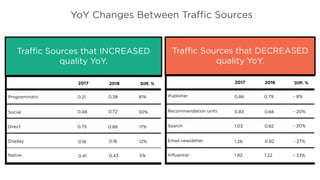

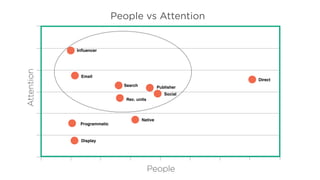

The Q1 2018 traffic quality study by Nudge analyzed human-based engagements across various content types, highlighting a notable decrease in overall traffic quality year-over-year. While social media showed improvement, sources like email and search faced declines despite remaining high in quality. Nudge also blocked 76 million bot impressions and intends to provide real-time measurement through its analytics tools.

![Traffic Sources vs Benchmark [Q1 2018]

Quality Benchmark: 0.7 attention minutes

Influencer

Email

Direct

Search

Publisher

Social

75%

32%

26%

17%

13%

3%

Recommendation Units

Native

Programmatic

Display

6%

36%

46%

74%

Above benchmark Below benchmark](https://image.slidesharecdn.com/nudgetrafficstudyq12018-180705100007/85/Nudge-Traffic-Study-Q1-2018-6-320.jpg)