More Related Content

Similar to Newsletter 092115 Final Volume 1 Issue 13

Similar to Newsletter 092115 Final Volume 1 Issue 13 (20)

More from Jonathan M. Lamb

More from Jonathan M. Lamb (15)

Newsletter 092115 Final Volume 1 Issue 13

- 1. Copyright © 2015 EQS Capital Management LLC, See important disclosure on last page

All rights reserved. 1 www.eqstrading.com

SIGNALS

Does it feel like Groundhog Day? No, not

February 2nd, but the 1993 Bill Murry clas-

sic film “Groundhog Day.” Since December

16, 2008 we have had the Fed benchmark

rate pegged at 0-0.25%, and Thursday all

eyes were on Janet Yellen and the Fed to

await the announcement of whether the

economy had again seen its shadow or if it

would finally be time for lift off.

Like Phil Connors (Bill Murray), we are left

living the same time-loop, but unlike audi-

ences that love watching the movie over and

over, the market is just plain tired of the Fed

drama. After the release of the Fed

minutes, Yellen held a press conference

leaving the market with no clear direction.

On one hand, the committee wants to raise,

but on the other hand, we have met some

targets, but not others. We have strong

jobs, but wages are not high enough; we

have a strong domestic economy, but a

weak world outlook; we have inflating ser-

vice prices, and deflating commodity prices.

The list goes on and on, and we are stuck

living the same Groundhog Day.

There are arguments by Wall Street, Main

Street, and Academia both for and against

hikes, for and against a “stay the course”

policy, and for and against easing. There is

no clear right and wrong answer; however, at least an

answer would give us direction. All the Fed did was to

wake us up again the next morning to Sonny and

Cher, “I Got You Babe.” The lack of direction from the

Fed sets up uncertainty, and what do we say about

uncertainty? That’s right, the markets hate uncertain-

ty!

The inevitable rate hike is still hanging over the stock

market, like the blizzard about to hit Punxsutawney

Pennsylvania. On the table was a wimpy quarter

point hike. A hike would have allowed the market to

move to the next stage of assessing how the global

economy will be able to adjust to the slow normaliza-

tion of Fed policy, as there are only two options in the

long run, raise rates or inflate the bubble to the point

of a burst that no monetary or fiscal policy can stop.

(continued on Page 2)

GROUNDHOG DAY

EQS recommended energy

positions have yielded a YTD

average return of 26%!

**You can achieve these

results with discipline and

by following the EQS daily

trade recommendations and

using the daily EQS Stop

Loss guidance

I N S I D E T H I S I S S U E :

Groundhog Day Cont. 2

Oil and Products 3

Natural Gas 4

About EQS 5

Terms and Disclosures 6

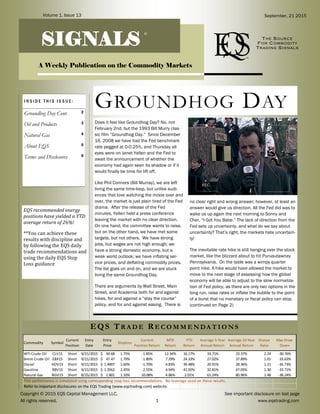

EQS TR A D E RE C O M M E N DA T I O N S

THE S OUR C E

F OR C OM M OD ITY

TR AD ING SIGN ALS

Volume 1, Issue 13 September, 21 2015

A Weekly Publication on the Commodity Markets

©

Commodity Symbol

Current

Position

Entry

Date

Entry

Price

Stoploss

Current

Position Return

MTD

Return

YTD

Return

Average 5-Year

Annual Return

Average 10-Year

Annual Return

Sharpe

Ratio

Max Draw

Down

WTI Crude Oil CLV15 Short 9/21/2015 44.68$ 1.75% -1.85% 12.34% 16.17% 33.71% 33.37% 2.24 -30.76%

Brent Crude Oil EBX15 Short 9/21/2015 47.47$ 1.70% -1.80% 7.29% 24.33% 27.02% 37.89% 1.01 -33.63%

Diesel HOV15 Short 9/21/2015 1.4907$ 1.60% -1.70% 4.83% 39.48% 20.91% 28.36% 1.21 -35.73%

Gasoline RBV15 Short 9/21/2015 1.3562$ 2.45% -2.55% 4.94% 41.92% 32.81% 47.05% 1.30 -33.71%

Natural Gas NGV15 Short 8/25/2015 2.801$ 1.10% 10.08% 4.86% 2.01% 61.24% 80.96% 1.48 -38.24%

This performance is simulated using corresponding stop loss recommendations. No leverage used on these results.

Refer to important disclosures on the EQS Trading (www.eqstrading.com) website.

- 2. Copyright © 2015 EQS Capital Management LLC, See important disclosure on last page

All rights reserved. 2 www.eqstrading.com

After the meeting, the markets proceeded to substantially delay expectations for the Fed’s first

rate hike. The market is now fully expecting the Fed’s first rate hike by the March 2016 FOMC

meeting, much later than pre-meeting expectations for the Dec 2015 meeting. The federal

funds futures market is now discounting the chances for a rate hike at only 24% at the next

FOMC meeting on Oct 27-28, 58% by the Dec 15-16 meeting, 72% by the Jan 26-27 meeting,

and 100% by the March 15-16 meeting. The odd changes have almost been Groundhog Hog

Day,

them-

selves,

as they

have

basical-

ly just

kicked

the can

down

the

road to

the

next

period.

There

will

never

be the

perfect

time to raise rates, and to the Fed’s credit, at this meeting they noted what has been on the

mind of the markets, and that is the world. We have reported in multiple issues, the world econ-

omy is not healthy. Raising rates too soon could be the straw that breaks the camel’s back, but

as academia would argue, sometimes things have to get worse before they can get better.

The economy is made of events that create business cycles and we are at the end of such a

business cycle. However, this current business cycle is different; we are in “uncharted” territory.

Typically, as a cycle starts, rates are lowered and economic output rises, rates go up and cool

the economy; the cycle ends, recession kicks in and then the cycle starts over when fiscal and

monetary policy is used to stimulate the economy to kick start growth again. The last business

cycle ended with the “Great Recession,” and this business cycle has been entirely played out

with stimulus. This cycle is different in many ways, including the importance of the globe. It is

not the duty of the FMOC to “police” the world economy; however, as the world has gotten

“smaller” what happens to the world, greatly effects the American economy. We know that the

global economy is cooling. The crashing of commodity prices is a leading indicator of recession,

the commodity market has spoken, and the business cycle is ending.

When things are great, living the same Groundhog Day time-loop is not a bad thing. The mar-

kets like “Groundhog Day” because the market has certainty about what is going to happy to-

morrow. The Groundhog Day we are living now is one of uncertainty. We know that recession is

coming or here for many economies around the world, and we know that the American business

cycle is ending. We are living a Groundhog Day of uncertainty. Actions speak louder than

words. The Fed could not even manage a baby hike. What does the Fed's stay the course action

imply about the real risks? And what success does the Fed have, other than creating a commod-

ity, equity, and junk bond bubble with their nearly eight years of stimulus in some form or anoth-

er? There are and will be pains from tightening, and there are and will be pains from doing noth-

ing. The Fed has just said it; we live in a small world. What will the Fed do if volatility goes up

instead of down? How can we manage a global economy with American domestic policy?

Phil Connors had to get the girl to fall in love with him to break the Groundhog Day loop and

make it to the next day. What is it going to take to break our economic Groundhog Day and

keep from seeing the shadow of more economic winter?

GROUNDHOG DAY…(CONTINUED)

We are living a

Groundhog Day of

uncertainty. Actions

speak louder than

words. The Fed could

not even manage a baby

hike.

- 3. Copyright © 2015 EQS Capital Management LLC, See important disclosure on last page

All rights reserved. 3 www.eqstrading.com

It seems like the range bound nature of natural

gas has rubbed off on oil. After last week’s bullish

call on oil, EQS has determined it made its call too

early. One key event shifted our stance to bearish

– the EIA report. You might say, “The market ral-

lied after the report so the report was bullish”.

Well, yes and no and EQS believes the market

acted prematurely and more data is needed to

fight off those bears.

Let’s first examine the psychology of the entire

week. It all started Tuesday night when the API

report at 4:30pm reported a surprise large draw in

crude inventories. After this, it appeared that the

bulls finally broke loose as prices began their

breakout of the pennant formation. Wednesday morning, the more widely watched EIA report con-

firmed the bears’ worst nightmare, as a surprise crude draw was in the cards and by the end of the

day, oil had risen nearly 10 percent from its weekly low.

However, Wednesday night,

after the big rally, EQS be-

gan peeling back the covers

on the EIA report, discovered

some troubling data, and

began questioning why pric-

es rose. Although crude

inventories showed a sur-

prise draw of 2.1 million

barrels and production de-

clined again, total crude and

product inventories rose a

massive 8.5 million barrels,

setting another new record high. Furthermore, demand, which has been fairly robust, took a notable

dive. To measure the impact of the EIA report, EQS likes to use forward days

cover by dividing total inventories by total demand. Looking at the attached

chart, you begin to see that forward days cover is above the five-year range and

rising rapidly, indicating the inventories are rising faster than the US can con-

sume and what is troubling is the exponential nature of the slope. When Thurs-

day arrived, buying enthusiasm began to fade as the market realized the EIA

report really was undoubtedly bearish and to add more uncertainty to the mix,

the Fed announced they were not raising rates and this fueled concerns regard-

ing global growth. Oil and equities then sold off on Friday and oil retraced all its

earlier gains. EQS has noted in the past few issues of Signals that oil prices are

becoming increasingly correlated with equities, and the attached chart reveals

this is indeed the case. The magnitude of the selloff of Friday, coupled with the

weakness in the EIA report, was enough to change EQS’s from bullish to bearish.

Bottom line, EQS simply cannot justify a bullish stance with inventories rising so

rapidly. Again our call to long was too soon– perhaps three weeks too soon.

However, there is still hope for the bulls to stage a comeback. Although prices

fell hard on Friday, they remained above the key support level from the pennant

formation, bounced off the PSAR technical level. If prices rebound from these

levels, it’s a possibility that our neutral bias will be short-lived. Remember, refin-

ing maintenance peaks in early October, after which inventories begin to decline

once heating season sets in. A combination of heating season, holiday travel,

and further production declines could help the bulls, once again, claim their

stomping ground.

CRUDE OIL: DOWN, DOWN,UP, UP, AND REPEAT!

Oil and Refined Products

Bottom line, EQS

cannot justify a bullish

stance with inventories

rising so rapidly...

refining maintenance

peaks in early October,

after which inventories

begin to decline once

heating season sets in.

Crude Price Pennant Formation

50

52

54

56

58

60

62

64

66

68

J

F

M

A

M

J

J

A

S

O

N

D

DaysCover

Total US Oil and Products Forward Days Cover

5-Year Range Average 5-Year 2012 2013 2014 2015

Twins?

S&P

Crude Oil

Bearish

- 4. Copyright © 2015 EQS Capital Management LLC, See important disclosure on last page

All rights reserved. 4 www.eqstrading.com

After beginning the week on an upward climb,

Natural Gas prices fell prey to the bears Tuesday,

as prices failed to settle above a key technical

resistance level and continued to sell off to a

three month low. Put simply, the market is trading

lower, based on concerns that oversupply will

continue as production remains strong and de-

mand fades into the fall season. Natural-gas con-

sumption typically declines in the fall, when the

weather becomes more moderate. Demand ero-

sion is indeed evident as the U.S. Energy Infor-

mation Administration reported consumption de-

creased by 5.3% overall in the week of Sept. 16,

led by a 15% decline in natural gas used for pow-

er generation.

As far as supply goes, many analysts continue to

believe record high storage at the end of the sea-

son is possible. The total working natural gas

supply currently sits at 3,334 Bcf after a 73-Bcf

injection reported by the EIA for the week of Sept.

11 that compared to a 90-Bcf injection in the cor-

responding week in 2014 and a 75-Bcf five-year

average addition. Stocks are currently 456 Bcf

higher than last year at this time and 125 Bcf

above the five-year average.

The latest weather forecast for the six- to 10-day

and eight- to 14-day periods show above-average

temperatures will overtake the majority of the

country through the end of the month and beyond

the start of the fall season. For the six- to 10-day

period, the National Oceanic and Atmospheric

Administration expects above-average tempera-

tures to span across the majority of the East,

across the central U.S., and into the West. Por-

NATURAL GAS… A WEEK OF TECHNICAL FAILURES

Bearish

Natural Gas

tions of the Southeast and an area

of the Northwest will see average

temperatures, while below-average

temperatures will be confined to a

portion of the Northwest.

The two major technical failures that

occurred this week point to lower

prices in the short term. First, natu-

ral gas failed to breach $2.80/

mmbtu, a major resistance level

shown on the attached weekly bar

chart. Then, natural price declines

continued to accelerate as they

broke through a major support price

level, confirmed with the Relative

Strength Index (RSI), the Stochastic

Oscillator, and Momentum technical

indicators. It appears that prices could be

headed toward lows that occurred in April

around $2.44/mmbtu, and EQS would not rule

out a sell off to below the psychological $2.00/

mmbtu level, although this is not our base case.

We continue to watch for an inflection point this

month before the onset of winter.

Consumption

decreased... led by a

15% decline in

natural gas used for

power generation.

NG Price Technical Failure #1

NG Price Technical Failure #2

- 5. Copyright © 2015 EQS Capital Management LLC, See important disclosure on last page

All rights reserved. 5 www.eqstrading.com

Why You Need EQS

From technicals to fundamentals to macroeconomics, analyzing com-

modity markets can be a daunting task. Let EQS do the work for you.

Through its subscription service, EQS Trading provides traders and

hedgers easy to follow trading signals for major commodity futures mar-

kets, including crude oil, natural gas, gold, silver and many others. Now,

strategies used by institutions and hedge funds are at your fingertips.

The subscription service includes both daily trading signals and the

weekly Signals Newsletter, which provides in-depth insight to the com-

modity markets.

EQS Capital Management also offers a commodity hedge fund (EQS

Commodity Fund LLC), which employs the same signals in its subscrip-

tion service in a private placement fund for accredited investors and

institutions. Because EQS uses a “long” and “short” strategy, it is de-

signed to

generate

returns,

regardless

of which

way the

market is

moving.

EQS

Commodi-

ty Fund

imbeds strict risk management principles through diversifying its portfolio

(energy, metals, and agriculture) and actively managing stop loss limits.

What is EQS?

Economic Quantitative Strategy (aka EQS) is an investment and trading

strategy that translates economic data and technical indicators into price

direction for

commodi-

ties. Be-

cause of its

quantitative

nature,

EQS has

been rigor-

ously back-

tested with

15 years of

historical

data to

ensure the

strategy works in a variety of market conditions. Furthermore, because

the global economy changes over time, EQS employs dynamic parame-

ters that evolve as the market changes.

About Us

Who is EQS?

Richard C. Rhodes

Mr. Richard C. Rhodes is the President and Founder of EQS Capital

Management LLC. Richard has a Bachelor of Science with honors in

Mechanical Engineering from Texas A&M University and an MBA

from Duke University. He brings almost 25 years of diverse energy

experience, covering all phases of the oil and natural gas value chain

from producer to end-user. Richard is a li-

censed Series 3 CTA (Commodity Trading

Advisor) with the Commodity Futures Trading

Commission and a member of the National

Futures Association.

Richard began his professional career on a

drilling rig in West Texas with Conoco Explo-

ration and Production. Richard continued his

oil and gas career with Koch Industries

(ranked as one of the largest privately-owned companies in the U.S.)

where he worked in midstream, refining, pipeline, and distribution

operations. During his eight years with Koch Industries, Richard be-

gan as an operations engineer and later found his true passion in

trading, which leveraged his professional interests in mathematics

and economics. Richard joined Duke Energy in 2002, where he spent

ten years working in the energy trading department and earned The

Pinnacle Award, the company’s highest honor. Richard then left Duke

Energy to launch EQS Capital Management in 2012.

Jonathan M. Lamb

Mr. Jonathan M. Lamb is the Director of Business Development at

EQS Trading. As a four year varsity hurdler

on the track team at Ball State University,

Jonathan earned Bachelor of Science de-

grees in Risk Management, Insurance, and

Economics, and started working on his PhD

in Economics at North Carolina State Uni-

versity before focusing on business and

trading.

As part of the first wave of Millennials to

join the work force, Jonathan started his

professional career almost 15 year ago,

joining ACES Power Marketing as an Operations Specialist, providing

demand side economics for Co-Op Power Providers before becoming

a Real-Time Electricity Power Trader. He continued his career trading

power for seven years with Progress Energy (now Duke Energy, the

largest utility in the nation) as a Senior Real Time Trader. Jonathan

then opted to become an entrepreneur and started a consulting firm

specializing in finance and economics, owning and running seven

different small businesses before joining EQS in 2015.

- 6. Copyright © 2015 EQS Capital Management LLC, See important disclosure on last page

All rights reserved. 6 www.eqstrading.com

EQS Trading

A Division of EQS Capital Management, LLC

8480 Honeycutt Road, Suite 200

Raleigh, NC 27615

Phone: 919.714.7453

www.EQStrading.com

E-mail: JL@EQScapital.com

Your use of this subscription is governed by these Terms and Conditions.

You may print the documents published in hard copy for internal reference purposes, but not for

any other purpose. Specifically, you may not copy, reproduce, distribute or modify the content.

The information may be changed by EQS at any time without notice. While EQS will use reason-

able efforts to ensure that the information is accurate and up to date, no representations or war-

ranties are given as to the reliability, accuracy and completeness of the information.

This material has been compiled and presented as general information, without specific regard

to the particular circumstances or risks of any company, institution, or individual. It is not intend-

ed as, nor should it be construed to be, investment advice. In no event will EQS, its affiliates,

nor any of its officers, partners or employees be liable for any loss or damage including without

limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising

from loss of data or profits arising out of it, or in any connection with, your use of the Subscrip-

tion or the failure of performance, error, omission, interruption, delay in operation or transmis-

sion.

Use of the Subscription Service shall be governed by all applicable Federal laws of the United

States of America and the laws of the State of Delaware. The user hereby acknowledges and

agrees that EQS may be harmed irreparably by any violation of this Agreement and that EQS

shall be entitled to injunctive relief to enforce this Agreement. The information contained has

been prepared solely for informational purposes and is not an offer to sell or purchase or a solici-

tation of an offer to sell or purchase any interests or shares in funds managed by EQS. Any such

offer will be made only pursuant to an offering memorandum and the documents relating thereto

describing such securities.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. HYPOTHETICAL PERFORMANCE RE-

SULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESEN-

TATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMI-

LAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPO-

THETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY

PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RE-

SULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HY-

POTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD

CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE,

THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE

OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING

RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO

THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED

FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN AD-

VERSELY AFFECT ACTUAL TRADING RESULTS.

THE RISK OF LOSS IN TRADING COMMODITY INTERESTS CAN BE SUBSTANTIAL. YOU SHOULD THERE-

FORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FI-

NANCIAL CONDITION. THE HIGH DEGREE OF LEVERAGE THAT IS OFTEN OBTAINABLE IN COMMODITY

INTEREST TRADING CAN WORK AGAINST YOU AS WELL AS FOR YOU. THE USE OF LEVERAGE CAN LEAD

TO LARGE LOSSES AS WELL AS GAINS.

THE REGULATIONS OF THE COMMODITY FUTURES TRADING COMMISSION ("CFTC") REQUIRE THAT

PROSPECTIVE CLIENTS OF A CTA RECEIVE A DISCLOSURE DOCUMENT WHEN THEY ARE SOLICITED TO

ENTER INTO AN AGREEMENT WHEREBY THE CTA WILL DIRECT OR GUIDE THE CLIENT'S COMMODITY

INTEREST TRADING AND THAT CERTAIN RISK FACTORS BE HIGHLIGHTED. YOU MAY REQUEST A COPY

OF THE DISCLOSURE DOCUMENT BY EMAILING EQS. THE CFTC HAS NOT PASSED UPON THE MERITS

OF PARTICIPATING IN THIS TRADING PROGRAM NOR ON THE ADEQUACY OR ACCURACY OF THE DIS-

CLOSURE DOCUMENT. THIS BRIEF STATEMENT CANNOT DISCLOSE ALL OF THE RISKS AND OTHER SIG-

NIFICANT ASPECTS OF THE COMMODITY MARKETS. THEREFORE, YOU SHOULD PROCEED DIRECTLY TO

THE DISCLOSURE DOCUMENT AND STUDY IT CAREFULLY TO DETERMINE WHETHER SUCH TRADING IS

APPROPRIATE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION.

EQS CAPITAL LLC IS A CFTC REGISTERED COMMODITY TRADING ADVISOR AND COMMODITY POOL

OPERATOR. PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION

IN CONNECTION WITH POOLS WHOSE PARTICIPANTS ARE LIMITED TO QUALIFIED ELIGIBLE PERSONS,

AN OFFERING MEMORANDUM FOR THIS POOL IS NOT REQUIRED TO BE, AND HAS NOT BEEN, FILED

WITH THE COMMISSION. THE COMMODITY FUTURES TRADING COMMISSION DOES NOT PASS UPON

THE MERITS OF PARTICIPATING IN A FUND OR UPON THE ADEQUACY OR ACCURACY OF AN OFFERING

MEMORANDUM. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT RE-

VIEWED OR APPROVED THIS OFFERING OR ANY OFFERING MEMORANDUM FOR THIS FUND.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EX-

CHANGE COMMISSION (THE “SEC”) OR ANY STATE SECURITIES COMMISSION NOR HAS THE SEC OR

ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS AS A

PRIVATE PLACEMENT MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OF-

FENSE.

THE SOUR C E

F OR C OM M OD ITY

TR AD ING SIGN ALS

TERMS and DISCLOSURES