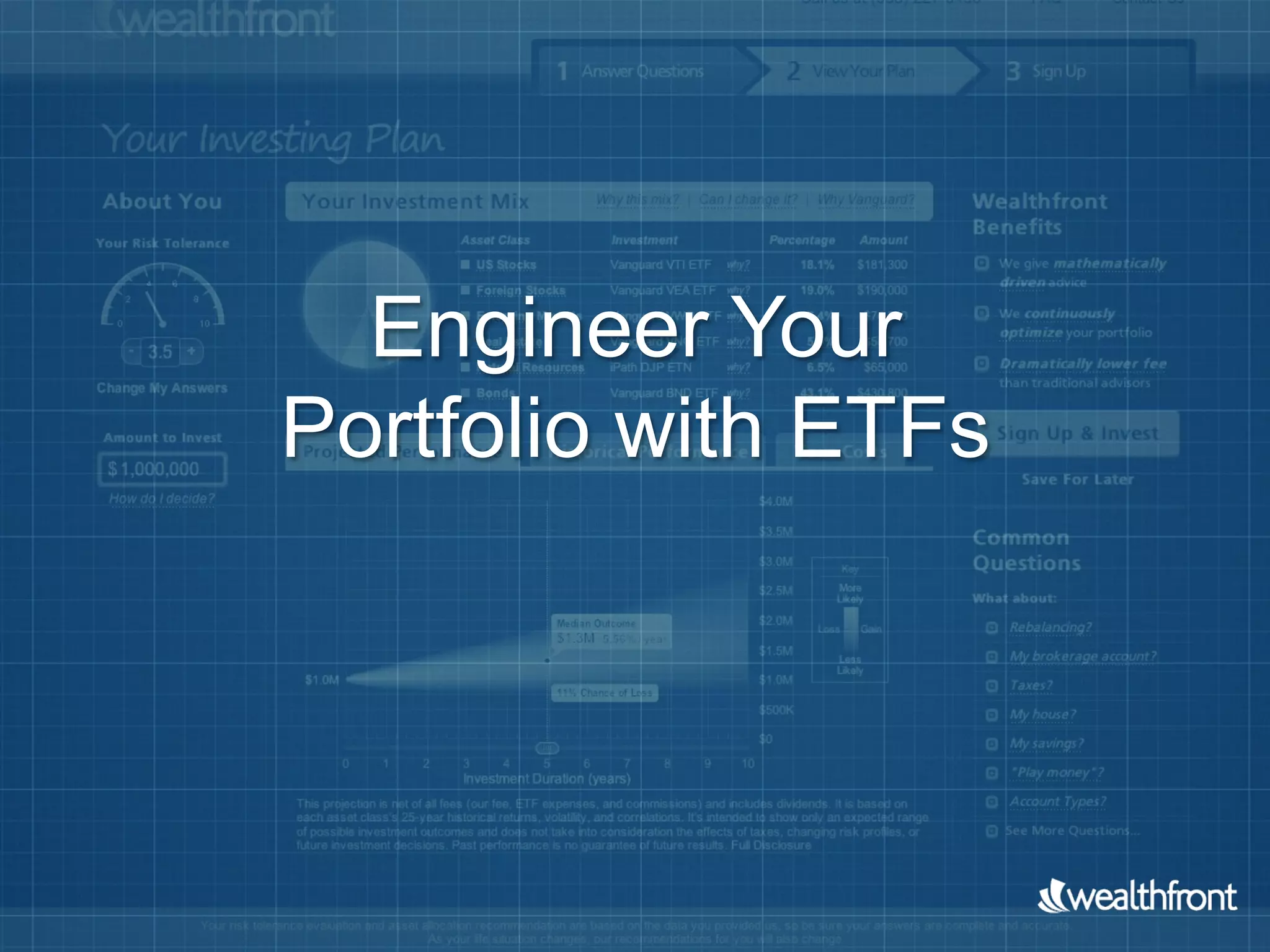

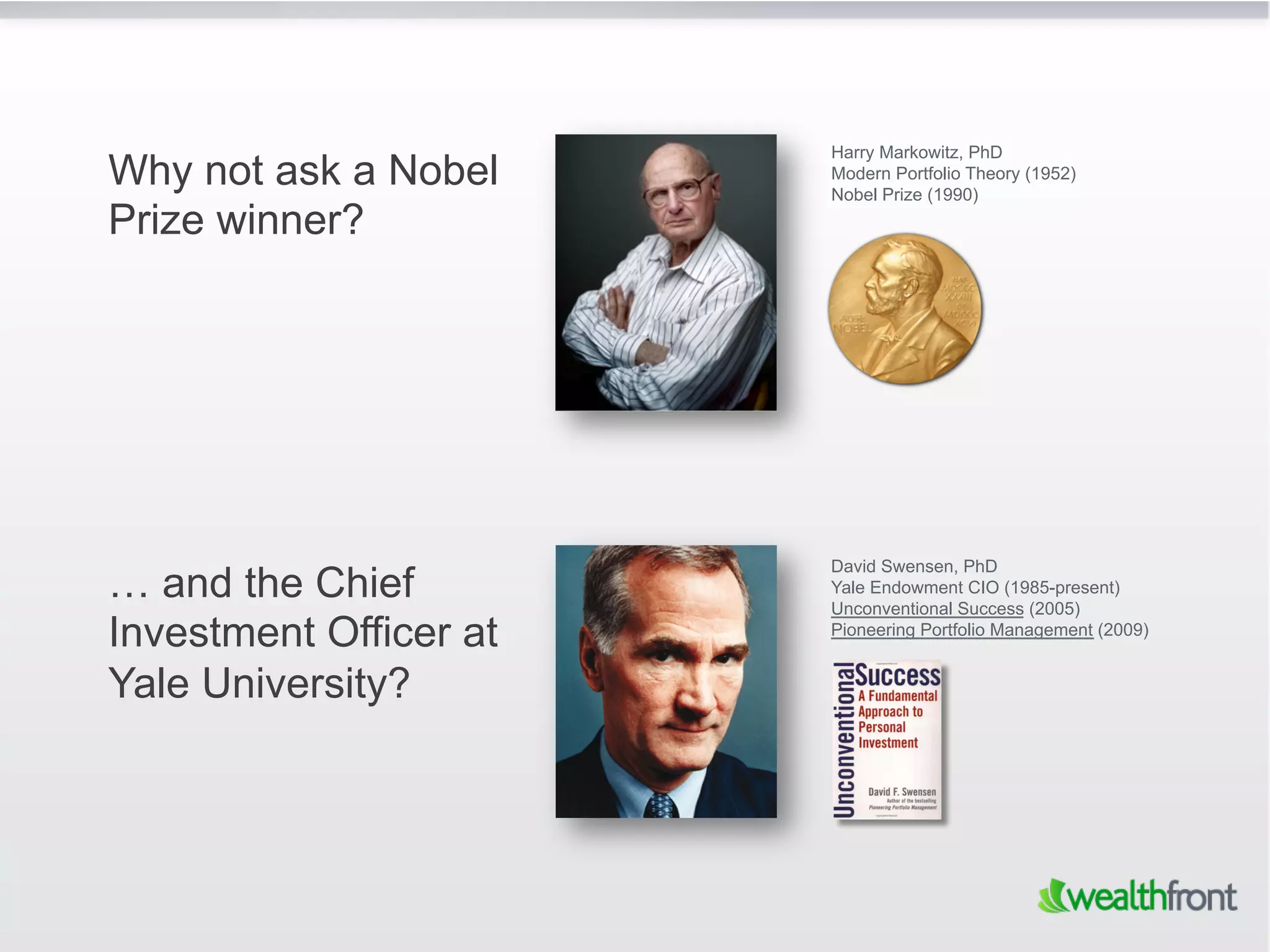

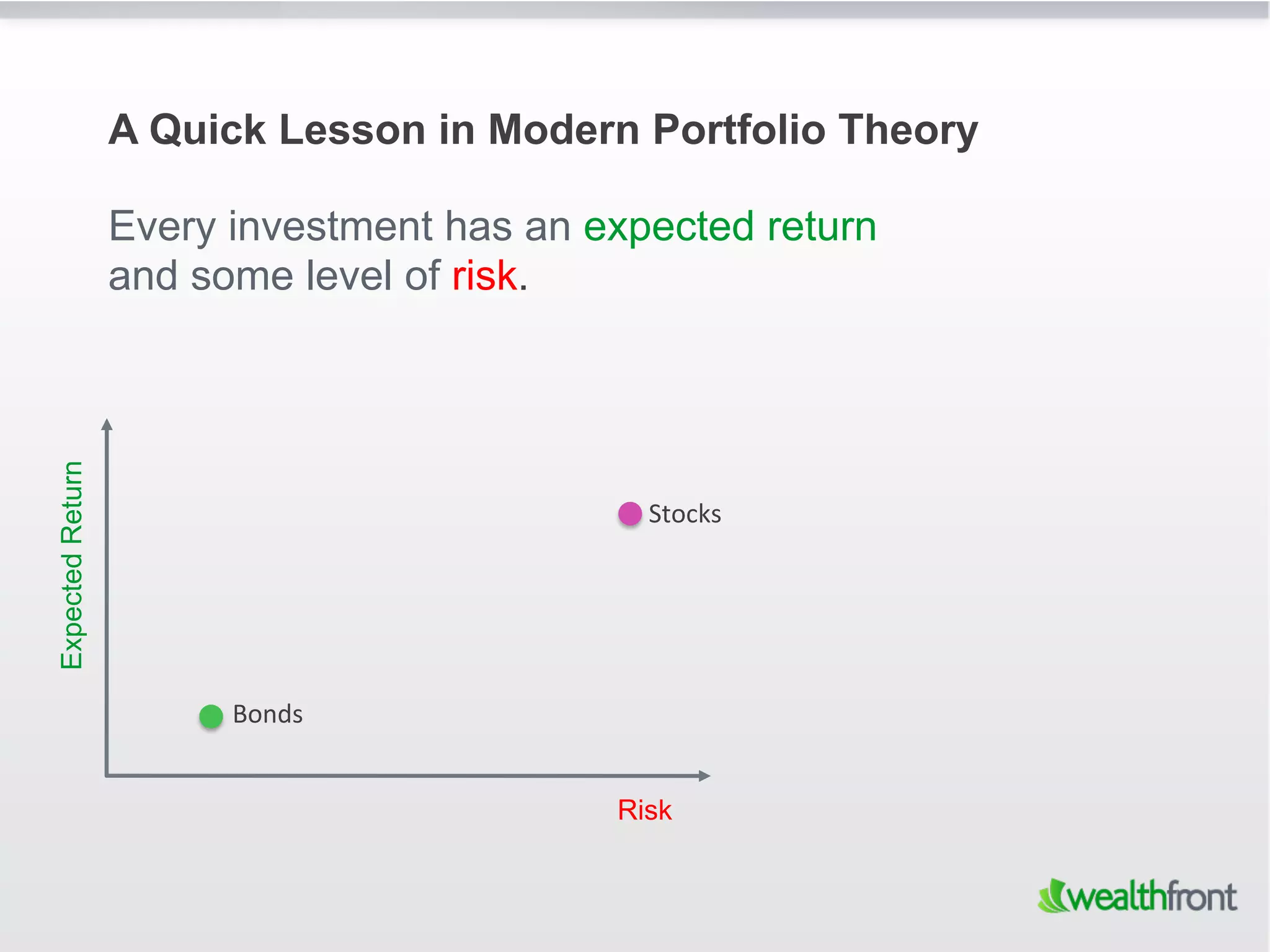

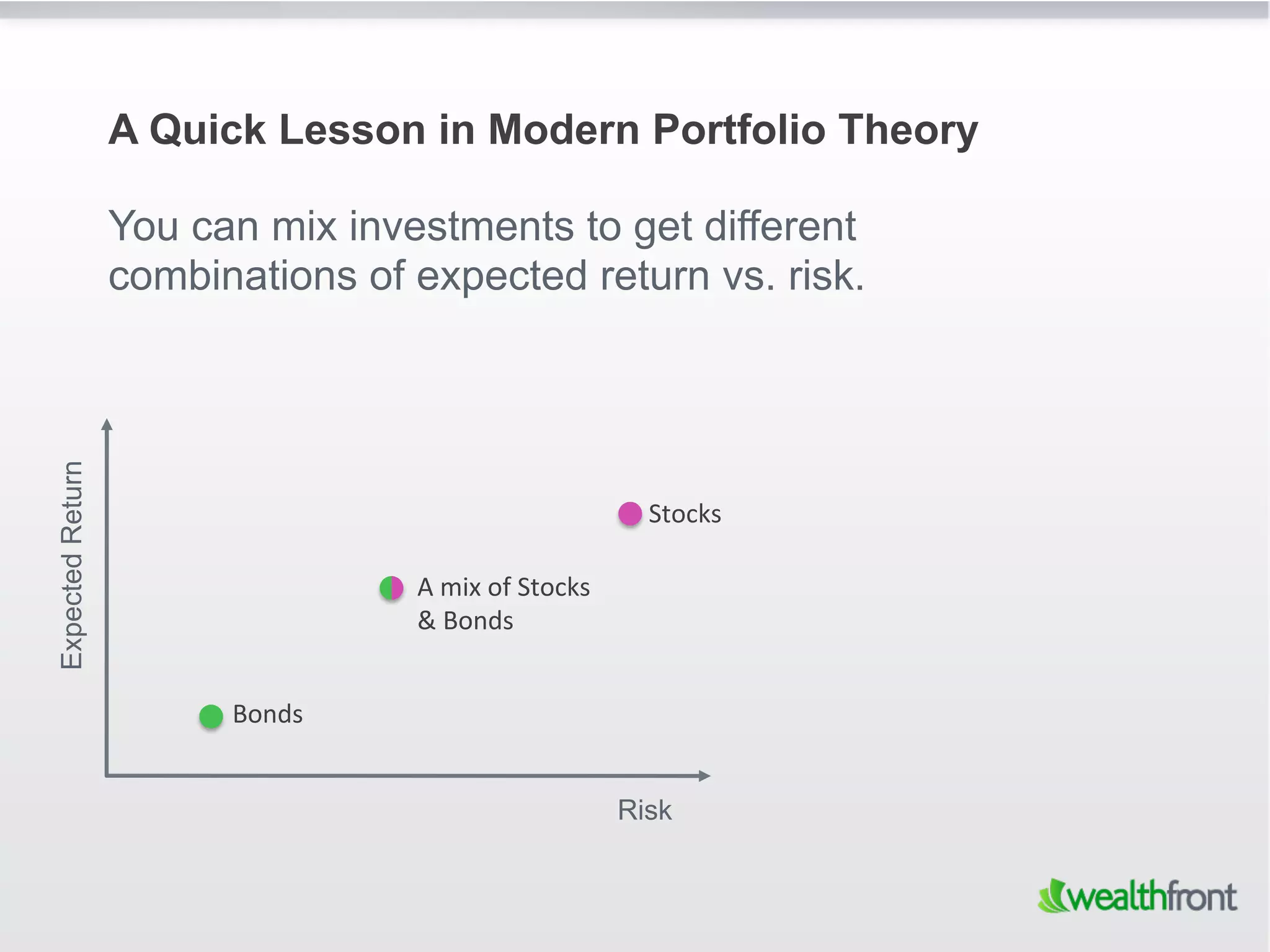

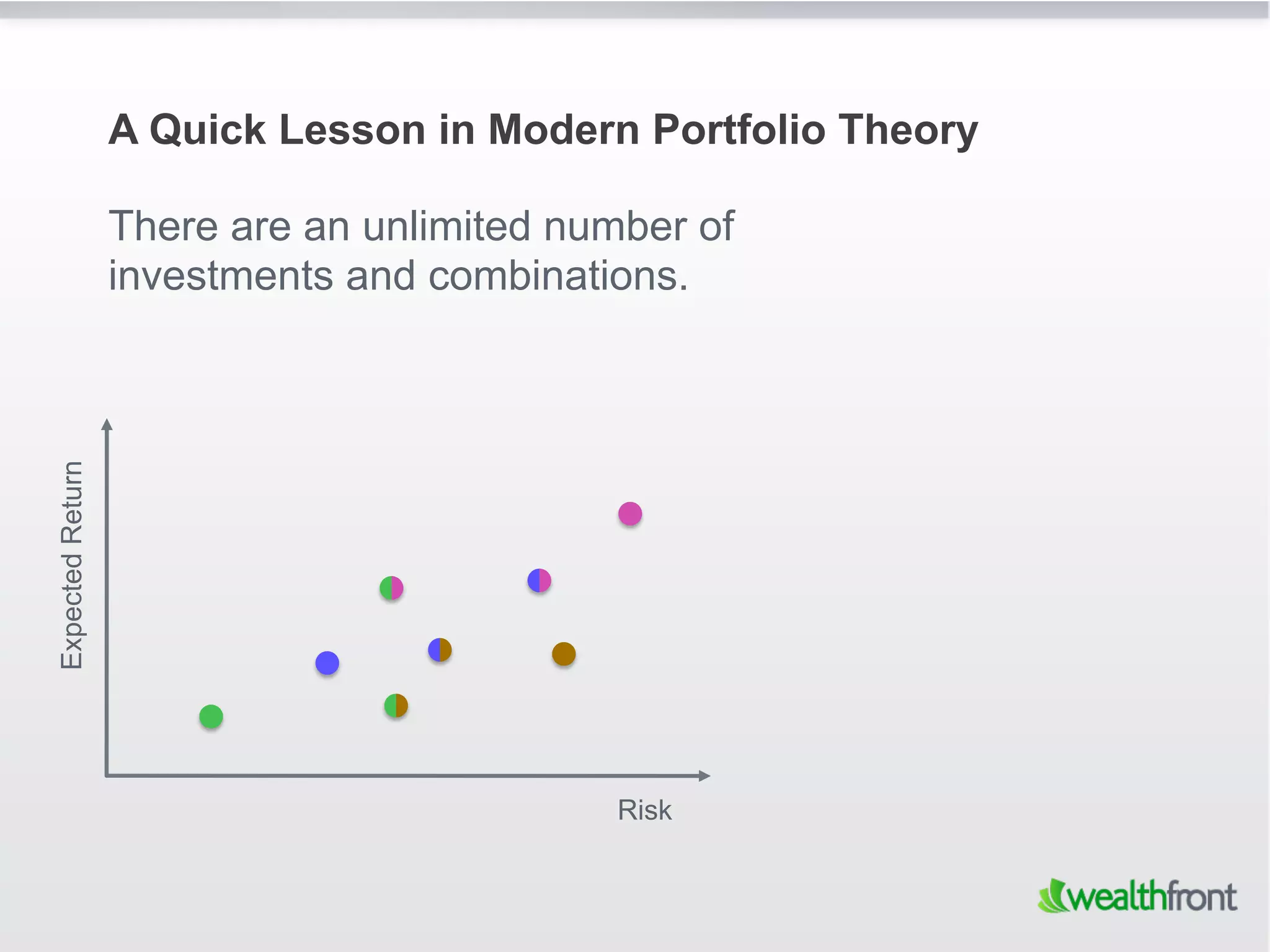

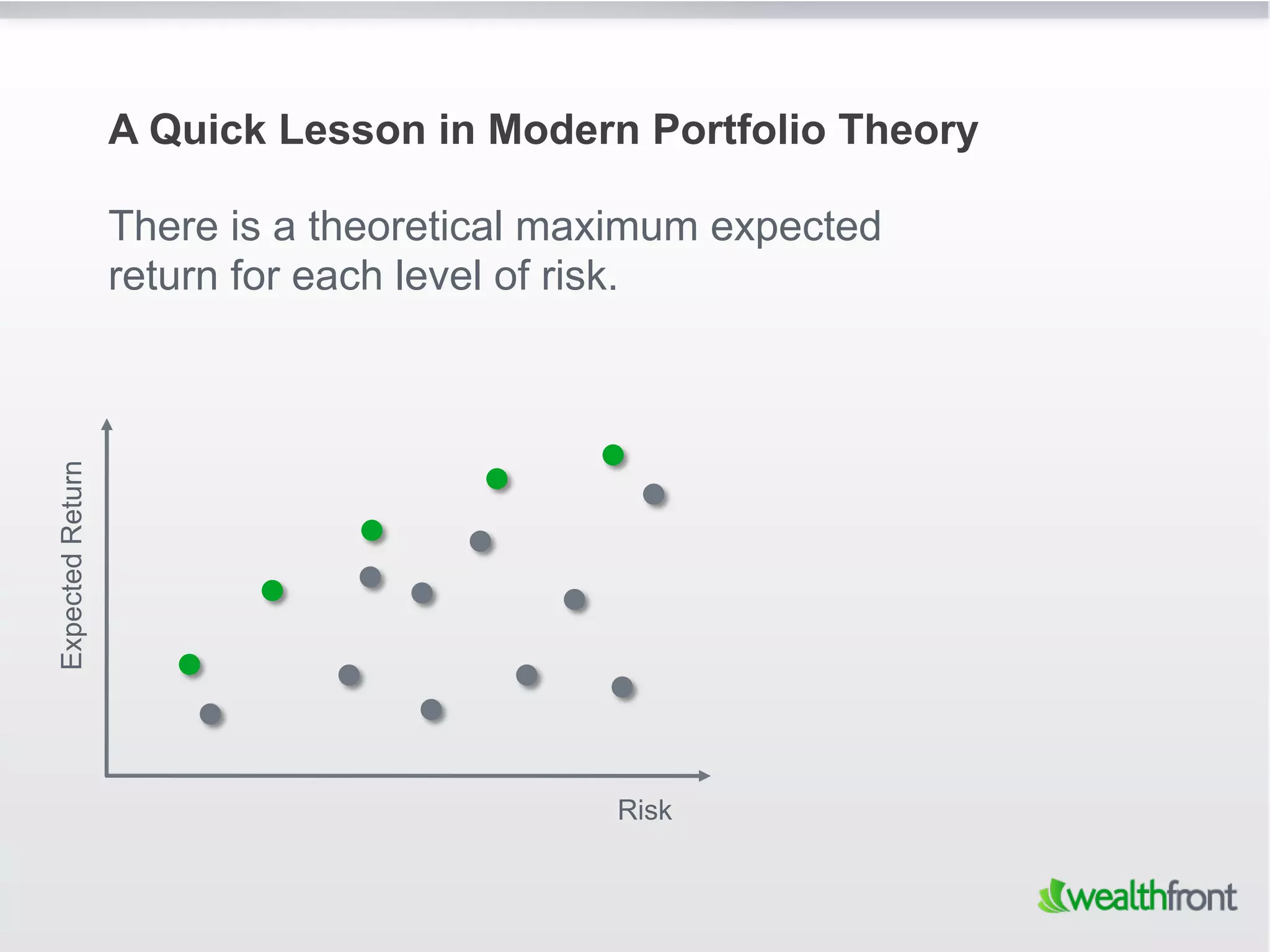

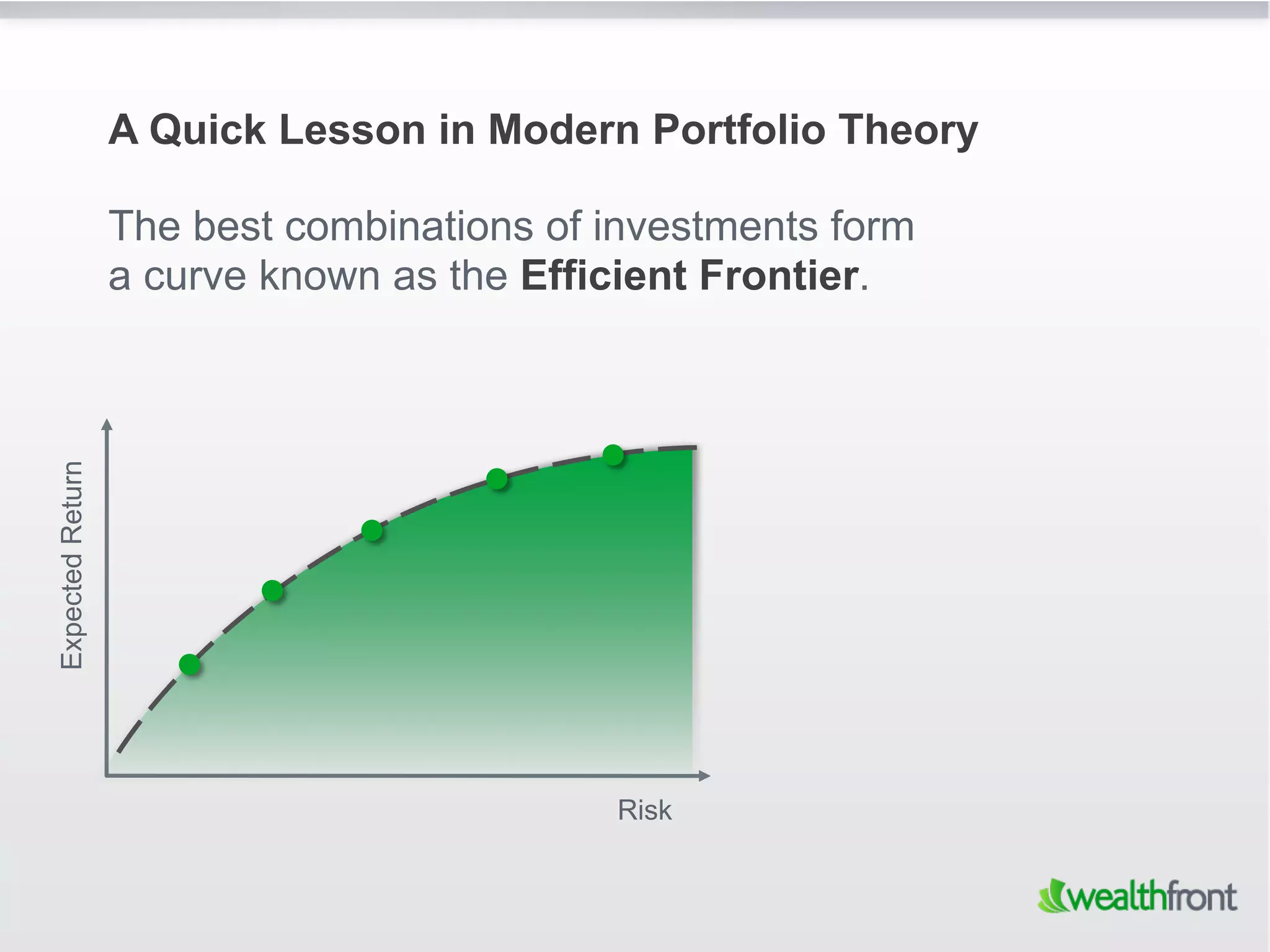

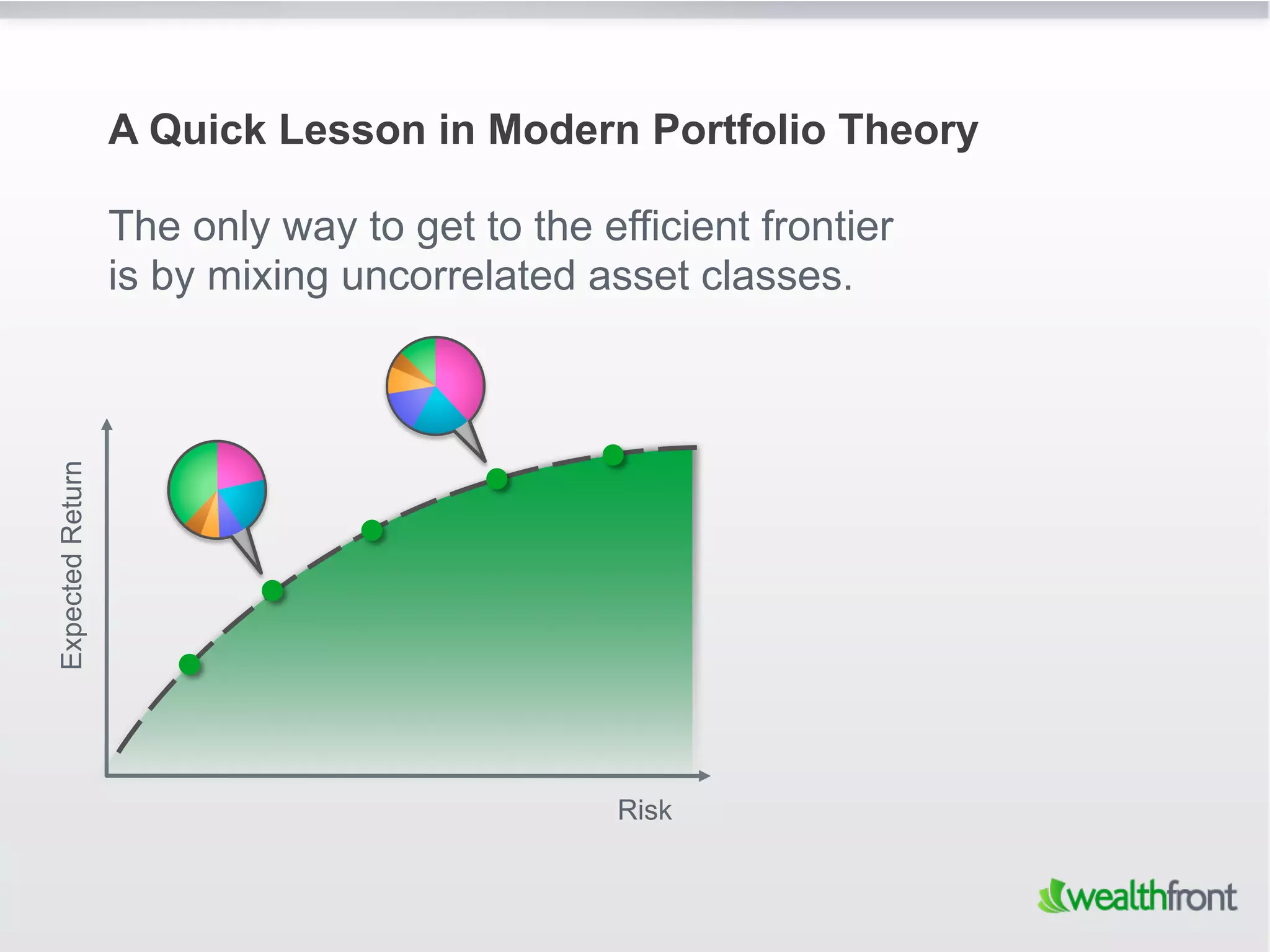

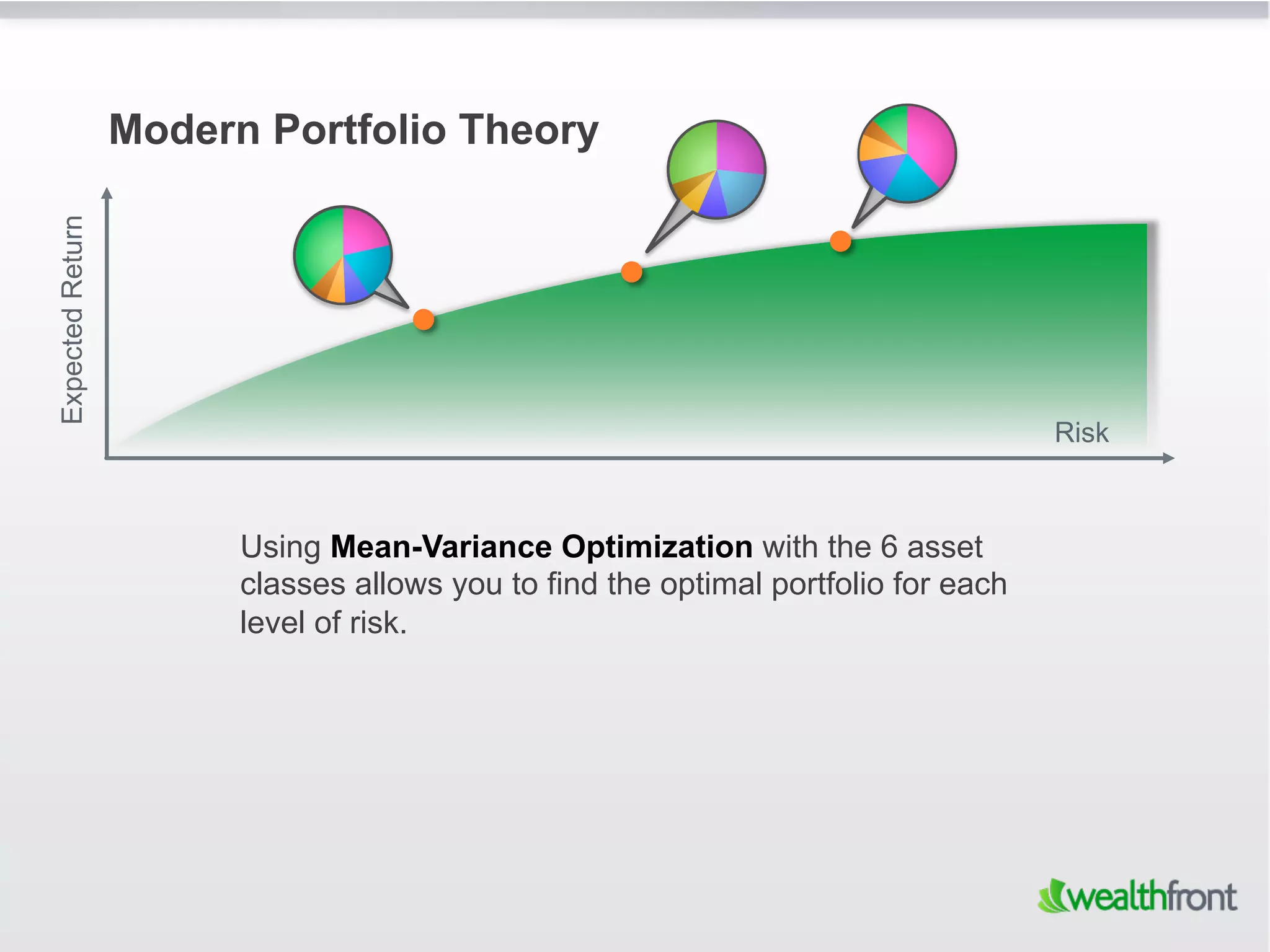

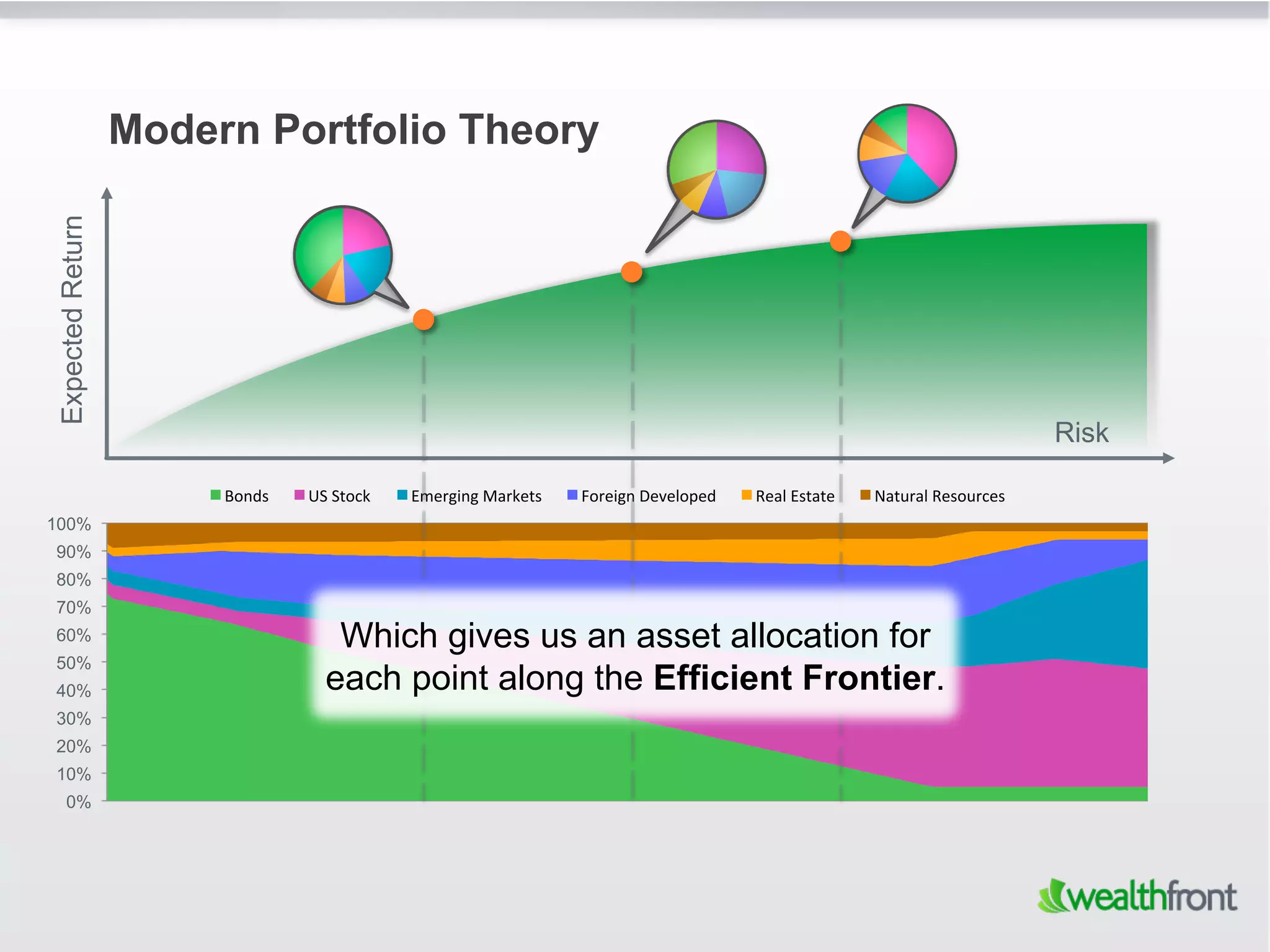

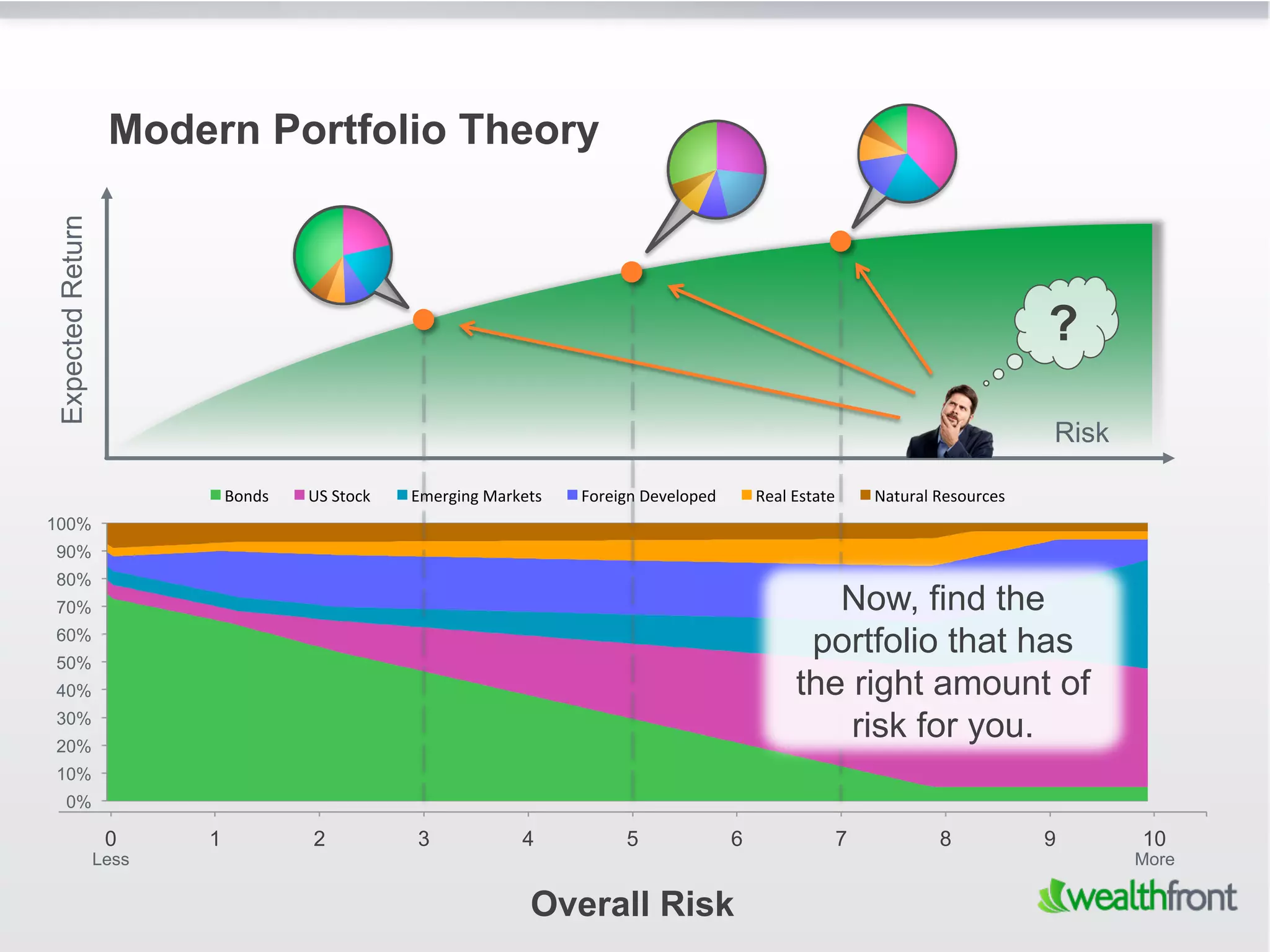

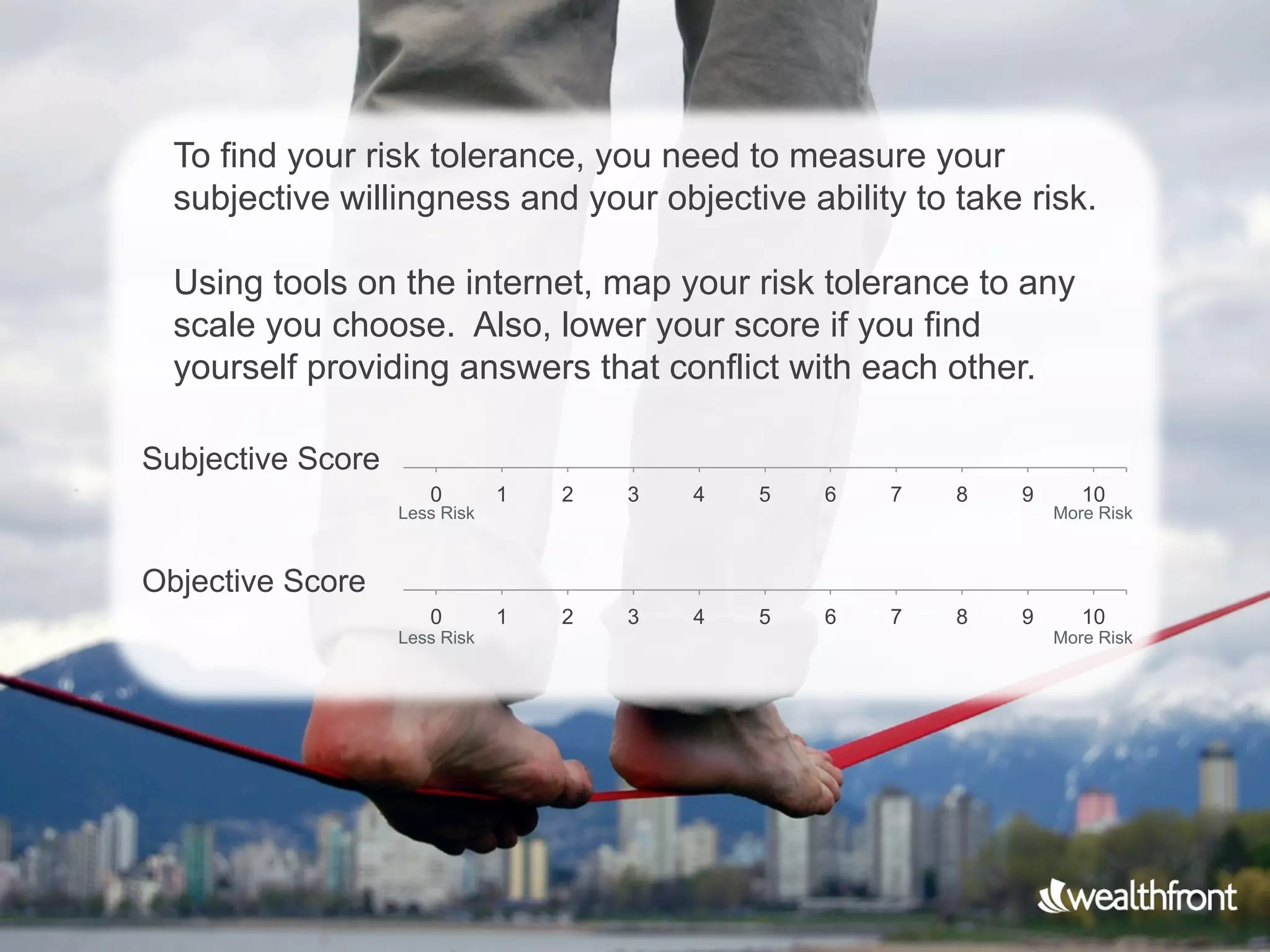

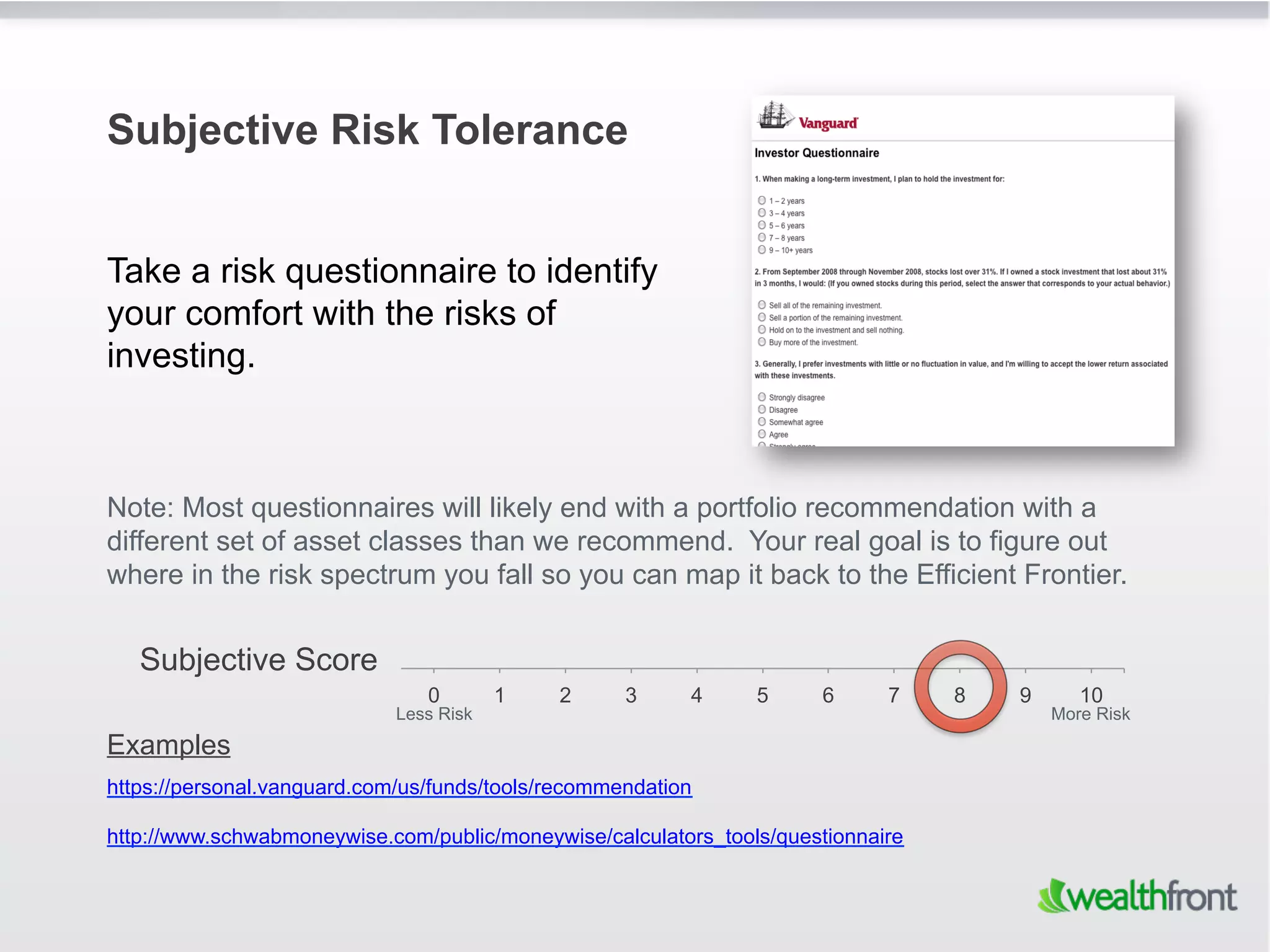

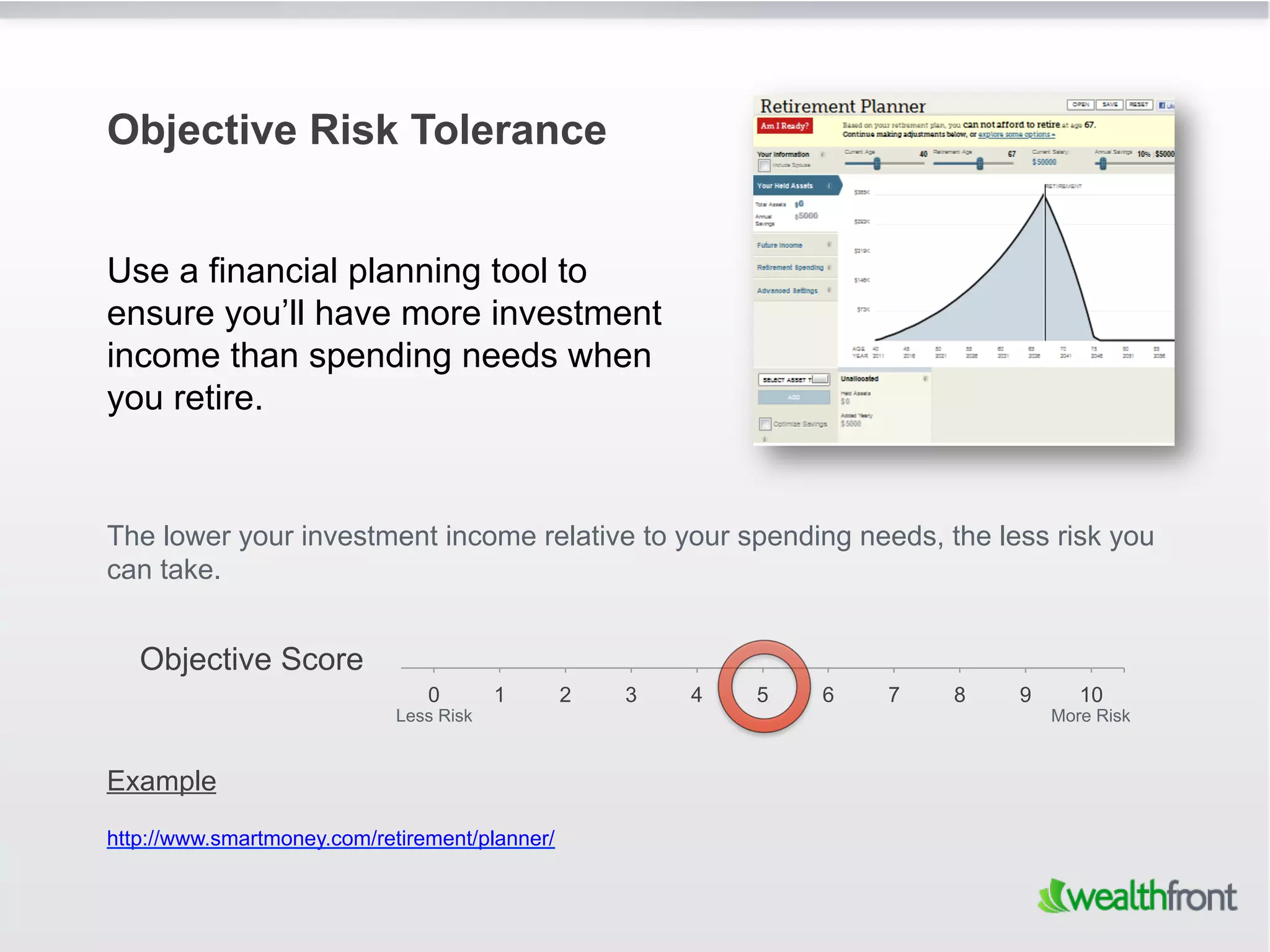

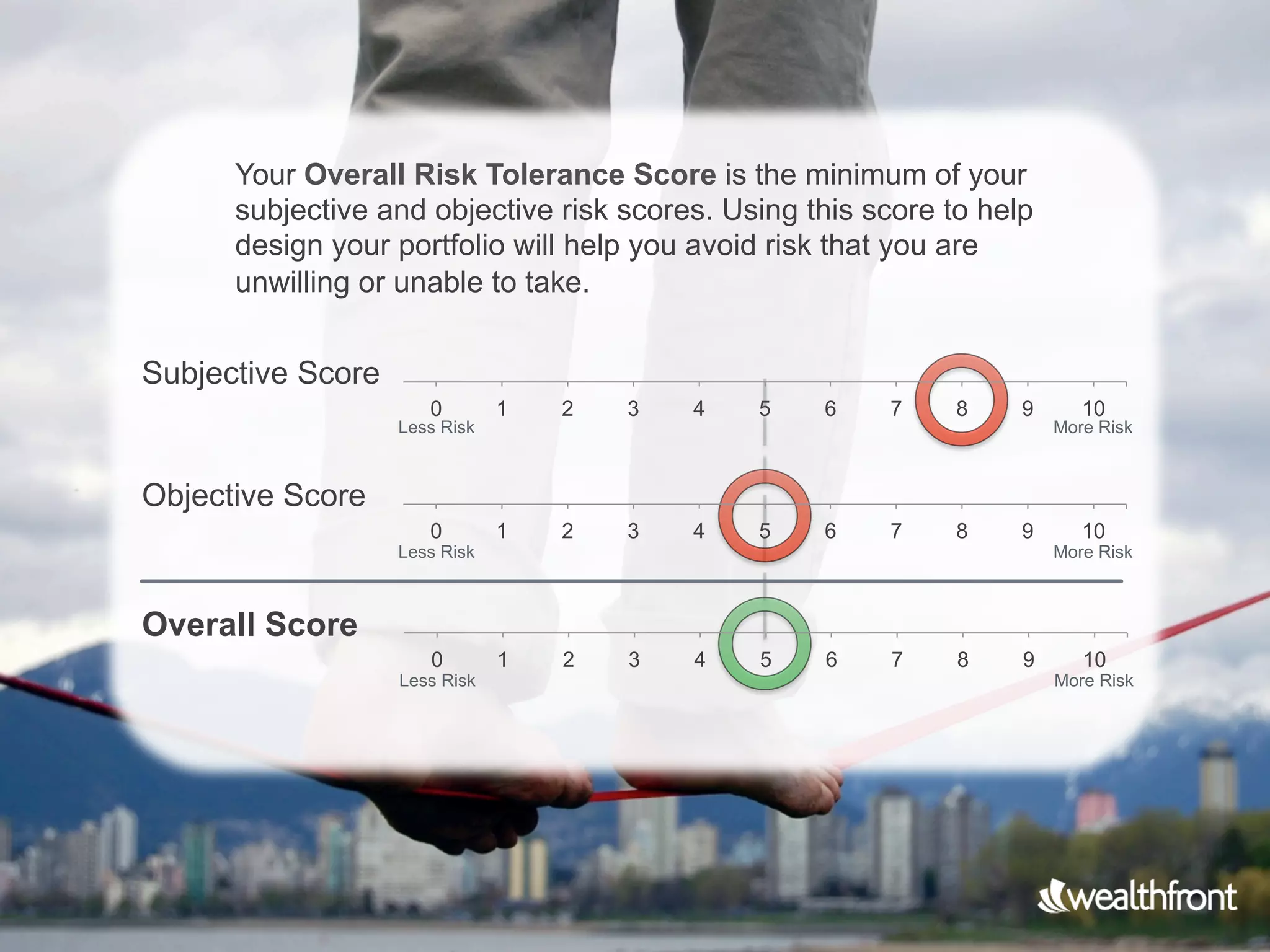

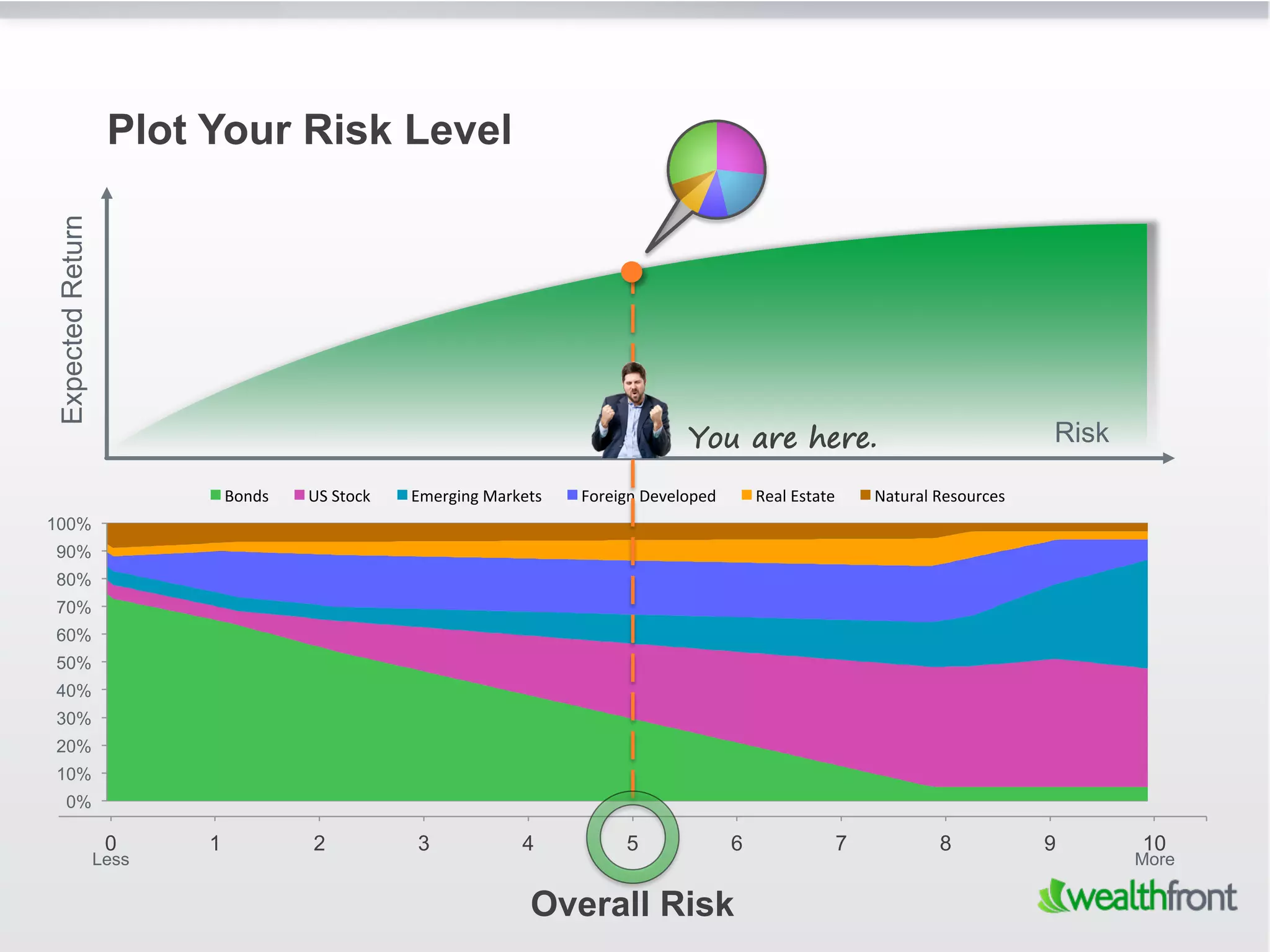

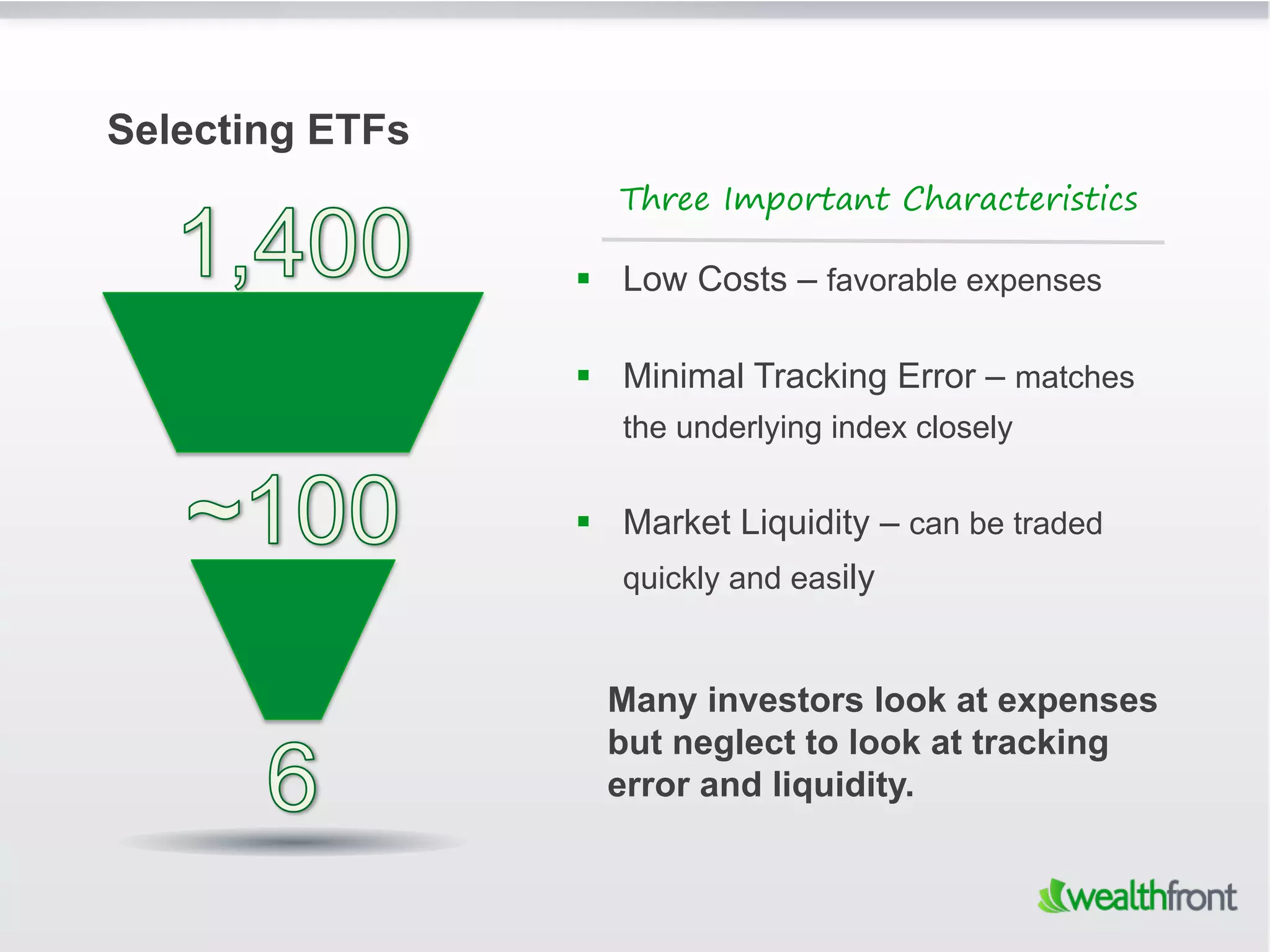

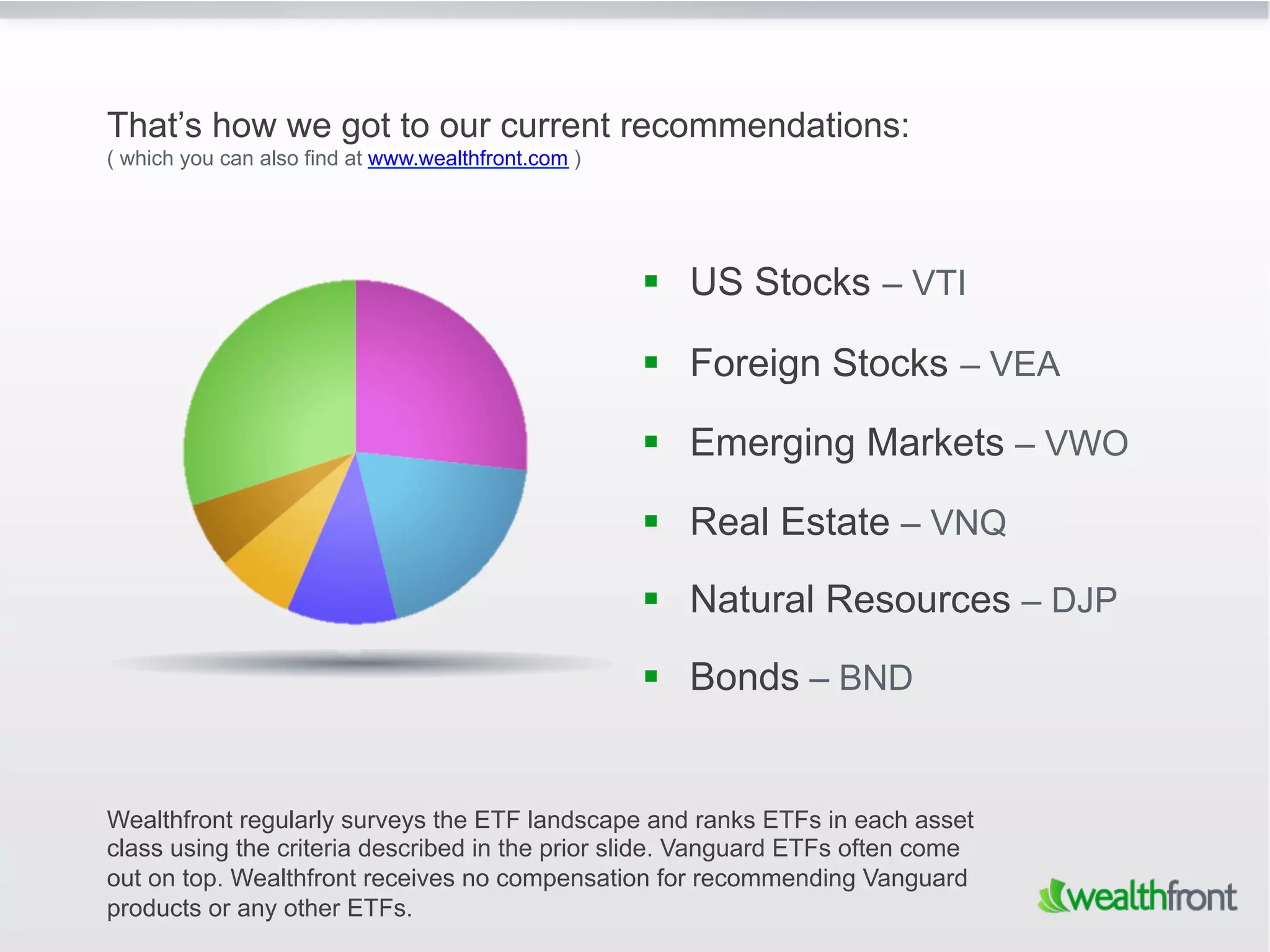

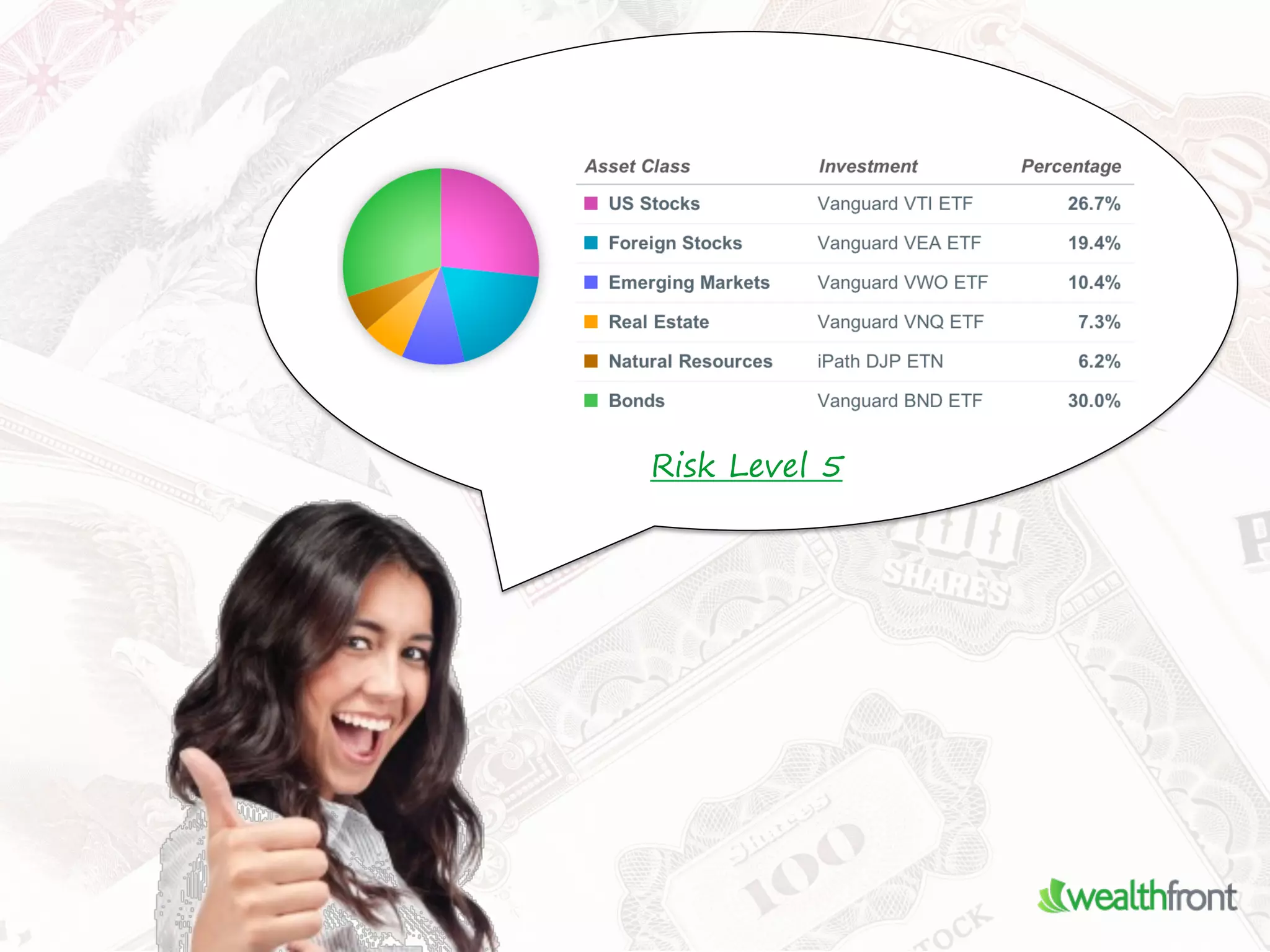

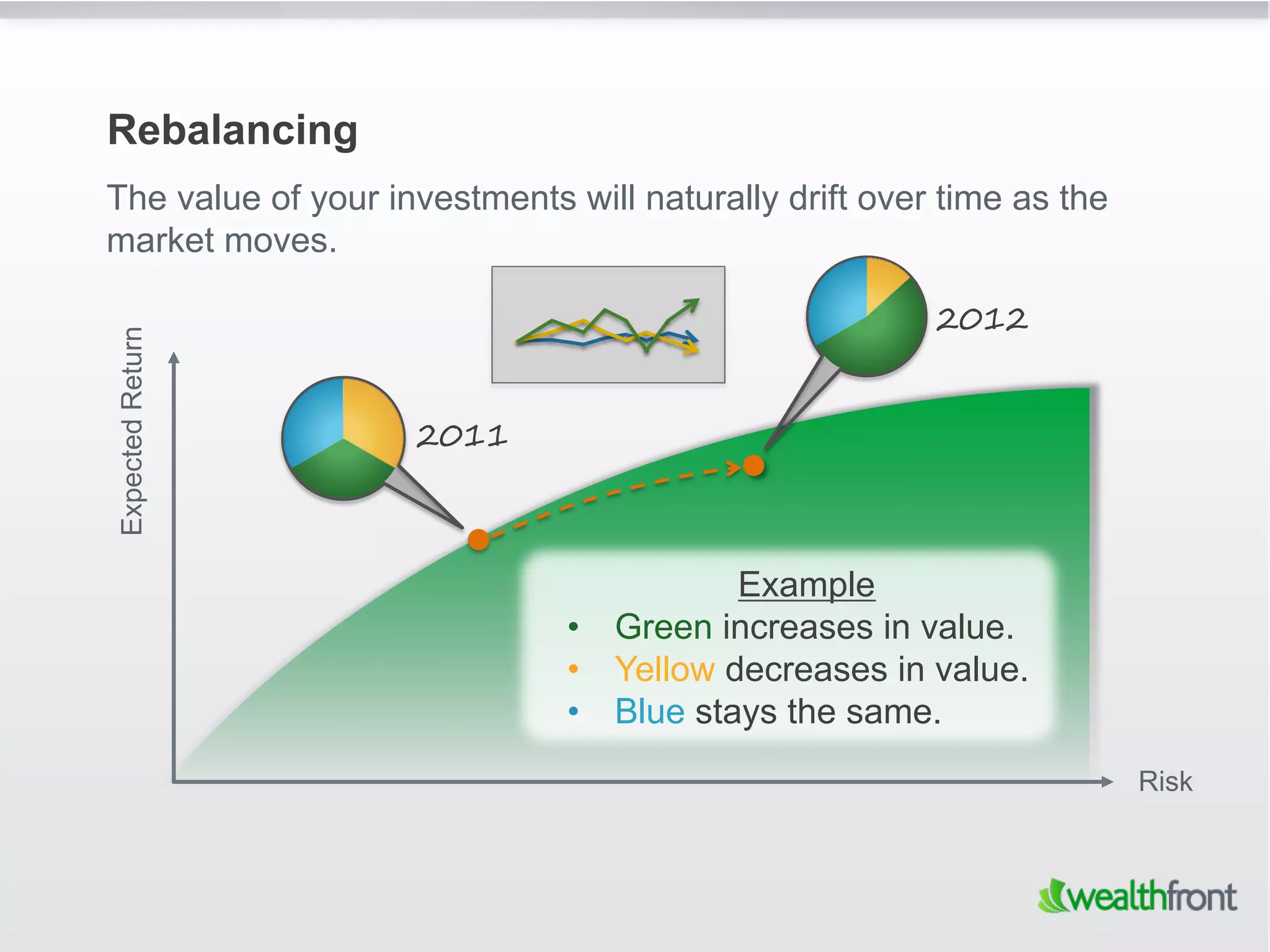

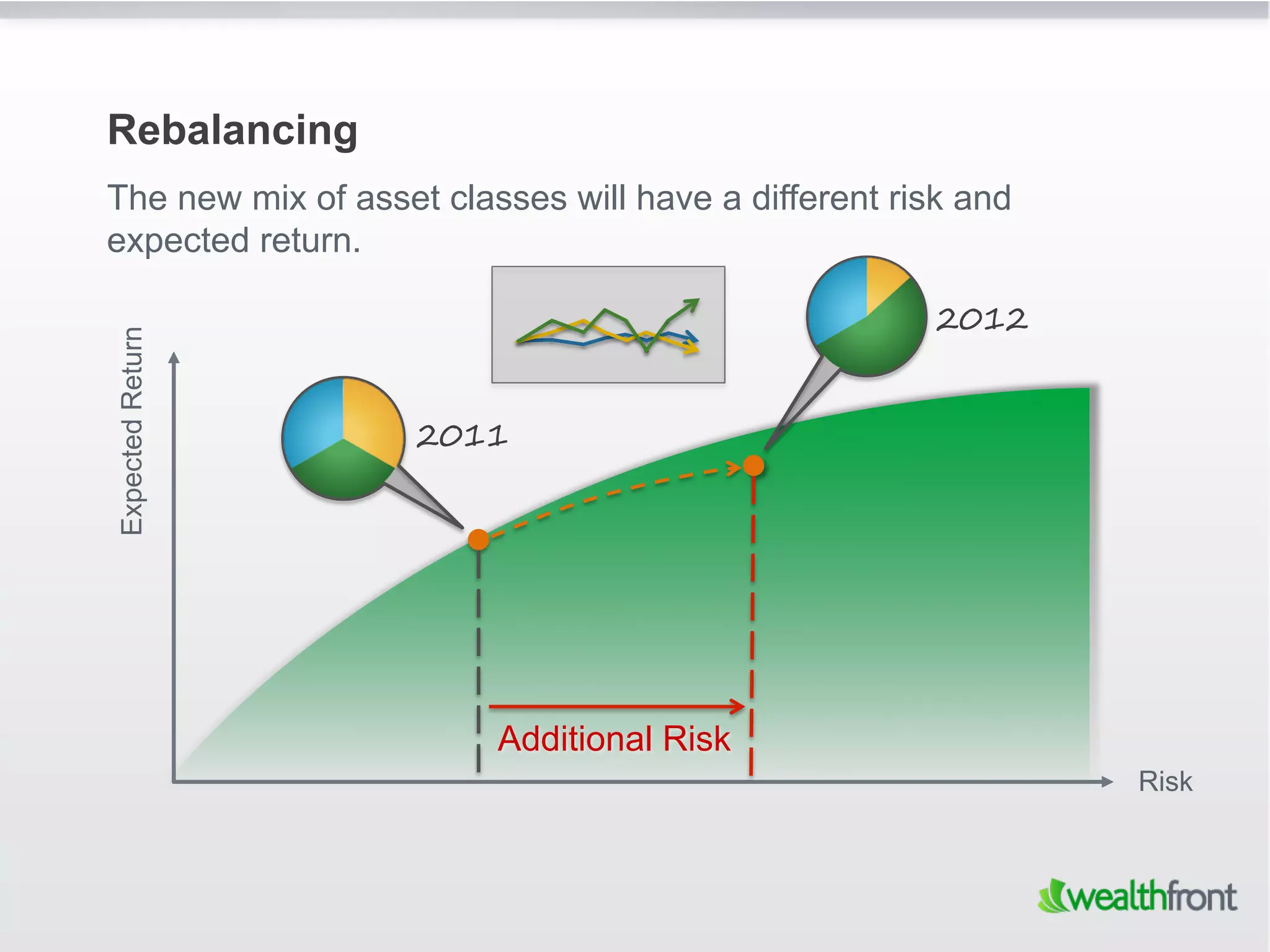

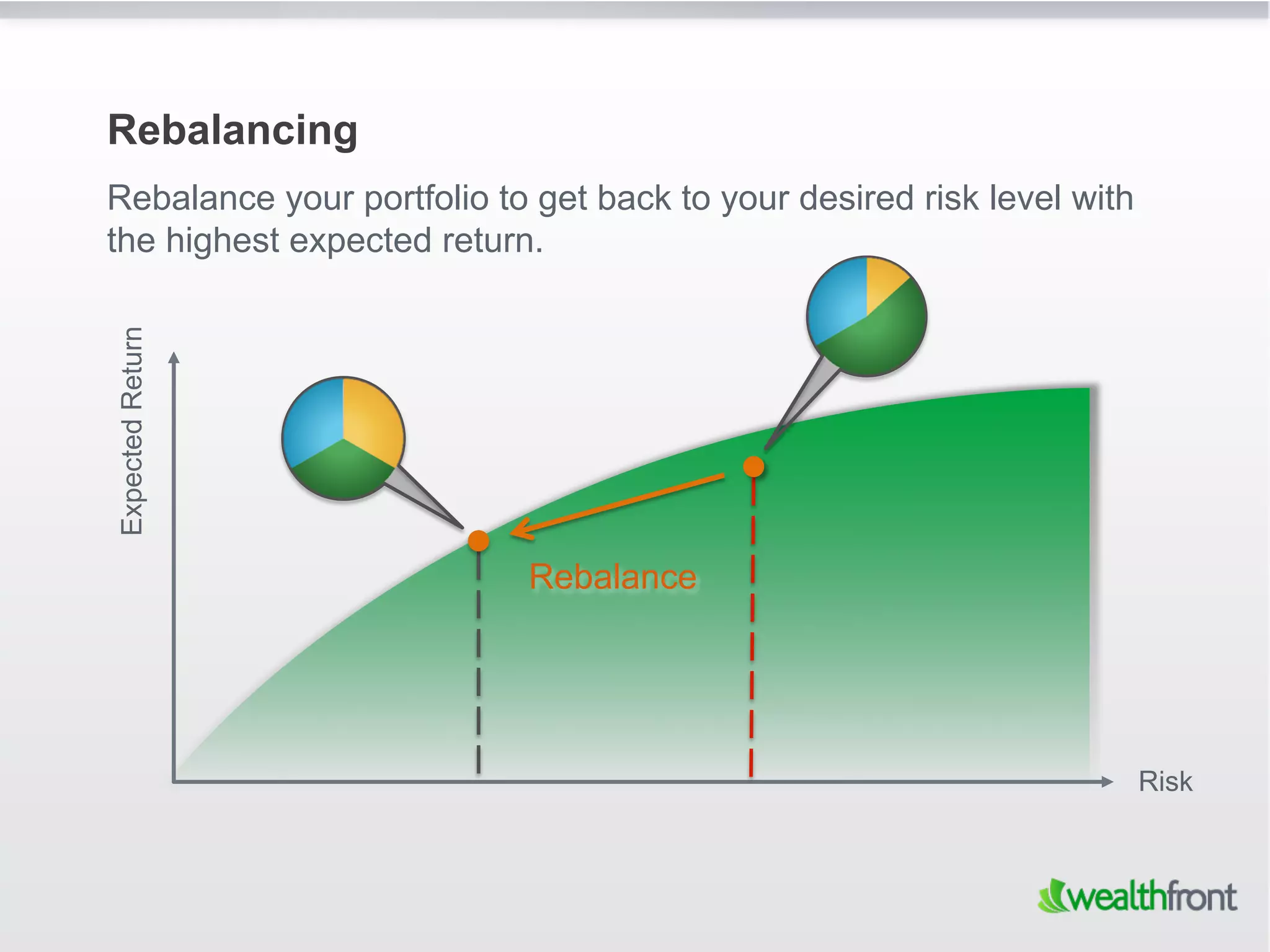

The document discusses using exchange-traded funds (ETFs) to engineer a diversified investment portfolio based on modern portfolio theory, which emphasizes the balance of expected return and risk. It identifies six core asset classes and outlines a method for selecting suitable ETFs while highlighting the importance of risk tolerance assessment and portfolio rebalancing. The document concludes with a reminder that ongoing management is essential to maintain optimal portfolio performance.