Summary of Recent Notifications & Circulars in GST

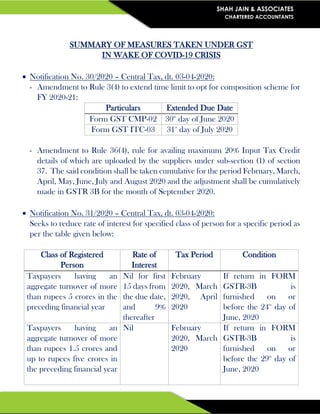

- 1. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS SUMMARY OF MEASURES TAKEN UNDER GST IN WAKE OF COVID-19 CRISIS Notification No. 30/2020 – Central Tax, dt. 03-04-2020: - Amendment to Rule 3(4) to extend time limit to opt for composition scheme for FY 2020-21: Particulars Extended Due Date Form GST CMP-02 30th day of June 2020 Form GST ITC-03 31st day of July 2020 - Amendment to Rule 36(4), rule for availing maximum 20% Input Tax Credit details of which are uploaded by the suppliers under sub-section (1) of section 37. The said condition shall be taken cumulative for the period February, March, April, May, June, July and August 2020 and the adjustment shall be cumulatively made in GSTR 3B for the month of September 2020. Notification No. 31/2020 – Central Tax, dt. 03-04-2020: Seeks to reduce rate of interest for specified class of person for a specific period as per the table given below: Class of Registered Person Rate of Interest Tax Period Condition Taxpayers having an aggregate turnover of more than rupees 5 crores in the preceding financial year Nil for first 15 days from the due date, and 9% thereafter February 2020, March 2020, April 2020 If return in FORM GSTR-3B is furnished on or before the 24th day of June, 2020 Taxpayers having an aggregate turnover of more than rupees 1.5 crores and up to rupees five crores in the preceding financial year Nil February 2020, March 2020 If return in FORM GSTR-3B is furnished on or before the 29th day of June, 2020

- 2. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Taxpayers having an aggregate turnover of more than rupees 1.5 crores and up to rupees five crores in the preceding financial year April 2020 If return in FORM GSTR-3B is furnished on or before the 30th day of June, 2020 Taxpayers having an aggregate turnover of up to rupees 1.5 crores in the preceding financial year Nil February 2020 If return in FORM GSTR-3B is furnished on or before the 30th day of June, 2020 March 2020 If return in FORM GSTR-3B is furnished on or before the 3rd day of July, 2020 April 2020 If return in FORM GSTR-3B is furnished on or before the 6th day of July, 2020 Note: Similar Notification No. 03/2020 – Integrated Tax dt. 08-04-2020 issued for reduction in interest payable on Integrated Tax

- 3. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Notification No. 32/2020 – Central Tax, dt. 03-04-2020: Seeks to give conditional waiver of late fee in filing FORM GSTR-3B for the class of registered persons as mentioned below: Class of Registered Person Tax Period Condition Taxpayers having an aggregate turnover of more than rupees 5 crores in the preceding financial year February 2020, March 2020 and April 2020 If return in FORM GSTR3B is furnished on or before the 24th day of June, 2020 Taxpayers having an aggregate turnover of more than rupees 1.5 crores and up to rupees five crores in the preceding financial year February 2020 and March 2020 If return in FORM GSTR3B is furnished on or before the 29th day of June, 2020 April 2020 If return in FORM GSTR3B is furnished on or before the 30th day of June, 2020 Taxpayers having an aggregate turnover of up to rupees 1.5 crores in the preceding financial year February 2020 If return in FORM GSTR3B is furnished on or before the 30th day of June, 2020 March 2020 If return in FORM GSTR3B is furnished on or before the 3rd day of July, 2020 April 2020 If return in FORM GSTR3B is furnished on or before the 6th day of July, 2020 Notification No. 33/2020 – Central Tax, dt. 03-04-2020: The late fee payable for filing of GSTR-1 shall be waived for the months of March 2020, April 2020 and May 2020 and for the quarter ending 31st March 2020, for the registered person who furnish the return on or before 30th day of June 2020.

- 4. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Notification No. 34/2020 – Central Tax, dt. 03-04-2020: Seeks to increase time limit for furnishing returns under composition scheme RETURN / FORM Period Extended Due Date Form GST CMP-08 Quarter ended 31st March 2020 7th day of July 2020 Form GSTR-4 Financial year ended 31st March 2020 15th day of July 2020 Notification No. 35/2020 – Central Tax, dt. 03-04-2020: 1. Seeks to extend time limit for completion or compliance of any action, by authority or by any person, which falls during the period from 20.03.2020 to 29.06.2020 up to 30.06.2020, including: a. Completion of proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action, by whatever name called, by any authority, commission or tribunal, by whatever name called b.Filing of any appeal, reply or application or furnishing of any report, document, return, statement or such other record, by whatever name called However, the said exemption under notification 35/2020 Central Tax, dt. 03- 04-2020 shall not be applicable for the following compliances under the relevant act and rules made there off: Relevant Provisions Particulars Chapter IV of CGST Act Time and Value of Supply Section10 sub-section (3) Lapse of benefits under composition scheme if aggregate turnover exceeds prescribed limit Section 25 of CGST Act Time limit and procedure for registration under GST Section 27 of CGST Act Provisions relating to casual taxable person

- 5. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Section 31 of CGST Act Provisions relating to issue of Tax Invoice Section 37 of CGST Act Time limit for furnishing FORM GSTR-1 & rectification of error or omission in GSTR-1 Note: Time limit for furnishing GSTR-1 is not extended only conditional waiver of late fee provided by Notification No. 33/2020 – Central Tax dt. 03/04/2020 Section 47 of CGST Act Late fee for furnishing FORM 9, 9A, 9B & 9C (Statement u/s 44 of CGST Act) Note: Late fee for furnishing regular returns under sub- section (1) is conditionally waived under various other notifications &; Time limit for furnishing statement u/s 44 of CGST Act for FY 2018-19 is extended by Notification No.41/2020 – Central Tax dt. 05-05-2020 Section 50 of CGST Act There is no concession in time limit for interest levy however conditional reduction of rate is provided under Notification No. 31/2020 – Central Tax dt. 03/04/2020 Section 69 of CGST Act Power to arrest by commissioner in case of offence Section 90 of CGST Act Liability of partners of the firm to pay tax Section 122 of CGST Act Penalties for various offences Section 129 of CGST Act Detention, seizure and release of goods and conveyances in transit Section 68 of CGST Act Issuance of e-way bill 2. It also extends validity till 30th day of April 2020 of those e-way bills whose validity expires during the period from 20th day of May 2020 to 15th day of April 2020. (Further extended by Notification 40/2020 – Central Tax dt. 05-05-2020)

- 6. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Notification No. 36/2020 – Central Tax, dt. 03-04-2020: Extends due date for furnishing FORM GSTR-3B for the month of May 2020 as follows: Class of Registered Person State Extended Due Date Taxpayers having an aggregate turnover of more than rupees 5 crores in the preceding financial year All States 27th day of June 2020 Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial year Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, The Union Territories of Daman & Diu, Dadra & Nagar Haveli, Puducherry, Andaman & Nicobar Islands or Lakshadweep 12th day of July 2020 Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, The Union Territories of Jammu & Kashmir, Ladakh, Chandigarh or D`elhi 14th day of July 2020

- 7. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Notification No. 37/2020 – Central Tax, dt. 28-04-2020: The Government had passed Central Goods and Service Tax (Fourth Amendment) Rules, 2019, vide notification no. 31/2019 – Central Tax, dt. 28-06- 2019. Clause (c) of Rule 9 and Rule 25 of the said notification (Amendment Rules) is being made effective from 21st April 2020 vide this notification. This relates to furnishing of FORM PMT-09 for transfer of balance of tax, interest, penalty, fee or any other amount in cash ledger under one Act / Cess to the balance of cash ledger under other Act / Cess. Notification No. 38/2020 – Central Tax, dt. 05-05-2020: Seeks to amend rules for simplifying furnishing GST returns as follows: 1. Persons registered under the provisions of Companies Act,2013 will be allowed to furnish FORM GSTR-3B verified through electronic verification of code (EVC), instead of mandatory digistal signature certificate (DSC) of authorised signatory earlier. 2. Rules framed for allowing tax payers to file “NIL” GSTR-3B by way of short messaging services (SMS) facility. However, technical implementation of the same on common portal is not done yet. “NIL” return means, nil or not entry in any of the tables in FORM GSTR 3B Notification No. 39/2020 – Central Tax, dt. 05-05-2020: 1. Notification No.11/2020 – Central Tax, required to corporate debtors under Insolvency & Bankruptcy code undergoing the corporate insolvency to be treated as distinct person of the corporate debtor and new registration within 30 days of appointment of IRP / RP. The time period of obtaining new registration is extended to 30days or 30.06.2020 whichever is later.

- 8. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS 2. It is also provided that Notification No.11/2020 shall not include those persons who have already furnished statements under section 37 and returns under section 39 of the CGST Act for all tax periods prior to the appointment of IRP / RP. Thus if the said corporate debtor is in compliance of the GST law at the time appointment of IRP/RP, they shall not be liable to take a fresh registration and only the newly appointed IRP/RP shall be added as a primary authorised signatory by way of amendment to existing registration. Notification No. 40/2020 – Central Tax, dt. 05-05-2020: It seeks to further extend validity of e-waybills which have been generated before 24th day of March 2020 and its period of validity expires during the period from 20th day of March 2020 to the 15th day of April 2020 up to 31st May 2020. Notification No. 41/2020 – Central Tax, dt. 05-05-2020: Seeks to extend time limit for furnishing of annual return specified under section 44 of CGST Act read with rule 80 of the CGST Rule (FORM 9/9A/9B/9C) for FY 2018-19 till 30th September 2020. Notification No. 42/2020 – Central Tax, dt. 05-05-2020: Seeks to extend time limit for furnishing return in FORM GSTR-3B for the union territories of Jammu & Kashmir and Ladakh for specific period as mentioned below: Return Period Union Territory Extended Due Date November 2019 to February 2020 Jammu & Kashmir 24th day of March 2020 November 2019 to December 2019 Ladakh 24th day of March 2020 January 2020 to March 2020 Ladakh 20th day of May 2020

- 9. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS OTHER KEY POINTS UNDER CLARIFCATORY CIRCULARS Various circulars for ease of understanding in implementation of GST Law and for clarification regarding the recent notifications have been issued by the Government. Some of the key highlights of the same have been expressed below: 1. Circular No. 136/06/2020 – Central Tax, dt. 03-04-2020 Q. Whether due date for furnishing FORM GSTR 3B for the month of February 2020, March 2020 & April 2020 is extended? Ans.: No, the due date for furnishing FORM GSTR 3B for the month of February 2020, March 2020 & April 2020 is not extended. It is only extended for the month of May 2020. However, there is a conditional reduction in rate of interest and waiver of late fee vide notification no. 31/2020 Central Tax & notification no. 31/2020 Central Tax dated 03-04-2020 respectively. Important Note: The reduced rate of interest and late fee waiver is conditional upon furnishing of FORM GSTR 3B before a specific date. In case of delay in furnishing FORM GSTR 3B beyond the conditional date, the benefit will be withdrawn. Thus, the interest will have to be paid at actual rate and late fee will be levied from the actual due date of furnishing the return. Q. What are the measures that have been specifically taken for taxpayers who are required to deduct tax at source under section 51 and collect tax at source under section 52, Input Service Distributors and Non-resident Taxable Persons? Ans.: As per notification no.35/2020 – Central Tax, dated 03-04-2020 such persons have been allowed to furnish respective returns for the month of March 2020 to May 2020 on or before 30th day of June 2020.

- 10. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS 2. Circular No. 137/07/2020 – Central Tax, dt. 13-04-2020 Q. An advance is received by a supplier for a Service contract which subsequently got cancelled. The supplier has issued the invoice before supply of service and paid the GST hereon. Whether he can claim refund of tax paid or is he required to adjust his tax liability in his returns? Ans.: Where the services are not supplied and the supplier has issued Invoice and paid GST on advance before providing such services, he shall issue a “credit note” in terms of section 34 of the CGST Act. It is clarified that so much as such excess tax paid is adjusted against the output liability, it shall be so adjusted and no separate claim for refund shall be claimed. Only in case where there is no output liability against which the credit note can be adjusted, registered person may proceed to file a claim for “Excess payment of tax, if any” through FORM RFD-01. Q. An advance is received by a supplier for a Service contract which got cancelled subsequently. The supplier has issued receipt voucher and paid the GST on such advance received. Whether he can claim refund of tax paid on advance or he is required to adjust his tax liability in his returns? Ans.: Where the supplier has paid GST on advance for which no Invoice is issued and later the services are not supplied due to cancellation of contract, the supplier shall issue a “refund voucher” in terms of section 31(3)(e) of CGST Act. The tax payer can apply for refund of the same under “Refund of excess payment of tax” through FORM RFD-01. Q. Goods supplied by a supplier under cover of a tax invoice are returned by the recipient. Whether he can claim refund of tax paid or is he required to adjust his tax liability in his returns? Ans.: In such case the supplier shall issue a “credit note” in terms of section 34 of CGST Act. It is clarified that so much as such excess tax paid is adjusted against the output liability, it shall be so adjusted and no separated claim for refund shall be filed. Only in case where there is no output liability against which the credit note can be adjusted, registered person may proceed to file a claim for “Excess payment of tax, if any” through FORM RFD-01.

- 11. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Q. Letter of Undertaking (LUT) furnished for the purposes of zero rated supplies as per provisions of section 16 of the Integrated Goods and Services Tax Act, 2017 read with rule 96A of the CGST Rules has expired on 31.03.2020. Whether a registered person can still make a zero-rated supply on such LUT and claim refund accordingly or does he have to make such supplies on payment of IGST and claim refund of such IGST? Ans.: In terms of notification no. 35/2020 Central Tax dated 03.04.2020, where any compliance (except for as mentioned in circular) under GST falls during the period from 20th March 2020 to 29th June 2020, it shall be extended to 30th June 2020. Thus the time limit for filing LUT for the year 2020-21 shall stand extended to 30.06.2020 and the taxpayer can continue to make the zero rated supply without payment of tax under LUT provided FORM RFD-11 for 2020-21 is furnished on or before 30th June 2020. Q. While making the payment to recipient, amount equivalent to one per cent was deducted as per the provisions of section 51 of Central Goods and Services Tax Act, 2017 i. e. Tax Deducted at Source (TDS). Whether the date of deposit of such payment has also been extended vide notification N. 35/2020-Central Tax dated 03.04.2020? Ans.: In terms of notification no. 35/2020 Central Tax dated 03.04.2020, where any compliance (except for as mentioned in circular) under GST falls during the period from 20th March 2020 to 29th June 2020, it shall be extended to 30th June 2020. Accordingly, due date for furnishing return in FORM GSTR-7 under provisions of section 39(3) read with section 51 of the CGST Act, has been xtended and no interest shall be levied if tax deducted and deposited before 30.06.2020.

- 12. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Q. As per section 54 (1), a person is required to make an application before expiry of two years from the relevant date. If in a particular case, date for making an application for refund expires on 31.03.2020, can such person make an application for refund before 29.07.2020? Ans.: In terms of notification no. 35/2020 Central Tax dated 03.04.2020, where any compliance (except for as mentioned in circular) under GST falls during the period from 20th March 2020 to 29th June 2020, it shall be extended to 30th June 2020. Thus if the last date i.e. expiry of 2 years from relevant date for filing application for refund under section 54(1) of the CGST Act falls between 20th March 2020 to 29th June 2020, it shall be deemed to be extended up to 30th June 2020. 3. Circular No. 138/08/2020 – Central Tax, dt. 06-05-2020 Q. doubt has been raised that the present notification has used the terms IRP and RP interchangeably, and in cases where an appointed IRP is not ratified and a separate RP is appointed, whether the same new GSTIN shall be transferred from the IRP to RP, or both will need to take fresh registration? Ans.: In cases where the RP is not the same as IRP or in cases where different IRP/RP is appointed midway during the insolvency process, there is no need to take a fresh registration as the change in IRP/RP would only need change of authorised signatory. The change shall only be reported by way of amendment to non-core fields of GST registration particulars, which does not require approval of tax officer. If the previous authorised signatory does not share his credentials, then the newly appointed person can get his details added through the jurisdictional authority.

- 13. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS Q. As per notification no. 40/2017- Central Tax (Rate) dated 23-10-2017, a registered supplier is allowed to supply the goods to a registered recipient (merchant exporter) at 0.1% provided, inter-alia, that the merchant exporter exports the goods within a period of ninety days from the date of issue of a tax invoice by the registered supplier. Request has been made to clarify the provision vis-à-vis the exemption provided vide notification no. 35/2020-Central Tax dated 03.04.2020? Ans.: The said notification no.40/2017 - Central tax (Rate) dt. 23-10-2017 is issued under section 11 of the CGST Act. The extension of time limit provided under notification 35/2020 Central Tax is applicable to said section. Thus, if the completion of 90days falls between 20th March 2020 to 29th June 2020, then the same shall be deemed to be extended up to 30th June 2020. Q. Sub-rule (3) of that rule 45 of CGST Rules requires furnishing of FORM GST ITC-04 in respect of goods dispatched to a job worker or received from a job worker during a quarter on or before the 25th day of the month succeeding that quarter. Accordingly, the due date of filing of FORM GST ITC-04 for the quarter ending March, 2020 falls on 25.04.2020. Clarification has been sought as to whether the extension of time limit as provided in terms of notification No. 35/2020-Central Tax dated 03.04.2020 also covers furnishing of FORM GST ITC-04 for quarter ending March, 2020? Ans.: As clarified in the circular, the benefit of extension of time limit under notification 35/2020 – Central Tax dt. 03-04-2020 is applicable to FORM ITC 04 as required to be filed under sub-rule (3) of rule 45 of CGST rules. Thus due date of furnishing FORM ITC 04 for the quarter ended 31st March 2020, which falls on 25- 04-2020, has been extended to 30th June 2020.

- 14. SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS PREPARED BY CA PRIYANK SURESH SHAH PARTNER +919773568946 SHAH JAIN & ASSOCIATES CHARTERED ACCOUNTANTS 601, 6th Floor, Rajesh Rayon Bhavan, Opp. Kakkad Market, Kalbadevi Road, Mumbai – 400 002. Email: office@shahjain.in PARTNERS CA BHARAT JAIN | +919920496581 CA AMIT JAIN | +919773398194