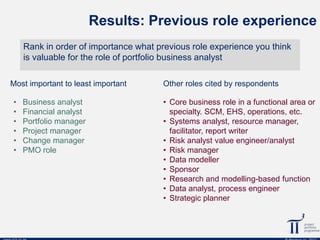

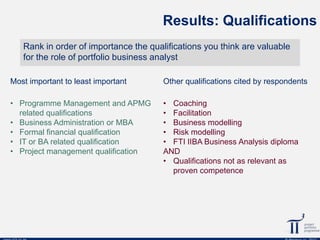

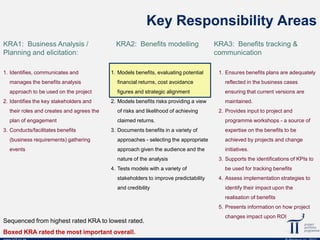

The document describes a survey conducted on the role of a portfolio business analyst. It provides background on why the survey was conducted and the sources used to design the survey. It then summarizes the results which identify valuable previous experience, qualifications, key responsibility areas, and competencies for the role. The top three key responsibility areas identified were business analysis/planning and elicitation, benefits modelling, and benefits tracking and communication. The top competency areas identified were business/analytical skills, interpersonal skills, and personal attributes.