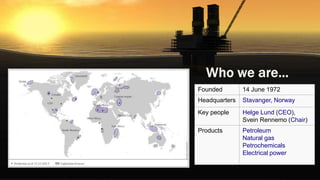

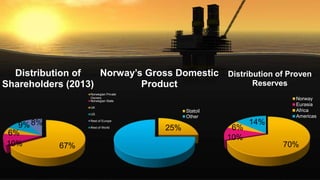

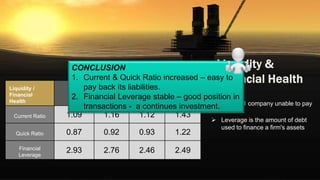

Statoil is a Norwegian state-owned oil and gas company founded in 1972 that explores for and produces petroleum and natural gas on the Norwegian continental shelf, with operations worldwide. It generates 25% of Norway's GDP and has majority government ownership, distributing its shares among Norwegian private and institutional owners as well as international investors. The company aims to responsibly meet global energy needs through technology and innovation while maintaining a strong safety culture and commitment to sustainability.