IMCA Wealth Monitor

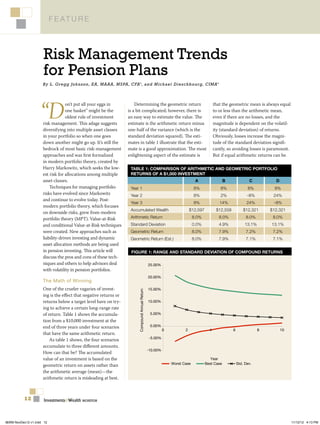

- 1. F e at u r e Risk Management Trends for Pension Plans By L. Gregg Jo h n s o n , E A, M AAA, M SPA, CFA , a n d M i c h a e l D i e s c h b ou rg, C I M A ® ® “D on’t put all your eggs in Determining the geometric return that the geometric mean is always equal one basket” might be the is a bit complicated; however, there is to or less than the arithmetic mean, oldest rule of investment an easy way to estimate the value. The even if there are no losses, and the risk management. This adage suggests estimate is the arithmetic return minus magnitude is dependent on the volatil- diversifying into multiple asset classes one-half of the variance (which is the ity (standard deviation) of returns. in your portfolio so when one goes standard deviation squared). The esti- Obviously, losses increase the magni- down another might go up. It’s still the mates in table 1 illustrate that the esti- tude of the standard deviation signifi- bedrock of most basic risk-management mate is a good approximation. The most cantly, so avoiding losses is paramount. approaches and was first formalized enlightening aspect of the estimate is But if equal arithmetic returns can be in modern portfolio theory, created by Harry Markowitz, which seeks the low- TABLE 1: COMPARISON OF ARITHMETIC AND GEOMETRIC PORTFOLIO est risk for allocations among multiple RETURNS OF A $1,000 INVESTMENT asset classes. A B C D Techniques for managing portfolio Year 1 8% 8% 8% 8% risks have evolved since Markowitz Year 2 8% 2% ‒8% 24% and continue to evolve today. Post- Year 3 8% 14% 24% ‒8% modern portfolio theory, which focuses Accumulated Wealth $12,597 $12,558 $12,321 $12,321 on downside risks, grew from modern portfolio theory (MPT). Value-at-Risk Arithmetic Return 8.0% 8.0% 8.0% 8.0% and conditional Value-at-Risk techniques Standard Deviation 0.0% 4.9% 13.1% 13.1% were created. New approaches such as Geometric Return 8.0% 7.9% 7.2% 7.2% liability-driven investing and dynamic Geometric Return (Est.) 8.0% 7.9% 7.1% 7.1% asset allocation methods are being used in pension investing. This article will FIGURE 1: RANGE AND STANDARD DEVIATION OF COMPOUND RETURNS discuss the pros and cons of these tech- niques and others to help advisors deal 25.00% with volatility in pension portfolios. 20.00% The Math of Winning One of the crueler vagaries of invest- 15.00% Compound Annual Return ing is the effect that negative returns or returns below a target level have on try- 10.00% ing to achieve a certain long-range rate of return. Table 1 shows the accumula- 5.00% tion from a $10,000 investment at the end of three years under four scenarios 0.00% 0 2 4 6 8 10 that have the same arithmetic return. -5.00% As table 1 shows, the four scenarios accumulate to three different amounts. -10.00% How can that be? The accumulated value of an investment is based on the Year Worst Case Best Case Std. Dev. geometric return on assets rather than the arithmetic average (mean)—the arithmetic return is misleading at best. 12 Investments&Wealth MONITOR I&WM NovDec12 v1.indd 12 11/12/12 4:13 PM

- 2. F e at u r e and practice. In practice there is.” The FIGURE 2: RANGE AND STANDARD DEVIATION OF WEALTH elegant and formal mathematics of $2,000 MPT has relied too much on theory Millions rather than the reality of market move- $1,750 ments. Experience has proven that in practice, MPT does not deliver the $1,500 promised results, particularly when $1,250 they are needed the most. Post-modern portfolio theory Assets $1,000 (PMPT) focuses on losses or downside risk to seek portfolios that will pro- $750 vide the most return for any expected $500 level of loss or to generally attempt to accurately measure the potential losses $250 in a portfolio. Tail risk, or extreme loss scenarios, are measured using Value- $0 0 2 4 6 8 10 at-Risk (VaR) to attempt to quantify how much a portfolio might lose in any Year Worst Case Best Case Std. Dev. specified period; or conditional Value- at-Risk (CVaR), which is the amount of loss expected given that a loss occurs. These measures were developed origi- achieved in two portfolios, the portfolio to deliver the returns you need. Static nally for highly complex investment with the lowest volatility always will strategies actually may decrease the bank structures that included diverse accumulate to the most wealth. chances of attaining a fully funded plan. instruments and also are utilized extensively in hedge fund risk manage- Investment Risk Portfolio Theory ment. Their application to investment Many people have heard the adage MPT was developed by Harry portfolios is more suspect because of that investment risk decreases with Markowitz in 1952 and uses expected the fragile relationships of near-homog- time—that achieving your investment return, standard deviation, and correla- enous asset classes. PMPT suffers from goals will be easier the longer you stick tion estimates to produce the efficient many of the same shortfalls as MPT. with your asset allocation. While this frontier of asset allocations representing statement is partially true, it misses a the highest return for any level of risk. Best Practices big issue. The expected return, standard devia- Establishing best practices in building If you are investing pension assets tion, and correlations estimates can portfolios begins with the development and attempting to achieve a certain rate be generated from historical data or of an objective process to establish goals of return, say 8 percent, and you select forward-looking anticipated estimates. and benchmarks of performance. Best an asset allocation that historically pro- However, the asset allocation outcomes practices should include the following vides an expected return of that amount, are very sensitive to small changes in steps: the long-term compound (or geometric) assumptions that lead to artificial asset Establish realistic goals within a return should approach that number. class limits to prevent unreasonable risk budget. In establishing realistic Figure 1 illustrates this concept. allocations. The imposition of these goals, the investor or plan sponsor However, as time increases, the limits makes the allocations generated must articulate what is most important uncertainty of your accumulated wealth almost pre-determined—the efficient to the situation. The goals might be to increases as shown in figure 2. If you are frontier of the set of feasible portfolios achieve a consumer price index plus the sponsor of a pension plan attempting with the desired return or risk is virtu- 3-percent annual return with no more to fund a liability, this means the uncer- ally a straight line. than 10-percent volatility or, in the case tainty of the funded status of your plan The limitations of MPT are best of a pension plan sponsor, to achieve increases with time. Attempting to fund summarized in a quote attributed to the highest funded ratio possible while your liability becomes a great deal more computer scientist and educator Jan taking no more than a 5-percent chance difficult than simply selecting an asset L. A. van de Snepscheut: “In theory that the funded ratio will drop by 5 per- allocation and waiting for the long term there is no difference between theory cent or more during any one year. November/December 2012 13 I&WM NovDec12 v1.indd 13 11/12/12 4:13 PM

- 3. F e at u r e Identify relevant risk metrics. In Monitor progress. Performance is Return enhancers provide for the the process of setting goals, relevant measured on achieving the goals out- selection of managers or nontraditional risk measures usually are apparent. In lined in the process rather than focusing classes where alpha ability can be the example above, minimum annual on the performance of any one manager demonstrated. return and standard deviation are or asset class. Inflation hedges accommodate important to the first investor whereas Defining asset classes by function in benefits that are dependent, directly funded ratio and stochastic probabili- a core-satellite approach is useful when or indirectly, on inflation. Treasury ties are important to the second. Many considering the potential asset alloca- inflation-protected securities (TIPS) plan sponsors are worried about the tions that are most likely to achieve or real assets typically are found in this volatility of the contributions required one’s goals. Figure 3 shows how asset bucket. by the plan so this is the relevant risk classes can be defined by function. Direct hedges are used to hedge metric. At the core of all portfolios is the portfolio risk, equity, or fixed income, Measure current risk exposures. beta or market exposure class. This class either tactically or for leaving on a The relevant risk measures are quan- consists of equity market exposures and hedge (such as a tail-risk hedge) at all tified under the current or initially other highly correlated asset classes. times. Futures and options uses are proposed asset allocation to establish The portfolio is optimized based on growing rapidly and most investors a benchmark to use for determining return and risk expectations and any have a choice of many hedging options improvements. necessary allocation constraints. A previously not available to them. Evaluate alternatives to improve single risk-and-return metric is deter- Risk diversifiers come in many the risk profile. Alternative asset allo- mined based on this allocation; it will forms, and several are unique to pen- cations are identified and risk metrics be used in the remainder of the process sion plans. The most fundamental risk are measured to determine improve- and will help determine the allocation to diversifier is the fixed-income asset ments from the initial allocation. An the beta class. class. Because the risk in most portfo- asset-liability modeling study is com- The following satellite portfolios are lios is dominated by equity risk, adding pleted to produce the metrics needed to then added: fixed income—which typically has a evaluate the pension plan. Liquidity accommodates the near- correlation with equity of less than Implement solutions. The portfolio term (5–7 years) benefit payments or 0.50—is a common risk diversifier. In allocation needs to be dynamic at the cash outflows while maximizing return; the past, fixed income has been the only asset allocation level, manager level, or satellite liquidity portfolios are updated real risk diversifier for many investors. both. annually. Today, more asset classes are available to satisfy this function with specialized FIGURE 3: CORE-SATELLITE PORTFOLIO CONSTRUCTION OF ASSET classes for some pension investors. CLASSES BY FUNCTION Risk diversifiers could be any asset class that exhibits a low correlation with the beta portfolio and whose correla- tion is not expected to approach 1.0 in Risk anything but the most extreme circum- Diversifiers stances. Real estate is a good fit in this category. Absolute return appears to be an excellent risk diversifier and could Liquidity Direct be a very attractive alternative to fixed Allocation Hedges income. The key here is that it is futile Beta to attempt to diversify equity risk with Market other equity classes—most equity cor- Exposure relations are at least 0.70 and it doesn’t take anything like a crisis for these cor- relations to approach 1.0. Therefore, all Inflation Return Hedge equity classes are included in the beta Enhancers Allocation portfolio, a single return and risk mea- sure is used to represent them, and the real risk reducers are then introduced into the optimization. 14 Investments&Wealth MONITOR I&WM NovDec12 v1.indd 14 11/12/12 4:13 PM

- 4. F e at u r e TABLE 2: DYNAMIC ASSET ALLOCATION BASED ON PLAN FUNDED STATUS Less than 80%‒90% 90%‒100% 100%‒110% More than 110% Class 80% Funded Funded Funded Funded Funded Cash 5% 5% 5% 5% 5% Fixed Income 35% 45% 60% 70% 80% Real Estate 10% 5% 5% 5% 0% Large-Cap Equity 15% 15% 10% 10% 10% Mid-Cap Equity 10% 10% 5% 5% 5% Small-Cap Equity 5% 5% 5% 0% 0% International Equity 10% 10% 5% 5% 0% Private Equity 10% 5% 5% 0% 0% Expected Return 7.8% 6.9% 5.8% 5.0% 4.2% Standard Deviation 11.8% 8.9% 6.4% 4.9% 5.1% Projected Contributions over 20 Years 95th Percentile $404,478,630 50th Percentile $172,162,360 5th Percentile $61,286,462 Because corporate pension plan liabilities are now marked-to-market, or measured at current yields, specialized instruments are available to lower their “ T h e pro lif e ratio n o f LDI applicatio n s am ong co n s ultan ts h as co me to make LDI appea r mo re o f a pro du ct th an jus t addin g an ” risk, primarily from decreases in inter- est rates. Public pension plans are not i nt eres t-match in g as s e t. required to mark liabilities to market on the current yield curve, so none of these opportunities, nor liability- fixed-income instruments of the same The proper way to address interest- driven investing (see below), is a risk duration as liabilities, the movement rate risk is to configure asset classes diversifier. of the assets and liabilities would be by function, as described above, then perfectly correlated and the plan always to investigate the effect of varying the Liability-Driven Investing (LDI) would remain 100-percent funded. This allocation to the interest-matching It is difficult to read about pension is the basis for LDI. (Insurance compa- fixed-income class by examining the investing today without reading about nies have been doing this for years and effect on identified metrics through an LDI. The concept gained traction call it “matching assets and liabilities.” asset-liability study in the best prac- through the Pension Protection Act of Pension plan investors apparently tices process. Exposure to interest-rate 2006, which requires corporate pension wanted their own nomenclature.) risk can be clearly evaluated from the plan liabilities—i.e., the present value of The proliferation of LDI applications metrics and plan sponsors can make future benefit payments—to be deter- among consultants has come to make informed decisions about the risks they mined on current yields of investment- LDI appear more of a product than are willing to accept. quality bonds. Because interest rates are just adding an interest-matching asset. so low, the liabilities of pension plans Additionally, most consultants have Dynamic Asset Allocation or and the underfunding of plans (liabili- indicated that LDI is used to “de-risk” a Defined Benefit Glidepath ties in excess of assets) are at histori- pension plan; however, LDI addresses Another popular topic in pension cally high levels. only a single risk (interest-rate expo- investing is dynamic asset allocation, Now that liabilities of corporate pen- sure) while many risks still remain in also called defined benefit glidepath. sion plans are inversely related to interest the assets and liabilities. LDI also seems This approach seeks to achieve closely rates, there exists an opportunity to to be presented as a solution to an matched fixed-income assets to liabili- directly match the movements of assets underfunded pension plan. LDI itself ties at the time the plan becomes well- and liabilities. For example, if a plan were cannot directly help the underfunding funded. Acknowledging that return 100-percent funded and invested only in of a pension plan. Continued on page 16 November/December 2012 15 I&WM NovDec12 v1.indd 15 11/12/12 4:13 PM

- 5. F e at u r e Johnson–Dieschbourg Continued from page 15 is important when the plan is under- happening primarily because the com- returns is the surest path to having the funded and that some investment risk monly accepted static approach to asset resources to distribute required amounts will be taken to help achieve improved allocation and asset management is not to pensioners. funding, the roadmap or glidepath for working. Indeed, the static approach is asset allocation will be based on the based on a number of assumptions and L . Gr e g g Jo hn s o n , E A , M A A A , MSPA , funded status of the plan. Plans with theories that all too often are proving C FA ® , i s m an ag ing p r in c ip al of lower funded status will have higher false in common practice. Consequently, P e n sio n Ap p lic a tio n s . He e ar n e d a allocations to beta or alpha-generating the math of losing is forcing a move to B B A w ith ho n o r s in a c tu ar i al s ci e n ce assets, gradually moving to matching a more dynamic approach that focuses f r o m the Univ e r sit y o f Te x a s an d fixed-income investments as funded more on success than on theory. The key a Ma s te r s o f Fin an c e f r o m Ge org i a status improves. An asset-liability study to the success of this dynamic approach S t a te Univ e r sit y. C o n t a c t him at can optimize the glidepath based on a is a collaborative effort among all inter- lg r e g g j o hn s o n @ p e n - ap p s .c o m . metric identified by the plan sponsor, ested parties, plan boards, consultants, and this optimized glidepath will be actuaries, and investment managers to Michael D ie schbourg, C I M A®, is included in the investment policy state- achieve the liability objective of the plan manag ing director at BRO ADM ARK ment. Table 2 illustrates an example of a rather than market-focused goals. Better Asset Management . He earned a BB A glidepath based on funded status. tools for describing portfolio behav- from Loyola University of Chicago ior will help. But the most important and ser ve s on I MC A’s Board of Conclusion improvement is the establishment of D irectors a s well a s the editorial The funding crisis in pension plans is a new core that seeks to avoid large boards of Investments & Wealth causing plan administrators, consultants, drawdowns while still maintaining Monitor and the Journal of Investment and asset managers to rethink traditional equity exposure. The avoidance of large Consulting. Contact him at approaches to return and risk. This is drawdowns while maintaining adequate mdie schbourg@broadmarka sset .com. Gillespie–Curwood Continued from page 11 Mina, J. 2005. Risk Budgeting for Pension Plans. Disclaimer: This document is issued by is not a reliable indicator of future RiskMetrics Journal 6, no. 1: 9–34. Russell Investment Management Pty performance. Russell Investments. 2012. De-risking Risk: Ltd ABN53 068 338 974, AFS Licence Nothing contained in this material Investors Making Progress on Risk 247185 (RIM). It provides general is intended to constitute legal, tax, Management, But Still Face Challenges information for wholesale investors only securities, or investment advice, nor an in Governance. Russell Investments and and has not been prepared having regard opinion regarding the appropriateness Pensions & Investments, Part 2. http://sup- to your objectives, financial situation, of any investment, nor a solicitation plement.pionline.com/risk-trending/_pdf/ or needs. Before making an investment of any type. Copyright © 2012 Russell PI_Russell_De-risking_Risk_Pt2.pdf. decision, you need to consider whether Investments. All rights reserved. This Schmid, M. A., and Q. Nguyen. 2012. A Total this information is appropriate to your material is proprietary and may not be Enterprise Approach to Endowment objectives, financial situation, or needs. reproduced, transferred, or distributed Management. The NMS Exchange: This information has been compiled in any form without prior written Investment Bulletin for the Endowment & from sources considered to be reliable, permission from RIM. Foundation Community (January). but is not guaranteed. Past performance 16 Investments&Wealth MONITOR I&WM NovDec12 v1.indd 16 11/12/12 4:13 PM