July 2023 Tax and GST compliance calendar important dates and requirements | Academy Tax4wealth

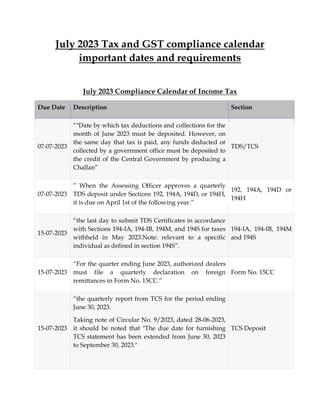

- 1. July 2023 Tax and GST compliance calendar important dates and requirements July 2023 Compliance Calendar of Income Tax Due Date Description Section 07-07-2023 “"Date by which tax deductions and collections for the month of June 2023 must be deposited. However, on the same day that tax is paid, any funds deducted or collected by a government office must be deposited to the credit of the Central Government by producing a Challan” TDS/TCS 07-07-2023 ” When the Assessing Officer approves a quarterly TDS deposit under Sections 192, 194A, 194D, or 194H, it is due on April 1st of the following year.” 192, 194A, 194D or 194H 15-07-2023 “the last day to submit TDS Certificates in accordance with Sections 194-IA, 194-IB, 194M, and 194S for taxes withheld in May 2023.Note: relevant to a specific individual as defined in section 194S”. 194-IA, 194-IB, 194M and 194S 15-07-2023 “For the quarter ending June 2023, authorized dealers must file a quarterly declaration on foreign remittances in Form No. 15CC.” Form No. 15CC 15-07-2023 “the quarterly report from TCS for the period ending June 30, 2023. Taking note of Circular No. 9/2023, dated 28-06-2023, it should be noted that "The due date for furnishing TCS statement has been extended from June 30, 2023 to September 30, 2023." TCS Deposit

- 2. 15-07-2023 “The receivers' declarations received in Form No. 15G/15H during the quarter ending in June 2023 should be uploaded.” Form 15G/15H 15-07-2023 “Due date for a stock exchange to submit a Form 3BB statement about transactions where client codes were changed after registering in the system for the month of June 2023.” Form no. 3BB 30-07-2023 Quarterly TCS certificate for taxes that were paid for the period ending June 30, 2023 Note: As a result of the Circular No. 9/2023, dated 28- 06-2023, which extended the deadline for TCS statements, the new deadline for submitting TCS certificates is October 15, 2023. “″ TCS certificate 30-07-2023 “the deadline for submitting challan-cum-statements for taxes deducted under sections 194-IA, 194-IB, section 194M, and section 194S in the month of June 2023. "Note: Applies to a certain individual as described in section 194S." 194-IA, 194-IB, 194M and 194S 31-07-2023 Statement of TDS for the quarter ended June 30, 2023 The deadline for submitting TDS statements has been delayed from June 30, 2023, to September 30, 2023, per Circular No. 9/2023, dated 28-06-2023. TDS deposited 31-07-2023 “Quarterly report of a banking company's failure to deduct tax at source from interest on a time deposit for the quarter ending June 30, 2023.” Non-deduction of Tax 31-07-2023 “If the deadline for submitting a return of income is July 31, 2023, a statement pursuant to regulations 5D, 5E, and 5F must be provided by a scientific research college, association, university or other organization, or an Indian scientific research firm.” Rules 5D, 5E and 5F

- 3. 31-07-2023 “A pension fund's notification in Form 10BBB of each investment made in India for the quarter ending June 2023.” Form 10BBB 31-07-2023 “Sovereign Wealth Fund's notification on Form II regarding an investment made in India for the quarter ending June 2023” Sovereign Wealth Fund GST Compliance Calendar of July 2023 Due Dates Compliance Particulars Forms/(Filing Mode) 11.07.2023 For taxpayers with a yearly aggregate turnover of more than INR 1.5 crore or those who have chosen to file monthly returns, the deadline to submit the GSTR-1 form is July 11, 2023. GSTR 1 13.07.2023 For taxpayers with an annual aggregate turnover of up to INR 1.5 crore or those who have chosen to file monthly returns, the deadline to submit the GSTR-1 form is July 13, 2023. GSTR 1 13.07.2023 Monthly (June 2023) IIF 20.07.2023 More than INR 5 Crore in annual revenue in the last fiscal year | June 2023 GSTR 3B 20.07.2023 Up to INR 5 Crore in annual revenue in the last fiscal year | June 2023 GSTR 3B 22.07.2023 Quarterly (April-June) GSTR 3B (G1) 24.07.2023 Quarterly (April-June) GSTR 3B (G2) 20.07.2023 For the month of June 2023, all non-resident ODIAR service providers must file their monthly return GSTR- GSTR 5A

- 4. 5A on or before the specified due date of July 20, 2023. 13.07.2023 All non-residents are required to complete Form GSTR- 5 and pay GST by the specified deadline of July 13, 2023, for the month of June 2023. GSTR 5 13.07.2023 Every Input Service Distributor (ISD) is required to submit Form GSTR-6 by the deadline of July 13 for the period ending in June 2023. GSTR 6 10.07.2023 The 10th of July is the deadline for submitting GSTR 7 for the month of June 2023. GSTR-7 10.07.2023 For registered Indian e-commerce taxpayers who are required to pay TCS, the deadline for submitting GSTR 8 for the month of June 2023 is on or before July 10th. GSTR 8 18.07.2023 Quarterly (April-June) CMP-08