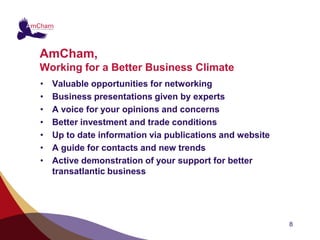

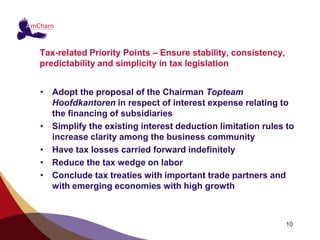

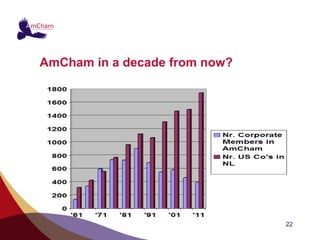

AMCHAM is a non-profit organization aimed at promoting US investment in the Netherlands and advocating for a favorable investment climate. Established in 1961, it represents American companies and Dutch firms engaged with the US, offering networking opportunities and focusing on issues like labor flexibility and taxation. Key priorities include stimulating innovation and maintaining stability in tax legislation to foster growth and attract further foreign investment.