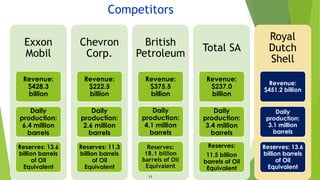

Royal Dutch Shell is a multinational oil and gas company founded in 1907 through the merger of Royal Dutch Petroleum Company and Shell Transport and Trading Company. It operates in over 90 countries and produces 3.1 million barrels of oil equivalent per day. Shell has a long history of oil production and supplying the Allied forces during World Wars I and II. It is currently one of six oil supermajors and has diversified into renewable energy. Shell engages in corporate social responsibility initiatives and had $451 billion in revenue in 2013.

![References

Clee, DJ. “Royal Dutch – Shell: 1919-1946” [Slide 5,6,7]

http://en.wikipedia.org/wiki/Royal_Dutch_Shell [Slide 2,3,4,11,13]

www.shell.com [Slide 10,12]

http://royaldutchshellplc.com/2011/03/31/you-can-be-sure-of-shell-

the-biggest-confidence-trick-in-history/ [Slide 7]

http://www.reuters.com/finance/stocks/companyOfficers?symbol=R

DSb.L&WTmodLOC=C4-Officers-5 [Slide 8,9]

http://www.londonstockexchange.com/exchange/prices-and-

markets/stocks/prices-search/stock-prices-

search.html?nameCode=RDSA [Slide 13]

15](https://image.slidesharecdn.com/8a7e96cd-f169-497c-b44e-bf2985f8fe22-150208053912-conversion-gate02/85/Royal-Dutch-Shell_Group-1_Section-D-15-320.jpg)

![References

Shell Analyst Management Day London [Slide 10]

http://www.shell.com/ind/aboutshell/shell-businesses/india-business-structure/lubes-

india.html [Slide 9]

http://www.nasdaq.com/symbol/rds.a/ownership-summary#ixzz3BnDRtYlr [Slide 7]

http://www.4-traders.com/ROYAL-DUTCH-SHELL-PLC-4005177/company/ [Slide 4,7]

http://www.4-traders.com/EXXON-MOBIL-CORPORATION-4822/company/ [Slide 5]

https://www.google.com/finance?q=NYSE%3ARDS.B&fstype=ii&ei=3e4AVKDyDsO9lAWUtIDYDQ

[Slide 8]

http://en.wikipedia.org/wiki/Petroleum_industry [Slide 2,3]

27](https://image.slidesharecdn.com/8a7e96cd-f169-497c-b44e-bf2985f8fe22-150208053912-conversion-gate02/85/Royal-Dutch-Shell_Group-1_Section-D-27-320.jpg)