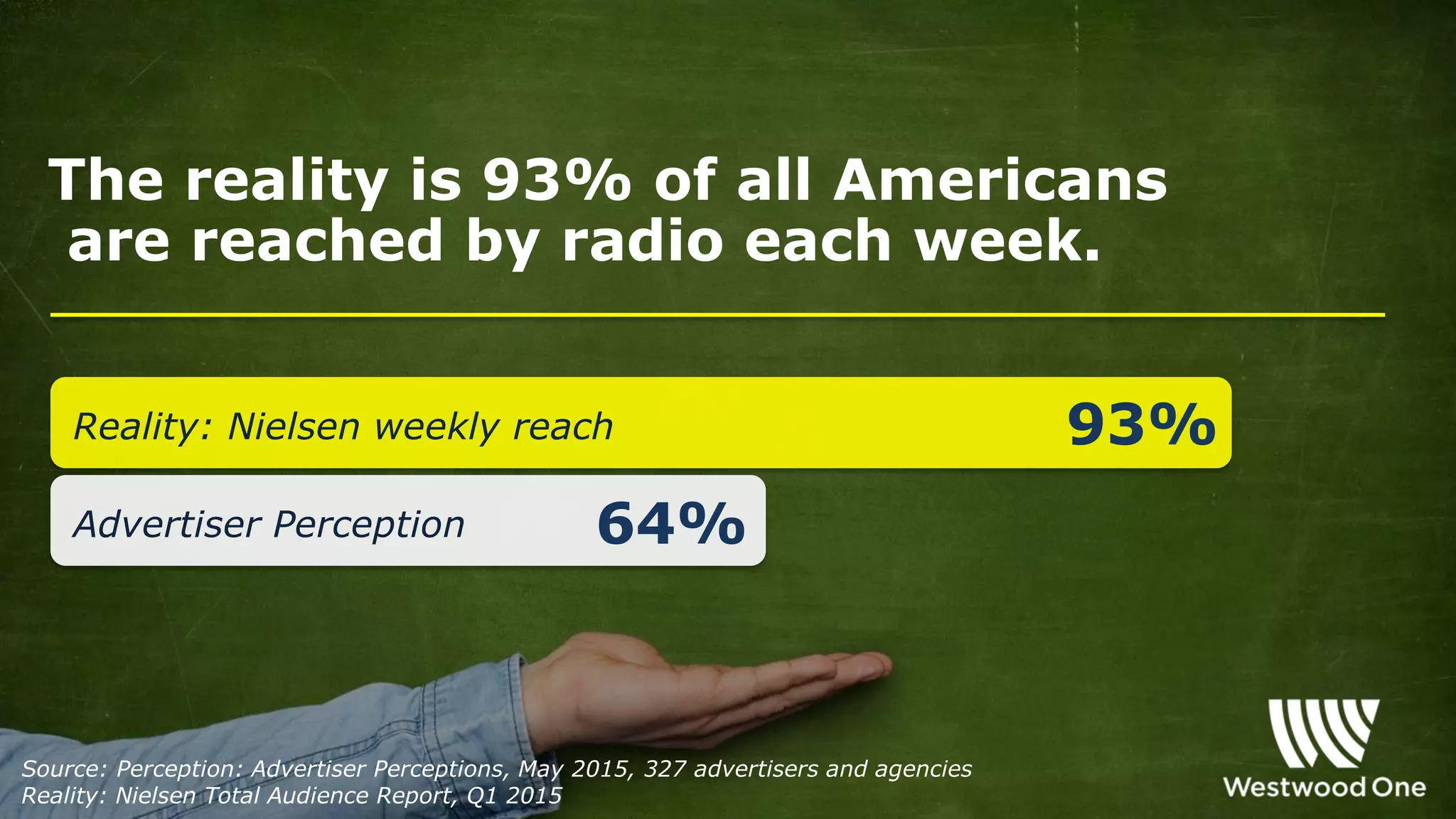

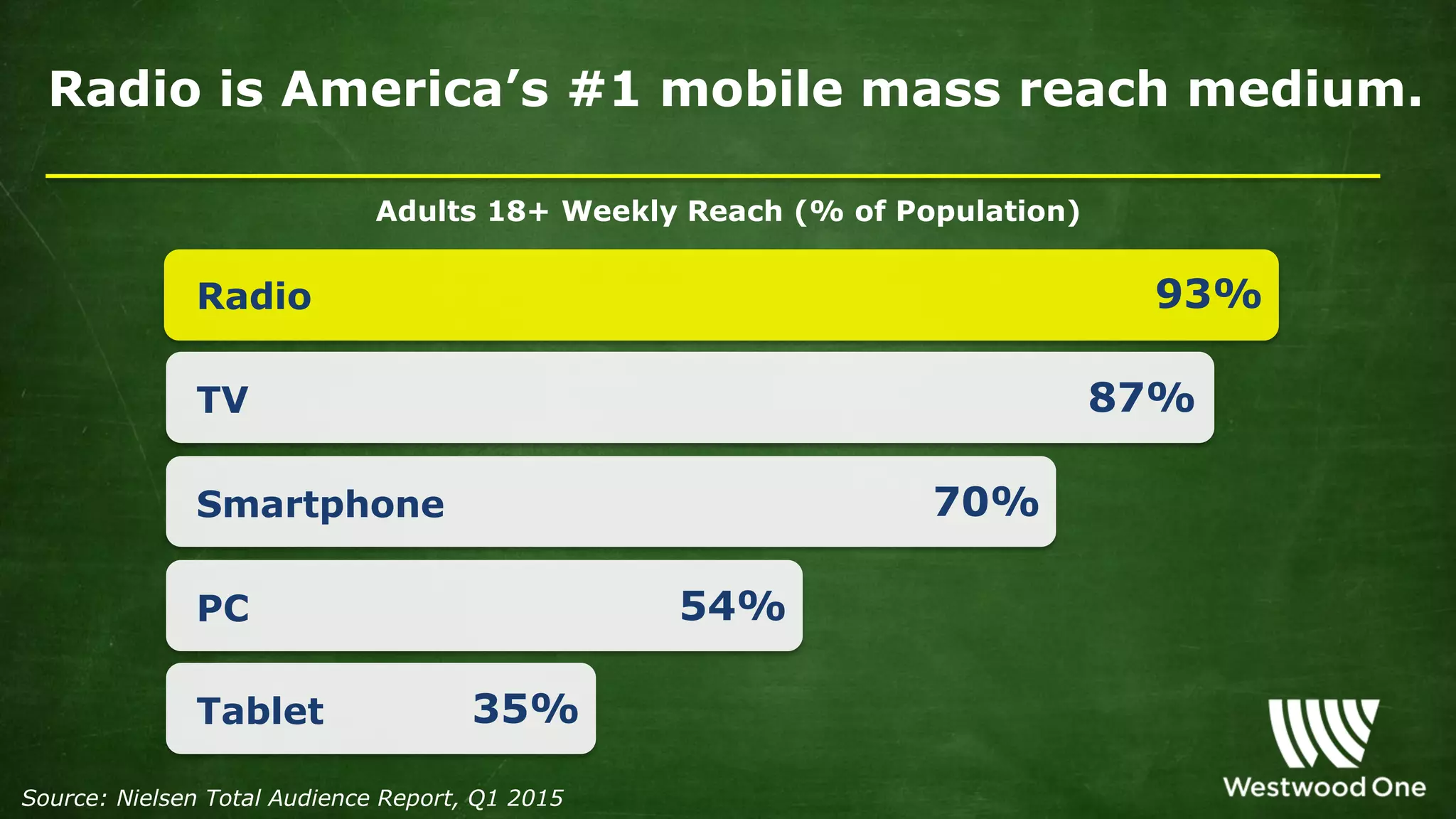

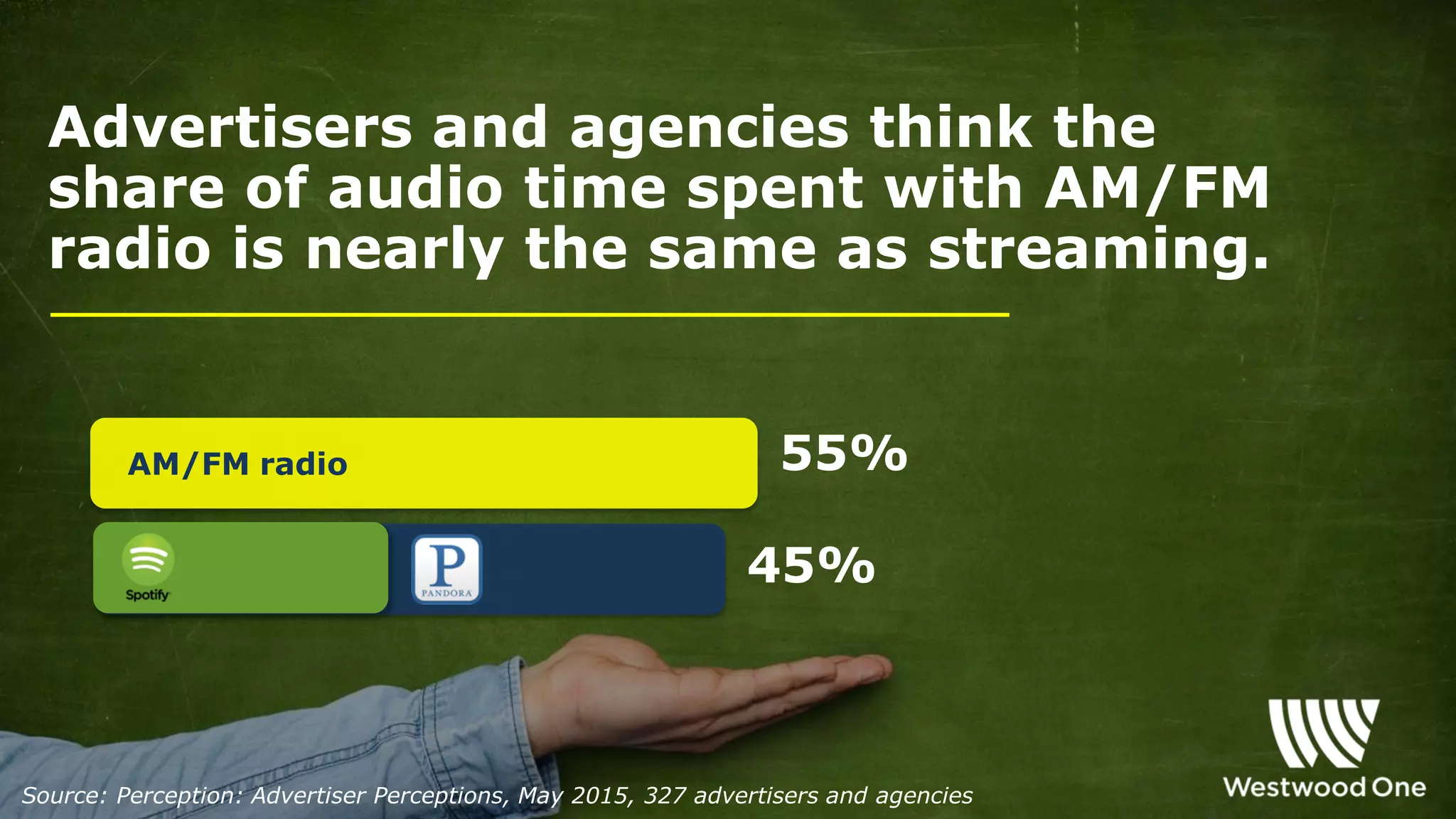

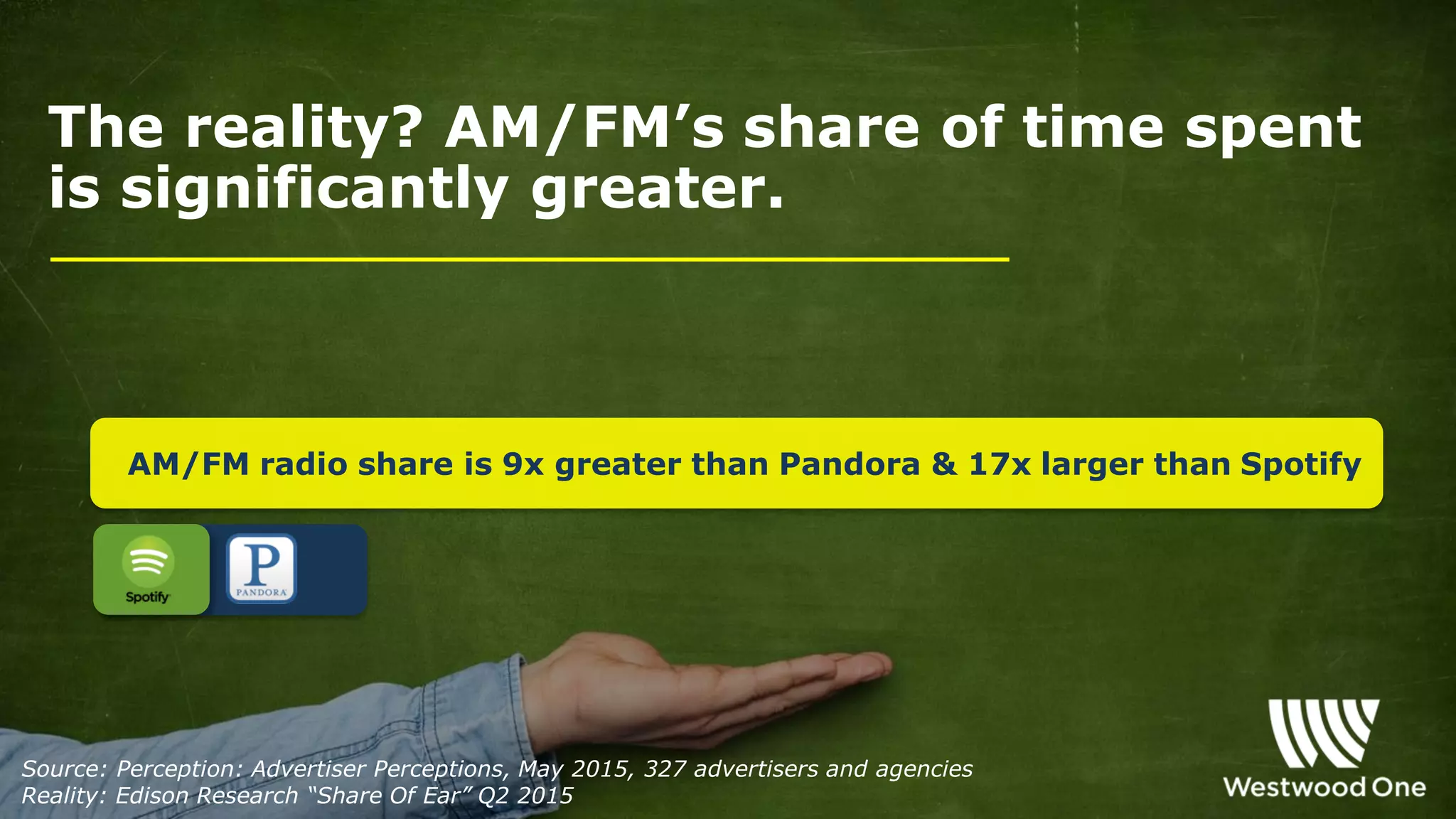

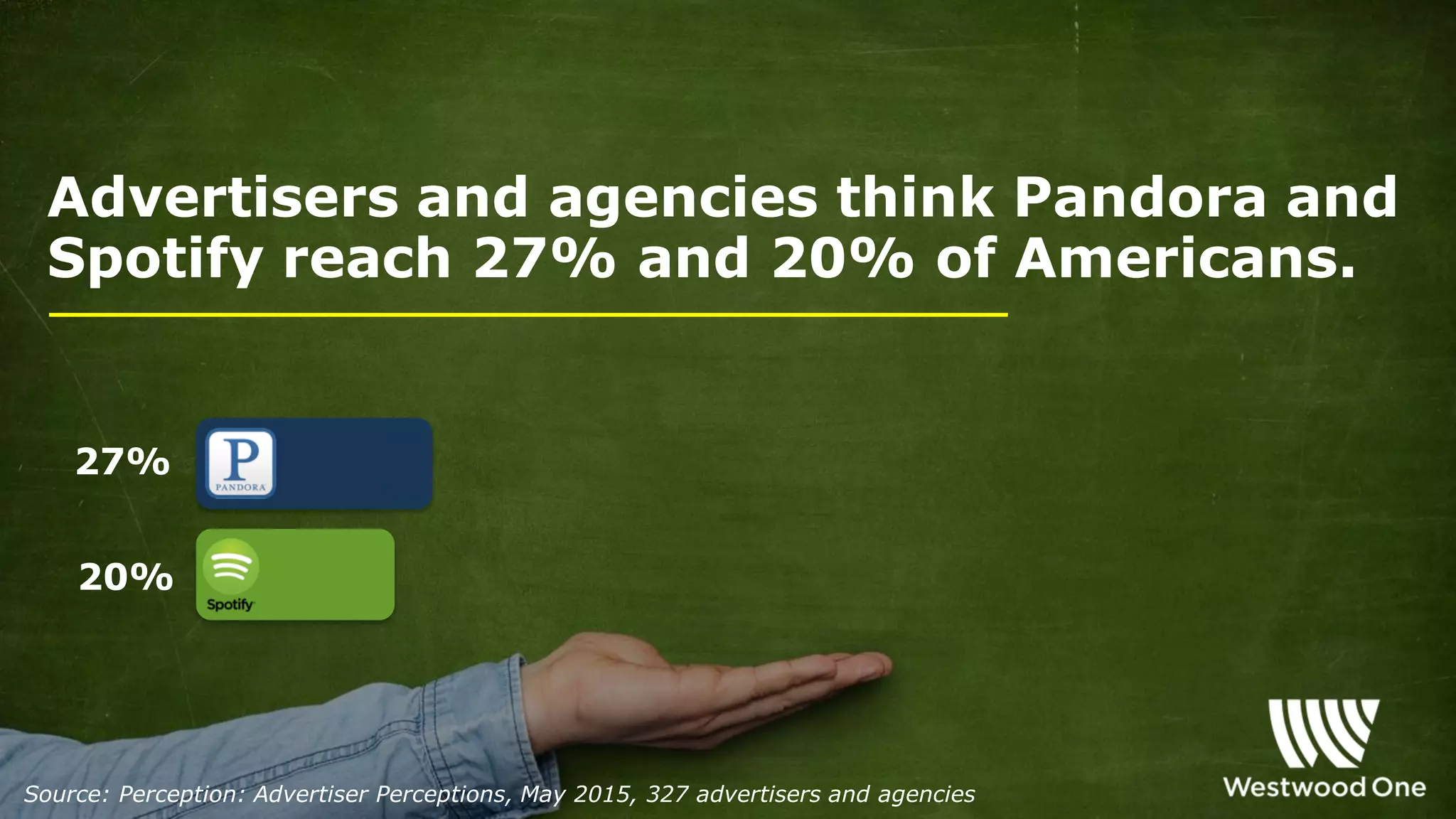

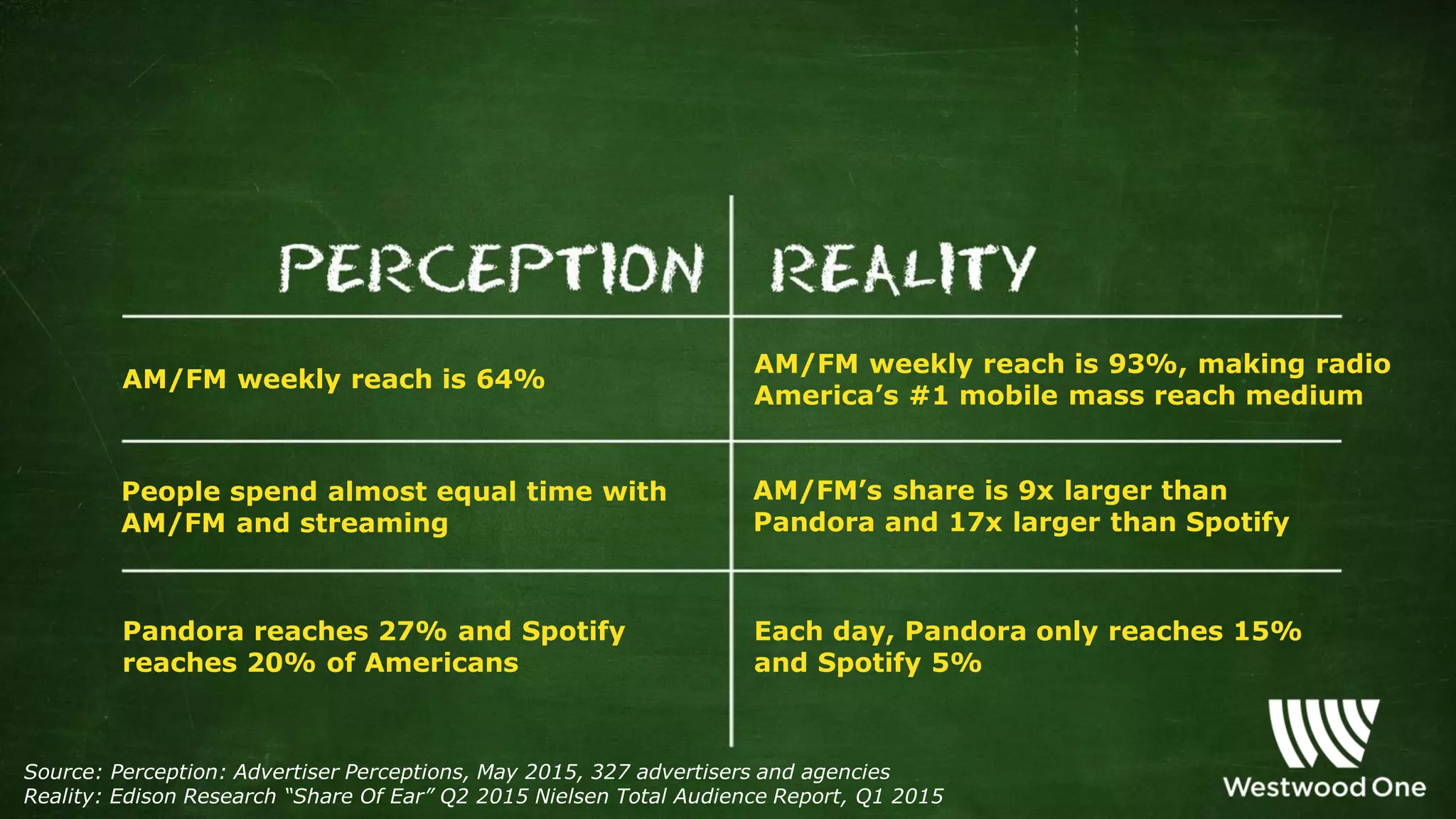

The radio industry commissioned a study to understand the relationship between perceived and actual audience size and usage of AM/FM radio and streaming services. The study found that advertisers and agencies significantly underestimate the reach and time spent with AM/FM radio. In reality, AM/FM radio reaches 93% of Americans weekly, dominates streaming services in time spent, and far surpasses the reach of Pandora and Spotify which only reach 15% and 5% of Americans daily. The radio industry needs to better promote its value as a mass reach medium.