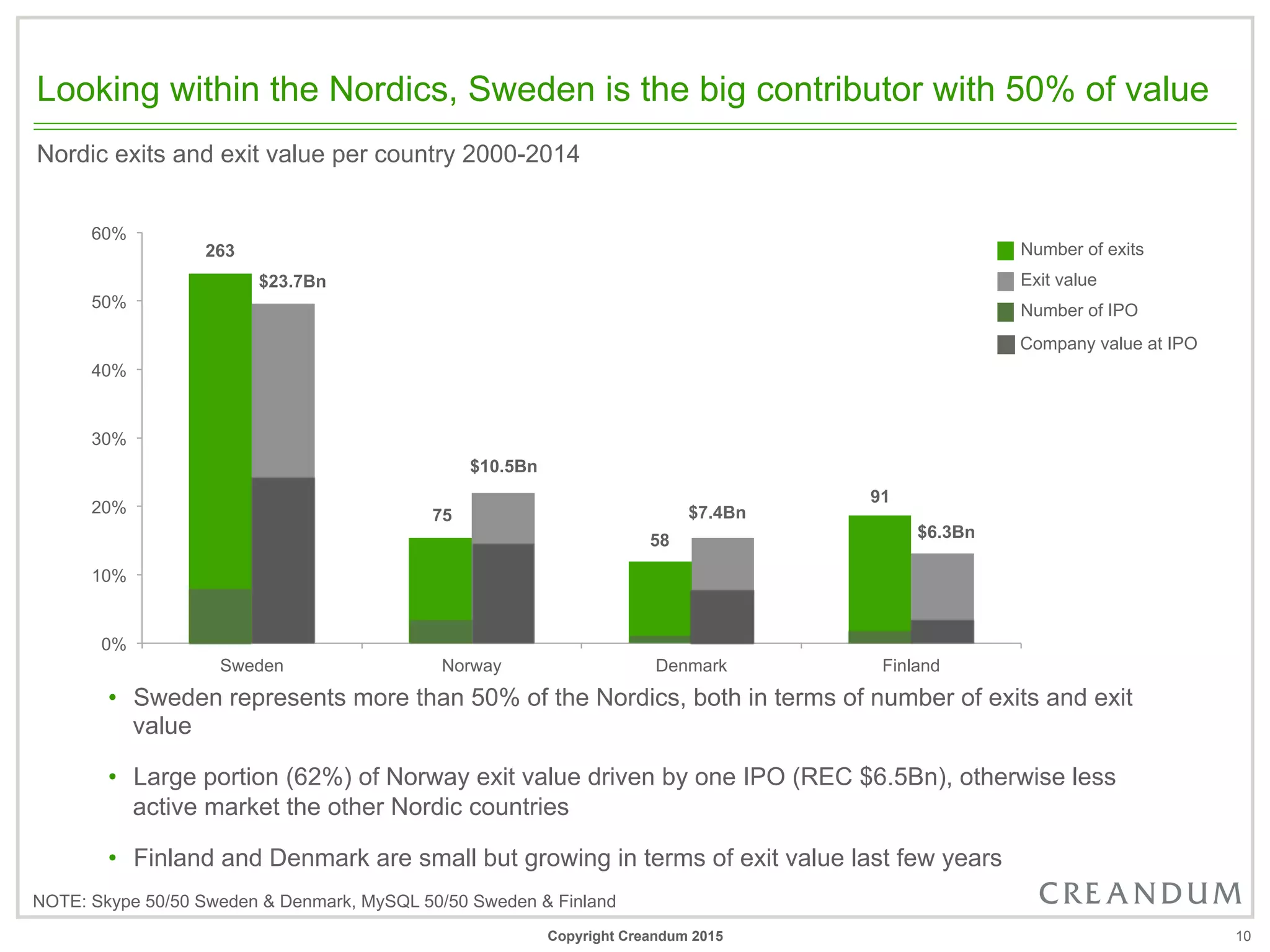

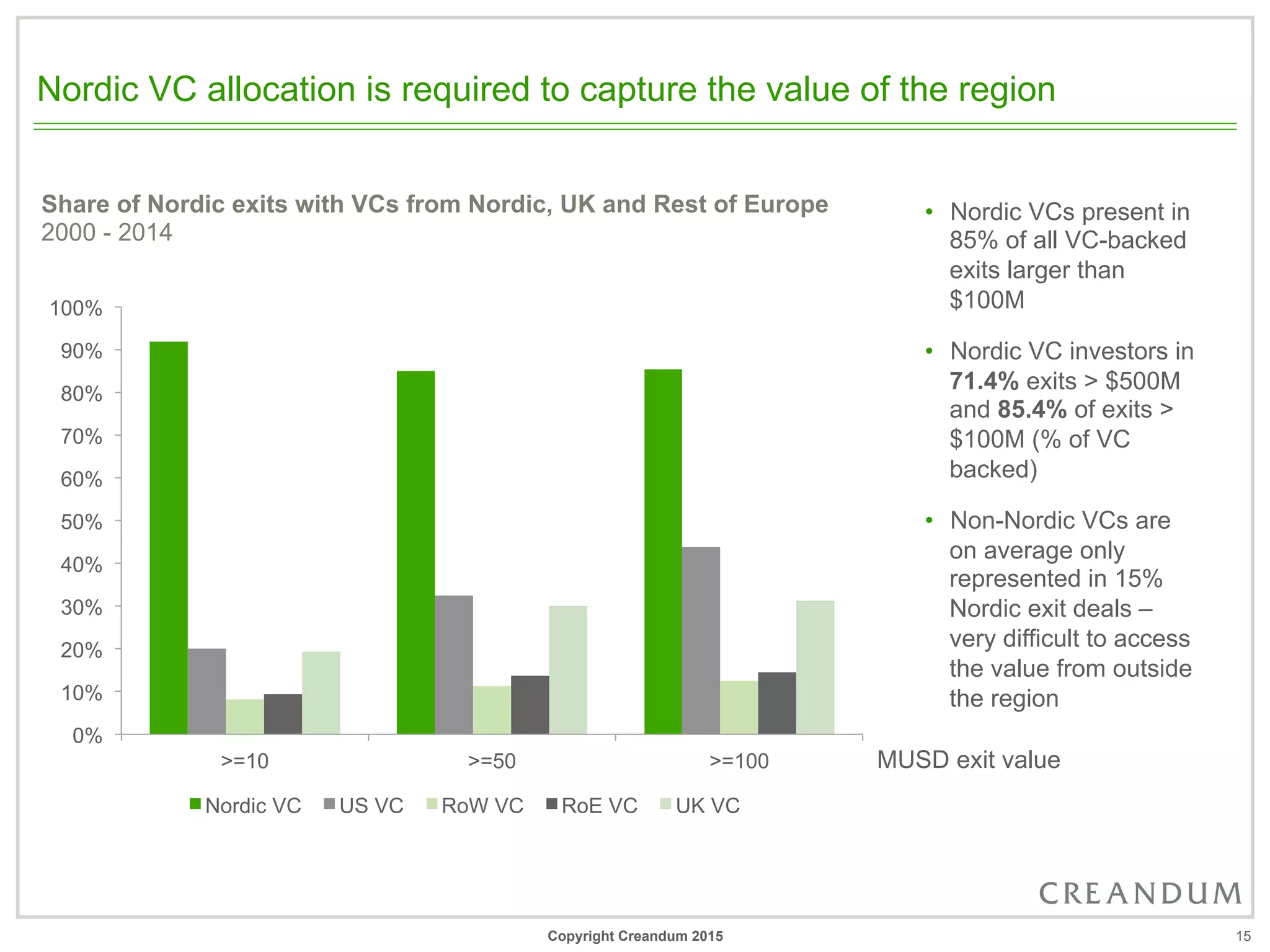

2014 was a record year for Nordic tech exits, with over $13 billion in total exit value including three exits over $1 billion. The Nordic region has averaged over $4 billion in annual exit value over the last five years and represents close to 10% of global exits over $1 billion, despite having only 2% of global GDP. Within the Nordics, Sweden is the dominant market, contributing 50% of the region's exit value. Digital consumer services produce the most valuable exits, while software generates the most exits over $100 million. Nordic venture capital is important for capturing the value in the region, as Nordic VCs are present in over 90% of exits over $500 million.