The document provides an overview of KPMG's publication "Insights into IFRS" which discusses the requirements of International Financial Reporting Standards (IFRS). It covers topics such as the conceptual framework underlying IFRS, general issues related to financial statements, specific statement items, and special topics. The overview reflects the work of current and former members of KPMG's International Standards Group.

![2 | Insights into IFRS: An overview

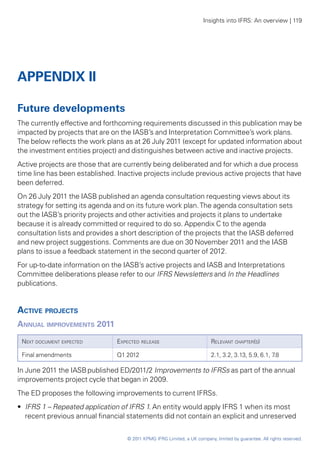

CONTENTS

1. Background 4

1.1 Introduction 4

1.2 The Conceptual Framework 5

2. General issues 9

2.1 Form and components of financial statements 9

2.2 Changes in equity 11

2.3 Statement of cash flows 12

2.4 Basis of accounting 13

2.5 Consolidation 14

2.5A Consolidation: IFRS 10 16

2.6 Business combinations 18

2.7 Foreign currency translation 21

2.8 Accounting policies, errors and estimates 23

2.9 Events after the reporting period 24

3. Specific statement of financial position items 25

3.1 General 25

3.2 Property, plant and equipment 26

3.3 Intangible assets and goodwill 28

3.4 Investment property 30

3.5 Investments in associates and the equity method 32

3.6 Investments in joint ventures and proportionate

consolidation 35

3.6A Investments in joint arrangements 37

3.7 [Not used]

3.8 Inventories 38

3.9 Biological assets 39

3.10 Impairment of non-financial assets 40

3.11 [Not used]

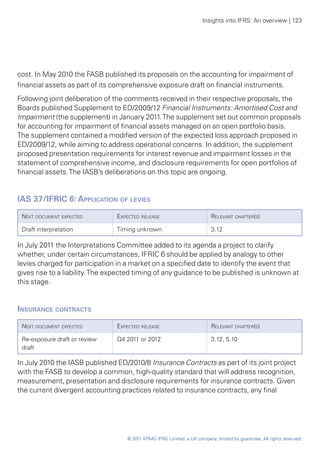

3.12 Provisions, contingent assets and liabilities 43

3.13 Income taxes 45

4. Specific statement of comprehensive income items 47

4.1 General 47

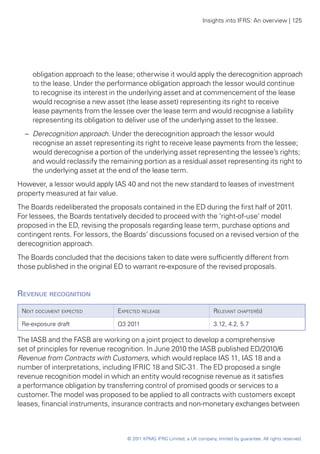

4.2 Revenue 49

4.3 Government grants 51

© 2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.](https://image.slidesharecdn.com/ifrsanoverview2011-13379454917902-phpapp01-120525063351-phpapp01/85/Ifrs-An-Overview-2011-3-320.jpg)

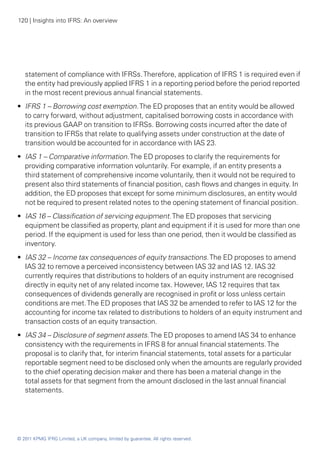

![Insights into IFRS: An overview | 3

4.4 Employee benefits 52

4.5 Share-based payments 61

4.6 Borrowing costs 63

5. Special topics 64

5.1 Leases 64

5.2 Operating segments 66

5.3 Earnings per share 67

5.4 Non-current assets held for sale and discontinued

operations 69

5.5 Related party disclosures 71

5.6 [Not used]

5.7 Non-monetary transactions 72

5.8 Accompanying financial and other information 73

5.9 Interim financial reporting 74

5.10 Insurance contracts 76

5.11 Extractive activities 78

5.12 Service concession arrangements 79

5.13 Common control transactions and Newco formations 81

6. First-time adoption of IFRSs 83

6.1 First-time adoption of IFRSs 83

7. Financial instruments 87

7.1 Scope and definitions 87

7.2 Derivatives and embedded derivatives 88

7.3 Equity and financial liabilities 89

7

.4 Classification of financial assets and financial

liabilities 91

7 Recognition and derecognition

.5 92

7 Measurement and gains and losses

.6 94

7.7 Hedge accounting 99

7.8 Presentation and disclosure 100

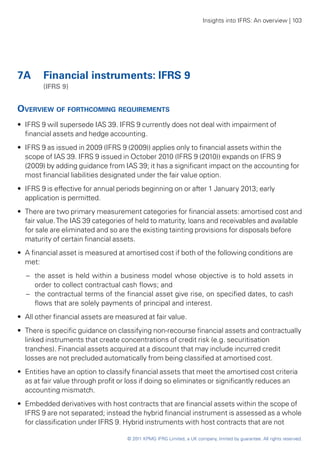

7A Financial instruments: IFRS 9 103

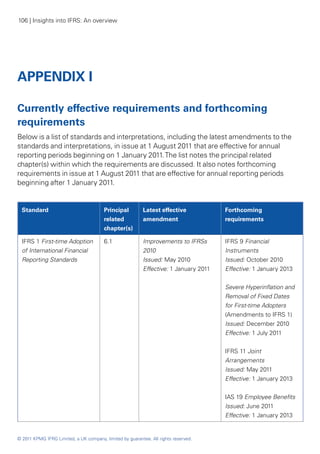

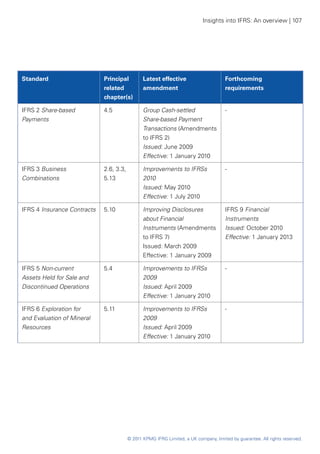

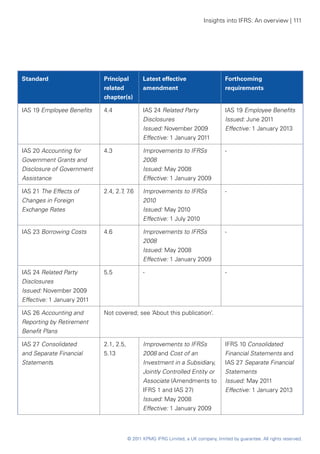

Appendix I: Currently effective requirements and

forthcoming requirements 106

Appendix II: Future developments 119

About this publication 133

© 2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.](https://image.slidesharecdn.com/ifrsanoverview2011-13379454917902-phpapp01-120525063351-phpapp01/85/Ifrs-An-Overview-2011-4-320.jpg)