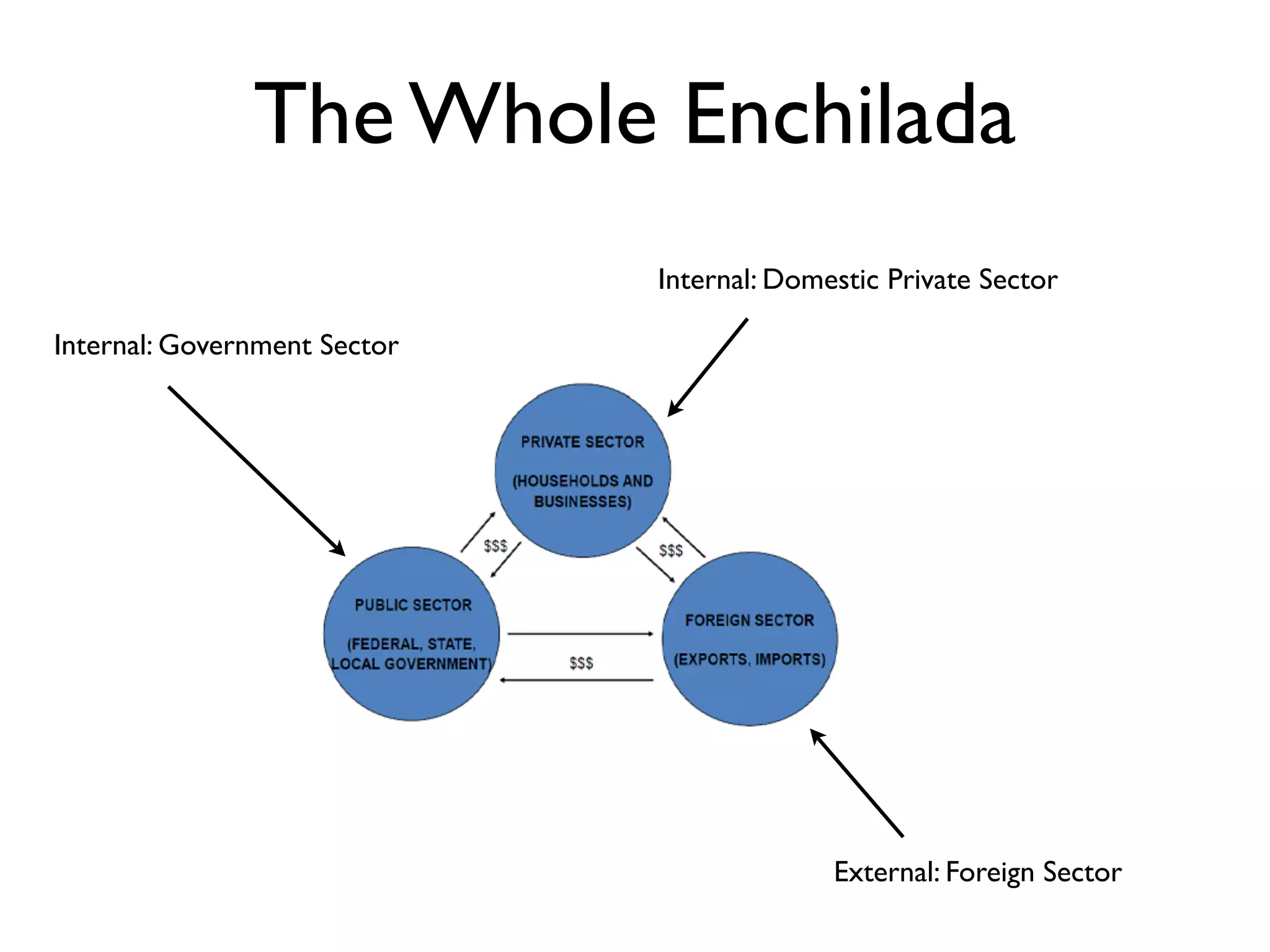

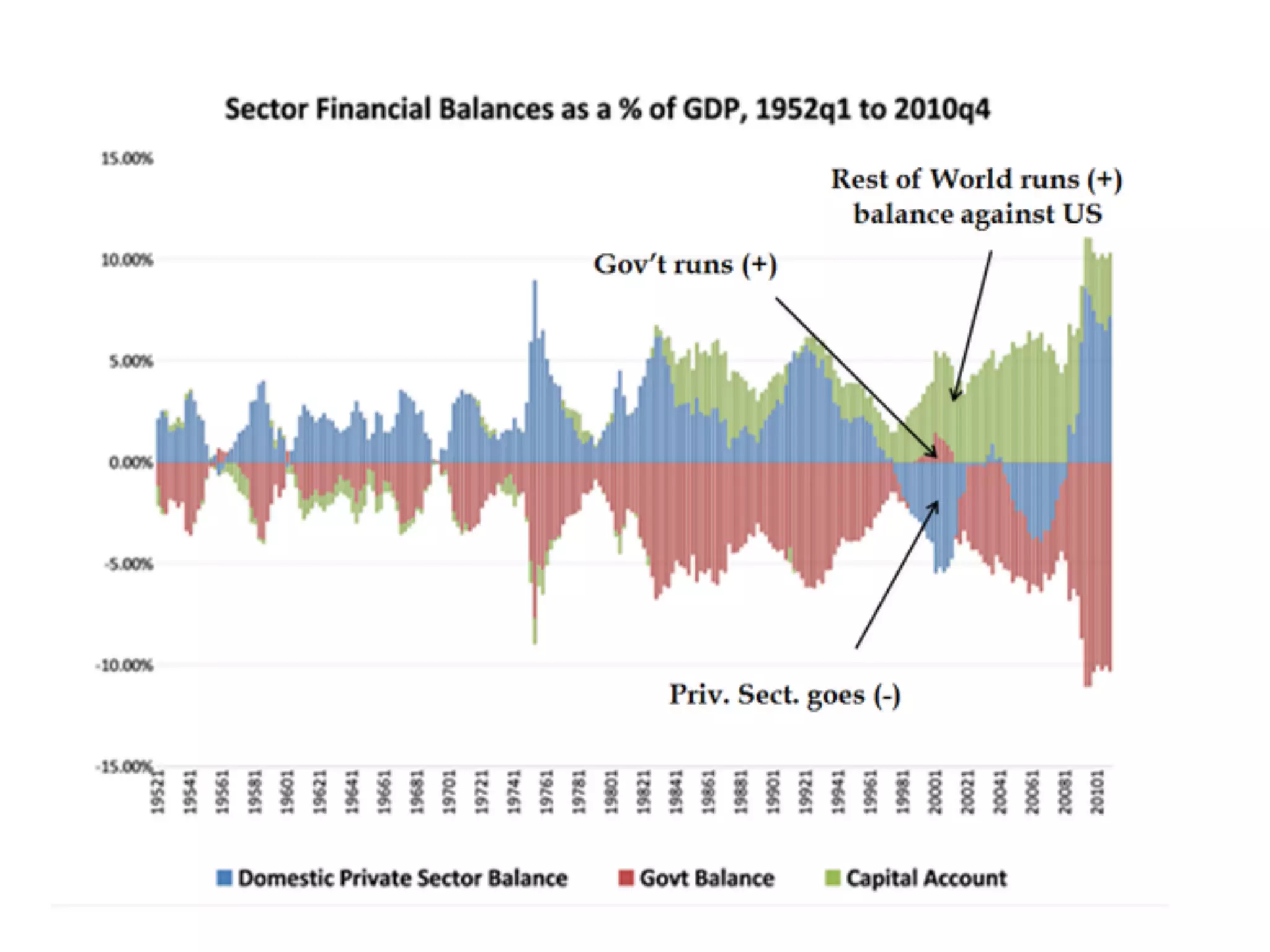

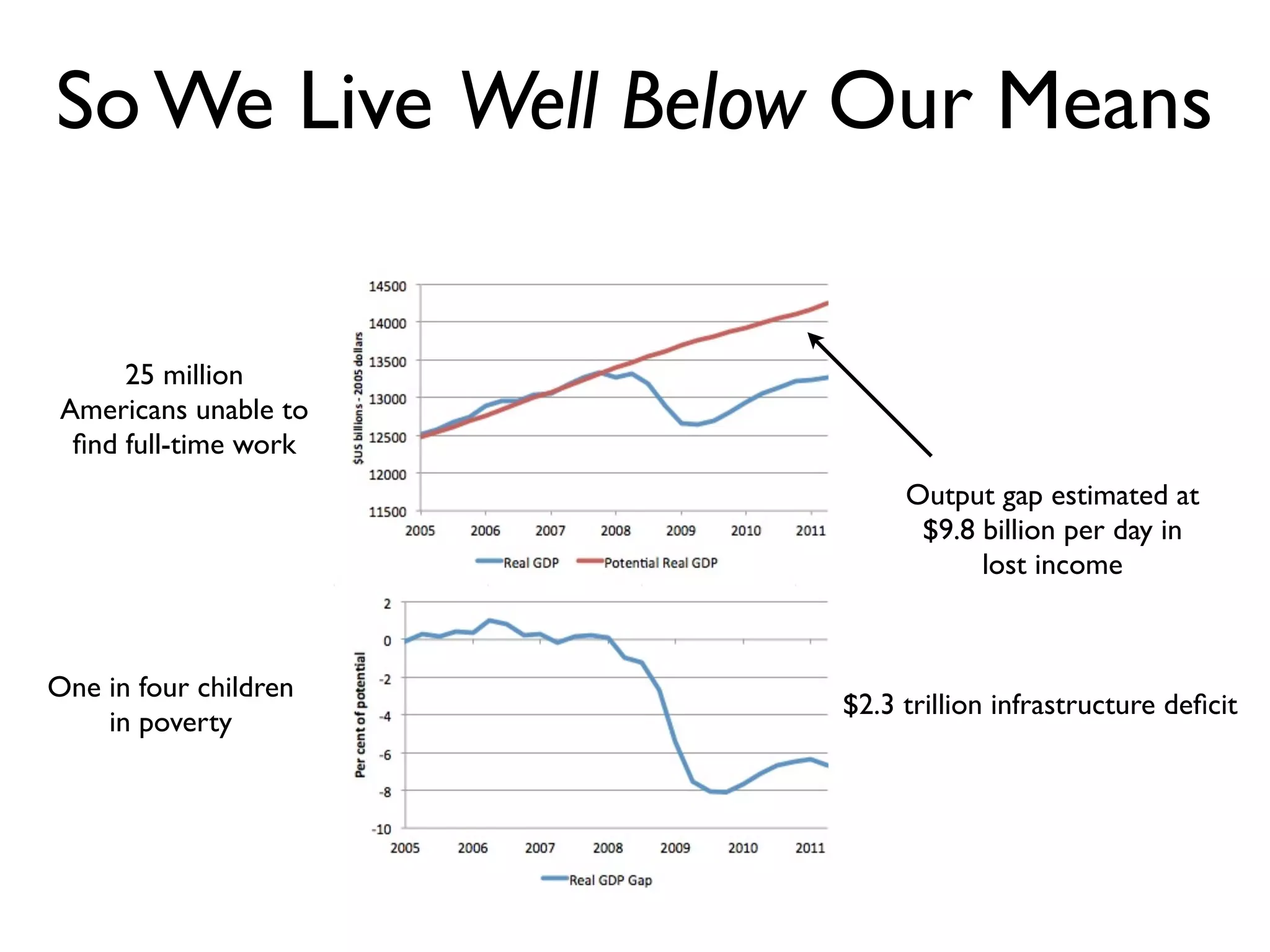

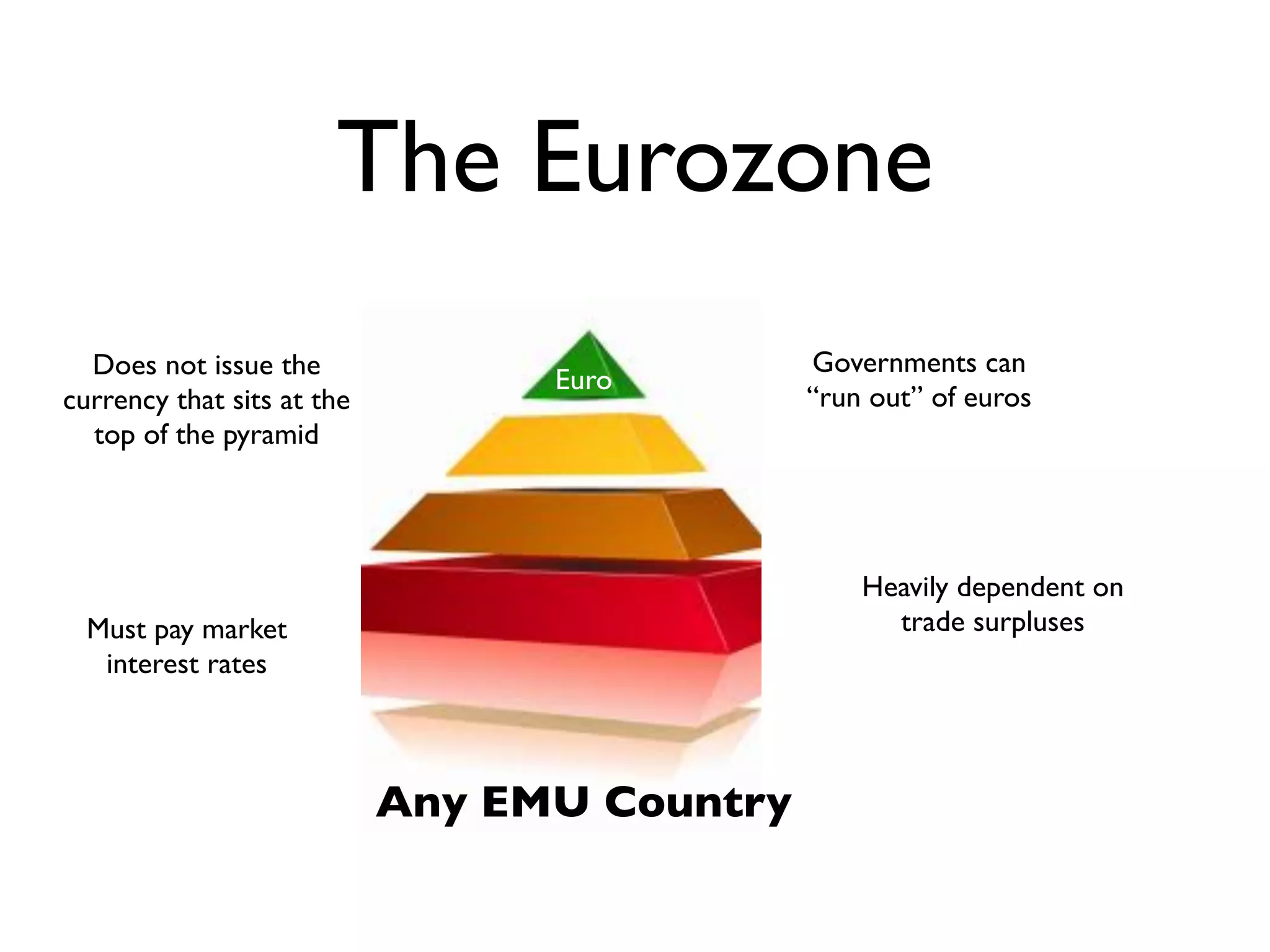

This document discusses modern monetary theory and its view of government spending and deficits. It argues that a sovereign government that issues its own currency cannot go bankrupt and can afford to spend as needed. In contrast to conventional views, MMT asserts that unemployment is economically inefficient and support should be given to maintaining full employment. The sectoral balances of an economy are also discussed, showing that one sector must run a deficit if another runs a surplus.

![Money Matters

• Governments should be in control of the

currency that sits at the top of the pyramid

• Otherwise, they lack the power to keep their

domestic economies on track

“By virtue of its power to create or destroy money by fiat and its power to take

money away from people by taxation, [the State] is in a position to keep the rate

of spending in the economy at the level required to [maintain full employment].”

~Abba P. Lerner](https://image.slidesharecdn.com/scottsdaletalkonmoneyanddeficits-120504154946-phpapp02/75/Money-is-No-Object-20-2048.jpg)

![Money is No Object

• As Chairman Bernanke

explained on 60 Minutes in

2009:

(PELLEY): Is that tax money

that the Fed is spending?

(BERNANKE): It’s not tax

money. [W]e simply use the

computer to mark up the

size of the account.](https://image.slidesharecdn.com/scottsdaletalkonmoneyanddeficits-120504154946-phpapp02/75/Money-is-No-Object-27-2048.jpg)

![The Issuer of the Currency Can’t Go Broke

“[A] government cannot become insolvent with respect to

obligations in its own currency. A fiat money system, like the

ones we have today, can produce such claims without limit”

~Alan Greenspan, 1997](https://image.slidesharecdn.com/scottsdaletalkonmoneyanddeficits-120504154946-phpapp02/75/Money-is-No-Object-28-2048.jpg)