Weekly Mutual Fund and Debt Report - HDFC Sec

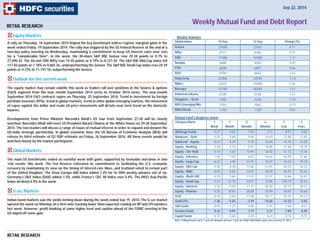

- 1. RETAIL RESEARCH RETAIL RESEARCH Weekly Statistics Global Index 19-Sep 12-Sep Change (%) Sensex 27090 27061 0.11 Nifty 8121 8106 0.19 DJIA 17280 16988 1.72 Nasdaq 4580 4583 -0.07 FTSE 6838 6807 0.46 DAX 9799 9651 1.53 Hang Seng 24306 24595 -1.18 Nikkei 16321 15948 2.34 Bovespa 57789 56928 1.51 Indonesia Jakarta 5228 5144 1.63 Singapore – Strait 3305 3346 -1.23 MSCI Emerging Mkt 1054 1062 -0.75 MSCI World 1740 1729 0.64 Mutual Fund Categories watch Category Name 1 Week 1 Month 3 Months 6 Months 1 Year 3 Years Arbitrage Funds 0.21 0.56 1.94 4.37 8.97 8.83 Balanced - Debt 0.25 2.60 5.60 14.43 21.80 12.45 Balanced - Equity -0.23 4.39 9.76 29.49 43.70 18.28 Equity - Banking -0.38 4.16 5.91 34.00 47.68 18.78 Equity – Div Yield 0.14 5.60 10.90 36.92 51.72 17.46 Equity - Infrastru -1.34 3.20 6.07 44.44 66.99 12.46 Equity - Large Cap -0.32 4.58 10.35 32.07 44.55 18.78 Equity - Mid Cap -0.40 8.38 15.66 51.81 86.70 26.23 Equity - MNC 0.50 8.06 19.01 46.04 64.95 25.65 Equity - Multi CAP -0.29 5.86 11.91 37.41 53.86 20.45 Equity - Small Cap 0.24 12.70 23.07 72.85 104.10 28.40 Equity - Infotech 2.26 9.06 17.41 26.92 45.73 28.21 Equity - Pharma 0.20 10.95 28.08 35.89 58.65 30.66 ELSS -0.47 5.56 11.58 35.17 52.35 20.33 Gold ETFs -1.48 -5.83 -3.49 -10.68 -12.22 -3.05 Gilt Funds 0.45 1.23 2.09 5.91 7.45 8.21 Income Funds 0.34 0.99 1.79 5.21 7.85 8.45 Liquid Funds 0.15 0.68 2.02 4.24 8.76 8.75 Note: Trailing Returns up to 1 year are absolute and over 1 year are CAGR. NAV/index values are as on Sep 19, 2014. Equity Markets A rally on Thursday, 18 September 2014 helped the key benchmark indices register marginal gains in the week ended Friday, 19 September 2014. The rally was triggered by the US Federal Reserve at the end of a two-day policy meeting on Wednesday, maintaining a commitment to keep US interest rates near zero for a "considerable time". In the week, the 30-share S&P BSE Sensex rose 29.38 points or 0.1% to 27,090.42. The 50-unit CNX Nifty rose 15.95 points or 0.19% to 8,121.45. The S&P BSE Mid-Cap index fell 117.82 points or 1.18% to 9,865.26, underperforming the Sensex. The S&P BSE Small-Cap index rose 24.39 points or 0.21% to 11,191.18, outperforming the Sensex. Outlook for the current week The equity market may remain volatile this week as traders roll over positions in the futures & options (F&O) segment from the near month September 2014 series to October 2014 series. The near-month September 2014 F&O contracts expire on Thursday, 25 September 2014. Trend in investment by foreign portfolio investors (FPIs), trend in global markets, trend in other global emerging markets, the movement of rupee against the dollar and crude oil price movements will dictate near term trend on the domestic bourses. Developments from Prime Minister Narendra Modi's US tour from September 27-30 will be closely watched. Narendra Modi will meet US President Barack Obama at the White House on 29-30 September 2014. The two leaders will discuss a range of issues of mutual interest in order to expand and deepen the US-India strategic partnership. In global economic data, the US Bureau of Economic Analysis (BEA) will release its third estimate of Q2 GDP estimate on Friday, 26 September 2014. All these events would be watched closely by the market participants. Global Markets The main US benchmarks ended an eventful week with gains, supported by favorable outcomes in two ‘risk events’ this week. The Fed Reserve reiterated its commitment to facilitating the U.S. economic recovery by maintaining its view on the timing of interest-rate hikes, and Scotland voted to remain part of the United Kingdom. The Stoxx Europe 600 Index added 1.2% for its fifth weekly advance out of six. Germany’s DAX Index (DAX) added 1.5%, while France’s CAC 40 Index rose 0.4%. The MSCI Asia-Pacific Index declined 0.9% in the week. G sec Markets Indian bond markets saw the yields inching down during the week ended Sep 19, 2014. The G sec market opened the week on Monday on a firm note tracking lower than expected reading on IIP and CPI numbers last week. However, profit booking at some higher level and caution ahead of the FOMC meeting in the US wiped off some gain. Sep 22, 2014 Weekly Mutual Fund and Debt Report

- 2. RETAIL RESEARCH 10 Year G sec Benchmark move: Weekly Statistics Debt Securities Benchmarks watch Debt (%) 19-Sep 12-Sep Change (bps) Call Rate 7.83 7.95 -12 CBLO 8.07 7.85 22 Repo 8.00 8.00 0 Reverse Repo 7.00 7.00 0 10 Year G sec 8.45 8.50 -5 LIBOR – UK 0.56 0.56 0 LIBOR – USA 0.24 0.24 0 LIBOR – Europe 0.17 0.17 0 The G-Sec prices closed range-bound on Tuesday. However, the sentiment improved tracking a good response to the repurchase auction. The rupee’s gain against the dollar also supported the bond prices. The G-Sec market traded mostly range-bound on Wednesday awaiting the outcome to the FOMC meeting. Government bond prices ended higher on Thursday tracking the improvement seen in the domestic currency. Government bond prices ended marginally higher on Friday as the auction results came in line with expectations. Hence, the yields of the 10-year benchmark 8.40% 2024 bond ended down by 5 bps to 8.45% (Rs 99.62) yield on Friday against the last week close of 8.50%. Outlook for the week We feel that the new 10-year G Sec yields could trade in the 8.35% - 8.70% band for the week. T Bill Auctions The T-Bill auctions held last week were fully subscribed in the 91 days T-Bill. The cut-off for 91-Days T-Bill was set at Rs 97.9, implying a yield of 8.60% (previous week yield 8.60%). The 364-Days T-Bill auctions were fully subscribed. The cut-off for 182-Days T-Bill was set at Rs 92.05, implying a yield of 8.65%. Liquidity, Call & CBLO The liquidity in the banking system hardened last week compared to the previous week. The net infusion from the LAF window was a daily average of Rs. 14,747 crore for last week (Rs. 6,193 crore in previous week). The inter-bank call rates traded around 7.83% levels on Friday. The CBLO rates were positioned at 8.07% level. Corporate Debts The 1 year bond ended at 9.05% compared to the previous week close of 9.05%. The 10-year AAA bond traded at 9.24% compared to the previous week close 9.34%.

- 3. RETAIL RESEARCH AAA Corporate Bond Spread over Gsec AAA Corporate Bond Spread over Gsec Security 19-Sep 12-Sep 1 Year 49 38 3 Year 51 57 5 Year 68 64 10 Year 61 64 Forthcoming Auctions Security Date of Auction Value (Rs. Crs) 91 Day T-Bill 22-Sep-14 9,000 182 Day T-Bill 22-Sep-14 5,000 Certificates of Deposits: Maturity 22-Sep 15-Sep 3 Months 8.65 8.75 6 Months 8.8 9. 1 Year 9.05 9.1 Commercial Papers: Maturity 22-Sep 15-Sep 3 Months 9 9 6 Months 9.25 9.25 1 Year 9.4 9.35 Commodity Update: Commodity 19-Sep 12-Sep Change (%) NYMEX Crude Oil ($/bbl) 92.41 92.27 +0.15% Gold (oz/$) 1,215.5 1231.5 -1.30% Currency The USD appreciated against the Euro by 1.05% for week ended 19th September 2014. The dollar appreciated against the yen by 1.57% for the week. The USD depreciated against the Pound by 0.11%. Gold & Crude oil International crude oil prices (WTI) rose by 0.15% for the week ended 19th September 2014 to close at USD 92.41 per barrel. International gold prices fell by 1.30% for the week ended 19th September 2014 to close at USD 1215.50 per troy ounce. Gilt Securities Yields Movements in last 4 weeks

- 4. Scheme Analysis ICICI Pru Focused Blue Chip Equity - G RETAIL RESEARCH

- 5. RETAIL RESEARCH Unit Growth of investments Vs. Benchmark (Rebased to 100) Fund Performance Vis-a-vis Benchmark (Excess return): Key Points ICICI Pru Focused Bluechip Equity is one of the best performing schemes from Large-cap category. Despite the mediocre performance seen in the recent periods, the scheme has delivered notable returns than its benchmark –Nifty and category since its launch. The scheme registered +42%, +22% and 17% of compounded returns for one, three and five year periods while the benchmark posted +33%, +17% and +10% of returns respectively. For the same period, the category clocked 45%, +19% and +12% of CAGR returns respectively. The better performance by the scheme has been mainly attributable to the period the scheme entered into the market. The scheme was launched in the year 2008, a period in which the equity market witnessed correction across the board. This helped the scheme to set up the portfolio at lower valuation. The portfolio of the scheme comprises bluechip stocks (from top 200 stocks by market capitalisation on the NSE) which are relatively stable and have the capability to grow the corpus in long-run. The approach of containing an average of 35-45 well established stocks in the portfolio, buy and hold strategy, being almost fully invested in equity and efficient call strategy helped the scheme to outperform the category during all market cycles. The portfolio has been churned moderately in the last six months periods as it added 9 new stocks and exited from 23 stocks. The turnover ratio stood at 40%. ICICI, HDFC Bank, ITC Ltd are the stocks that topped in its latest portfolio having weights of 8.24%, 7.08% and 5.24% to its net assets respectively. The expense ratio of 2.23% for the scheme is lower compared to the category average of 2.62%. Rating agencies like Value research & Crisil assigned ‘5 star’ and ‘CPR 1’ respectively for the scheme. These reflect very good performance of the scheme in generating high risk adjusted returns. The scheme is managed by Mr. Manish Gunwani. The corpus of the scheme as per latest data was at Rs. 7,274 crore. As far as risk measures are concerned, the scheme has done very well in terms of Sharpe and Jensons Alpha. It registered Sharpe of 0.06% (Category 0.05%) and Alpha of 0.02% (Category 0.01%). It seems to be less risky while compared to peers as it generated 0.94% (category 0.98%) of Standard Deviation over the last one-year.

- 6. Mutual Fund ready reckoner: RETAIL RESEARCH Equity - Diversified - Large CAP Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 3 Year Return 5 Year Return Return Since Inception Top holdings Crisil Rank Value Research Rating Risk Grade Return Grade Birla Sun Life Frontline Equity - Plan A (G) 142.61 6162 55.89 22.52 15.71 24.80 ICICI Bank, L&T, HDFC Bank, ITC and Infy CPR 2 4 Star Average Above Average Quantum Long-Term Equity Fund (G) 35.95 323 54.99 22.04 18.33 16.21 HDFC Ltd, Bajaj Auto Ltd, Maruti Suzuki India Ltd, Infosys Ltd, Container CPR 1 5 Star Below Average High ICICI Pru Focused Bluechip Equity Fund (G) 26.34 6908 50.35 21.27 17.19 16.73 HDFC Bank Ltd, Infosys Ltd, ICICI Bank Ltd, ITC Ltd, Kotak Mahindra Bank Ltd CPR 2 5 Star Low High Equity - Diversified - Multi CAP Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 3 Year Return 5 Year Return Return Since Inception Top holdings Crisil Rank Value Research Rating Risk Grade Return Grade Birla Sun Life Pure Value Fund (G) 32.51 249 110.50 27.67 21.80 20.17 Jyoti Structures, Reliance Infrastructure, Federal Bank, ICICI - 5 Star Below Average High ICICI Pru Dynamic Plan (G) 173.31 4840 55.36 22.46 17.59 27.28 Power Grid Corp, Infy, ICICI, HDFC Bank & SBI CPR 1 5 Star Low High Mirae Asset India Opportunities Fund (G) 28.11 591 65.97 23.77 19.46 17.62 INFY, ICICI, HDFC, ITC and HDFC Ltd CPR 2 5 Star Below Average High Equity - Diversified - Mid n Small CAP Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 3 Year Return 5 Year Return Return Since Inception Top holdings Crisil Rank Value Research Rating Risk Grade Return Grade IDFC Premier Equity Fund - Plan A (G) 58.35 5417 67.27 22.28 21.84 21.89 Page Ind, Kaveri Seed Company, Blue Dart Express, Bata India, United CPR 1 4 Star Below Average Above Average ICICI Pru Value Discovery Fund (G) 96.65 5724 95.41 30.92 23.73 25.38 ICICI Bank, RIL, Sadbhav Engineering, SBI & Amara Raja Batteries CPR 2 5 Star Low Above Average SBI Emerging Businesses Fund (G) 78.14 1484 60.18 22.86 23.79 22.87 HDFC Bank, Shriram Citi, 3M India, P&G Hygiene & Health Care CPR 1 3 Star Below Average Average Equity - Tax Planning Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 3 Year Return 5 Year Return Return Since Inception Top holdings Crisil Rank Value Research Rating Risk Grade Return Grade AXIS Long Term Equity Fund (G) 25.02 1854 78.50 28.21 21.76 HDFC Bank Ltd, TCS, L&T, Kotak Mahindra Bank Ltd, ITC Ltd CPR 1 5 Star Low High ICICI Pru Tax Plan - (G) 243.14 2090 70.27 24.89 19.82 23.66 NMDC, Infosys Ltd, ICICI Bank Ltd, HDFC Bank Ltd & Cairn Ind CPR 2 5 Star Low High

- 7. RETAIL RESEARCH Hybrid - Equity Oriented (Atleast 60% in equity) Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 3 Year Return 5 Year Return Return Since Inception Top holdings Crisil Rank Value Research Rating Risk Grade Return Grade HDFC Balanced Fund (G) 93.52 1897 61.60 19.73 19.67 17.37 Infosys Ltd, Mindtree, TCS, ICICI Bank Ltd, Persistent Systems Ltd CPR 2 4 Star Below Average High ICICI Pru Balanced Fund - (G) 80.81 941 52.12 21.36 17.87 15.14 HDFC Bank, Motherson Sumi, Balkrishna Inds, Maruti Suzuki Ind CPR 2 5 Star Below Average Above Average Hybrid - Monthly Income Plan - Long Term (About 15% to 20% in equity) Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 3 Year Return 5 Year Return Return Since Inception Top holdings Crisil Rank Value Research Rating Risk Grade Return Grade Reliance Monthly Income Plan (G) 29.67 2247 19.18 10.86 9.71 10.74 Eq: Sundaram-Clayton, Federal Mogul Goetze, HDFC Bank. CP: PFC CPR 3 4 Star Above Average Above Average HDFC Monthly Income Plan - LTP (G) 31.92 3561 25.94 11.41 10.37 11.49 Eq: SBI, Infy, ICICI Bank, L&T. Debt: TATA Power, Hindalco Inds CPR 4 1 Star Below Average Average Liquid Funds Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 2 Year Return 3 Year Return Return Since Inception Top Holdings Crisil Rank Value Research Rating Risk Grade Return Grade HDFC Liquid Fund (G) 26.21 15152 9.58 9.17 9.33 7.20 CP: National Bank Agr. Rur. Devp, CD: National Bank Agr. Rur. Devp, Union CPR 2 4 Star Below Average Above Average SBI Magnum InstaCash - Cash Plan 2937.55 1675 9.54 9.11 9.25 7.29 CP: M&M Financial Services, Kotak Mahindra Prime, PFC, CD: SIDBI 2014 CPR 2 5 Star Below Average Above Average Ultra Short Term Funds Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 2 Year Return 3 Year Return Return Since Inception Top Holdings Crisil Rank Value Research Rating Risk Grade Return Grade JM Money Manager Fund - Super Plan (G) 18.99 332 9.94 9.28 9.64 8.44 CD: PNB, SBT, Corp Bank, OBC. CP: Shriram Equipment Finance CPR 3 4 Star Average Above Average SBI Magnum Income FRP - Savings Plus Bond (G) 20.64 948 9.46 9.11 9.43 7.43 CD: HDFC, ICICI, IDBI. Debt: LIC Hou, HDFC. CP: Sesa ste CPR 2 5 Star Average Low Short Term Income Funds Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 2 Year Return 3 Year Return Return Since Inception Top Holdings Crisil Rank Value Research Rating Risk Grade Return Grade Sundaram Select Debt - STAP (G) 22.70 798 10.07 9.68 9.77 7.08 FD: J&K Bank, D: 11.6% DHFL. 2015, CD: Central Bank of India 2013, - 5 Star Average High Franklin india Low Duration Fund (G) 14.49 2247 10.67 9.67 9.85 9.50 Debenture: M&M Financial Serv, Tata Capital Fin, JSW Energy, CD: SBB CPR 4 3 Star Average High

- 8. RETAIL RESEARCH Income Funds Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 2 Year Return 3 Year Return Return Since Inception Top Holdings Crisil Rank Value Research Rating Risk Grade Return Grade Birla Sun Life Medium Term Plan (G) 15.89 3285 12.19 10.38 10.84 8.92 Debenture: DLF, Tata Mot, IL&FS Transport, RHC Holdings CPR 3 5 Star Below Average High ICICI Pru Flexible Income Plan - Regular (G) 147.58 11179 9.19 8.55 8.72 7.42 CP: HDFC, Indiabulls Housing Finance, JSW Steel. Bonds: NHB CPR 1 4 Star Below Average High Gilt Funds Scheme Name NAV (Rs) Fund Size (Crs. Rs) 1 Year Return 2 Year Return 3 Year Return Return Since Inception Top Holdings Crisil Rank Value Research Rating Risk Grade Return Grade IDFC G Sec Fund - PF (G) 21.29 58 6.21 8.91 9.79 7.52 7.16% GOI 20/05/2023, 8.07% GOI 03/07/2017, 8.33% GOI 09/07/2026, CPR 2 5 Star Below Average High L&T Gilt Fund (G) 30.85 70 9.01 10.49 9.94 8.13 8.83% GOI 2023, 9.2% GOI 2030, 7.28% GOI 2019, 8.24% GOI 2027 - 5 Star Low High Notes: NAV value as on Sep 19, 2014. Portfolio data as on July 2014. Returns are trailing and annualized (CAGR). The notations '5 Star & CPR 1' (used by VR & Crisil respectively) are considered as top in respective rating and ranking scales. The performance of the funds are rated and classified by Value Research in the following ways. Top 10% funds in each category were classified ‘*****’ funds, the next 22.5% got a ‘****’ star, while the middle 35% got a ‘***’, while the next 22.5% and bottom 10% got ‘**’ and ‘*’ respectively. The criteria used in computing the CRISIL Composite Performance Rank are Superior Return Score, based on NAVs over the Quarter Ended June ‘14, Based on percentile of number of schemes considered in the category, the schemes are ranked as follows: CPR 1- Very Good performance, CPR 2 - Good performance, CPR 3 - Average performance, CPR 4 - Below average and CPR 5 - Relatively weak performance in the category. While short listing schemes adequate importance has been given to corpus and age of scheme. NFO: Scheme name Tenure Open Date Close Date Minimum Investments Equity Reliance Capital Builder Fund - Series C (G) 3 Years 9/17/2014 10/1/2014 5000 IDFC Dynamic Equity Fund (G) 9/17/2014 10/1/2014 5000 JPMorgan India Equity Savings Fund (G) 9/22/2014 10/1/2014 5000 SBI Equity Opportunities Fund - Sr.I (G) 3 Years 9/11/2014 9/25/2014 5000 Sundaram Select Micro Cap - Sr.VI (G) 42 Months 9/10/2014 9/24/2014 5000 Balanced ICICI Pru Multiple Yield Fund - Sr.7-Plan E-Reg(G) 1825 Days 9/17/2014 10/1/2014 5000 Kotak Equity Savings Fund (G) 9/17/2014 10/1/2014 5000

- 9. ICICI Pru Multiple Yield Fund - Sr.7-Plan D-Reg(G) 1338 Days 9/12/2014 9/25/2014 5000 LIC NOMURA MF CPO Fund - Series 5 (G) 36 Months 9/16/2014 9/24/2014 5000 UTI-CPO - Sr.IV - II(1104Days) - Reg (G) 1104 Days 9/8/2014 9/22/2014 5000 Gilt Funds DSP BR Constant Maturity 10Y G-Sec (G) 9/16/2014 9/23/2014 1000 Fixed Maturity Plans SBI Debt Fund Series A - 44 (G) 1111 Days 9/23/2014 10/7/2014 5000 Reliance Dual Advantage FTF - VI - Plan D (G) 1113 Days 9/19/2014 9/30/2014 5000 Birla Sun Life FTP - Series LY (G) 1101 Days 9/23/2014 9/29/2014 5000 DWS FMP - Series 77 - 1100Days (G) 1100 Days 9/19/2014 9/26/2014 5000 SBI Debt Fund Series A - 43 (G) 1111 Days 9/18/2014 9/25/2014 5000 UTI-FTI - Series XX - II(1103Days)-Reg (G) 1103 Days 9/17/2014 9/25/2014 5000 DWS Hybrid FTF - Series 30 (G) 40 Months 9/15/2014 9/25/2014 5000 Religare Invesco FMP - Sr.XXIV - Plan E (G) 1098 Days 9/12/2014 9/25/2014 5000 L&T FMP - Series XI - Plan E(1125Days) (G) 1125 Days 9/10/2014 9/24/2014 10000 HDFC FMP - 1128Days-Sep 2014(1)(XXXII) (G) 1128 Days 9/19/2014 9/24/2014 5000 DSP BR Dual Advantage Fund - Sr.29 - 40Mth (G) 40 Months 9/10/2014 9/24/2014 5000 Reliance Dual Advantage FTF - VI - Plan C (G) 1113 Days 9/12/2014 9/24/2014 5000 Birla Sun Life FTP - Series LX (G) 1099 Days 9/15/2014 9/24/2014 5000 ICICI Pru FMP - Series 75 - 1100Days Plan J-Reg(G) 1100 Days 9/17/2014 9/24/2014 5000 DSP BR FTP - Series 44 - 36Mth (G) 36 Months 9/12/2014 9/23/2014 5000 Reliance Fixed Horizon - XXVII - Sr.7 (G) 1099 Days 9/19/2014 9/22/2014 5000 ICICI Pru FMP - Series 75 - 1100Days Plan I-Reg(G) 1100 Days 9/9/2014 9/22/2014 5000 RETAIL RESEARCH Dividend Scheme Name Record Date Gross (%) Ex Date ICICI Pru Balanced Advantage Fund (D) 9/19/2014 15.00 9/22/2014 Sundaram Tax Saver (D) 9/19/2014 5.00 9/22/2014 Birla Sun Life Buy India Fund (D) 9/18/2014 30.00 9/19/2014 IDBI Equity Advantage Fund - Regular (D) 9/17/2014 10.00 9/18/2014 Reliance Regular Savings Fund-Balanced (Div-Q) 9/15/2014 6.00 9/16/2014 SBI Magnum Multiplier Plus 93 (D) 9/12/2014 115.00 9/15/2014 Mutual Fund NEWS: Change in exit load in Edelweiss Short Term Income Fund: Edelweiss Mutual Fund has announced to revise the Exit Load of Edelweiss Short Term Income Fund to 0.50 per cent for redemption within two months from the date of allotment. The scheme currently charges 0.50 per cent for redemption within four months from the date of allotment. The change will take effect from September 18, 2014. No exit load in Tata Gilt Mid Term Fund: Tata Mutual Fund has removed the exit load from Tata Gilt Mid Term Fund, against the previous 2 per cent for redemption within 365 days, 1 per cent for redemption between 365 days - 730 days, 0.5 per cent for redemption between 730 days - 1095 days.

- 10. Global Updates: (Source: AMC Newsletters) India: • According to Department of Industrial Policy and Promotion data, foreign direct investment (FDI) flows into India more than doubled to $3.5 bn in July compared to a year ago. • RBI Governor Raghuram Rajan says the central bank is limiting the country's reliance on foreign debt and will continue to do so. • According to SEBI data, investments into Indian capital markets through participatory notes (P Notes) surged to Rs 2.11 lakh cr in August. • India’s wholesale price index (WPI)-based inflation fell to a five-year low of 3.74% in August from 5.19% in July. • India’s trade deficit in August stood at $10.83 bn, higher than $10.68 bn in the same month last year, but lower than July’s $12.28 bn; export growth slipped to 2.35% at $26.95bn in August, while imports grew 2.08% to $37.79bn. • SEBI issues clarification on position limits for mutual funds in interest rate futures, stating that fund houses can have position limits as available to trading members of the stock exchanges. • RBI Governor Raghuram Rajan says an abrupt reversal of low interest rates globally could create substantial amounts of damage and that it should be done in a predictable and careful way. • Moody’s Analytics expects India’s GDP growth to approach a 6% pace by the year’s end and accelerate towards 6.5% by end of 2015. • RBI says companies and individuals who have furnished guarantees for wilful defaulters can also be accused as wilful defaulters. Asia: • China’s industrial output rose 6.9% in August from a year earlier, slowing sharply from a 9% rise in July. • China’s retail sales rose 11.9% in August, compared with a 12.2% jump in the previous month. • Japan’s industrial production expanded 0.4% in July, faster than the initial estimate of 0.2% rise and following the 3.4% decline in June. • Japan’s consumer confidence index fell to 41.2 in August from 41.5 in July. US: • US producer prices increased 1.8% in the 12 months to August after rising 1.7% in July. • US industrial production fell by a seasonally adjusted 0.1% in August, after a revised gain of 0.2% in July; capacity utilization dipped to 78.8% in August from 79.1% in July. • US Empire State general business conditions index rose to a five-year high of 27.54 in September from August's 14.69. • US Treasury Department says the federal government ran a budget deficit of $129bn in August, $19bn less than the same month a year ago. • US initial jobless claims in the week ending September 6 increased by 11,000 to a seasonally adjusted 315,000 from the previous week’s revised total of 304,000. • US wholesale inventories edged up 0.1% in July, the smallest rise in a year, after a downwardly revised 0.2% gain in June. UK: • UK consumer prices grew by 1.5% in the year to August, down from 1.6% in July. • UK producer prices fell 0.3% in the year to August, compared with a fall of 0.1% in the year to July • UK RICS House Price Balance fell to 40 in August from 48 in July. Euro Zone: • Euro zone services PMI fell to 53.1 in August from 54.2 in July, while composite PMI fell to 52.5 in August from 53.8 in July. • Euro zone’s industrial production rose by 1% in July after falling 0.3% in June. • Euro zone ZEW economic sentiment survey fell to 14.2 in September from 23.7 in August. • Euro zone’s trade balance stood at a surplus of 21.2 bn euros in July, compared to a surplus of 16.7 bn euros in June. RETAIL RESEARCH

- 11. Economic Calendar: Date Country Event Period Frequency Unit Previous 22-09-2014 India Output of Crude oil Aug Monthly mln tn 3.15 22-09-2014 India Output of Refinery Aug Monthly mln tn 18.09 22-09-2014 India Output of Natural gas Aug Monthly bln cu m 2.74 22-09-2014 US Chicago Fed National Activity Index Aug, 2014 Monthly 22-09-2014 US Existing Home Sales Aug, 2014 Monthly Million 5.15 23-09-2014 US ICSC-Goldman Store Sales wk9/20, 2014 Weekly 23-09-2014 US Redbook wk9/20, 2014 Weekly 23-09-2014 US FHFA House Price Index Jul, 2014 Monthly 23-09-2014 US Richmond Fed Manufacturing Index (level change) Sep, 2014 Monthly 12 24-09-2014 India 91 day T- Bills auction of Rs 70 bln (cut-off yld) Weekly pct 8.6 24-09-2014 India Reserve Money (change on year) Wk to Sep 19 Weekly pct 7.31 24-09-2014 India 182 days T- Bills auction of Rs 50 bln (cut-off yld) Fortnightly pct 8.71 24-09-2014 Switzerland UBS Consumption Index (Level) Aug, 2014 Monthly 1.66 24-09-2014 US MBA Purchase Applications wk9/19, 2014 Weekly 24-09-2014 US New Home Sales (New Home Sales - Level - SAAR) Aug, 2014 Monthly K 412 24-09-2014 US EIA Petroleum Status Report wk9/19, 2014 Weekly 25-09-2014 European Monetary Union M3 Money Supply (M3-Y/Y) Aug, 2019 Yearly Percent 1.5 25-09-2014 UK CBI Distributive Trades (Level) Sep, 2014 Monthly 37 25-09-2014 US Jobless Claims wk9/20, 2014 Weekly 25-09-2014 US EIA Natural Gas Report wk9/19, 2014 Weekly 26-09-2014 US Money Supply wk9/15, 2014 Weekly 26-09-2014 US Fed Balance Sheet wk9/24, 2014 Weekly 26-09-2014 Japan CPI Aug, 2014 Monthly 26-09-2014 US Consumer Sentiment (Sentiment Index - Level) Sep, 2014 Monthly 84.6 26-09-2014 India WMA (ways and means advance) - to central govt Wk to Sep 19 Weekly Rs bln 26-09-2014 India WMA (ways and means advance) - to state govts Wk to Sep 19 Weekly Rs bln 5.06 26-09-2014 India FX reserve (change on wk) Wk to Sep 19 Weekly $ mln -1615.4 29-09-2014 India IIP Core (YoY Chg) Aug Monthly pct 2.7 29-09-2014 UK M4 Money Supply Aug, 2014 Monthly 29-09-2014 European Monetary Union EC Economic Sentiment (Ec. Sentiment) Sep, 2014 Monthly 100.6 29-09-2014 US Personal Income and Outlays Aug, 2014 Monthly Percent 0.2 29-09-2014 US Pending Home Sales Index Aug, 2014 Monthly Percent 3.3 30-09-2014 India RBI Fourth Bi-monthly Monetary Policy Statement 2014-15 30-09-2014 India CPI-Industrial Workers Aug Monthly pct 7.23 30-09-2014 India Government finances -fiscal deficit Apr-Aug Monthly pct 61.2 RETAIL RESEARCH

- 12. RETAIL RESEARCH Relationship among policy rates and benchmarks: At the Third Bi-Monthly Monetary Policy Statement for 2014-15 held on Aug 05, the RBI kept the Repo and Reverse Repo Rates unchanged at 8.00% and 7.00% respectively. The RBI reduced the Statutory Liquidity Ratio of scheduled commercial banks by 50bps to 22%. Further, the central bank highlighted the upside risks to inflation in the medium run. As per the proposals presented by Finance Minister Mr. Arun Jaitley, the gross borrowings of the government in 2014‐15 are pegged at Rs 6 lakh crore, 6.4% higher than the level in 2013‐14. It is to be noted that if there is an upward revision in the borrowing program for this fiscal, then that will impact the bond market putting more pressure in the yields of the long dated securities. Deposit vs. Advance Growth (YoY)% Bank credit growth continued to remain sluggish with addition being a tepid 9.6 per cent to Rs 61,40,925 crore for the fortnight to September 4, according to data released by the Reserve Bank of India here today. The demand deposit grew 14.64 per cent to Rs 7,46,002 crore as of September 5 from Rs 6,50,705 crore in the year ago period. Deposits of commercial banks stood at Rs 71,47,778 crore in the same period last year. Economy Updates US Dollar Vs Indian Rupee The US dollar depreciated against the rupee marginally by 0.05% for the week ended 19th September 2014. The Indian rupee edged up to end on sustained dollar selling by exporters and capital inflows. A strong dollar overseas and some hesitancy in local stocks, however, limited the rupee rise. WPI Inflation (YoY) The Wholesale Price Index (WPI) based inflation came in August at a five year low of 3.74% (lower than the 5.19% yoy noted on July month).

- 13. RETAIL RESEARCH Corporate Bonds Spread Vs Gilt Securities: Corporate bond Yields saw a fall across the curve in the last week. However, the one year AAA credit spreads rose by 11 basis points while 10 year spread fell by 3 basis points. Liquidity support from RBI (Bn. Rs) The liquidity in the banking system hardened last week compared to the previous week. The net infusion from the LAF window was a daily average of Rs. 14,747 crore for last week (Rs. 6,193 crore in previous week). The inter-bank call rates traded around 7.83% levels on Friday. The CBLO rates were positioned at 8.07% level. Money Stock (M3) (YoY) (%) India's money supply (y-o-y ) growth at 13.2 percent on September 5 RBI data show. The reserve money grew 7.3 percent year on year in week to September 12 versus 8.1 percent year ago. The currency in circulation grew 10.6 pct y-o-y in week to September 12 versus 9.8 percent year ago. Currency in circulation up 45.7 billion rupees to 13.52 trln rupees in week to September 12. Foreign Exchange Reserves (mn of USD) India’s foreign exchange reserves fell by $1,327 mn to $317.313 bn for the week ended Sep 12.

- 14. RETAIL RESEARCH Certificates of Deposit (%): CD rates are trending marginally lower in the recent periods. The CD rates hovered around 9.05% levels (as per the latest data) (one year CD). Commercial Paper (%): Rates of Commercial papers are seen trading lower in the recent periods. The CP rates are hovering around 9.4% levels (one year maturity CP). MF’s net investment in Debt (Rs Crs): Mutual funds had been net buyers in July by buying worth Rs. 17,008 crore while they remained buyers in Aug by buying worth Rs. 65,649 crore. So far in Sep, mutual funds have bought debts so far to the tune of Rs. 19,451 crore. FII’s net investment in Debt (Rs Crs): FII bought net of Rs. 22,333 crore during July month while they have remained buyers in Aug by buying debt to the tune of Rs. 17,106 crore. So far in Sep, FII have bought debts to the tune of Rs. 14,438 crore. Analyst: Dhuraivel Gunasekaran (dhuraivel.gunasekaran@hdfcsec.com) RETAIL RESEARCH Fax: (022) 3075 3435 Corporate Office: HDFC Securities Limited, I Think Techno Campus, Building –B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435 Website: www.hdfcsec.com Disclaimer: Mutual Funds and Debt investments are subject to risk. Past performance is no guarantee for future performance. This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients.