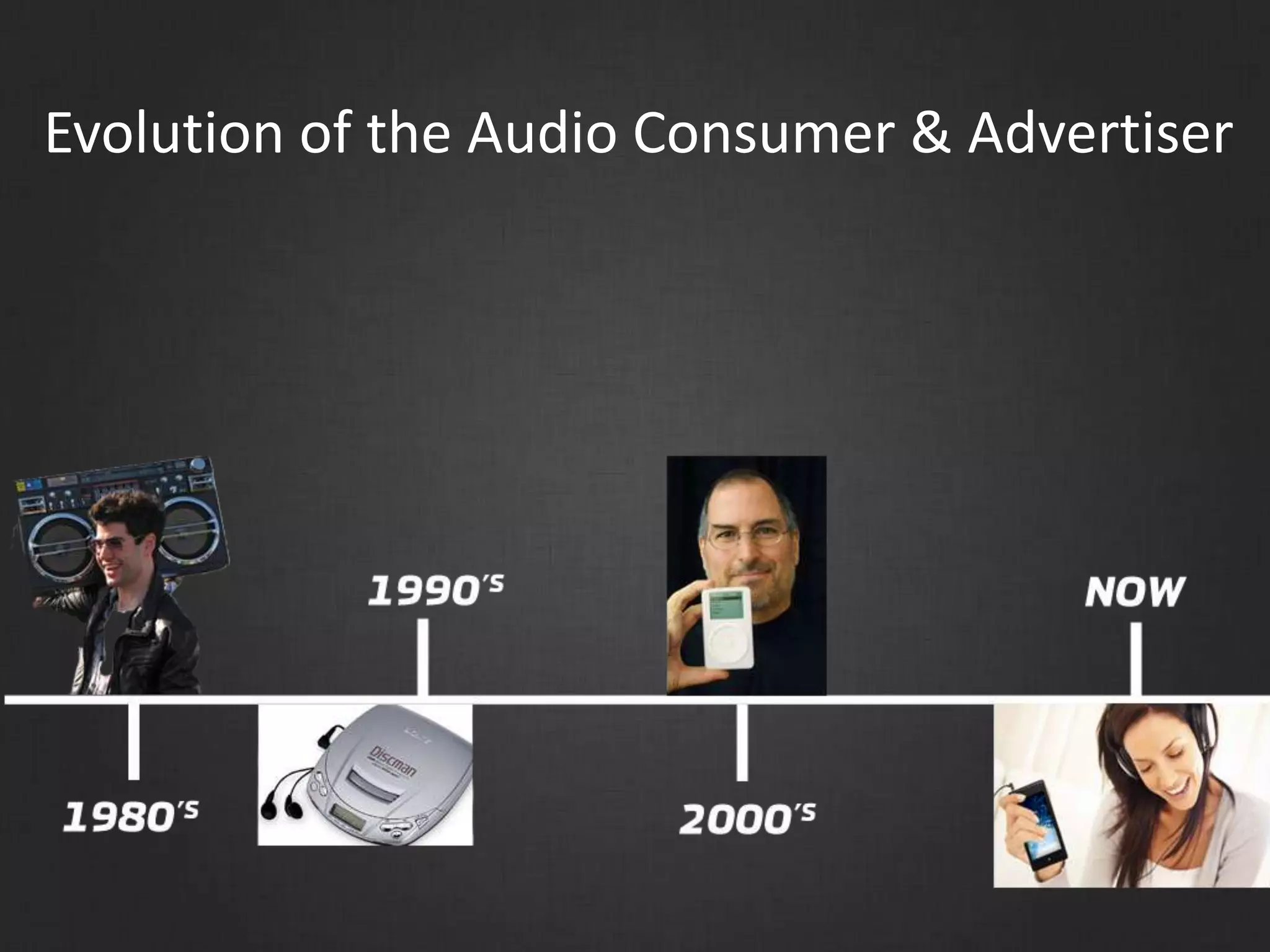

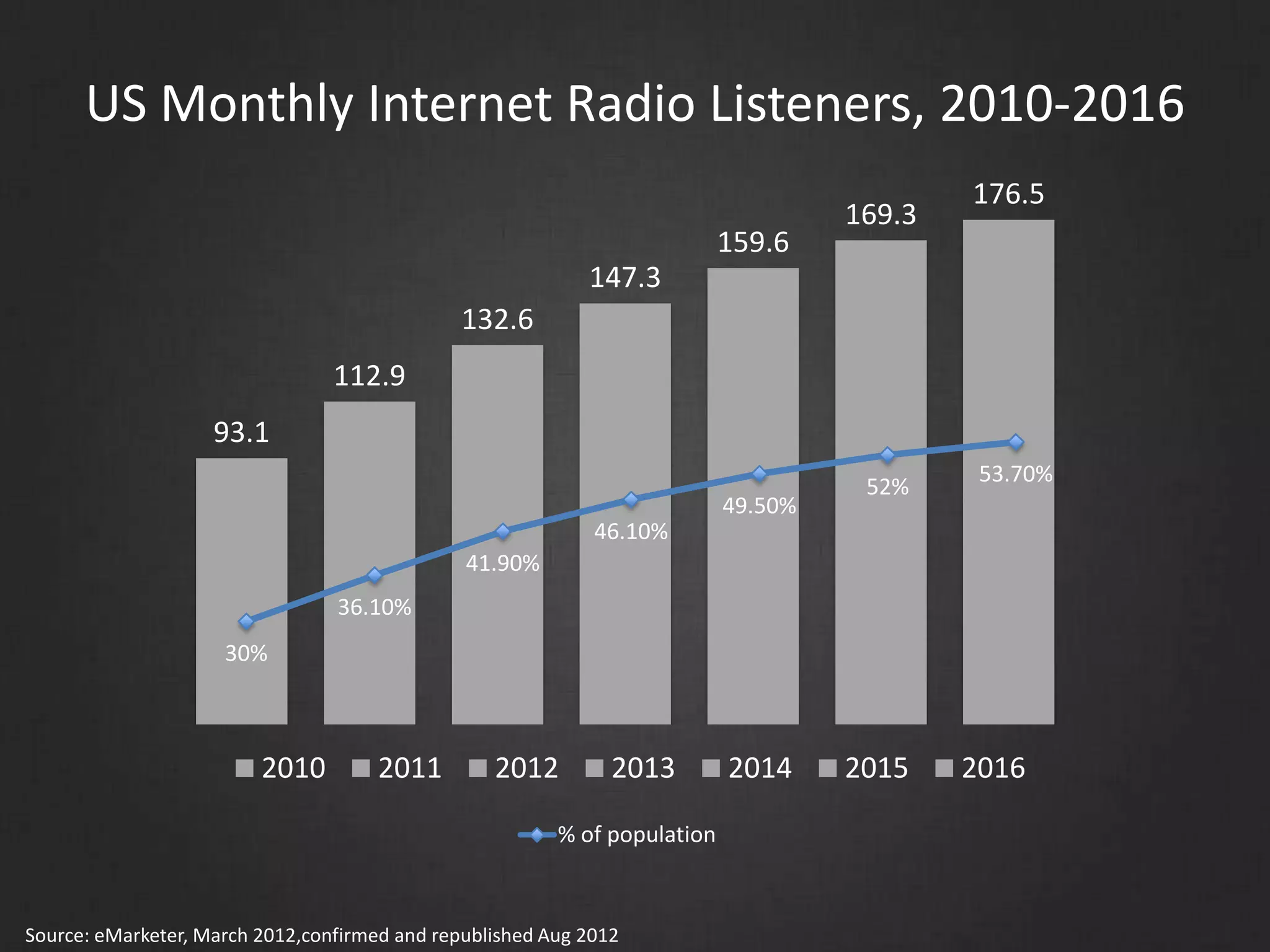

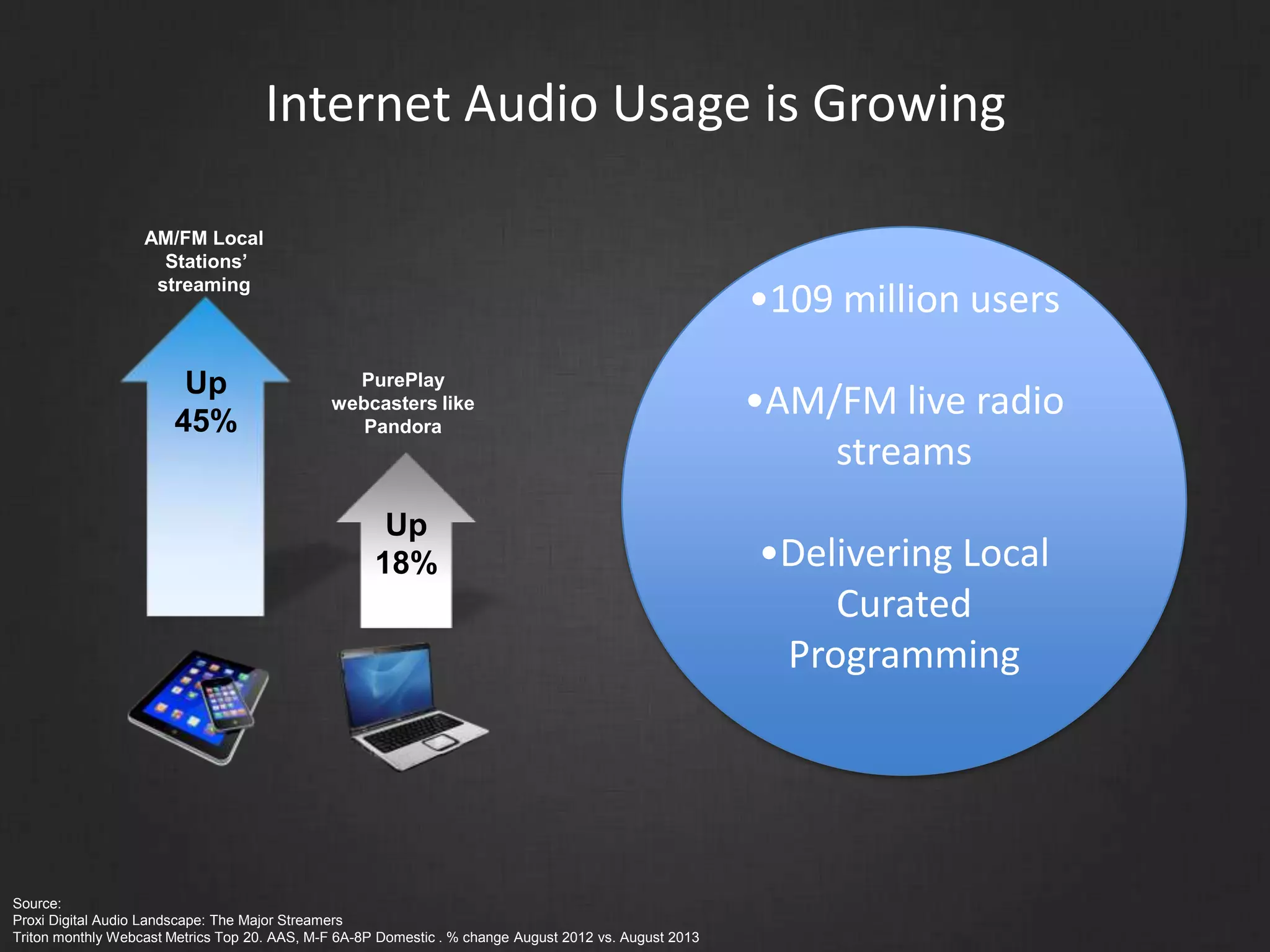

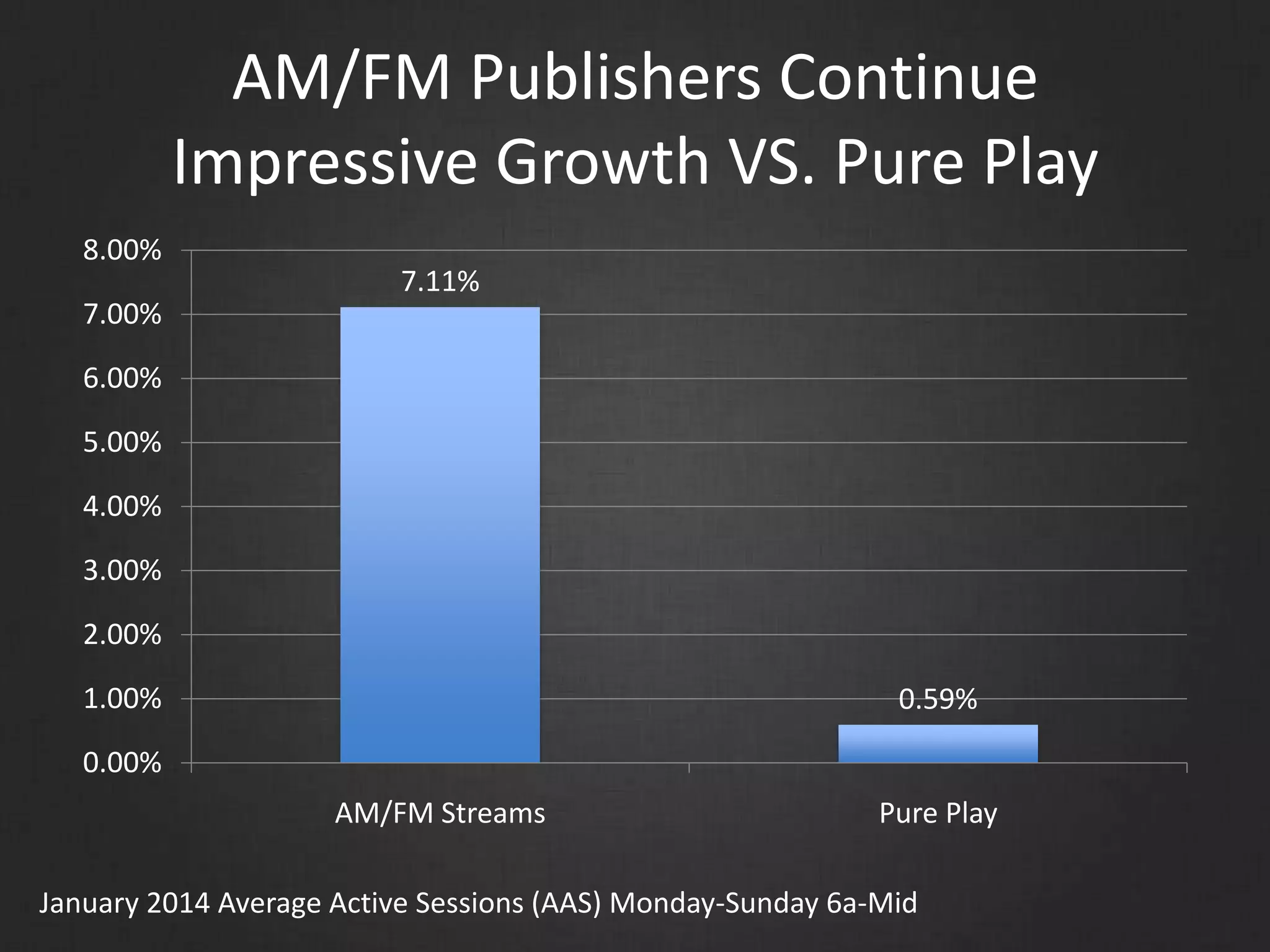

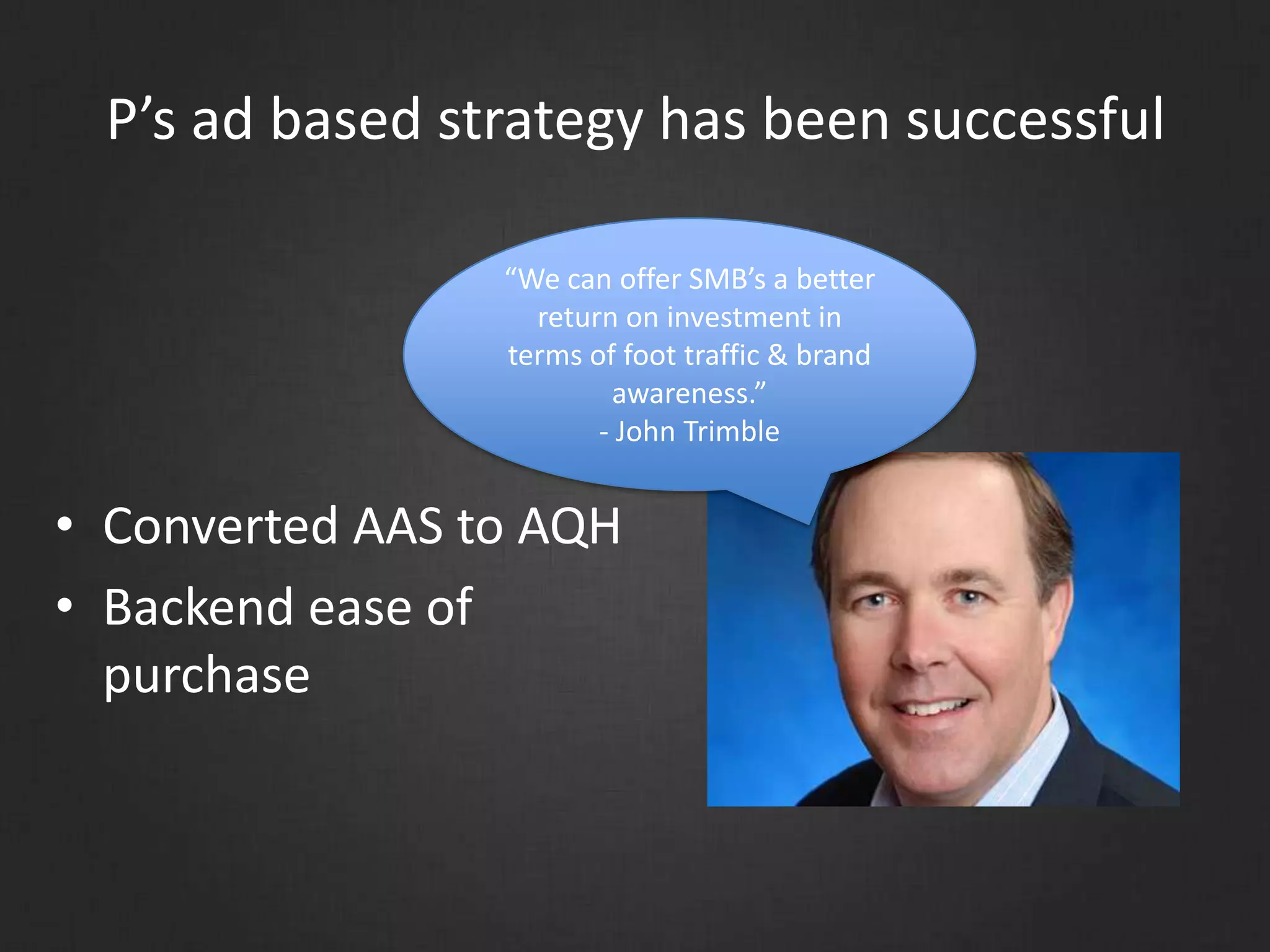

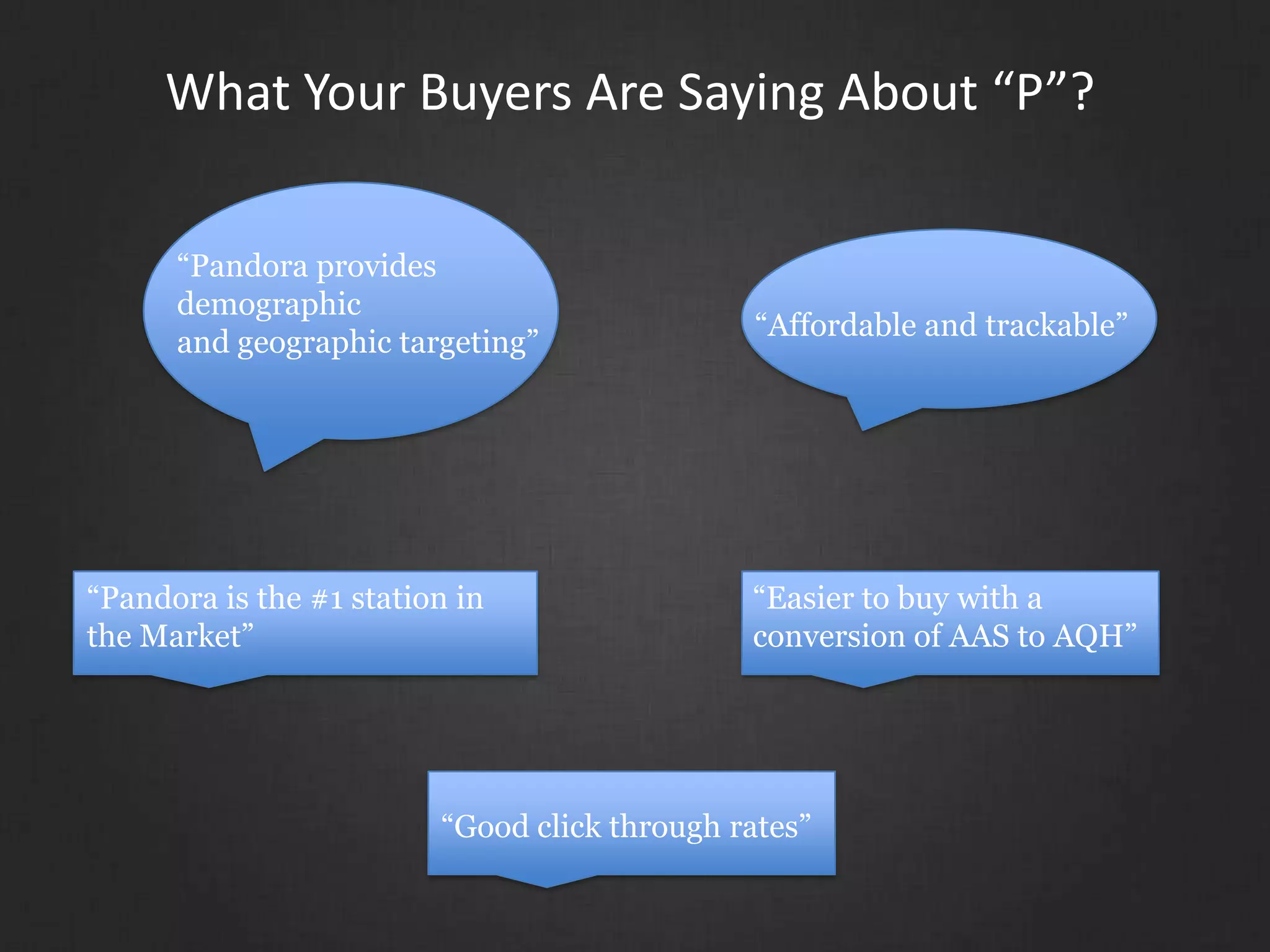

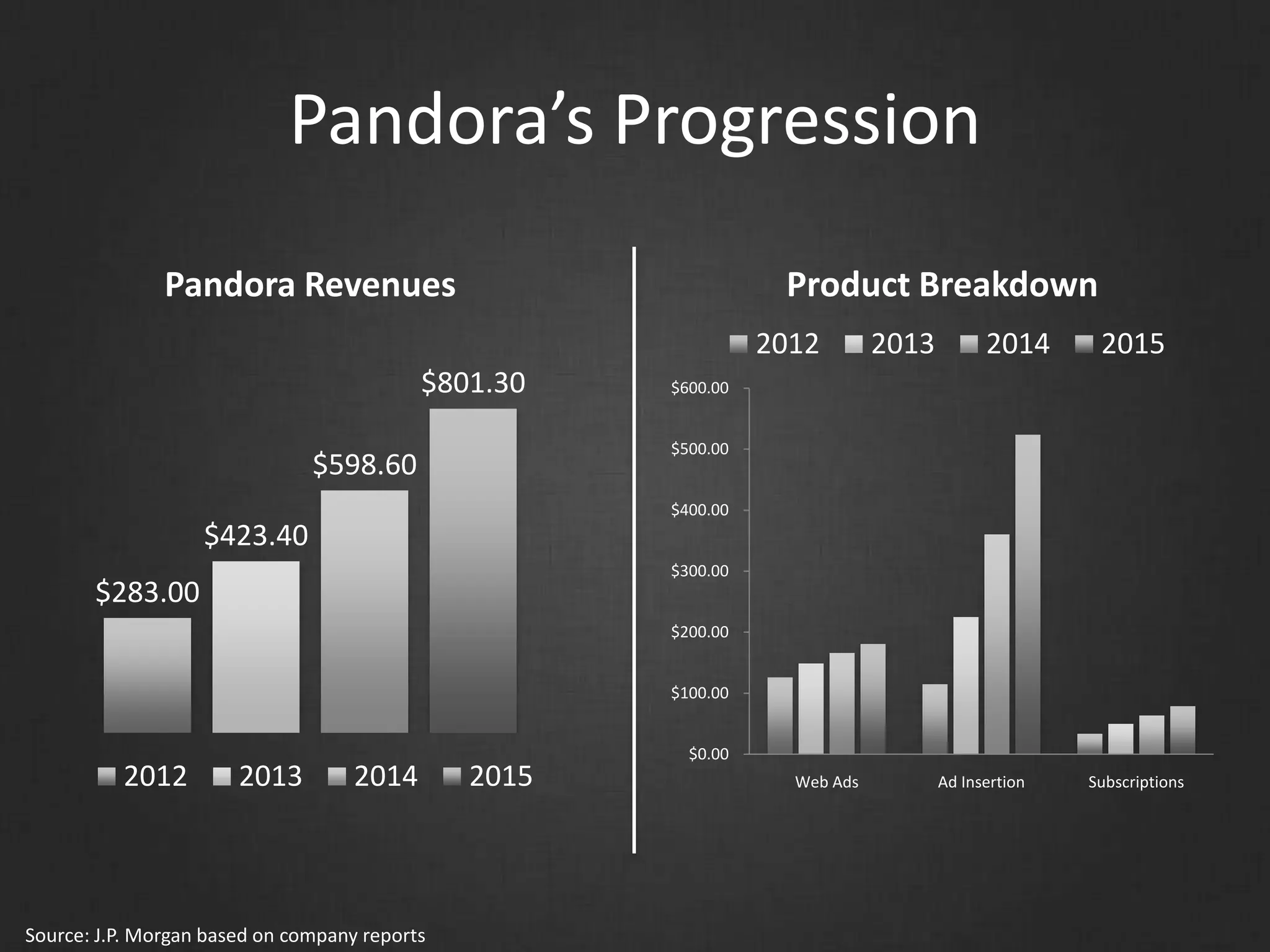

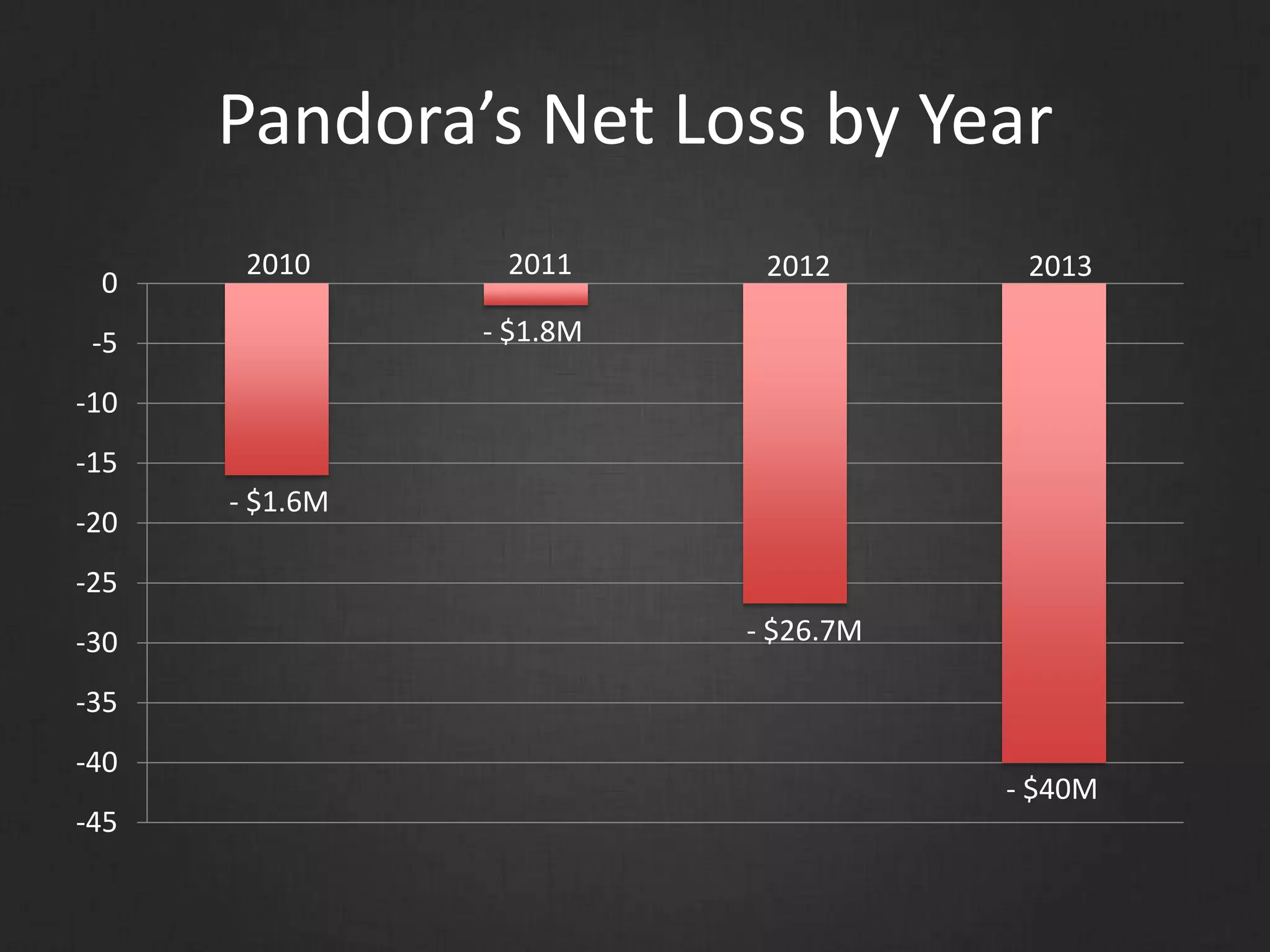

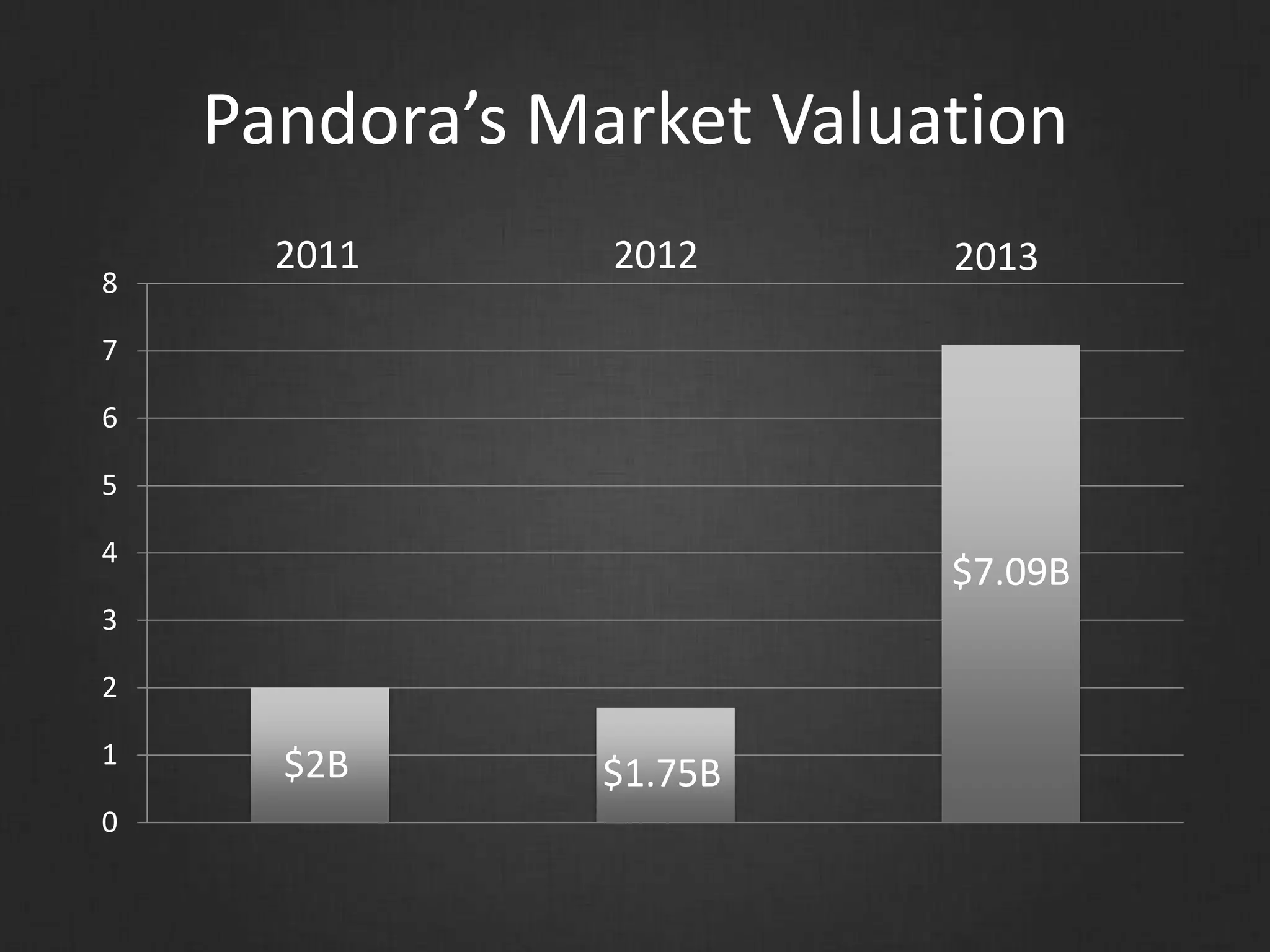

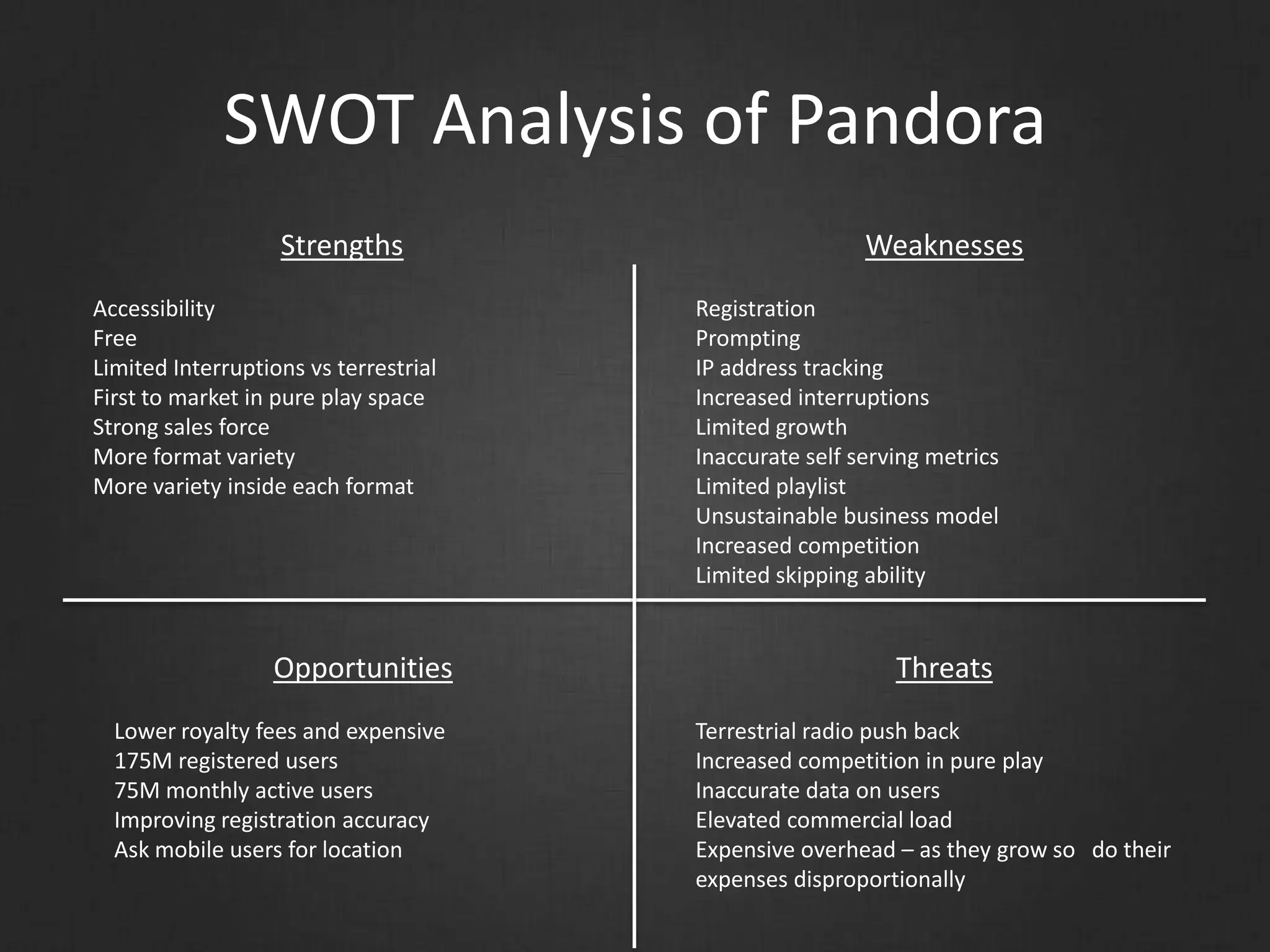

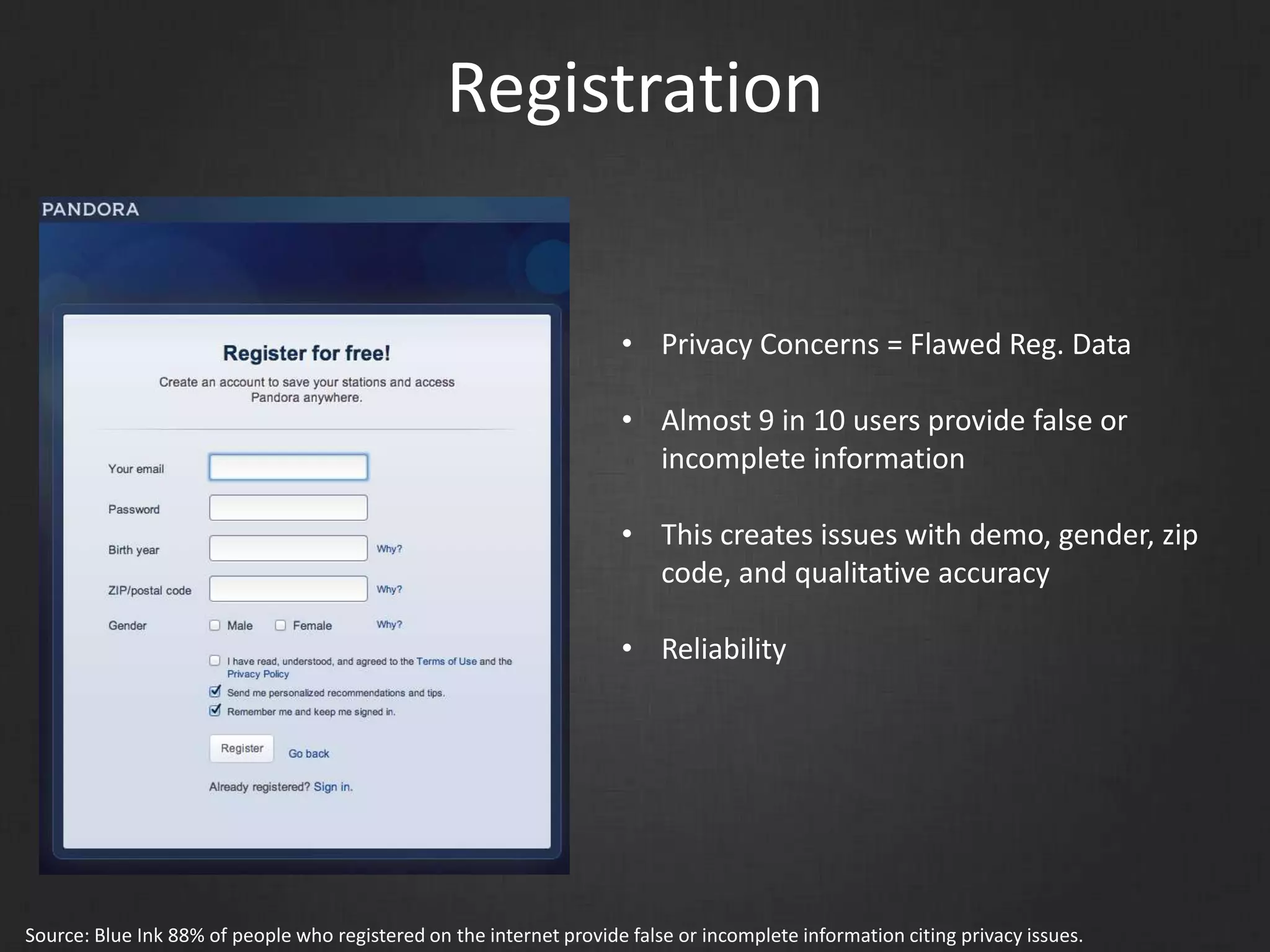

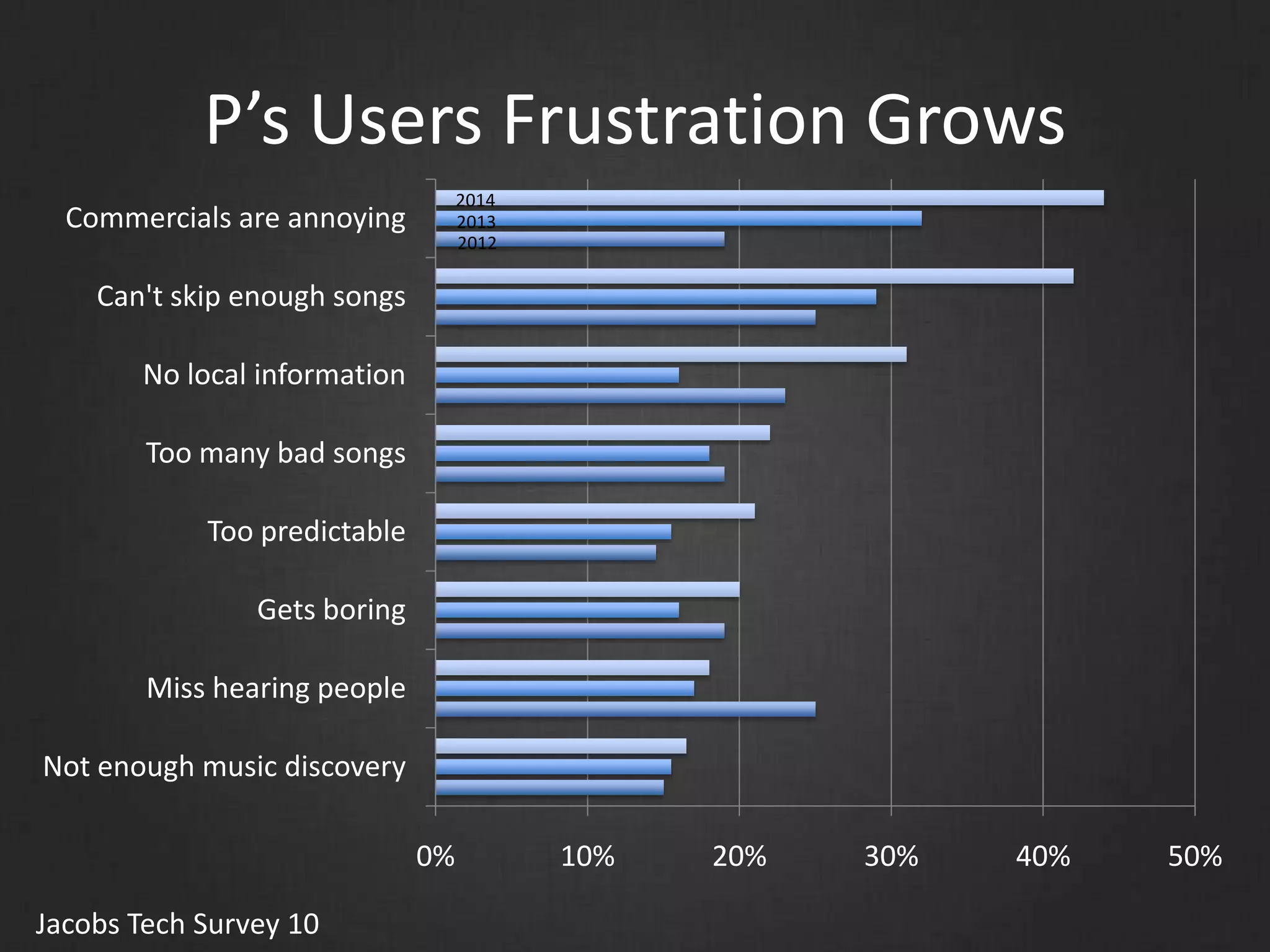

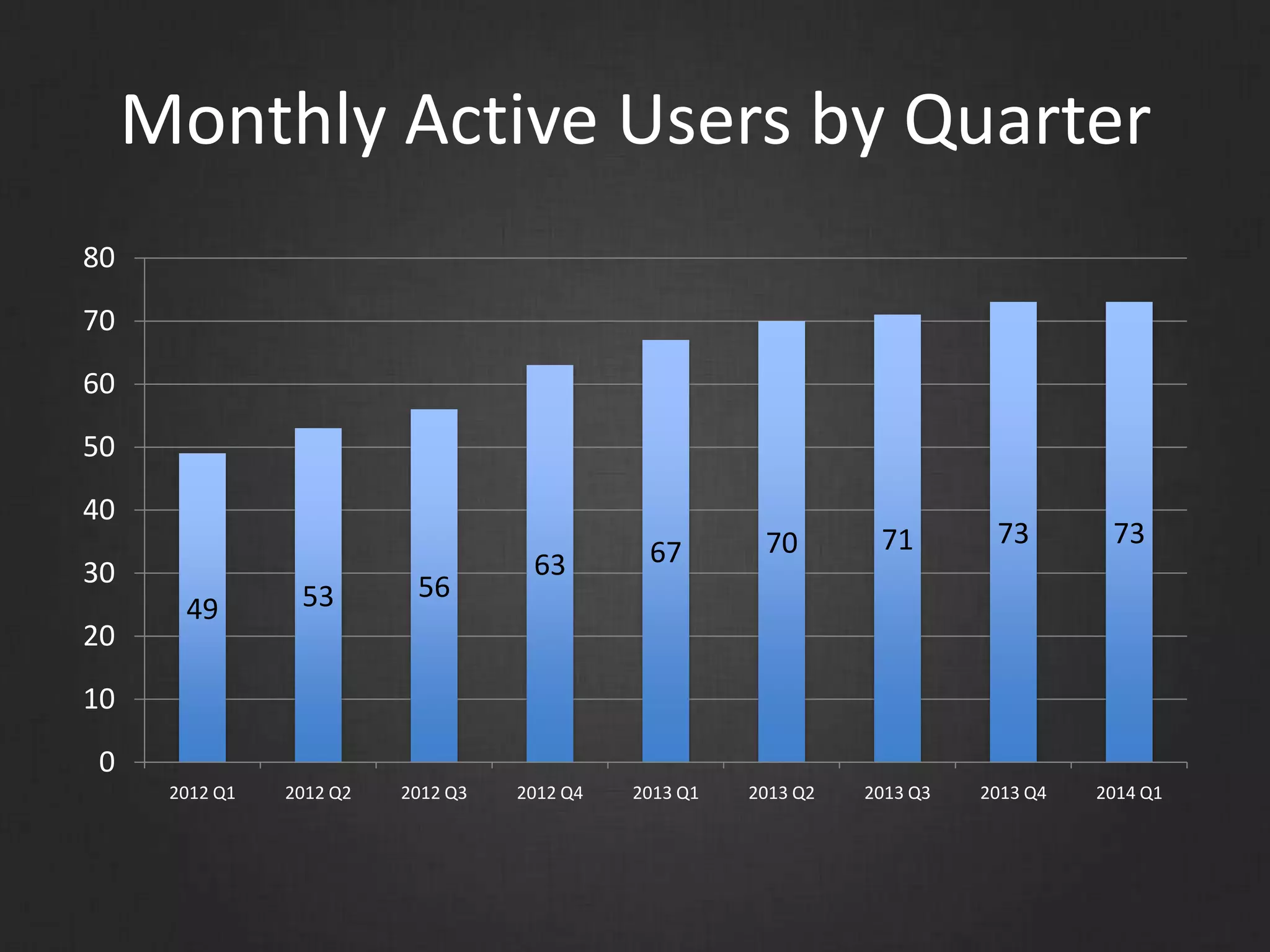

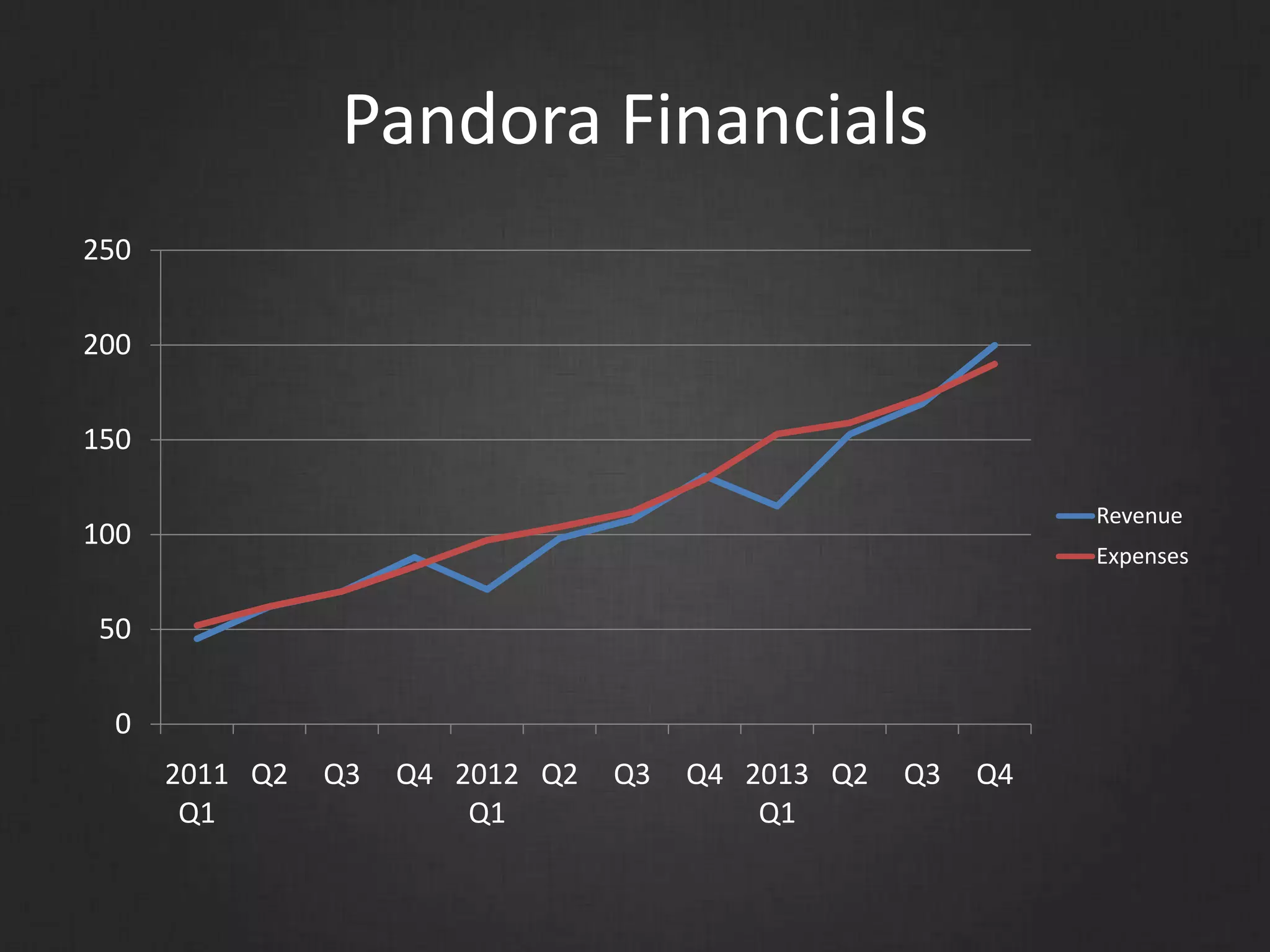

The document discusses the evolution of internet radio and audio advertising. It notes rising internet radio listenership from 2010-2016 as options expanded through new technologies. AM/FM radio streaming grew 45% while Pandora grew 18%. The document also analyzes Pandora's financials, business model, metrics and competition, noting weaknesses like unreliable user data and an unsustainable model against rising royalties and competition.