Active Duration Management for Navigating Fixed Income Markets

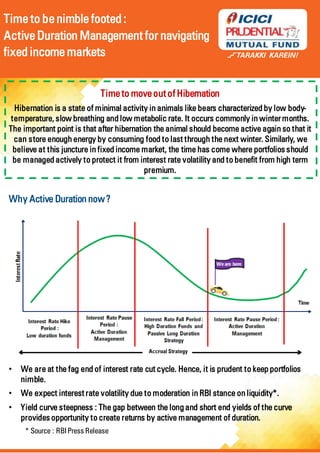

- 1. Time to move outof Hibernation Hibernation is a state of minimal activity in animals like bears characterized by low body- temperature, slow breathing and low metabolic rate. It occurs commonly in winter months. The important point is that after hibernation the animal should become active again so that it can store enough energy by consuming food to last through the next winter. Similarly, we believe at this juncture in fixed income market, the time has come where portfolios should be managed actively to protect it from interest rate volatility and to benefit from high term premium. Why Active Duration now ? • We are at the fag end of interest rate cut cycle. Hence, it is prudent to keep portfolios nimble. • We expect interest rate volatility due to moderation in RBI stance on liquidity*. • Yield curve steepness : The gap between the long and short end yields of the curve provides opportunity to create returns by active management of duration. * Source : RBI Press Release Time to be nimble footed : Active Duration Management for navigating fixed income markets

- 2. What our DebtValuation Index for Duration RiskManagement Suggests? Data as on July 31, 2021. Debt Valuation Index considers Whole sale Price Index (WPI), Consumer Price Index (CPI),Sensex returns,Gold returns and Real estate returns over G-Sec yield,Current Account Balance, Fiscal Balance and Crude Oil Movement for calculation. We remain very cautious on duration as the interest rates are expected to remain volatile due to RBI normalizing liquidity and upside risk to inflation due to economic recovery Investment Approach forthe Current Market A. Active Duration for benefitting from high term premium Time to be nimble footed : Active Duration Management for navigating fixed income markets Aggressive Highly Aggressive Very Cautious Cautious Moderate Source: CRISIL Research, Data as on July 31, 2021. Pastperformance may or may not sustain in future 1.76 0 1 2 3 4 5 6 7 8 9 10 Very Cautious Cautious Moderate Aggressive Highly Aggressive -3 -2 -1 0 1 2 3 4 Jul-02 Jul-03 Jul-04 Jul-05 Jul-06 Jul-07 Jul-08 Jul-09 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17 Jul-18 Jul-19 Jul-20 Jul-21 Term Premium (10 Yr Gsec - 1 Yr Tbill) % Long Term Average Premium % Average 83 bps 253 bps

- 3. B. Accrual Strategy to benefit from higher carry provided by good quality spread assets Time to be nimble footed : Active Duration Management for navigating fixed income markets Avg. 91 bps Avg.54 bps S P R E A D Avg. 359bps Source: CRISIL Research, Data as on July 31, 2021. Past performance may or may not sustain in future Our Portfolio Positioning • Across our portfolios we aim to manage duration actively • In short duration schemes, we aim to run Barbell Strategy (combination of high duration and low duration instrument) to benefit from term premium ((10 Yr Gsec yield over 1 Yr Tbill yield) and to reduce interest rate volatility • In Schemes which aim to invest in short end of the yield curve, we have added exposure towards Floating Rate Bonds (FRB) • We have added reasonable quality AA Corporate Bond in select portfolios, due to higher spread premium 3 4 5 6 7 8 9 6 Months 1 Yr 3 Yr 5 Yr Yields (%) AA AAA Gsec Repo Rate

- 4. Over the last 2-3 months we had added duration to our portfolios due to the following reasons: 1. GDP growth rate slashed: On the back of the outbreak of the second wave and its connected implications on the overall economy 2. Accommodative stance to continue: RBI has unequivocally hinted that normalization in monetary policy is not being thought about yet. 3. Yield Curve Control: RBI is actively managing the yield curve with its regular Open Market Operations (OMOs) along with the recently launched G-Sec acquisition program or G-SAP program which may not allow yields at the longer end to rise despite government borrowing and inflation concerns 4. Benefit from Higher Term Premium: Currently, the term premium is at one of the highest levels seen in the last 10 years at around 250 bps. We have tactically taken exposure on the longer end of the curve to capture the term premium. However, with the unlock phase beginning and covid cases declining, growth is expected to improve and hence we have moderated duration in the month of July Time to be nimble footed : Active Duration Management for navigating fixed income markets Our Duration Management Scheme Name (A) (B) (C) Changein Mod Duration (C-B) Mod Duration in Yrs (Nov 30,2020) Mod Duration in Yrs (June 30 ,2021) Mod Duration in Yrs (July 31,2021) ICICI Prudential Liquid Fund 0.10 0.12 0.09 -0.03 ICICI Prudential Money Market Fund 0.33 0.36 0.28 -0.08 ICICI Prudential Ultra Short Term Fund 0.39 0.4 0.33 -0.07 ICICI Prudential Savings Fund 0.89 0.97 0.82 -0.15 ICICI Prudential Floating Interest Fund 1.19 1.25 0.99 -0.26 ICICI Prudential Credit Risk Fund 2.09 1.96 1.92 -0.04 ICICI Prudential Short Term Fund 2.41 2.53 2.4 -0.13 ICICI Prudential Corporate Bond Fund 2.94 2.06 2.31 0.25 ICICI Prudential Banking & PSU Debt Fund 3.30 3.1 3.86 0.76 ICICI Prudential Medium Term Bond Fund 3.23 3.15 2.97 -0.18 ICICI Prudential Bond Fund 5.05 5.38 5.38 0 ICICI Prudential All Seasons Bond Fund 4.34 3.97 4.12 0.15 ICICI Prudential Long Term Bond Fund 7.82 8.74 8.72 -0.02 ICICI Prudential Gilt Fund 7.66 5.13 5.91 0.78

- 5. Time to be nimble footed : Active Duration Management for navigating fixed income markets Scheme Recommendation – FixedIncome / Arbitrage Approach Scheme Name Callto Action Rationale Arbitrage ICICIPrudential Equity Arbitrage Fund Invest with 3 Months & above horizon Spreads at reasonable levels Short Duration ICICIPrudential Savings Fund ICICIPrudential Ultra Short Term Fund ICICIPrudential FloatingInterest Fund Invest for parking surplus funds Accrual+ Moderate Volatility Accrual Schemes ICICI Prudential Credit Risk Fund ICICI Prudential Medium Term Bond Fund Core Portfolio with>1 Yr investment horizon Better Accrual DynamicDuration ICICIPrudential All Seasons Bond Fund LongTerm Approach with >3 Yrs investment horizon Active Duration and Better Accrual

- 6. Time to be nimble footed : Active Duration Management for navigating fixed income markets Riskometers ICICI Prudential Credit RiskFund (Anopenended debtschemepredominantlyinvestinginAAand belowrated corporatebonds)is suitable for investors who are seeking*: Medium term savings A debt scheme that aims to generate income through investing predominantly in AA and below rated corporate bonds while maintaining the optimum balance of yield, safety and liquidity ICICI Prudential Medium Term Bond Fund (An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 Years and 4 Years. The Macaulay duration of the portfolio is 1 Year to 4 years under anticipated) adverse situation is suitable for investors who are seeking*: Medium term savings A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. ICICI Prudential Gilt Fund (An open ended debt scheme investing in government securities across maturity) is suitable for investors who are seeking*: Long term wealth creation A Gilt scheme that aims to generate income through investment in Gilts of various maturities. *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. ICICI Prudential Short Term Fund (An open ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 Year and 3 Years) is suitable for investors who are seeking*: Short term income generation and capital appreciation solution A debt fund that aims to generate income by investing in a range of debt and money market instruments of various maturities. *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. ICICI Prudential LongTermBond Fund (An open ended debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 Years) is suitable for investors who are seeking*: Long term wealth creation A debt scheme that invests in debt and money market instruments with an aim to maximise income while maintaining an optimumbalance of yield, safetyand liquidity. *Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

- 7. Riskometers Time to be nimble footed : Active Duration Management for navigating fixed income markets ICICI Prudential All Seasons Bond Fund (An open ended dynamic debt scheme investing across duration)is suitablefor investors who are seeking*: All duration savings A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety andliquidity ICICI Prudential Floating Interest Fund (An open ended debt scheme predominantly investing in floating rate instruments (including fixed rate instruments converted to floating rate exposures using swaps/derivatives) is suitablefor investors who are seeking*: Short term savings An open ended debt scheme predominantly investing in floating rate instruments ICICI Prudential Ultra Short Term Fund (An open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 months and 6 monthsis suitable for investors who are seeking*: Short term regular income An open ended ultra-short term debt scheme investing in a range of debt and money market instruments ICICI Prudential Savings Fund (An open ended low duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 6 months and 12 months) is suitable for investors who are seeking* Short term savings An open ended low duration debt scheme that aimsto maximize incomeby investing in debt and moneymarket instruments while maintaining optimum balance of yield, safetyand liquidity ICICI Prudential Equity Arbitrage Fund (Anopenendedscheme investing inarbitrage opportunities) is suitable for investors who are seeking* Short Term Income Generation A hybrid scheme that aims to generate low volatility returns by using arbitrage and other derivative strategies in equity markets and investments in debt and money market instruments ICICI Prudential Banking & PSU Debt Fund (An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds. is suitable for investors who are seeking*: Short term savings An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds *Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

- 8. Riskometer and Disclaimers Time to be nimble footed : Active Duration Management key for navigating fixed income markets ICICI Prudential Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds) is suitable for investors whoare seeking*: Short term savings An open ended debt scheme predominantly investing in highest rated corporate bonds *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Money Market Fund (An open ended debt scheme investing in money market instruments) is suitable for investors who are seeking*: Short term savings A money market scheme that seeks to provide reasonable returns, commensurate with low risk while providing a high level of liquidity *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. ICICI Prudential LiquidFund (an open ended liquid scheme) is suitable for investors who are seeking*: Short term savings solution A liquid fund that aims to provide reasonable returns commensurate with low risk and providing a high level of liquidity *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. ICICI Prudential Bond Fund (An open ended medium to long term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 4 Years and 7 Years. The Macaulay duration of the portfolio is 1 Year to 7 years under anticipated adverse situation) is suitable for investors who are seeking*: Medium to Long term savings A debt scheme that invests in debt and money market instruments with an aim to maximise income while maintaining an optimumbalance of yield, safetyand liquidity. *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. "Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis as per SEBI circular dated October 05, 2020 on Product Labeling in Mutual Fund schemes - Risk-o-meter. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details." Macaulay Duration : The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price.

- 9. Riskometer and Disclaimers Mutual Fund investments are subject tomarket risks, readallscheme related documents carefully. All figures and other data given in this document are dated. The same may or may not be relevant at a future date. The AMC takes no responsibility of updating any data/information in this material from time to time. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited. Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICIPrudential Mutual Fund. Past Performance may or may not be sustained in future. Disclaimer: In the preparation of the material contained in this document, ICICI Prudential Asset Management Company Ltd. (the AMC) has used information that is pub- licly available, including Budget speech and information developed in-house. The stock(s)/sector(s) mentioned in this slide do not constitute any recommendation and ICICI Prudential Mutual Fund may or may not have any future position in this stock(s). Some of the material used in the document may have been obtained from mem- bers/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any informa- tion. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Lim- ited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise or investment advice. The recipient alone shall befully responsible/are liable for any decision taken on this material. Time to be nimble footed : Active Duration Management for navigating fixed income markets