Embed presentation

Download to read offline

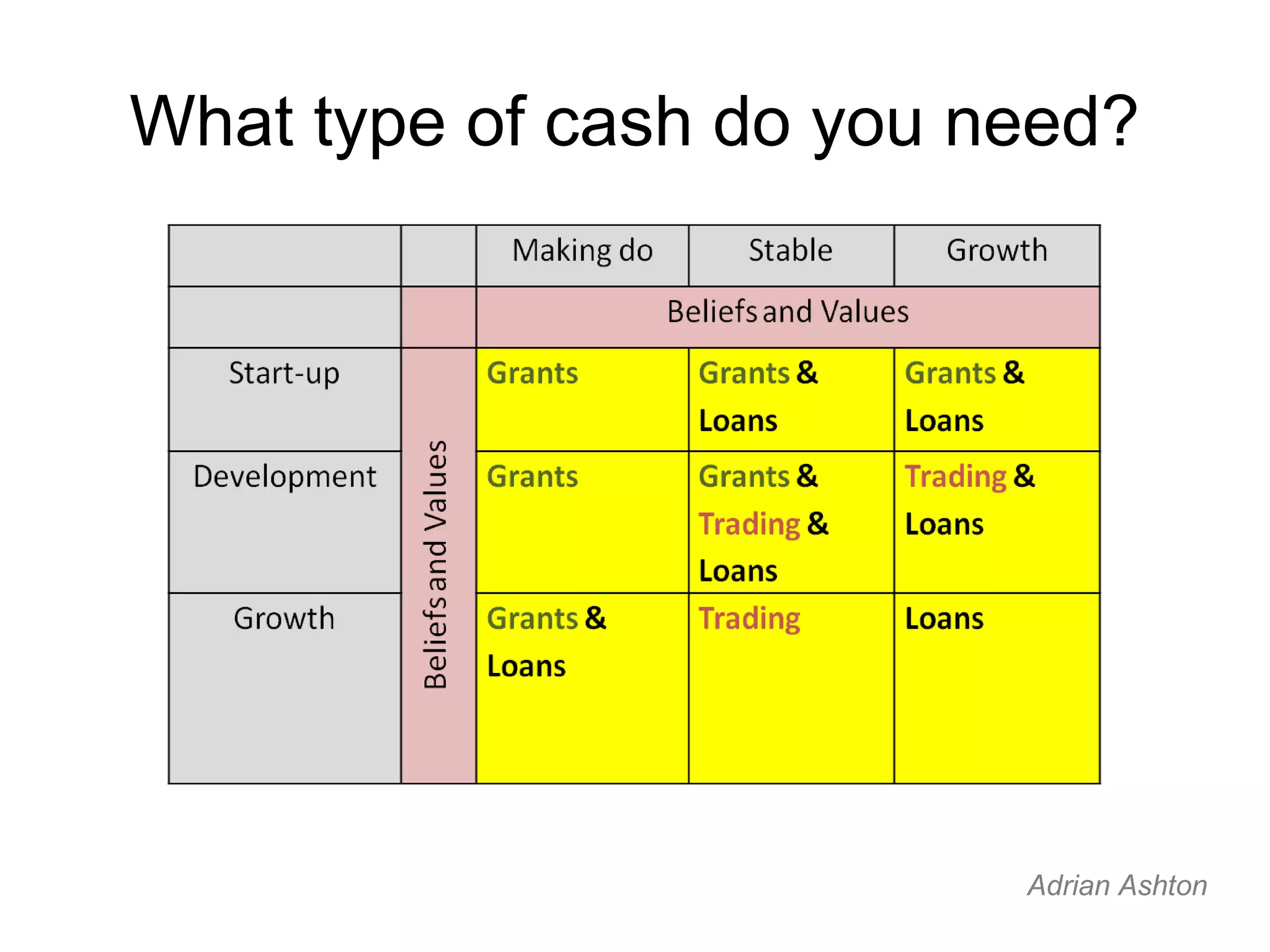

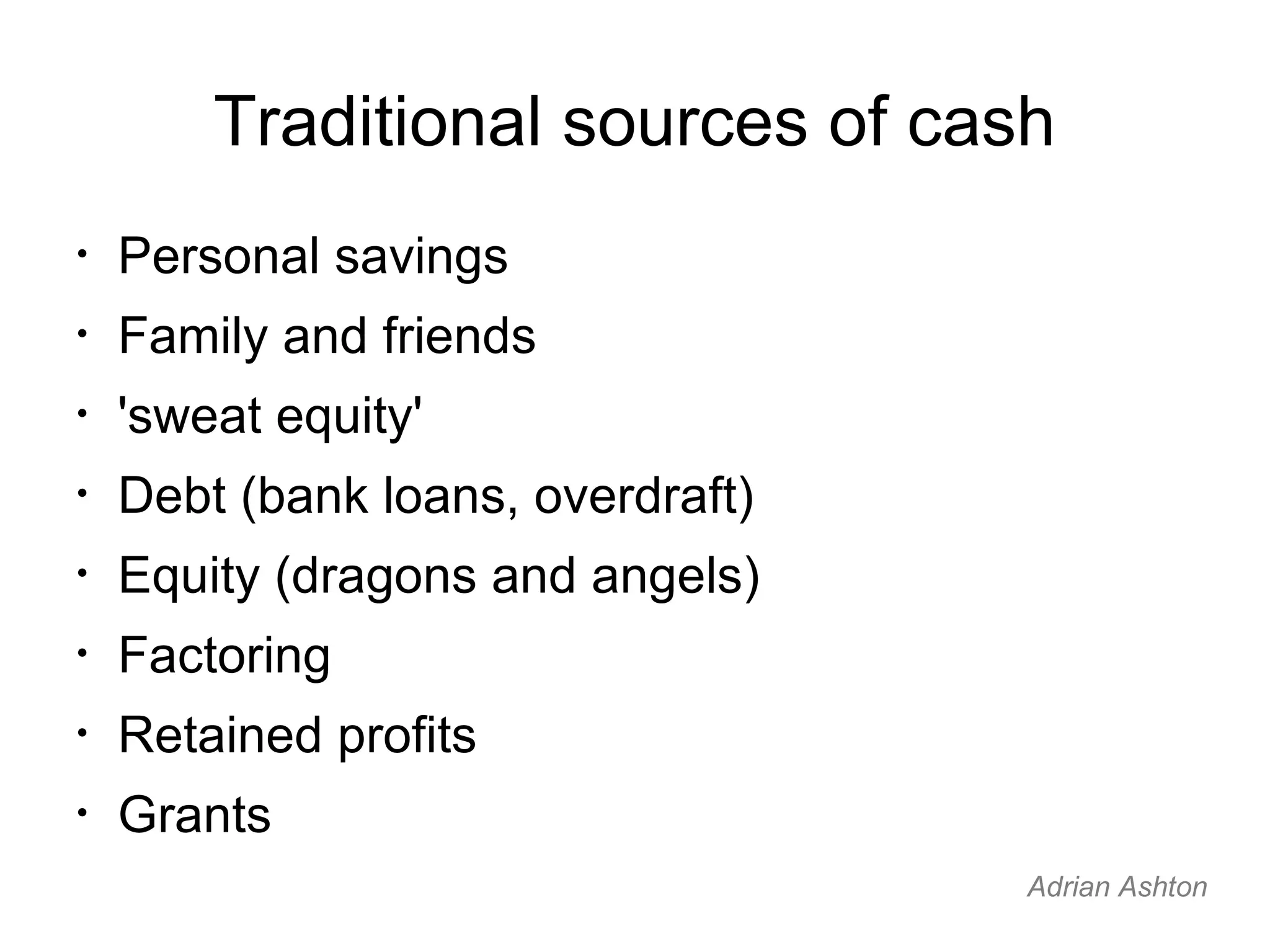

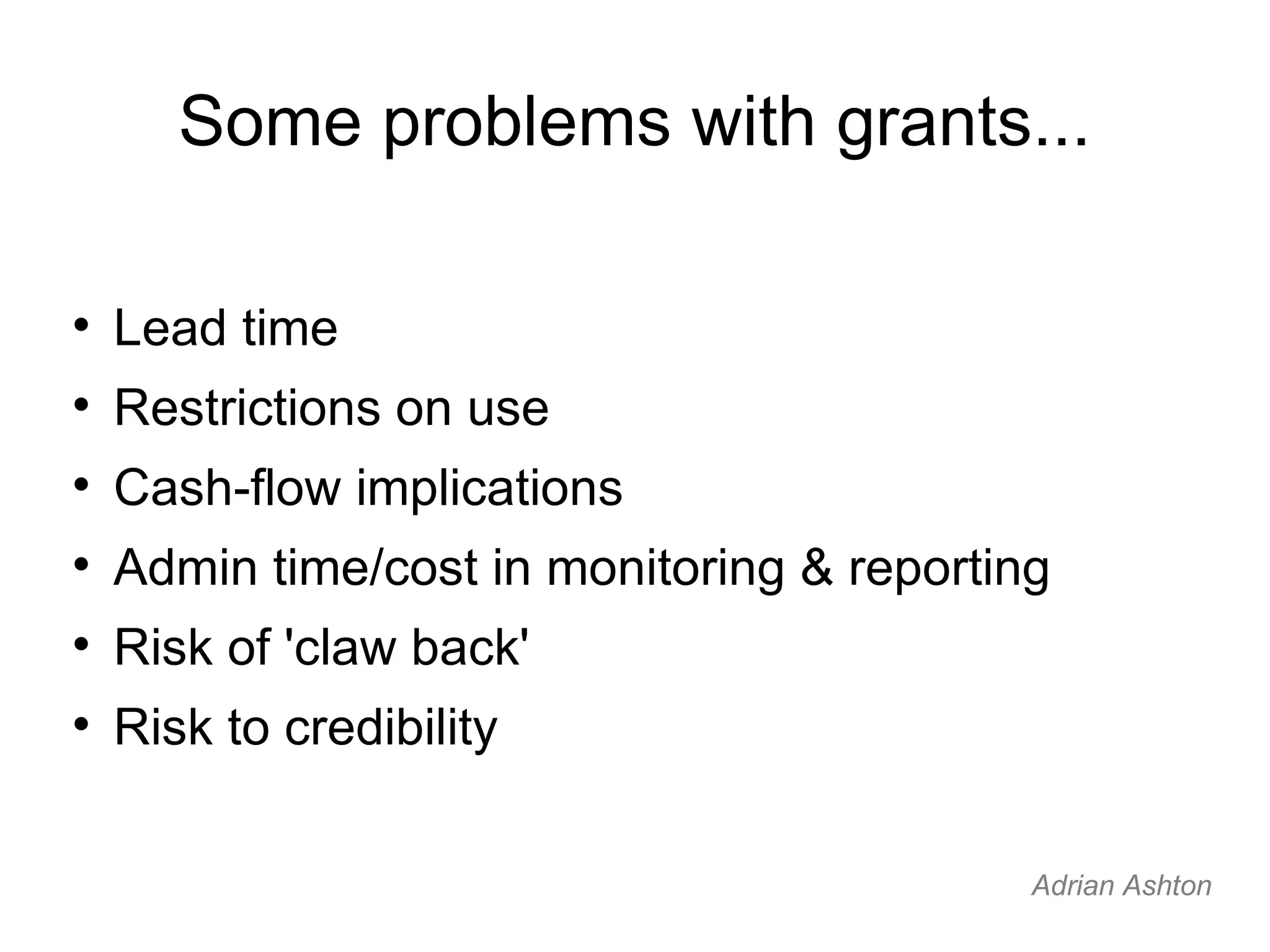

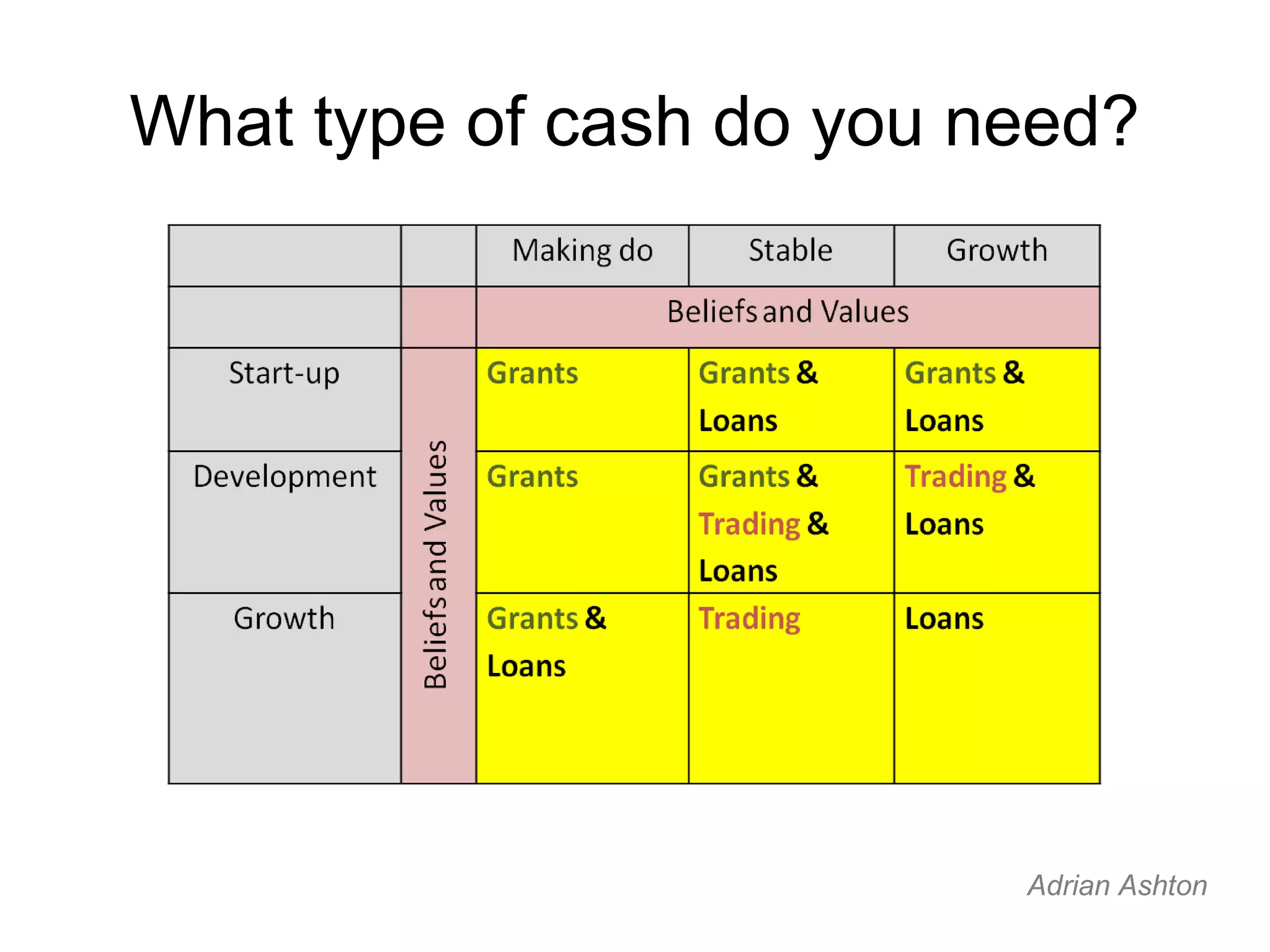

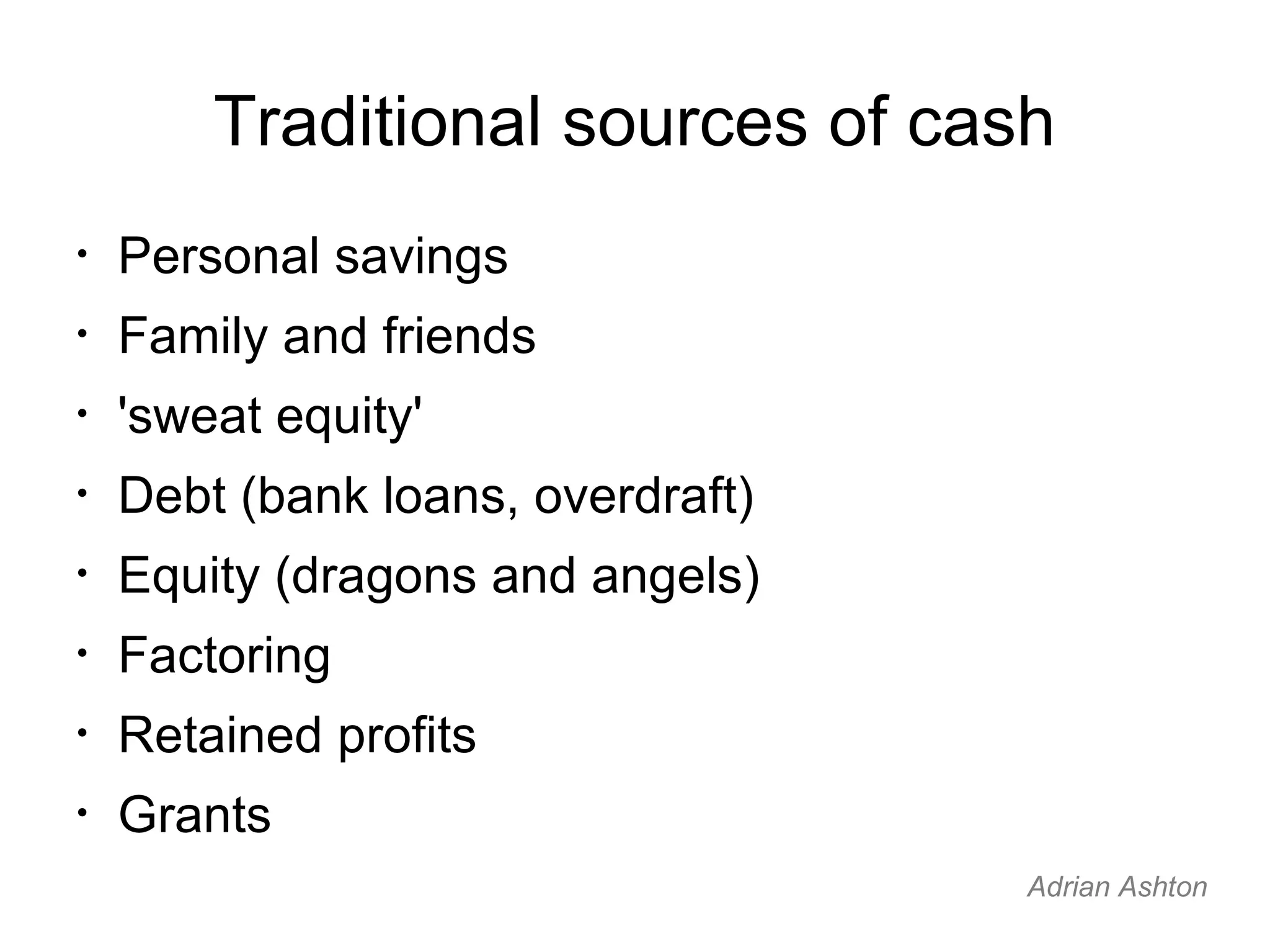

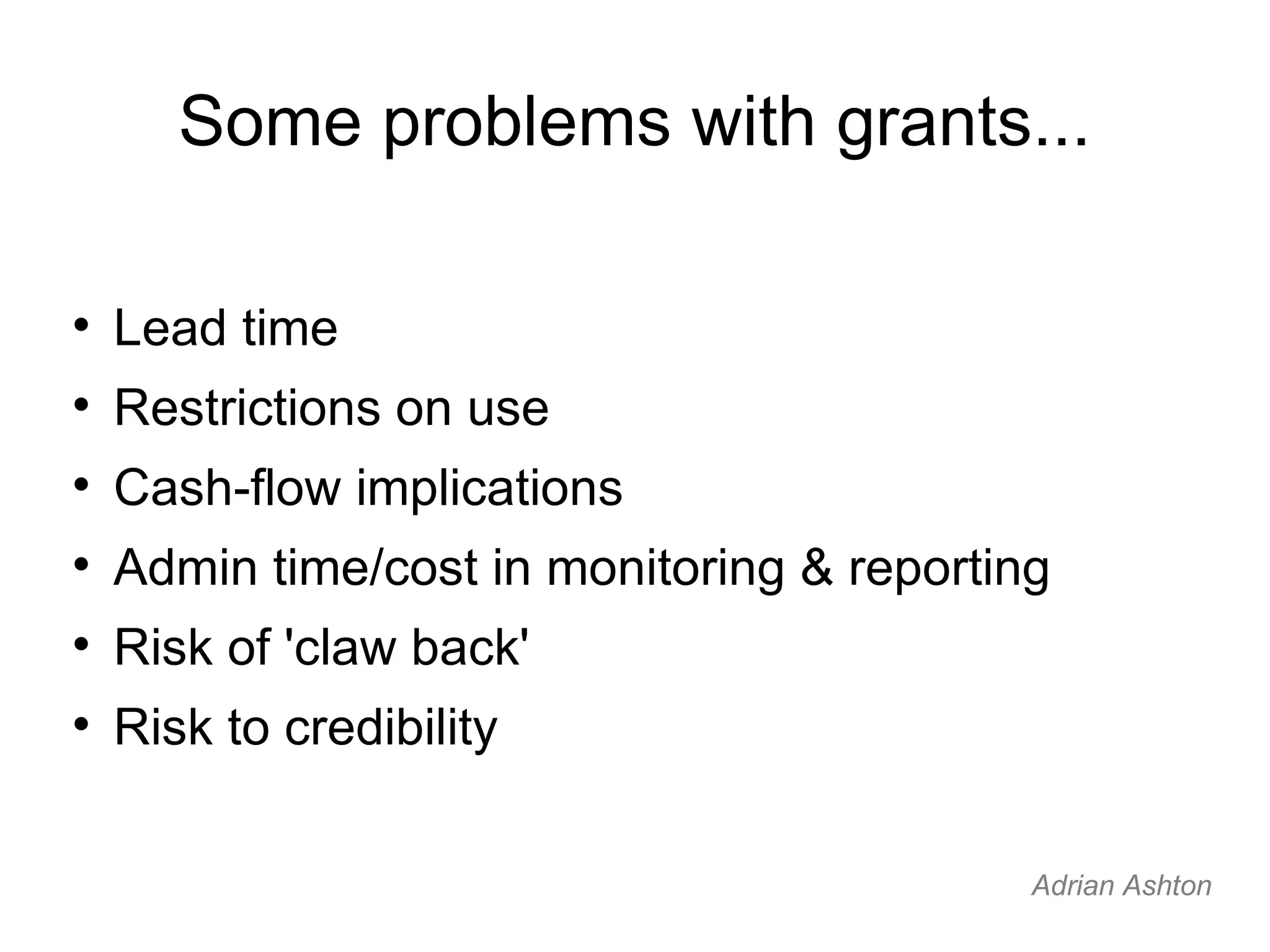

This document discusses different sources of financing for social enterprises, including traditional sources like personal savings, loans, equity, and grants. It also covers "social enterprise specials" like community shares, social impact bonds, and loan stock. While grants can help with validation and development, they have downsides like restrictions, cash flow issues, and reporting requirements. The document emphasizes that financing alone cannot ensure an enterprise's success and provides additional resources for information.