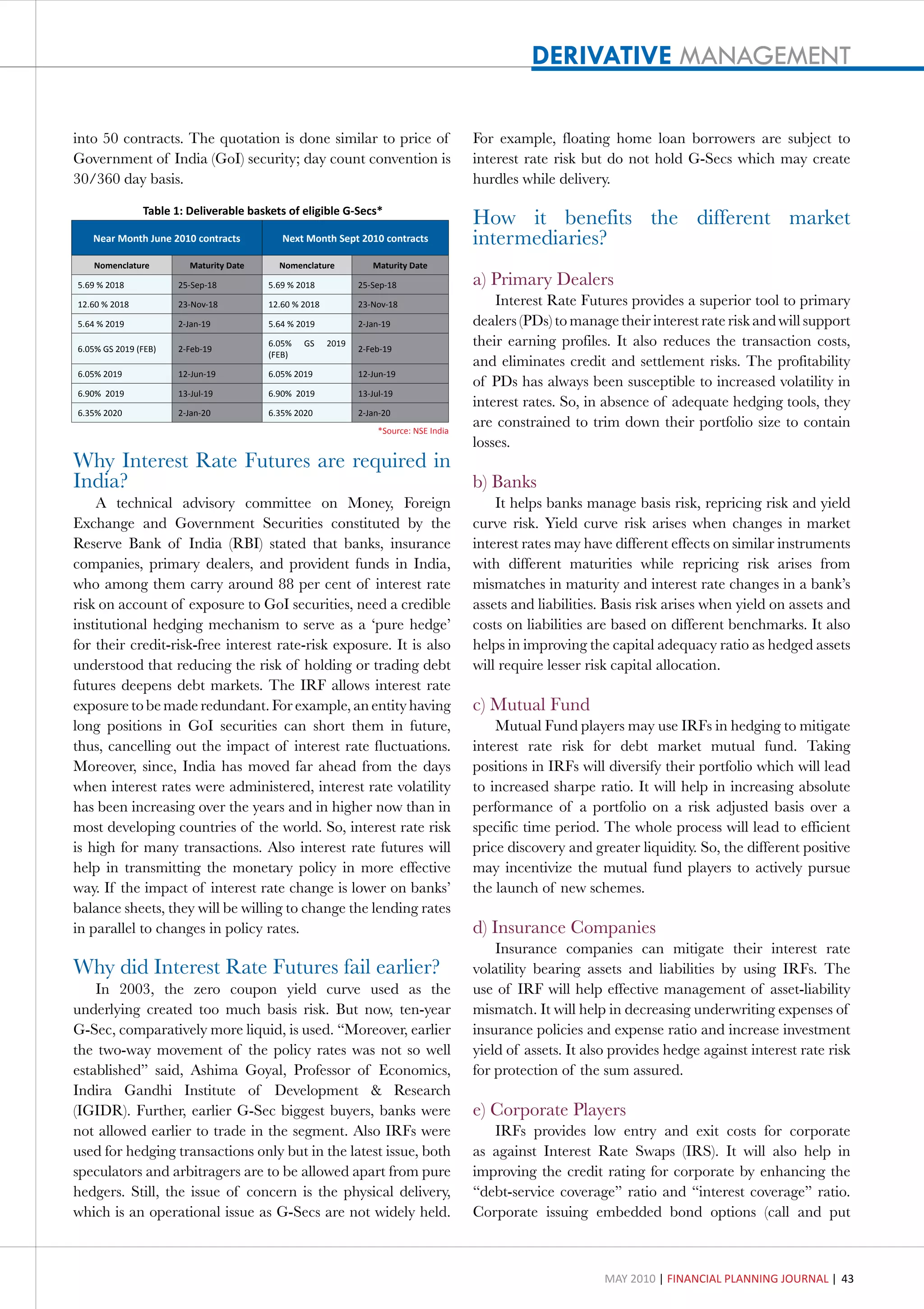

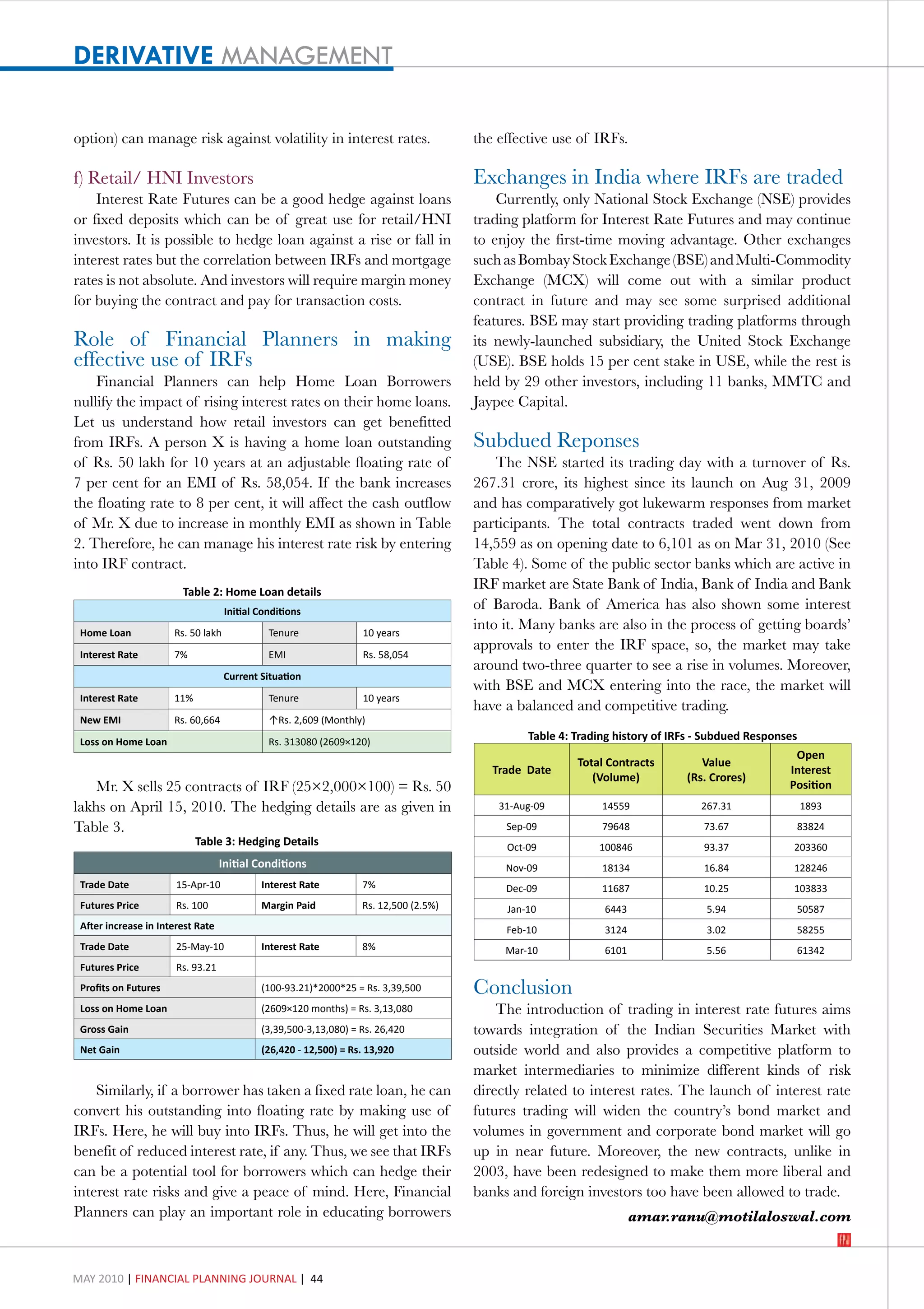

The document discusses interest rate futures (IRFs) as a financial instrument introduced in India to help various market participants, including banks and mutual funds, manage interest rate risks. It highlights how IRFs serve as hedging tools, the reasons for their prior failures, and their potential benefits for different financial players, including individual investors. Additionally, it emphasizes the role of financial planners in guiding borrowers on using IRFs to mitigate the impact of rising interest rates on loans.