The document provides information about Employee Stock Ownership Plans (ESOPs), including:

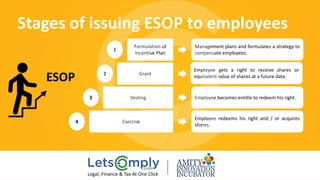

- ESOPs allow employees to acquire shares in the company they work for over time at a predetermined price.

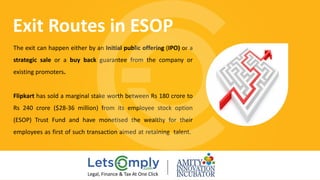

- ESOPs can benefit startups by aligning employee and founder interests and improving company performance and finances.

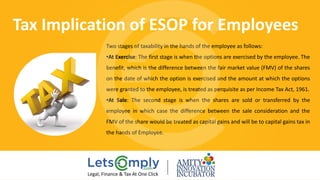

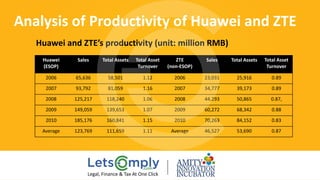

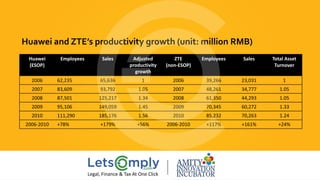

- The document discusses the history, purpose, implementation process, taxation, and case studies of ESOPs to demonstrate their benefits for employee motivation, retention, and company productivity.