July 2023 Tax and GST compliance calendar important dates and requirements | Academy Tax4wealth

•

0 likes•6 views

Income Tax and GST Return filing is coming back again. Know all about the important dates and relevant provisions via this Tax and GST compliance calendar for July 2023 learn more!

Report

Share

Report

Share

Download to read offline

Recommended

Indirect Tax Newsletter – July 2023.pdf

This document provides a summary of recent tax law notifications, circulars, and case rulings across Goods and Services Tax (GST) and customs. It covers topics such as clarifications on interest charges for IGST credits, input tax credit claims, the taxability of EV battery charging and vehicle body building services, and an extension of various GST return filing deadlines. Customs updates include increased duties on LPG and related fuels as well as amendments to notifications implementing the recommendations of GST Council meetings.

Tax Weekly 28 june- N Pahilwani & Associates

Tax Weekly 28 june- N Pahilwani & Associates

http://npahilwani.com/tax-weekly-28-june/

www.npahilwani.com

Corporate Compliance Calendar for the month of October 2019

ABOUT ARTICLE :

This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA)

5. SEBI (Listing Obligations And Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI (Depositories and Participants) Regulations 2018)

7. SEBI Takeover Regulations 2011

8. SEBI (Prohibition of Insider Trading) Regulations, 2015

9. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

10. SEBI (Buyback of Securities) Regulations, 2018

11. Companies Act, 2013 (MCA/ROC and LLP Compliance)

12. Investor Education and Protection Fund

Lunawat bulletin August 2020

Lunawat Bulletin for August 2020 has been published at http://lunawat.com/Uploaded_Files/Attachments/F_4827.pdf

Corporate compliance calendar april 2020

ABOUT ARTICLE :

This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

If you think compliance is expensive, try non‐ compliance”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST) & 39th GST Council Meeting Updates

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA) and Important Notifications

5. SEBI (Listing Obligations & Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI Takeover Regulations 2011

7. SEBI (Prohibition of Insider Trading) Regulations, 2015

8. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

9. SEBI (Buyback of Securities) Regulations, 2018 and Circulars / Notifications

10. Companies Act, 2013 (MCA/ROC and LLP Compliance) and Notifications

11. ICSI Updates on e-CSIN

12. . MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES (MSME)

13. Insolvency and Bankruptcy Board of India (IBBI) Updates

Taxmann Review Bulletin April 2020

Taxmann Review Bulletin: A quick review of important Taxes & Laws updates reported on Taxmann.com

1. Ordinance 2020: New due dates for compliances under the income-tax Act

2. Ordinance 2020: New interest rates on delayed payment of taxes:

3. Ordinance 2020: Deduction under Section 80G in respect of

contribution to ‘PM CARES Fund

4. Ordinance 2020:New due dates for compliances in

Indirect Tax Laws

101 faq - banking, insurance and stock

The document contains frequently asked questions and answers regarding banking, insurance, and stock brokers in relation to GST.

Some key points addressed are:

- Banks are not required to provide ATM details in their GST registration as ATMs alone do not constitute a place of business.

- Third party places like ATMs, business correspondents, or warehouses used by banks are not required to be included in their GST registration.

- For services provided up to June 30, 2017, the applicable tax (GST or prior tax) depends on whether the invoice was issued or payment was made before or after July 1, 2017.

- Banks/insurers must report exempt, non-GST and invoice

Corporate Compliance Calendar for the month of September 2019

"This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA)

5. SEBI (Listing Obligations And Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI (Depositories and Participants) Regulations 2018)

7. SEBI Takeover Regulations 2011

8. SEBI (Prohibition of Insider Trading) Regulations, 2015

9. Companies Act, 2013 (MCA/ROC)

Recommended

Indirect Tax Newsletter – July 2023.pdf

This document provides a summary of recent tax law notifications, circulars, and case rulings across Goods and Services Tax (GST) and customs. It covers topics such as clarifications on interest charges for IGST credits, input tax credit claims, the taxability of EV battery charging and vehicle body building services, and an extension of various GST return filing deadlines. Customs updates include increased duties on LPG and related fuels as well as amendments to notifications implementing the recommendations of GST Council meetings.

Tax Weekly 28 june- N Pahilwani & Associates

Tax Weekly 28 june- N Pahilwani & Associates

http://npahilwani.com/tax-weekly-28-june/

www.npahilwani.com

Corporate Compliance Calendar for the month of October 2019

ABOUT ARTICLE :

This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA)

5. SEBI (Listing Obligations And Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI (Depositories and Participants) Regulations 2018)

7. SEBI Takeover Regulations 2011

8. SEBI (Prohibition of Insider Trading) Regulations, 2015

9. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

10. SEBI (Buyback of Securities) Regulations, 2018

11. Companies Act, 2013 (MCA/ROC and LLP Compliance)

12. Investor Education and Protection Fund

Lunawat bulletin August 2020

Lunawat Bulletin for August 2020 has been published at http://lunawat.com/Uploaded_Files/Attachments/F_4827.pdf

Corporate compliance calendar april 2020

ABOUT ARTICLE :

This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

If you think compliance is expensive, try non‐ compliance”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST) & 39th GST Council Meeting Updates

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA) and Important Notifications

5. SEBI (Listing Obligations & Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI Takeover Regulations 2011

7. SEBI (Prohibition of Insider Trading) Regulations, 2015

8. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

9. SEBI (Buyback of Securities) Regulations, 2018 and Circulars / Notifications

10. Companies Act, 2013 (MCA/ROC and LLP Compliance) and Notifications

11. ICSI Updates on e-CSIN

12. . MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES (MSME)

13. Insolvency and Bankruptcy Board of India (IBBI) Updates

Taxmann Review Bulletin April 2020

Taxmann Review Bulletin: A quick review of important Taxes & Laws updates reported on Taxmann.com

1. Ordinance 2020: New due dates for compliances under the income-tax Act

2. Ordinance 2020: New interest rates on delayed payment of taxes:

3. Ordinance 2020: Deduction under Section 80G in respect of

contribution to ‘PM CARES Fund

4. Ordinance 2020:New due dates for compliances in

Indirect Tax Laws

101 faq - banking, insurance and stock

The document contains frequently asked questions and answers regarding banking, insurance, and stock brokers in relation to GST.

Some key points addressed are:

- Banks are not required to provide ATM details in their GST registration as ATMs alone do not constitute a place of business.

- Third party places like ATMs, business correspondents, or warehouses used by banks are not required to be included in their GST registration.

- For services provided up to June 30, 2017, the applicable tax (GST or prior tax) depends on whether the invoice was issued or payment was made before or after July 1, 2017.

- Banks/insurers must report exempt, non-GST and invoice

Corporate Compliance Calendar for the month of September 2019

"This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA)

5. SEBI (Listing Obligations And Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI (Depositories and Participants) Regulations 2018)

7. SEBI Takeover Regulations 2011

8. SEBI (Prohibition of Insider Trading) Regulations, 2015

9. Companies Act, 2013 (MCA/ROC)

Lunawat Bulletin - July 2017

Lunawat Bulletin - July 2017 is published and is now available at http://lunawat.com/Uploaded_Files/Attachments/F_3738.pdf

Lunawat bulletin september 2017

Lunawat Bulletin - September 2017 has been published and is available at http://lunawat.com/Uploaded_Files/Attachments/F_3787.pdf

Regards

Gst Return filing Due Dates Updates due to Coronavirus Lockdown response

The document provides updates on GST returns filing due dates and compliance procedures in light of COVID-19 relief measures. Key points include:

1. Extended due dates till June/July 2020 for filing various GST returns like GSTR-3B, GSTR-1, GSTR-5, GSTR-9 for different categories of taxpayers.

2. Late payment interest waived off or reduced for delayed filing within the extended dates.

3. New facility introduced to shift tax balances between heads using PMT-09.

4. Composition scheme and exporter compliance procedures also given leeway.

5. Areas without relaxation like invoice issuance, new registrations etc. also outlined.

Lunawat bulletin - october 2017

The document discusses various topics related to taxes and compliance in India for the month of October 2017.

Key points include:

1) CBDT introducing Rule 39A and Form 28AA for voluntary reporting of estimated current income and advance tax liability.

2) Taxpayers advised to confirm identities of Income Tax search authorities to avoid fraud.

3) CBDT clarifies impact of SARFAESI Act on collection of taxes from attached properties.

4) GST council revises due dates for filing returns and provides exemptions for casual traders and job workers.

Corporate compliance calendar _ January 2020

Corporate compliance calendar for the month of January 2020

ABOUT ARTICLE :

This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA)

5. SEBI (Listing Obligations And Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI Takeover Regulations 2011

7. SEBI (Prohibition of Insider Trading) Regulations, 2015

8. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

9. SEBI (Buyback of Securities) Regulations, 2018

10. Companies Act, 2013 (MCA/ROC and LLP Compliance)

11. Investor Education and Protection Fund

12. ICSI Updates on e-CSIN

An Overview of 39th Meeting of the GST Council

On 14th March, 2020 GST Council Meeting was held at New Delhi and came up with few clarifications and amendments regarding various matters. An overview of the said meeting has been drafted in the attached slides.

For any assistance, please contact at urvashi@umco.co.in

Summary of Recent Notifications & Circulars in GST

The document summarizes measures taken by the Indian government under GST in response to the COVID-19 crisis, including:

1) Extending various GST return filing deadlines and reducing interest rates for delayed filings.

2) Conditionally waiving late fees for filing certain GST returns by specified dates.

3) Increasing time limits for composition scheme returns and providing other compliance reliefs till June 30, 2020.

The summaries clarify procedures for claiming refunds, new registrations for insolvency cases, and other key points.

May Monthly Newsletter- N Pahilwani and Associates

1. The document provides updates on tax compliance deadlines in India for May 2020, including extensions granted due to COVID-19. Key dates are extended for income tax returns and refunds, GST returns, TDS/TCS statements, and other compliance requirements.

2. The CBDT has extended various tax payment and compliance deadlines that were falling between March 20 to June 30, 2020 to June 30, 2020. This includes deadlines for income tax returns and refunds, TDS/TCS statements, and other requirements.

3. Due dates for GST returns have also been extended, with the deadline for GSTR-3B returns for April-May 2020 being June 12th/14

Critical compliance under GST to be taken care of before 30 September 2018

GST has completed its first financial year (July 17 – Mar 18) and there are certain critical issues to be considered by the taxpayers on or before 30 September 2018. Certain critical areas requiring urgent attention is captured in the article

Corporate compliance calendar march 2020

Corporate Compliance Calendar for the month of March, 2020.

This article includes various Compliances related to various Laws.

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA) and Important Notifications

5. SEBI (Listing Obligations & Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI Takeover Regulations 2011

7. SEBI (Prohibition of Insider Trading) Regulations, 2015

8. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

9. SEBI (Buyback of Securities) Regulations, 2018 and Circulars / Notifications

10. Companies Act, 2013 (MCA/ROC and LLP Compliance) and Notifications

11. Investor Education and Protection Fund

12. ICSI Updates on e-CSIN

13. Ministry of Labour & Employment Update

14. Insolvency and Bankruptcy Board of India (IBBI) Updates

Newsletter on daily professional updates- 24/03/2020

“Your mind is a powerful thing.

When you fill it with positive thoughts, your life will start to change.”

Here is your Daily dose of professional updates 24.03.2020, it contains all summary of all 20 GST non-tariff notifications, 2 circulars dated 23/03/200 issued by CBIC. Also contain various updates on Income Tax, Corporate Laws, RBI and others.

Lunawat Bulletin January 2017

Happy New Year 2017

For Lunawat Monthly Bulletin – January 2017 click at http://lunawat.com/Uploaded_Files/Attachments/F_3529.pdf

The same is also available on www.lunawat.com as well as on free Mobile App ‘LUNAWAT’ available through playstore.

I hope the same shall be of use to you.

Warm Regards

CA. Pramod Jain

Acquisory news-bytes-9th-oct-2017

Corporate Updates

RBI

RBI announces Sovereign Gold Bond Scheme

MCA

IBBI has amended the Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 and Insolvency and Bankruptcy Board of India (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017

TAXATION

Recommendations made by the GST Council in its 22nd Meeting

No extension of last date for filing GSTR-1 for July, 2017

Company Website-

www.acquisory.com

31 May Weekly Newsletter - N Pahilwani & Associates

This weekly newsletter contains income tax and GST updates for the week. For income tax, it summarizes changes to ITR forms for AY 2020-21 including new schedules for investments, the launch of instant PAN through Aadhaar-based e-KYC, and notifications regarding annual information statements replacing Form 26AS. For GST, it provides updates on the GST portal including new registration options for insolvency professionals and enabling EVC filing for companies. It also summarizes some judicial rulings related to transfer of goods ownership, tax deduction at source on exempt supplies, and authority of subordinate officers.

Notified Late Fee waiver for period from July 2017 to January 2020

The CBIC provided relief for late filing fees for GSTR-3B returns between July 2017 to January 2020. If the return is filed between July 1, 2020 to September 30, 2020, there will be no late fees charged, otherwise the maximum late fee is Rs. 250 CGST + Rs. 250 SGST for each period. The relief applies to each return period filed in the specified dates and is available only for returns not previously filed along with late fees.

Gst returns

This document provides information about GST returns in India. It defines what a GST return is and details that are required to file returns such as purchases, sales, debit/credit notes, output and input tax credits. It outlines the different types of GST returns like GSTR-1, GSTR-3B, GSTR-9, etc. and provides details on what information is included in each return. It also discusses late filing fees and interest charges for late/delayed GST returns and extensions provided for return filing due dates during COVID-19. In the end, it briefly introduces the new proposed GST return system with simplified return forms.

Notifications & Circulars - GST - 9th & 10th June 2020

The government has issued a few notifications and circulars on 9th & 10th June 2020, ahead of the GST Councils meet on 12th June 2020. We have summarized the said notifications and circulars for simple understanding.

GST

The document provides information about an upcoming 3-day workshop on GST, ROC, and income tax annual returns for students. It will cover recent changes, dos and don'ts, and the student perspective. The workshop will be organized by the Student Committee of the Chamber of Tax Consultants and led by CA Karan Lodaya. It will include sessions on annual return filing and audit requirements, details on filing GSTR-1 and GSTR-3B returns, as well as an analysis of the annual return.

1-NATIONAL-BUDGET-CIRCULAR-NO-590-JANUARY-3-2023_2.pdf

This document provides guidelines on the release of funds for fiscal year 2023. It outlines the purposes, coverage, general guidelines, and validity of FY 2023 appropriations. Key points include: the aggregate allotment release program shall not exceed P5.268 trillion; funds will be released through GAAAO and SARO/GARO based on evaluated BEDs; and validity periods for obligations, disbursements, and reversion of unreleased/unexpended funds to the national treasury. Modification of allotments within activities/projects may be allowed under exceptional circumstances subject to approval.

GST Annual Return Analysis

The document provides information about filing GST annual returns, including practical issues and concerns. It discusses key details like the statutory requirement to file annual returns, consequences of non-compliance, important dates and deadlines. It emphasizes the importance of annual returns for claiming input tax credit, adjusting credit and debit notes, retention of accounts, and timelines for assessments. The annual return aims to consolidate transaction details declared over the previous 15 months in GSTR-1, GSTR-3B and other returns.

Accounting Standards: Definition, Rules, and Applicability | Academy Tax4wealth

Accounting standards can be defined as a set of principles, guidelines, and rules that govern the preparation and presentation of financial statements. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/accounting-standards

Understanding the Importance of Balance Sheets | Academy Tax4wealth

A balance sheet outlines a company’s assets, liabilities, and shareholder equity at a given moment. The balance sheet provides a holistic view of a company’s & financial stability.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/understanding-the-importance-of-balance-sheets

More Related Content

Similar to July 2023 Tax and GST compliance calendar important dates and requirements | Academy Tax4wealth

Lunawat Bulletin - July 2017

Lunawat Bulletin - July 2017 is published and is now available at http://lunawat.com/Uploaded_Files/Attachments/F_3738.pdf

Lunawat bulletin september 2017

Lunawat Bulletin - September 2017 has been published and is available at http://lunawat.com/Uploaded_Files/Attachments/F_3787.pdf

Regards

Gst Return filing Due Dates Updates due to Coronavirus Lockdown response

The document provides updates on GST returns filing due dates and compliance procedures in light of COVID-19 relief measures. Key points include:

1. Extended due dates till June/July 2020 for filing various GST returns like GSTR-3B, GSTR-1, GSTR-5, GSTR-9 for different categories of taxpayers.

2. Late payment interest waived off or reduced for delayed filing within the extended dates.

3. New facility introduced to shift tax balances between heads using PMT-09.

4. Composition scheme and exporter compliance procedures also given leeway.

5. Areas without relaxation like invoice issuance, new registrations etc. also outlined.

Lunawat bulletin - october 2017

The document discusses various topics related to taxes and compliance in India for the month of October 2017.

Key points include:

1) CBDT introducing Rule 39A and Form 28AA for voluntary reporting of estimated current income and advance tax liability.

2) Taxpayers advised to confirm identities of Income Tax search authorities to avoid fraud.

3) CBDT clarifies impact of SARFAESI Act on collection of taxes from attached properties.

4) GST council revises due dates for filing returns and provides exemptions for casual traders and job workers.

Corporate compliance calendar _ January 2020

Corporate compliance calendar for the month of January 2020

ABOUT ARTICLE :

This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA)

5. SEBI (Listing Obligations And Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI Takeover Regulations 2011

7. SEBI (Prohibition of Insider Trading) Regulations, 2015

8. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

9. SEBI (Buyback of Securities) Regulations, 2018

10. Companies Act, 2013 (MCA/ROC and LLP Compliance)

11. Investor Education and Protection Fund

12. ICSI Updates on e-CSIN

An Overview of 39th Meeting of the GST Council

On 14th March, 2020 GST Council Meeting was held at New Delhi and came up with few clarifications and amendments regarding various matters. An overview of the said meeting has been drafted in the attached slides.

For any assistance, please contact at urvashi@umco.co.in

Summary of Recent Notifications & Circulars in GST

The document summarizes measures taken by the Indian government under GST in response to the COVID-19 crisis, including:

1) Extending various GST return filing deadlines and reducing interest rates for delayed filings.

2) Conditionally waiving late fees for filing certain GST returns by specified dates.

3) Increasing time limits for composition scheme returns and providing other compliance reliefs till June 30, 2020.

The summaries clarify procedures for claiming refunds, new registrations for insolvency cases, and other key points.

May Monthly Newsletter- N Pahilwani and Associates

1. The document provides updates on tax compliance deadlines in India for May 2020, including extensions granted due to COVID-19. Key dates are extended for income tax returns and refunds, GST returns, TDS/TCS statements, and other compliance requirements.

2. The CBDT has extended various tax payment and compliance deadlines that were falling between March 20 to June 30, 2020 to June 30, 2020. This includes deadlines for income tax returns and refunds, TDS/TCS statements, and other requirements.

3. Due dates for GST returns have also been extended, with the deadline for GSTR-3B returns for April-May 2020 being June 12th/14

Critical compliance under GST to be taken care of before 30 September 2018

GST has completed its first financial year (July 17 – Mar 18) and there are certain critical issues to be considered by the taxpayers on or before 30 September 2018. Certain critical areas requiring urgent attention is captured in the article

Corporate compliance calendar march 2020

Corporate Compliance Calendar for the month of March, 2020.

This article includes various Compliances related to various Laws.

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST)

3. Other Statutory Laws

4 Foreign Exchange Management Act, 1999 (FEMA) and Important Notifications

5. SEBI (Listing Obligations & Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI Takeover Regulations 2011

7. SEBI (Prohibition of Insider Trading) Regulations, 2015

8. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

9. SEBI (Buyback of Securities) Regulations, 2018 and Circulars / Notifications

10. Companies Act, 2013 (MCA/ROC and LLP Compliance) and Notifications

11. Investor Education and Protection Fund

12. ICSI Updates on e-CSIN

13. Ministry of Labour & Employment Update

14. Insolvency and Bankruptcy Board of India (IBBI) Updates

Newsletter on daily professional updates- 24/03/2020

“Your mind is a powerful thing.

When you fill it with positive thoughts, your life will start to change.”

Here is your Daily dose of professional updates 24.03.2020, it contains all summary of all 20 GST non-tariff notifications, 2 circulars dated 23/03/200 issued by CBIC. Also contain various updates on Income Tax, Corporate Laws, RBI and others.

Lunawat Bulletin January 2017

Happy New Year 2017

For Lunawat Monthly Bulletin – January 2017 click at http://lunawat.com/Uploaded_Files/Attachments/F_3529.pdf

The same is also available on www.lunawat.com as well as on free Mobile App ‘LUNAWAT’ available through playstore.

I hope the same shall be of use to you.

Warm Regards

CA. Pramod Jain

Acquisory news-bytes-9th-oct-2017

Corporate Updates

RBI

RBI announces Sovereign Gold Bond Scheme

MCA

IBBI has amended the Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 and Insolvency and Bankruptcy Board of India (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017

TAXATION

Recommendations made by the GST Council in its 22nd Meeting

No extension of last date for filing GSTR-1 for July, 2017

Company Website-

www.acquisory.com

31 May Weekly Newsletter - N Pahilwani & Associates

This weekly newsletter contains income tax and GST updates for the week. For income tax, it summarizes changes to ITR forms for AY 2020-21 including new schedules for investments, the launch of instant PAN through Aadhaar-based e-KYC, and notifications regarding annual information statements replacing Form 26AS. For GST, it provides updates on the GST portal including new registration options for insolvency professionals and enabling EVC filing for companies. It also summarizes some judicial rulings related to transfer of goods ownership, tax deduction at source on exempt supplies, and authority of subordinate officers.

Notified Late Fee waiver for period from July 2017 to January 2020

The CBIC provided relief for late filing fees for GSTR-3B returns between July 2017 to January 2020. If the return is filed between July 1, 2020 to September 30, 2020, there will be no late fees charged, otherwise the maximum late fee is Rs. 250 CGST + Rs. 250 SGST for each period. The relief applies to each return period filed in the specified dates and is available only for returns not previously filed along with late fees.

Gst returns

This document provides information about GST returns in India. It defines what a GST return is and details that are required to file returns such as purchases, sales, debit/credit notes, output and input tax credits. It outlines the different types of GST returns like GSTR-1, GSTR-3B, GSTR-9, etc. and provides details on what information is included in each return. It also discusses late filing fees and interest charges for late/delayed GST returns and extensions provided for return filing due dates during COVID-19. In the end, it briefly introduces the new proposed GST return system with simplified return forms.

Notifications & Circulars - GST - 9th & 10th June 2020

The government has issued a few notifications and circulars on 9th & 10th June 2020, ahead of the GST Councils meet on 12th June 2020. We have summarized the said notifications and circulars for simple understanding.

GST

The document provides information about an upcoming 3-day workshop on GST, ROC, and income tax annual returns for students. It will cover recent changes, dos and don'ts, and the student perspective. The workshop will be organized by the Student Committee of the Chamber of Tax Consultants and led by CA Karan Lodaya. It will include sessions on annual return filing and audit requirements, details on filing GSTR-1 and GSTR-3B returns, as well as an analysis of the annual return.

1-NATIONAL-BUDGET-CIRCULAR-NO-590-JANUARY-3-2023_2.pdf

This document provides guidelines on the release of funds for fiscal year 2023. It outlines the purposes, coverage, general guidelines, and validity of FY 2023 appropriations. Key points include: the aggregate allotment release program shall not exceed P5.268 trillion; funds will be released through GAAAO and SARO/GARO based on evaluated BEDs; and validity periods for obligations, disbursements, and reversion of unreleased/unexpended funds to the national treasury. Modification of allotments within activities/projects may be allowed under exceptional circumstances subject to approval.

GST Annual Return Analysis

The document provides information about filing GST annual returns, including practical issues and concerns. It discusses key details like the statutory requirement to file annual returns, consequences of non-compliance, important dates and deadlines. It emphasizes the importance of annual returns for claiming input tax credit, adjusting credit and debit notes, retention of accounts, and timelines for assessments. The annual return aims to consolidate transaction details declared over the previous 15 months in GSTR-1, GSTR-3B and other returns.

Similar to July 2023 Tax and GST compliance calendar important dates and requirements | Academy Tax4wealth (20)

Gst Return filing Due Dates Updates due to Coronavirus Lockdown response

Gst Return filing Due Dates Updates due to Coronavirus Lockdown response

Summary of Recent Notifications & Circulars in GST

Summary of Recent Notifications & Circulars in GST

May Monthly Newsletter- N Pahilwani and Associates

May Monthly Newsletter- N Pahilwani and Associates

Critical compliance under GST to be taken care of before 30 September 2018

Critical compliance under GST to be taken care of before 30 September 2018

Newsletter on daily professional updates- 24/03/2020

Newsletter on daily professional updates- 24/03/2020

31 May Weekly Newsletter - N Pahilwani & Associates

31 May Weekly Newsletter - N Pahilwani & Associates

Notified Late Fee waiver for period from July 2017 to January 2020

Notified Late Fee waiver for period from July 2017 to January 2020

Notifications & Circulars - GST - 9th & 10th June 2020

Notifications & Circulars - GST - 9th & 10th June 2020

1-NATIONAL-BUDGET-CIRCULAR-NO-590-JANUARY-3-2023_2.pdf

1-NATIONAL-BUDGET-CIRCULAR-NO-590-JANUARY-3-2023_2.pdf

More from Academy Tax4wealth

Accounting Standards: Definition, Rules, and Applicability | Academy Tax4wealth

Accounting standards can be defined as a set of principles, guidelines, and rules that govern the preparation and presentation of financial statements. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/accounting-standards

Understanding the Importance of Balance Sheets | Academy Tax4wealth

A balance sheet outlines a company’s assets, liabilities, and shareholder equity at a given moment. The balance sheet provides a holistic view of a company’s & financial stability.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/understanding-the-importance-of-balance-sheets

Understanding the Importance of Balance Sheets | Academy Tax4wealth

A balance sheet outlines a company’s assets, liabilities, and shareholder equity at a given moment. The balance sheet provides a holistic view of a company’s & financial stability.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/understanding-the-importance-of-balance-sheets

The Role of Accounting in Corporate Governance | Academy Tax4wealth

Accounting steps onto the bridge, playing a crucial role in upholding corporate governance and maintaining the delicate harmonisation in the organisation. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/what-is-the-role-of-accounting-in-corporate-governance

The Role of Accounting in Corporate Governance | Academy Tax4wealth

Accounting steps onto the bridge, playing a crucial role in upholding corporate governance and maintaining the delicate harmonisation in the organisation. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/what-is-the-role-of-accounting-in-corporate-governance

2-Factor Authentication under GST for e-Invoice | Academy Tax4wealth

2-factor Authentication adds an extra layer of security to the ordinary login process by requiring users to provide two forms of identification before accessing their accounts. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/2-factor-authentication-in-e-invoice-system

2-Factor Authentication under GST for e-Invoice | Academy Tax4wealth

2-factor Authentication adds an extra layer of security to the ordinary login process by requiring users to provide two forms of identification before accessing their accounts. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/2-factor-authentication-in-e-invoice-system

How does e-payment of Direct Taxes work? | Academy Tax4wealth

E-payment of Direct Taxes is the electronic mode of paying direct taxes to the Indian government, such as income tax, corporate tax, and capital gains tax. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/e-payment-of-direct-taxes

Audit Interview: Commonly Asked Questions & Expert Answers | Academy Tax4wealth

To help you prepare for and nail your next audit interview, we have compiled a list of commonly asked audit interview questions and provided expert answers. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/audit-interview-questions

GSTN: It’s Meaning, Features and Functions | Academy Tax4wealth

GSTN is the vital database for GST ensuring the management of the entire IT system of the GST portal. This portal is used by the government to provide services to the taxpayers such as registration to online filing of taxes. Enroll now.

For more information, visit us at;-

https://academy.tax4wealth.com/blog/gstn

Equity in Accounting: Meaning, Types, & Practical Examples | Academy Tax4wealth

The value of equity can be determined through the current share price or a valuation established by professionals or investors. Enroll now, and make your career.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/what-is-equity-in-accounting

Role of CBDT in Indian Taxation System.pptx

The CBDT is the authority vested with the responsibility of the administration of laws related to direct taxes through the Department of Income Tax. Join us to learn more.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/role-of-cbdt-in-indian-taxation-system

Role of CBDT in Indian Taxation System | Academy Tax4wealth

The CBDT is the authority vested with the responsibility of the administration of laws related to direct taxes through the Department of Income Tax. Join us to learn more.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/role-of-cbdt-in-indian-taxation-system

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

If you are looking for refund, appeal and revision under Income Tax, Academy Tax4wealth provides the right procedure to find it. For more information join us.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/refund-appeal-and-revision-under-income-tax

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

If you are looking for refund, appeal and revision under Income Tax, Academy Tax4wealth provides the right procedure to find it. For more information join us.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/refund-appeal-and-revision-under-income-tax

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

If you are looking for refund, appeal and revision under Income Tax, Academy Tax4wealth provides the right procedure to find it. For more information join us.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/refund-appeal-and-revision-under-income-tax

Income Tax Return Statistics Assessment Year 2021.pptx

This collection of Income Tax Return stats aims to foster broader engagement and analysis of income tax information among Department personnel and scholars. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/income-tax-return-statistics-assessment-year-2021-22

Income Tax Return Statistics Assessment Year 2021.pdf

This collection of Income Tax Return stats aims to foster broader engagement and analysis of income tax information among Department personnel and scholars. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/income-tax-return-statistics-assessment-year-2021-22

What is The Difference between Accounting and Taxation Course | Academy Tax4w...

Accounting and taxation courses provide individuals with distinct skill sets and knowledge necessary for successful careers in their respective domains. Explore the disparities between accounting and taxation courses. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/what-is-the-difference-between-accounting-and-taxation-course

What is The Difference between Accounting and Taxation Course | Academy Tax4w...

Accounting and taxation courses provide individuals with distinct skill sets and knowledge necessary for successful careers in their respective domains. Explore the disparities between accounting and taxation courses. Enroll now.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/what-is-the-difference-between-accounting-and-taxation-course

More from Academy Tax4wealth (20)

Accounting Standards: Definition, Rules, and Applicability | Academy Tax4wealth

Accounting Standards: Definition, Rules, and Applicability | Academy Tax4wealth

Understanding the Importance of Balance Sheets | Academy Tax4wealth

Understanding the Importance of Balance Sheets | Academy Tax4wealth

Understanding the Importance of Balance Sheets | Academy Tax4wealth

Understanding the Importance of Balance Sheets | Academy Tax4wealth

The Role of Accounting in Corporate Governance | Academy Tax4wealth

The Role of Accounting in Corporate Governance | Academy Tax4wealth

The Role of Accounting in Corporate Governance | Academy Tax4wealth

The Role of Accounting in Corporate Governance | Academy Tax4wealth

2-Factor Authentication under GST for e-Invoice | Academy Tax4wealth

2-Factor Authentication under GST for e-Invoice | Academy Tax4wealth

2-Factor Authentication under GST for e-Invoice | Academy Tax4wealth

2-Factor Authentication under GST for e-Invoice | Academy Tax4wealth

How does e-payment of Direct Taxes work? | Academy Tax4wealth

How does e-payment of Direct Taxes work? | Academy Tax4wealth

Audit Interview: Commonly Asked Questions & Expert Answers | Academy Tax4wealth

Audit Interview: Commonly Asked Questions & Expert Answers | Academy Tax4wealth

GSTN: It’s Meaning, Features and Functions | Academy Tax4wealth

GSTN: It’s Meaning, Features and Functions | Academy Tax4wealth

Equity in Accounting: Meaning, Types, & Practical Examples | Academy Tax4wealth

Equity in Accounting: Meaning, Types, & Practical Examples | Academy Tax4wealth

Role of CBDT in Indian Taxation System | Academy Tax4wealth

Role of CBDT in Indian Taxation System | Academy Tax4wealth

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

Get Refund, Appeal and Revision under Income Tax | Academy Tax4wealth

Income Tax Return Statistics Assessment Year 2021.pptx

Income Tax Return Statistics Assessment Year 2021.pptx

Income Tax Return Statistics Assessment Year 2021.pdf

Income Tax Return Statistics Assessment Year 2021.pdf

What is The Difference between Accounting and Taxation Course | Academy Tax4w...

What is The Difference between Accounting and Taxation Course | Academy Tax4w...

What is The Difference between Accounting and Taxation Course | Academy Tax4w...

What is The Difference between Accounting and Taxation Course | Academy Tax4w...

Recently uploaded

Advanced Java[Extra Concepts, Not Difficult].docx![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This is part 2 of my Java Learning Journey. This contains Hashing, ArrayList, LinkedList, Date and Time Classes, Calendar Class and more.

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

Denis is a dynamic and results-driven Chief Information Officer (CIO) with a distinguished career spanning information systems analysis and technical project management. With a proven track record of spearheading the design and delivery of cutting-edge Information Management solutions, he has consistently elevated business operations, streamlined reporting functions, and maximized process efficiency.

Certified as an ISO/IEC 27001: Information Security Management Systems (ISMS) Lead Implementer, Data Protection Officer, and Cyber Risks Analyst, Denis brings a heightened focus on data security, privacy, and cyber resilience to every endeavor.

His expertise extends across a diverse spectrum of reporting, database, and web development applications, underpinned by an exceptional grasp of data storage and virtualization technologies. His proficiency in application testing, database administration, and data cleansing ensures seamless execution of complex projects.

What sets Denis apart is his comprehensive understanding of Business and Systems Analysis technologies, honed through involvement in all phases of the Software Development Lifecycle (SDLC). From meticulous requirements gathering to precise analysis, innovative design, rigorous development, thorough testing, and successful implementation, he has consistently delivered exceptional results.

Throughout his career, he has taken on multifaceted roles, from leading technical project management teams to owning solutions that drive operational excellence. His conscientious and proactive approach is unwavering, whether he is working independently or collaboratively within a team. His ability to connect with colleagues on a personal level underscores his commitment to fostering a harmonious and productive workplace environment.

Date: May 29, 2024

Tags: Information Security, ISO/IEC 27001, ISO/IEC 42001, Artificial Intelligence, GDPR

-------------------------------------------------------------------------------

Find out more about ISO training and certification services

Training: ISO/IEC 27001 Information Security Management System - EN | PECB

ISO/IEC 42001 Artificial Intelligence Management System - EN | PECB

General Data Protection Regulation (GDPR) - Training Courses - EN | PECB

Webinars: https://pecb.com/webinars

Article: https://pecb.com/article

-------------------------------------------------------------------------------

For more information about PECB:

Website: https://pecb.com/

LinkedIn: https://www.linkedin.com/company/pecb/

Facebook: https://www.facebook.com/PECBInternational/

Slideshare: http://www.slideshare.net/PECBCERTIFICATION

Natural birth techniques - Mrs.Akanksha Trivedi Rama University

Natural birth techniques - Mrs.Akanksha Trivedi Rama UniversityAkanksha trivedi rama nursing college kanpur.

Natural birth techniques are various type such as/ water birth , alexender method, hypnosis, bradley method, lamaze method etcclinical examination of hip joint (1).pdf

described clinical examination all orthopeadic conditions .

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...Nguyen Thanh Tu Collection

https://app.box.com/s/y977uz6bpd3af4qsebv7r9b7s21935vdMain Java[All of the Base Concepts}.docx

This is part 1 of my Java Learning Journey. This Contains Custom methods, classes, constructors, packages, multithreading , try- catch block, finally block and more.

How to Fix the Import Error in the Odoo 17

An import error occurs when a program fails to import a module or library, disrupting its execution. In languages like Python, this issue arises when the specified module cannot be found or accessed, hindering the program's functionality. Resolving import errors is crucial for maintaining smooth software operation and uninterrupted development processes.

CACJapan - GROUP Presentation 1- Wk 4.pdf

Macroeconomics- Movie Location

This will be used as part of your Personal Professional Portfolio once graded.

Objective:

Prepare a presentation or a paper using research, basic comparative analysis, data organization and application of economic information. You will make an informed assessment of an economic climate outside of the United States to accomplish an entertainment industry objective.

RPMS TEMPLATE FOR SCHOOL YEAR 2023-2024 FOR TEACHER 1 TO TEACHER 3

RPMS Template 2023-2024 by: Irene S. Rueco

The simplified electron and muon model, Oscillating Spacetime: The Foundation...

Discover the Simplified Electron and Muon Model: A New Wave-Based Approach to Understanding Particles delves into a groundbreaking theory that presents electrons and muons as rotating soliton waves within oscillating spacetime. Geared towards students, researchers, and science buffs, this book breaks down complex ideas into simple explanations. It covers topics such as electron waves, temporal dynamics, and the implications of this model on particle physics. With clear illustrations and easy-to-follow explanations, readers will gain a new outlook on the universe's fundamental nature.

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

বাংলাদেশের অর্থনৈতিক সমীক্ষা ২০২৪ [Bangladesh Economic Review 2024 Bangla.pdf] কম্পিউটার , ট্যাব ও স্মার্ট ফোন ভার্সন সহ সম্পূর্ণ বাংলা ই-বুক বা pdf বই " সুচিপত্র ...বুকমার্ক মেনু 🔖 ও হাইপার লিংক মেনু 📝👆 যুক্ত ..

আমাদের সবার জন্য খুব খুব গুরুত্বপূর্ণ একটি বই ..বিসিএস, ব্যাংক, ইউনিভার্সিটি ভর্তি ও যে কোন প্রতিযোগিতা মূলক পরীক্ষার জন্য এর খুব ইম্পরট্যান্ট একটি বিষয় ...তাছাড়া বাংলাদেশের সাম্প্রতিক যে কোন ডাটা বা তথ্য এই বইতে পাবেন ...

তাই একজন নাগরিক হিসাবে এই তথ্য গুলো আপনার জানা প্রয়োজন ...।

বিসিএস ও ব্যাংক এর লিখিত পরীক্ষা ...+এছাড়া মাধ্যমিক ও উচ্চমাধ্যমিকের স্টুডেন্টদের জন্য অনেক কাজে আসবে ...

PCOS corelations and management through Ayurveda.

This presentation includes basic of PCOS their pathology and treatment and also Ayurveda correlation of PCOS and Ayurvedic line of treatment mentioned in classics.

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

Chapter 4 - Islamic Financial Institutions in Malaysia.pptxMohd Adib Abd Muin, Senior Lecturer at Universiti Utara Malaysia

This slide is special for master students (MIBS & MIFB) in UUM. Also useful for readers who are interested in the topic of contemporary Islamic banking.

A Survey of Techniques for Maximizing LLM Performance.pptx

A Survey of Techniques for Maximizing LLM Performance

Recently uploaded (20)

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

Natural birth techniques - Mrs.Akanksha Trivedi Rama University

Natural birth techniques - Mrs.Akanksha Trivedi Rama University

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

Pride Month Slides 2024 David Douglas School District

Pride Month Slides 2024 David Douglas School District

RPMS TEMPLATE FOR SCHOOL YEAR 2023-2024 FOR TEACHER 1 TO TEACHER 3

RPMS TEMPLATE FOR SCHOOL YEAR 2023-2024 FOR TEACHER 1 TO TEACHER 3

The simplified electron and muon model, Oscillating Spacetime: The Foundation...

The simplified electron and muon model, Oscillating Spacetime: The Foundation...

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

A Survey of Techniques for Maximizing LLM Performance.pptx

A Survey of Techniques for Maximizing LLM Performance.pptx

July 2023 Tax and GST compliance calendar important dates and requirements | Academy Tax4wealth

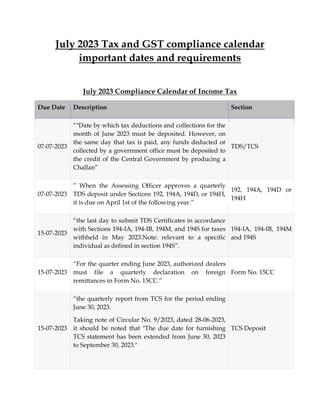

- 1. July 2023 Tax and GST compliance calendar important dates and requirements July 2023 Compliance Calendar of Income Tax Due Date Description Section 07-07-2023 “"Date by which tax deductions and collections for the month of June 2023 must be deposited. However, on the same day that tax is paid, any funds deducted or collected by a government office must be deposited to the credit of the Central Government by producing a Challan” TDS/TCS 07-07-2023 ” When the Assessing Officer approves a quarterly TDS deposit under Sections 192, 194A, 194D, or 194H, it is due on April 1st of the following year.” 192, 194A, 194D or 194H 15-07-2023 “the last day to submit TDS Certificates in accordance with Sections 194-IA, 194-IB, 194M, and 194S for taxes withheld in May 2023.Note: relevant to a specific individual as defined in section 194S”. 194-IA, 194-IB, 194M and 194S 15-07-2023 “For the quarter ending June 2023, authorized dealers must file a quarterly declaration on foreign remittances in Form No. 15CC.” Form No. 15CC 15-07-2023 “the quarterly report from TCS for the period ending June 30, 2023. Taking note of Circular No. 9/2023, dated 28-06-2023, it should be noted that "The due date for furnishing TCS statement has been extended from June 30, 2023 to September 30, 2023." TCS Deposit

- 2. 15-07-2023 “The receivers' declarations received in Form No. 15G/15H during the quarter ending in June 2023 should be uploaded.” Form 15G/15H 15-07-2023 “Due date for a stock exchange to submit a Form 3BB statement about transactions where client codes were changed after registering in the system for the month of June 2023.” Form no. 3BB 30-07-2023 Quarterly TCS certificate for taxes that were paid for the period ending June 30, 2023 Note: As a result of the Circular No. 9/2023, dated 28- 06-2023, which extended the deadline for TCS statements, the new deadline for submitting TCS certificates is October 15, 2023. “″ TCS certificate 30-07-2023 “the deadline for submitting challan-cum-statements for taxes deducted under sections 194-IA, 194-IB, section 194M, and section 194S in the month of June 2023. "Note: Applies to a certain individual as described in section 194S." 194-IA, 194-IB, 194M and 194S 31-07-2023 Statement of TDS for the quarter ended June 30, 2023 The deadline for submitting TDS statements has been delayed from June 30, 2023, to September 30, 2023, per Circular No. 9/2023, dated 28-06-2023. TDS deposited 31-07-2023 “Quarterly report of a banking company's failure to deduct tax at source from interest on a time deposit for the quarter ending June 30, 2023.” Non-deduction of Tax 31-07-2023 “If the deadline for submitting a return of income is July 31, 2023, a statement pursuant to regulations 5D, 5E, and 5F must be provided by a scientific research college, association, university or other organization, or an Indian scientific research firm.” Rules 5D, 5E and 5F

- 3. 31-07-2023 “A pension fund's notification in Form 10BBB of each investment made in India for the quarter ending June 2023.” Form 10BBB 31-07-2023 “Sovereign Wealth Fund's notification on Form II regarding an investment made in India for the quarter ending June 2023” Sovereign Wealth Fund GST Compliance Calendar of July 2023 Due Dates Compliance Particulars Forms/(Filing Mode) 11.07.2023 For taxpayers with a yearly aggregate turnover of more than INR 1.5 crore or those who have chosen to file monthly returns, the deadline to submit the GSTR-1 form is July 11, 2023. GSTR 1 13.07.2023 For taxpayers with an annual aggregate turnover of up to INR 1.5 crore or those who have chosen to file monthly returns, the deadline to submit the GSTR-1 form is July 13, 2023. GSTR 1 13.07.2023 Monthly (June 2023) IIF 20.07.2023 More than INR 5 Crore in annual revenue in the last fiscal year | June 2023 GSTR 3B 20.07.2023 Up to INR 5 Crore in annual revenue in the last fiscal year | June 2023 GSTR 3B 22.07.2023 Quarterly (April-June) GSTR 3B (G1) 24.07.2023 Quarterly (April-June) GSTR 3B (G2) 20.07.2023 For the month of June 2023, all non-resident ODIAR service providers must file their monthly return GSTR- GSTR 5A

- 4. 5A on or before the specified due date of July 20, 2023. 13.07.2023 All non-residents are required to complete Form GSTR- 5 and pay GST by the specified deadline of July 13, 2023, for the month of June 2023. GSTR 5 13.07.2023 Every Input Service Distributor (ISD) is required to submit Form GSTR-6 by the deadline of July 13 for the period ending in June 2023. GSTR 6 10.07.2023 The 10th of July is the deadline for submitting GSTR 7 for the month of June 2023. GSTR-7 10.07.2023 For registered Indian e-commerce taxpayers who are required to pay TCS, the deadline for submitting GSTR 8 for the month of June 2023 is on or before July 10th. GSTR 8 18.07.2023 Quarterly (April-June) CMP-08