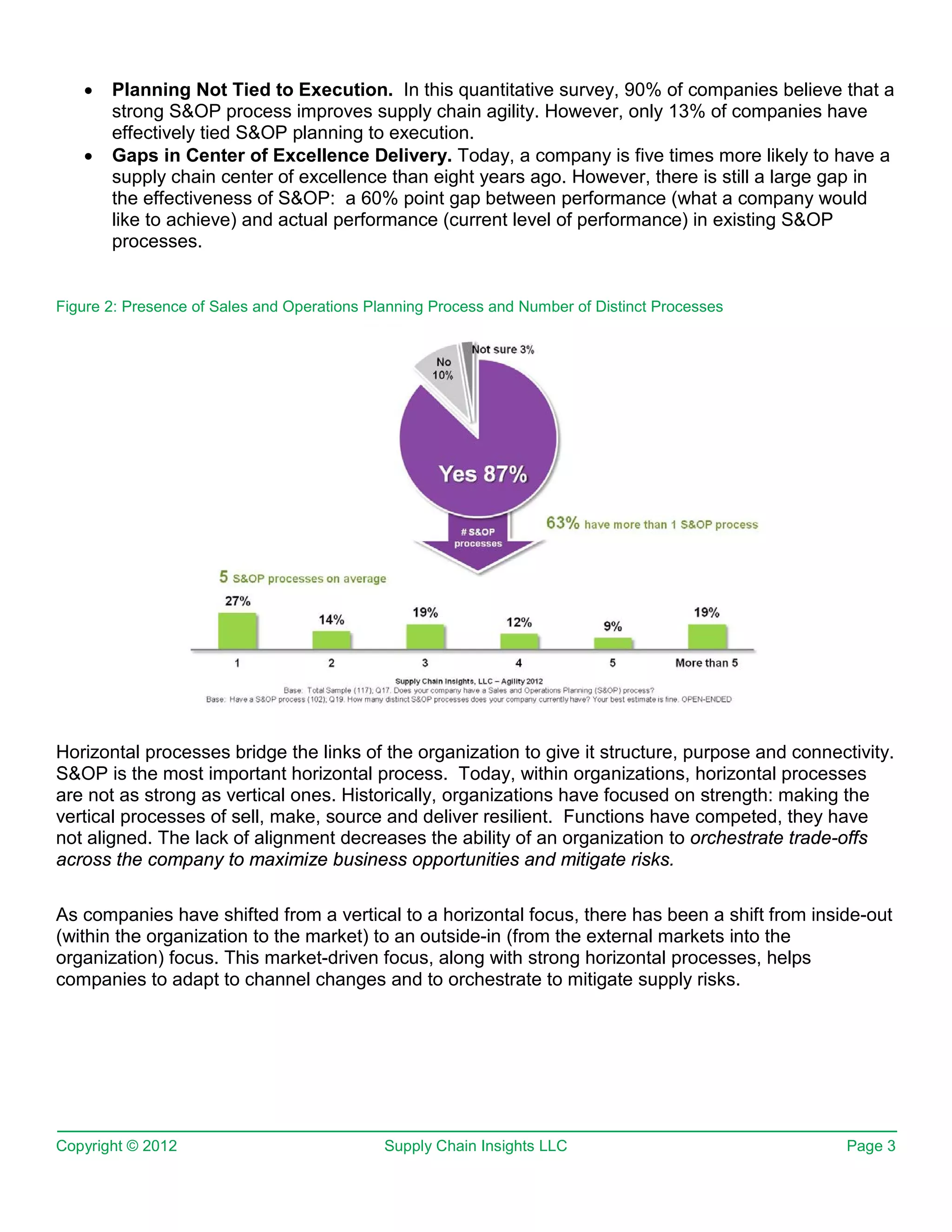

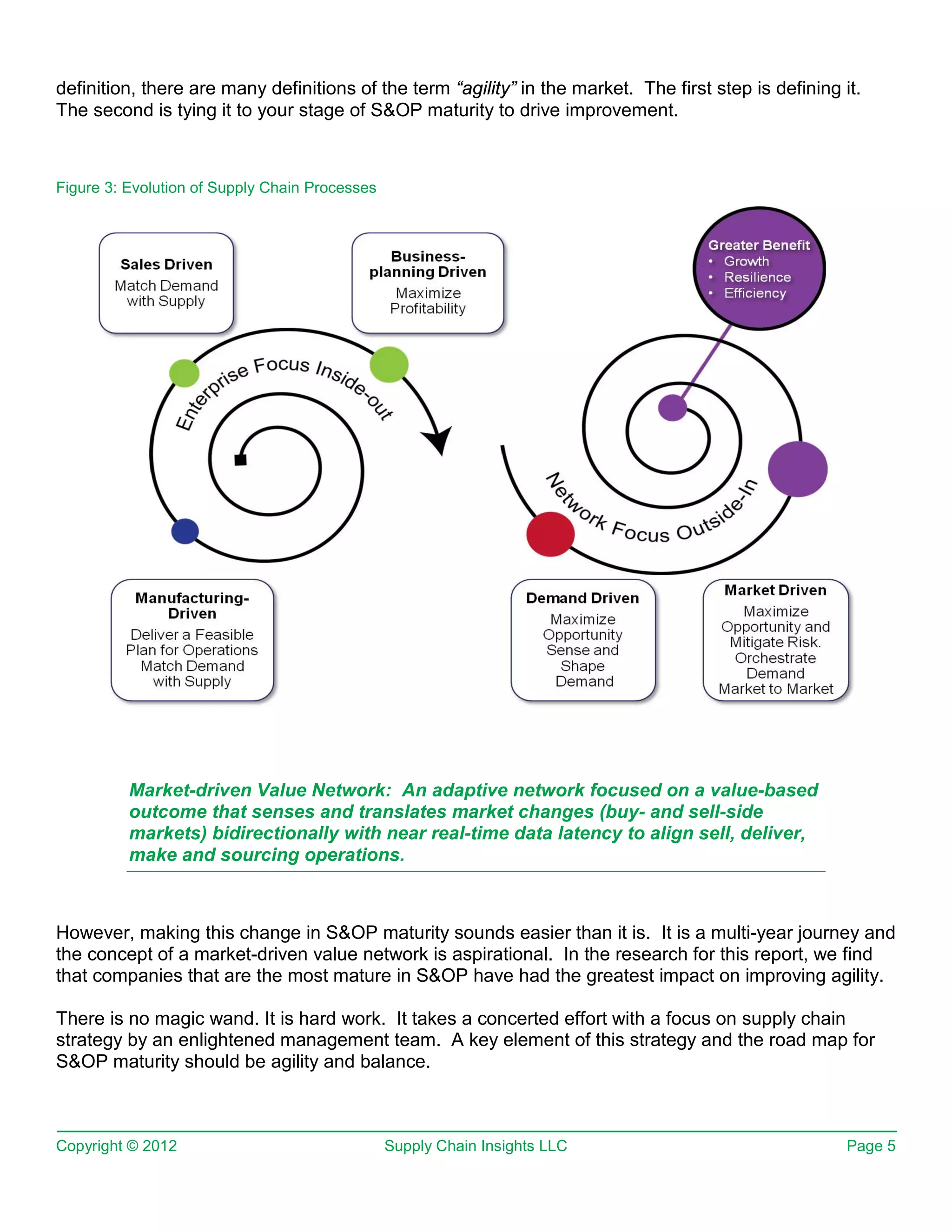

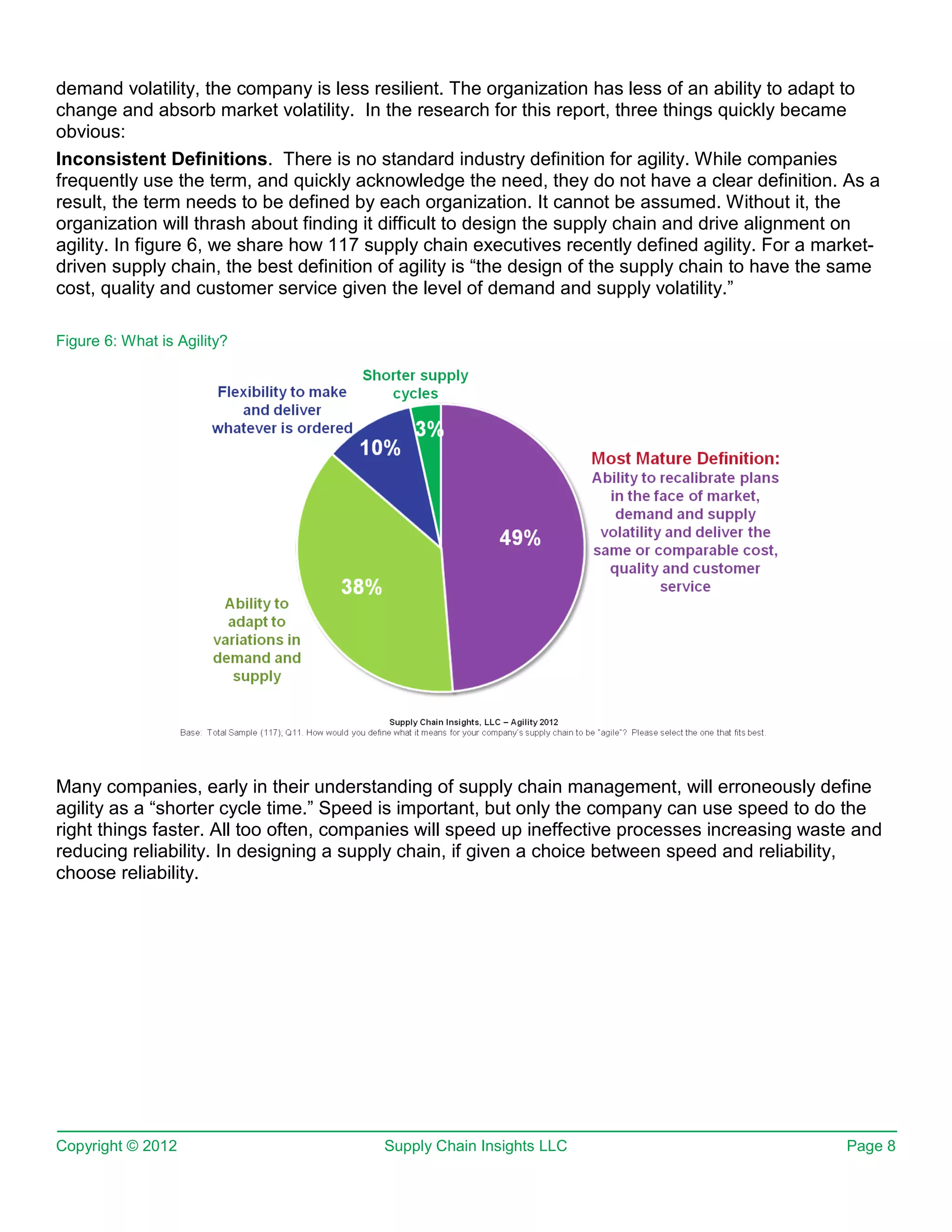

The document discusses how the Sales and Operations Planning (S&OP) process significantly enhances supply chain agility, with 90% of companies recognizing its benefits. It emphasizes the increasing complexity and challenges faced by supply chains today, driven by global expansion and volatility, and highlights that although many see S&OP as crucial, only a small percentage effectively tie planning to execution. A solid S&OP framework contributes to balancing operational efficiency and adaptability in responding to market fluctuations, which is essential for modern supply chain management.