17 December Daily market report

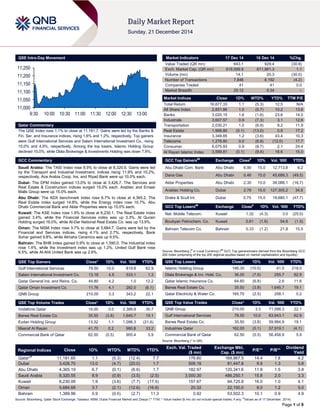

- 1. Page 1 of 9 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.1% to close at 11,181.7. Gains were led by the Banks & Fin. Ser. and Insurance indices, rising 1.6% and 1.2%, respectively. Top gainers were Gulf International Services and Salam International Investment Co., rising 10.0% and 4.9%, respectively. Among the top losers, Islamic Holding Group declined 10.0%, while Dlala Brokerage & Investments Holding was down 7.9%. GCC Commentary Saudi Arabia: The TASI Index rose 8.9% to close at 8,320.6. Gains were led by the Transport and Industrial Investment, indices rising 11.9% and 10.2%, respectively. Ace Arabia Coop. Ins. and Riyad Bank were up 10.0% each. Dubai: The DFM Index gained 13.0% to close at 3,426.7. The Services and Real Estate & Construction indices surged 15.0% each. Arabtec and Emaar Malls Group were up 15.0% each. Abu Dhabi: The ADX benchmark index rose 6.7% to close at 4,365.2. The Real Estate index surged 14.8%, while the Energy index rose 10.7%. Abu Dhabi Commercial Bank and Aldar Properties were up 15.0% each. Kuwait: The KSE Index rose 1.9% to close at 6,230.1. The Real Estate index gained 3.4%, while the Financial Services index was up 3.3%. Al Qurain Holding surged 16.0%, while Al-Dar National Real Estate Co. was up 13.9%. Oman: The MSM Index rose 3.7% to close at 5,684.7. Gains were led by the Financial and Services indices, rising 4.1% and 2.7%, respectively. Bank Sohar gained 9.8%, while Almaha Ceramics was up 9.5%. Bahrain: The BHB Index gained 0.9% to close at 1,390.0. The Industrial index rose 1.4%, while the Investment index was up 1.2%. United Gulf Bank rose 9.5%, while Al-Ahli United Bank was up 2.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Gulf International Services 79.50 10.0 819.8 62.9 Salam International Investment Co. 13.18 4.9 533.1 1.3 Qatar General Ins. and Reins. Co. 44.80 4.2 1.0 12.2 Qatar Oman Investment Co. 11.76 4.1 282.0 (6.1) QNB Group 210.00 3.3 343.2 22.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.00 0.0 2,389.8 30.7 Barwa Real Estate Co. 35.50 (3.8) 1,645.7 19.1 Ezdan Holding Group 13.32 1.1 1,098.3 (21.6) Masraf Al Rayan 41.70 0.2 980.8 33.2 Commercial Bank of Qatar 62.50 (0.5) 905.4 5.9 Market Indicators 17 Dec 14 16 Dec 14 %Chg. Value Traded (QR mn) 643.1 929.4 (30.8) Exch. Market Cap. (QR mn) 618,599.9 611,961.3 1.1 Volume (mn) 14.1 20.3 (30.5) Number of Transactions 7,846 8,192 (4.2) Companies Traded 41 41 0.0 Market Breadth 25:12 5:34 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,677.33 1.1 (5.3) 12.5 N/A All Share Index 2,851.86 1.0 (5.7) 10.2 13.6 Banks 3,020.15 1.6 (1.6) 23.6 14.0 Industrials 3,607.57 0.9 (7.3) 3.1 12.6 Transportation 2,030.21 1.0 (6.9) 9.2 11.9 Real Estate 1,968.80 (0.1) (13.0) 0.8 17.2 Insurance 3,349.85 1.2 (3.6) 43.4 10.3 Telecoms 1,278.80 0.0 (6.8) (12.0) 17.7 Consumer 6,075.93 0.9 (8.7) 2.1 24.4 Al Rayan Islamic Index 3,599.81 (0.1) (9.4) 18.6 15.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Com. Bank Abu Dhabi 6.90 15.0 12,713.8 6.2 Dana Gas Abu Dhabi 0.46 15.0 45,688.3 (49.5) Aldar Properties Abu Dhabi 2.30 15.0 39,088.1 (16.7) Arabtec Holding Co. Dubai 2.76 15.0 127,305.2 34.6 Drake & Scull Int. Dubai 0.75 15.0 19,680.1 (47.7) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Mobile Telecom. Kuwait 1.32 (4.3) 3.0 (25.0) Boubyan Petrochem. Co. Kuwait 0.61 (1.6) 54.6 (1.5) Bahrain Telecom Co. Bahrain 0.33 (1.2) 21.8 15.5 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 146.30 (10.0) 41.5 218.0 Dlala Brokerage & Inv. Hold. Co. 36.00 (7.9) 255.7 62.9 Qatar Islamic Insurance Co. 64.60 (6.8) 2.6 11.6 Barwa Real Estate Co. 35.50 (3.8) 1,645.7 19.1 Qatar Electricity & Water Co. 165.70 (2.5) 258.1 0.2 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 210.00 3.3 71,098.3 22.1 Gulf International Services 79.50 10.0 63,643.1 62.9 Barwa Real Estate Co. 35.50 (3.8) 59,884.9 19.1 Industries Qatar 162.00 (0.1) 57,919.1 (4.1) Commercial Bank of Qatar 62.50 (0.5) 56,458.9 5.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar*# 11,181.65 1.1 (5.3) (12.4) 7.7 176.60 169,867.5 14.4 1.8 4.2 Dubai 3,426.70 13.0 (4.7) (20.0) 1.7 508.18 81,447.8 9.9 1.3 5.8 Abu Dhabi 4,365.19 6.7 (0.1) (6.6) 1.7 182.97 120,341.6 11.8 1.5 3.8 Saudi Arabia 8,320.55 8.9 (0.9) (3.5) (2.5) 3,000.30 486,250.1 15.8 2.0 3.3 Kuwait 6,230.09 1.9 (3.6) (7.7) (17.5) 157.67 94,725.8 16.0 1.0 4.1 Oman 5,684.68 3.7 (2.1) (12.6) (16.8) 20.32 22,150.0 8.0 1.2 5.0 Bahrain 1,389.96 0.9 (0.0) (2.7) 11.3 0.92 53,502.3 10.1 0.9 4.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, MSM, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any; # Values as of 17 December, 2014) 11,000 11,050 11,100 11,150 11,200 11,250 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QSE Index rose 1.1% to close at 11,181.7. The Banks & Financial Ser. and Insurance indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from non-Qatari shareholders. Gulf International Services and Salam International Investment Co. were the top gainers, rising 10.0% and 4.9%, respectively. Among the top losers, Islamic Holding Group declined 10.0%, while Dlala Brokerage & Invest. Holding Co. was down 7.9%. Volume of shares traded on Wednesday fell by 30.5% to 14.1mn from 20.3mn on Tuesday. However, as compared to the 30-day moving average of 13.5mn, volume for the day was 4.2% higher. Vodafone Qatar and Barwa Real Estate Co. were the most active stocks, contributing 17.0% and 11.7% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Arab National Bank (ANB) S&P Saudi Arabia LT CCR/ST CCR A/A-1 A/A-1 – Stable Banque Saudi Fransi (BSF) S&P Saudi Arabia LT CCR/ST CCR A/A-1 A/A-1 – Stable The Saudi British Bank (SABB) S&P Saudi Arabia LT CCR/ST CCR A/A-1 A/A-1 – Stable Source: News reports (* LT – Long Term, ST – Short Term, FSR– Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, CCR – Counterparty Credit Ratings, CR – Corporate Rating) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 12/18 US Department of Labor Initial Jobless Claims 13-December 289K 295K 295K 12/18 US Department of Labor Continuing Claims 6-December 2,373K 2,436K 2,520K 12/18 US Markit Markit US Composite PMI December 53.8 – 56.1 12/18 US Markit Markit US Services PMI December 53.6 56.3 56.2 12/18 US Bloomberg Bloomberg Consumer Comfort 14-December 41.7 – 41.3 12/18 US Bloomberg Bloomberg Economic Expectations December 51.0 – 47.0 12/18 US Philadelphia Fed. Res. Philadelphia Fed Business Outlook December 24.5 26.0 40.8 12/18 EU Eurostat Construction Output MoM October 1.30% – -1.00% 12/18 EU Eurostat Construction Output YoY October 1.40% – -2.00% 12/19 EU European Central Bank ECB Current Account SA October 20.5B – 32.0B 12/19 EU European Central Bank Current Account NSA October 30.6B – 32.9B 12/19 France INSEE National Stat. Offi Own-Company Production Outlook December 4.0 – 8.0 12/19 France INSEE National Stat. Offi Production Outlook Indicator December -16.0 – -16.0 12/19 France INSEE National Stat. Offi Manufacturing Confidence December 99.0 99.0 99.0 12/19 France INSEE National Stat. Offi Business Confidence December 94.0 95.0 94.0 12/18 Germany IFO Institute IFO Business Climate December 105.5 105.5 104.7 12/18 Germany IFO Institute -Institut fuer IFO Current Assessment December 110.0 110.4 110.0 12/18 Germany IFO Institute Institut fuer IFO Expectations December 101.1 100.5 99.8 12/19 Germany Federal Statistical Off PPI MoM November 0.00% -0.20% -0.20% 12/19 Germany Federal Statistical Off PPI YoY November -0.90% -1.10% -1.00% 12/19 Germany GfK AG GfK Consumer Confidence January 9.0 8.8 8.7 12/19 Italy ISTAT Industrial Sales MoM October 0.40% – -0.40% 12/19 Italy ISTAT Industrial Sales WDA YoY October -0.70% – -2.20% 12/19 Italy ISTAT Industrial Orders MoM October 0.10% – -1.50% 12/19 Italy ISTAT Industrial Orders NSA YoY October -0.20% – -0.40% 12/19 Italy ISTAT Hourly Wages MoM November 0.10% – 0.10% 12/19 Italy ISTAT Hourly Wages YoY November 1.10% – 1.00% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 58.22% 44.25% 89,837,191.06 Non-Qatari 41.78% 55.74% (89,837,191.06)

- 3. Page 3 of 9 News Qatar MDPS: Qatar November CPI rises 3% YoY – According to the Ministry of Development Planning & Statistics (MDPS), the Consumer Price Index (CPI) in Qatar reached 119.0 points in November 2014, showing no change, as compared to the CPI of October 2014, but rising 3.0% YoY over November 2013. This stability resulted from the combined effect of price changes in the main groups. The price increases are observed in most of the groups: garments & footwear by 0.2%, rentals, fuel & energy by 0.1%, furniture, textiles & home appliances by 0.1%, entertainment, recreation & culture by 0.3%. On the other hand, the prices of transport & communication, and miscellaneous goods & services fell 0.3% and 0.7% respectively, during this month. However, the prices of food, beverages & tobacco, and medical care remained unchanged. On a YoY basis, the price increases are observed in all of the groups except miscellaneous goods & services where the index decline by 0.4%. Increases have been registered in: food, beverages & tobacco by 0. 1%, garments and footwear by 2.9%, rentals, fuel & energy by 7.6%, (mainly hikes noticed in rentals of residential buildings), furniture, textiles & home appliances by 3.8%, medical care by 0.8%, transport and communication and miscellaneous goods & services by 1.5% each. The CPI of November 2014, excluding rentals, fuel and energy group, reached 128.4 points, recording a decrease of 0.1% as compared to October 2014 and a rise by 1.4% as compared to November 2013. (QSA) NBK: Qatar’s current account surplus to narrow in 2015 – According to the National Bank of Kuwait’s (NBK) ‘MENA Outlook for 1Q2015’, Qatar’s current account surplus, which stands at an estimated 27.6% of GDP in 2014, is projected to narrow to 21.2% in 2015 and 16.6% of GDP in 2016 due to a combination of factors. The surplus, which is quite large by international standards, will decrease due to stagnating LNG and crude oil exports, softer energy prices and rising imports. While export growth is expected to level off, the commissioning of the Barzan facility should provide some increase in exports of products associated with gas production. On the other hand, imports will continue to be spurred by population growth and the needs of the development plan. The NBK outlook expects the pace of accumulation of foreign exchange reserves will slow, which increased to a record high of $45.3bn in October 2014. Meanwhile, NBK expects Qatar’s budget surplus to narrow down from an estimated 10.8% of GDP in 2014 to 8.0% and 5.0% of GDP in 2015 and 2016, respectively. Revenue growth is expected to moderate due to the impact of lower energy prices on hydrocarbon revenues, which account for at least 55% of total state revenues. An environment of softer oil and gas prices is expected to persist during the forecast period. Exports of manufactured products, receipts from corporate taxes and income from investments, on the other hand, are expected to increase. On the expenditures side, development spending including outlays on public infrastructure projects is expected to accelerate and come in above 35% of total expenditures and 10% of GDP as project execution picks up. However, the current expenditure growth, including salaries, is expected to be more restrained. (Peninsula Qatar) QNBFS: Public sector pulls down Qatar banks’ credit growth in November – The loan book decreased by 0.1% MoM (up 7.8% YTD) while deposits increased by 1.2% MoM (+9.3% YTD) in the month of November 2014. Public sector pulled total credit growth down (down 2.4% MoM in November), as private sector posted a healthy growth of 1.5% MoM. Moreover, deposits gained by 1.2% MoM (deposits were flat MoM in the month of October). Thus, the LDR declined to 104% vs. 105% in October. The public sector deposits increased by 0.1% MoM (+6.4% YTD 2014) for the month of November 2014. Delving into segment details, the government institutions’ segment (represents ~58% of public sector deposits) improved by 1.8% MoM (+13.4% YTD 2014). Moreover, the semi- government institutions’ segment posted a growth of 5.7% MoM (up 5.8% YTD 2014). However, the government segment decreased by 6.3% MoM (down 6.0% YTD). On the other hand, private sector deposits increased by 0.4% MoM (+9.6% YTD 2014). On the private sector front, the companies & institutions’ segment increased by 1.0% MoM (+9.1% YTD 2014) while the consumer segment posted a decline of 0.1% MoM (up 10.0% YTD). Non-resident deposits drove the growth MoM (+15.1% MoM and +26.8% YTD). The overall loan book posted a flat performance. Total domestic public sector loans decreased by 2.4% MoM (also down 7.9% YTD). The government segment’s loan book went down by 10.7% MoM (also down 9.3% YTD 2014). Moreover, the government institutions’ segment (represents ~60% of public sector loans) declined by 1.1% MoM and is down 12.8% YTD. However, the semi-government institutions’ segment grew by 6.6% MoM (+18.8% YTD). Hence, the government and government institutions pulled the overall loan book down for the month of November 2014. Private sector loans gained by 1.5% MoM and are up 15.5% YTD. General Trade followed by Services and Contractors positively contributed toward the loan growth. On the other hand, the Real Estate sector pulled credit growth down in the month of November 2014. General Trade (contributes ~14% to private sector loans) increased by 4.9% MoM. Services (contributes ~18% to private sector loans) increased by 3.4% MoM (+15.6% YTD). Contractors (contributes ~9% to private sector loans) increased by 2.1% MoM. However, Real Estate segment (contributes ~26% to private sector loans) declined by 0.5% MoM (+5.2% YTD). Overall, the segments representing General Trade (+33.3% YTD) and Contractors (+25.6% YTD) are the best performing segments in the private sector YTD. On the other hand, the Industry segment is flattish YTD. (QNBFS Research) Suez Environnement gets €94mn contract for Doha West wastewater treatment plant expansion – The Public Works Authority (Ashghal) has commissioned Suez Environnement through its subsidiary Degrémont, in a consortium with its Japanese partner Marubeni Corporation, to expand the Doha West wastewater treatment and recycling plant. The total contract is worth €178mn, out of which €94mn is for Suez Environnement. This expansion will increase the plant’s treatment capacity by an additional 105,000 cubic meters a day to 280,000 cubic meters a day. The plant will be able to manage the wastewater of 1,040,000 people in Doha city. (Company Press Release) QTA: $45bn investments seen in tourism projects in Qatar up to 2030 – The Qatar Tourism Authority’s (QTA) Chairman, Issa bin Mohamed Al-Mohannadi, said that investments worth up to $45bn are projected for tourism-related projects in Qatar up to 2030. There is a projected investment of $11.5bn in the tourism sector alone up to 2030. He said the authority is introducing the National Tourism Strategy 2030 to continue to develop Qatar as a destination while strengthening the tourism industry, which will have various socio-economic benefits on a national scale in addition to helping prepare for the FIFA World Cup. (Zawya) Jeeves of Belgravia forms JV with Fardan Hospitality – Jeeves of Belgravia, a London-based garment care company,

- 4. Page 4 of 9 announced the opening of its operations in Qatar to capitalize on the growing regional demand for world-class dry cleaning and laundry services from the affluent market. The flagship operation is brought to Qatar through a JV between Jeeves of Belgravia Bahrain and Doha-based Al Fardan Hospitality Group. (Bloomberg) GOIC: Qatar’s scientific R&D outlay tops GCC – According to the Gulf Organization for Industrial Consulting (GOIC), Qatar has a solid footing in scientific research & development (R&D) with an allocation of 2.8% of its GDP, which is more than the developed world’s average and much higher than the GCC average. Developed countries allot around 2.5% of their GDP to R&D activities, in which the private sector contributes around 80% of the total cost. Spending on R&D in the GCC countries is low, which is only 0.2% of the GDP. GOIC stated that GCC countries need to improve their performance on the basis of the competitive industrial performance index to identify new industrial scenarios. (GulfBase.com) Part of Al Rayyan Road to remain closed for two and a half months – The Public Works Authority (Ashghal) has announced that it will close a 700 meter stretch of Al Rayyan Road from the Al Diwan intersection to Al Jasra intersection, as part of construction works to develop Al Rayyan Road - Jassim Bin Mohamed Street. The section of the road will remain open in the opposite direction (Al Jasra intersection to Al Diwan intersection). Meanwhile, Ashghal announced the opening of East Industrial Street to traffic after completion of the main construction works. East Industrial Street is one of the major road projects undertaken in the Doha Industrial Area. (Gulf- Times.com) CBQK launches mPOS – The Commercial Bank of Qatar (CBQK) has announced the launch of mPOS (mobile point of sale), a new way of accepting payments specifically designed to support merchants’ growing use of mobile devices. CBQK’s EGM and Head of Retail & Enterprise Dean Proctor said that retail businesses are looking for secure and portable ways to accept payments beyond just cash and promote their business to a broader customer base. (Gulf-Times.com) ORDS offers ‘Cloud Marketplace’ smart technology to SMBs – Ooredoo (ORDS) has launched the Ooredoo ‘Smart Cloud Marketplace’, which enables small & medium-sized businesses (SMBs) to enter Qatar’s smart technology market. SMB customers can rent virtual cloud-based business software and applications on the marketplace’s online portal, which were previously only available for large enterprises and required significant investment. The software applications can be used from any location and on any mobile device, delivering flexibility and value-for-money. The marketplace has been launched with six applications across the fields of security, video collaboration, marketing, storage, backup and homepage builder. (Gulf- Times.com) KCBK BoD approves new budget – Al Khalij Commercial Bank’s (KCBK) board of directors in a meeting approved the new budget as well as discussed on a number of governance items including new and revised policies and considered certain activities, projects and business of the bank. (QSE) International Dollar resumes climb as Fed signals rate rise in 2015 – A gauge of the US dollar rose for the eighth time in nine weeks after the Federal Reserve Chairperson Janet Yellen signaled that the central bank is poised to increase its interest rates in 2015, starting as early as April. The greenback headed for gains this year against almost all currencies, a major feat unaccomplished since 1997, as Yellen said the impact of Russian turmoil on the US economy is small. Meanwhile, Hungary’s forint and the Polish zloty sank on concerns about the economic crisis that has driven the Russian ruble down 44% this year. The Swiss franc weakened the most in two months versus the euro after the central bank introduced negative interest rates. (Bloomberg) Citigroup buys Credit Suisse commodities trading; Deutsche Bank weighs investment bank cuts – Global banking major Citigroup has bought the commodity trading books of Credit Suisse, as the US bank extends its reach in the sector while others retreat. Citigroup will buy Credit Suisse's trading books on base and precious metals, coal, iron ore, freight, crude oil products and US and European natural gas. This move follows its purchase of Deutsche Bank's metals, oils and power books earlier this year. Credit Suisse had announced in July that it was exiting commodities trading as tighter regulations and higher capital requirements squeezed its profits. Meanwhile, Deutsche Bank AG is poised to trim additional businesses at its securities unit to boost returns after scaling back in credit derivatives. Co-CEO Anshu Jain has said Deutsche Bank remains Europe’s last global investment bank, as competitors retreat. The bank’s reliance on debt trading has not been rewarded by investors this year, since revenues declined and capital requirements increased. (Reuters, Bloomberg) GfK: German consumer morale highest in 8 years – A recent survey by research group GfK showed consumer sentiment in Germany reached its highest level in eight years, heading into January as shoppers expect Europe's largest economy to gain momentum. GfK said its forward-looking consumer sentiment indicator, based on a survey of around 2,000 Germans, rose to 9.0 going into January from 8.7 in December. This was the highest reading since December 2006, which beats the Reuters’ consensus forecast for a reading of 8.8. (Reuters) ECB will not hesitate to act if needed; expects negative inflation rate in 2015 – The European Central Bank (ECB) Executive Board Member Peter Praet said that the bank will not hesitate to act if needed, including the possibility of the central bank buying sovereign bonds. With the Eurozone inflation standing far below its target of around 2%, the central bank is ready to review its policy stance early in 2015 and consider printing money to buy sovereign bonds (quantitative easing). This strategy is widely seen as the ECB's last resort to prevent a slide into deflation since it has largely exhausted its policy tool- kit, with its main interest rate at a record-low 0.05%. Meanwhile, ECB Vice President Vitor Constancio said he expected the Eurozone inflation rate to turn negative in the coming months but said that this was just a temporary phenomenon and he did not see a risk of deflation. Annual inflation in the Eurozone slowed to 0.3% in November as energy prices fell, putting it well below the ECB's target. In early December, the ECB had forecast 0.7% inflation for 2015, but Constancio told oil prices had fallen by an extra 15% since then and that, while this should support growth and so drive up inflation in the longer term, it created a tricky situation in the short-term. (Reuters) BoJ keeps record easing as oil price tumble – The Bank of Japan (BoJ) maintained its unprecedented stimulus, as Governor Haruhiko Kuroda’s bid to stoke inflation faces increasing challenges from the recent tumble in crude oil prices. The central bank said that it will boost the monetary base at an annual pace of $670bn. Kuroda said the slide in oil could weigh on consumer price gains in the first half of the year starting in April 2015. The BoJ said Japanese exports have shown signs of picking up, while production has started to bottom out, striking a

- 5. Page 5 of 9 more upbeat tone in its view of the world’s third-largest economy. Oil has lost more than a quarter of its value since the central bank boosted easing on October 31 to end a deflationary mindset. (Bloomberg) China cuts red-tape for foreign bank branches; revises 3Q2014 current account surplus – China has cut red-tape for foreign bank branch openings and entry into Chinese Renminbi (RMB) business, the latest in a series of measures to liberalize the banking sector. The state cabinet revised the existing rules by abolishing the requirement for foreign-owned and joint-stock banks to inject CNY100mn or an equivalent in other currencies of working capital into a newly opened branch, which should speed up the approval process. These revisions also lower the threshold for foreign banks to enter the RMB business. Meanwhile, the State Administration of Foreign Exchange said that the country revised down its current account surplus for 3Q2014 to $72.2bn from a preliminary figure of $81.5bn. The foreign exchange regulator also sharply revised down the country's capital and financial account deficit for 3Q2014 to $9bn from $81.6bn. (Reuters) Regional BHB sign MoU with DFM for swift transfer of securities from 2H2015 – Bahrain Bourse (BHB) signed a MoU with Dubai Financial Market (DFM) to introduce an electronic system that represents a significant advance in the method of share transfer between the two exchanges, by enabling investors to transfer their shares easily and quickly. DFM listed securities currently include three Bahraini companies: Gulf Finance House, Al Salam Bahrain Bank and Arab Insurance Group (ARIG). It has been agreed to introduce the new electronic system during the 2H2015, enabling swift share transfers to be executed during the official working hours of the exchanges. A total of 4,707,846,560 shares in those companies have been transferred to DFM. This MoU underlines the strong cooperation between both markets which aims at achieving the ultimate objective of integrating GCC markets and improve the quality of services provided to investors and companies. (Bahrain Bourse) IDC: MEA ICT spending to cross $270bn in 2015 – International Data Corporation’s (IDC) Software Research Manager Megha Kumar said accelerating innovation on social, mobile, cloud and big data is expected to fuel information and communications technology (ICT) spending in the Middle East and Africa (MEA) by 9% in 2015 to more than $270bn. Among the Gulf countries, Qatar is expected to see the biggest percentage growth in spending (by 11.36%), followed by Saudi Arabia by 5.44% and the UAE by 5.32%. She said majority of the growth will come from software, services and mobile phones, while wireless and fixed data will drive the growth in telecom services. (GulfBase.com) StanChart: Oil decline may hit GCC fiscal balance, growth – According to a report by Standard Chartered bank (StanChart), Gulf countries may see an impact on their fiscal balances and growth from the drop in Brent crude oil prices and the possibility of production cuts later in 2015. StanChart said that positive signals are seen in MENA (Middle East and North Africa) economies that have gone through political transitions, and are now undergoing economic transitions and implementing the right economic reforms. StanChart see three important themes for the region in 2015. First, the growth dynamics of the major oil exporters will be adversely affected, while positive growth signals is seen from some oil importers that have implemented reforms and are benefiting from investment inflows. Second, as recent oil-price moves have shown, fiscal spending that is heavily dependent on the hydrocarbon sector cannot rise indefinitely. Finally, reducing high energy subsidies in the MENA region may be crucial to provide economies the fiscal leeway needed to meet growing investment need. (GulfBase.com) Fitch: Oil prices, policies & politics to dominate MEA in 2015 – Fitch Ratings, in its 2015 Outlook for the Middle East and Africa (MEA) region, said that falling oil prices, the policy response of oil exporters, reform momentum and politics, will be the main influence on ratings in the MEA in 2015. High oil prices have been one factor resulting in rating divergence in the region and this influence will lessen as oil exporters come under pressure, while oil importers will benefit. Fitch forecasts Brent to average $83 per barrel in 2015 after $99 per barrel in 2014. This will not cause major headaches for the AA rated Gulf oil producers - Abu Dhabi, Kuwait and Saudi Arabia - which have accumulated large buffers. However, it will increase pressure on Bahrain (BBB/Stable) and the sub-investment grade exporters in Africa - Nigeria, Angola and Gabon (all BB-). (GulfBase.com) Moody’s: Bahrain, Oman may mull debt issuance – According to Moody's Investors Service, Bahrain and Oman is likely to finance any increase in fiscal deficits next year through sovereign debt issuance. The ratings agency said that while the six GCC states can withstand the pressure of oil prices averaging around its estimate of $80 to $85 a barrel next year, Bahrain and Oman's credit profiles may be affected, because the two sovereigns exhibit a combination of high fiscal breakeven oil prices and low reserve buffers. As per the report, most of the GCC states can withstand the pressures resulting from lower oil prices without having to make significant policy adjustments, but that they would, if needed, likely to adjust their fiscal policies accordingly. Kuwait and Qatar are the most resilient, given their very low fiscal and external breakeven oil prices, and large reserve buffers, while Saudi Arabia and the UAE exhibit slightly weaker fiscal fundamentals and higher external breakeven oil prices than Kuwait and Qatar. Moody's expects that Saudi Arabia's fiscal balance will turn into a deficit in 2015, and Bahrain and Oman's deficits may widen to above 7% of their respective GDP. All GCC countries except Oman should show current account surpluses next year. The report also said that GCC governments' fiscal adjustments to lower oil prices will vary, starting with expenditure adjustments on non- strategic investment projects. (GulfBase.com) Reuters: Oil fall won’t derail $500bn gulf infrastructure boom – According to Reuters, slumping oil prices will not halt a massive ramp-up in Gulf infrastructure spending, as rich nations deploy huge reserves to maintain a breakneck development pace and the rest turn to buoyant funding markets. However, states are being urged to consider the most effective funding mix for these schemes in the longer term, especially against a backdrop of lower oil prices. The World Bank estimates up to $500bn will be spent by gulf countries on infrastructure by 2020, as governments seek to improve the lives of citizens and create jobs. With trillions of dollars of reserves between them, Saudi Arabia, Abu Dhabi and Qatar have been increasingly by-passing banks due to frustration at the time it takes to get funding. According to the Ministry of Development Planning and Statistics (MDPS) of Qatar, more reliance on self-financing supported by large fiscal surpluses pushed outstanding credit to the public sector down 3.7% between January and August 2014. Gulf infrastructure loans totaled $8.94bn in 9M2014, compared with $16.12bn in 2013. (GulfBase.com) Lithium Technologies makes significant strides in Mideast – Lithium Technologies, San Francisco based company which connects brands with their customers on social platforms, announced that it has made significant strides in the Middle East (Mideast). In 2014, several new customers in the Middle East

- 6. Page 6 of 9 launched Lithium solutions, including Axiom Telecom, DenizBank, National Bank of Kuwait, Ooredoo Qatar and Turkcell. With more than 40% the total Mideast population accessing the web and 88% of that online population using social media daily, brands are taking note and advancing their social strategies with Lithium. Lithium is seeing telecommunications and financial service companies at the forefront of using digital platforms to connect with their customers. (GulfBase.com) Kellogg outbids Abraaj for third time in race for Egypt's Bisco – Kellogg Company has again raised its bid for Egypt- based Bisco Misr, outbidding private equity group Abraaj for the third time and snatching the lead in a $140mn takeover battle. Kellogg said it would improve its offer to Egyptian pound (EGP) 86.36 per share, hoping to secure a brand that will give it a high profile presence in the Arab world's most populous nation. Abraaj had earlier increased its own bid to EGP 84.66 per share, topping a previous Kellogg offer. (Reuters) Al Alamiya receives SAMA’s approval for insurance product – Al Alamiya for Cooperative Insurance Company (Al Alamiya) has obtained Saudi Arabian Monetary Agency’s (SAMA) final approval for the product: Fire & allied perils insurance. (Tadawul) Ma’aden to compensate shareholders not participated in rights issue – Saudi Arabian Mining Company (Ma’aden) announced that it will pay compensation to shareholders who have not exercised their rights to subscribe the rights issue, as well as to holders of fractional shares. A total of SR76.52mn will be paid to shareholders who have not exercised their subscription rights in whole or in part, as well as to holders of fractional shares. Ma’aden has appointed the National Commercial Bank (NCB) to deposit the compensation amounts in shareholders’ accounts. (Tadawul) eXtra opens Apple outlets in Riyadh, Al Khobar – United Electronics Company (eXtra) has opened Apple’s first generation stores in Saudi Arabia, following a successful three- year collaboration between the two companies. The outlets will be located in eXtra’s shops in Riyadh and Al Khobar and will offer a wide range of Apple accessories. (GulfBase.com) SABIC eyeing cash dividend – Saudi Basic Industries Corporation (SABIC) board of directors proposed to pay a cash dividend of SR3 per share for the 2H2014. (GulfBase.com) SHB BoD recommends SR476.3mn dividend for 2014; proposes 20% capital increase – Saudi Hollandi Bank (SHB) board of directors has recommended the distribution of SR1 per share cash dividend for the financial year 2014, representing 10% of stock par value and totaling SR476.3mn. Additionally, the BoD recommended increasing capital by 20% from SR4.76bn to SR5.72bn to support its capital base and the business growth. This increase shall be implemented by distributing one-for-five bonus shares, thus raising share capital from 476.28mn shares to 571.54mn shares. The SR952.6mn capital increases shall be financed from retained earnings. This recommendation is subject to the approval at extraordinary general meeting (EGM) which will be held in 1Q2015, after obtaining the approval of concerned authorities. Shareholders registered at the conclusion of the day of EGM will be eligible for cash dividends and bonus shares. The cash dividends will not accrue to bonus shares. (Tadawul) JODI: Kingdom’s crude exports rise to around 6.9mn bpd in October 2014 – According to data published by the Joint Organizations Data Initiative (JODI), Saudi Arabia shipped more crude oil in October than September while volumes used by domestic refineries remained high allowing more oil products exports. Saudi Arabia exported 6.897mn barrels per day (bpd) of crude in October 2014, up from 6.722mn bpd in September 2014, while production was slightly lower in October 2014 at 9.69mn bpd from 9.704mn bpd. As per the report, oil products exports rose to 909,000 bpd in October 2014 from 787,000 bpd in September 2014, while domestic refiners processed 2.061mn bpd of crude in October 2014, almost flat from 2.035mn bpd in September 2014. Oil markets monitor changes in output from Saudi Arabia, which has enough spare capacity to significantly alter production according to demand. (GulfBase.com) Massive spending to continue in Kingdom despite 50% oil price drop – Saudi Arabia’s Finance Minister (FM), Ibrahim Al- Assaf said that the Kingdom will continue massive public spending despite a 50% drop in the price of oil, which provides the bulk of its revenue. The minister said the 2015 budget is ready and would be unveiled in the near future. Al-Assaf said the budget comes during challenging global economic conditions but surpluses and reserves built over many years by the Kingdom have given it depth and a line of defense that comes in handy in times of need. He said this policy would continue, enabling the government to implement massive projects in health, education, social services and development as well as state security. The spending, combined with private sector activity, is expected to bring positive economic growth. (GulfBase.com) Low oil prices not to affect the UAE – UAE Minister of Energy (MoE), Suhail bin Mohammad Faraj Faris Al Mazroui has stressed that the UAE will continue making investments in the oil & gas industries, and that with its balanced and long-term policy, the country will not be affected by the decline in oil prices, especially if they do not decline for a long time. He said that OPEC did not contribute to the increase in supply. It has a fixed share on the global market which does not exceed 30%. So it is not logical to expect OPEC to resolve the effects of market oversupply. He stressed that any change in the output policy must be well thought out and that the new producers must assume their responsibilities to balance the market for everyone’s benefit. (GulfBase.com) Al Thuriah hands over 70% of Sahara 3 project – UAE-based property developer, Al Thuriah announced the handing over of 70% of the Sahara 3 project to buyers and investors. Sahara Tower 3 is part of Sahara Complex consisting of a ground floor and three floors of parking and twenty residential floors, in addition to the helicopter landing pad on the roof and pool hall located on the ground floor. It is located in Al Nahda, Sharjah, near the prominent Sahara Shopping Centre, which is very much on the border between Sharjah and Dubai, It is conveniently located to offer easy access to main roads and connect with many Emirates of the country. (GulfBase.com) DSI BoD to discuss shares buy back – Drake & Scull International’s (DSI) board of will discuss the proposal to buy back up to 10% of DSI’s share capital as per laws and regulations, at the seventh board of directors meeting to be held on December 22, 2014. (DFM) DED: Dubai expects real estate to lead economic growth – According to the Department of Economic Development (DED), Dubai is expected to grow by 4.5% in 2015 from an estimated 4% in 2014. Real-estate and construction may expand about 6% each. Preliminary forecasts for 2014 show the property sector will grow by 3.5%. The Emirate has relied on tourism and hospitality since the 2008 real-estate crash. Property prices rebounded last year, prompting authorities to take steps against speculation, including measures to curb mortgage lending and

- 7. Page 7 of 9 the doubling of the transaction tax. Capital spending is expected to remain steady for 2015 though it may slow in the following year if the drop in oil prices continues. (GulfBase.com) DP World wins key investor backing for EZW buy – DP World’s shareholders have approved buying Economic Zones World (EZW) from its majority shareholder and also backed the port operator's delisting from the London Stock Exchange. The assent was granted at a meeting on December 18, 2014 with the proposals received near-unanimous support from independent shareholders. DP World said last month that it would pay $2.6bn to Dubai World for its EZW logistics infrastructure firm and would delist from the London bourse due to thin trading volumes. Dubai World owns 80.45% of DP World. (GulfBase.com) Emaar’s Dubai real estate head leaves amid revamp – According to sources, Emaar Properties’ head of Dubai real estate has left the company amid a revamp of top management. Robert Booth left the job in 2H2014 but he may still act as an adviser to Emaar on some matters. (Bloomberg) Intracom Holdings sells 49% stake in Intracom Telecom – Intracom Holdings announced that it has completed transfer of the remaining 49% of Intracom Telecom to investors in Dubai for €47mn, whereas €35mn are payable in cash and €12mn in assets. (Reuters) Dau Tu: Nakheel to continue $550mn project in Vietnam – According to the Dau Tu (Investment) newspaper, Dubai property developer, Nakheel, said it would propose a plan to restart a delayed $550mn project in Vietnam's northern province of Quang Ninh in January 2015. Chairman of Nakheel, Ali Rashid Lootah, and Quang Ninh authority in 2013 have signed a MoU to continue the project, which was postponed due to financial issues after its groundbreaking in 2007. (Reuters) Regional banks fund Etihad’s first A380, B787 aircrafts – Etihad Airways said that two banks from Abu Dhabi and one from Saudi Arabia funded the airline’s first Airbus A380 and Boeing 787-9 Dreamliner aircrafts. The Abu Dhabi Commercial Bank (ADCB) financed Etihad’s first Airbus A380, while Abu Dhabi’s First Gulf Bank (FGB) and Saudi Arabia’s National Commercial Bank (NCB) have jointly funded several of Etihad’s 787-9 Dreamliners. The three banks funded the aircraft following a request for proposals (RFP). While the amount of the financing was not stated, the airline said that the FGB and NCB facility is Shari’ah-compliant. Meanwhile, Etihad, which owns stakes in nine airlines, said it’s planning no further purchases in the short term and will focus on consolidating existing partnerships. Etihad’s CEO, James Hogan said the airline wants to access secondary cities in China and grow its footprint in Africa, though it is not considering an investment in South African Airways, which earlier said Etihad has an option on a stake. (GulfBase.com, Bloomberg) Fitch affirms Kuwait at AA with Stable outlook – Fitch Ratings has affirmed Kuwait's Long-term foreign and local currency Issuer Default Ratings (IDR) at AA. The outlooks are Stable. The Country Ceiling has been affirmed at AA+ and the Short-term foreign currency IDR at F1+. The Stable outlook reflects Fitch's assessment that upside and downside risks to the rating are currently well balanced. At forecasted oil prices, Kuwait will continue to accumulate assets, further enhancing its capacity to deal with economic shocks. (Reuters) NBK: Kuwait's non-oil growth to hit 5.6% in 2015-16 – According to a report by National Bank of Kuwait (NBK), Kuwait's non-oil real growth is anticipated to go up to 5.6% in 2015-2016, as implementation of the government's development projects maintains its robust pace. Real non-oil growth accelerated notably in 2013 and is expected to maintain a more robust pace in the coming years. The improved growth is driven by capital spending and the government's ambitious development plan. The consumer sector remains a strong driver of economic growth, though it has moderated since 2013. While large pay hikes for Kuwaitis are not expected in the near term, household income growth will remain healthy supported by robust employment growth. As per the report, the latest official figures show that other indicators have also reflected the pick-up in economic activity and the accelerating pace of growth. Private credit growth has been picking up gradually, reaching 7.7% YoY in September 2014. Growth in domestic demand slowed somewhat in 2013 following strong growth the year before. Domestic demand rose by 5.7% in real terms in 2013, following 9% growth in 2012. Most of the moderation came from slower growth in private consumption. Government current spending growth also slowed but maintained a rapid pace of 10%. Meanwhile, momentum in investment is rising, both from government and private sources. The report indicated that total investment spending in Kuwait grew by 6.2% in real terms in 2013 (nominal growth topped 10%). (GulfBase.com) Kuwait Energy discovers oil at East Ras Qattara – Kuwait Energy and its main partner, Egyptian General Petroleum Corporation (EGPC), announced that the exploration well Shahd-4 on the East Ras Qattara development lease, located in the Northern Western Desert onshore Egypt discovered hydrocarbons in the Wadi El Natrun formation (Jurassic) formation. Kuwait Energy holds a 49.5% revenue interest in the East Ras Qattara development lease, while the remaining 50.5% is held by the operating company Sipetrol. (GulfBase.com) AIB announces launch of branch in Sohar – Alizz Islamic Bank (AIB) announced launch of its branch in Sohar. This launch is part of the AIB’s s strategic initiatives to reach new customers with innovative and value added products and services to further boosting the AIB brand in the region. (MSM) Thomson Reuters: Islamic banking in Oman likely to grow at double-digit rate – According a study by Thomson Reuters, Islamic banking in Oman is expected to grow at double-digit rates as Shari’ah-compliant banking products increasingly gain acceptance and the government's plans to ease restrictions come to fruition. Launched in 2012, Oman's nascent Islamic banking segment saw assets surge more than five-fold to OMR1.1bn at the end of 2Q2014. The sector, which comprises two dedicated Shari’ah-compliant lenders and six commercial banks with registered Islamic banking windows, currently represents more than 4% of Oman's total banking assets, but this may increase to 10% by 2018 if the best-case scenario for asset growth is achieved. Under a base scenario, the study estimates Islamic banking assets could reach OMR5bn by 2018, a 7% share of estimated total assets. (GulfBase.com) Orpic’s Liwa plastic project to increase petrochemical production – Oman Oil Refineries and Petroleum Industries Company (Orpic) will witness a jump in production capacity of polypropylene and polyethylene to 1.4mn tons, when the company's Liwa plastic project starts production in 2018. Installed capacity of polypropylene at Orpic will go up to 340,000 tons per annum from 220,000 tons, after completing Sohar refinery improvement project. (GulfBase.com) Deadline for Oman Rail commercial bids further extended – Oman Rail, after extending the deadline for the submission of bids for the Segment 1 of its national railway project, has granted further time to bidders to hand in their pricing offers for

- 8. Page 8 of 9 this key package. Accordingly, commercial bids are now due by March 1, 2015. Technical offers, however, must be handed in by January 18, 2015. Bidders have argued that volatility in commodity prices, weakening currencies, as well as wider global economic uncertainty, have complicated the task of pricing bids for contracts as complex and diverse as Segment 1 of the Oman National Railway project. (GulfBase.com) OLC inks deals for $320mn Oman pipeline project – Orpic Logistics Company (OLC) has awarded engineering, procurement and construction (EPC) contract and a financing deal for a major pipeline project worth $320mn in Oman. OLC is a joint venture between Oman Oil Refineries and Petroleum Industries (Orpic) and the Spanish company Compania Logística de Hidrocarburos (CLH). As per the deal, the Oman- based Gulf Petrochemcial Services (GPS) will be the lead contractor in the EPC contract. It will be supported by Abantia, a Spanish construction company, which has experience in terminal construction, along with Diseprosa, an engineering company based in Spain. The financing agreement, which will cover 70% of the project value, has been given to Ahli Bank and Ahli United Bank. (GulfBase.com) Oman’s SGRF boosts buying of local stocks – Oman's State General Reserve Fund’s (SGRF) Executive President, Abdulsalam Al Murshidi said that SGRF has boosted its buying of shares in the local stock market as prices have slid to attractive levels. Muscat Securities Market's (MSM) main index is down 20% from its November 2014 peak, hit by concerns that the plunge in global oil prices will crimp government spending and therefore corporate profit growth. (Reuters) Fitch revises Bahrain's outlook to Negative; affirms at BBB – Fitch Ratings has revised the outlooks on Bahrain's Long-term foreign and local currency Issuer Default Ratings (IDR) to Negative from Stable and affirmed the IDRs at BBB and BBB+, respectively. The agency has simultaneously affirmed Bahrain's Country Ceiling at BBB+ and Short-term foreign currency IDR at F3. (Reuters) BBK divests whole stake in Saudi Mais – Bank of Bahrain and Kuwait (BBK) announced that it has exited its entire ownership stake of 24% in Saudi Mais For Medical Products Limited (Saudi Mais), a Saudi Arabia-based company engaged in the trade and production of medical supplies. Saudi Mais is a private equity investment that was originally made by Capinnova Investment Bank in 2011 and was subsequently transferred to BBK in 2013. (Bahrain Bourse) BNA: Bahrain may start importing Russian gas from 2017 – According to state news agency BNA, Bahrain could start importing gas from Russia in 2017. The gas will be transported by sea from Russia to Bahrain. (GulfBase.com)

- 9. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg (* Value as of 17 December, 2014) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Nov-10 Nov-11 Nov-12 Nov-13 Nov-14 QSE Index S&P Pan Arab S&P GCC 8.9% 1.1% 1.9% 0.9% 3.7% 6.7% 13.0% 0.0% 1.6% 3.2% 4.8% 6.4% 8.0% 9.6% 11.2% 12.8% 14.4% SaudiArabia Qatar* Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,196.35 (0.2) (2.1) (0.8) MSCI World Index 1,717.00 0.6 2.5 3.4 Silver/Ounce 16.08 1.2 (5.6) (17.4) DJ Industrial 17,804.80 0.1 3.0 7.4 Crude Oil (Brent)/Barrel (FM Future) 61.38 3.6 (0.8) (44.6) S&P 500 2,070.65 0.5 3.4 12.0 Crude Oil (WTI)/Barrel (FM Future) 56.52 4.5 (2.2) (42.6) NASDAQ 100 4,765.38 0.4 2.4 14.1 Natural Gas (Henry Hub)/MMBtu 3.44 (6.5) (4.0) (20.9) STOXX 600 340.30 0.0 1.2 (8.0) LPG Propane (Arab Gulf)/Ton 56.50 4.6 3.0 (55.3) DAX 9,786.96 (0.6) 0.2 (9.1) LPG Butane (Arab Gulf)/Ton 68.75 3.8 4.2 (49.4) FTSE 100 6,545.27 1.0 3.3 (8.6) Euro 1.22 (0.5) (1.9) (11.0) CAC 40 4,241.65 (0.5) 1.4 (12.4) Yen 119.50 0.6 0.6 13.5 Nikkei 17,621.40 2.0 0.5 (4.9) GBP 1.56 (0.3) (0.6) (5.6) MSCI EM 944.60 1.0 0.7 (5.8) CHF 1.02 (0.4) (2.1) (9.3) SHANGHAI SE Composite 3,108.60 1.6 5.2 43.0 AUD 0.81 (0.4) (1.4) (8.8) HANG SENG 23,116.63 1.3 (0.6) (0.8) USD Index 89.60 0.4 1.4 11.9 BSE SENSEX 27,371.84 0.3 (1.2) 26.1 RUB 59.62 (3.3) 2.3 81.4 Bovespa 49,650.98 2.2 3.5 (14.4) BRL 0.38 (0.1) (0.2) (11.1) RTS 768.06 0.4 (3.9) (46.8) 160.7 128.8 117.4