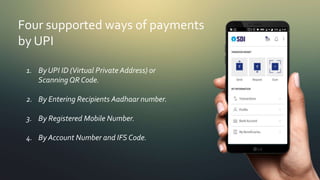

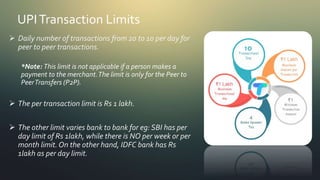

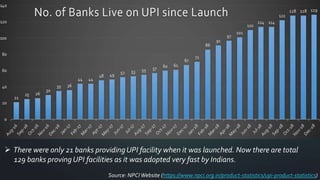

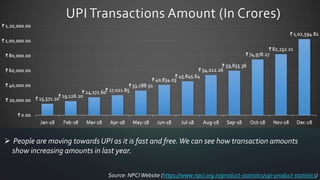

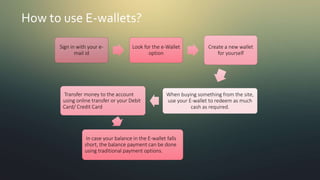

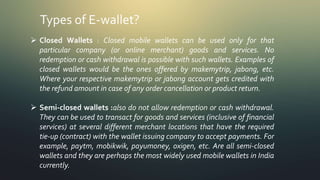

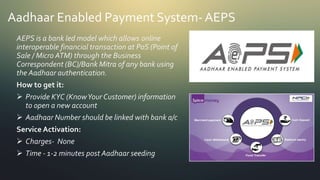

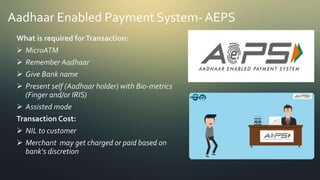

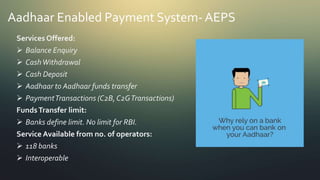

This document provides information about Unified Payments Interface (UPI), e-wallets, Aadhaar Enabled Payment System (AEPS), and Bharat QR. UPI allows instant fund transfer between bank accounts on mobile. E-wallets store money online to make purchases. AEPS allows cash withdrawals and deposits using Aadhaar authentication at micro ATMs. Bharat QR is a common QR code standard for person to merchant mobile payments in India.