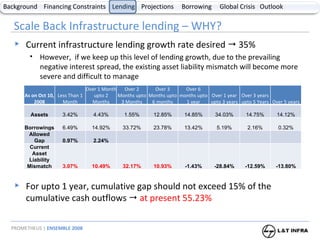

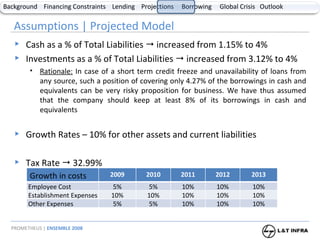

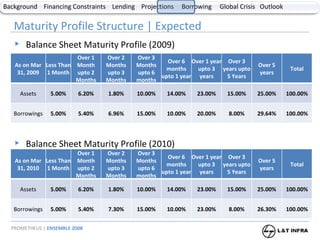

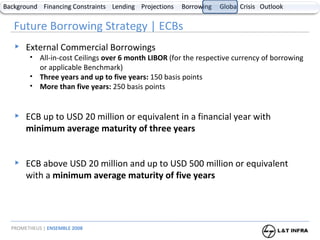

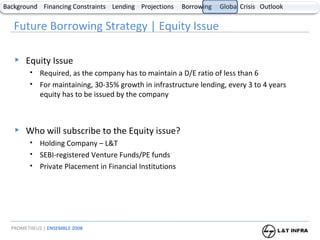

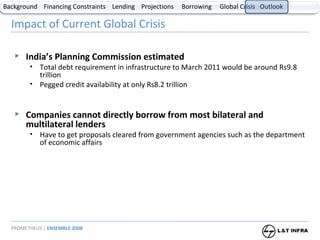

The document discusses infrastructure financing in India, outlining constraints such as inadequate long-term funds and shallow capital markets. It analyzes the current treasury management strategy of borrowing short-term while lending long-term, noting issues caused by an inverted yield curve. Projections are made to scale back infrastructure lending growth to 25% in the first year and 30% in the second year. Revisions to the sources of funds and future borrowing strategies involving debt issues, ECBs, and equity issues are proposed.