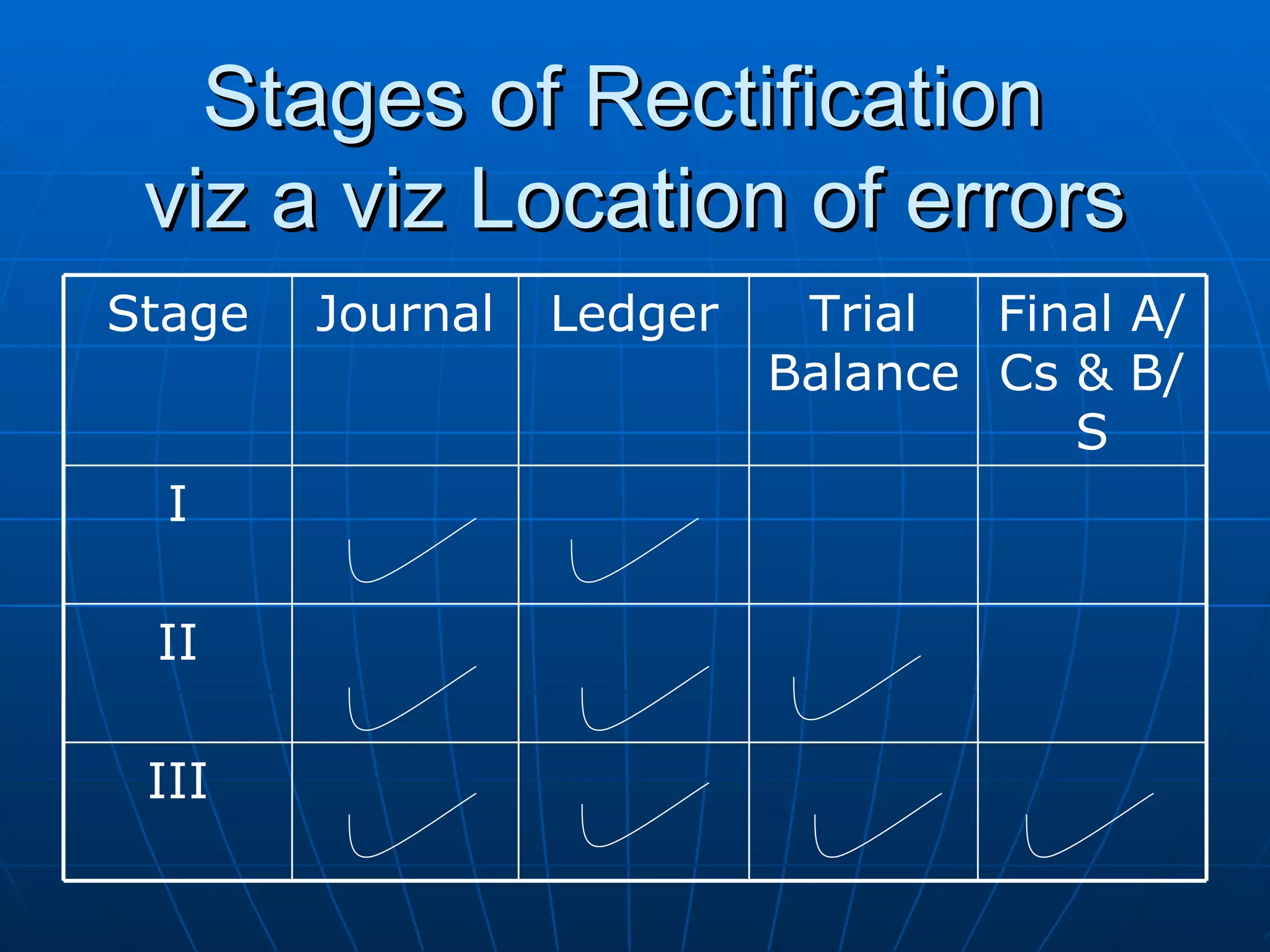

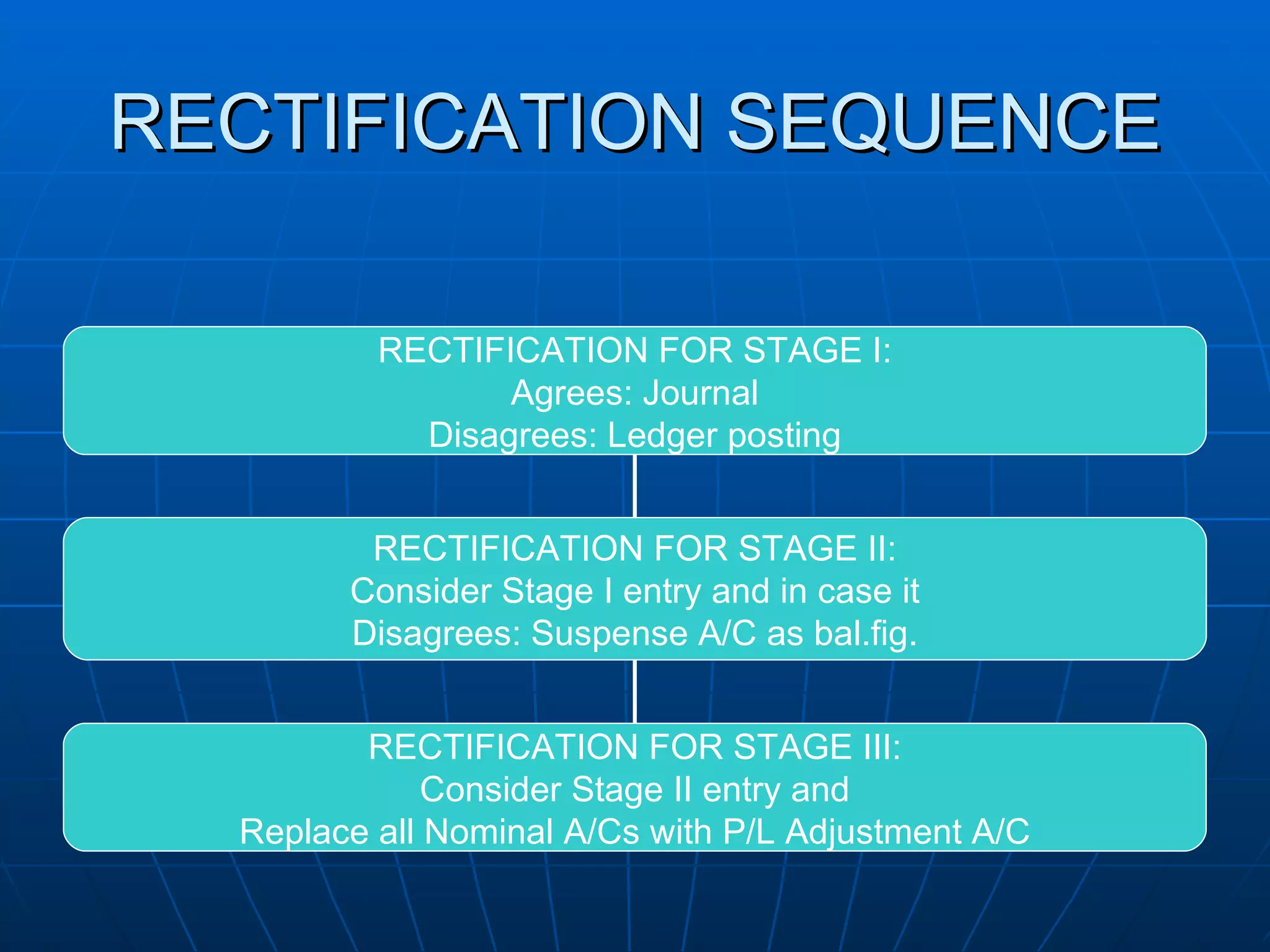

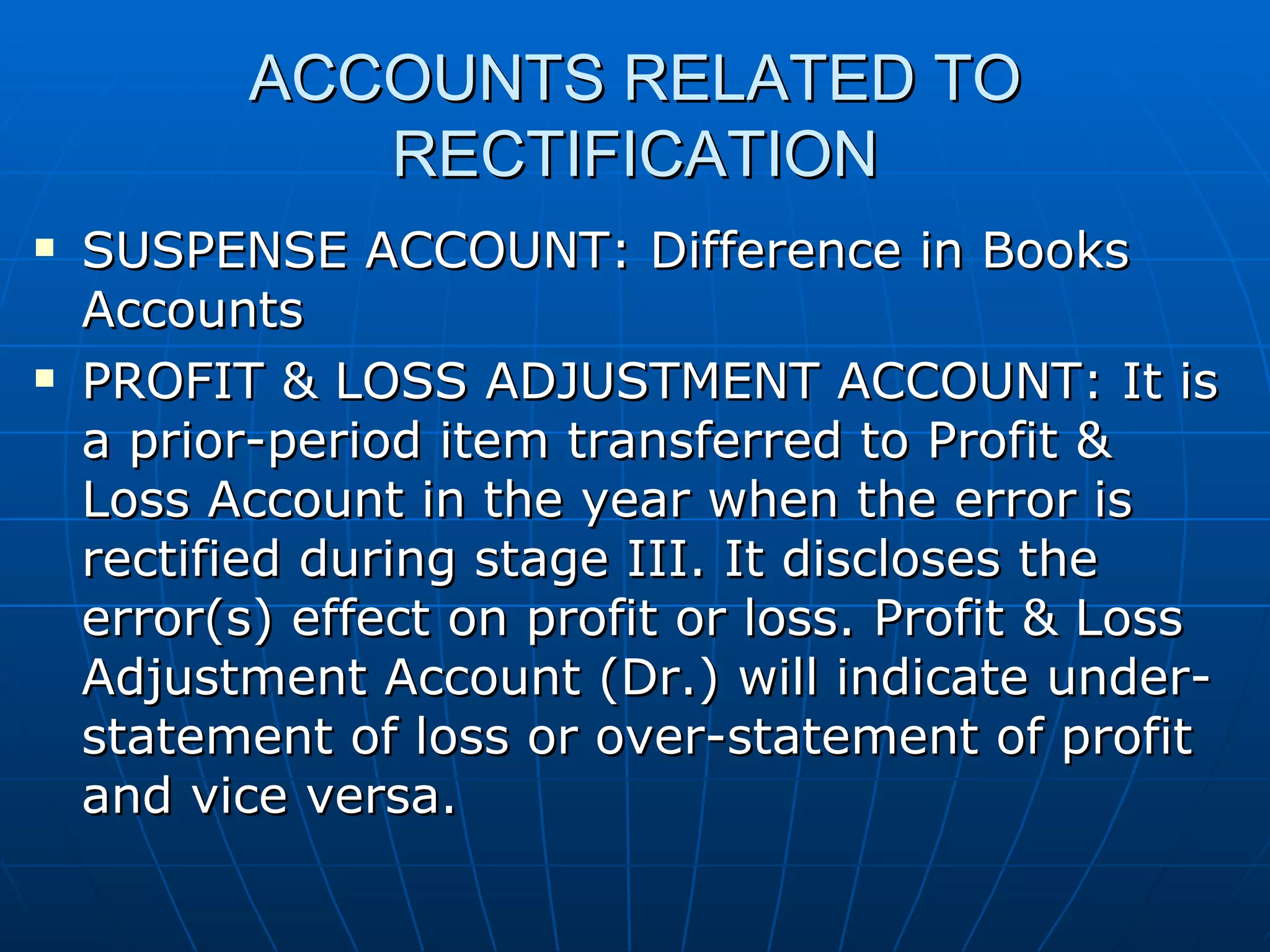

The document discusses error management and rectification in accounting. It outlines three steps to error management: prevention, detection, and rectification of errors. It describes different types of errors and methods for detecting errors, including trial balances. The key aspects of rectification are identifying the wrong and correct entries, reversing the wrong entry, and determining the rectification entry. The stages of rectification depend on whether errors are identified before or after accounts are finalized.