Prepare Financial Statements from Adjusted Trial Balance Worksheet.docx

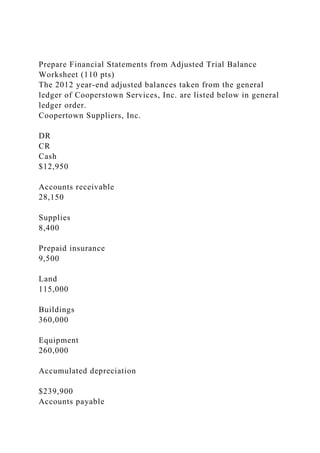

- 1. Prepare Financial Statements from Adjusted Trial Balance Worksheet (110 pts) The 2012 year-end adjusted balances taken from the general ledger of Cooperstown Services, Inc. are listed below in general ledger order. Coopertown Suppliers, Inc. DR CR Cash $12,950 Accounts receivable 28,150 Supplies 8,400 Prepaid insurance 9,500 Land 115,000 Buildings 360,000 Equipment 260,000 Accumulated depreciation $239,900 Accounts payable

- 2. 35,300 Salaries payable 7,300 Taxes payable Common stock 5,200 31,500 Additional paid-in capital – Common Retained earnings 15,400 427,600 Dividends 25,400 Service revenue 475,000 Salaries expense 335,600 Depreciation expense 25,100 Supplies expense 12,950 Insurance expense 8,200 Miscellaneous expense 30,850

- 3. Utilities expense 5,100 Total $1,237,200 $1,237,200 Transfer these accounts and balances to a spreadsheet worksheet and prepare an Income statement, a Classified Balance Sheet, and a Statement of Retained Earnings all in good form using proper headings for each statement. Note that Cooperstown is a service company so there is no cost of goods sold in its chart of accounts. Also, assume that all the liabilities are current liabilities. Keep in mind that you should not report any accounts without balances in your statements. Assignment 5 Text edition 7: Chapter 12 - Questions and Problems - 5, 7, 8, 9, 12, 13. 5. Nominal versus Real Returns: a. In nominal terms? b. In real terms? a) The nominal return is 10.23% from the table. b) To find the real return, we use the fisher equation (1 + R) = (1 + r) (1 + h) (1 + 0.1023) = (1 + r) (1 + 0.0406) 1.1023 = (1 + r) (1.0406) 1 + r = 1.0593

- 4. r = 1.0593 – 1 r = 0.0593 or 5.93% 7. Calculating Returns and Variability: Returns Year X Y 1 6% 18% 2 24 39

- 5. 3 13 -6 4 -14 -20 5 15 47 Return X Arithmetic average returns, R = [R1 +R2 + R3 + R4 + R5]/N = [0.06 + 0.24 + 0.13 - 0.14 + 0.15]/5

- 6. = 0.44/5 = 0.088 or 8.80% Variance = 1/ (N – 1) [(R1 – R) 2 + (R2 – R) 2 + (R3 – R) 2 + (R4 – R) 2+ (R5 – R) 2] = 1/ (5 – 1) [(0.06 – 0.088)2 + (0.24 – 0.088)2 + (0.13 – 0.088)2 + (-0.14 – 0.088)2+ (0.15 – 0.088)2] = ¼ [0.08148] = 0.02037 Standard deviation = √Variance = √0.02037 = 0.1427 or 14.27% Return Y Arithmetic average returns, R = [R1 +R2 + R3 + R4 + R5]/N = [0.18 + 0.39 + (-0.06) + (-0.20) + 0.47]/5 = 0.78/5 = 0.1560 or 15.60% Variance = 1/ (N – 1) [(R1 – R) 2 + (R2 – R) 2 + (R3 – R) 2 + (R4 – R) 2+ (R5 – R) 2] = 1/ (5 – 1) [(0.18 – 0.156)2 + (0.39 – 0.156)2 + (-0.06

- 7. – 0.156)2 + (-0.20 – 0.156)2+ (0.47 – 0.156)2] = ¼ [0.32732] = 0.08183 Standard deviation = √Variance = √0.08183 = 0.2861 or 28.61% 8. Risk Premiums: a. Calculate the arithmetic average returns for large-company stocks and T-Bills over this period. b. Calculate the standard deviation of the returns for large- company stocks and T-Bills over this period. c. Calculate the observed risk premium in each year for the large-company stocks versus T-Bills. What was the average risk premium over this period? What was the standard deviation of the risk premium over this period? d. Is it possible for the risk premium to be negative before an investment is undertaken? Can the risk premium be negative after the fact? Year Large stock return T-bill return Risk premium 1970 -3.57% 6.89 -10.46

- 8. 1971 8.01 3.86 4.15 1972 27.37 3.43 23.94 1973 0.27 4.78 -4.51 1974 -25.93 7.68 -33.61 1975 18.48 7.05 11.43 Total 24.63 33.69 -9.06 a) Large Company Stocks Arithmetic average returns, R = [R1 +R2 + R3 + R4 + R5 + R6]/N = 24.63/6 = 4.105% T-bills Arithmetic average returns, R = [R1 +R2 + R3 + R4 + R5 +

- 9. R6]/N = 33.69/6 = 5.615% b) Large Company Stocks Variance = 1/ (N – 1) [(R1 – R) 2 + (R2 – R) 2 + (R3 – R) 2 + (R4 – R) 2+ (R5 – R) 2 + (R6 – R) 2] = 1/ (6 – 1) [(-3.57 – 4.105)2 + (8.01 – 4.105)2 + (27.37 – 4.105)2 + (0.27 – 4.105)2+ (-25.93 – 4.105)2+ (18.48 – 4.105)2] = 1/5 [0.173885] = 0.034777 Standard deviation = √Variance = √0.034777 = 0.1865 or 18.65% T-bills Variance = 1/ (N – 1) [(R1 – R) 2 + (R2 – R) 2 + (R3 – R) 2 + (R4 – R) 2+ (R5 – R) 2 + (R6 – R) 2] = 1/ (6 – 1) [(6.89 – 5.615)2 + (3.86 – 5.615)2 + (3.43 – 5.615)2 + (4.78 – 5.615)2+ (7.68 – 5.615)2+ (7.05 – 5.615)2] = 1/5 [0.00165005] = 0.00033001

- 10. Standard deviation = √Variance = √0.00033001 = 0.0182 or 1.82% c) Average observed risk premium = [R1 +R2 + R3 + R4 + R5 + R6]/N = -9.06/6 = -1.51% Variance = 1/ (N – 1) [(R1 – R) 2 + (R2 – R) 2 + (R3 – R) 2 + (R4 – R) 2+ (R5 – R) 2 + (R6 – R) 2] = 1/ (6 – 1) [(-10.46 – 1.51)2 + (4.15 – 1.51)2 + (23.94 – 1.51)2 + (-4.51 – 1.51)2+ (-33.61 – 1.51)2+ (11.43 – 1.51)2] = 1/5 [0.1966694] = 0.03933 Standard deviation = √Variance = √0.03933 = 0.1983 or 19.83% d) Before the fact, the risk premium will positive, investors demand compensation above the risk-free return to invest money. After the fact, the risk premium can be negative if assets nominal return is low and risk-free return is high unexpectedly. 9. Calculating Returns and Variability: a. What was the arithmetic average return on Crash-n-Burn’s stock over this 5-year period?

- 11. b. What was the variance of Crash-n-Burn’s returns for this period? The standard deviation? a) Arithmetic average return, R = [R1 +R2 + R3 + R4 + R5]/N = [0.02 + (-0.08) + 0.24 + 0.19 + 0.12]/5 = 0.49/5 = 0.098 or 9.80% b) Variance = 1/(N – 1) [(R1 – R)2 + (R2 – R)2 + (R3 – R)2 + (R4 – R)2+ (R5 – R)2] = 1/ (5 – 1) [(0.02 – 0.098)2 + (-0.08 – 0.098)2 + (0.24 – 0.098)2 + (0.19 – 0.098)2+ (0.12 – 0.098)2] = ¼ [0.06688] = 0.01672 Standard deviation = √Variance = √0.01672 = 0.1293 or 12.93% 12. Effects of Inflation: T-bill rates were highest in initial period. During the period of high inflation, it was consistent in accordance with the Fisher effect. 13. Calculating Investment Returns: Given that Coupon rate = 7%,

- 12. Price 1 year ago, P1 = $920 Required return on bond, I = 8% Number of years, n = 6 Inflation rate, h = 4.2% To find total real return, we have to find the nominal return based on the current price of bond. Now, Coupon payment, C = 0.07 x 1000 = $70 P1 = C (PVIFA @ 8%, 6) + Face value (PVIF @ 8%, 6) = $70 [(1.086 – 1)/ (0.08*1.086)] + 1000/1.086 = $70 (0.58687/0.12695) + 630.17 = $70 (4.6228) + 630.17 = $323.60 + $630.17 = $953.77 Nominal return, R = [(P1 – P0 + C]/P0 = [(953.77 – 920 + 70]/920 = 103.77/920 = 0.1128 or 11.28% Using the fisher equation, (1 + R) = (1 + r) (1 + h)

- 13. (1 + 0.1128) = (1 + r) (1 + 0.042) (1.1128) = (1 + r) (1.042) 1 + r = 1.1128/1.042 1 + r = 1.0679 r = 1.0679 – 1 r = 0.0679 or 6.79% The total real return on investment is 6.79%