QSE Intra-Day Movement Rises Marginally; Top Gainers Led by Gulf International Services and Qatar National Cement

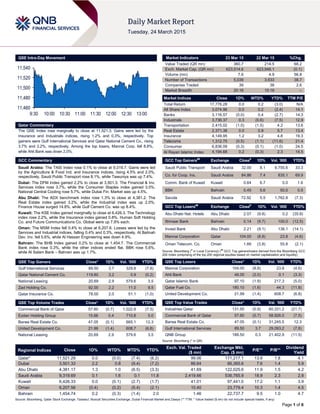

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose marginally to close at 11,521.3. Gains were led by the Insurance and Industrials indices, rising 1.2% and 0.3%, respectively. Top gainers were Gulf International Services and Qatar National Cement Co., rising 3.7% and 3.2%, respectively. Among the top losers, Mannai Corp. fell 8.8%, while Ahli Bank was down 2.0%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 9,319.7. Gains were led by the Agriculture & Food Ind. and Insurance indices, rising 4.5% and 2.0%, respectively. Saudi Public Transport rose 8.1%, while Tawuniya was up 7.4%. Dubai: The DFM Index gained 2.2% to close at 3,501.3. The Financial & Inv. Services index rose 3.7%, while the Consumer Staples index gained 3.0%. National Central Cooling rose 5.7%, while Dubai Fin. Market was up 4.5%. Abu Dhabi: The ADX benchmark index rose 1.3% to close at 4,381.2. The Real Estate index gained 3.2%, while the Industrial index was up 2.0%. Finance House surged 14.8%, while Gulf Cement Co. was up 8.4%. Kuwait: The KSE Index gained marginally to close at 6,426.3. The Technology index rose 2.2%, while the Insurance index gained 0.8%. Human Soft Holding Co. and Future Communications Co. Global were up 7.9% each. Oman: The MSM Index fell 0.4% to close at 6,207.6. Losses were led by the Services and Industrial indices, falling 0.4% and 0.3%, respectively. Al Batinah Dev. Inv. fell 5.6%, while Al Hassan Engineering was down 4.9%. Bahrain: The BHB Index gained 0.2% to close at 1,454.7. The Commercial Bank index rose 0.3%, while the other indices ended flat. BBK rose 5.6%, while Al Salam Bank – Bahrain was up 1.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Gulf International Services 89.50 3.7 329.8 (7.8) Qatar National Cement Co. 119.80 3.2 0.9 (0.2) National Leasing 20.69 2.9 579.6 3.5 Zad Holding Co. 92.00 2.2 11.0 9.5 Qatar Insurance Co. 78.00 2.0 51.1 (1.0) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Commercial Bank of Qatar 57.60 (0.7) 1,022.8 (7.5) Ezdan Holding Group 15.66 0.4 710.8 5.0 Barwa Real Estate Co. 47.05 (0.1) 665.1 12.3 United Development Co. 21.99 (1.4) 608.7 (6.8) National Leasing 20.69 2.9 579.6 3.5 Market Indicators 23 Mar 15 22 Mar 15 %Chg. Value Traded (QR mn) 360.7 214.5 68.2 Exch. Market Cap. (QR mn) 623,514.6 623,946.1 (0.1) Volume (mn) 7.6 4.9 56.8 Number of Transactions 5,039 3,633 38.7 Companies Traded 39 38 2.6 Market Breadth 20:16 15:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,776.28 0.0 0.2 (3.0) N/A All Share Index 3,074.96 0.0 0.2 (2.4) 14.1 Banks 3,116.57 (0.0) 0.4 (2.7) 14.3 Industrials 3,736.37 0.3 (0.6) (7.5) 12.9 Transportation 2,415.02 (1.0) (1.5) 4.2 13.6 Real Estate 2,371.38 0.0 0.9 5.7 13.4 Insurance 4,149.95 1.2 3.2 4.8 19.3 Telecoms 1,312.75 (0.5) (1.1) (11.6) 21.4 Consumer 6,836.09 (0.3) (0.1) (1.0) 24.5 Al Rayan Islamic Index 4,194.68 0.2 (0.3) 2.3 14.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Public Transport Saudi Arabia 32.00 8.1 9,755.6 33.3 Co. for Coop. Ins. Saudi Arabia 84.86 7.4 835.1 69.9 Comm. Bank of Kuwait Kuwait 0.64 6.7 0.0 1.6 BBK Bahrain 0.45 5.6 50.0 0.5 Savola Saudi Arabia 72.92 5.5 1,762.8 (7.3) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Hotels Abu Dhabi 2.57 (9.8) 0.2 (35.8) Ithmaar Bank Bahrain 0.14 (9.7) 100.0 (12.5) Invest Bank Abu Dhabi 2.21 (9.1) 136.1 (14.1) Mannai Corporation Qatar 104.00 (8.8) 23.8 (4.6) Oman Telecom. Co. Oman 1.66 (3.8) 55.8 (2.1) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 104.00 (8.8) 23.8 (4.6) Ahli Bank 48.00 (2.0) 0.1 (3.3) Qatar Islamic Bank 97.10 (1.9) 217.3 (5.0) Qatar Fuel Co. 180.10 (1.6) 44.3 (11.8) United Development Co. 21.99 (1.4) 608.7 (6.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 131.50 (0.9) 60,331.2 (21.7) Commercial Bank of Qatar 57.60 (0.7) 58,926.0 (7.5) Barwa Real Estate Co. 47.05 (0.1) 31,245.5 12.3 Gulf International Services 89.50 3.7 29,093.2 (7.8) QNB Group 188.50 0.3 21,402.9 (11.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,521.29 0.0 (0.0) (7.4) (6.2) 99.06 171,217.1 13.6 1.8 4.1 Dubai 3,501.33 2.2 0.8 (9.4) (7.2) 86.64 86,365.6 7.6 1.4 5.9 Abu Dhabi 4,381.17 1.3 1.0 (6.5) (3.3) 41.69 122,025.6 11.9 1.5 4.2 Saudi Arabia 9,319.69 0.1 1.6 0.1 11.8 2,419.66 536,765.9 18.9 2.3 2.8 Kuwait 6,426.33 0.0 (0.1) (2.7) (1.7) 41.01 97,441.0 17.2 1.1 3.9 Oman 6,207.56 (0.4) (0.2) (5.4) (2.1) 10.40 23,779.4 10.3 1.4 4.5 Bahrain 1,454.74 0.2 (0.3) (1.4) 2.0 1.46 22,737.7 9.5 1.0 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,460 11,480 11,500 11,520 11,540 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose marginally to close at 11,521.3. The Insurance and Industrials indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from non-Qatari shareholders. Gulf International Services and Qatar National Cement Co. were the top gainers, rising 3.7% and 3.2%, respectively. Among the top losers, Mannai Corp. fell 8.8%, while Ahli Bank was down 2.0%. Volume of shares traded on Monday rose by 56.8% to 7.6mn from 4.9mn on Sunday. However, as compared to the 30-day moving average of 12.9mn, volume for the day was 40.8% lower. Commercial Bank of Qatar and Ezdan Holding Group were the most active stocks, contributing 13.4% and 9.3% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/23 US Chicago Fed. Chicago Fed Nat Activity Index February -0.1 0.1 -0.1 03/23 US National Assoc. of Realt. Existing Home Sales February 4.88M 4.90M 4.82M 03/23 US National Assoc. of Realt. Existing Home Sales MoM February 1.20% 1.70% -4.90% 03/23 EU European Commission Consumer Confidence March -3.7 -6.0 -6.7 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar DBIS announces agenda for OGM, EGM on April 7 – Dlala Brokerage & Investment Holding Company (DBIS) announced that its ordinary & extraordinary general assembly meeting (OGM & EGM) will be held on April 7, 2015. Shareholders at the OGM will approve the board of directors’ proposal to distribute 28% bonus shares of the company’s capital. Meanwhile, shareholders at the EGM will approve the OGM’s resolution to increase DBIS’ capital by 28% (6,216,000 shares) resulting from the distribution of bonus shares. Following the distribution, the company’s total shares shall become 28,416,000 shares. In case the required quorum is not met, a second meeting will be held on April 13, 2015. (QSE) VFQS’ shares soar after becoming Shari’ah compliant – Vodafone Qatar’s (VFQS) shares jumped 18.99% MoM in February 2015, after the company announced it had switched its financial activity to Islamic transactions. In February 2015, VFQS announced it had successfully refinanced its conventional interest-bearing borrowings with a Shari’ah-compliant Wakala investment agreement in December 2014. The transition was completed in accordance with the current laws that do not contradict Shari’ah rules. (Peninsula Qatar) QOIS AGM approves 8% cash dividend – Qatar Oman Investment Company’s (QOIS) general assembly meeting (AGM) has approved the board’s recommendation to distribute of 8% cash dividends, representing 80 dirhams per share. AGM also approved election of new board for a three year period from 2015-2017. (QSE) LREDC awards construction contracts worth QR6.2bn – Lusail City Real Estate Development Company (LREDC) has announced QR6.2bn worth development works in Lusail City. The projects will be located within the Central Zone of the Lusail City spread over 38 square kilometers and will include development packages for Lusail Plaza, Commercial Street and a unique crescent-shaped street. The Qatari Diar-Bin Laden Construction joint venture is the contractor of Lusail Plaza. The QR4.12bn estimated project will be linked with internal roads connected to trams and underground rails. A joint venture of WCT and Al Ahli has bagged the QR1.21bn worth contract for the Commercial Street project, while the third package for the Crescent Street includes the development of 3 km-long stretch at QR918m. (Peninsula Qatar) NPPSC awards QR239mn Hamad Port contract to Belgian firm – The New Port Project Steering Committee (NPPSC) has awarded a QR239mn contract for the Hamad Port project to Gulf Earth Moving Company, a Qatar-based subsidiary of the Belgian group Aertssen. Under the contract terms, Gulf Earth will install a causeway and coastal protection by placing armor rocks over a length of 1,350 meters and undertake the necessary soil improvements before filling the lagoon area with 9mn cubic meters of processed materials. (Gulf-Times.com) QPMC signs deal with Rent-A-Port to develop quarry, jetty in Oman – Qatar Primary Materials Company (QPMC) and Belgian port & logistical operator, Rent-A-Port have signed an agreement to initiate work on a limestone and gabbro quarry besides a 1-kilometer long jetty in Oman. The jetty will be used to transport more than 3mn tons of gabbro and primary materials by barges to Qatar. The agreement commissions Rent-A-Port to provide consultancy and manage the project and related operations at Khatmat Malaha, Oman. QPMC has recently acquired two licenses to set up mining operations in Khatmat Malaha. (Gulf-Times.com) QSE conducts BCP test – The Qatar Stock Exchange (QSE) has successfully conducted an exercise to test the efficacy of its Business Continuity Plan (BCP) in adverse conditions. The exchange, brokers and business partners participated in the BCP test, which was held at QSE premises as part of QSE's regular BCP procedures. The test ensured that the QSE trading session continues uninterrupted even if a major disaster strikes its primary data center. (QSE) Overall Activity Buy %* Sell %* Net (QR) Qatari 63.12% 53.25% 35,598,998.71 Non-Qatari 36.88% 46.75% (35,598,998.71)

- 3. Page 3 of 6 QAFCO signs MoU with Belgium University – Qatar Fertilizer Company (QAFCO) has signed a memorandum of understanding (MoU) with the University of Liege, Belgium. The MoU is meant to further the research initiatives on the use of urea in poultry feed, enhancing the fish biodiversity of Qatar and crossbreeding of lamb varieties. (Gulf-Times.com) QCB: Qatar a hub for Islamic finance – The Qatar Central Bank Governor, HE Sheikh Abdullah bin Saud Al-Thani said that Islamic financial institutions enjoy a prominent place in the State of Qatar, making the country one of the world’s leading hubs for Islamic finance. He noted that Qatari Islamic banks have 25% of all the equity held by Qatari banks and play a major role in financing different developmental projects. However, he said that Islamic banks face many challenges starting with maintaining their current growth levels and managing risks. To combat these challenges, the QCB has dedicated an entire section to Islamic financial institutions in its new law issued in 2012. (Gulf-Times.com) SEC issues new guidelines; approves 91 new private schools – Qatar Supreme Education Council (SEC) has issued new set of guidelines for private schools. According to the new rules, schools will have to announce the number of vacancies for each academic year in advance and admit the students within the period of time specified by the SEC. No student shall be registered over and above a school’s capacity unless an approval is obtained from the SEC. The school’s capacity is calculated according to the report produced by the SEC. Also, expatriate students in the country can now be enrolled directly in private schools without the need of equivalency certificate. Similarly, parents can hereafter transfer their children between private schools without the SEC’s permission, if there are vacancies at the appropriate level in the receiving school. Meanwhile, senior SEC official Aisha Al Hashmi revealed that SEC has given initial approval to 91 new private schools to open in the next academic year, including six Indian schools. (Gulftimes.com, Bloomberg) International US changes tack after diplomatic setback on China-led AIIB – The Obama administration, stung by allies who have thrown their weight behind a new China-led Asian Infrastructure Investment Bank (AIIB), has turned its focus to a new front: exerting its remaining leverage to influence the bank's lending standards. For months, the US had urged countries to think twice about joining the AIIB until it could show sufficient standards of governance as well as environmental and social safeguards. The AIIB has been seen as a challenge to the World Bank and Asian Development Bank, institutions Washington helped found and over which it exerts considerable influence. However, the AIIB's interim head was able to announce that at least 35 countries will join the Beijing-based bank by the March 31 deadline. Despite Washington's misgivings, US allies Britain, France, Germany and Italy have said they would join the bank, while Australia, Japan and South Korea are considering doing so. That reality has led the Obama administration to reassess its stance on the bank, which will be capitalized at an initial $50bn to provide project loans to developing states. (Reuters) US homes sales up marginally; supply a constraint – US home resales rebounded modestly in February as a persistent shortage of properties on the market spurred the biggest price jump in a year, a trend that could undermine the spring selling season. The National Association of Realtors said that existing home sales rose 1.2% to an annual rate of 4.88mn units. That left the bulk of January's 4.9% plunge intact. Economists had forecast home resales rising to a 4.90mn-unit pace in February. Sluggish home sales are yet another sign that the economic activity slowed sharply in 1Q2015, which could further diminish expectations that the Federal Reserve will increase interest rates in June. The dollar fell against a basket of currencies, while prices for US Treasury debt were little changed. (Reuters) Eurozone consumer confidence jumps in March – According to the first estimate from the European Commission, Eurozone consumer confidence jumped much more than expected in March to -3.7 points from -6.7 points in February. Economists polled by Reuters had expected an improvement only to -5.95 in March. (Reuters) PwC: Europe's banks set to sell €100bn of unwanted loans – According to consultants PricewaterhouseCoopers (PwC), Europe's banks are likely to sell a record €100bn of loans in 2015 that are no longer part of their main businesses, chipping away at a pile of €1.9tn of unwanted assets. PwC said European banks sold €91bn in 2014 of so-called 'non-core' loans, and that number is likely to rise by another 10% in 2015. The consultancy predicted it would take at least another five years for Europe's banks to get rid of their problem assets, meaning the clean-up will have taken more than a decade since the 2007-09 financial crisis. The €1.9tn of unwanted loans equates to about 4% of the industry's assets. Around half are non-performing loans and the other half are performing loans that banks do not consider part of their core businesses after changing strategy. Banks are shrinking balance sheets that were bloated before the financial crisis. Most of the deleveraging comes from loans running off, but banks are also selling loan portfolios to speed up the process. (Reuters) Japan March flash manufacturing PMI falls to 50.4, domestic orders weak – Japanese manufacturing activity expanded in March at a much slower pace than February as domestic orders contracted in a worrying sign that the recovering economy may be losing some momentum. The Markit/JMMA flash Japan Manufacturing Purchasing Managers Index (PMI) fell to a seasonally adjusted 50.4 in March from a final 51.6 in February. The index remained above the 50 threshold for the 10th consecutive month but fell to the lowest since manufacturing activity began expanding in June 2014. New orders fell to a preliminary 49.5 from 51.0 in February, contracting for the first time in 10 months. The index for new export orders also fell to a preliminary 52.2 from a final 53.7 in February, but continued to expand as the weak yen helped improve Japanese exporters' price competitiveness. The output index fell to 52.0 in March to reach the lowest level since October 2014. (Reuters) China flash HSBC PMI contracts to 11-month low in March ; PBoC lowers benchmark money rate – According to a private survey, activity in the Chinese factory sector dipped to a 11- month low in March as new orders shrank, signaling persistent weakness in the world's second-largest economy that will likely fuel calls for more policy easing to support growth. The flash HSBC/Markit Purchasing Managers' Index (PMI) dipped to 49.2 in March, below the 50-point level on a monthly basis. Economists polled by Reuters had forecast a reading of 50.6, slightly weaker than February's final PMI of 50.7. Meanwhile, the People's Bank of China (PBoC) lowered its guidance rate for the benchmark seven-day bond repurchase agreement, lowering the rate to 3.55% down from 3.65% the previous week. This is the third time that the central bank has lowered the guidance interest rate for the instrument, considered the best indicator of short-term liquidity conditions in China, since it announced a cut in interest rates at the end of February. The PBoC has been moving to ease tight lending conditions in China, which have

- 4. Page 4 of 6 remained stubbornly high after the spring festival holiday in late February, showing that easing measures to reserve requirement ratios and lending rates are failing to work their way into real lending rates. (Reuters) Regional Al-Khodari renews financing agreement with SHB, NCB – Abdullah A. M. Al-Khodari Sons Company (Al-Khodari) has renewed its Islamic credit facilities agreement with the National Commercial Bank (NCB) and Saudi Hollandi Bank (SHB) at a total value of SR1.135bn. The facilities are to provide bonding commitments, finance capital requirements and working capital needs. The credit facilities are secured by promissory notes and assignment of the contract proceeds of the financed projects. (Tadawul) CPC signs MoU to build five industrial cities in Egypt – Saudi Construction Products Holding Company (CPC) has signed a MoU with the newly-launched Ayadi Company for Development & Investment to build five industrial cities for small and medium enterprises (SMEs) in Egypt at a cost of $500mn. The agreement is part of the Egyptian government’s support toward SMEs in the country's private sector. (GulfBase.com) APICORP secures $950mn new financing through Shari’ah- compliant syndication – Arab Petroleum Investments Corporation (APICORP) has secured new financing through a Shari’ah-compliant syndication totaling $950mn. The deal featured two tranches: the first, worth $800mn, matures in five years and was arranged by SABB, National Commercial Bank, Samba Financial Group, Riyad Bank and Banque Saudi Fransi. The second tranche was for $150mn, matures in three years and was arranged by First Gulf Bank, HSBC Middle East and National Bank of Abu Dhabi. The transactions were officially completed in early 2015. APICORP will use the facility to grow its portfolio of equity investments in regional energy projects. (GulfBase.com) APC completes periodic scheduled maintenance at P&P plants – Advanced Petrochemical Company (APC) announced that its Propylene & Polypropylene (P&P) plants had commenced operations on March 23, 2015, after the successful completion of all required routine and preventive maintenance as per schedule. The company said that both plants are expected to reach their full operational capacity in the next 8 to 10 days. (Tadawul) DI forms JV with RED House to develop KSA projects – Dubai Investments (DI) has announced an equal stake joint venture (JV) partnership with RED House SAL, a Saudi- Lebanese joint stock company to manage and operate mega, mixed-use real estate development projects across Saudi Arabia. The launch of the new company comes amid burgeoning growth trends in the Saudi Arabia real estate sector, which is valued at more than SR1.3tn, and is expected to reach SR1.5tn over the next few years. The new JV will begin operations with a project in Riyadh, while other significant projects are in the pipeline. The project ‘Riyadh Investment Park’, which will be unveiled soon, will spread across approximately 11mn square meters and is strategically located at the periphery of the Saudi capital. A new entity will be entrusted with the development and management of the Riyadh Investment Park project, as well as other future projects in the pipeline across Saudi Arabia. Dubai Investments will own 25% stake in this new entity. (DFM) Damac AGM approves 10% bonus shares – Damac Properties annual general meeting (AGM) has approved the board of directors’ recommendation to distribute bonus shares representing 10% of the capital amounting AED5bn. (DFM) Arabtec seeks to sell Saudi units, eyes Kingdom expansion – Arabtec Holding is planning to sell four of its five Saudi Arabian units. The company after reporting a surprise 4Q2014 loss has approved disposing of Arabtec Saudi Arabia, Arabtec Construction Machinery, Saudi Austrian Arabian Ready Mix Company and EFECO Saudi. Arabtec owns stakes of between 45-62% of these firms and has control over all of them. Selling the quartet would leave the company with a solitary Saudi subsidiary, Saudi Target Engineering Construction Company, although it also owns 24% of a Riyadh residential project. Arabtec’s main aim in 2015 is to expand its activities in the Kingdom. (Reuters) ESBD secured creditors to get 82.7% payout – According to advisory firm Deloitte, liquidators for ES Bankers (Dubai) Ltd (ESBD), a part of Espírito Santo Financial Group (ESFG), have estimated that they will pay out 82.7% of the $93.5mn owed to depositors. However, unsecured creditors will get none of the $14mn they are owed. In October 2014, a Dubai judge approved an application to liquidate ESBD following an earlier freezing of deposits to protect customers. It was part of global legal action taken after a $5.35bn bailout for Banco Espirito Santo, formerly Portugal's largest listed bank, in the wake of the accounting issues. (Reuters) ADNTC OGM approves 16% cash dividend – Abu Dhabi National Takaful Company’s (ADNTC) ordinary general assembly meeting (OGM) has approved the distribution of 16% cash dividend of the paid-up capital, amounting to AED16mn for 2014. (ADX) ADA announces 12% dividend – Abu Dhabi Aviation Company’s (ADA) annual general meeting (AGM) has announced a 12% dividend for 2014. (GulfBase.com) UFC forms committee to consider M&As – United Finance Company’s (UFC) board of directors has appointed a committee to consider offers of mergers & acquisitions (M&As) received from parties. (MSM) Al Maha OGM approves 110% cash dividend – Al Maha Petroleum Products Marketing Company’s annual ordinary general meeting (OGM) has approved the distribution of 110% cash dividend of the share capital (i.e. 110 baizas per share) for 2014. (MSM) SOMC OGM approves 92 baizas per share cash dividend – Shell Oman Marketing Company’s (SOMC) annual ordinary general meeting (OGM) has approved a final cash dividend of 92 baizas per share (92% of the nominal value) for 2014. (MSM) ORC AGM approves 100% cash dividend – Oman Refreshment Company’s (ORC) annual general meeting (AGM) has approved the cash dividend at the rate of 100% (equivalent to 100 baizas per share) of the paid-up capital for 2014. (MSM) Al Jazeera set to open new rebar facility – Al Jazeera Steel Products Company (Al Jazeera) has completed building a new rebar production line, which is already in trial production, and is expected to start commercial production in 2Q2015. This move will enhance Al Jazeera’s revenues and diversify its product offerings, as well as increase the capacity utilization of the merchant bar mill from its current 35% utilization, offering significant growth potential. (GulfBase.com) Bank Sohar signs MoU with Zain Property Development – Bank Sohar has signed a memorandum of understanding (MoU) with Zain Property Development to provide preferential housing loans to Omani Citizens interested in investing in properties located in phases five and six of the Dar Al Zain project. The bank is offering both conventional housing finance as well as

- 5. Page 5 of 6 Islamic housing finance through its Islamic window, Sohar Islamic. (AMEInfo.com) Saudi's ACWA, Mitsui win $630mn Oman power plant deal – Saudi Arabia's ACWA Power and Japan's Mitsui & Co had won a contract from Oman's government to build and operate a $630mn, 445 megawatt (MW) natural gas-fired power plant at the city of Raysut. The contract was won along with Dhofar International Development & Investment Holding Co, which will take 10% of the project, while the Saudi and Japanese companies will each take 45%. The partners will sell electricity to Oman under a 15-year agreement with the new plant to be operational in January 2018. As part of the deal, the consortium will also acquire Dhofar Generating Co, which owns and operates an existing 273 MW gas-fired power plant. (Reuters)

- 6. Contacts Saugata Sarkar Ahmed Al-Khoudary Sahbi Kasraoui Head of Research Head of Sales Trading – Institutional Manager – HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6548 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Feb-11 Feb-12 Feb-13 Feb-14 Feb-15 QSE Index S&P Pan Arab S&P GCC 0.1% 0.0% 0.0% 0.2% (0.4%) 1.3% 2.2% (0.8%) 0.0% 0.8% 1.6% 2.4% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,189.51 0.6 0.6 0.4 MSCI World Index 1,778.00 0.2 0.2 4.0 Silver/Ounce 16.99 1.4 1.4 8.2 DJ Industrial 18,116.04 (0.1) (0.1) 1.6 Crude Oil (Brent)/Barrel (FM Future) 55.92 1.1 1.1 (2.5) S&P 500 2,104.42 (0.2) (0.2) 2.2 Crude Oil (WTI)/Barrel (FM Future) 47.45 3.8 3.8 (10.9) NASDAQ 100 5,010.97 (0.3) (0.3) 5.8 Natural Gas (Henry Hub)/MMBtu 2.69 (4.8) (4.8) (10.3) STOXX 600 401.24 0.1 0.1 5.8 LPG Propane (Arab Gulf)/Ton 51.00 1.7 1.7 4.1 DAX 11,895.84 (0.4) (0.4) 9.1 LPG Butane (Arab Gulf)/Ton 57.38 1.1 1.1 (8.6) FTSE 100 7,037.67 0.0 0.0 2.8 Euro 1.09 1.2 1.2 (9.5) CAC 40 5,054.52 0.1 0.1 6.9 Yen 119.73 (0.3) (0.3) (0.0) Nikkei 19,754.36 1.1 1.1 12.9 GBP 1.50 0.0 0.0 (4.0) MSCI EM 975.38 0.6 0.6 2.0 CHF 1.04 0.9 0.9 2.9 SHANGHAI SE Composite 3,687.73 1.7 1.7 13.8 AUD 0.79 1.4 1.4 (3.6) HANG SENG 24,494.51 0.5 0.5 3.7 USD Index 97.03 (0.9) (0.9) 7.5 BSE SENSEX 28,192.02 (0.1) (0.1) 4.2 RUB 58.75 (0.9) (0.9) (3.3) Bovespa 51,908.46 1.8 1.8 (13.0) BRL 0.32 3.1 3.1 (15.4) RTS 859.14 (0.3) (0.3) 8.7 165.6 135.8 124.6