QSE gains 0.9% led by Telecom and Industrial indices

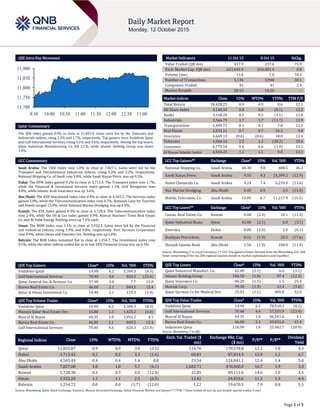

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 0.9% to close at 11,855.9. Gains were led by the Telecoms and Industrials indices, rising 2.2% and 1.7%, respectively. Top gainers were Vodafone Qatar and Gulf International Services, rising 6.2% and 4.6%, respectively. Among the top losers, Qatar Industrial Manufacturing Co. fell 2.1%, while Islamic Holding Group was down 1.8%. GCC Commentary Saudi Arabia: The TASI Index rose 1.8% to close at 7,827.1. Gains were led by the Transport and Petrochemical Industries indices, rising 5.2% and 3.2%, respectively. National Shipping Co. of Saudi rose 9.8%, while Saudi Kayan Petro. was up 9.3%. Dubai: The DFM Index gained 0.2% to close at 3,713.4. The Transport index rose 1.7%, while the Financial & Investment Services index gained 1.1%. Gulf Navigation rose 4.8%, while Islamic Arab Insurance was up 3.6%. Abu Dhabi: The ADX benchmark index rose 0.4% to close at 4,565.5. The Services index gained 5.8%, while the Telecommunication index rose 0.7%. National Corp for Tourism and Hotels surged 15.0%, while National Marine Dredging was up 6.9%. Kuwait: The KSE Index gained 0.3% to close at 5,728.4. The Telecommunication index rose 2.4%, while the Oil & Gas index gained 0.9%. Kuwait Business Town Real Estate Co. and Al-Safat Energy Holding were up 7.1% each. Oman: The MSM Index rose 1.1% to close at 5,932.2. Gains were led by the Financial and Industrial indices, rising 1.9% and 0.8%, respectively. Port Services Corporation rose 8.9%, while Oman and Emirates Inv. Holding was up 6.0%. Bahrain: The BHB Index remained flat to close at 1,254.7. The Investment index rose 0.5%, while the other indices ended flat or in red. GFH Financial Group was up 6.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.90 6.2 5,304.3 (8.3) Gulf International Services 70.40 4.6 824.3 (23.4) Qatar General Ins. & Reinsur. Co. 57.90 3.4 7.7 15.8 Barwa Real Estate Co. 46.00 2.1 849.5 15.4 Qatar & Oman Investment Co. 14.40 2.1 119.3 (1.4) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.90 6.2 5,304.3 (8.3) Mazaya Qatar Real Estate Dev. 16.88 1.3 1,425.2 (6.0) Masraf Al Rayan 44.35 1.0 1,052.2 4.1 Barwa Real Estate Co. 46.00 2.1 849.5 15.4 Gulf International Services 70.40 4.6 824.3 (23.4) Market Indicators 11 Oct 15 8 Oct 15 %Chg. Value Traded (QR mn) 417.9 237.6 75.9 Exch. Market Cap. (QR mn) 621,642.9 616,481.4 0.8 Volume (mn) 13.6 7.6 78.3 Number of Transactions 5,136 3,948 30.1 Companies Traded 42 41 2.4 Market Breadth 28:10 14:26 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,428.25 0.9 0.9 0.6 12.1 All Share Index 3,148.33 0.8 0.8 (0.1) 12.2 Banks 3,168.28 0.5 0.5 (1.1) 12.8 Industrials 3,566.79 1.7 1.7 (11.7) 12.9 Transportation 2,499.71 0.1 0.1 7.8 12.1 Real Estate 2,833.21 0.7 0.7 26.2 9.0 Insurance 4,669.13 (0.6) (0.6) 18.0 12.4 Telecoms 1,066.16 2.2 2.2 (28.2) 30.0 Consumer 6,779.54 0.6 0.6 (1.9) 15.1 Al Rayan Islamic Index 4,504.25 1.1 1.1 9.8 13.1 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% National Shipping Co. Saudi Arabia 46.30 9.8 688.5 36.3 Saudi Kayan Petro. Saudi Arabia 9.55 9.3 24,399.2 (12.9) Nama Chemicals Co. Saudi Arabia 9.24 7.4 6,233.0 (13.6) Nat. Marine Dredging Abu Dhabi 5.45 6.9 3.5 (21.0) Mobile Telecomm. Co. Saudi Arabia 10.09 6.7 11,217.9 (15.5) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Comm. Real Estate Co. Kuwait 0.08 (2.4) 10.1 (11.4) Qatar Industrial Manu. Qatar 42.00 (2.1) 6.0 (3.1) Emirates Dubai 8.86 (2.0) 2.0 (0.3) Boubyan Petrochem. Kuwait 0.51 (1.9) 20.3 (17.6) Sharjah Islamic Bank Abu Dhabi 1.56 (1.9) 100.0 (11.4) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Industrial Manufact. Co. 42.00 (2.1) 6.0 (3.1) Islamic Holding Group 106.50 (1.8) 97.4 (12.3) Qatar Insurance Co. 96.20 (1.5) 1.5 25.5 Mannai Corp. 99.30 (1.3) 42.4 (3.8) Qatar German Co for Medical Dev. 15.43 (1.1) 485.8 52.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Vodafone Qatar 14.90 6.2 78,518.3 (8.3) Gulf International Services 70.40 4.6 57,531.9 (23.4) Masraf Al Rayan 44.35 1.0 46,541.6 4.1 Barwa Real Estate Co. 46.00 2.1 39,031.0 15.4 Industries Qatar 126.90 1.6 25,042.7 (20.9) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,855.87 0.9 0.9 3.4 (3.5) 114.76 170,578.8 12.1 1.8 4.3 Dubai 3,713.42 0.2 0.2 3.3 (1.6) 60.81 87,814.3 12.9 1.2 6.7 Abu Dhabi 4,565.49 0.4 0.4 1.4 0.8 23.54 124,041.1 12.4 1.4 5.0 Saudi Arabia 7,827.08 1.8 1.8 5.7 (6.1) 1,682.71 470,060.0 16.7 1.9 3.3 Kuwait 5,728.38 0.3 0.3 0.0 (12.4) 32.85 89,111.6 14.6 1.0 4.5 Oman 5,932.20 1.1 1.1 2.5 (6.5) 12.42 24,010.6 11.3 1.3 4.4 Bahrain 1,254.72 0.0 0.0 (1.7) (12.0) 1.22 19,670.5 7.9 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,700 11,750 11,800 11,850 11,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index gained 0.9% to close at 11,855.9. The Telecoms and Industrials indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Vodafone Qatar and Gulf International Services were the top gainers, rising 6.2% and 4.6%, respectively. Among the top losers, Qatar Industrial Manufacturing Co. fell 2.1%, while Islamic Holding Group was down 1.8%. Volume of shares traded on Sunday rose by 78.3% to 13.6mn from 7.6mn on Thursday. Further, as compared to the 30-day moving average of 8.4mn, volume for the day was 61.2% higher. Vodafone Qatar and Mazaya Qatar Real Estate Development were the most active stocks, contributing 39.0% and 10.5% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Unikai Foods Dubai AED 80.2 -1.4% 4.3 NA 4.2 NA Sohar Poultry Co. (SPC) Oman OMR 1.8 13.0% 0.0 0.0% 0.0 NA Al Madina Investment Co. * Oman OMR 0.0 -86.8% 0.0 NA -1.4 NA Source: Company data, DFM, ADX, MSM (*2Q-FY2015-16 results) News Qatar QSE suspends trading of IHGS shares on Oct 12 – The Qatar Stock Exchange (QSE) has announced trading suspension of Islamic Holding Group’s (IHGS) shares on October 12, 2015 due to the company’s EGM being held during the day. (QSE) MCGS to announce financial statements on Oct 25 – MediCare Group (MCGS) will disclose its financial reports for the period ending September 30, 2015 on October 25, 2015. (QSE) QIIK to disclose financial statements on Oct 20 – Qatar International Islamic Bank (QIIK) will announce its financial reports for the period ending September 30, 2015 on October 20, 2015. (QSE) MERS to disclose financial statements on Oct 27 – Al Meera Consumer Goods Company (MERS) will announce its financial reports for the period ending September 30, 2015 on October 27, 2015. (QSE) QGTS to announce financial statements on Oct 21 – Qatar Gas Transport Company (QGTS) will disclose its financial reports for the period ending September 30, 2015 on October 21, 2015. (QSE) Energy Minister: Oil prices have bottomed out – Qatari Energy Minister Mohammed Al Sada has said that global oil prices have bottomed out, with signs of a recovery in 2016. He said growth in non-OPEC oil supply slowed substantially in 2015 and is likely to remain flat or turn negative in 2016. Al Sada said that call on OPEC oil is expected to become healthier to 30.5mn barrels a day in 2016 from 29.3mn in 2015, citing increasing demand from both developed and emerging markets. Current low prices have caused oil companies to reduce their capital expenditure by almost 20% in 2015 from $650bn in 2014. This trend of reducing investment in the oil industry could result in production shortfalls down the line. (Bloomberg) UDCD plans to sell 56 villa plots at Giardino Villas – United Development Company (UDCD) is planning to sell 56 villa plots for residential development in Giardino Villas. Open for sale during the three weeks from November 1 to 21, 2015, the plots range in size from 520 to 1,570 square meters. (QSE) Kahramaa: 7.8% growth in water output during 2010-14 – The Qatar General Electricity and Water Corporation (Kahramaa), in a report, has said though the annual average growth in water production was 7.8% between 2010 and 2014, the growth rate fell below 7% in the last two years. While it was only 6.3% in 2013, compared to 2012, this had risen marginally to 6.5% in 2014. What is interesting is that the growth rate was up only by 0.2% in 2014 in spite of a massive growth of over 100,000 in the country’s population in 2014 as compared to 2013. It is understood that the general water and electricity consumption in the country came down in the last two years owing to Kahramaa’s ongoing conservation and preservation campaign of “Tarsheed”, started in April 2012. The report said the latest growth rate in water production was much lower to the period between 2009 and 2010, when the growth was 9.6%. The report also informed that the annual non-revenue water (NRW) generated in the country is falling steadily. The NRW is the difference between the system input volume and water sold to customers. The NRW was reduced from a high of 25% in 2009 to 21.2% in 2014. According to the authorities, the figure went up only between 2012 and 2013, when the rise was 20.5% in 2013 compared to 19.6% in 2012. (Gulf- Times.com) New five-year health strategy from 2017 – Supreme Council of Health (SCH) Director, Public Health, Dr. Mohammad bin Hamad Al Thani has said that the SCH is currently working on the next five- year National Health Strategy 2017-2022, which will lay more emphasis on workers’ health and wellbeing. The new five-year plan will be launched after completion of the current National Health Strategy 2011-2016. It will address a wider area of health issues including work place wellbeing of both blue-collar and white-collar workers. Dr. Al Thani was speaking on the sidelines of Employee Health and Wellbeing Conference which opened on October 11, 2015. (Peninsula Qatar) International Fischer: US economy may merit rate hike later in 2015 − Federal Reserve Vice Chairman Stanley Fischer has said that the US Overall Activity Buy %* Sell %* Net (QR) Qatari 72.94% 74.51% (6,575,790.27) GCC 5.99% 6.17% (782,704.63) Non-Qatari 21.08% 19.32% 7,358,494.90

- 3. Page 3 of 5 economy may be strong enough to merit an interest-rate increase by 2015-end, while cautioning that the policy makers are monitoring slower domestic job growth and international developments in deciding the precise timing of liftoff. He said the increase in rates is an expectation, and not a commitment, and could change if the global economy pushes the US economy further off course. He said considerable uncertainties surrounded the US economic outlook, particularly the drag on exports from slowing global growth, low investment caused by the decline in oil prices and a “disappointing” recent drop in US job growth. Fischer explained that the US unemployment rate, which currently sits at 5.1%, does not fully capture additional forms of slack in the labor market. Fischer was speaking on the sidelines of an IMF meeting where some other central bankers were encouraging the Fed to eliminate uncertainty and move forward with their rate “lift-off.” (Bloomberg, Reuters) Australia confident of support for Pacific trade deal − According to Australian Trade Minister Andrew Robb, the trade deal agreed on in October 2015 by the US and 11 other Pacific-rim nations is important enough to the interests of participating countries that it would secure approval even if Hillary Clinton is elected the US president in 2016. While nations that make up around 40% of the global economy last week struck an accord on the Trans-Pacific Partnership, it still needs to be ratified by domestic lawmakers in each of the countries and could face obstacles. One of those might be Clinton, who is battling to secure the Democratic Party’s presidential nomination and last week voiced opposition to the pact. The agreement, which was announced after final talks in Atlanta, includes provisions to guarantee intellectual property rights for drug makers and reduce tariffs on goods from food to cars. (Bloomberg) PMI: Japan services activity grows at much slower pace in September – Japan’s services sector expanded at a much slower pace in September as compared with August as new business slackened in a sign that domestic demand had ended 3Q2015 on a soft note. The Markit/Nikkei Japan Services Purchasing Managers Index (PMI) fell to a seasonally adjusted 51.4 in September from 53.7 in August, which was the highest since October 2013. The index for new business eased slightly to 51.7 from 52.9 in August, showing growth slowed for two consecutive months. Slowing activity in the services sector could increase concern about the economy after an unexpected decline in August industrial production raised the risk that the economy slipped into recession. (Reuters) China ‘Golden Week’ holiday sales surge − China’s restaurant, cinema and travel sales surged in the ‘Golden Week’ national holiday, providing an indication that robust household spending remains a prop for a slowing economy. The October 1-7 holiday to celebrate the Communist Party’s founding of the People’s Republic in 1949 came this year after a period of historic volatility in China’s financial markets that rattled global confidence in the world’s second-biggest economy. According to the official Xinhua News Agency, more than 750mn trips were taken in the seven days and more than 4mn tourists traveled abroad in the period. The Ministry of Commerce said sales at restaurants and retailers amounted to yuan 1.082tn – that is about equivalent to Kuwait’s total economic output in the whole of 2014 − during the seven days. That was an 11% jump from a year earlier. The Golden Week spending provided further evidence that the transition to a more consumer-led economy is holding up. (Bloomberg) Global shipping rates rise on China supertanker traffic jam − Supertankers hauling crude to China are contending with increased waiting times to unload as some on-land storage depots reach capacity amid an oil-buying binge by the world’s most populous nation. As delays have increased, benchmark daily earnings for the tankers jumped above $100,000 in October 2015 for the first time since the global recession. Data from the Baltic Exchange in London showed day rates for ships delivering Saudi Arabian crude to Japan, a benchmark route, reached $106,381 on October 5, the most since July 2008. The tanker traffic jam shows just how much crude the world’s second biggest importer is buying at a time when economic growth is forecasted to slow to the lowest level in 25 years. China’s crude oil purchases have jumped around 10% this year from 2014, and could help keep prices from crashing. According to the International Energy Agency in Paris, China has amassed 200mn barrels of crude in reserves as oil prices slump, and aims to have 500mn barrels by the end of the decade. (Bloomberg) Regional OPEC: Oil demand to grow, market to get more balanced in 2016 − OPEC Secretary-General Abdalla Salem El-Badri has said that oil demand would grow and non-OPEC supply would contract, as he estimated a more balanced market in 2016. El-Badri said the oil industry’s best days are yet to come, as demand would grow to 110mn barrels per day (bpd) by 2040. He added the market remains oversupplied and stocks are above their 5-year average. World crude output is at 75mn bpd and other liquids add around 18mn bpd to global supply. (Bloomberg) AXA Cooperative gets SAMA approval for insurance product – AXA Cooperative Insurance Company has obtained the Saudi Arabian Monetary Agency’s (SAMA) final approval for its visitor’s insurance product, which is designed to insure individuals wishing to obtain visit visa to Saudi Arabia. (Tadawul) ANB Insurance invests SR10mn in ANB’s Sukuk issue – Metlife AIG ANB Insurance Company (ANB Insurance) has invested SR10mn in Arab National Bank’s (ANB) Sukuk issue. The financial impact of the investment will reflect in 4Q2015 financials. (Tadawul) Saudi Aramco appoints acting senior VP for upstream operations – Saudi Arabian Oil Company (Saudi Aramco) has appointed Mohammed Al-Qahtani as acting senior vice-president (VP) for upstream operations until 2015-end. Mr. Qahtani replaces Amin Nasser, who was appointed CEO and President of the company in September 2015. Meanwhile, sources reported that Saudi Aramco is considering building a $20bn refining and petrochemical complex at Yanbu on the Red Sea coast. The new refinery would have a capacity of 400,000 barrels per day and stand next to an existing refinery at Yanbu. (Reuters) France to agree on aerospace deals with KSA – According to sources, Saudi Arabia and France will agree on big aerospace contracts when French Prime Minister Manuel Valls visits the kingdom on October 13, 2015. Reportedly, important contracts would be agreed with Saudi and there would be a military contract with Airbus Helicopters. Recently, Saudi has shown interest in purchasing flexible assault naval vessels like the Mistral helicopter carriers sold to Egypt as well as multi-purpose Fremm frigates. (Reuters) Saudi regulator suspends trading in Mobily shares – The Saudi’s Capital Market Authority (CMA) suspended trading in Etihad Etisalat Company’s (Mobily) shares on October 11, pending the mobile firm’s response to the preliminary findings of a regulator panel investigating its restatement of over two years of earnings. Mobily restated 27 months of earnings to March 31, 2015, slashing its total profits over the period by nearly SR1.76bn. Mobily first revealed there were errors in its financial statements on November 3, 2014, its shares have fallen 63% since. (Reuters) NCB net profit up 6.69% YoY in 3Q2015 – National Commercial Bank (NCB) has reported a net profit of SR1.99bn in 3Q2015 as compared to SR1.87bn in 3Q2014, representing a YoY increase of 6.69%. The bank’s total assets grew 9% YoY to reach SR477.31bn

- 4. Page 4 of 5 at the end of September 30, 2015 as compared to SR437.91bn on September 30, 2014. Loans & advances portfolio reached SR237.25bn, while customer deposits stood at SR363.72bn. EPS amounted to SR3.49 in 3Q2015 versus SR3.42 in 3Q2014. (Tadawul) SAMA approves Bupa Arabia’s insurance product – Bupa Arabia for Cooperative Insurance Company has obtained the Saudi Arabian Monetary Agency’s (SAMA) approval for its Inbound Travel Health Insurance product. The product is designed to insure individuals wishing to obtain visit visa to Saudi Arabia. (Tadawul) Tasweek: UAE property market resilient in 3Q2015 – According to a report by Tasweek, the UAE’s real estate market has managed to perform resiliently in 3Q2015. As per the report, the prices did not go down as significantly as expected except in some cases, with local consultancies now saying that the time is right for tenants to become homeowners given how equated monthly installments are falling below the monthly rental outgo. Tasweek warned that the ongoing slump in oil prices may eventually affect the overall management of various expenses and have a trickle-down effect on the domestic economy that should be watched out for. The report added that it is now mandatory for prospective homebuyers to shell out 25% as down payment for completed properties. (GulfBase.com) UAE aims to increase contribution of non-oil GDP to 80% – UAE Minister of Economy Sultan Bin Saeed Al Mansouri has said that the government is planning to increase the contribution of the non-oil sector to the nation’s gross domestic product (GDP) to 80% from the present figure of 70% in the next 10 to 15 years. He said the growth rate recorded by the UAE economy last year was 4.6% while the total GDP was $1.47tn. He added the government has a policy of economic diversification to reduce the contribution of the oil sector to just 20% to the overall GDP. (GulfBase.com) Takaful Emarat invites shareholders to subscribe for capital increase – Takaful Emarat - Insurance has obtained the Securities & Commodities Authority’s approval to invite its shareholders to subscribe for the company’s capital increase. Earlier, on December 22, 2014, the company’s extraordinary general assembly had given its nod to increasing capital by up to AED100mn. The company has decided to increase its capital from AED100mn to AED150mn, through the issuance of 50mn shares with a nominal value of AED1 each. Takaful Emarat will use the proceeds to finance its growth and projects development’s plan in Dubai. (DFM) Buroj Property to build €4.3bn tourist resort in Bosnia – Dubai’s Buroj Property Development is planning to invest €4.3bn to build a luxury tourist resort near Sarajevo, Bosnia. The Buroj Ozone will stretch over an area of 1.3mn square meters and include thousands of housing units, hotels and the largest shopping center in Bosnia. The initial investment in the project is worth around €920mn, while the total investment will amount to €4.3bn over the next eight years. Construction would begin in April or May 2016 pending a resolution of regulatory issues and necessary permits from the Trnovo municipality, which will lease the land to Buroj Property for 99 years. (GulfBase.com) Dubai textile trade reaches AED7.5bn in 1H2015 – Ahmed Abdul Salam Kazim, Director of Strategy & Corporate Excellence at Dubai Customs, has said that Dubai textile trade had reached AED7.5bn in 1H2015, with AED4.8bn in imports, AED2.2bn in re-exports and AED508mn in exports. (GulfBase.com) Al-Anba: KIA may sell assets to cover deficit – Al-Anba newspaper has reported that the Kuwait Investment Authority (KIA) is considering selling assets to cover a state budget deficit caused by low oil prices. The sovereign wealth fund, which is estimated to have over $500bn of assets, is studying whether to liquidate assets that generate annual returns of below 9%. Reportedly, the size of the sales is expected to be around $30bn. (Reuters) KPC to invest KD32bn for development projects – Kuwait Petroleum Corporation (KPC) CEO Nizar Al-Adsani has said that the company had spent KD4bn in the FY2014-15 and KD2bn so far in the current fiscal year on strategic oil projects. Adsani said KPC has allocated KD32bn for development projects in the five-year plan. He said KPC would build four gathering centers to boost natural gas and heavy oil production. Kuwait currently produces around 3mn barrels per day (bpd) of crude oil while it will be able to produce 4mn bpd by 2020. (Bloomberg) Al Falaj Hotel gets OMR14mn acquisition offer – Oman Hotels & Tourism Company (OHTC) received a nonbinding offer for the acquisition of assets and business of Al Falaj Hotel for a consideration of OMR14mn. The offer is subject to legal and financial due diligence by the prospective acquirer. (MSM) Oman Rail lists opportunities for Omani firms, SMEs – Oman Rail has identified 56 different categories of commercial opportunities that it wants Omani contractors as well as small and medium enterprises (SMEs) to capitalize on during the construction and operational phases of the multibillion-dollar rail venture. These opportunities are part of a robust In-Country Value (ICV) strategy designed to ensure that Oman’s National Railway Project creates employment for Omanis and opens up attractive economic benefits for local firms. (GulfBase) BisB seeks shareholders nod to reduce paid-up capital, issue up to 200mn shares – Bahrain Islamic Bank (BisB) has invited its shareholders to consider and approve its agenda, which contains consideration and approval of reduction in its issued and paid-up capital, in order to write-off accumulated losses. Earlier, on August 2, 2015, BisB’s board of directors (BoD) proposed to write-off accumulated losses of BHD27.4mn as of June 30, 2015, thereby reducing the bank’s paid up share capital by 15.34% (reduction of 2 shares for each 13 shares approximately) from BHD94.91mn to BHD80.35mn. The agenda also includes the consideration and approval of issuance of up to 200mn ordinary shares with a nominal value of BHD0.1 each, whose name appears on the share register on such date as determined by the BoD. The meeting will also consider and approve exempting any existing shareholder whose ownership reaches or increases up to 30% or more to make a mandatory offer to all shareholders as prescribed in the ‘Takeover, Merger and Acquisition Module’ (TMA) issued by the Central Bank of Bahrain. BisB CEO Mr. Hassan Amin Jarrar said reducing the paid-up capital and issuance of ordinary shares would ensure maintaining strong liquidity levels, while the bank continues to adopt a development strategy that would serve all parties, including customers and shareholders. Mr. Hassan said the bank continues to implement its five-year strategy for the period 2014-2018, which aims at improving performance in different business sectors of the bank in the foreseeable future and maintaining the shareholders’ equity and capital adequacy and the required liquidity to meet the requirements of Basle III standard to achieve better financial results. (Bahrain Bourse, GulfBase.com) Alba production rises 2.9% YoY in 3Q2015 – Aluminium Bahrain (Alba) has announced that despite the significant drop in LME prices and physical premiums, it was able to increase its overall sales and throughput for 3Q2015. Sales figures reached 238,862 metric tons (mt), an increase of 5,940 mt versus 232,922 mt in 3Q2014 while production figures jumped by 2.9% YoY to top 240,351 mt for the same period in 2014. In addition, Alba closed 3Q2015 with its value-added sales averaging 64% of total shipments versus 67% in 3Q2014. (Bahrain Bourse)

- 5. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC 1.8% 0.9% 0.3% 0.0% 1.1% 0.4% 0.2% 0.0% 0.8% 1.6% 2.4% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,157.28 1.6 1.6 (2.3) MSCI World Index 1,673.77 0.6 4.1 (2.1) Silver/Ounce 15.84 0.9 3.8 0.9 DJ Industrial 17,084.49 0.2 3.7 (4.1) Crude Oil (Brent)/Barrel (FM Future) 52.65 (0.8) 9.4 (8.2) S&P 500 2,014.89 0.1 3.3 (2.1) Crude Oil (WTI)/Barrel (FM Future) 49.63 0.4 9.0 (6.8) NASDAQ 100 4,830.47 0.4 2.6 2.0 Natural Gas (Henry Hub)/MMBtu 2.37 (2.9) 4.7 (21.0) STOXX 600 362.82 1.2 5.6 (0.4) LPG Propane (Arab Gulf)/Ton 49.00 (2.3) 4.3 0.0 DAX 10,096.60 1.9 7.0 (3.6) LPG Butane (Arab Gulf)/Ton 65.38 (1.9) 3.2 (0.2) FTSE 100 6,416.16 0.7 5.5 (3.9) Euro 1.14 0.7 1.3 (6.1) CAC 40 4,701.39 1.4 6.7 3.5 Yen 120.27 0.3 0.3 0.4 Nikkei 18,438.67 1.3 3.6 4.9 GBP 1.53 (0.2) 0.9 (1.6) MSCI EM 859.32 1.3 6.9 (10.1) CHF 1.04 0.5 1.0 3.4 SHANGHAI SE Composite 3,183.15 1.5 4.5 (3.7) AUD 0.73 1.0 4.1 (10.3) HANG SENG 22,458.80 0.5 4.4 (4.8) USD Index 94.81 (0.5) (1.1) 5.0 BSE SENSEX 27,079.51 1.2 4.7 (3.8) RUB 61.52 0.2 (7.3) 1.3 Bovespa 49,338.41 2.3 10.8 (30.4) BRL 0.27 0.6 4.5 (29.6) RTS 885.96 3.4 15.8 12.0 142.0 119.2 114.8