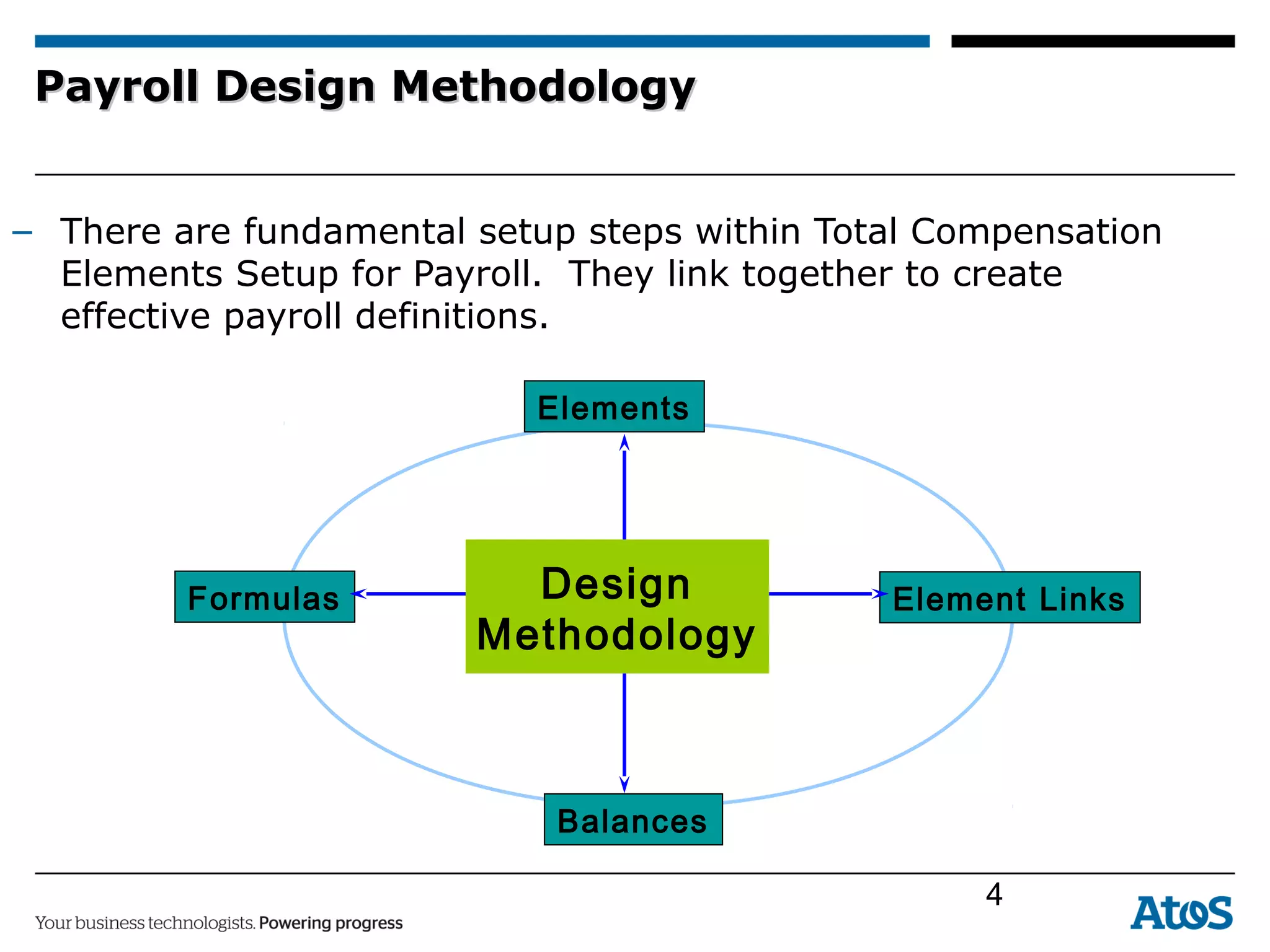

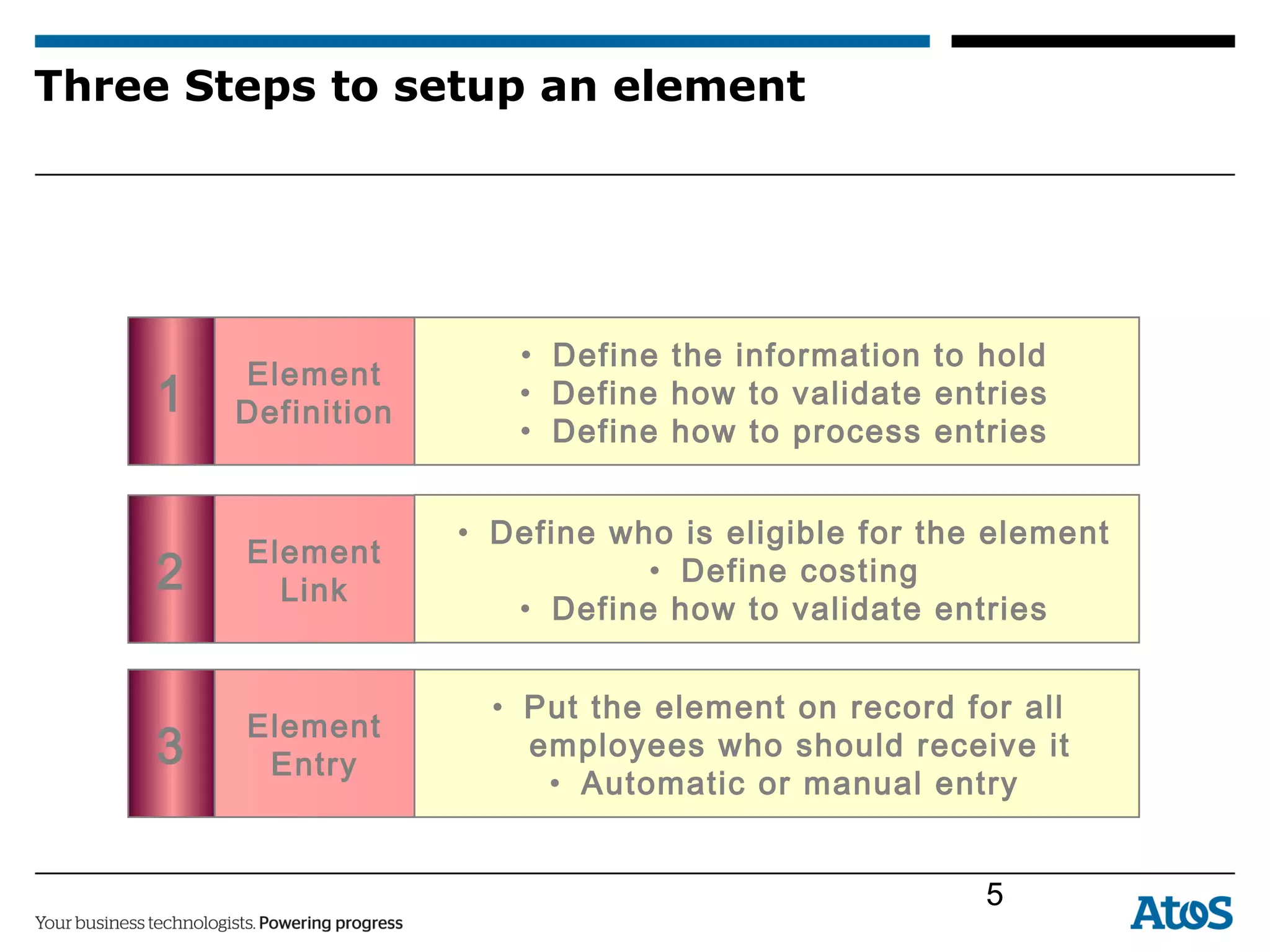

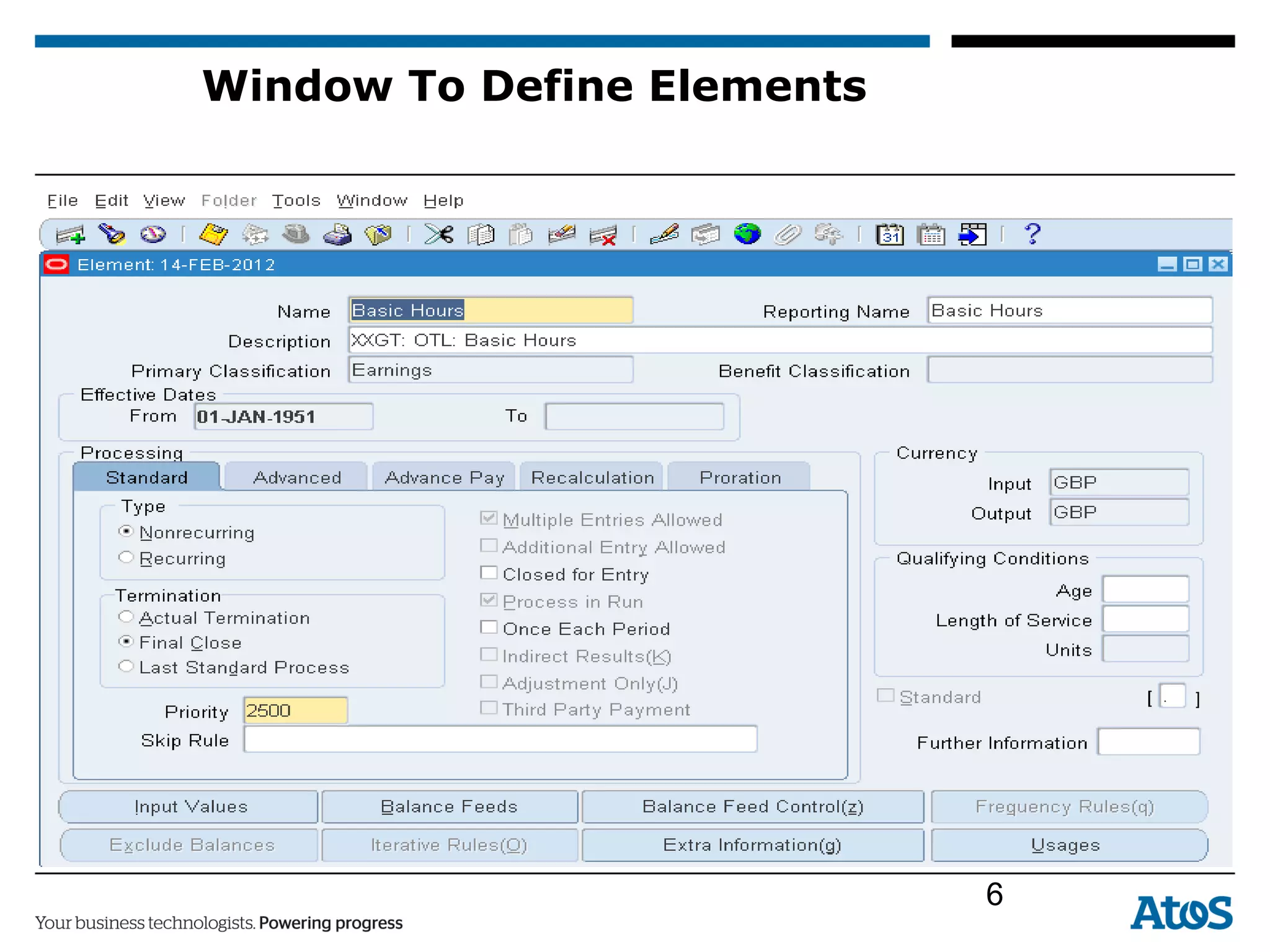

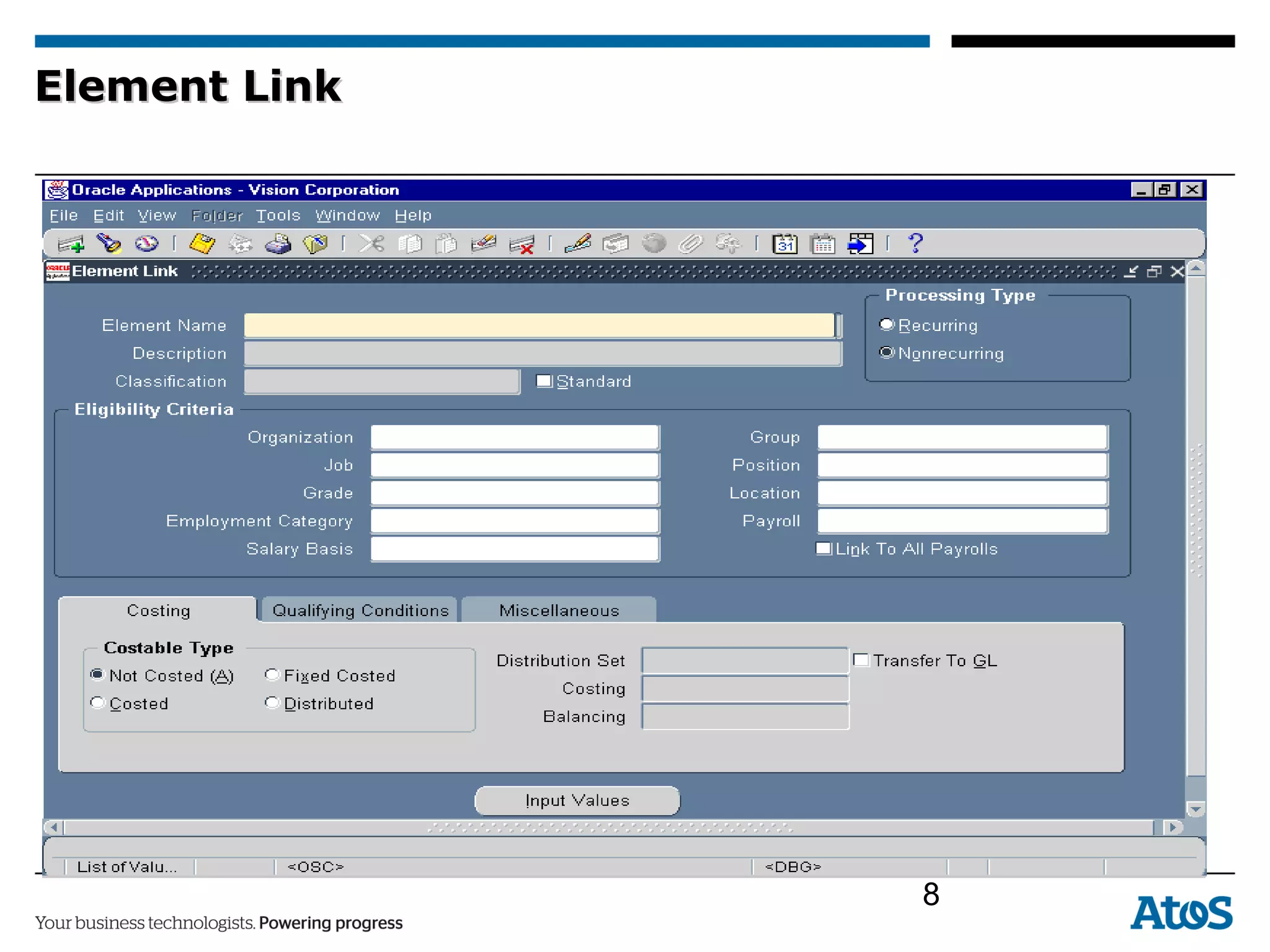

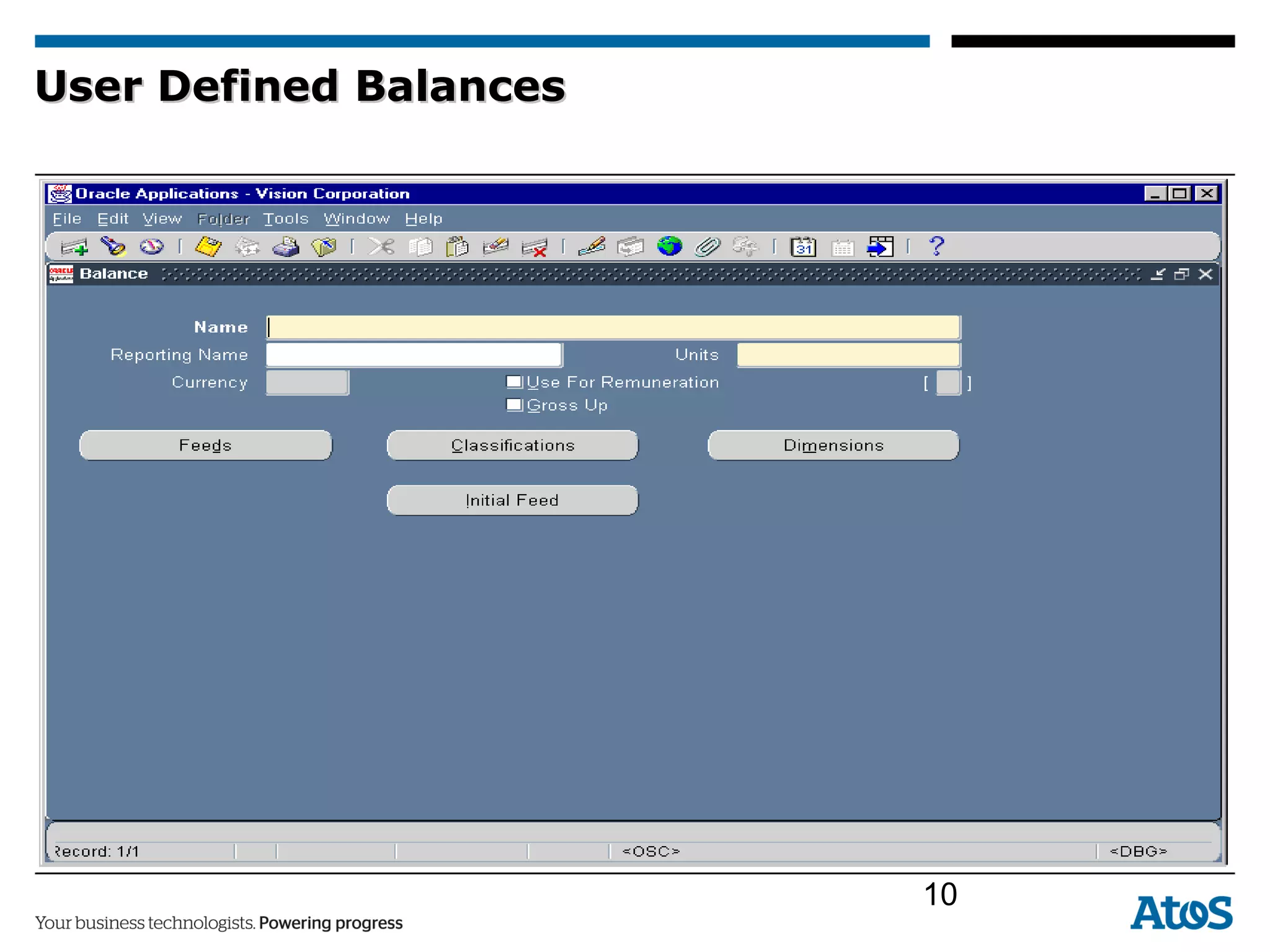

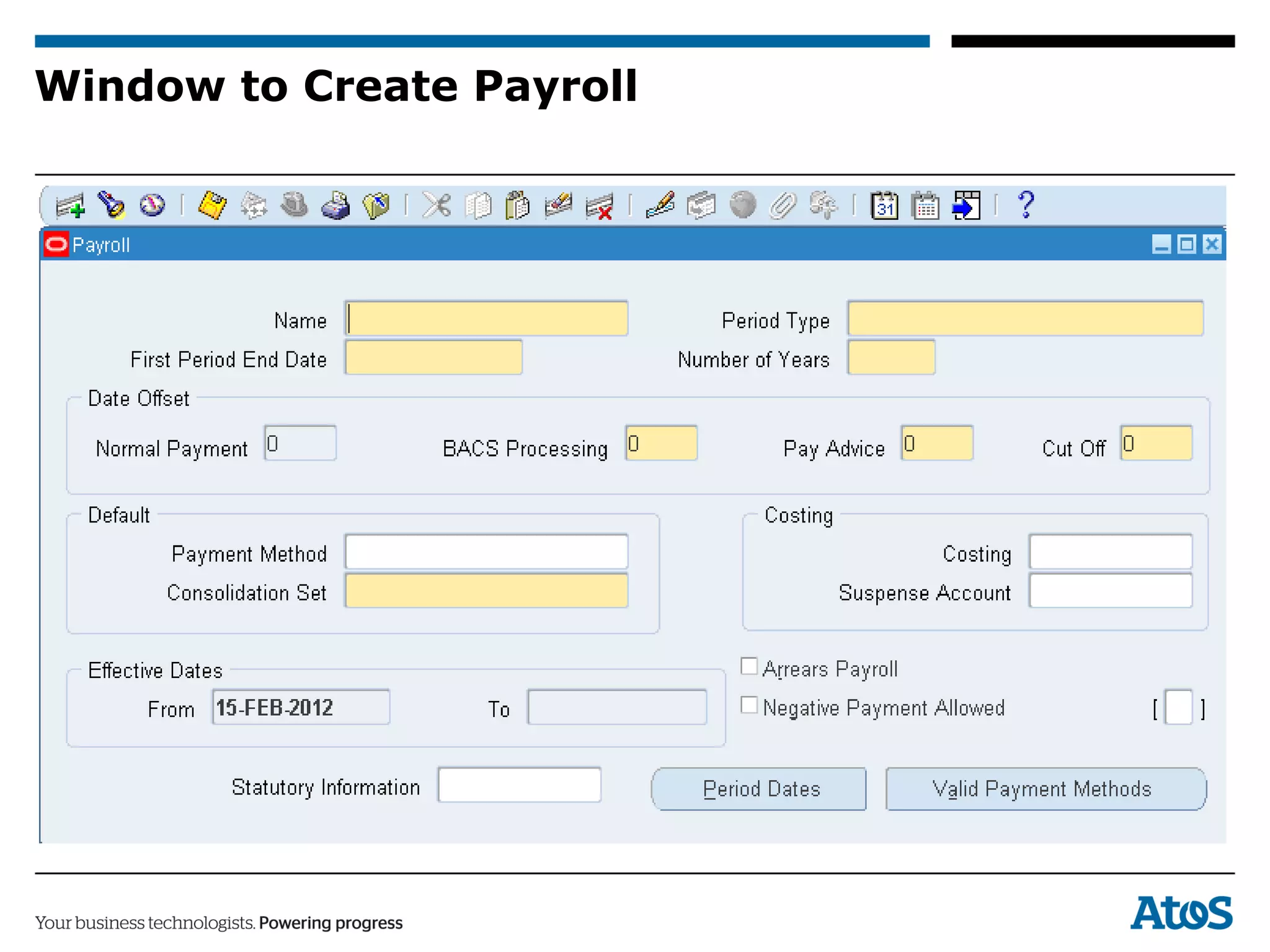

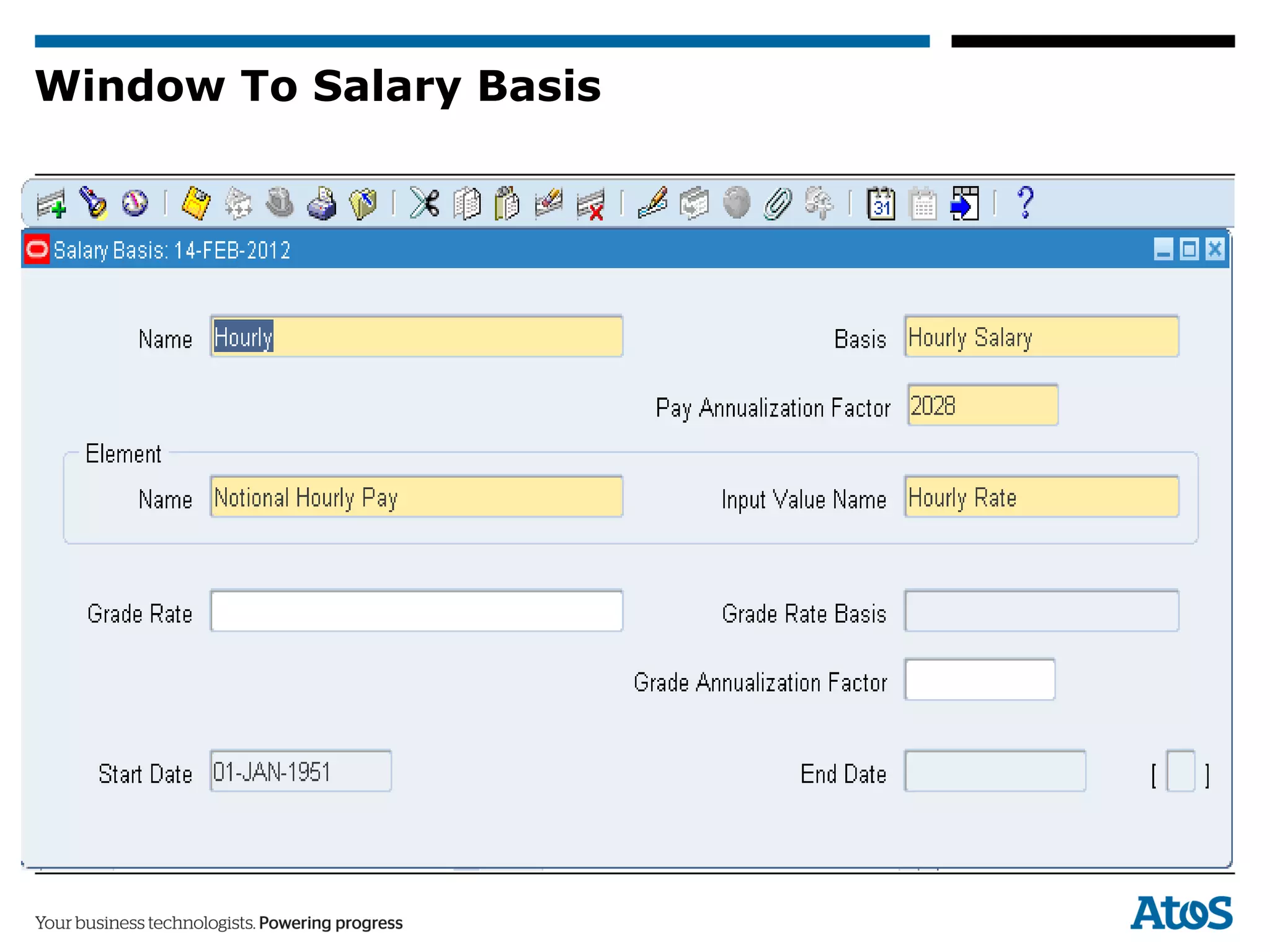

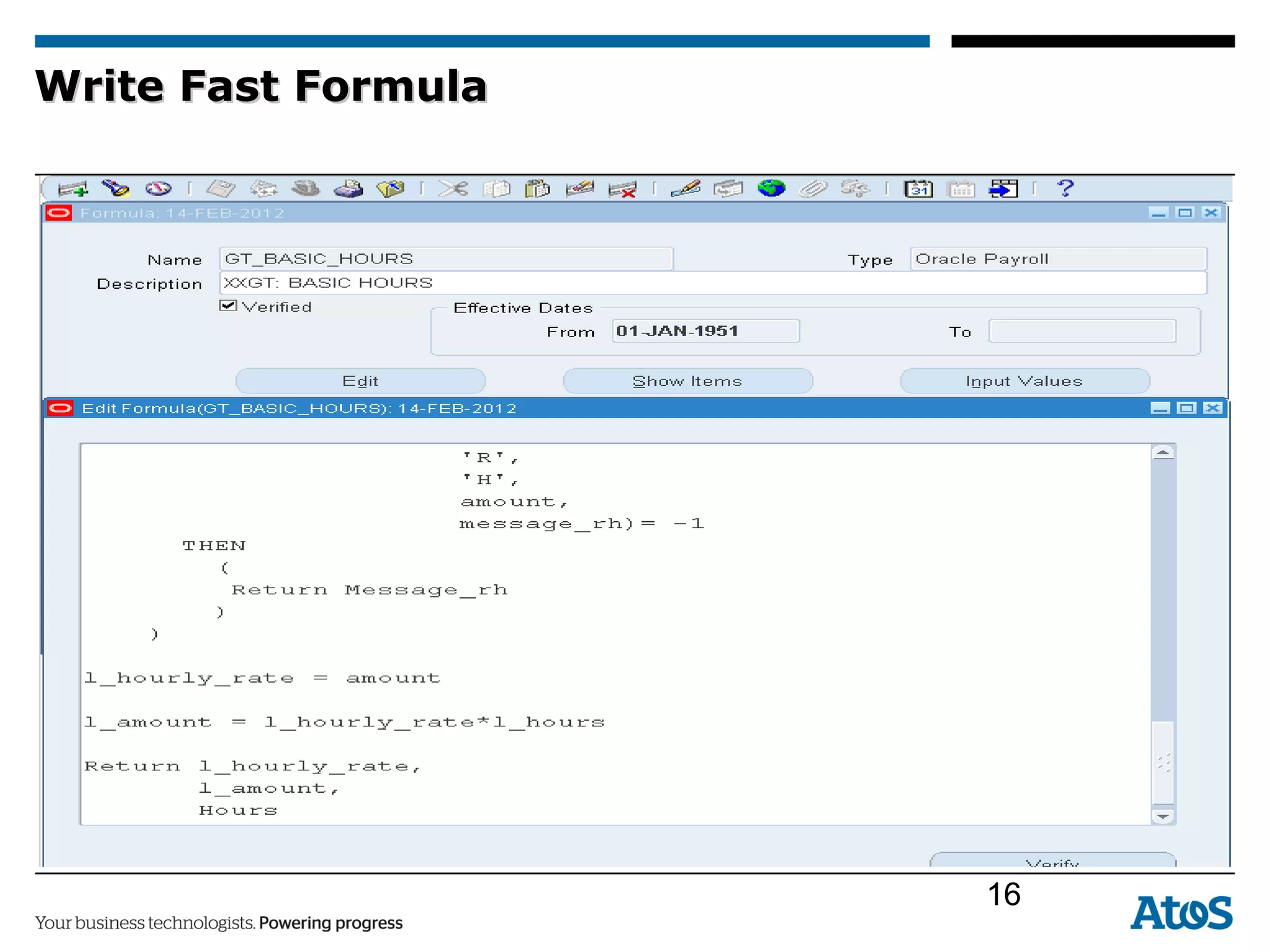

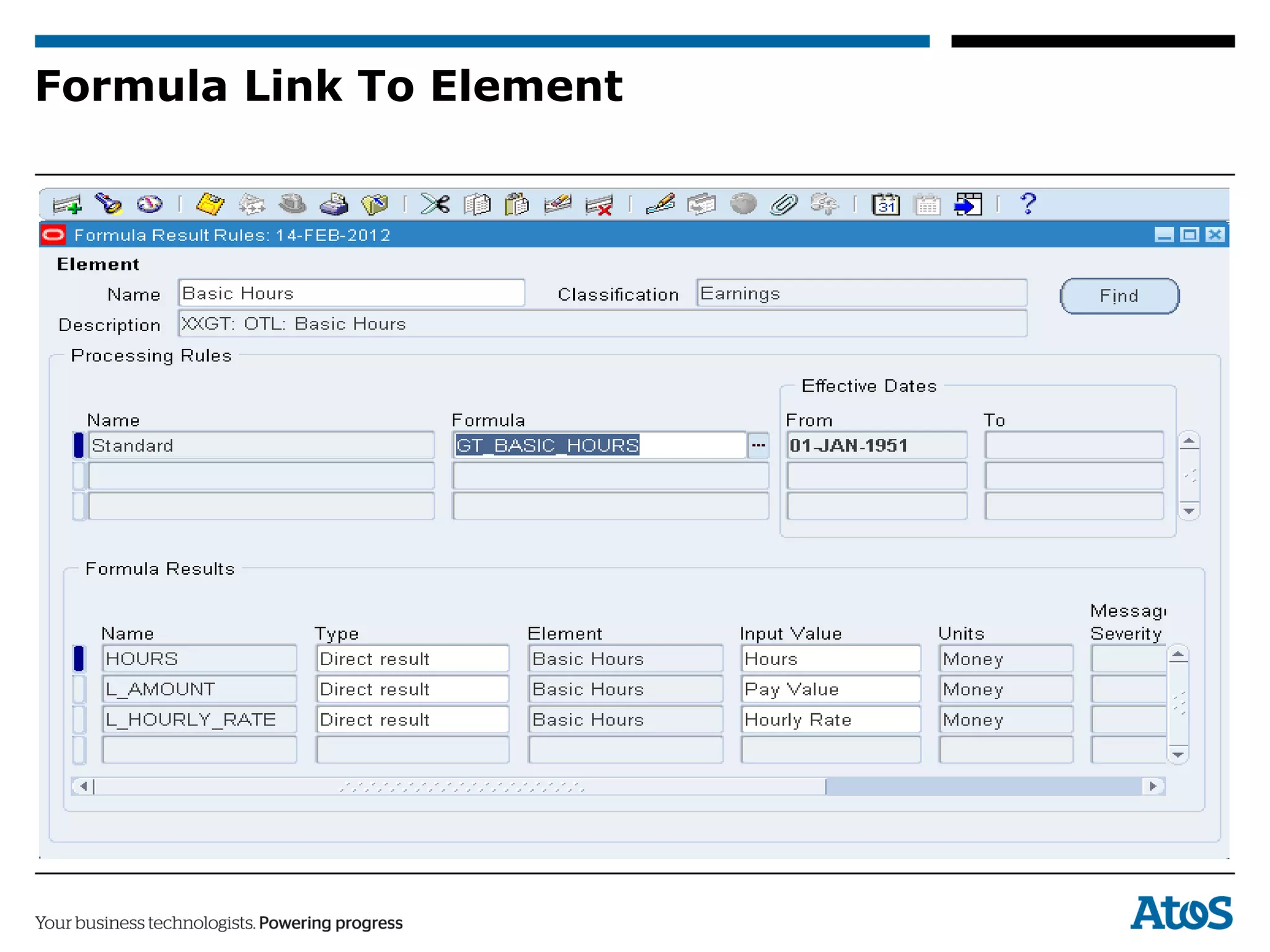

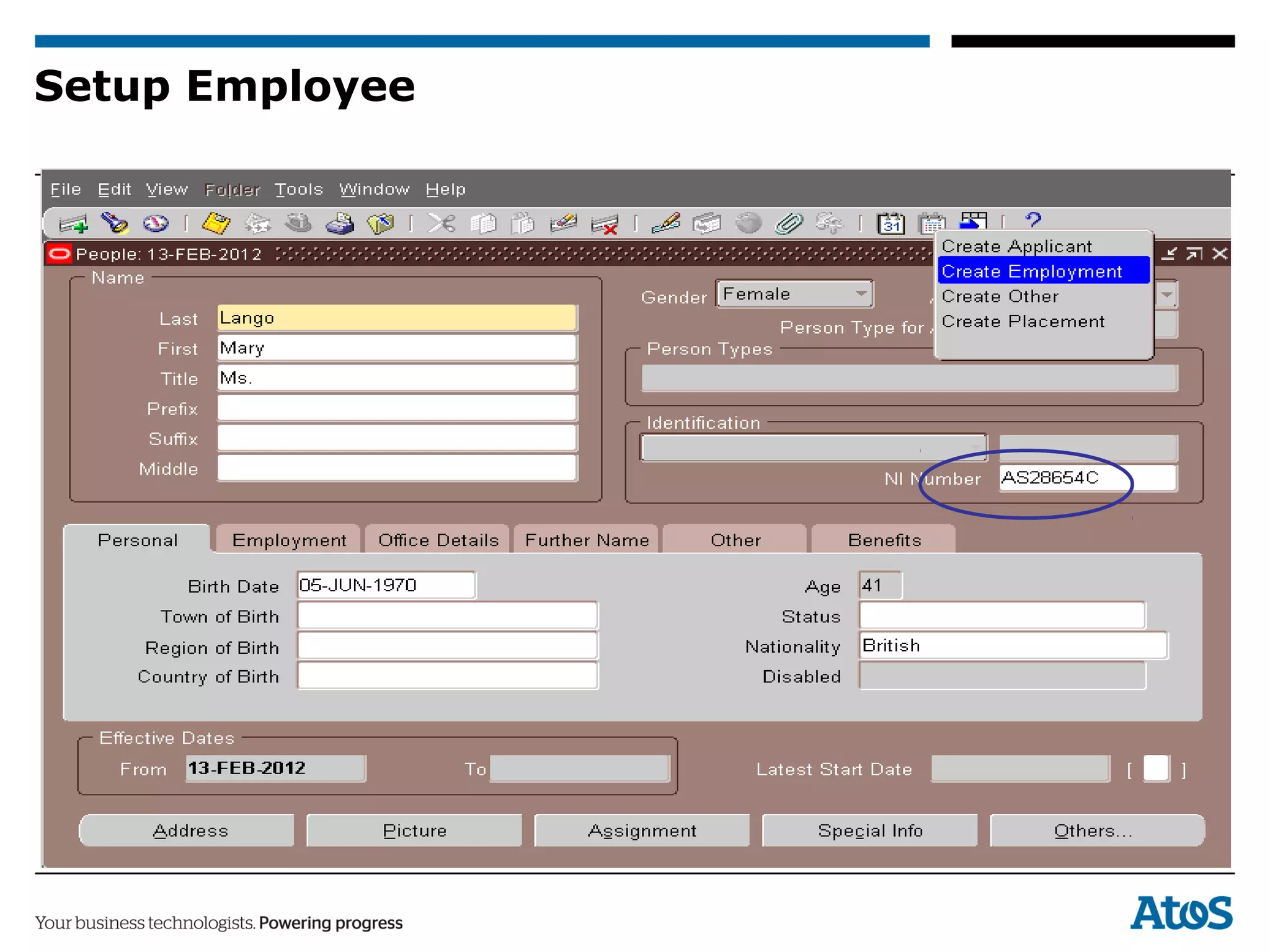

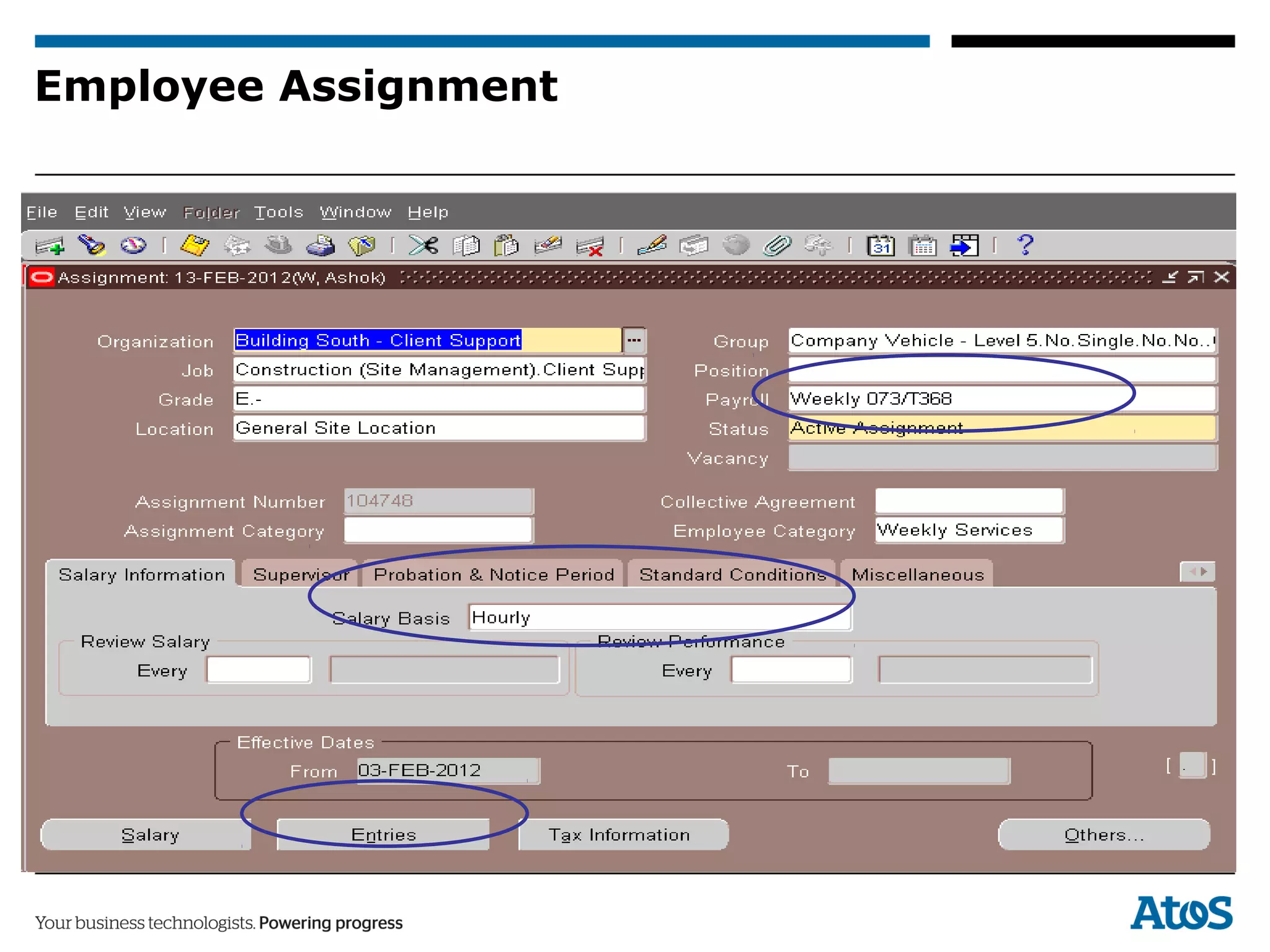

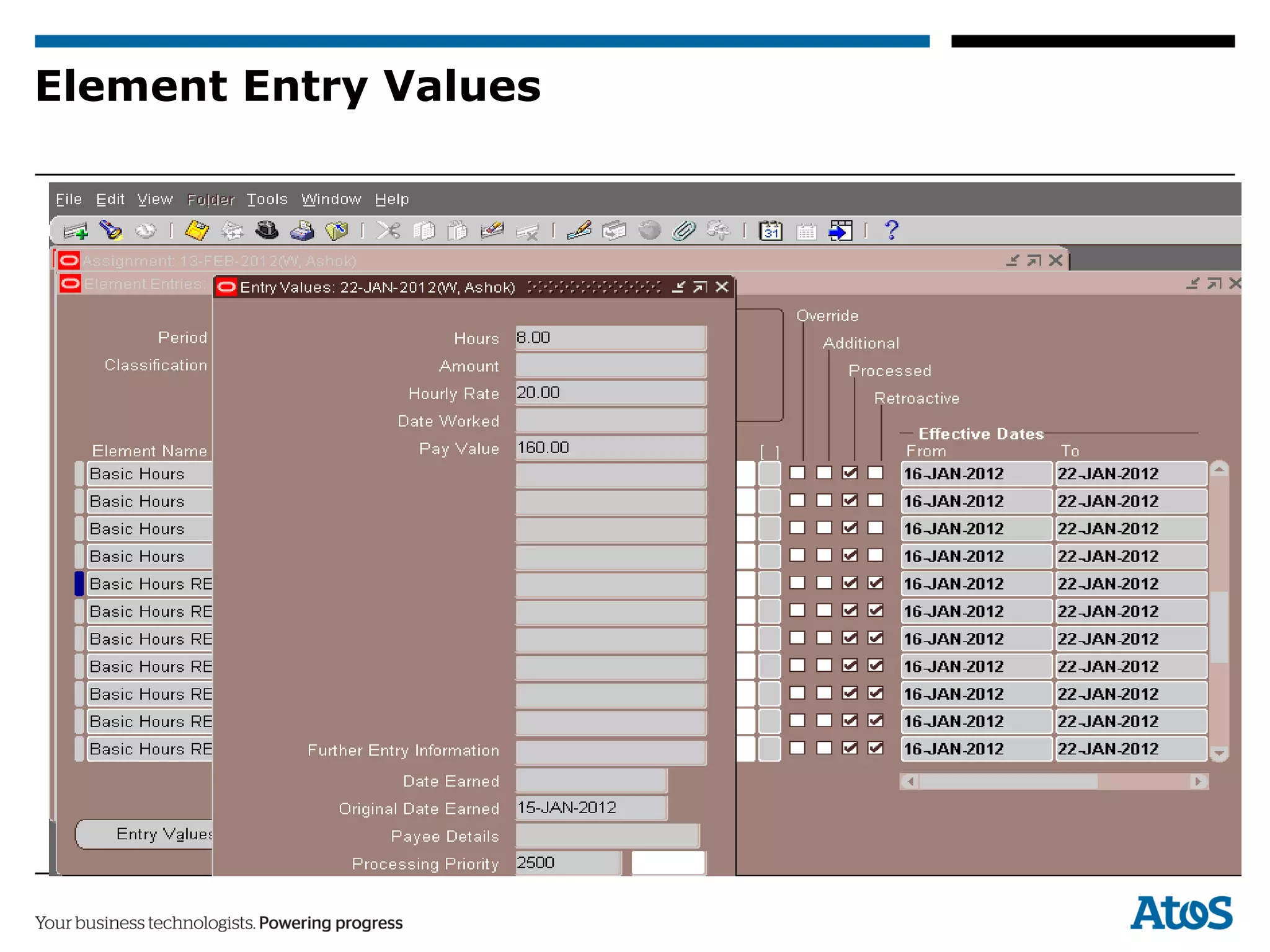

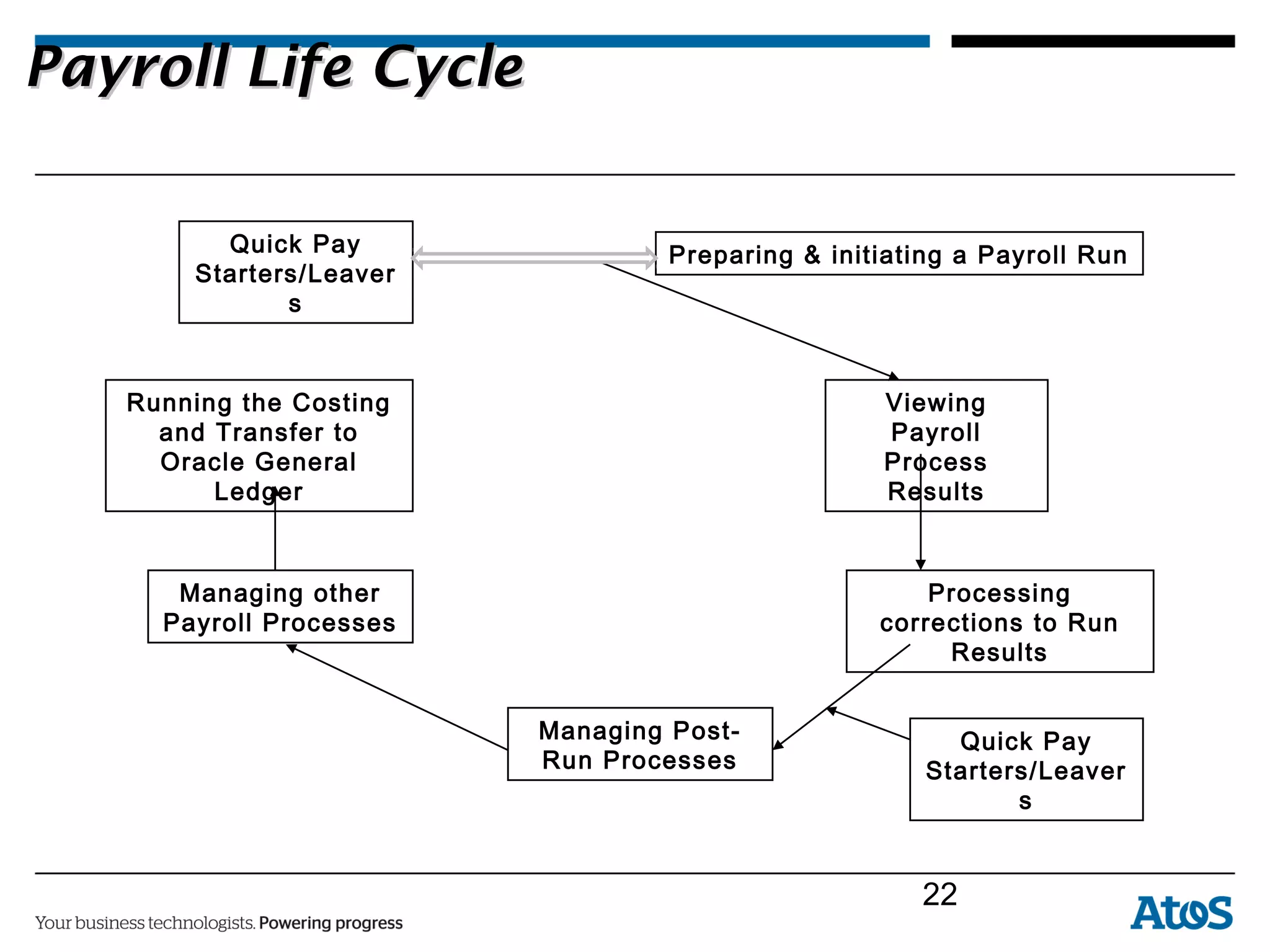

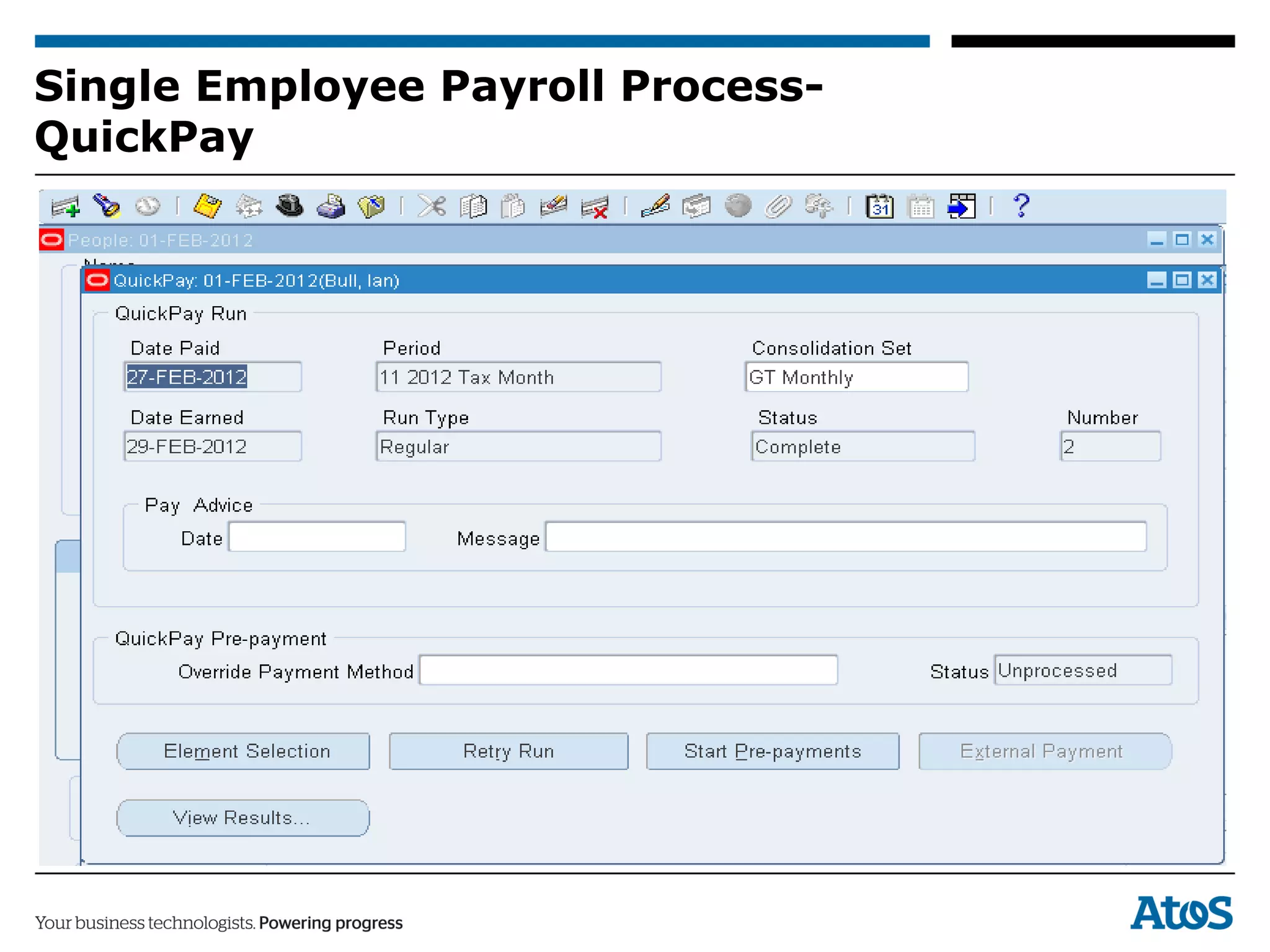

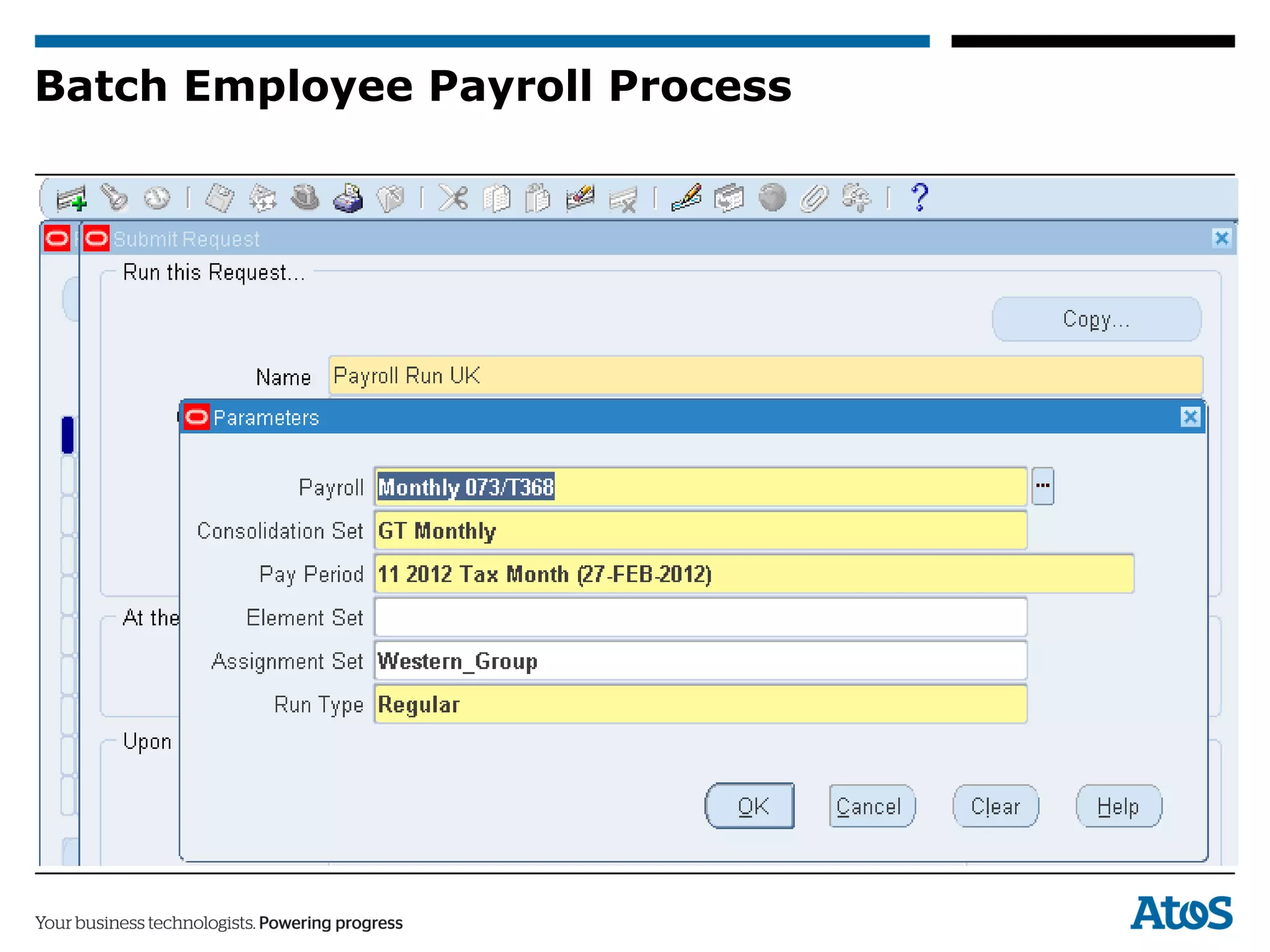

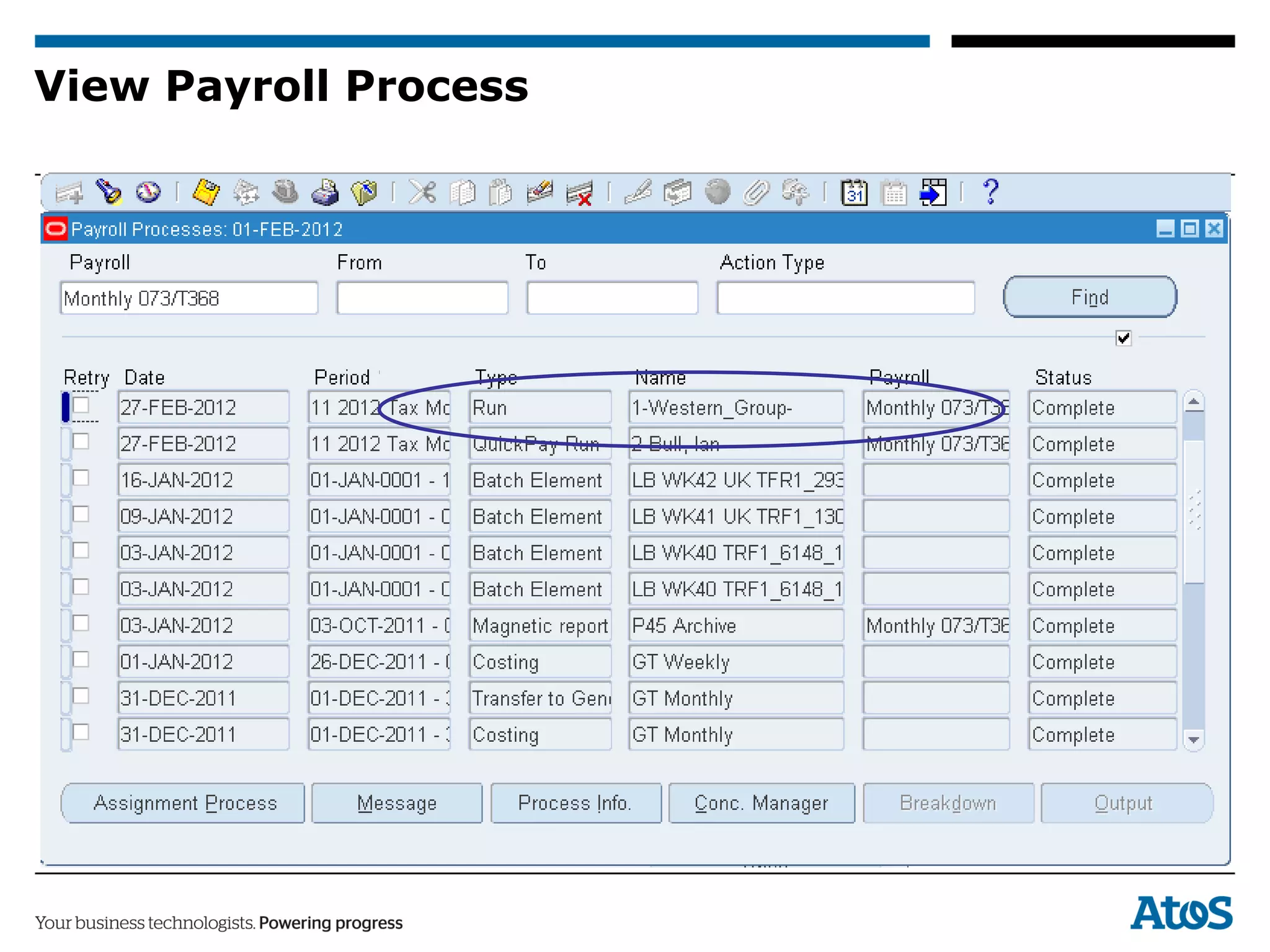

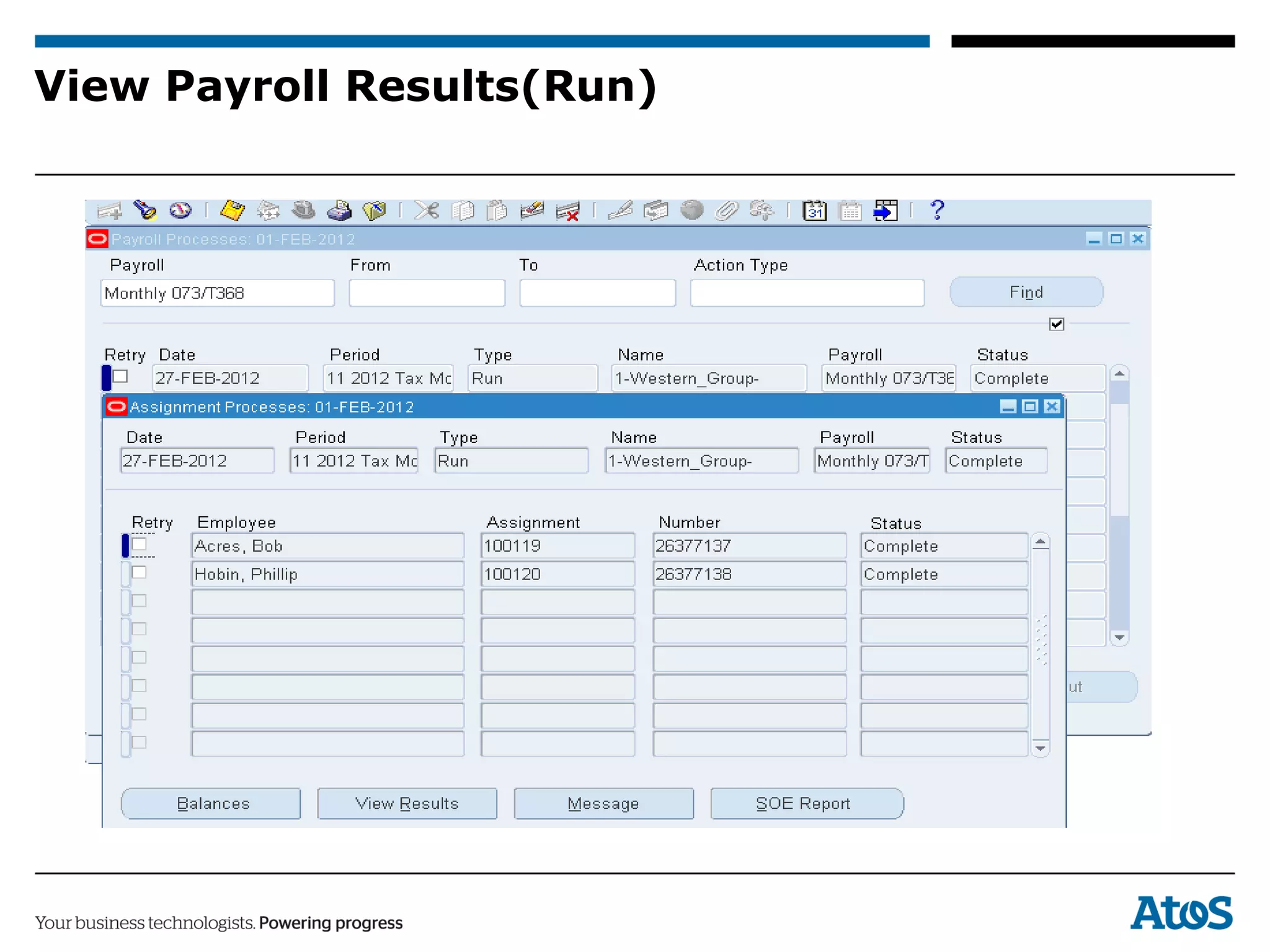

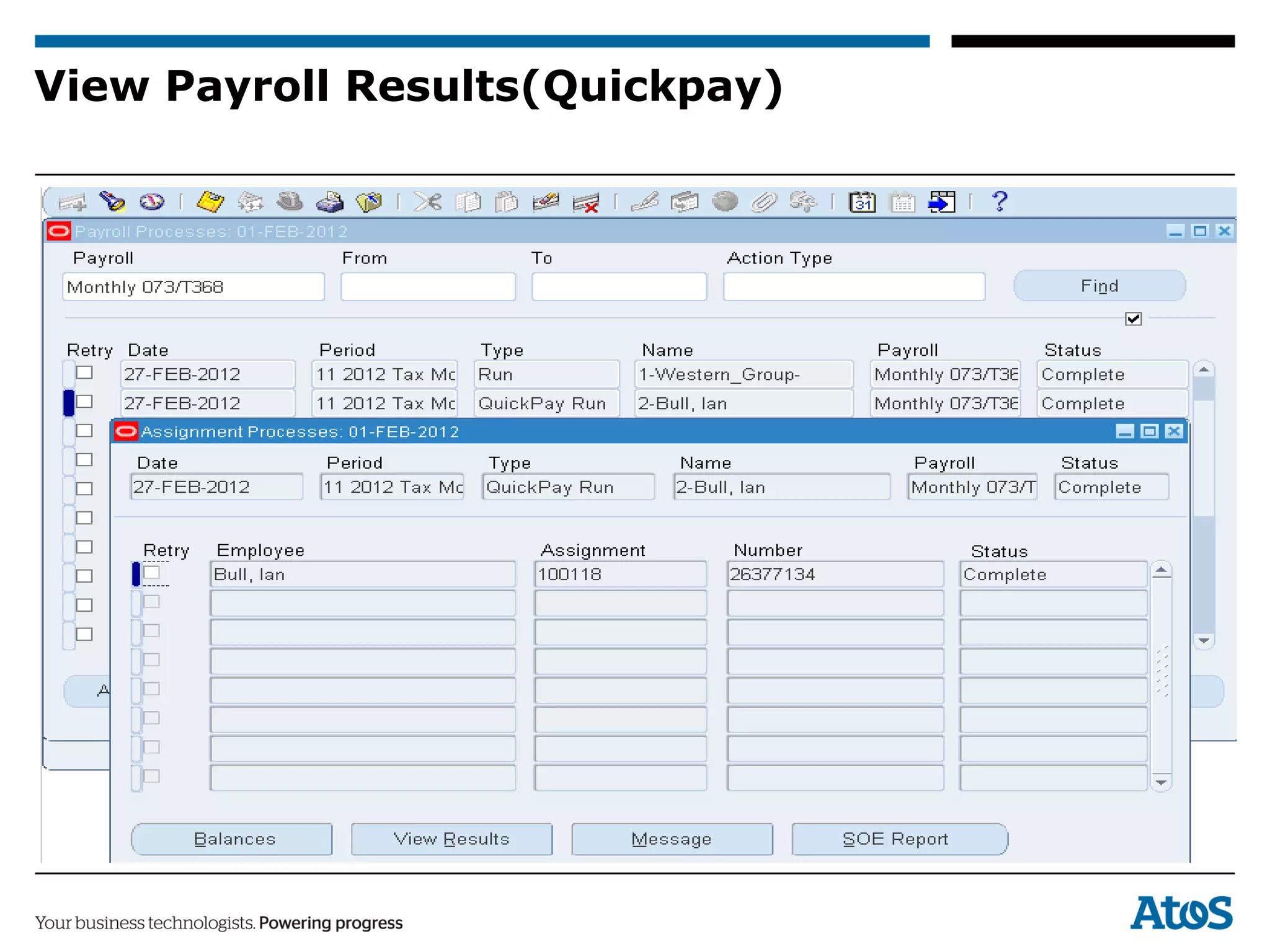

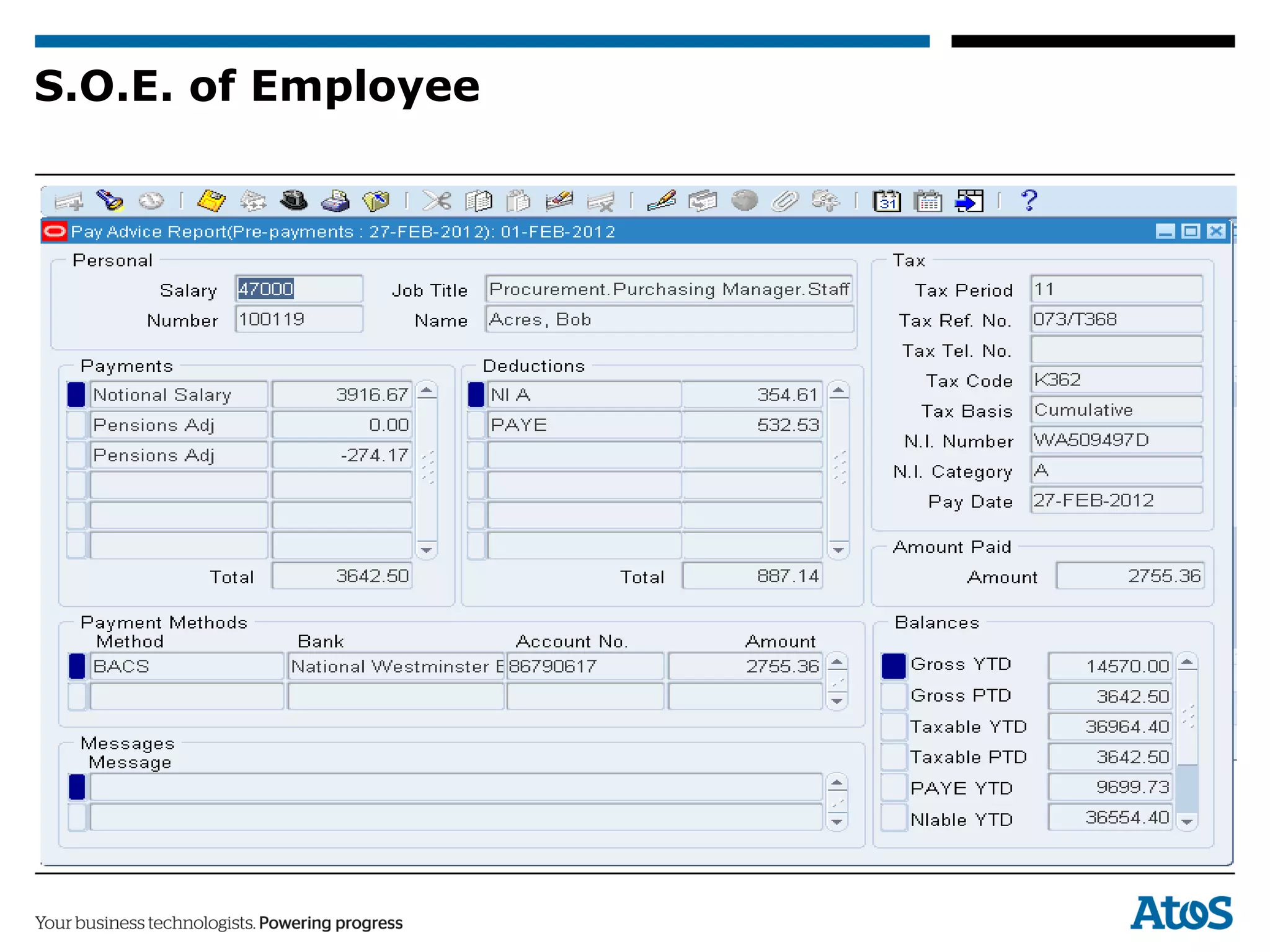

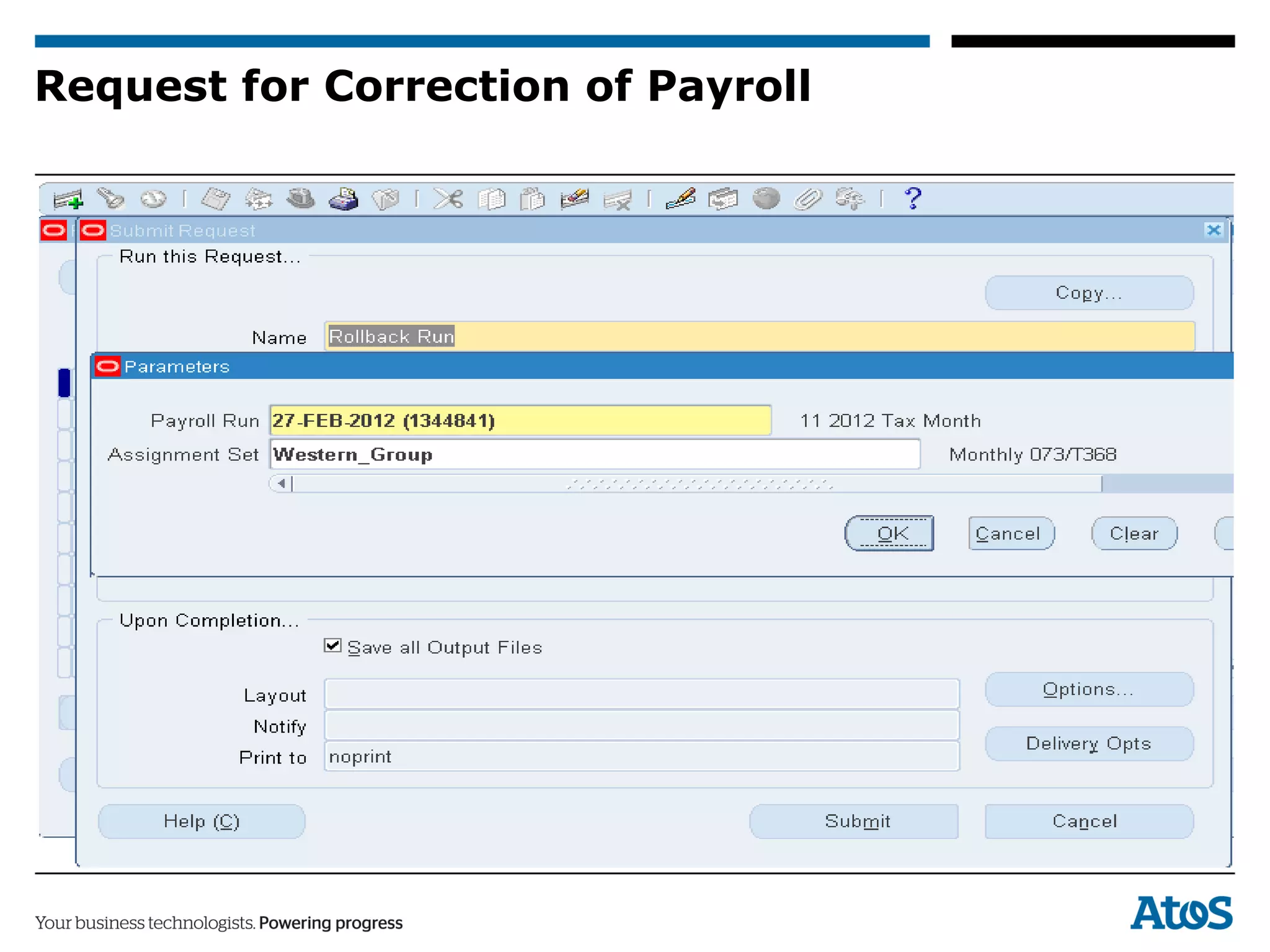

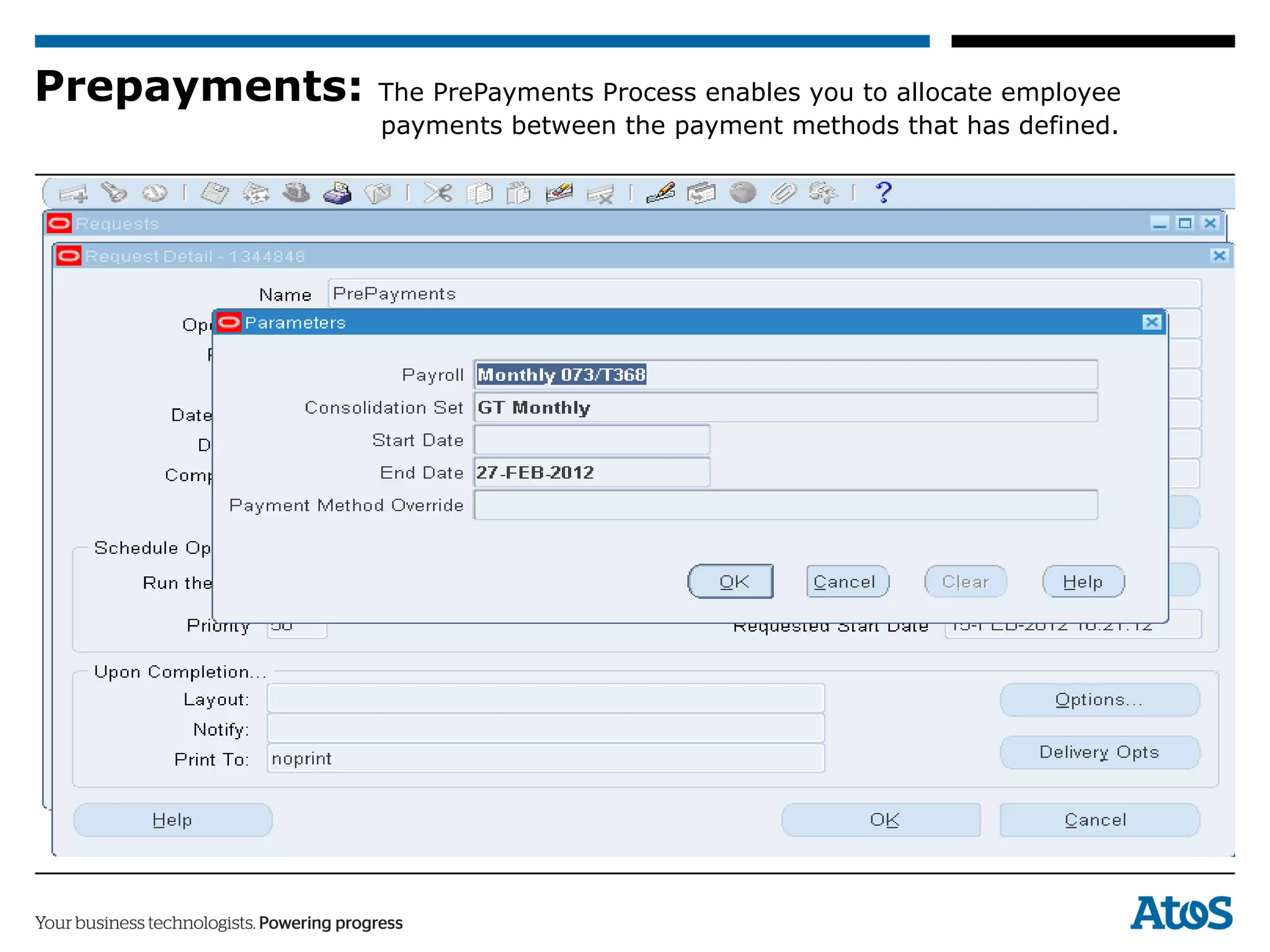

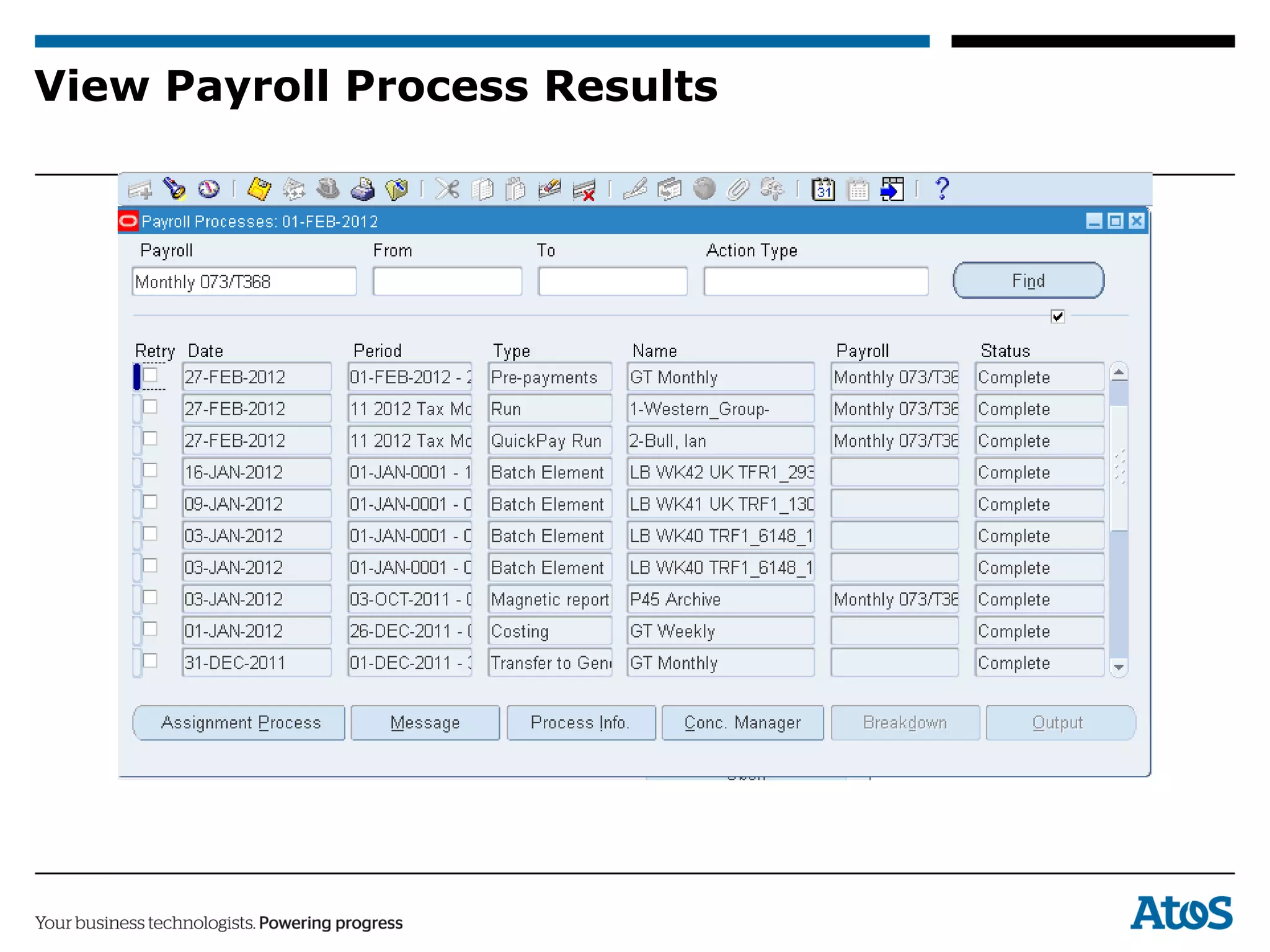

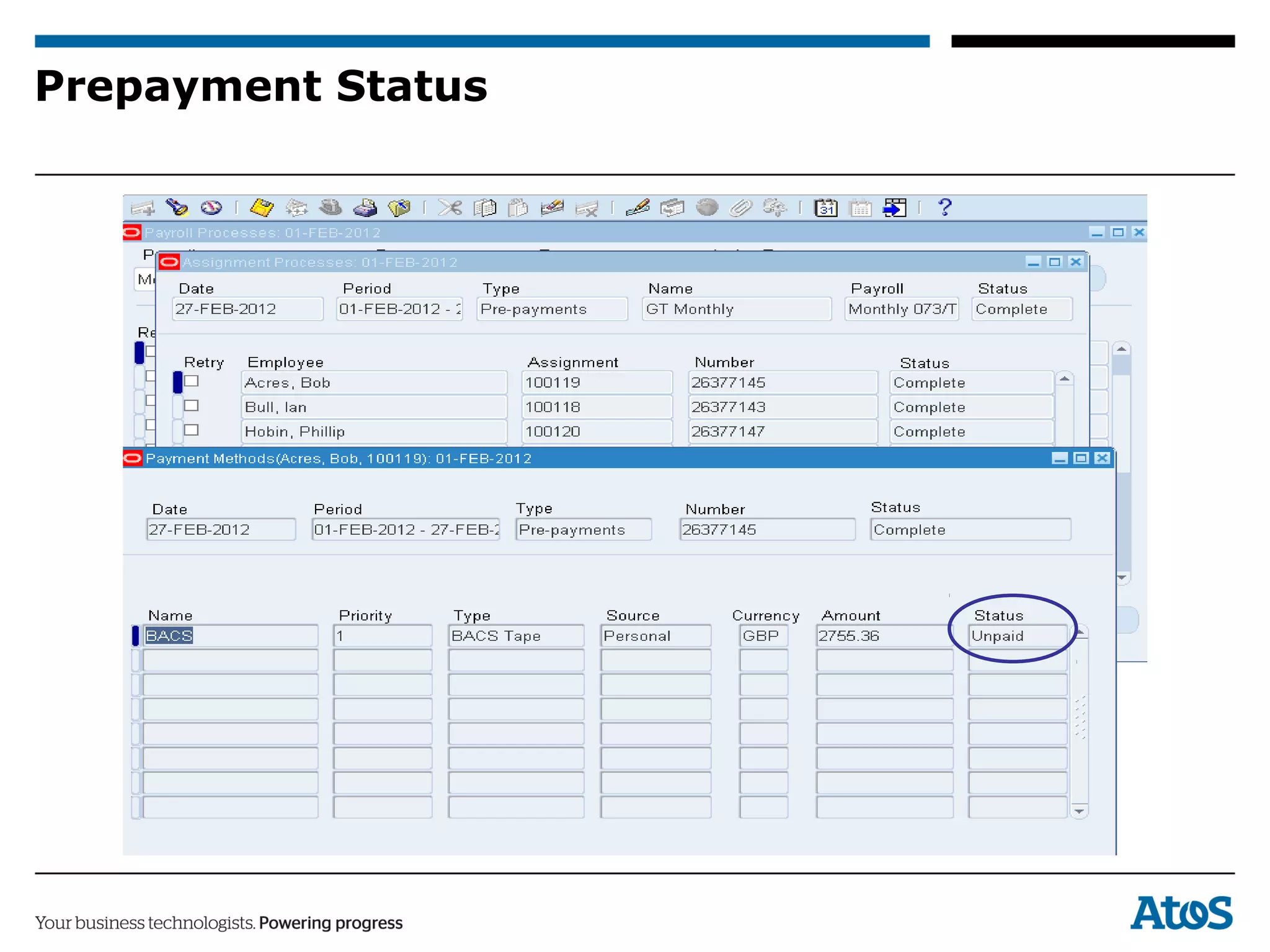

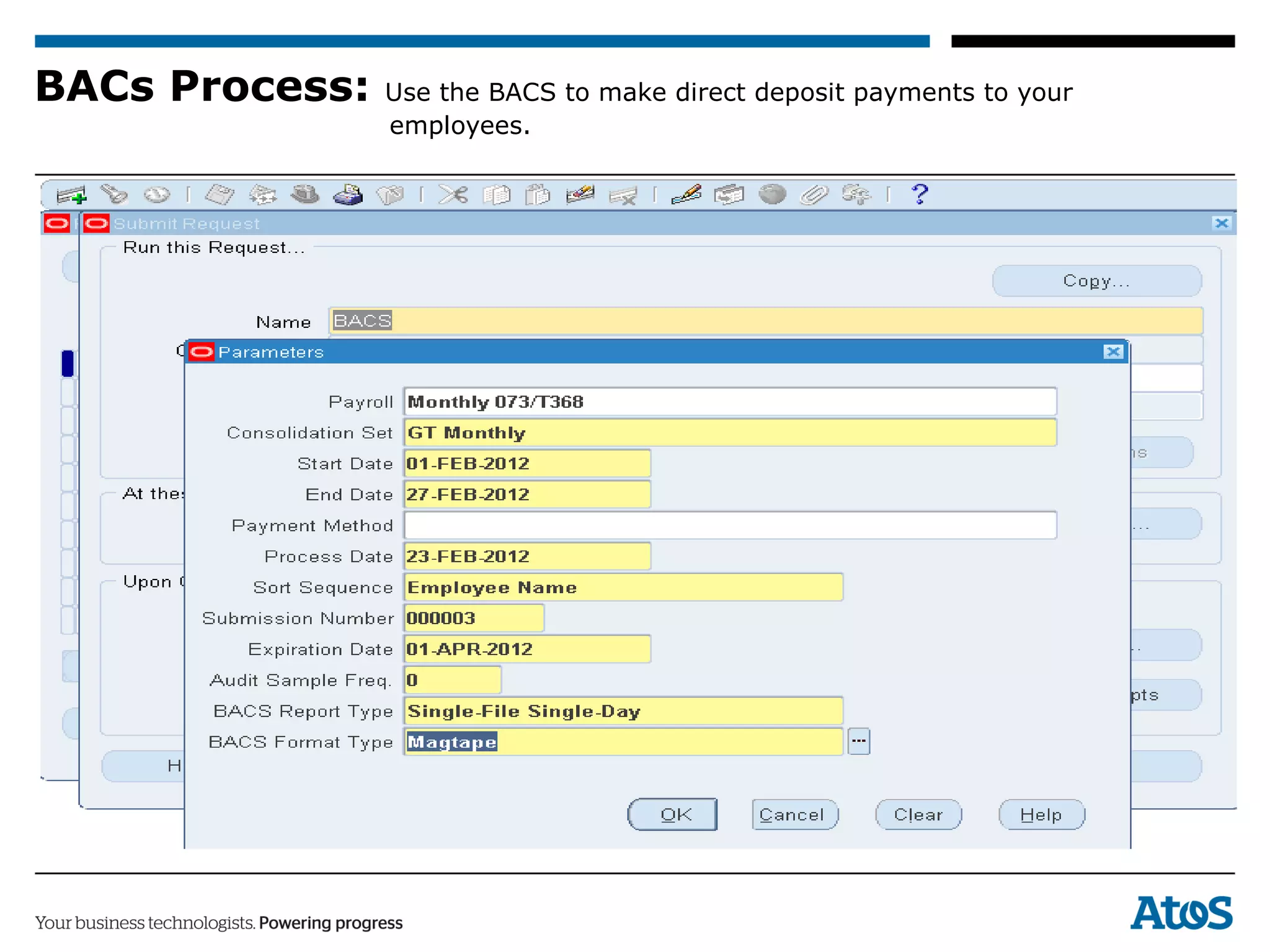

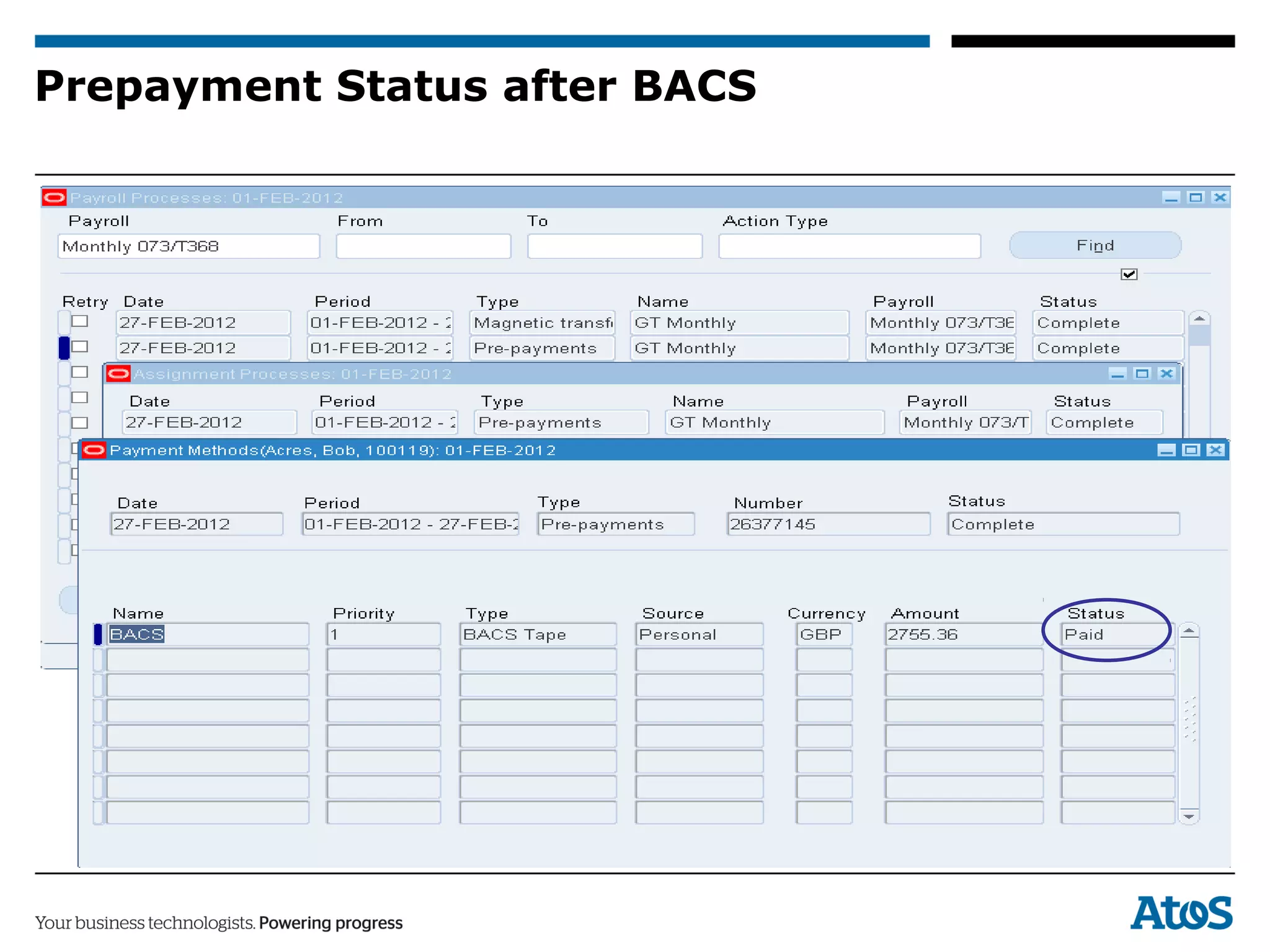

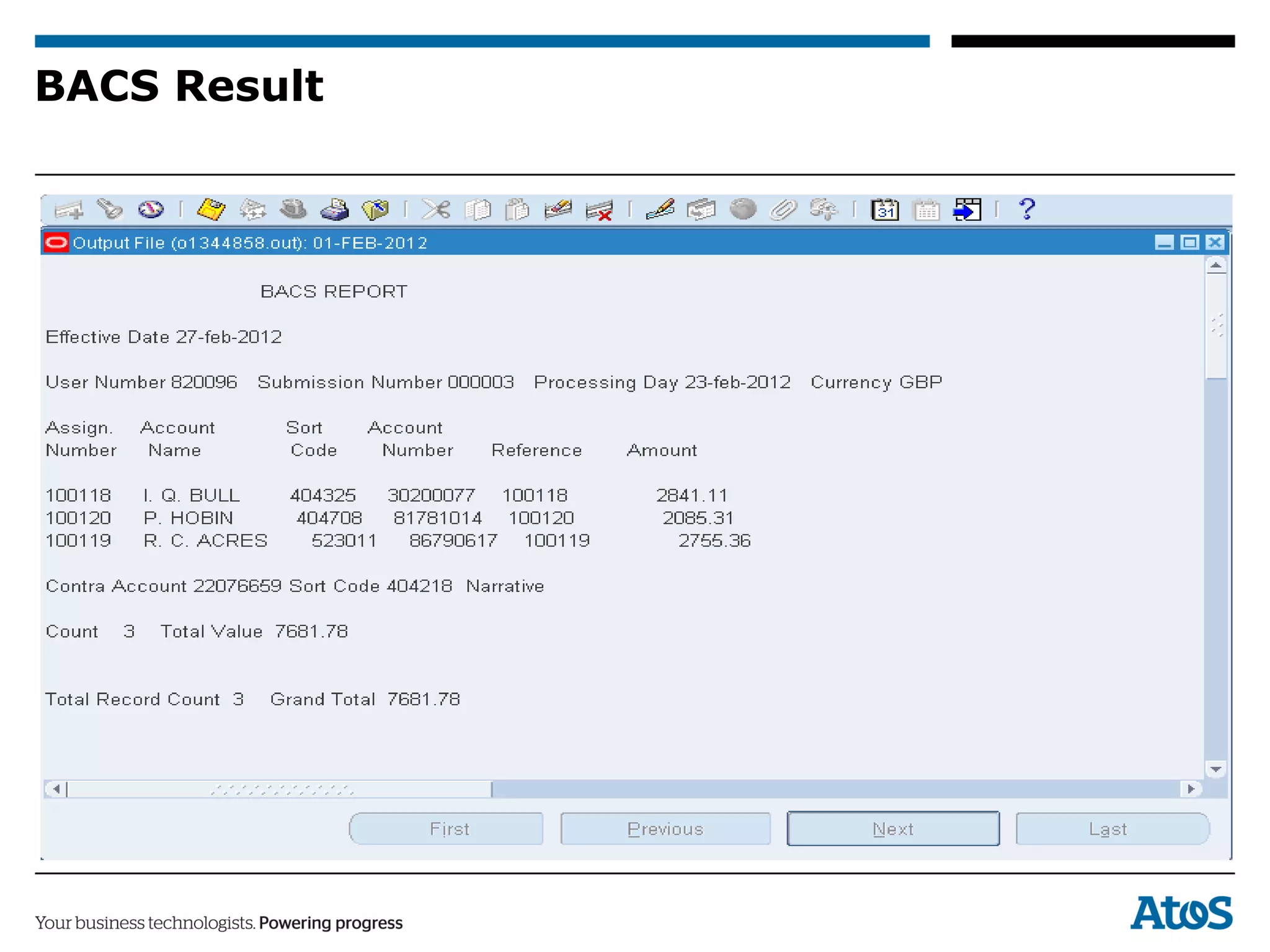

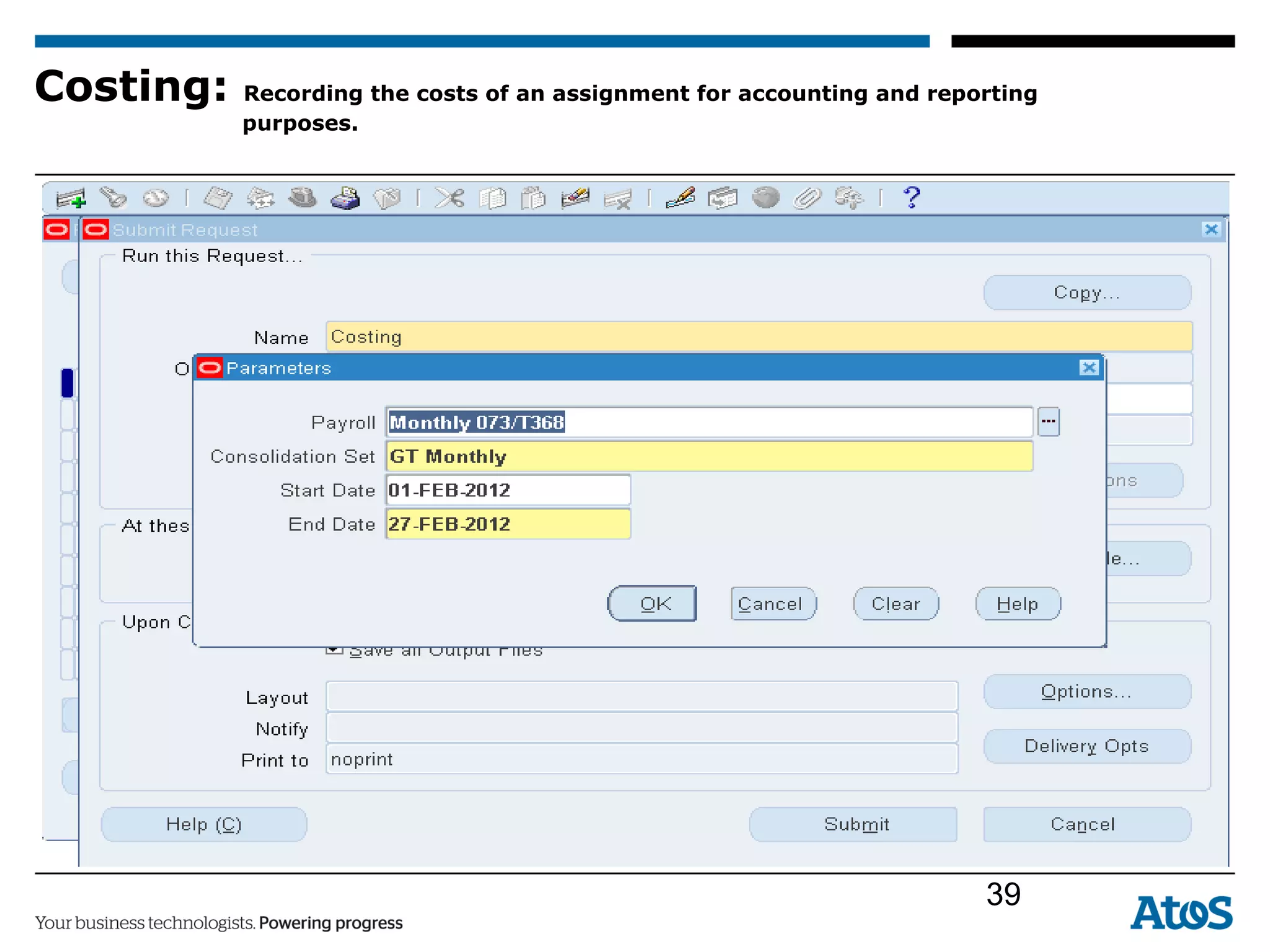

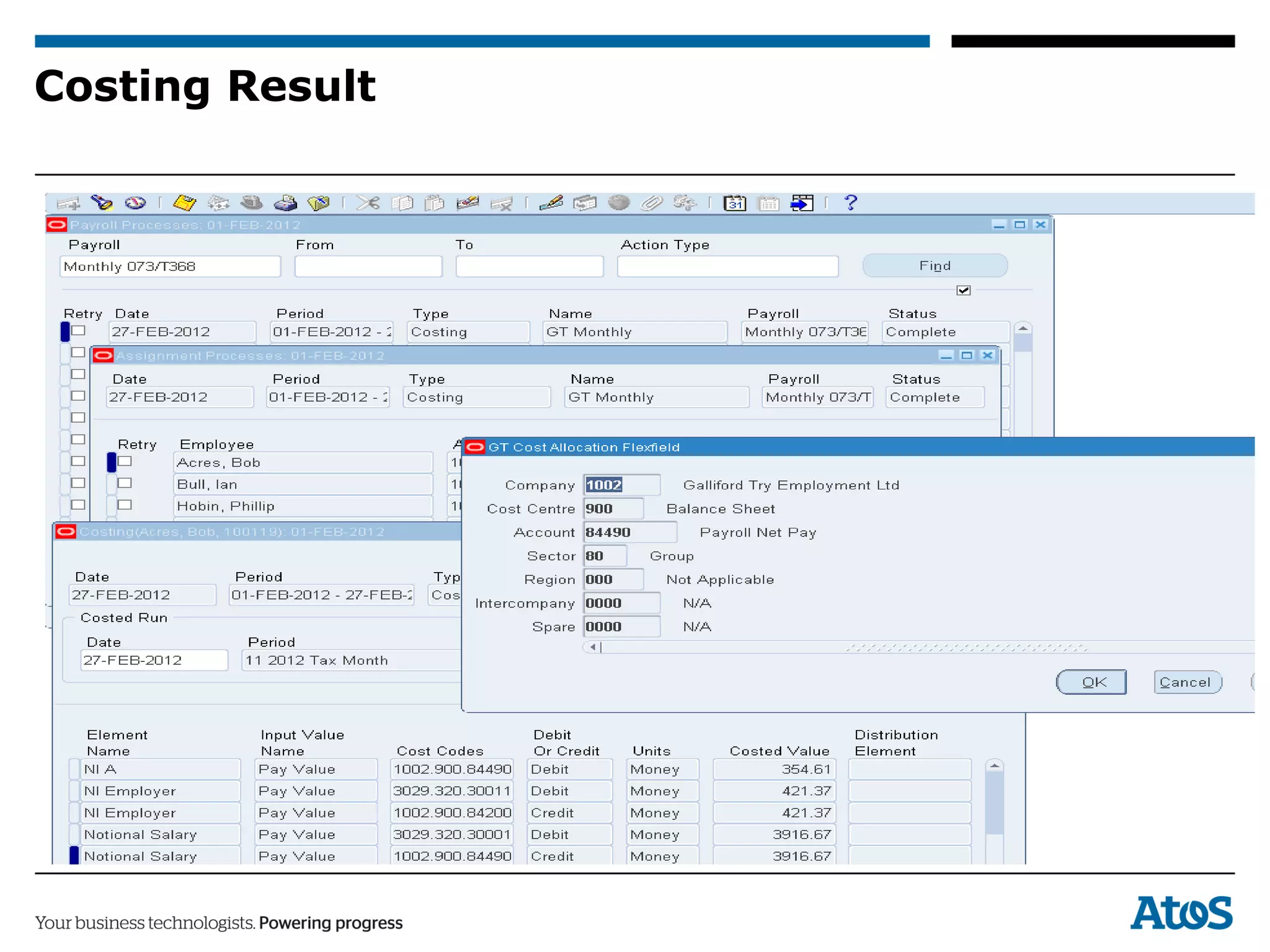

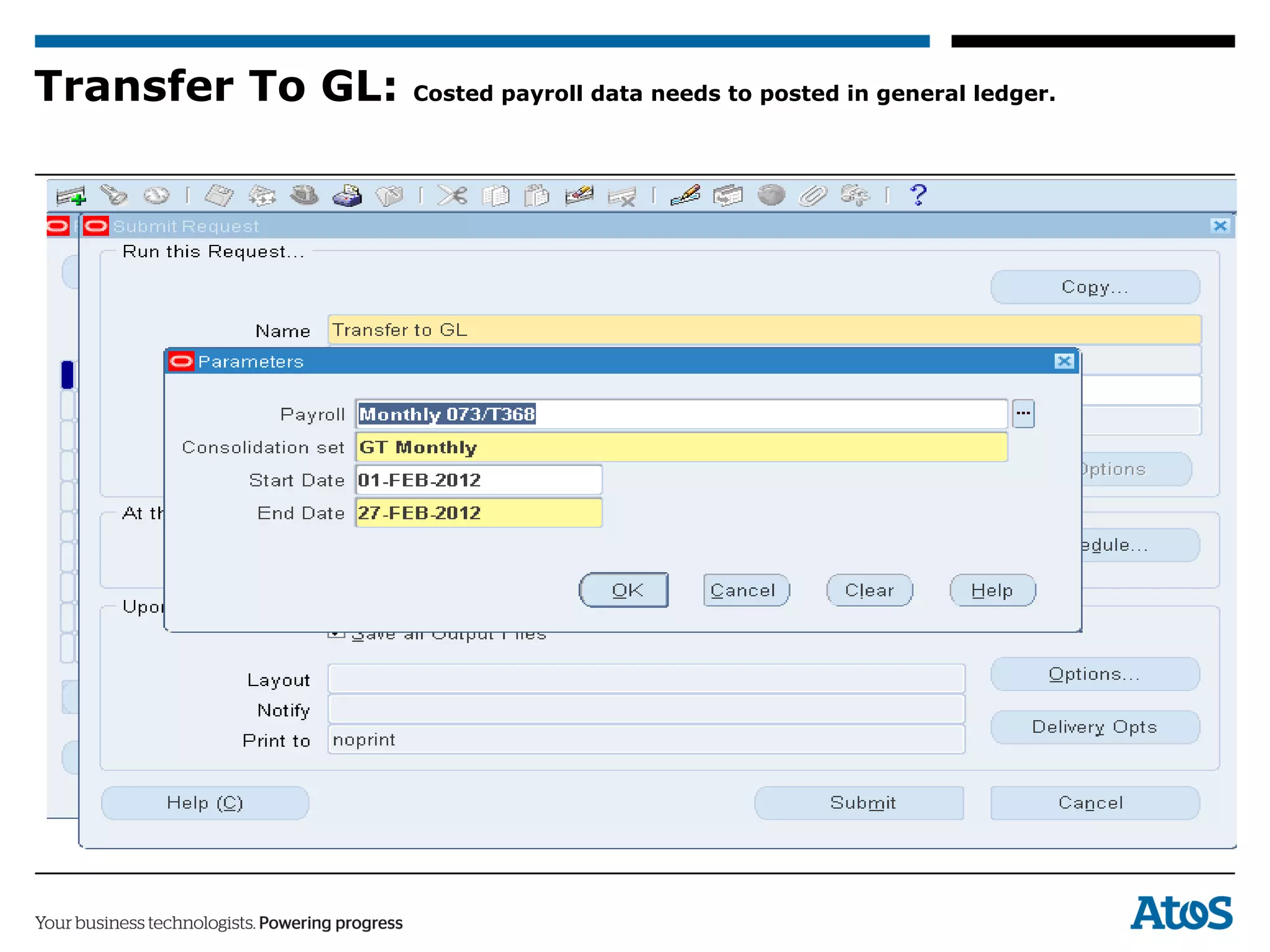

The document provides an overview of Oracle Payroll setup and processes. It discusses defining compensation elements and linking them to employees. It also covers creating payrolls, writing formulas, and processing payroll runs. The document outlines managing corrections and post-payroll activities like costing and transferring data to the general ledger.