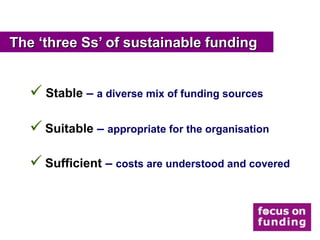

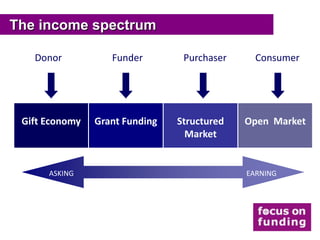

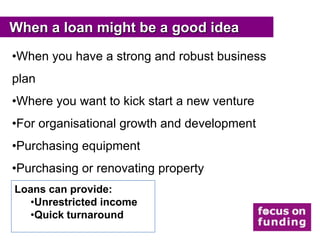

The document outlines key strategies for sustainable funding in social enterprises, emphasizing the importance of stable, suitable, and sufficient funding sources. It discusses various income streams such as grants, loans, and equity financing, and highlights conditions when loans may be appropriate. To effectively access funding, social enterprises should have clear structures, missions, and comprehensive planning in place.