – American Chamber of Commerce in Qatar (AmCham Qatar) is working aggressively to facilitate and boost business and economic relationships between Qatar and the US. The Qatar chapter of American Chamber of Commerce recently participated at an event in Washington to promote Qatar as one of the most attractive destinations for investments in the region. AmCham Qatar announced to host a senior official of the US Chamber of Commerce by the end of this month, which will be providing insight on Qatar-US economic relations, challenges, opportunities and other issues related to business and trade. (Peninsula Qatar) International US weekly jobless claims drop as labor market picks up steam – The number of Americans filing for unemployment benefits unexpectedly fell last week, pointing to a further tightening in labor market conditions. The robust labor market and firming inflation have cemented expectations the Federal Reserve will raise benchmark US interest rates next week. Many economists

- 4. Page 4 of 6 believe the US central bank will hike rates two more times after its June 12-13 policy meeting to prevent the economy from overheating. The labor market is considered to be close to or at full employment. Nonfarm payrolls increased by 223,000 jobs in May and the unemployment rate dropped to an 18-year low of 3.8%. The jobless rate, which has declined by three-tenths of a percentage point this year, is now at a level where the Fed projected it would be by the end of this year. (Reuters) US household net worth $100tn in 1Q2018 – US households added $1tn to their wealth in the first three months of this year, boosted by rising stock prices and home values, the Federal Reserve stated. US household wealth reached $100.8tn in the January-March period. The rising value of their investments has now boosted their net worth by over $6tn compared to 1Q2017, a period that largely overlaps with the first year of the Trump administration. Household borrowing rose at 3.3% annual rate in the January-March period, the Fed report also showed, down from 4.6% growth rate in the fourth quarter. The value of financial assets held by households rose by $511bn during the first quarter, while real estate value rose by $490bn. (Reuters) German industry output, exports fall in April – German industrial output and exports fell in April adding to signs that Europe’s largest economy started the second quarter on a weak footing. Data from the Economy Ministry showed output fell by 1.0%, well below a Reuters forecast for a rise of 0.3%. Separate data from the Federal Statistics Office showed exports fell by 0.3% in April while imports rose 2.2%. Data showed industrial orders fell unexpectedly by 2.5%. (Reuters) Greece’s consumer price inflation picks up to 0.8% in May – Greece’s annual EU-harmonized inflation rate accelerated in May, statistics service ELSTAT data showed. The reading in May was 0.8% from 0.5% in April. The data showed the headline consumer price index rose to 0.6% YoY from zero percent in the previous month. Greece had been in a protracted deflation mode since March 2013 based on its headline index, as wage and pension cuts and a multi-year recession took a heavy toll on Greek household incomes. Deflation in the country hit its highest level in Nov. 2013 when consumer prices registered 2.9% YoY decline. (Reuters) Greece’s industrial output rises 1.9% YoY in April – Greece’s industrial output increased by 1.9% in April compared to the same month last year, after an upwardly revised 1.2% rise in March, statistics service ELSTAT showed. Looking at index components, manufacturing production rose 2.4% from the same month last year, while mining output dropped 6.4%. Electricity production increased 2.2%. (Reuters) Japan’s economy contracted at an annualized rate of 0.6% in January-March – Japan’s economy contracted at an annualized rate of 0.6% in January-March, unchanged from a preliminary estimate issued last month, revised gross domestic product data from the Cabinet Office showed. The result compared with the median estimate of 0.4% annualized contraction in a Reuters poll of economists. On a QoQ basis, GDP fell 0.2% in real, price- adjusted terms, also unchanged from the initial reading. The median estimate among economists was for 0.1% decline. (Reuters) China’s May producer inflation picks up for second time in a row – China’s producer inflation picked up for the second month in a row to a four-month high in May, buoyed by stronger commodity prices, suggesting the world’s second number economy has retained growth momentum despite rocky trade relation with the US. Annual consumer inflation held steady in May from the previous month, as food prices remained largely stable, official data also showed. The producer price index (PPI) rose 4.1% in May from a year earlier, bolstered by a recent jump in commodity prices and up from a lower base last year, according to the National Bureau of Statistics (NBS). That compared with acceleration to 3.4% in April. On a MoM basis, the PPI rose 0.4% in May, compared with 0.2% decline in April. Analysts polled by Reuters had expected May producer inflation would pick up to 3.9%, and predicted that producer inflation will accelerate again in June as global crude oil prices continue to rise. (Reuters) China maintained solid export growth of 12.6% in May – China maintained solid export growth of 12.6% in May, slightly slower than in April, but still providing good news for China’s policymakers as they deal with tough trade negotiations with Washington. Imports also rose more than anticipated in May and at the fastest pace since January, with the data coming at a time when China has pledged to its trade partners, including the US, that steps would be taken to increase imports. Imports grew 26% in May, the General Administration of Customs stated, beating analysts’ forecast of 18.7% growth, and compared with 21.5% rebound in April. (Reuters) Regional MENA’s M&A activity down by 21.8% in 1Q2018 – The merger and acquisition activity (M&A) in MENA recorded 93 announced deals in 1Q2018, a decline of 21.8% when compared to 119 deals in 1Q2017, stated EY in a report. The total disclosed deal value in MENA also dropped by 26.7% in 1Q2018 to $15.4bn, compared to $21bn in 1Q2017, added the report. Of the transactions across the MENA region, the UAE saw the highest deal value with $5.1bn from 23 deals announced in 1Q2018. (GulfBase.com) Foreign direct investment in Saudi Arabia at 14-year low in blow to reforms – New foreign direct investment in Saudi Arabia dropped to 14-year low, figures showed, giving blow to ambitious economic reforms which aim to increase inflows of foreign capital sharply. FDI inflows shrank to $1.4bn in 2017 from $7.5bn in 2016, according to figures from the United Nations Conference on Trade and Development. The drop contrasts with the trend in other Gulf Arab oil exporting economies. FDI increased in Qatar, on which Saudi Arabia and some other countries imposed an unjust embargo last year. FDI in the UAE rose to $10.4bn last year from $9.6bn. Oman also attracted $1.9bn, up from $1.7bn. (Gulf-Times.com) Japan’s Canon to launch operations in Saudi Arabia – Saudi Arabia’s drive to attract foreign investment racked up another success when Japanese multinational Canon revealed plans to set up operations in Riyadh, Jeddah and Alkhobar, employing 300 by 2020. Canon has been operating in the UAE where it employs 260, but is now targeting Saudi Arabia as it expands in the Middle East and North Africa. The company is hoping that demand for Canon products will come from small and medium

- 5. Page 5 of 6 enterprises (SMEs), which make up 90% of all enterprises in Saudi Arabia, and which require efficient digital systems to prosper. (GulfBase.com) Fawaz Abdulaziz Alhokair raises $300mn Islamic loan – Saudi Arabia’s Fawaz Abdulaziz Alhokair raised a $300mn Islamic loan with a group of regional banks, a month after concluding a much larger facility for one of its businesses. Fawaz Abdulaziz Alhokair signed a new Mudarabah loan agreement with National Commercial Bank, Samba Financial Group and Abu Dhabi Islamic Bank. The loan will be used to repay the outstanding balance on a SR1bn syndicated loan obtained in 2014 and SR500mn in Sukuk issued in the same year and due in 2019. (Reuters) UAE’s banking sector maintains strong liquidity despite drop in deposits – The UAE’s banking sector liquidity continued to remain strong in the month of April despite sluggish growth in both deposits and credits, according to monetary data from Central Bank of the UAE. Data showed a monthly drop in both system-wide credit and deposits. Gross credit contracted by 0.1% MoM in April (AED1.5bn) after seeing three consecutive months of positive growth. The yearly rate remained steady at 2.1% YoY, as in March. The monthly contraction in April was led by domestic loans. Overall liquidity levels remained high with the loan-to-deposit ratio rising marginally to 96.8% in April from 96.7% in March. (GulfBase.com) Dubai council to slash government fees – The Executive Council of Dubai approved suggestions to slash government fees among a series of economic stimulus aiming to reduce the cost of doing business in Dubai and further cement position as destination of choice for investments. The board members also reviewed the objectives of the strategic programs along with the time frame of execution. The new policy aims to slash market fees imposed by Dubai Municipality from 5% to 2.5%, in addition to scrapping 19 fees related to aviation industry, as Dubai aims to attract foreign investments worth more than AED1bn in the aviation sector. The Council also directed Land Department to waive late payment fees on property registration imposed by Dubai Land Department for 60 days which used to be 4%. (GulfBase.com) ADIA takes top place in global real estate investment league table – Abu Dhabi Investment Authority (ADIA) is the biggest real estate investor in the world with about $62bn worth of assets under management, according to a report. IPE Real Estate and Indosuez Wealth Management compiled a list of the 100 largest institutional real estate investors. The list is dominated by various European and North American pension fund managers which make up 45% of the top ten. But Middle East players, ADIA and the Qatar Investment Authority account for a combined 26% in top ten. (GulfBase.com) Free zone dual licenses to benefit the Abu Dhabi’s economy – The issuance of dual licenses for companies in Abu Dhabi free zones to allow them to work outside the free zones and participate in government tenders will help the economy to grow, according to sources. “It’s a very good move that will benefit the economy. Companies operating in free zones can bid for businesses in the mainland. This will encourage more companies to set up businesses in the UAE,” said Mohammad Ali Yasin, CEO at First Abu Dhabi Bank Securities. He also said that a lot of new measures which were announced in the last one month or so are very positive for the UAE’s economy, be it 100% foreign ownership or granting of 10-year visa or increasing the loan for locals. (GulfBase.com) Higher government spending to boost Abu Dhabi’s non-oil sectors – The Abu Dhabi Government announced AED50bn stimulus package to support the economic growth, following a strong recovery in public finances of the Emirate supported by higher oil prices and improved fiscal position. The Emirate’s decision to inject more money into the economy through higher spending, waiver of certain fees and terms of licensing has come at a time when the non-oil private sector growth is poised to play big role in the economic growth from this year. (GulfBase.com)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 40.0 60.0 80.0 100.0 120.0 May-14 May-15 May-16 May-17 May-18 QSE Index S&P Pan Arab S&P GCC (0.5%) (0.9%) 0.1% (0.3%) 0.4% 0.2% (0.5%) (1.0%) (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,299.35 0.2 0.4 (0.3) MSCI World Index 2,137.74 0.0 1.4 1.6 Silver/Ounce 16.80 0.5 2.4 (0.8) DJ Industrial 25,316.53 0.3 2.8 2.4 Crude Oil (Brent)/Barrel (FM Future) 76.46 (1.1) (0.4) 14.3 S&P 500 2,779.03 0.3 1.6 3.9 Crude Oil (WTI)/Barrel (FM Future) 65.74 (0.3) (0.1) 8.8 NASDAQ 100 7,645.51 0.1 1.2 10.8 Natural Gas (Henry Hub)/MMBtu 2.92 (0.4) (0.3) (17.5) STOXX 600 385.12 (0.5) 0.5 (3.1) LPG Propane (Arab Gulf)/Ton 89.88 1.1 (2.2) (8.1) DAX 12,766.55 (0.6) 1.3 (3.2) LPG Butane (Arab Gulf)/Ton 97.00 0.8 4.4 (8.2) FTSE 100 7,681.07 (0.3) 0.2 (0.9) Euro 1.18 (0.3) 0.9 (2.0) CAC 40 5,450.22 (0.3) 0.6 0.5 Yen 109.55 (0.1) 0.0 (2.8) Nikkei 22,694.50 (0.3) 2.4 2.5 GBP 1.34 (0.1) 0.4 (0.8) MSCI EM 1,135.39 (1.2) 0.5 (2.0) CHF 1.01 (0.5) 0.3 (1.1) SHANGHAI SE Composite 3,067.15 (1.6) (0.0) (5.8) AUD 0.76 (0.3) 0.4 (2.7) HANG SENG 30,958.21 (1.7) 1.5 3.0 USD Index 93.54 0.1 (0.7) 1.5 BSE SENSEX 35,443.67 (0.2) (0.3) (1.6) RUB 62.33 (0.1) 0.2 8.2 Bovespa 72,942.07 3.8 (5.3) (15.8) BRL 0.27 5.4 1.5 (10.7) RTS 1,142.90 (2.4) (1.8) (1.0) 82.5 85.0 72.6