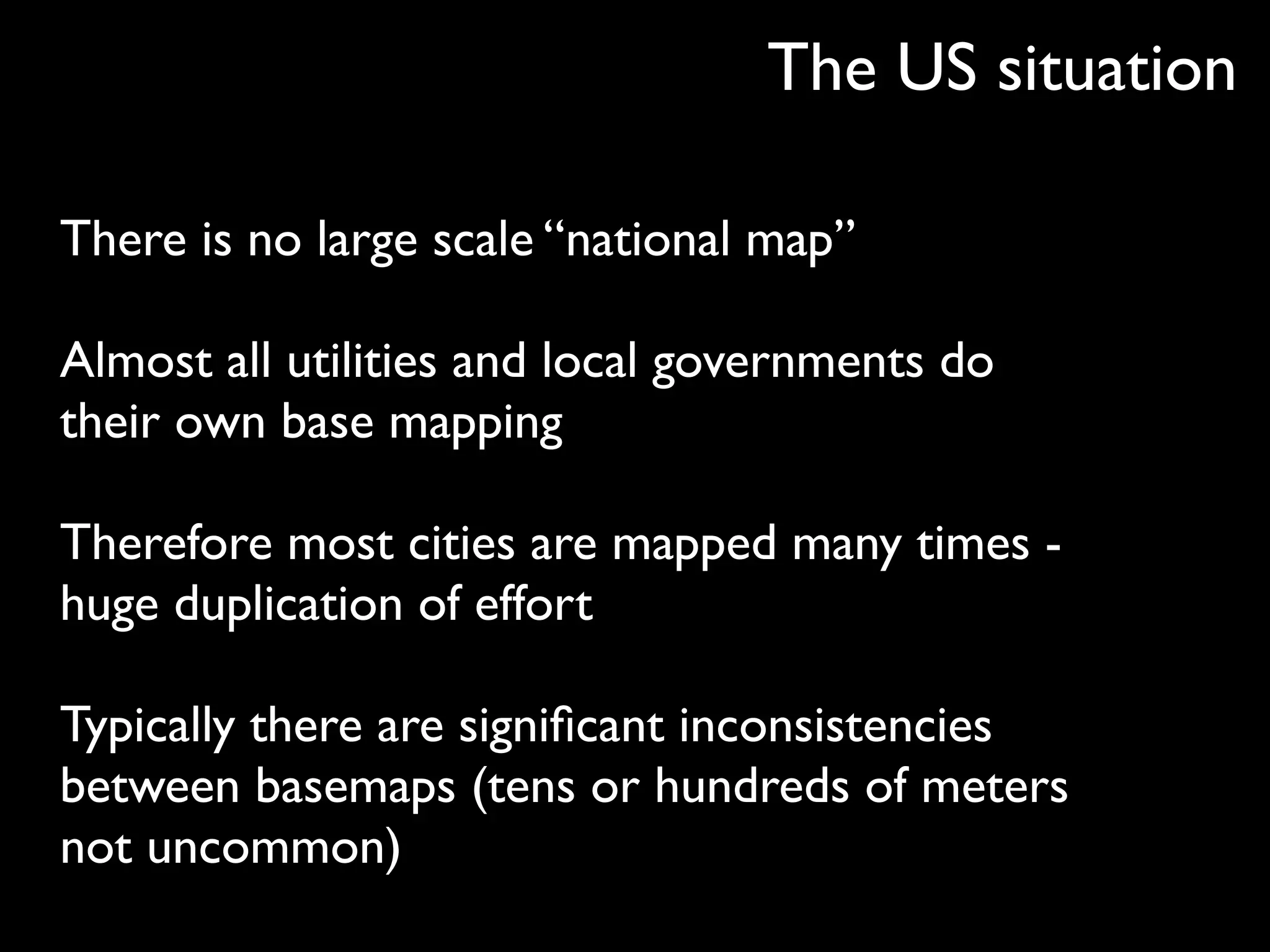

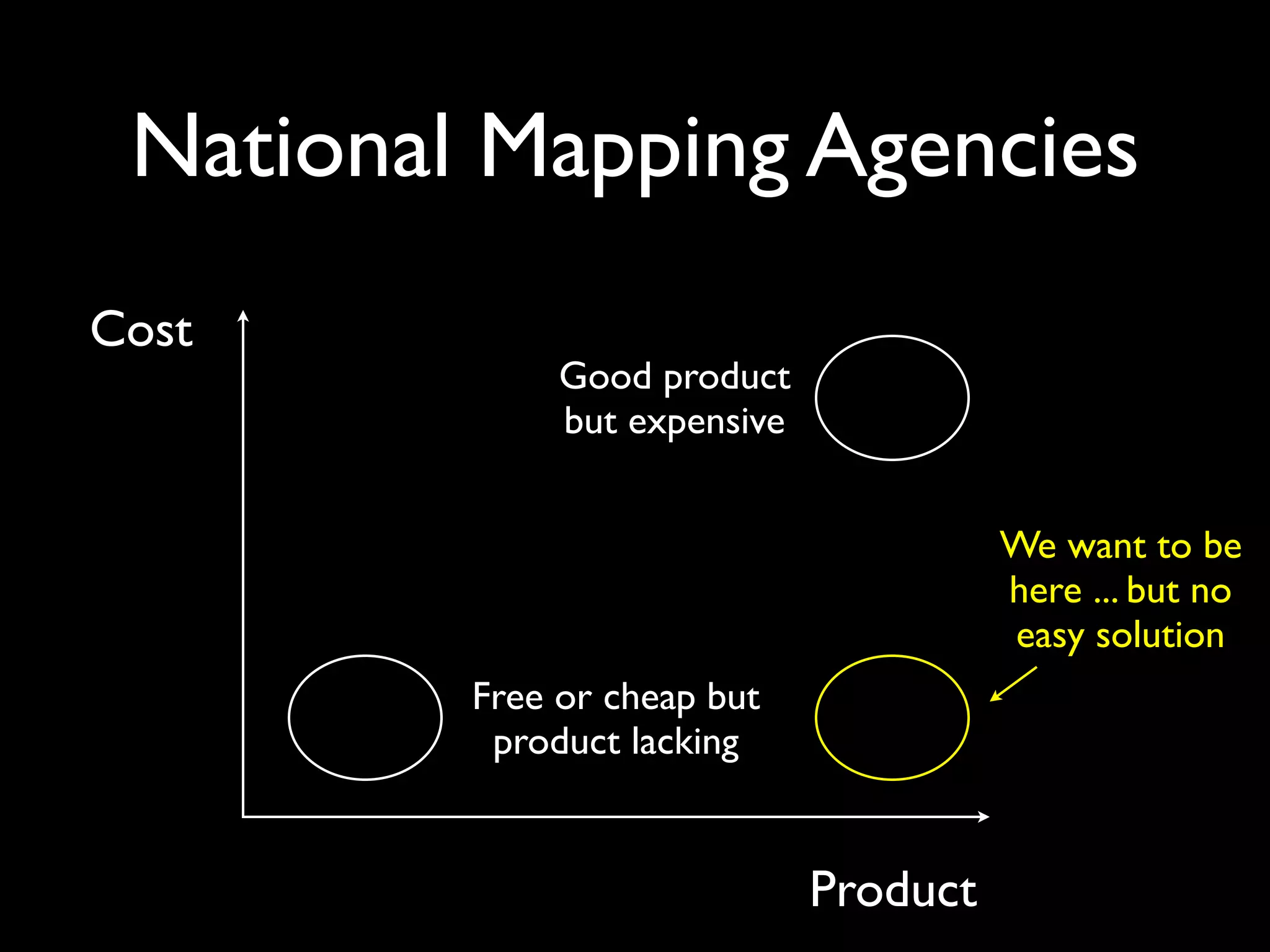

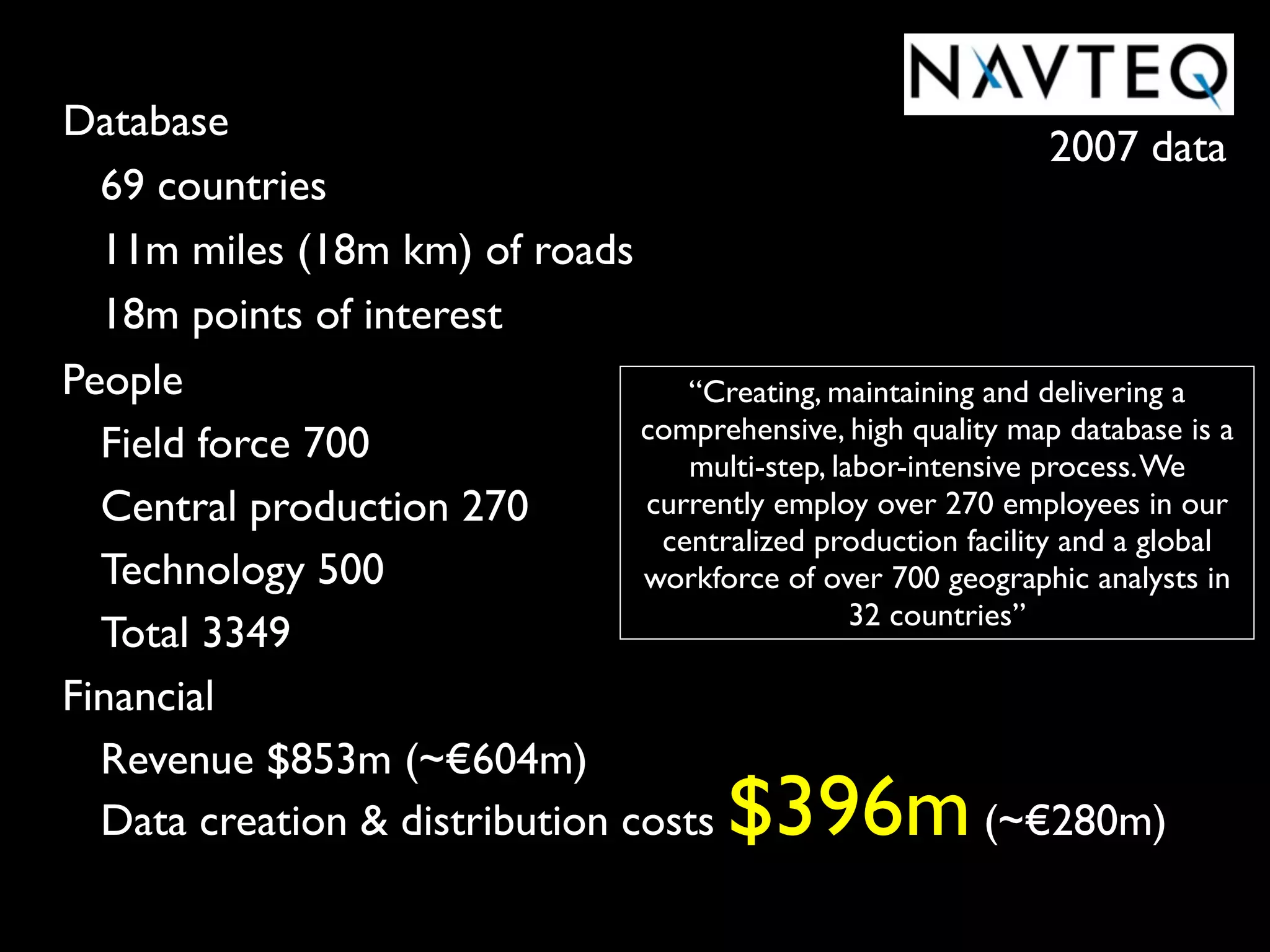

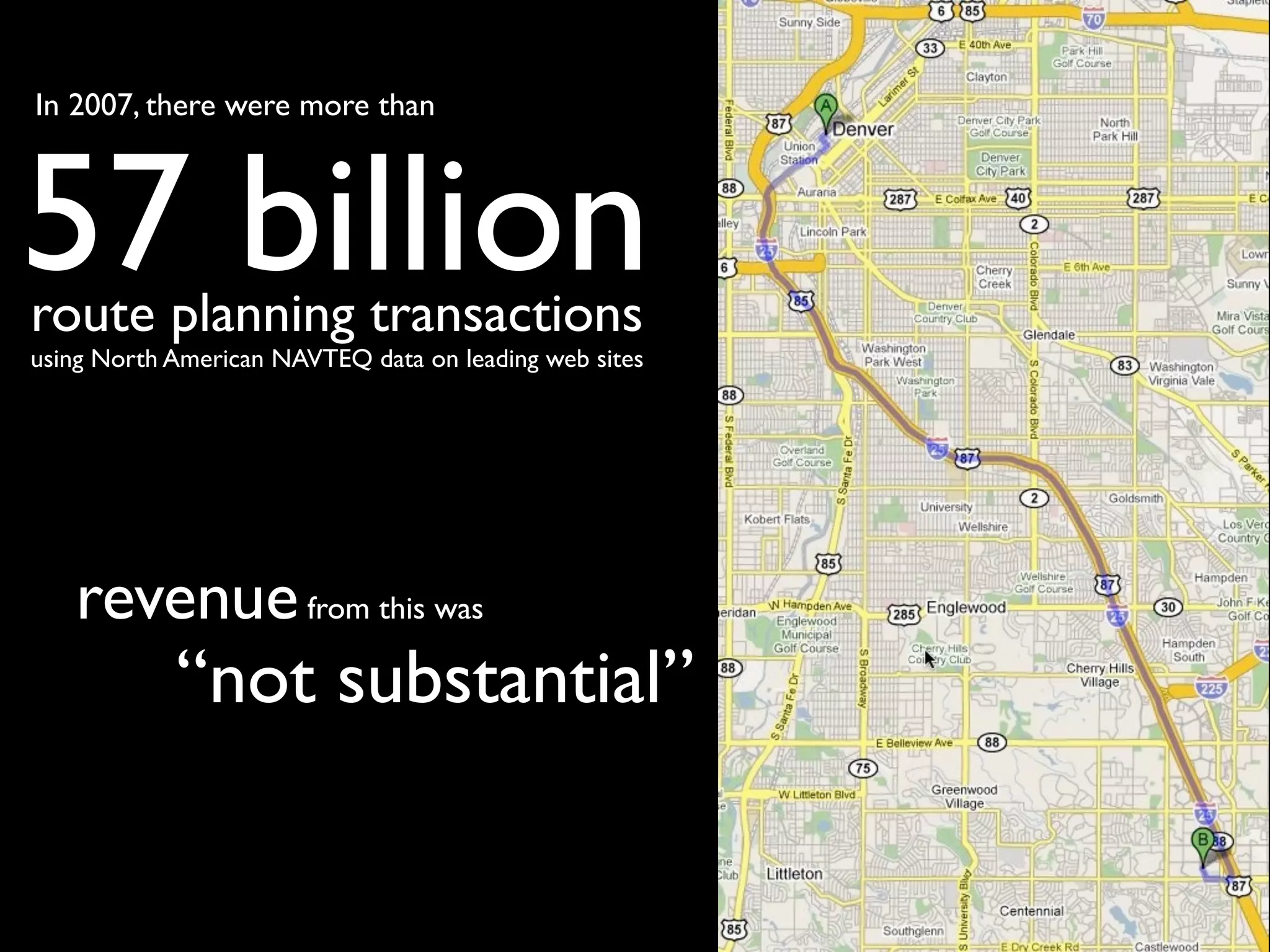

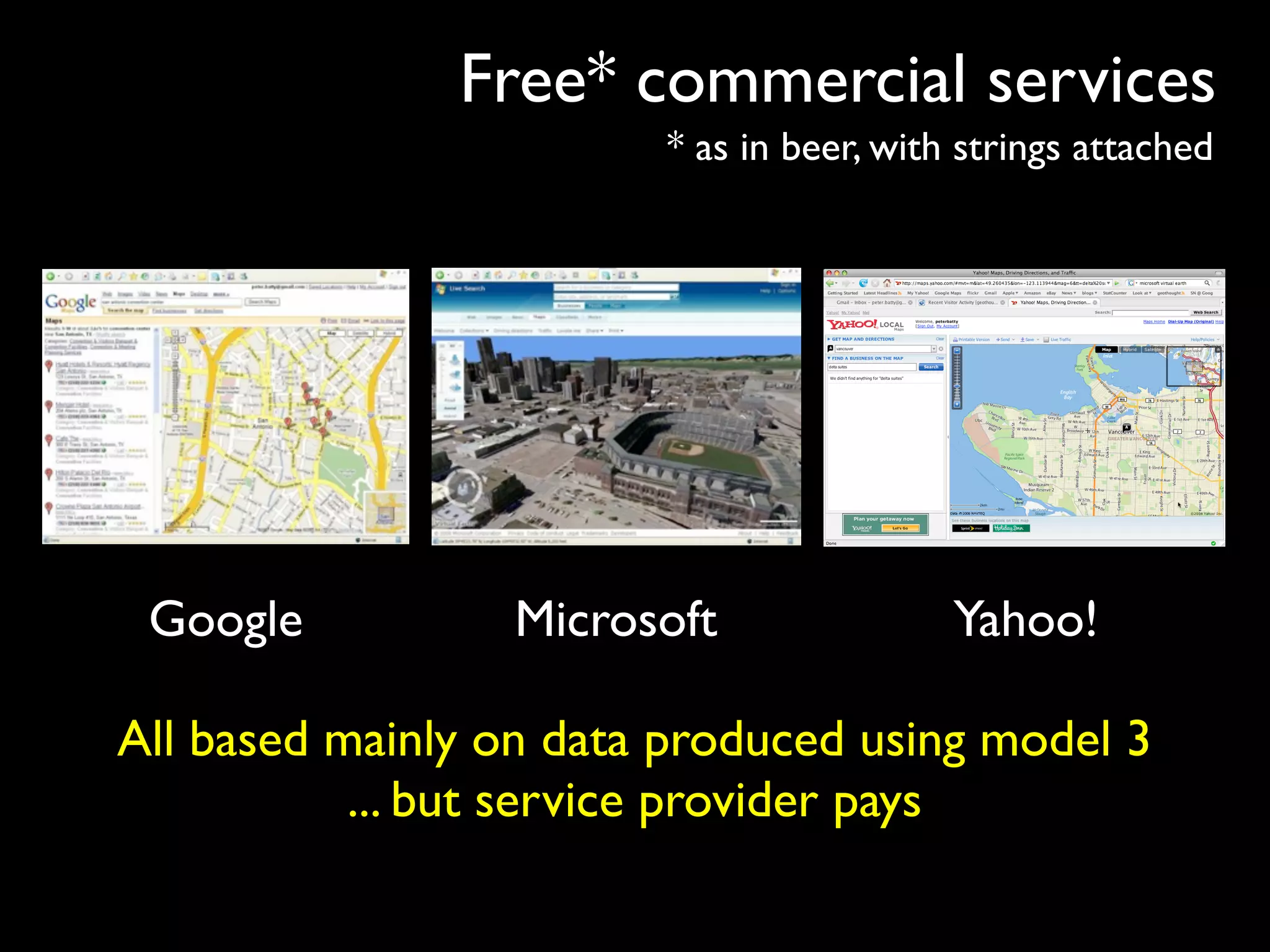

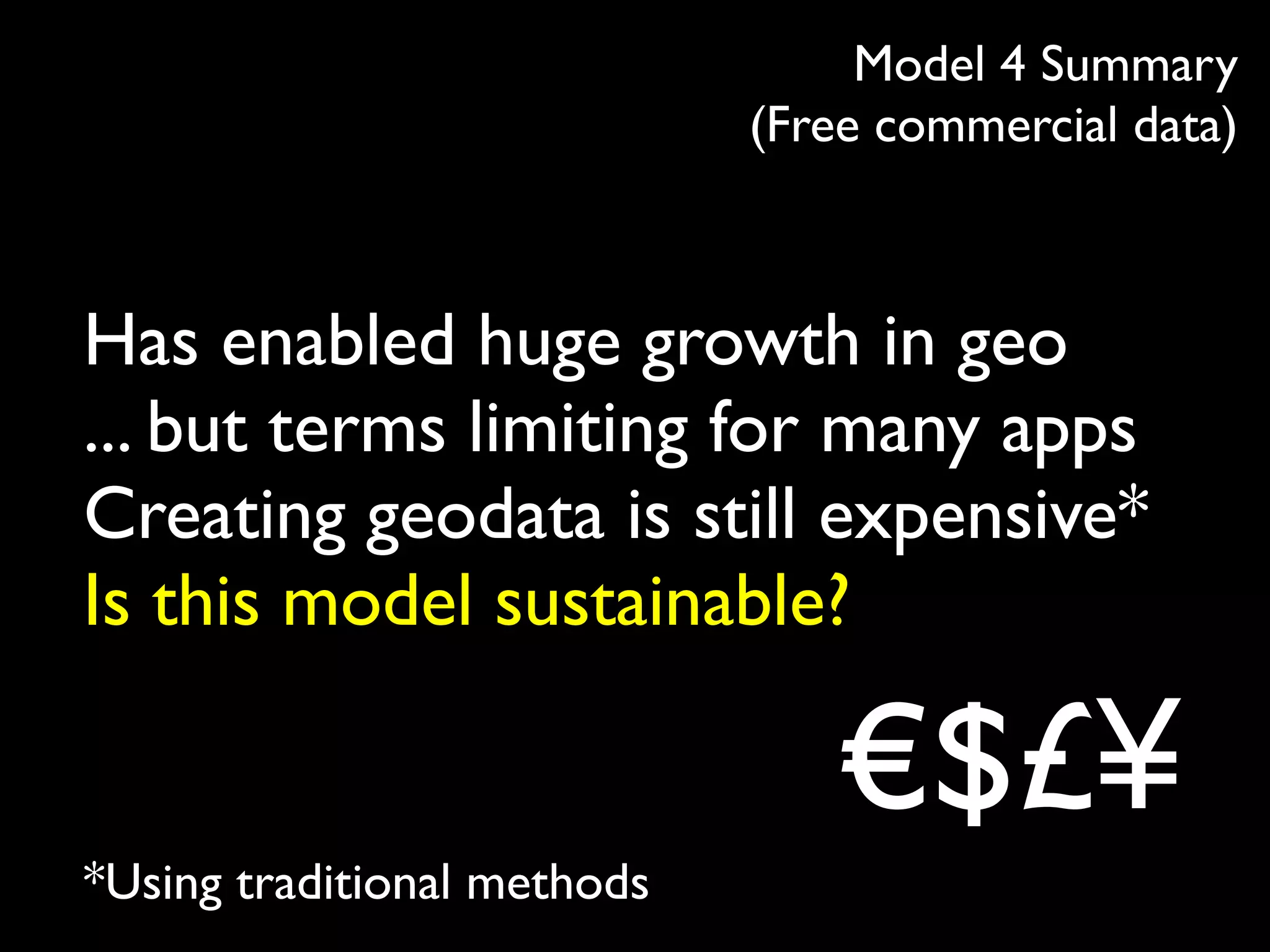

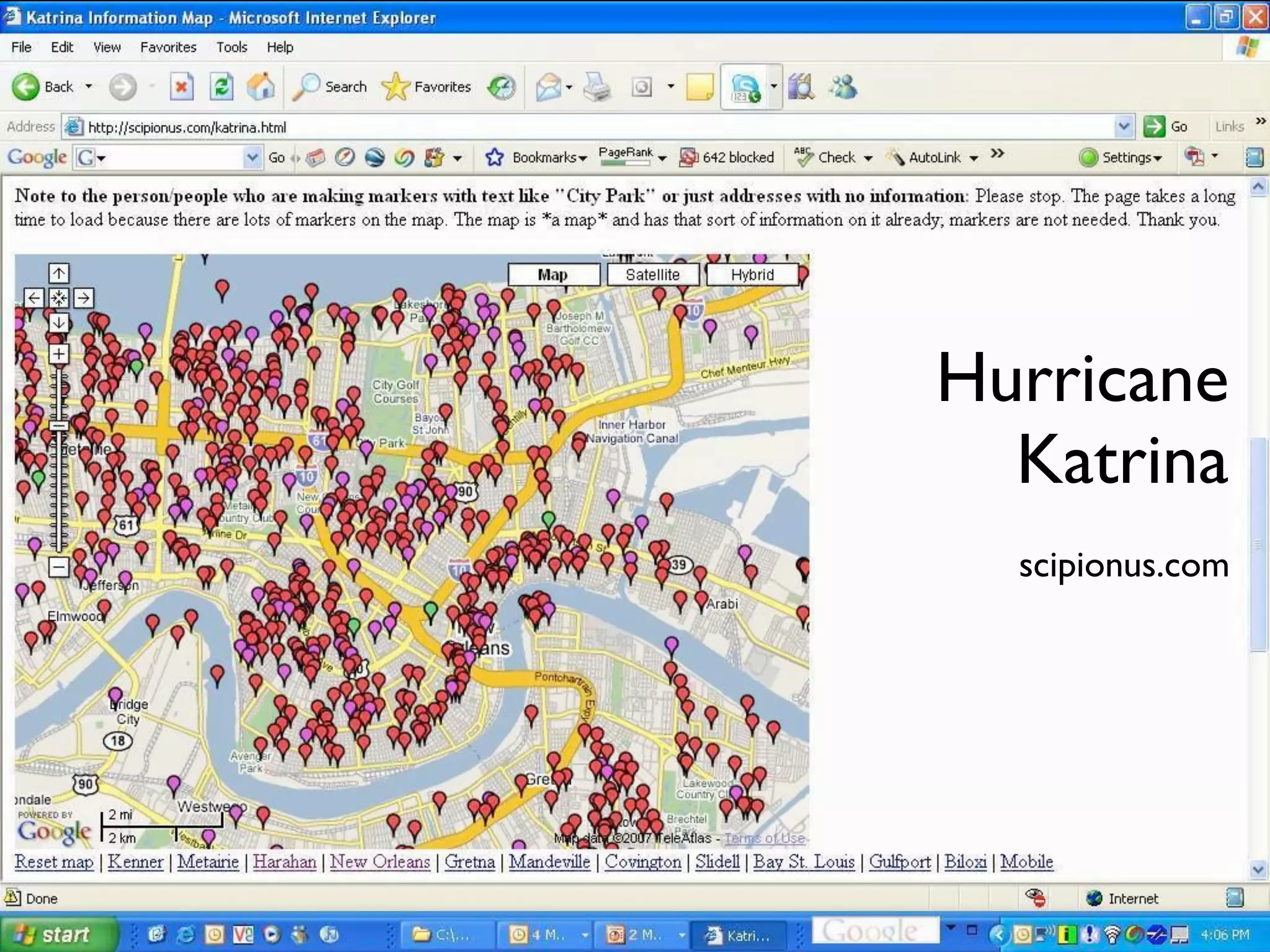

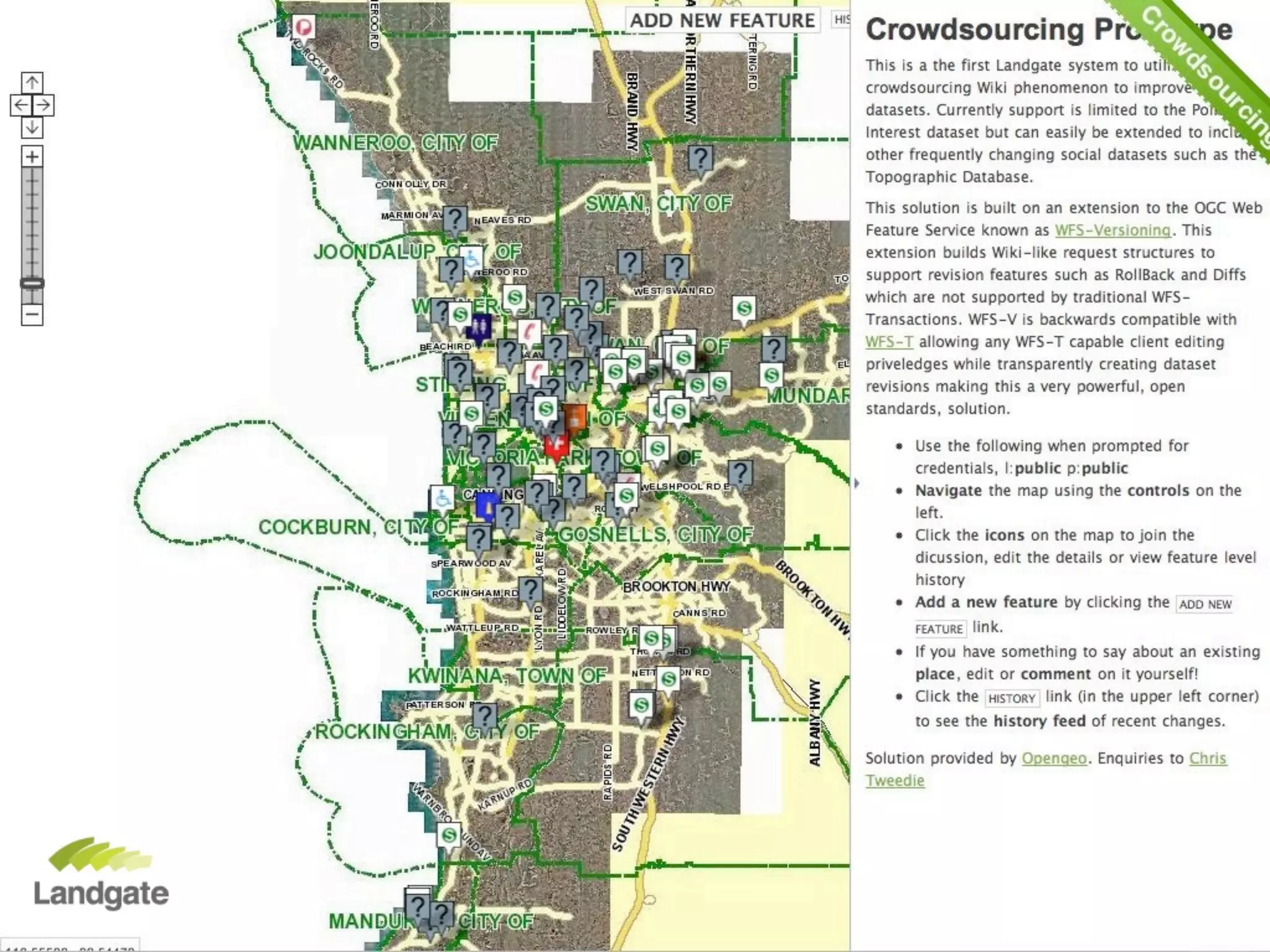

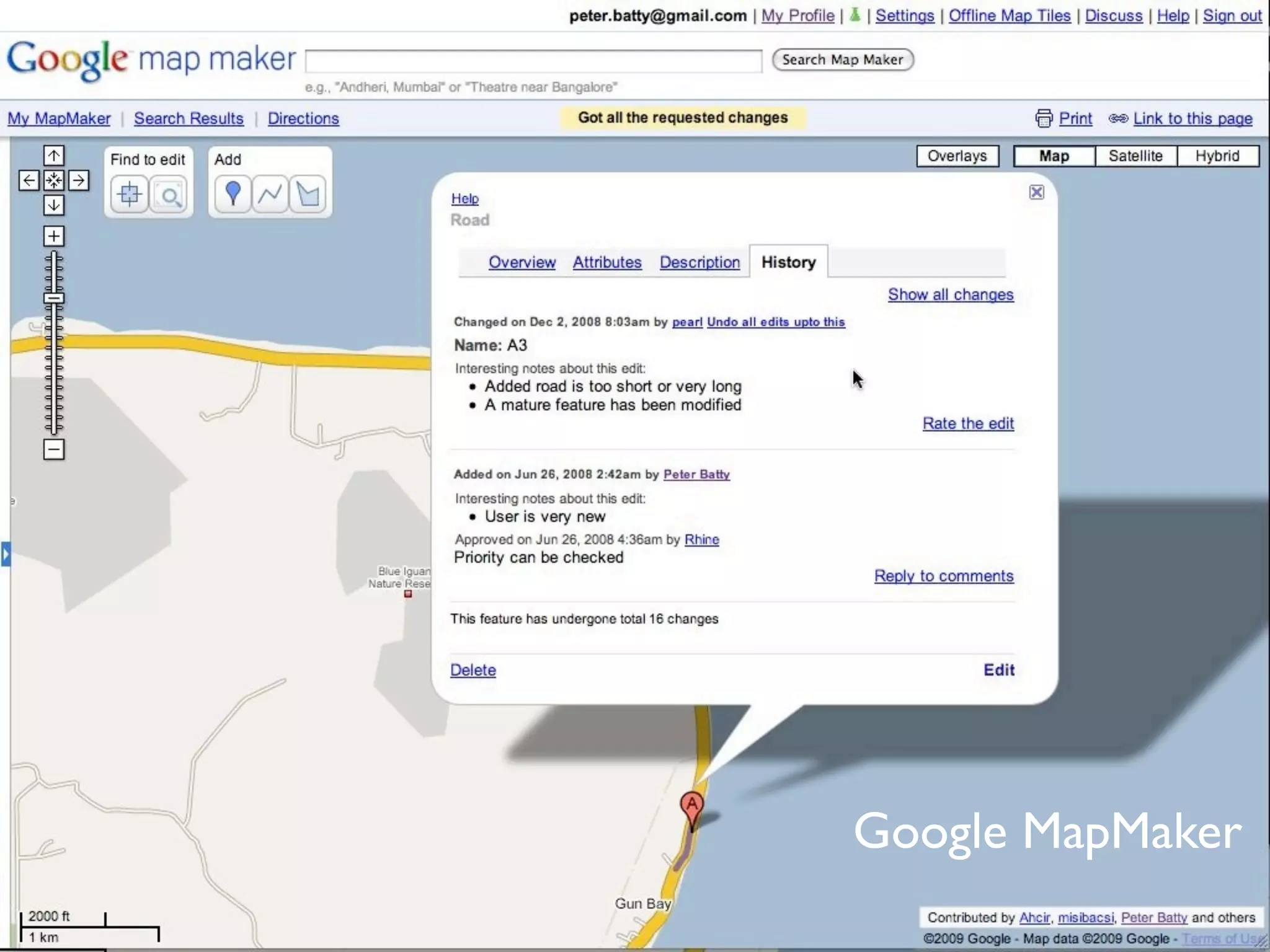

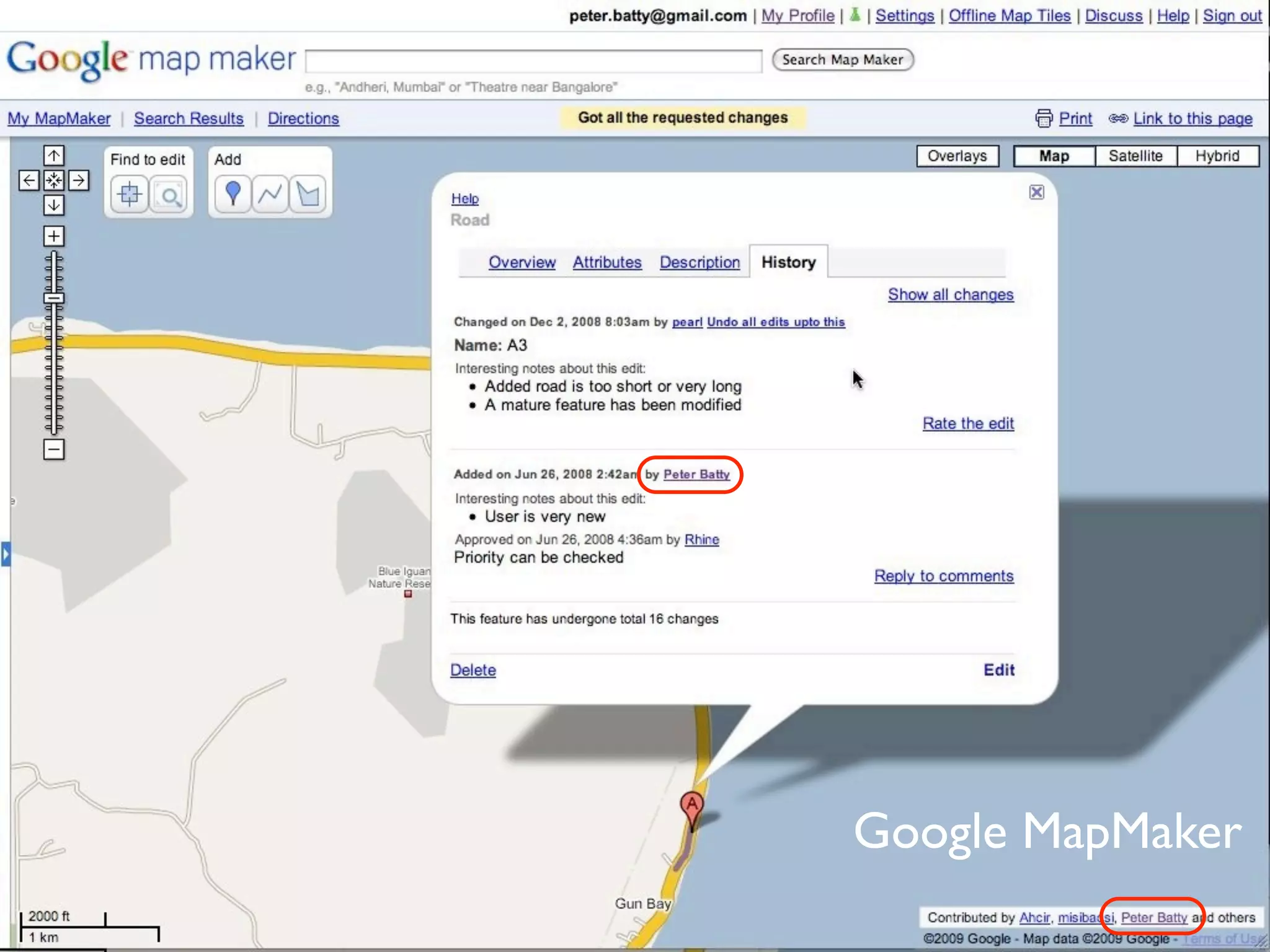

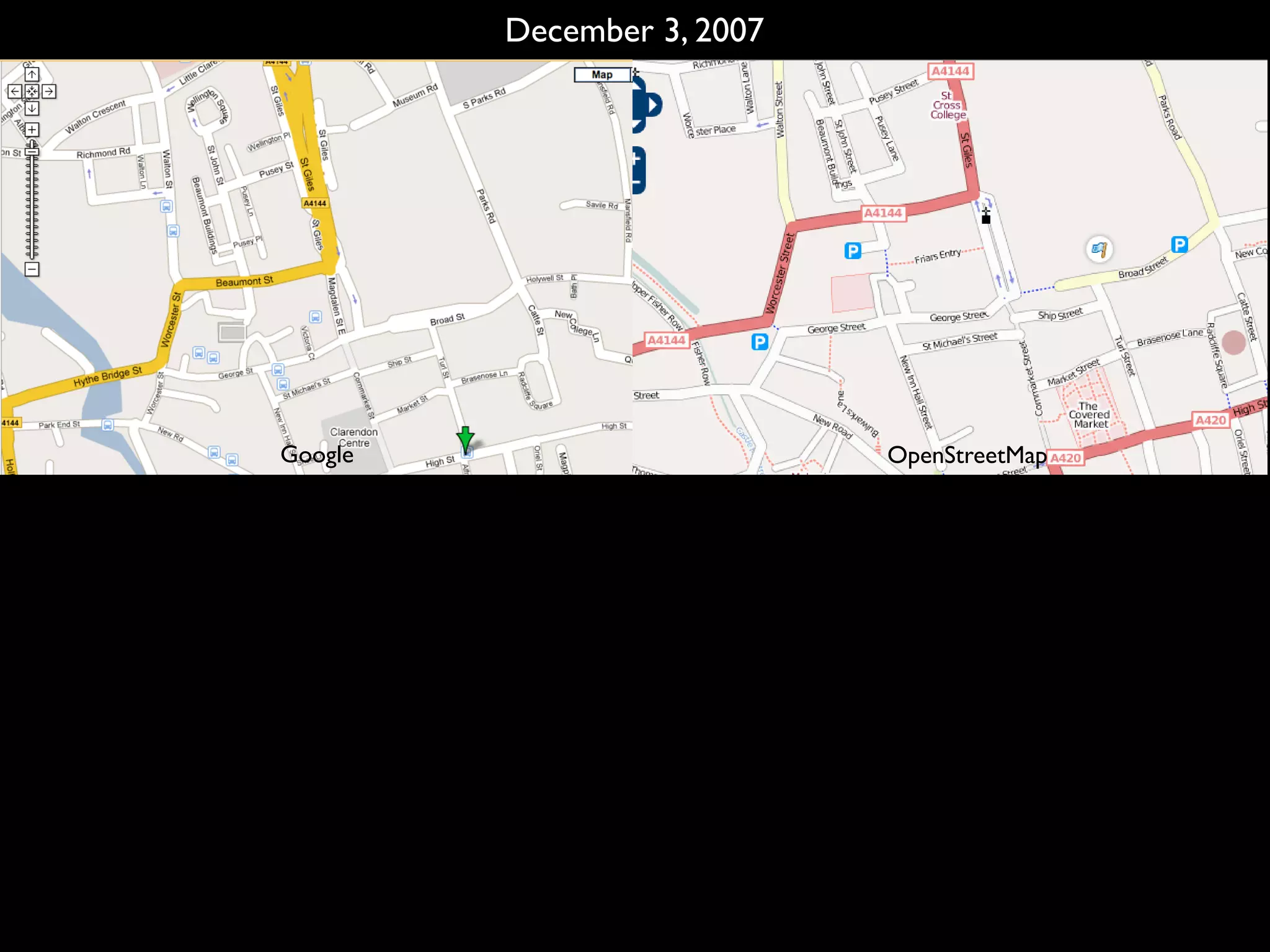

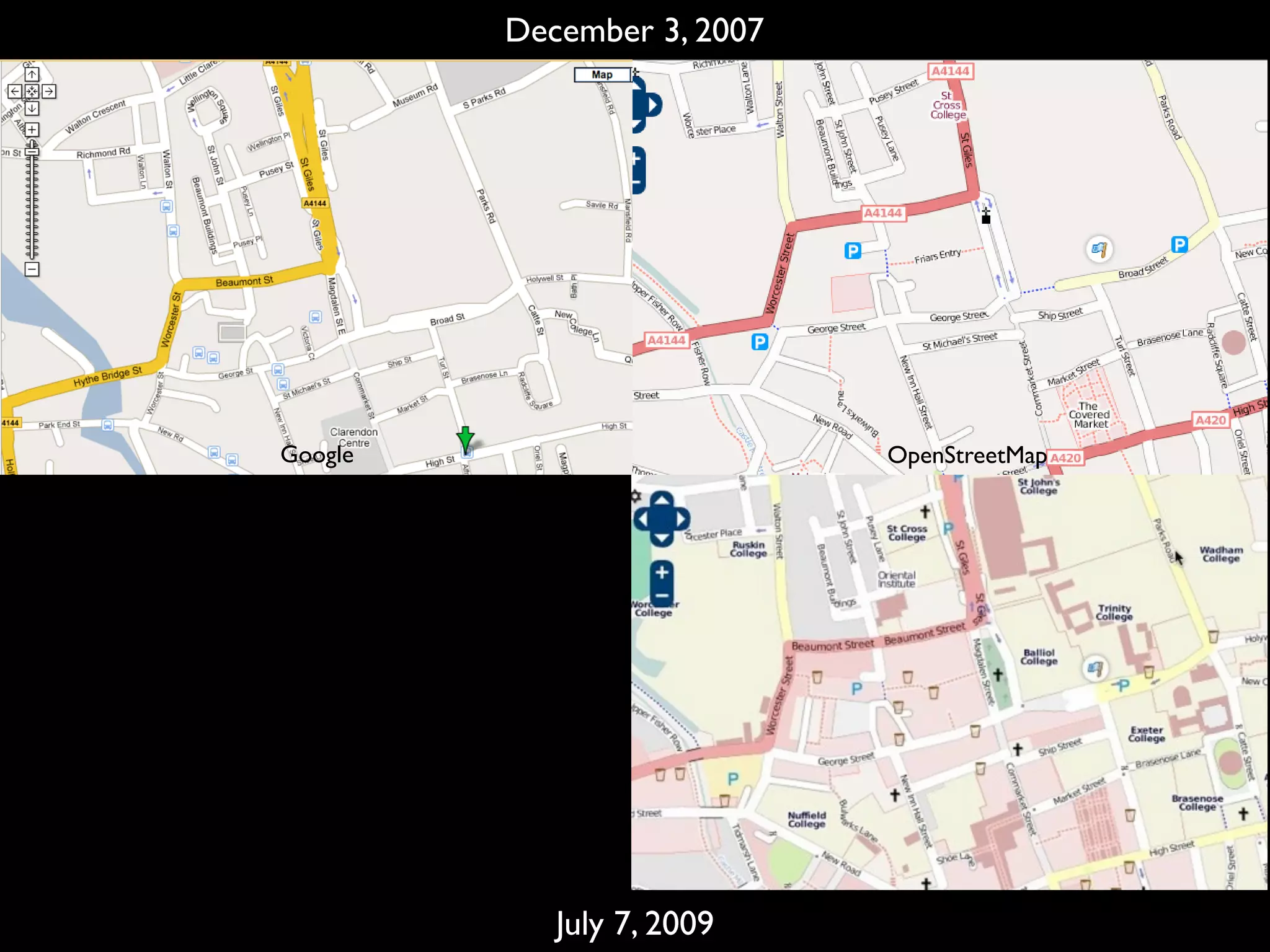

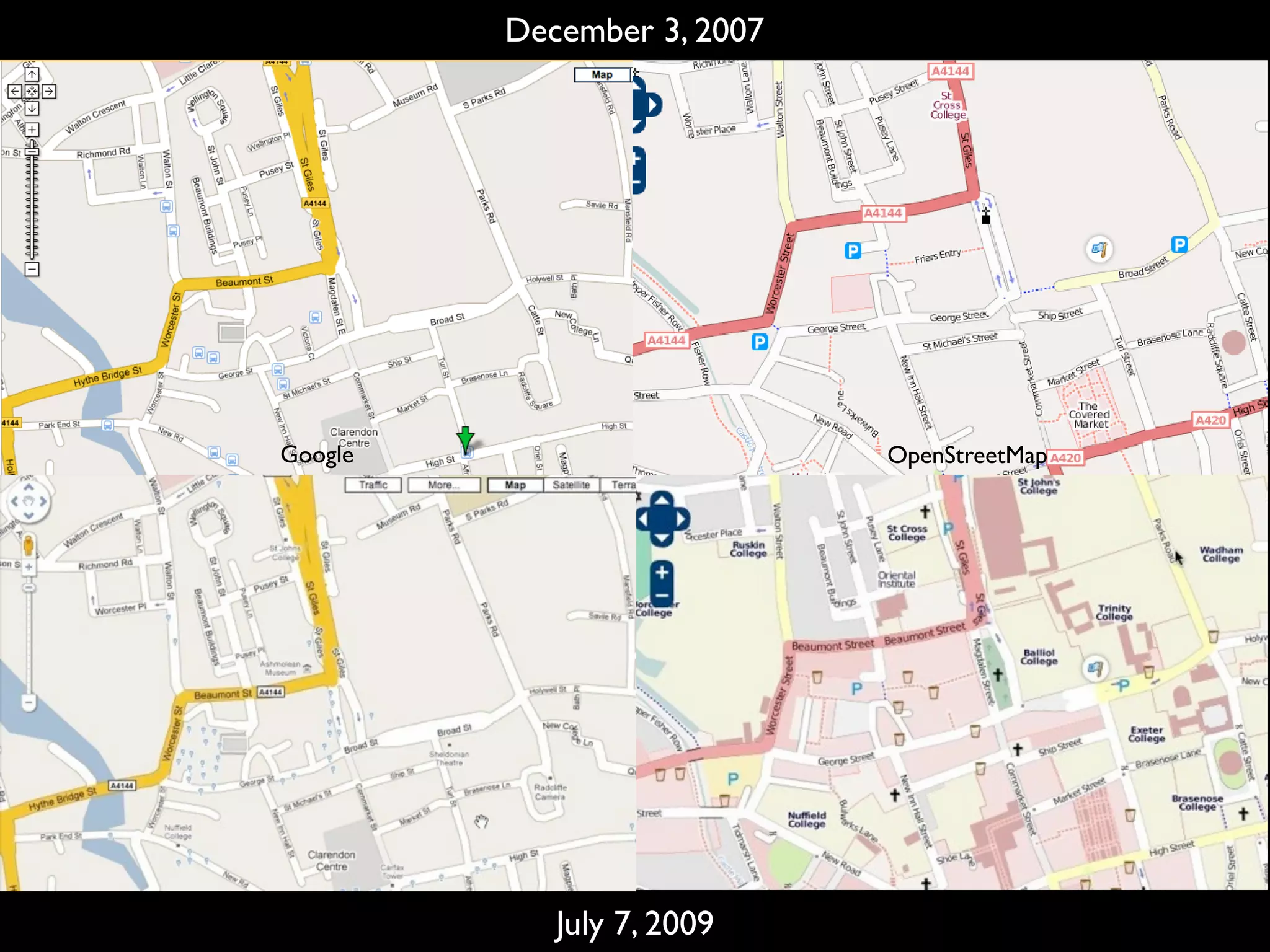

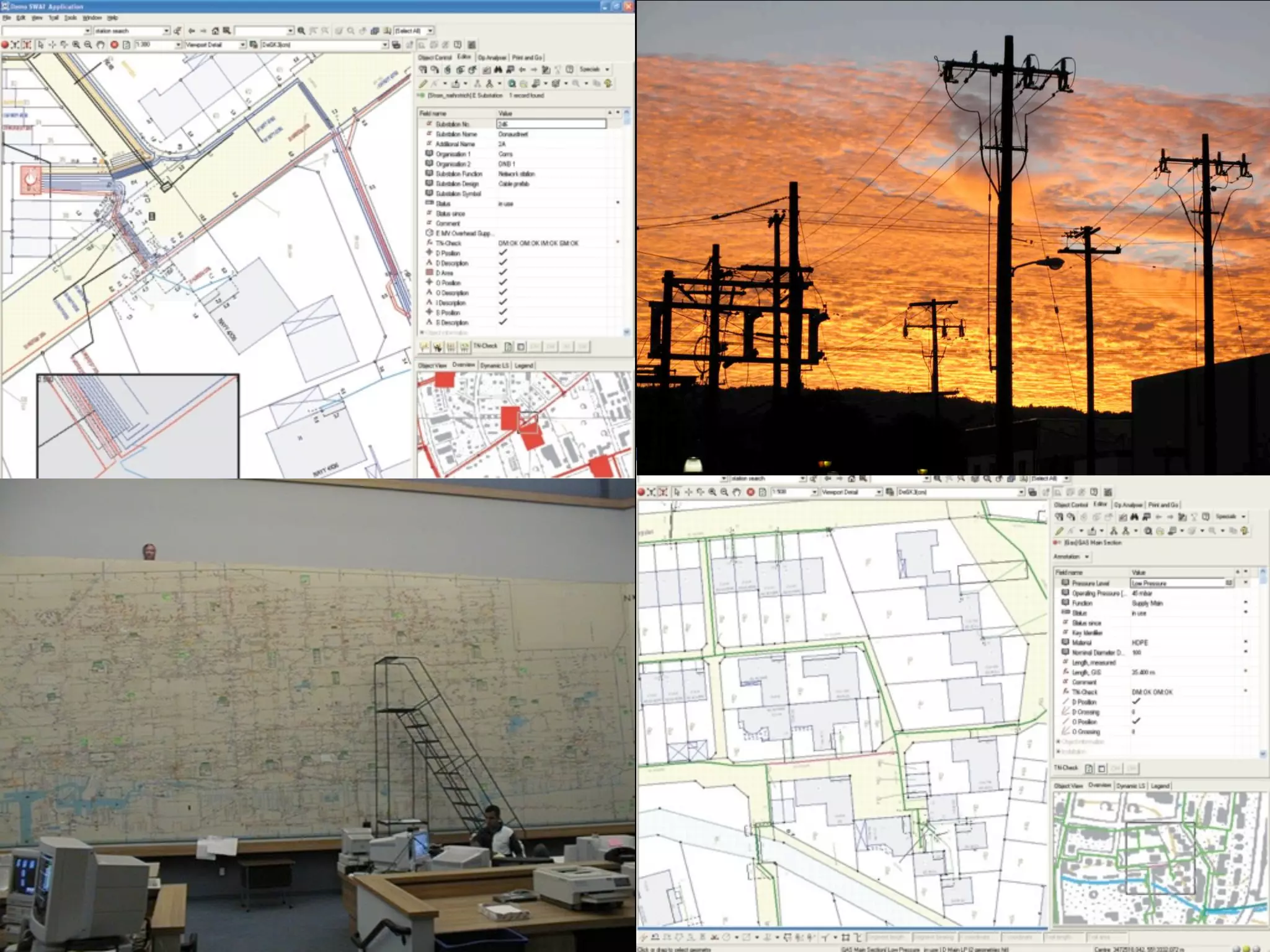

Creating geodata is very expensive using traditional methods. Crowdsourcing changes this by enabling many volunteers to contribute data at low individual cost, resulting in large datasets. However, ensuring quality is challenging. OpenStreetMap has grown rapidly since 2007 due to its open data model and large community, but managing legal issues, quality, and relationships with large commercial providers remains important.

![“Our taxes fund the collection of public data -

yet we have to pay again to access it. [Make] it

freely available to stimulate innovation”

The Guardian “Free Our Data” web site](https://image.slidesharecdn.com/sotmpeterbattyreduced-090712004955-phpapp02/75/Geodata-creation-past-present-and-future-15-2048.jpg)