Ifb industries ltd

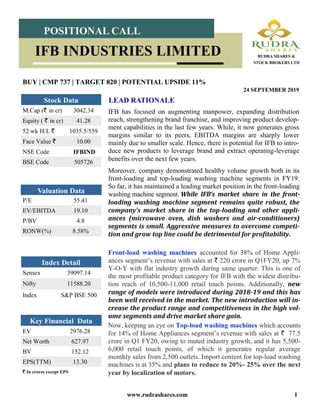

- 1. www.rudrashares.com 1 IFB has focused on augmenting manpower, expanding distribution reach, strengthening brand franchise, and improving product develop- ment capabilities in the last few years. While, it now generates gross margins similar to its peers, EBITDA margins are sharply lower mainly due to smaller scale. Hence, there is potential for IFB to intro- duce new products to leverage brand and extract operating-leverage benefits over the next few years. LEAD RATIONALE BUY | CMP 737 | TARGET 820 | POTENTIAL UPSIDE 11% 24 SEPTEMBER 2019 Index Detail Sensex 39097.14 Nifty 11588.20 Index S&P BSE 500 M.Cap (` in cr) 3042.34 Equity ( ` in cr) 41.28 52 wk H/L ` 1035.5/559 Face Value ` 10.00 NSE Code IFBIND BSE Code 505726 Stock Data Moreover, company demonstrated healthy volume growth both in its front-loading and top-loading washing machine segments in FY19. So far, it has maintained a leading market position in the front-loading washing machine segment. While IFB’s market share in the front- loading washing machine segment remains quite robust, the company’s market share in the top-loading and other appli- ances (microwave oven, dish washers and air-conditioners) segments is small. Aggressive measures to overcome competi- tion and grow top line could be detrimental for profitability. POSITIONAL CALL IFB INDUSTRIES LIMITED RUDRA SHARES & STOCK BROKERS LTD P/E 55.41 EV/EBITDA 19.10 P/BV 4.8 RONW(%) 8.58% Valuation Data EV 2976.28 Net Worth 627.97 BV 152.12 EPS(TTM) 13.30 Key Financial Data ` In crores except EPS Front-load washing machines accounted for 38% of Home Appli- ances segment’s revenue with sales at ` 220 crore in Q1FY20, up 7% Y-O-Y with flat industry growth during same quarter. This is one of the most profitable product category for IFB with the widest distribu- tion reach of 10,500-11,000 retail touch points. Additionally, new range of models were introduced during 2018-19 and this has been well received in the market. The new introduction will in- crease the product range and competitiveness in the high vol- ume segments and drive market share gain. Now, keeping an eye on Top-load washing machines which accounts for 14% of Home Appliances segment’s revenue with sales at ` 77.5 crore in Q1 FY20, owing to muted industry growth, and it has 5,500- 6,000 retail touch points, of which it generates regular average monthly sales from 2,500 outlets. Import content for top-load washing machines is at 35% and plans to reduce to 20%- 25% over the next year by localization of motors.

- 2. www.rudrashares.com 2 As a strategy to improve revenue growth of top-load washing machines, IFB has restructured its sales-force across its retail touch points. The market share for the company continues to expand in this category. The product range has fully automatic top loaders in the 6.5 to 9.5 kg capac- ity segments with high-end “Deep Clean” technology and unique wash features. The top load- ers continue to enjoy a niche position in the market with their aesthetics, features and wash performance. This category will continue to be a revenue growth and margin driver for the company along with the front loader category. The clothes dryer segment is growing moderately for the company. A design up- grade is planned to bolster this category. The same is expected to be complete by the Q4 of 2019-20. The dishwasher segment is also growing for the company. This is based on a marketing push in both offline and online channels POSITIONAL CALL IFB INDUSTRIES LIMITED RUDRA SHARES & STOCK BROKERS LTD Company has stared localization for some of the high cost import as a de-risking mechanism against future currency depreciation impact on the business. The work will result in a significant portion of electronic controller imports being substituted by localized production. The expected cus- tomer demand, combined with the launch of new models and plans to reduce material costs, provide a robust outlook for the appliance division. ACs accounted for 26% of Home Appliances segment’s revenue in Q1 FY20 with sales at `140 crore, up 40% on year basis. As it imports AC’s as a fully built unit, it is negatively impacted by in- crease in import duty to 20%. While IFB has undertaken price hikes over the past few quarters, it is still insufficient to turn the AC segment profitable. For a turn around, company is setting up a manufacturing plant for ACs, which is likely to commence production in Q1 FY21 (project is located at Goa). The total capacity planned is 600,000 units in two phases, Phase one is of 400,000 units capacity which will need capex of `140 crores, of which `17 crores has already been incurred. Company's localization initiative has resulted in a new generation of electronic compo- nents for models being manufactured in India

- 3. www.rudrashares.com 3 An Eye on Quarter Results: Company has reported a total income of `676.78 crore, a growth of 13.8% over the corresponding Quarter of the previous year. EBITDA (Before Exceptional Gain) Margin stood at 4.6% during the 1st Quarter of 2019-20 as against 5.8% during the corresponding period of the previous year, mainly due to adverse exchange fluctuation, increase in commodity prices and higher import duties on trading products. During the Quarter, the Company was affected by the level of the rupee compared to the previous year and the continued impact of the additional customs duties on traded prod- ucts (mainly microwaves and air conditioners). However, there was minimal impact on manufactured washers and clothes dryers as the localization programmes in these cate- gories have been completed . The impact of increased Forex levels and additional cus- toms duties is being addressed through localization of manufacturing in the air condi- tioner category. The Company has also made selective price increases in the microwave and air conditioners categories, which have already been rolled out. This has partially offset the negative impact of increased Forex and additional duties in these two catego- ries. Hence the 1st Quarter results are better than those of the previous Quarters. POSITIONAL CALL IFB INDUSTRIES LIMITED RUDRA SHARES & STOCK BROKERS LTD Key Highlights Given the elevated channel inventory levels, increased cost of ownership amid higher fuel and interest costs, higher insurance costs, weak liquidity at non-banking finance companies, declining rural incomes and impending implementation of Bharat Stage VI emission norms from 1st April 2020, expects the recovery in new vehicle sales to be mod- est for the remainder FY20, which is likely to result in subdued margins for the com- pany’s engineering division. The appliance segment’s EBIT margins although improved to 2.25% in Q1 FY20 (Q4 FY19: EBITDA losses) it remained below 2.72% in FY19 (FY18: 5.34%). However, expects the appli- ance segment’s profitability to remain stable in FY20 as in FY19 on account of expected better re- sult in Q2 FY20 with the advent of the festive season.

- 4. www.rudrashares.com 4 Company will also complete development of statutory labeling of energy efficiency, deploy- ment of Al and loT capabilities (including app-based control) from the 2nd Quarter of the new fis- cal year. With the introduction of the new range, it is hoped that sales will reach a far higher level. Industrial segment category is accretive to margins and offers an opportunity to expand the Company’s institutional sales focus. The industrial laundry segment will also benefit from the implementation of water saving technology, offering the hotel and launderette in- dustries a unique advantage. Immediately expanding the presence of the kitchen format at Goa and Bangalore by add- ing another 5 outlets by the end of the 2nd Quarter in a new design format that will combine modular kitchens with appliances. The Company’s designs in this category are of a high quality and include unique customer offerings. The products are well priced and include attractive EMI offers Total number of IFB Points currently stands at 535, which management intends to further ex- pand to 600 by FY20 and aims to increase profitability across these stores. Management expects healthy growth in fine blanking segment in Q2 FY20, driven by revival in demand during the festival season. IFB has a dominant market share of 70% in clothes dryer and 50% in dish washer, both in volume terms. For categories such as industrial laundry equipment and industrial dishwash- ers, IFB’s market share is 35%-40% in value terms. In the top-loading segment, which it entered in Q4 FY15, company has demonstrated faster- than-anticipated ramp-up in capacity use which reflects the company’s strong brand position and customers’ greater acceptance of its product. Corporate tax rate cut would lead to an earnings benefit of 11-12 % for consumer dur- ables makers. POSITIONAL CALL IFB INDUSTRIES LIMITED RUDRA SHARES & STOCK BROKERS LTD

- 5. www.rudrashares.com 5 POSITIONAL CALL IFB INDUSTRIES LIMITED RUDRA SHARES & STOCK BROKERS LTD Particulars Q1 FY 20 Q-Q Y-YQ4 FY 19 Q1 FY 19 Revenue 697.52 6.83 13.25652.91 615.91 EBITDA 31.71 38.47 -8.9822.90 34.84 PBT 13.26 146.01 -31.615.39 19.39 PAT 9.58 88.58 -29.255.08 13.54 EPS 2.48 82.35 -29.341.36 3.51 Key Financials (` in crores)

- 6. www.rudrashares.com 6 Disclosures : Business Activity : Rudra Shares & Stock Brokers Limited is engaged in the business of providing broking services & distribu- tion of various financial products. RUDRA is also registered as a Research Analyst under SEBI(Research Analyst) Regulations, 2014. SEBI Reg. No. INH100002524. Disciplinary History : There has been no instance of any Disciplinary action, penalty etc. levied/passed by any regula- tion/administrative agencies against RUDRA and its Directors. Pursuant to SEBI inspection of books and records of Rudra, as a Stock Broker, SEBI has not issued any Administrative warning to Rudra. Terms & Conditions of issuance of Research Report: The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational pur- pose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients. Disclosures with regard to ownership and material conflicts of interest : Rudra or its research analysts, or his/her relative or associate has any direct or Indirect financial interest in the subject company. NO Rudra or its research analysts, or his/her relative or associate has any other material conflict of interest at time of publication of the research report. NO Rudra or its research analysts, or his/her relative or associates have actual ownership of one per cent or more securities of the subject company. NO Disclosures with regard to receipt of compensation : Rudra or its associates have received any compensation from the subject company in the past twelve months. NO Rudra or its associates have managed or co-managed public offering of securities for the subject in the past twelve months. NO Rudra or its associates have received any compensation or other benefits from the subject company or third party in connection with the research report . NO POSITIONAL CALL IFB INDUSTRIES LIMITED RUDRA SHARES & STOCK BROKERS LTD

- 7. www.rudrashares.com 7 Other Disclosures: The research analyst has served as an officer,director,employee of the subject company. NO Rudra or its research analyst has been engaged in market making activity for the subject company. NO Rudra or its or associates have received any compensation from the subject company in the past twelve months. NO Disclaimers: This Research Report (hereinafter called report) has been prepared and presented by RUDRA SHARES & STOCK BROKERS LIMITED, which does not constitute any offer or advice to sell or does solicitation to buy any securities. The information presented in this report, are for the intended recipients only. Further, the intended recipients are ad- vised to exercise restraint in placing any dependence on this report, as the sender, Rudra Shares & Stock Brokers Limited, neither guarantees the accuracy of any information contained herein nor assumes any responsibility in rela- tion to losses arising from the errors of fact, opinion or the dependence placed on the same. Despite the information in this document has been previewed on the basis of publicly available information, internal data , personal views of the research analyst(s)and other reliable sources, believed to be true, we do not represent it as accurate, complete or exhaustive. It should not be relied on as such, as this document is for general guidance only. Besides this, the research analyst(s) are bound by stringent internal regulations and legal and statutory requirements of the Securities and Exchange Board of India( SEBI) and the analysts' compensation was, is, or will be not directly or indirectly related with the other companies and/or entities of Rudra Shares & Stock Brokers Ltd and have no bear- ing whatsoever on any recommendation, that they have given in the research report. Rudra Shares & Stock Brokers Ltd or any of its affiliates/group companies shall not be in any way responsible for any such loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Rudra Shares & Stock Bro- kers Ltd has not independently verified all the information, which has been obtained by the company for analysis purpose, from publicly available media or other sources believed to be reliable. Accordingly, we neither testify nor make any representation or warranty, express or implied, of the accuracy, contents or data contained within this document. Rudra Share & Stock Brokers Ltd and its affiliates are engaged in investment advisory, stock broking, retail & HNI and other financial services. Details of affiliates are available on our website i.e. www.rudrashares.com. We hereby declare, that the information herein may change any time due to the volatile market conditions, therefore, it is advised to use own discretion and judgment while entering into any transactions, whatsoever. Individuals employed as research analyst by Rudra Shares & Stock Brokers Ltd or their associates are not allowed to deal or trade in securities, within thirty days before and five days after the publication of a research report as pre- scribed under SEBI Research Analyst Regulations. Subject to the restrictions mentioned in above paragraph, we and our affiliates, officers, directors, employees and their relative may: (a) from time to time, have long or short positions acting as a principal in, and buy or sell the secu- rities or derivatives thereof, of Company mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or profits. POSITIONAL CALL IFB INDUSTRIES LIMITED RUDRA SHARES & STOCK BROKERS LTD