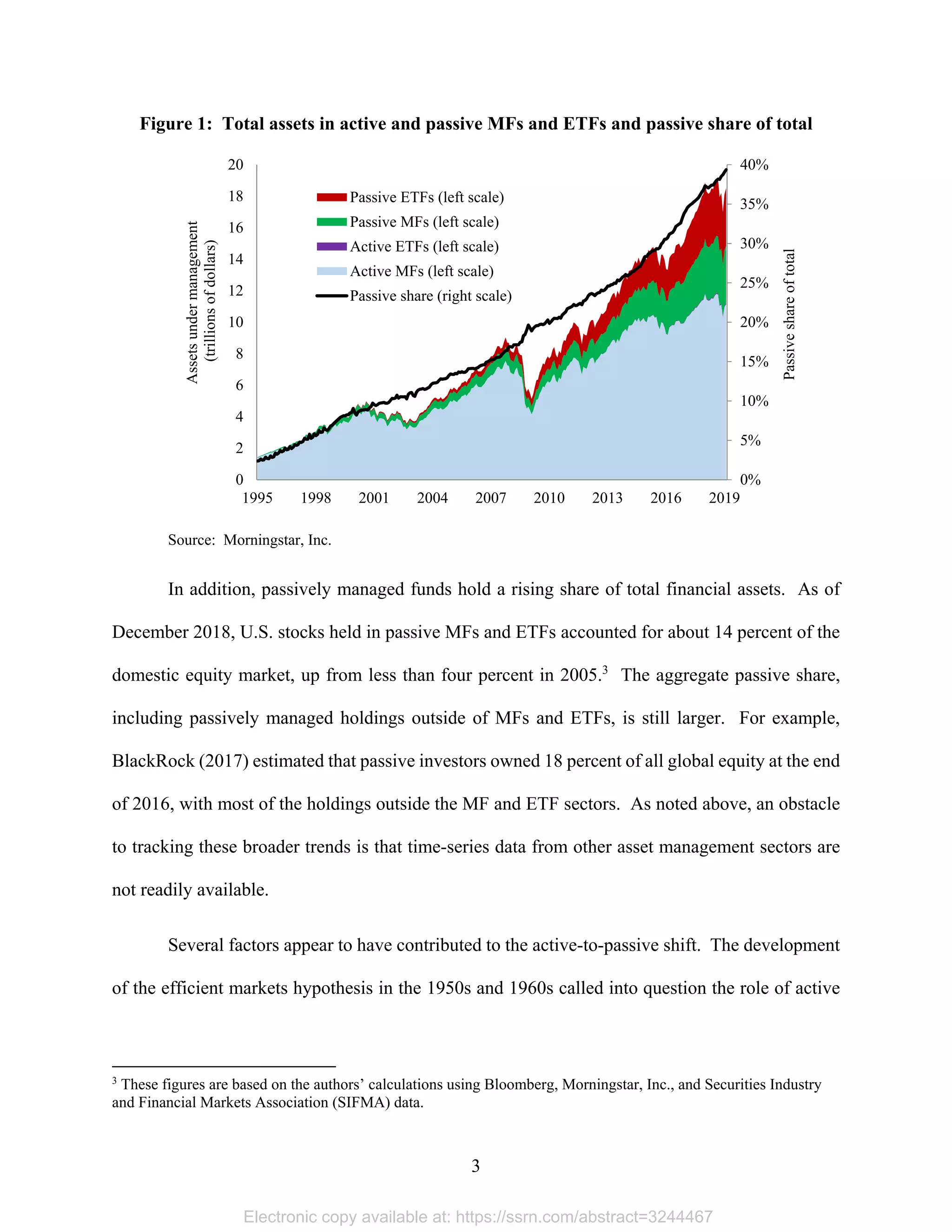

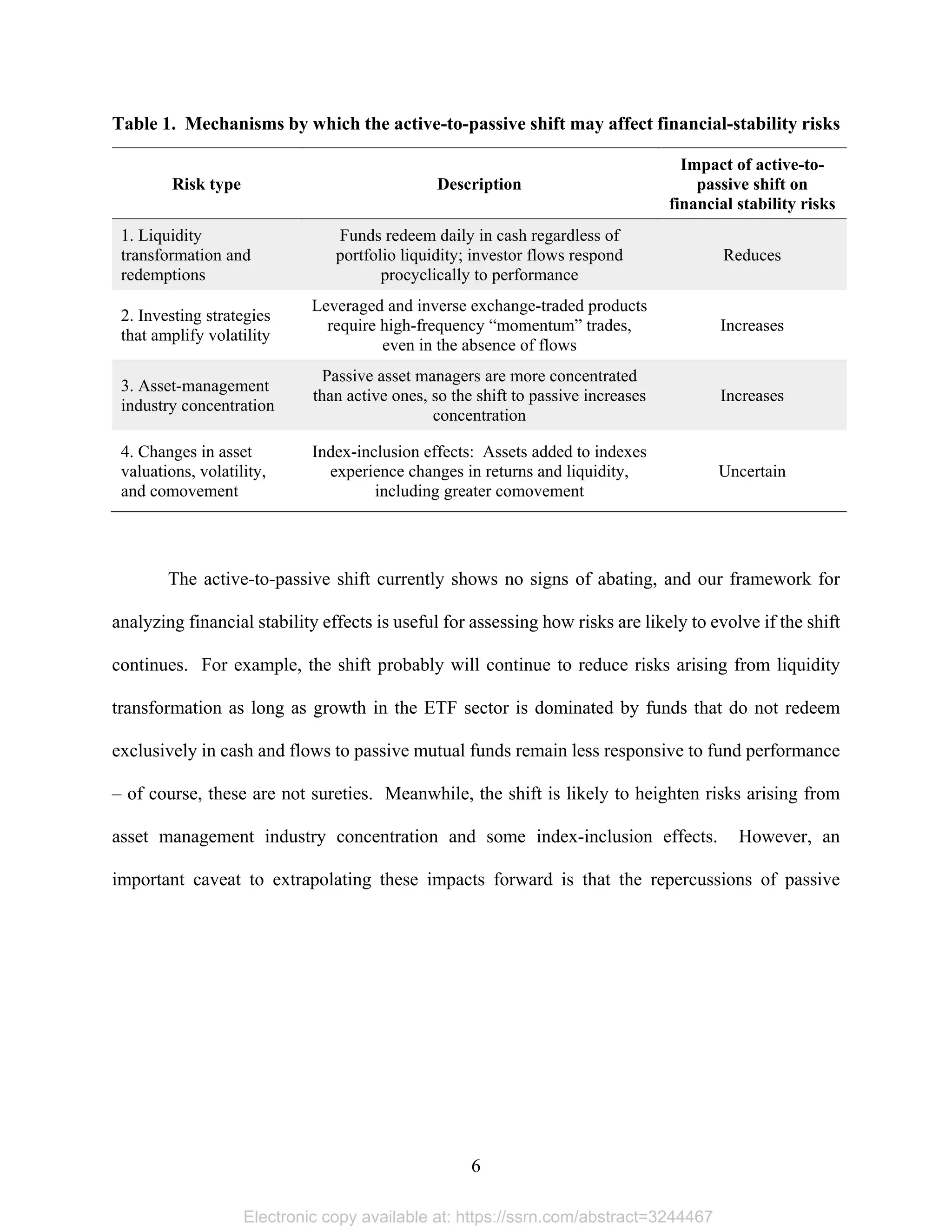

The document examines how the shift from active to passive investing affects financial stability. It finds that the shift both increases and decreases certain risks:

1) The growth of ETFs, which are largely passive and do not redeem in cash, has likely reduced risks from liquidity transformation and destabilizing redemptions compared to mutual funds.

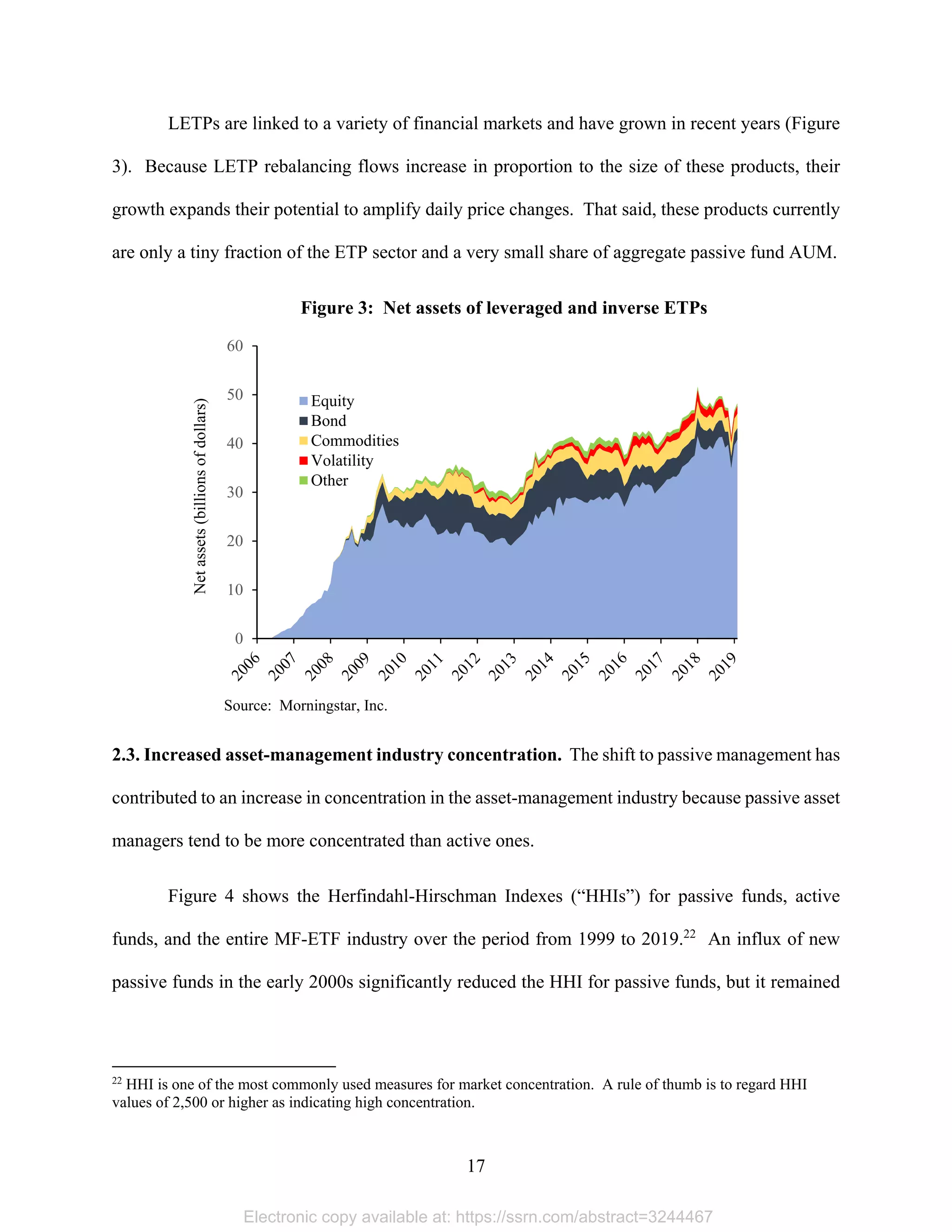

2) However, some passive strategies like leveraged ETFs amplify market volatility.

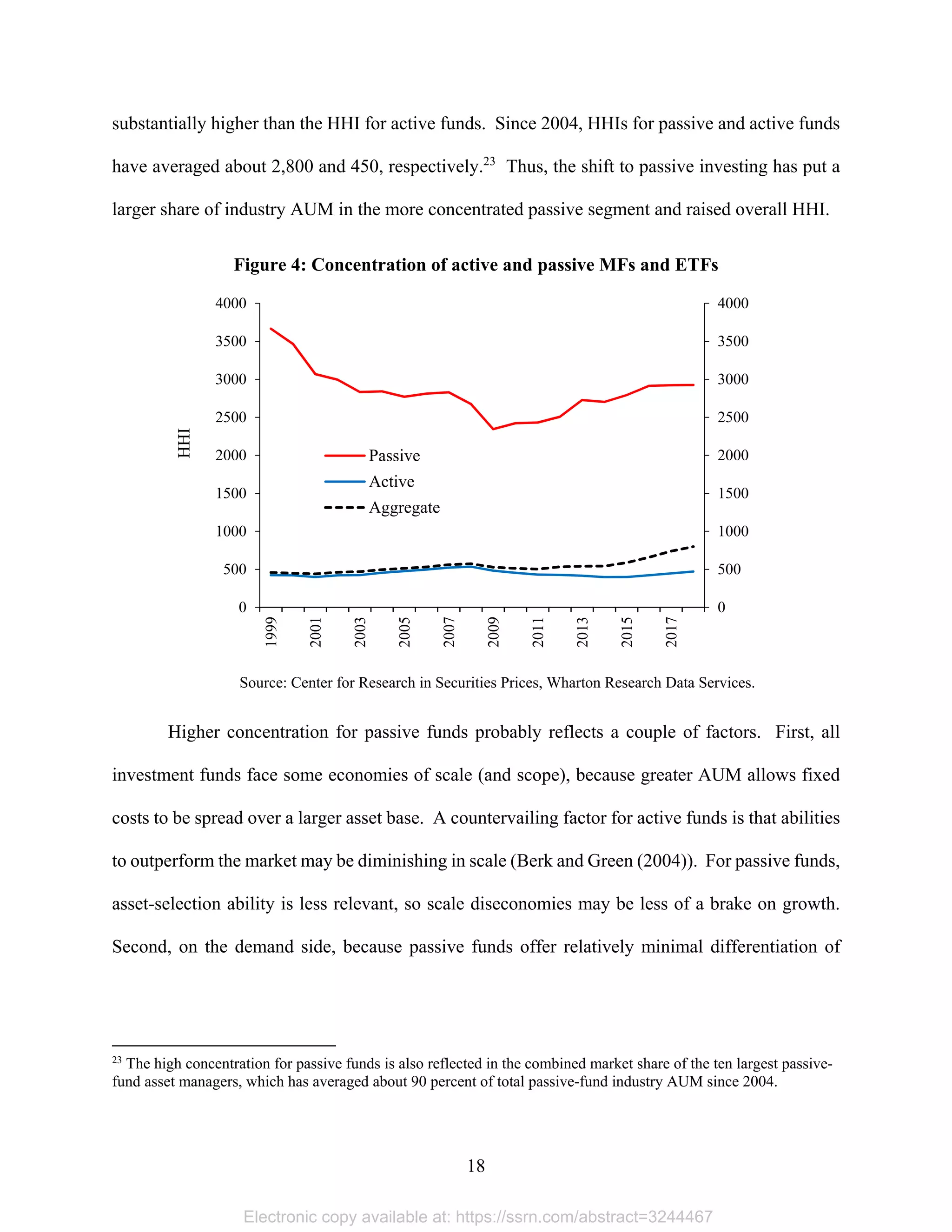

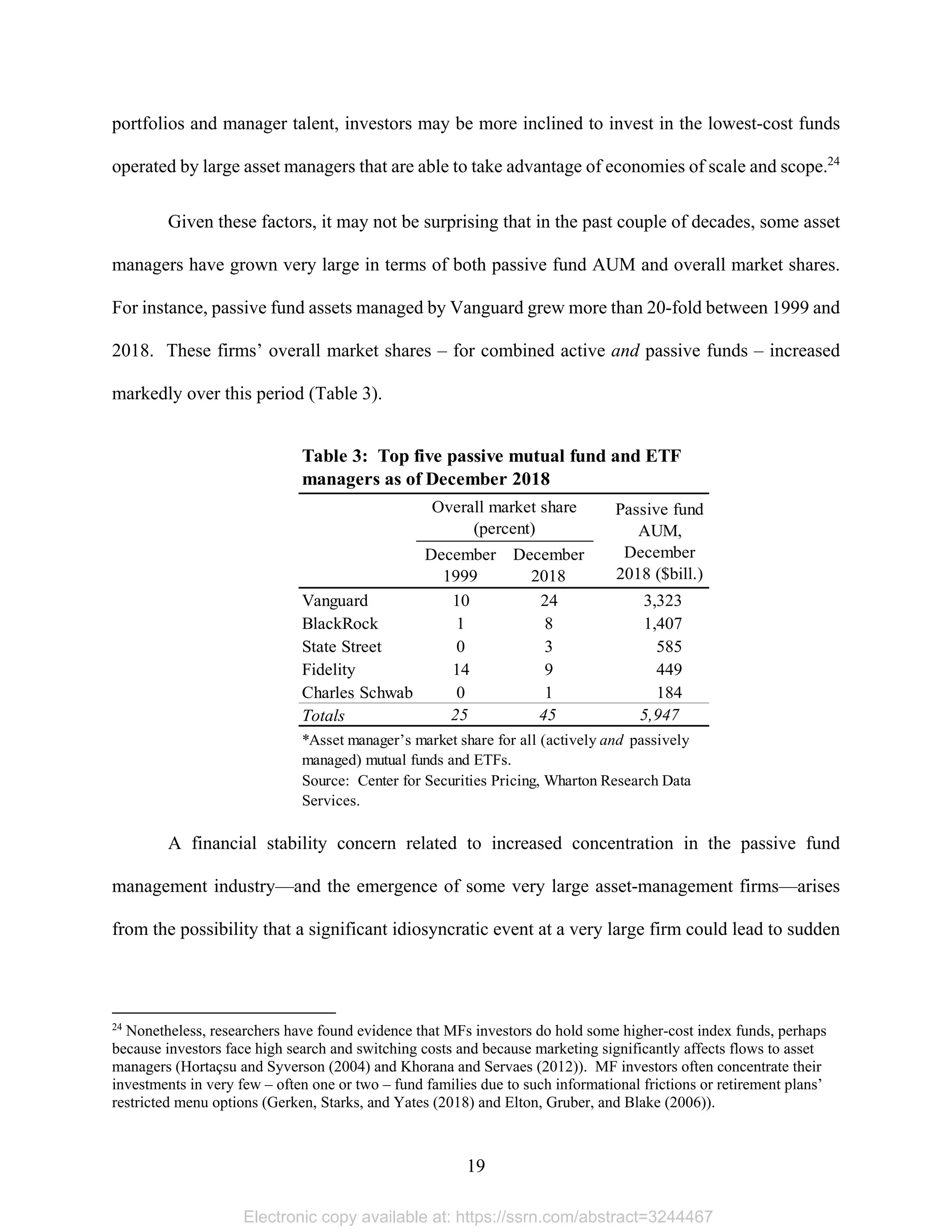

3) The shift has also increased asset management industry concentration, potentially exacerbating risks from operational problems at large firms.

4) Evidence is mixed on whether passive investing increases comovement of asset returns and liquidity through "index inclusion effects."