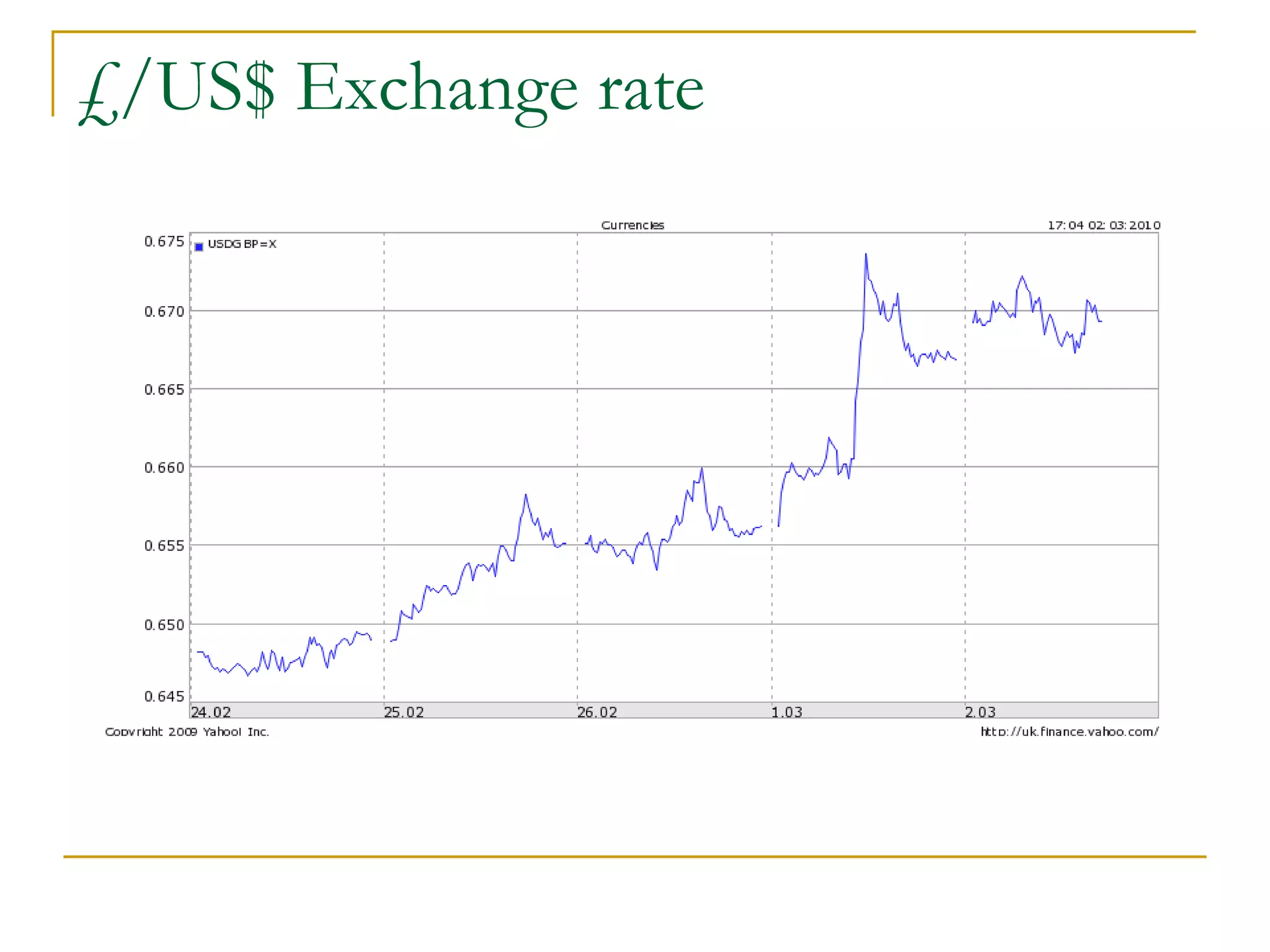

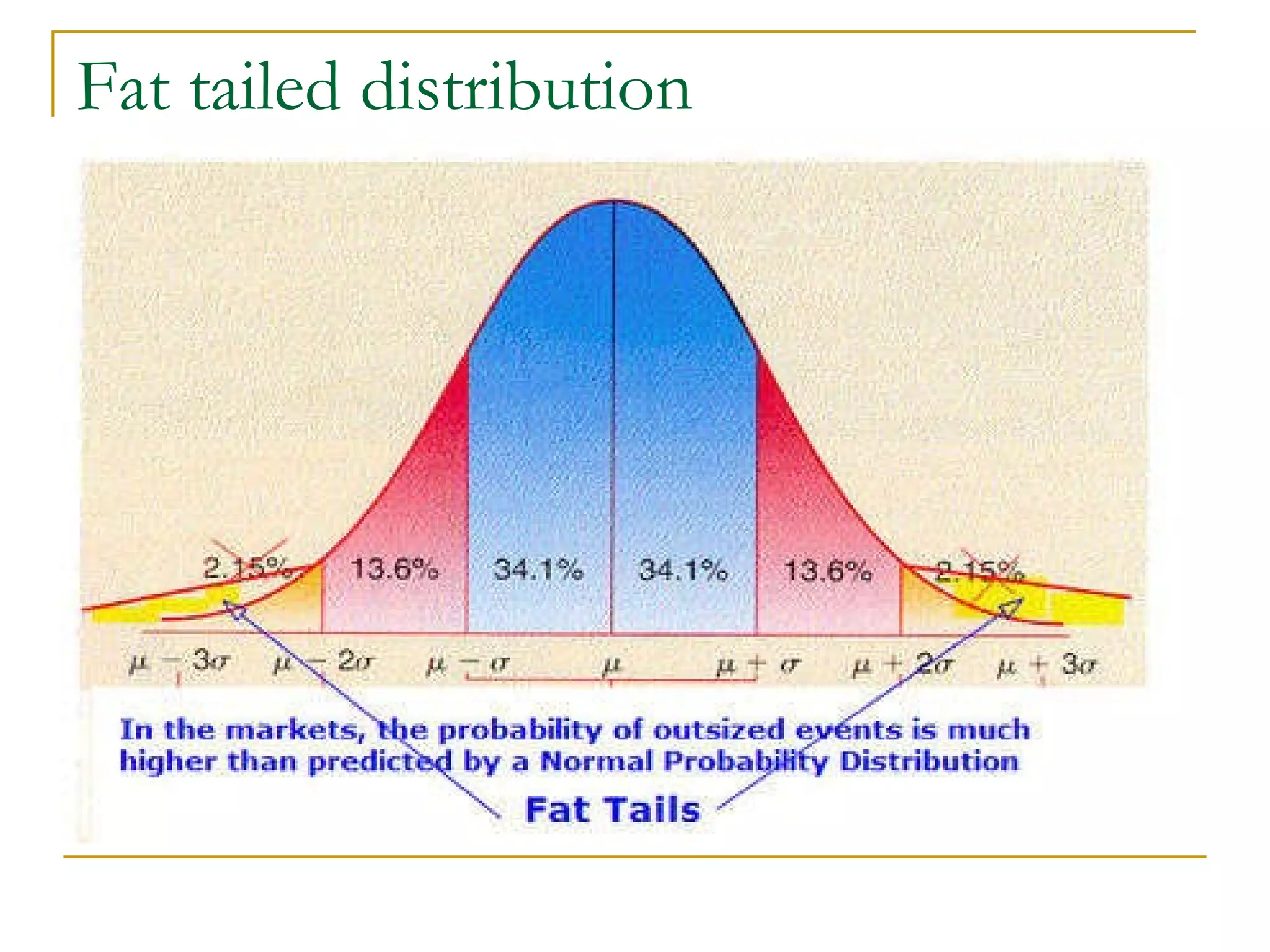

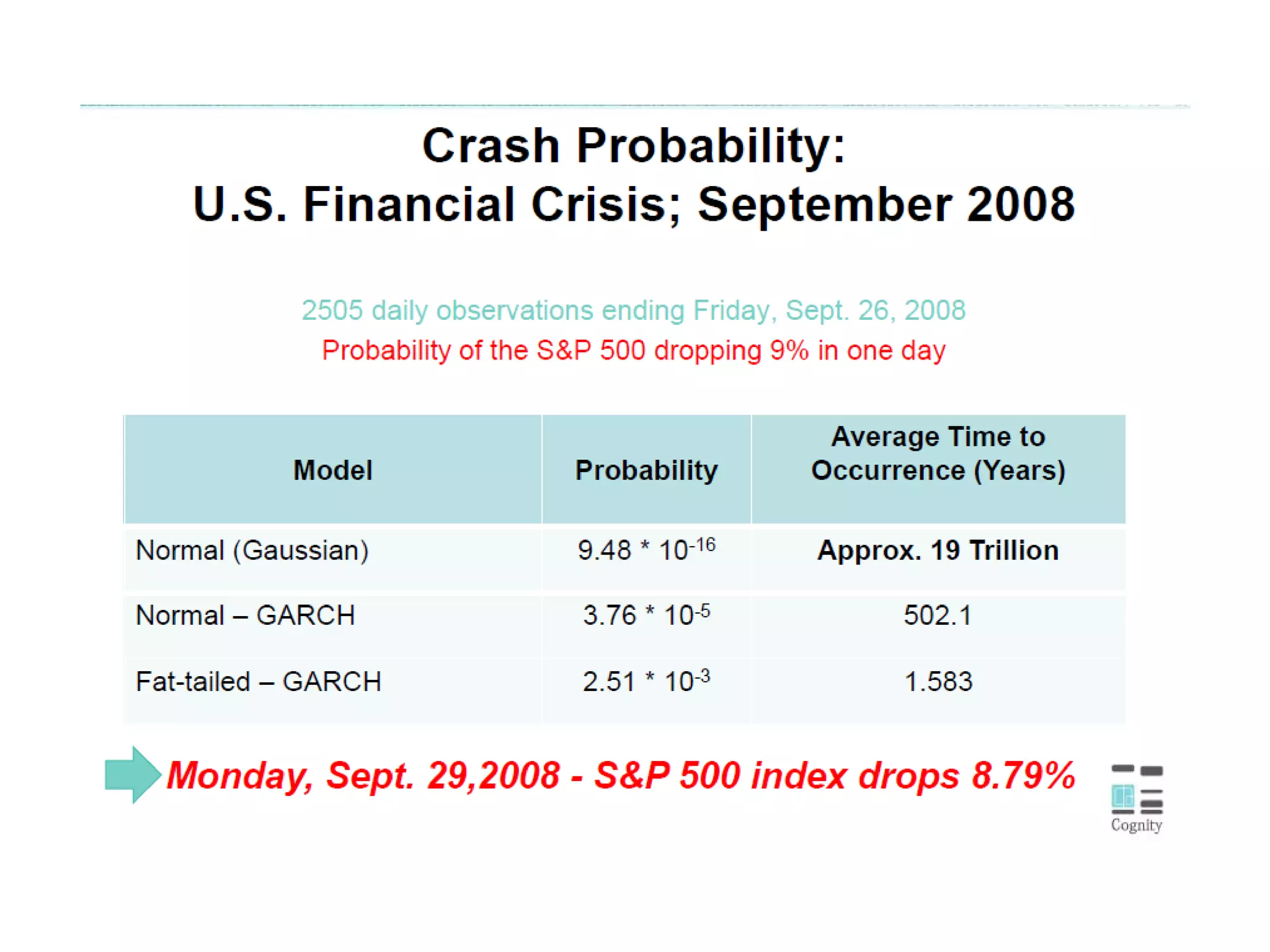

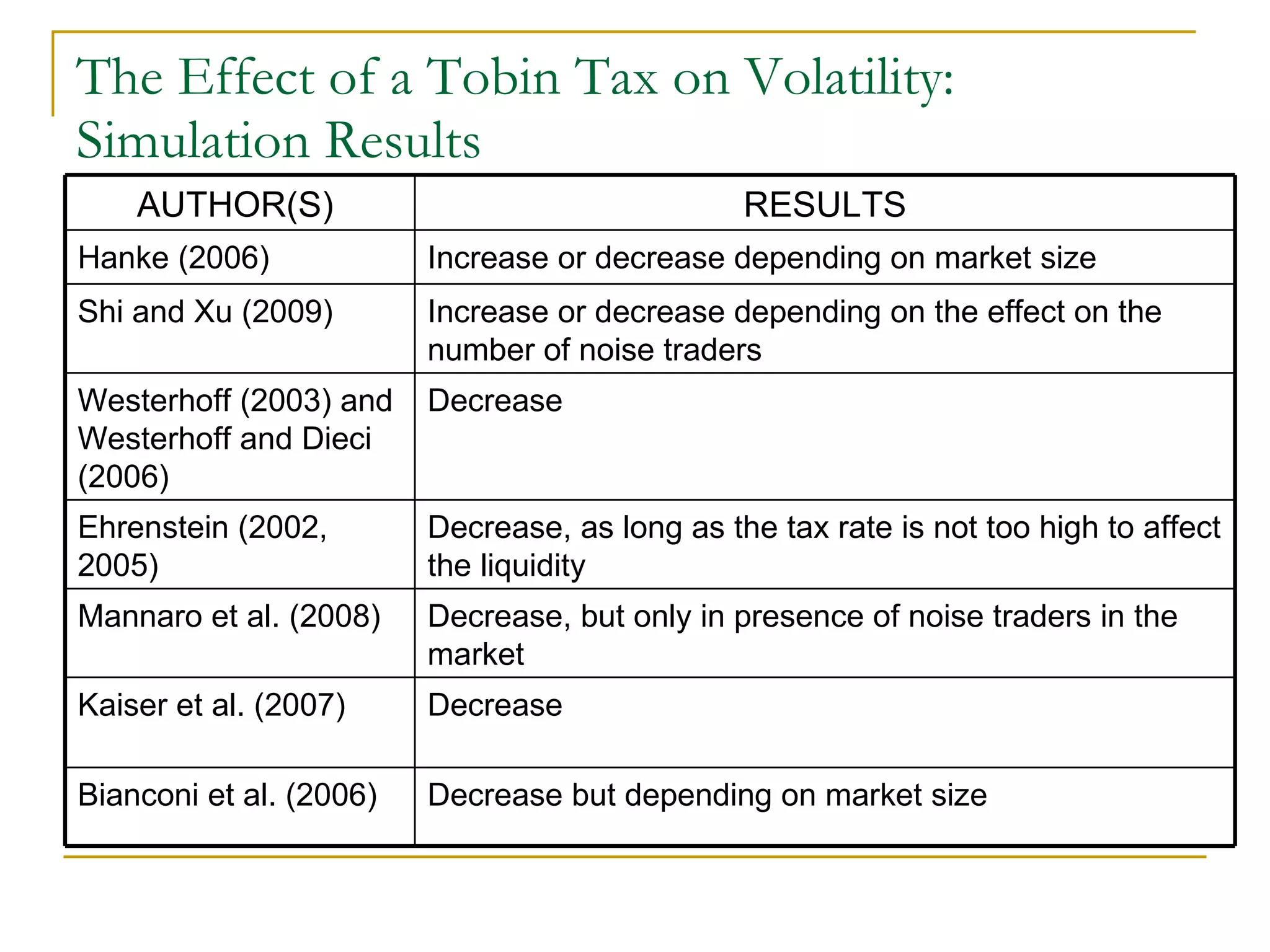

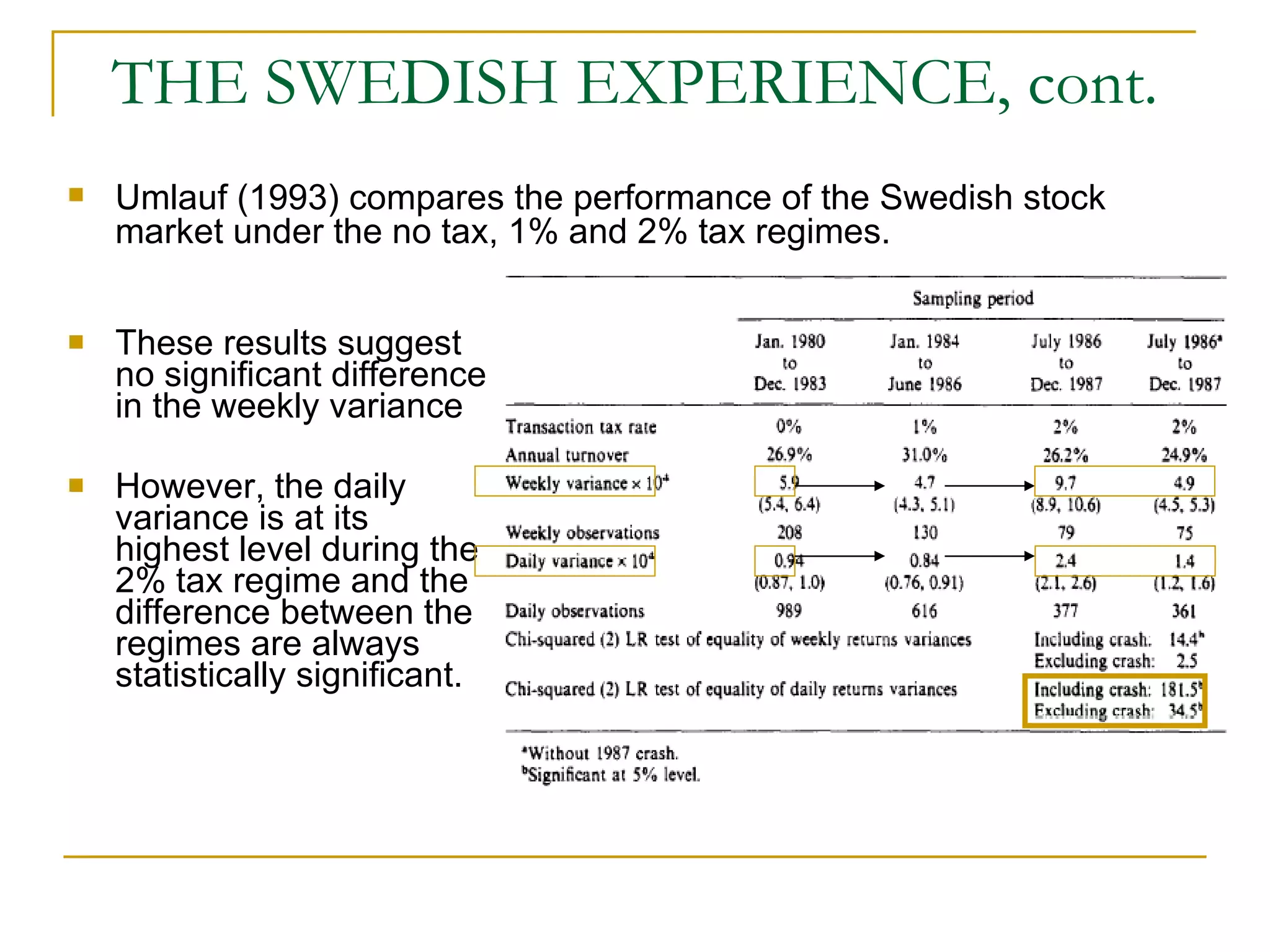

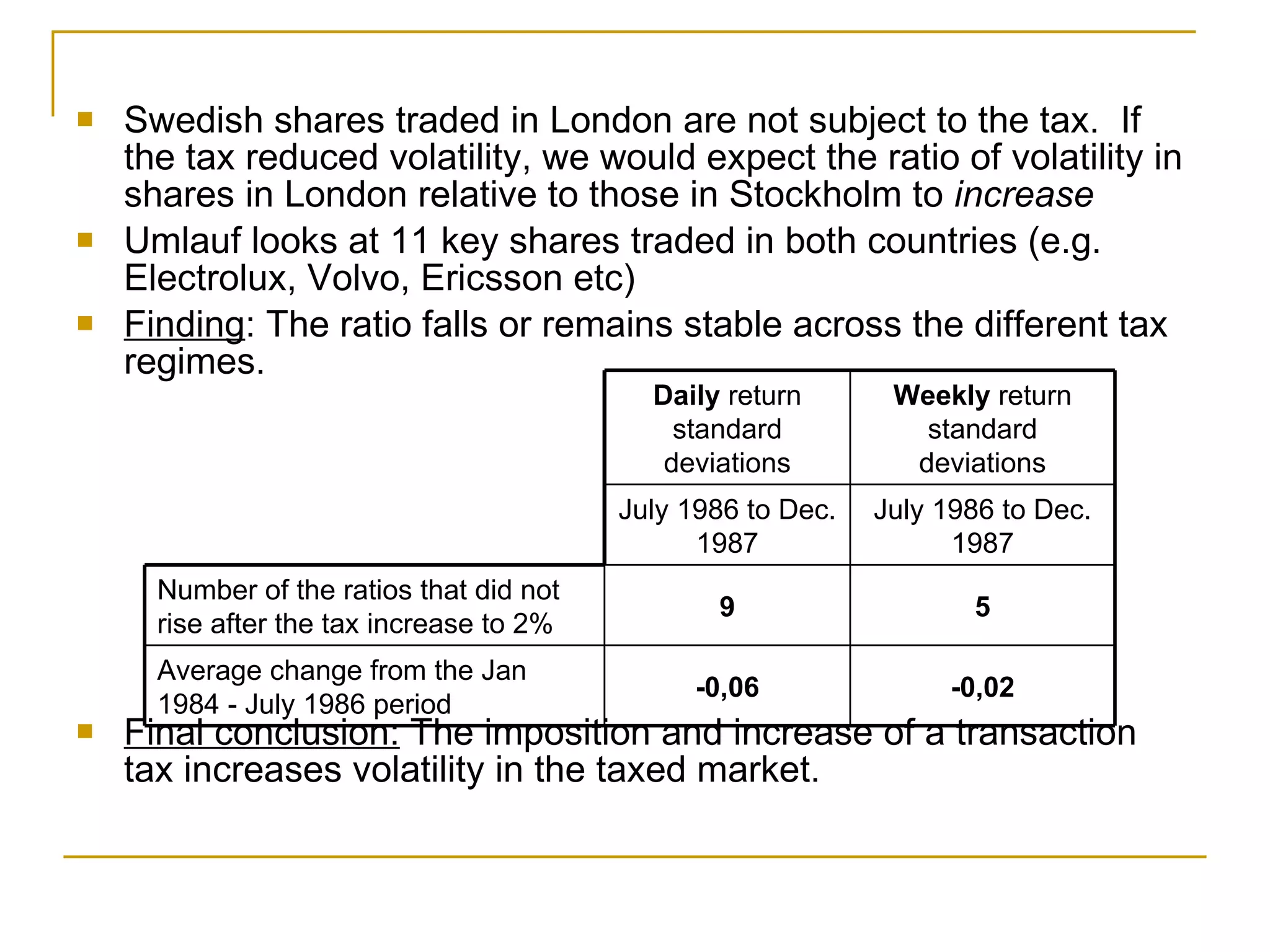

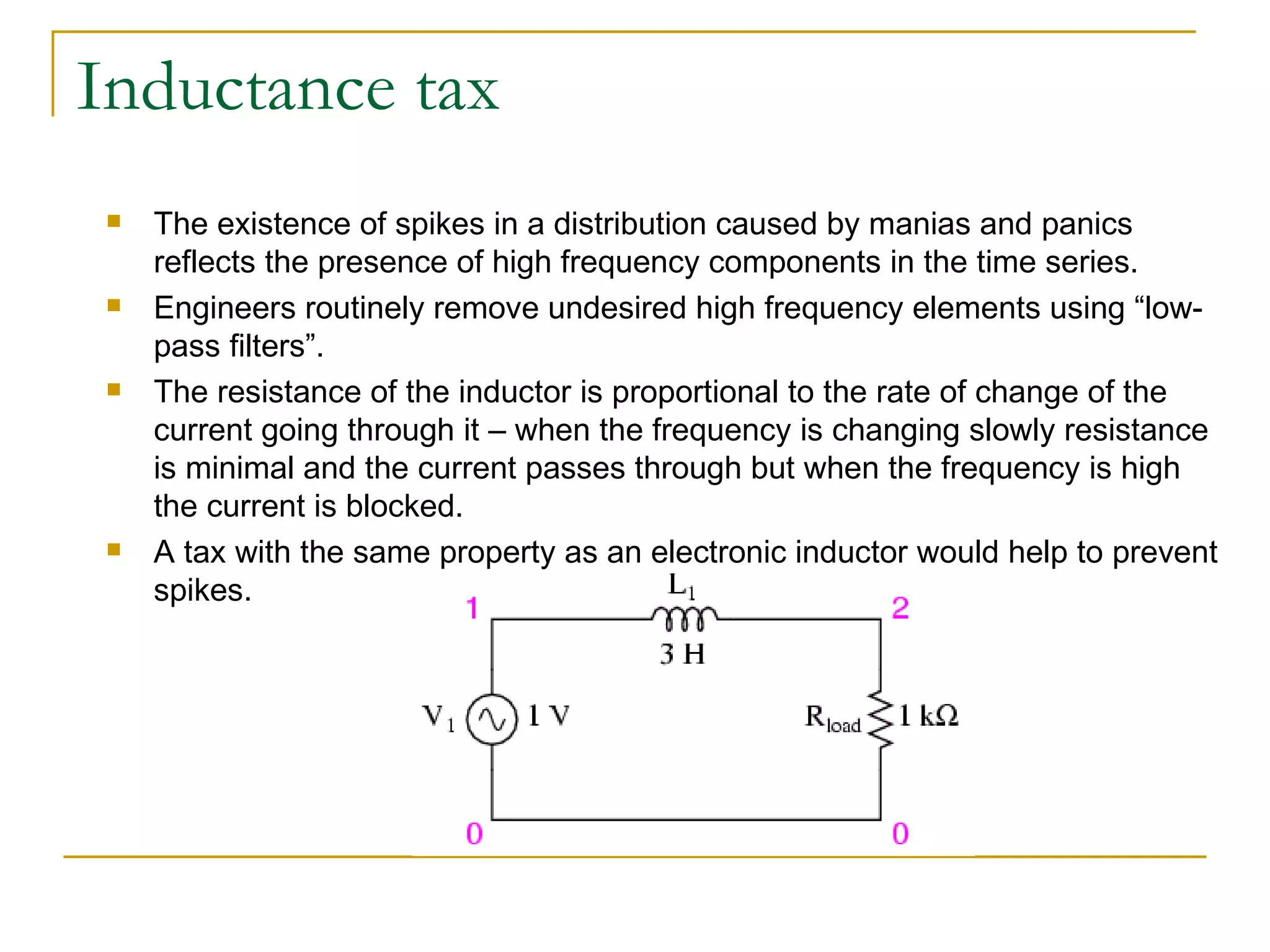

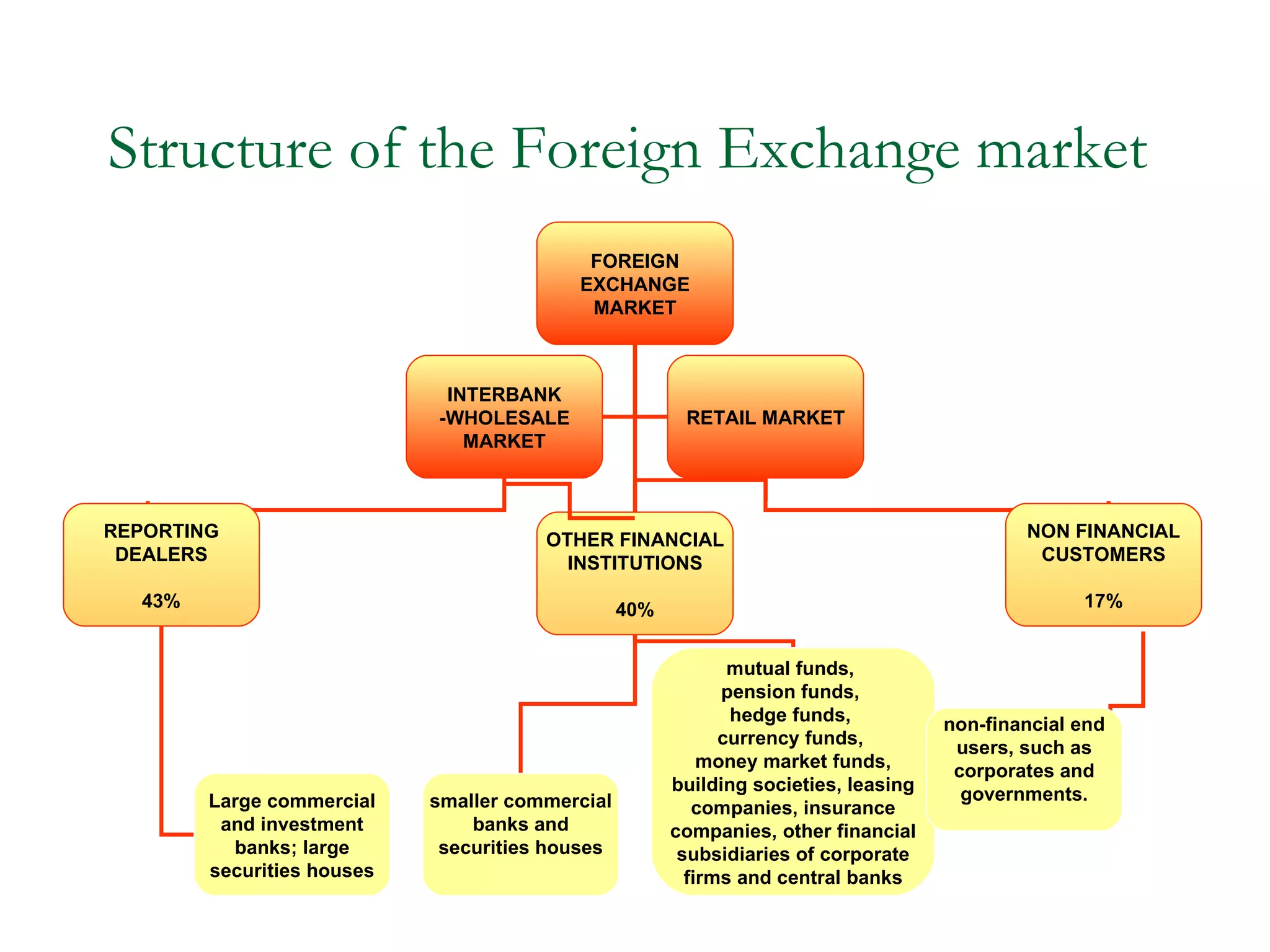

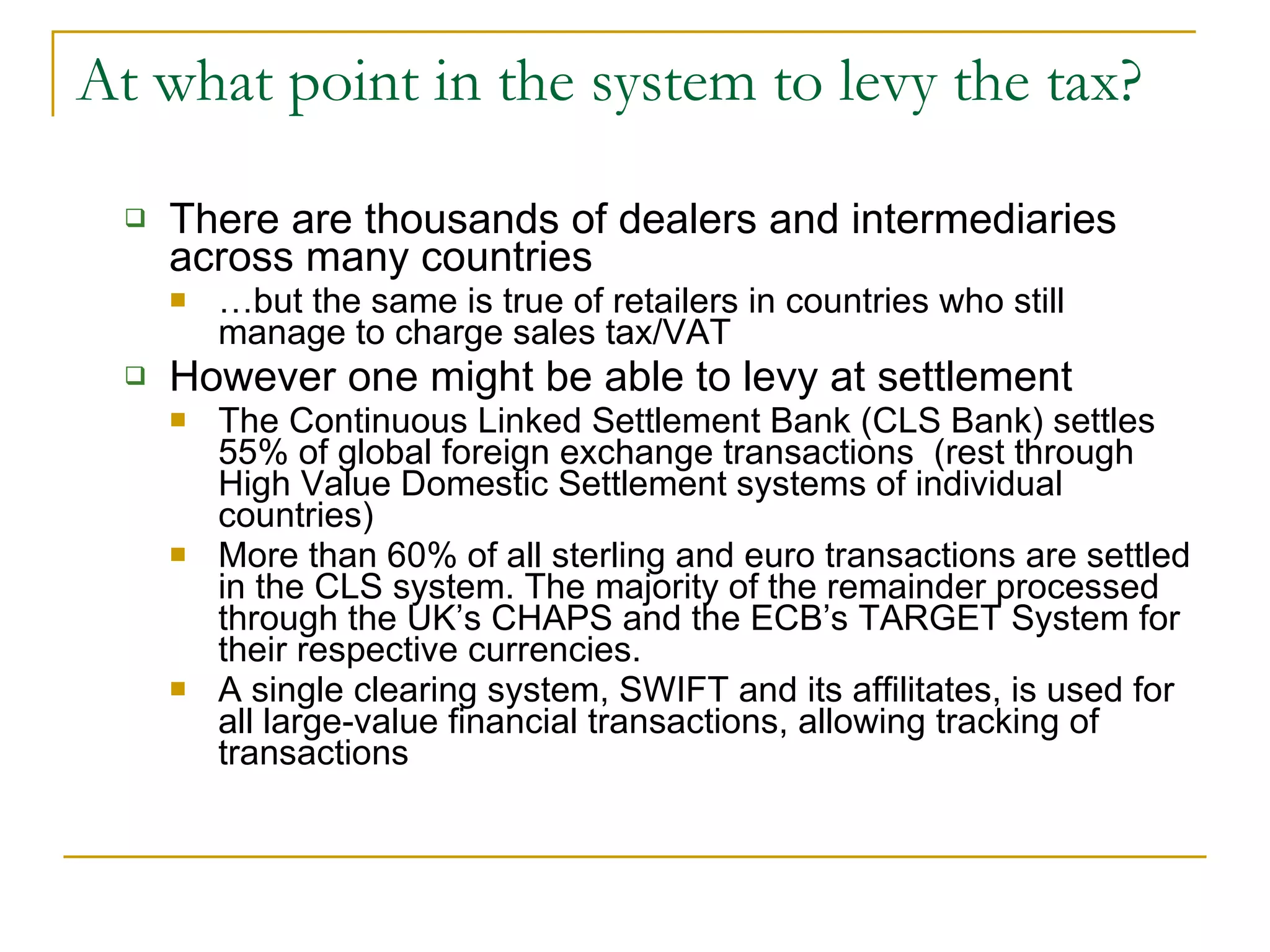

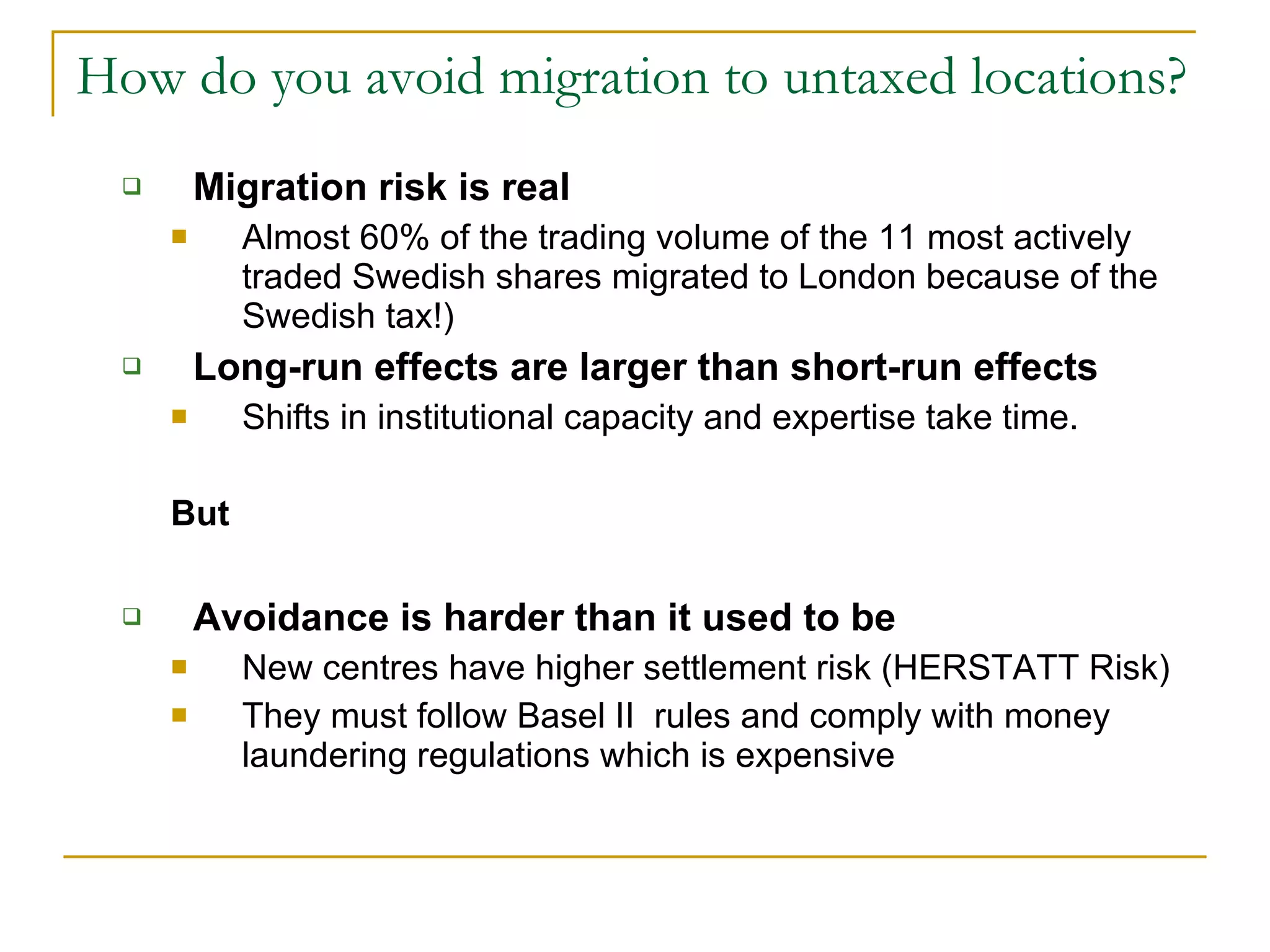

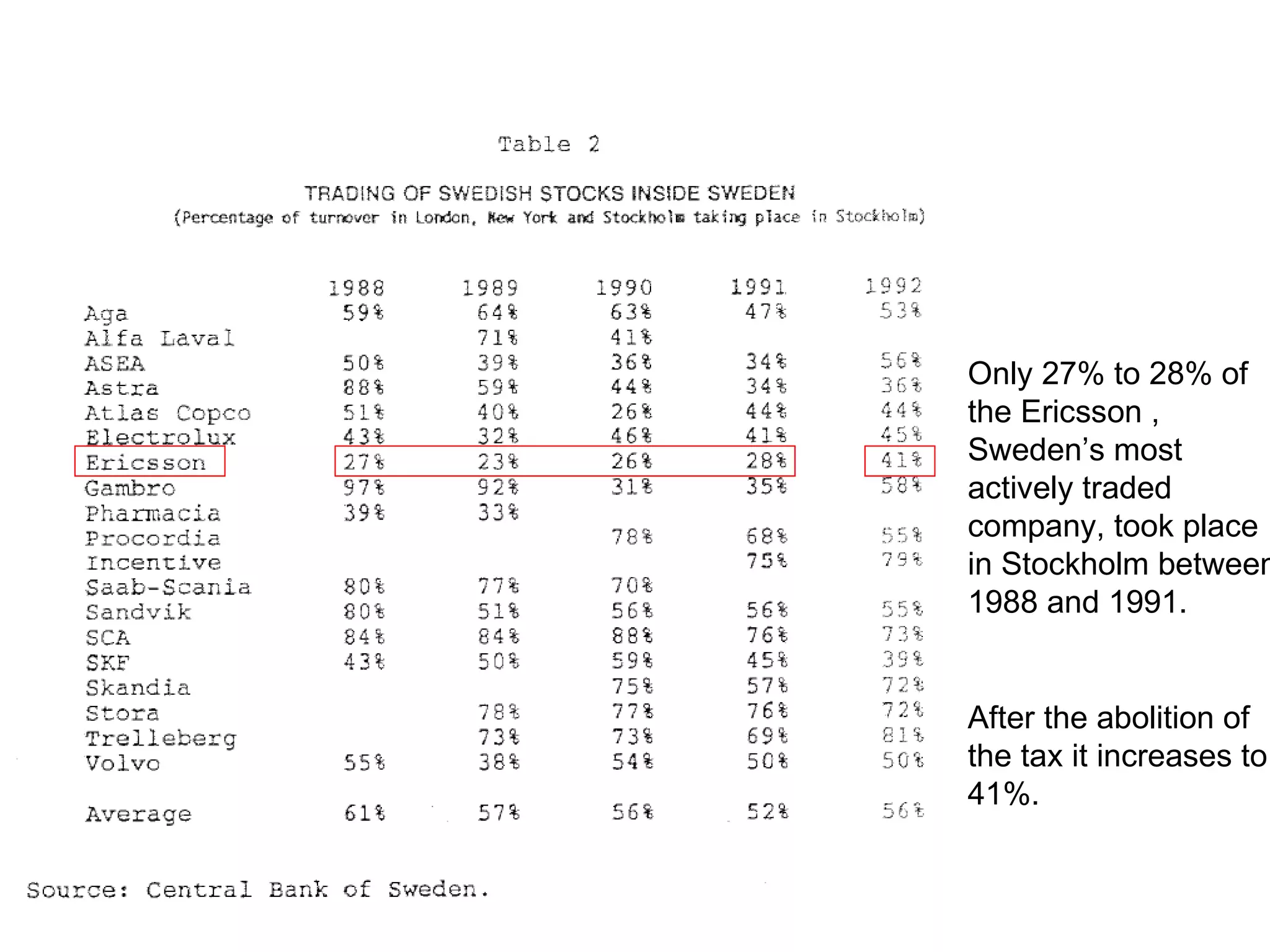

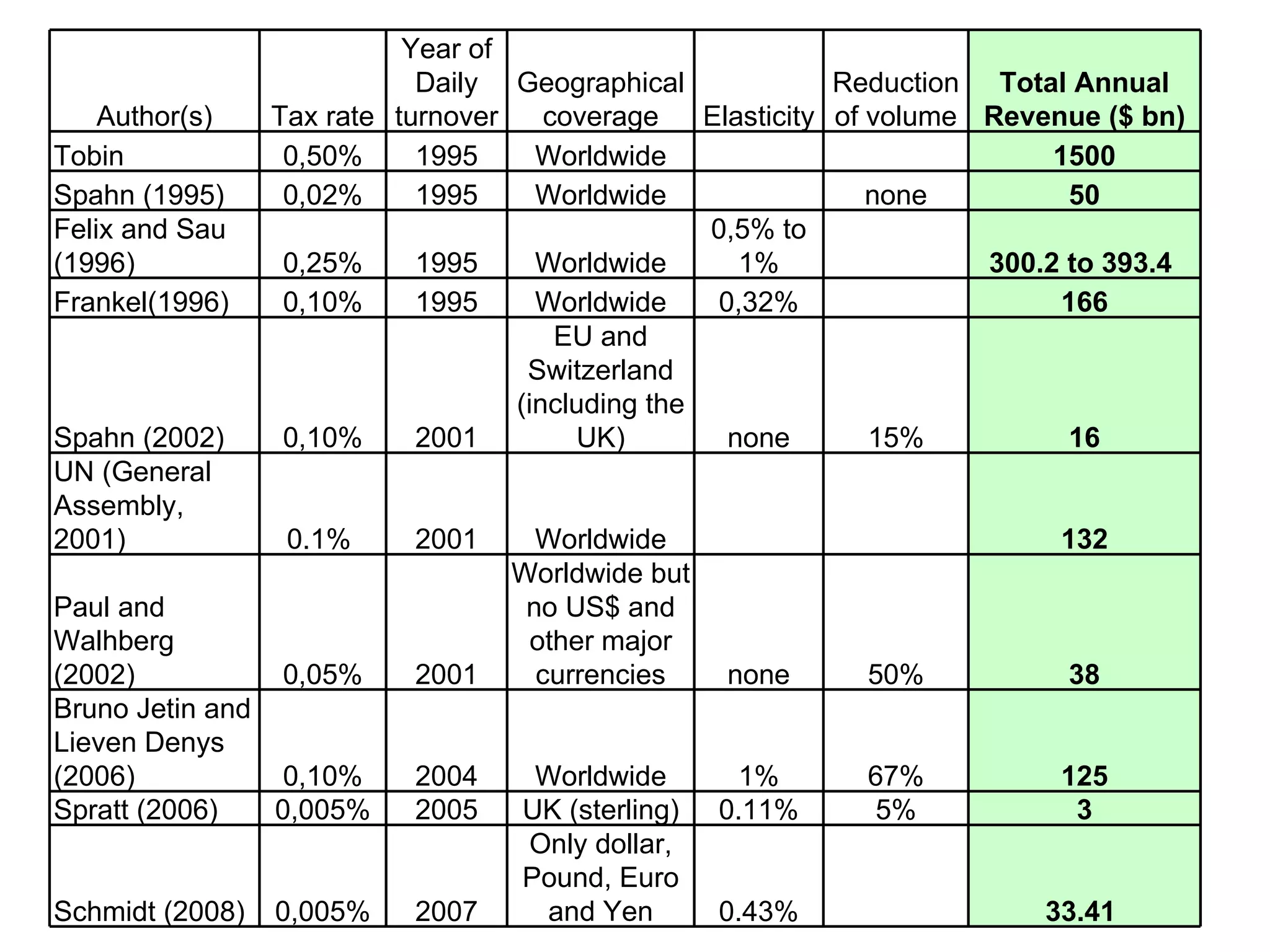

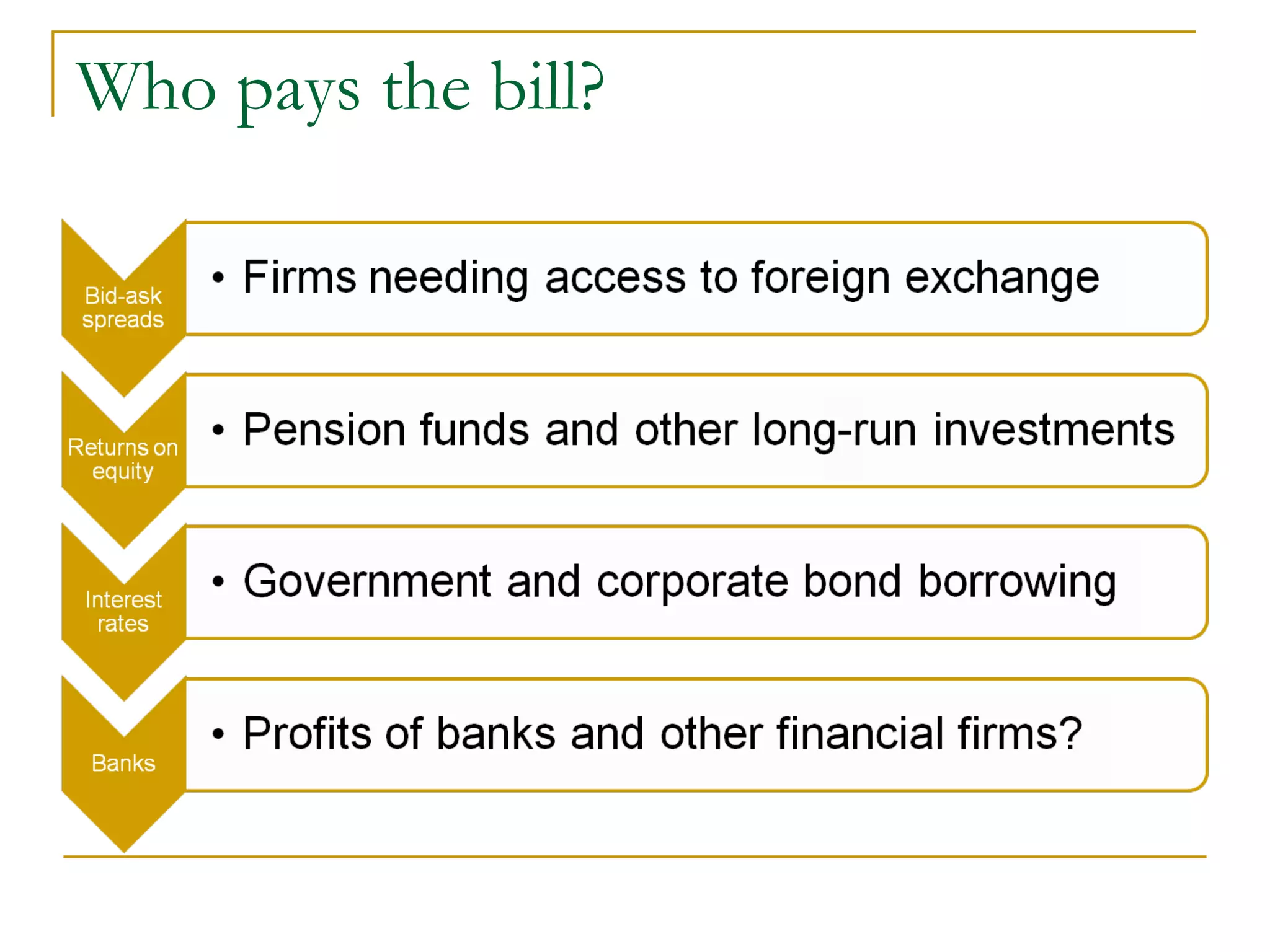

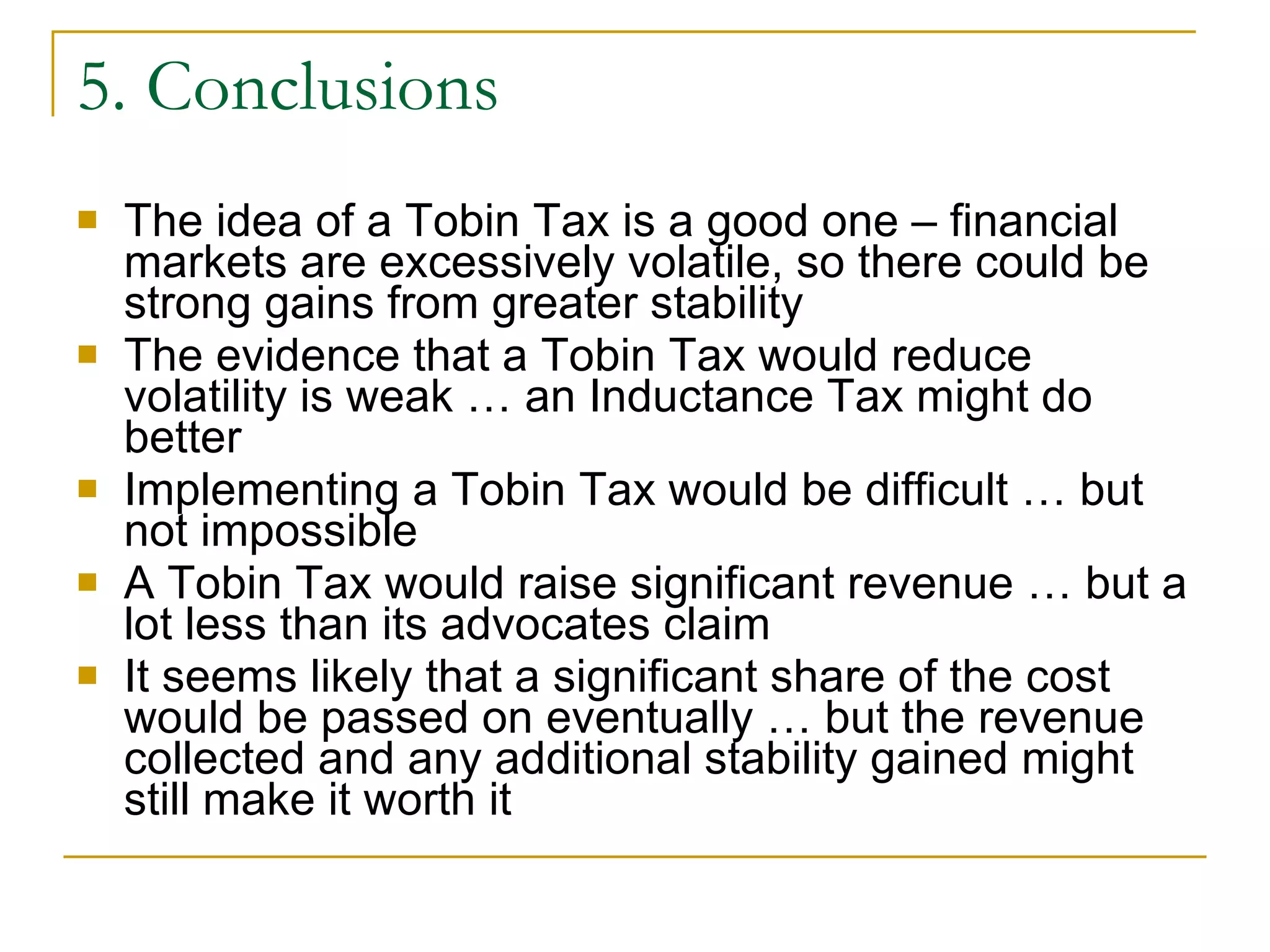

The document discusses the Tobin tax, a proposed international tax on currency transactions aimed at reducing financial market volatility and speculation. It outlines the characteristics of financial markets, theoretical models of trader behavior, empirical evidence from the Swedish experience with transaction taxes, and the feasibility and expected revenue from implementing a Tobin tax. Ultimately, the conclusion questions the effectiveness of a Tobin tax in stabilizing markets, suggests that an inductance tax might be more beneficial, and highlights challenges in implementation.