18 August Daily market report

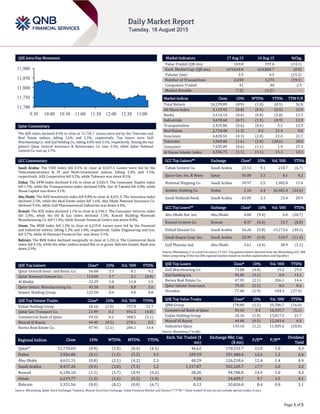

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.9% to close at 11,734.7. Losses were led by the Telecoms and Real Estate indices, falling 1.6% and 1.3%, respectively. Top losers were Gulf Warehousing Co. and Zad Holding Co., falling 4.0% and 3.1%, respectively. Among the top gainers Qatar General Insurance & Reinsurance Co. rose 3.3%, while Qatar National Cement Co. was up 1.7%. GCC Commentary Saudi Arabia: The TASI Index fell 0.3% to close at 8,437.3. Losses were led by the Telecommunication & IT and Multi-Investment indices, falling 2.4% and 1.5%, respectively. AXA Cooperative fell 9.2%, while Takween was down 8.5%. Dubai: The DFM Index declined 0.1% to close at 3,926.9. The Consumer Staples index fell 1.5%, while the Transportation index declined 0.8%. Dar Al Takaful fell 4.8%, while Shuaa Capital was down 3.1%. Abu Dhabi: The ADX benchmark index fell 0.8% to close at 4,631.3. The Insurance index declined 2.5%, while the Real Estate index fell 1.6%. Abu Dhabi National Insurance Co. declined 9.4%, while Gulf Pharmaceutical Industries was down 4.4%. Kuwait: The KSE Index declined 1.1% to close at 6,196.1. The Consumer Services index fell 2.0%, while the Oil & Gas index declined 1.5%. Kuwait Building Materials Manufacturing Co. fell 11.4%, while Kuwait Financial Centre was down 8.8%. Oman: The MSM Index fell 1.2% to close at 6,219.8. Losses were led by the Financial and Industrial indices, falling 1.2% and 1.0%, respectively. Galfar Engineering and Con. fell 3.7%, while Al Omaniya Financial Ser. was down 3.1%. Bahrain: The BHB Index declined marginally to close at 1,331.6. The Commercial Bank index fell 0.1%, while the other indices ended flat or in green. Bahrain Islamic Bank was down 2.9%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar General Insur. and Reins. Co. 56.00 3.3 0.1 9.2 Qatar National Cement Co. 119.00 1.7 3.1 (0.8) Al Khaliji 22.39 1.0 11.4 1.5 Qatar Indust. Manufacturing Co. 45.50 0.8 0.8 5.0 Islamic Holding Group 125.50 0.6 4.0 0.8 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 18.16 (1.0) 757.9 21.7 Qatar Gas Transport Co. 21.99 0.2 491.5 (4.8) Commercial Bank of Qatar 59.10 0.2 308.5 (5.1) Masraf Al Rayan 44.40 (0.5) 278.1 0.5 Barwa Real Estate Co. 47.95 (2.1) 206.1 14.4 Market Indicators 17 Aug 15 16 Aug 15 %Chg. Value Traded (QR mn) 169.8 197.6 (14.1) Exch. Market Cap. (QR mn) 619,634.8 624,883.7 (0.8) Volume (mn) 3.5 4.5 (21.2) Number of Transactions 2,650 3,275 (19.1) Companies Traded 41 40 2.5 Market Breadth 7:32 14:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,239.89 (0.9) (1.0) (0.5) N/A All Share Index 3,133.92 (0.8) (0.9) (0.5) 12.9 Banks 3,114.14 (0.6) (0.8) (2.8) 13.7 Industrials 3,678.68 (0.7) (1.5) (8.9) 12.9 Transportation 2,435.86 (0.6) (0.6) 5.1 12.5 Real Estate 2,724.48 (1.3) 0.3 21.4 9.0 Insurance 4,828.55 (0.3) (2.0) 22.0 22.7 Telecoms 1,060.86 (1.6) (2.4) (28.6) 28.0 Consumer 7,035.89 (0.6) (1.1) 1.9 27.1 Al Rayan Islamic Index 4,556.75 (1.1) (1.1) 11.1 13.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Tabuk Cement Co. Saudi Arabia 23.13 9.1 218.7 (6.7) Qatar Gen. Ins. & Reins Qatar 56.00 3.3 0.1 9.2 National Shipping Co. Saudi Arabia 39.97 2.5 1,902.8 17.6 Arabtec Holding Co. Dubai 2.16 2.4 26,481.3 (22.6) Saudi Hollandi Bank Saudi Arabia 45.00 2.3 23.4 20.9 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Ins, Abu Dhabi 4.80 (9.4) 6.0 (20.7) Kuwait Cement Co. Kuwait 0.37 (6.4) 15.7 (8.8) Etihad Etisalat Co. Saudi Arabia 26.26 (5.8) 15,172.6 (40.2) Saudi Enaya Coop. Ins. Saudi Arabia 22.99 (5.8) 510.7 (11.4) Gulf Pharma. Ind. Abu Dhabi 2.61 (4.4) 30.9 (5.2) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Gulf Warehousing Co. 73.00 (4.0) 19.2 29.4 Zad Holding Co. 95.00 (3.1) 0.9 13.1 Barwa Real Estate Co. 47.95 (2.1) 206.1 14.4 Qatar Islamic Insurance 79.50 (2.1) 0.6 0.6 Ooredoo 77.60 (1.9) 104.5 (37.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 178.80 (1.2) 25,786.7 (16.0) Commercial Bank of Qatar 59.10 0.2 18,355.7 (5.1) Ezdan Holding Group 18.16 (1.0) 13,817.5 21.7 Masraf Al Rayan 44.40 (0.5) 12,343.4 0.5 Industries Qatar 133.10 (1.2) 11,505.6 (20.8) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,734.69 (0.9) (1.0) (0.4) (4.5) 46.62 170,151.7 12.0 1.8 4.3 Dubai 3,926.86 (0.1) (1.5) (5.2) 4.1 109.59 101,486.6 12.6 1.2 6.6 Abu Dhabi 4,631.31 (0.8) (2.1) (4.2) 2.3 40.29 126,218.6 12.4 1.4 4.9 Saudi Arabia 8,437.26 (0.3) (2.8) (7.3) 1.2 1,157.87 502,165.7 17.7 2.0 3.2 Kuwait 6,196.10 (1.1) (1.7) (0.9) (5.2) 28.26 94,706.8 14.9 1.0 4.3 Oman 6,219.77 (1.2) (1.6) (5.2) (1.9) 9.28 24,609.7 9.7 1.5 4.1 Bahrain 1,331.56 (0.0) (0.2) (0.0) (6.7) 0.12 20,826.0 8.4 0.8 5.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,700 11,750 11,800 11,850 11,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index declined 0.9% to close at 11,734.7. The Telecoms and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari and GCC shareholders. Gulf Warehousing Co. and Zad Holding Co. were the top losers, falling 4.0% and 3.1%, respectively. Among the top gainers Qatar General Insurance & Reinsurance Co. rose 3.3%, while Qatar National Cement Co. was up 1.7%. Volume of shares traded on Monday fell by 21.2% to 3.5mn from 4.5mn on Sunday. Further, as compared to the 30-day moving average of 4.0mn, volume for the day was 12.5% lower. Ezdan Holding Group and Qatar Gas Transport Co. were the most active stocks, contributing 21.6% and 14.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 2Q2015 % Change YoY Operating Profit (mn) 2Q2015 % Change YoY Net Profit (mn) 2Q2015 % Change YoY Al Firdous Holdings Dubai AED 2.3 -33.9% – – -3.0 NA Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/17 US National Association of Home B NAHB Housing Market Index August 61.0 61.0 60.0 08/17 EU Eurostat Trade Balance SA June 21.9B 23.1B 21.3B 08/17 EU Eurostat Trade Balance NSA June 26.4B – 18.8B 08/17 UK Rightmove Rightmove House Prices MoM August -0.80% – 0.10% 08/17 UK Rightmove Rightmove House Prices YoY August 6.40% – 5.10% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 46.67% 55.31% (14,651,961.02) GCC 9.80% 9.64% 275,213.92 Non-Qatari 43.52% 35.05% 14,376,747.10

- 3. Page 3 of 5 News Qatar Nakilat (QGTS) proposes an increase in its foreign ownership limit (FOL) to 49% from 25%; EGM set for September 2 – Qatar Gas Transport Company (QGTS) will hold its extraordinary general meeting (EGM) on September 2, 2015. Importantly, the company has proposed increasing its FOL to 49% from 25% currently. Foreigners or non-Qataris in total currently own around 8% of Nakilat (non-Qatari institutions own 5.25%). Further, another proposed article states that Qatari Governmental Institutions, Qatari non-for-profit organizations, Qatari Governmental Pension and Investment Funds can own a percentage of share capital up to 5% of the total shares of the company. We note the company currently has and will continue to maintain an authorized share capital of 560mn shares and an issued share capital of 554mn shares. If the quorum for the September 2 EGM is not present, the company will hold a second meeting on September 7, 2015. (QNBFS Research, QSE) QDB launches ‘International Tender Services’ to support exports from Qatari SMEs – Qatar Development Bank (QDB) has launched the International Tender Services, which aim at enhancing the exports sector in Qatar and opening new global markets for the country’s small and medium-sized enterprises (SMEs). The QDB said the new service has been launched in cooperation with French company “InfoTrade 2000”. The QDB added that the service aims at providing Qatari SMEs with information on international tenders via email and QDB’s website. The SMEs will also be able to get any information about tenders around the world. (Gulf-Times.com) Online wage payment plan put off till November 2 – Qatar has postponed the launch of the mandatory online wage payment system for low-income private sector workers to November 2, 2015. The Wage Protection System (WPS) was scheduled to be launched from today as the six-month period allowed to private companies on February 18 vide a law ended yesterday. However, the government decided to put off the launch to November 2 as some companies were yet not ready to be part of the WPS. The companies have been given more time to comply. Over 50,000 private companies will be a part of the WPS, whereby all of their workers are to be mandatorily paid their wages through banking channels. Al Sharq reported that banks had already completed the preparations, both administrative and technical, to be part of the WPS. (Peninsula Qatar) Top Chinese firms to participate in Qatar expo – According to Qatari-owned AJ Exhibition & Events, Chinese companies are set to participate in Qatar Chamber’s “Made in China” expo slated this December in Doha. Over 200 Chinese companies are expected to showcase world-class products & services during the event, which is set to be held during December 14-16, 2015 at the Doha Exhibition & Convention Centre. (Gulf-Times.com) International US homebuilder sentiment in August at a decade high – According to the National Association of Home Builders (NAHB), homebuilder sentiment in the US rose in August to its highest level since a matching reading almost a decade ago. The NAHB/Wells Fargo Housing Market index rose to 61 from 60 in July. The latest level was the highest since a matching reading in November 2005. Readings above 50 indicate more builders view market conditions as favorable. The index has not been below 50 since June 2014. NAHB Chief Economist David Crowe said jobs and economic gains should keep the market moving forward at a modest pace throughout the rest of 2015. (Reuters) Moody’s: Global growth unlikely to reach pre-crisis anytime soon – According to Moody’s Investors Service, global economic growth is not expected to reach the level it attained before the financial crisis anytime soon. The credit-rating agency, in an update on its global outlook, said expansion in the Group of 20 economies would not return to its pre-2008 rate within the next five years. Combined output growth in the group, which includes 19 nations and the euro area, will average 3% per year from 2015 to 2019, about half a percentage point lower than in the decade through 2007. Moody’s lowered its 2015 US expansion forecast to 2.4% from 2.8% forecasted in May, to reflect a slower-than-projected rebound in 2Q2015 while leaving the G-20 growth forecast for 2015 unchanged at 2.7%. The ratings agency said that the world economy is being held back by the crisis’ lingering drag on productivity growth, China’s slowdown, unfavorable demographic trends and slowing gains from trade. Moody’s added it expects oil prices to remain “broadly unchanged” from current levels in 2H2015 before rising slowly starting in 2016. (Bloomberg) Bundesbank: Germany set for strong growth in 2H2015 – The Deutsche Bundesbank, in its monthly bulletin, said that conditions are in place for Europe’s largest economy to grow firmly in 2H2015 with momentum from both the domestic and export economy. The comments followed a trading day after official data showed Germany grew by only 0.4% in 2Q2015. The bank said domestic demand components will feature more prominently in 2H2015. The report said the export industry could also profit from the continuing recovery in the Eurozone and by the low value of the euro. However, the bank cautioned that external demand also currently faces downside risks stemming largely from emerging market economies. (WSJ) NBS: China new home prices edge up MoM in July – The National Bureau of Statistics (NBS) has reported that average new home prices in China’s 70 major cities rose 0.3% MoM in July, a third consecutive monthly rise. Home prices still fell 3.7% YoY in July, easing from the previous month’s 4.9% drop. NBS said new home prices in Beijing rose 1.0% YoY in July, compared with June’s drop of 1.1%. Shanghai’s home prices were up 3.1% YoY in July, compared with a rise of 0.3% YoY in June. China’s real estate investment growth continued to slow in the first seven months of 2015, but property sales and housing investment improved, indicating a mixed recovery in the struggling property market. (Reuters) Regional ArthVeda launches $250mn realty fund for GCC investors – India- based ArthVeda Fund Management has launched a $250mn realty fund for GCC investors to develop mid-income residential properties in India. ArthVeda Fund Management's STAR Fund II is the first realty fund to be offered in Gulf and other overseas markets, following the recent amendments to India’s foreign direct investment (FDI) policy in the realty segment. The newly-launched fund has projected an internal rate of return (IRR) of 18-21% in dollar terms with maximum fund tenure of 60 months. The fund will have two closures, the first one that is scheduled three months after the launch or upon reaching an investment milestone of $100mn, whichever is early. The second and final closure will be six months from the first closure or upon total commitments to the tune of $250mn, whichever is early. (GulfBase.com) ACWA Power secures SR1.1bn additional loan – Saudi-based ACWA Power has raised an additional SR1.1bn of loan finance from the Kingdom's banks. The company increased its 2013 revolving credit facility by SR400mn, with National Commercial Bank and Samba Financial Group contributing equally to the extra amount. The facility, now worth SR2.175bn, is also backed by Banque Saudi Fransi and Saudi British Bank, with its maturity extended by one year to 2019. ACWA Power has also signed a new five-year

- 4. Page 4 of 5 revolving corporate facility worth SR709mn with Arab National Bank, Bank Al Bilad and Saudi Hollandi Bank, as well as the extension of the 2013 facility was also completed without incremental cost to the borrower. These transactions enhance ACWA Power's financial flexibility. (GulfBase.com) CDSI: Saudi cost of living general index recorded at 133 points in July 2015 – According to a report issued by the Central Department of Statistics & Information (CDSI), the cost of living general index in Saudi Arabia recorded 133 points in July 2015, reflecting an increase from132.6 points in June 2015 and 130.2 points in July 2014, indicating an increase of 0.3% MoM and 2.2% YoY. The index’s monthly rise happened due to the rises witnessed by eight of the main divisions of the index: clothing & footwear (1%), home furniture & maintenance division (0.6%), health division (0.6%), transportation (0.5%), culture & recreation (0.5%), food & beverages (0.3%), housing, water, electricity, gas and other fuels (0.1%) and telecom division with (0.1%). In contrast, two main divisions for cost of living registered a drop in their record indexes – these are the restaurants & hotels divisions with a 0.5% drop and the miscellaneous goods & services division, which dropped by 0.2%. (GulfBase.com) Saudi CMA approves SAMBA Capital’s offering of investment fund – The Saudi CMA has issued a resolution approving the ‘Al Ataa GCC Equity Fund’, a new offer by SAMBA Capital & Investment Management Company. (Tadawul) UCA updates on use of rights issue proceeds – United Cooperative Assurance Company (UCA) has announced the developments regarding the use of proceeds from the rights issue held in 2015. The total amount of proceeds amounted to SR210mn, while the net proceeds from the capital increase stood at SR205.05mn. Following the statutory deposit of SR21mn, UCA used the remaining amount of SR184.05mn to meet the requirements of the required solvency margin, whereas SR44.52mn and SR10mn was invested in local funds and shares, respectively. The balance in the current account at a local bank was SR129.53mn. (Tadawul) Saudi CMA approves public offering of Aloula Geojit Capital IPO Fund – The Saudi CMA’s board of commissioners issued its resolution approving the public offer, by Aloula Geojit Capital Company of Aloula Geojit Capital IPO Fund. (Tadawul) UAE Exchange bids for Dunia – According to sources, the UAE Exchange is among bidders for consumer finance company, Dunia. Majid Al Futtaim was among other parties to have lodged initial bids for Dunia, which was due to be submitted two weeks ago, while there could also be interest from local banks. (Reuters) India, UAE plan $75bn fund – According to a joint statement at the end of India’s Prime Minister Narendra Modi’s visit, the UAE and India are planning to create a $75bn fund to invest in Indian infrastructure. The fund will support the expansion of India’s network of railways, ports, roads, airports and industrial corridors. The countries also aim to increase trade by 60% in the next five years. (Bloomberg) IFA BoD to hold meeting on August 19 – International Financial Advisors’ (IFA) board of directors will hold a meeting on August 19, 2015. The board will discuss the amendments of the previous BoD recommendation that the entire write-off of accumulated loss will become a partial write-off of the accumulated loss as per the request of the Capital Markets Authority. (DFM) UP seeks shareholders’ nod on Murabaha & Shari’ah-compliant financing arrangements – Union Properties’ (UP) has invited its shareholders to consider and approve the guarantee given by the company dated August 2, 2015 in favor of Dubai Islamic Bank (DIB) in respective of 50% of the amounts outstanding under the Murabaha facility agreement signed between Properties Investment LLC (50% owned by UP) and DIB for the full duration of the Murabaha agreement. The company will also seek shareholders’ approval and ratification of the company’s entry into AED360mn Shari’ah-compliant financing arrangements with DIB dated July 16, 2014 in connection with the company’s property in Uptown Mirdiff, Dubai (the Mirdiff Facility) for the full term of seven years. (DFM) NARESCO wins AED300mn construction contract – Naresco General Contracting (NARESCO) has been awarded an AED300mn contract by Danube Properties for the construction of upcoming residential projects, Glitz 1 & Glitz 2. The offering of 300 luxury apartment units ranging from studios to three bedrooms is being developed at Dubai Studio City. Additionally, Atlas Foundation Company secured the earthworks contract for the latest project Glitz 3 by Danube and is currently undertaking mobilization work on the site. Shoring and excavation work on the Glitz 3 development is scheduled to commence later in August 2015. (GulfBase.com) KBBO plans $1.2bn IPO of units – According to sources, KBBO Group, an Abu Dhabi-based investment firm, is seeking to raise about $1.2bn through the sale of shares in its Centurion Investment and Infinite Investment LLC units. KBBO is planning to merge the two companies and offer a 40% stake in a primary and secondary sale in 2016. The merged entity may be valued at about $3bn. The initial public offering is planned for 2Q2016 or 3Q2016 on the New York Stock Exchange. KBBO is expected to hire banks to manage the sale soon, with KBBO and Guggenheim Partners acting as financial advisers for the process. (Bloomberg) NEO to design Rusayl industrial park overhaul – National Engineering Office (NEO), an Omani consultancy firm, has been selected by the Public Establishment for Industrial Estates (PEIE) to come up with a blueprint for the overhaul of the infrastructure of the nation’s first industrial park at Rusayl in Muscat Governorate. (GulfBase.com) Orpic installs Oman’s first hydrocracker reactor – Oman Refineries and Petroleum Industries Company (Orpic) has completed the installation of a giant hydrocracker reactor as part of the Sohar Refinery Improvement Project (SRIP). The design of unit includes built-in features that enable a quick response to various emergency situations. The hydrocracker is one of the most critical units for Orpic’s future Sohar Refinery operations, and will enable Orpic to meet the increasing demand of petroleum products in the Sultanate, as well as reducing refinery emissions and improving refinery margins. (GulfBase.com) SGRF acquires 90% stake in Marriott Ambassador Paris Hotel – State General Reserve Fund (SGRF) has acquired a 90% stake in Marriott Ambassador Paris Hotel. The transaction was completed through a joint venture with Westmont Hospitality Group (WHG), which will own 10% of the hotel shares and will provide the operational oversight to the hotel. The hotel is situated at Haussman Boulevard in Central Paris and has 298 rooms together with a restaurant and meeting/conference rooms. (TimesofOman) Ooredoo opens first franchise store in Governorate of Dhofar – Ooredoo has opened its first fully-operated franchise store in Sa'dah. This move will further expand its retail reach in Oman's southernmost Governorate. Managed by new franchise partner Recharge Oman, the new store will inspire this fast growing suburban area by offering the full range of Ooredoo’s innovative products and services to customers. (Zawya) BB executes Ijarah Sukuk transaction – Bahrain Bourse (BB) announced that a trade has been executed on the Debt Market on Government Islamic Lease (Ijarah) Sukuk - Issue 23 (GILS23.SUK). In total, 10,000 Sukuk were executed at a price of BHD1.025 for a total value (without the return) of BHD10,250. (Bahrain Bourse)

- 5. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Aug-11 Aug-12 Aug-13 Aug-14 Aug-15 QSE Index S&P Pan Arab S&P GCC (0.3%) (0.9%) (1.1%) (0.0%) (1.2%) (0.8%) (0.1%) (1.5%) (1.0%) (0.5%) 0.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,117.71 0.2 0.2 (5.7) MSCI World Index 1,749.08 0.3 0.3 2.3 Silver/Ounce 15.34 0.5 0.5 (2.3) DJ Industrial 17,545.18 0.4 0.4 (1.6) Crude Oil (Brent)/Barrel (FM Future) 48.74 (0.6) (0.6) (15.0) S&P 500 2,102.44 0.5 0.5 2.1 Crude Oil (WTI)/Barrel (FM Future) 41.87 (1.5) (1.5) (21.4) NASDAQ 100 5,091.70 0.9 0.9 7.5 Natural Gas (Henry Hub)/MMBtu 2.76 (2.2) (2.2) (7.7) STOXX 600 387.26 (0.3) (0.3) 3.5 LPG Propane (Arab Gulf)/Ton 37.63 (1.0) (1.0) (23.2) DAX 10,940.33 (0.9) (0.9) 1.7 LPG Butane (Arab Gulf)/Ton 49.75 (1.5) (1.5) (20.7) FTSE 100 6,550.30 (0.4) (0.4) (0.2) Euro 1.11 (0.3) (0.3) (8.4) CAC 40 4,984.83 0.0 0.0 6.8 Yen 124.39 0.1 0.1 3.8 Nikkei 20,620.26 0.4 0.4 13.5 GBP 1.56 (0.4) (0.4) 0.1 MSCI EM 854.71 (1.1) (1.1) (10.6) CHF 1.02 (0.3) (0.3) 1.6 SHANGHAI SE Composite 3,993.67 0.7 0.7 19.8 AUD 0.74 (0.1) (0.1) (9.8) HANG SENG 23,814.65 (0.7) (0.7) 0.9 USD Index 96.81 0.3 0.3 7.2 BSE SENSEX 27,878.27 (1.2) (1.2) (2.0) RUB 65.49 0.8 0.8 7.8 Bovespa 47,217.43 (0.8) (0.8) (28.1) BRL 0.29 0.1 0.1 (23.9) RTS 825.12 (1.2) (1.2) 4.4 140.3 117.4 112.7