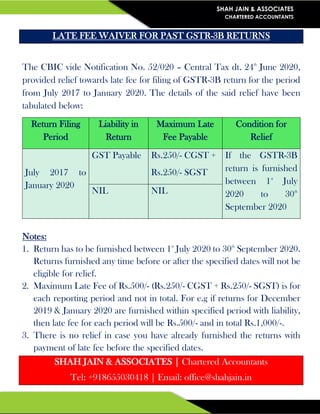

Notified Late Fee waiver for period from July 2017 to January 2020

•

0 likes•136 views

CBIC has notified Late Fee waiver for past returns from July 2017 to January 2020.

Report

Share

Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (19)

Notifications & Circulars - GST - 9th & 10th June 2020

Notifications & Circulars - GST - 9th & 10th June 2020

Similar to Notified Late Fee waiver for period from July 2017 to January 2020

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?Manish Anil Gupta & Co. - A CA firm in Delhi, India

Similar to Notified Late Fee waiver for period from July 2017 to January 2020 (20)

Summary of Recent Notifications & Circulars in GST

Summary of Recent Notifications & Circulars in GST

May Monthly Newsletter- N Pahilwani and Associates

May Monthly Newsletter- N Pahilwani and Associates

Economic and Tax Measures for Revival against COVID-19

Economic and Tax Measures for Revival against COVID-19

Corporate Compliance Tracker _ July 2020 _ CS Lalit Rajput

Corporate Compliance Tracker _ July 2020 _ CS Lalit Rajput

Gst Return filing Due Dates Updates due to Coronavirus Lockdown response

Gst Return filing Due Dates Updates due to Coronavirus Lockdown response

Know About TDS and TCS Return Due Dates for the FY 2022–2023 | Academy Tax4we...

Know About TDS and TCS Return Due Dates for the FY 2022–2023 | Academy Tax4we...

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

Can I file ITR for Financial Year 2020-21 after 31stDecember 2021?

July 2023 Tax and GST compliance calendar important dates and requirements | ...

July 2023 Tax and GST compliance calendar important dates and requirements | ...

More from Priyank Shah

More from Priyank Shah (8)

Benefits for MSME under "Aatmanirbhar Bharat Abhiyan"

Benefits for MSME under "Aatmanirbhar Bharat Abhiyan"

Recently uploaded

young Call Girls in Pusa Road🔝 9953330565 🔝 escort Service

young Call Girls in Pusa Road🔝 9953330565 🔝 escort Service9953056974 Low Rate Call Girls In Saket, Delhi NCR

Recently uploaded (20)

VIETNAM – LATEST GUIDE TO CONTRACT MANUFACTURING AND TOLLING AGREEMENTS

VIETNAM – LATEST GUIDE TO CONTRACT MANUFACTURING AND TOLLING AGREEMENTS

Special Accounting Areas - Hire purchase agreement

Special Accounting Areas - Hire purchase agreement

young Call Girls in Pusa Road🔝 9953330565 🔝 escort Service

young Call Girls in Pusa Road🔝 9953330565 🔝 escort Service

Legal Alert - Vietnam - First draft Decree on mechanisms and policies to enco...

Legal Alert - Vietnam - First draft Decree on mechanisms and policies to enco...

Comparison of GenAI benchmarking models for legal use cases

Comparison of GenAI benchmarking models for legal use cases

POLICE ACT, 1861 the details about police system.pptx

POLICE ACT, 1861 the details about police system.pptx

Notified Late Fee waiver for period from July 2017 to January 2020

- 1. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS LATE FEE WAIVER FOR PAST GSTR-3B RETURNS The CBIC vide Notification No. 52/020 – Central Tax dt. 24th June 2020, provided relief towards late fee for filing of GSTR-3B return for the period from July 2017 to January 2020. The details of the said relief have been tabulated below: Return Filing Period Liability in Return Maximum Late Fee Payable Condition for Relief July 2017 to January 2020 GST Payable Rs.250/- CGST + Rs.250/- SGST If the GSTR-3B return is furnished between 1st July 2020 to 30th September 2020 NIL NIL Notes: 1. Return has to be furnished between 1st July 2020 to 30th September 2020. Returns furnished any time before or after the specified dates will not be eligible for relief. 2. Maximum Late Fee of Rs.500/- (Rs.250/- CGST + Rs.250/- SGST) is for each reporting period and not in total. For e.g if returns for December 2019 & January 2020 are furnished within specified period with liability, then late fee for each period will be Rs.500/- and in total Rs.1,000/-. 3. There is no relief in case you have already furnished the returns with payment of late fee before the specified dates. SHAH JAIN & ASSOCIATES | Chartered Accountants Tel: +918655030418 | Email: office@shahjain.in