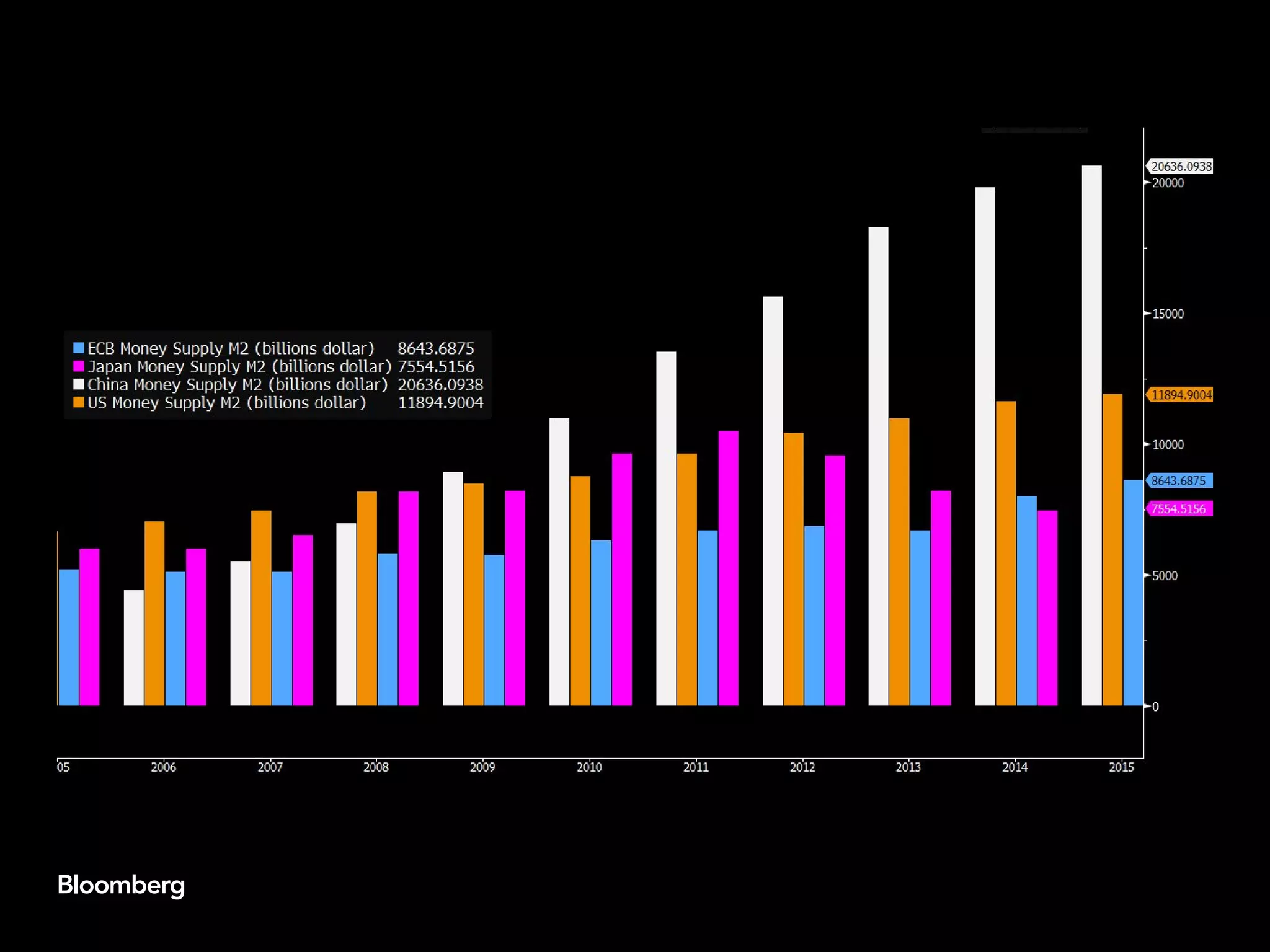

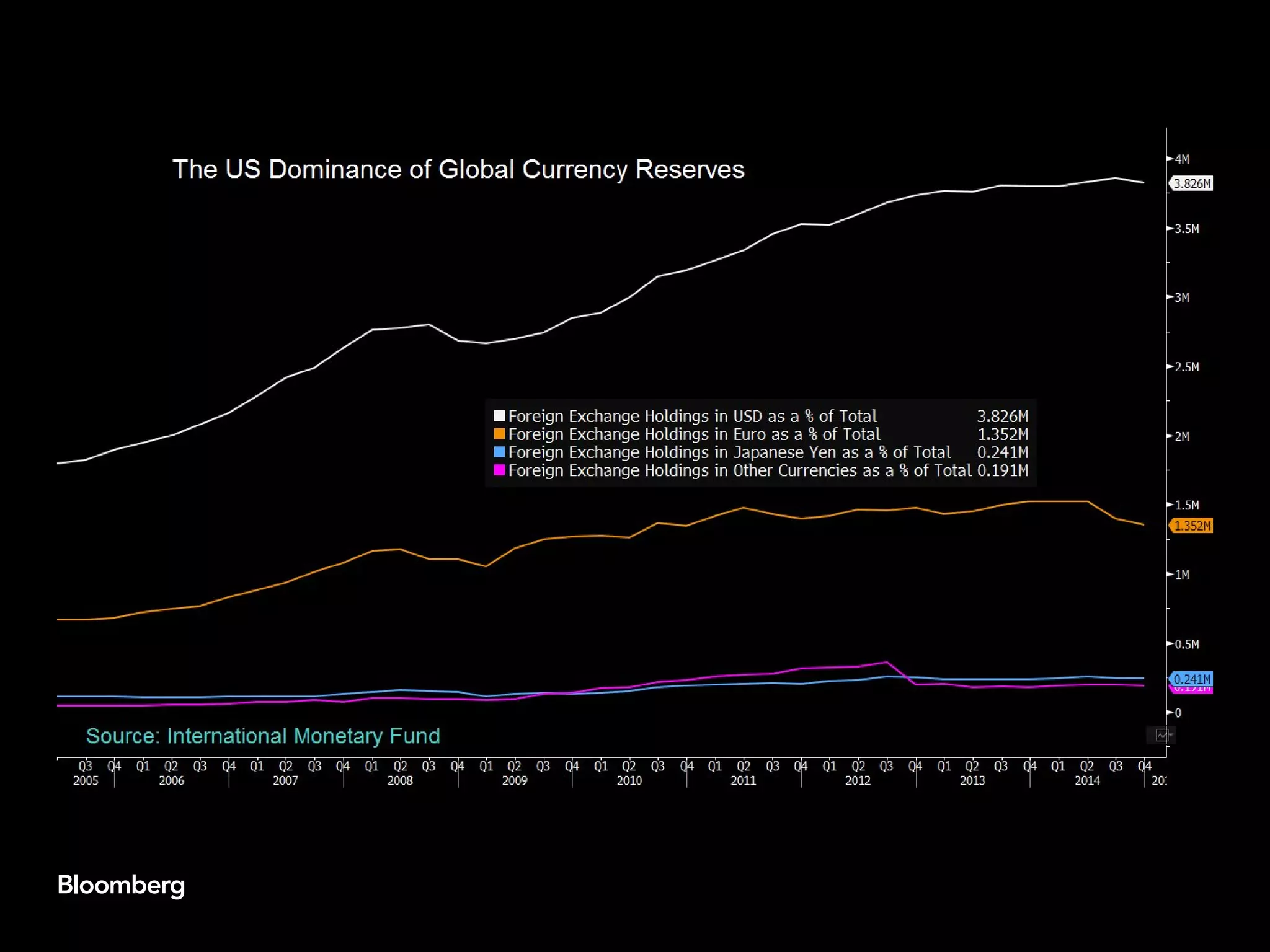

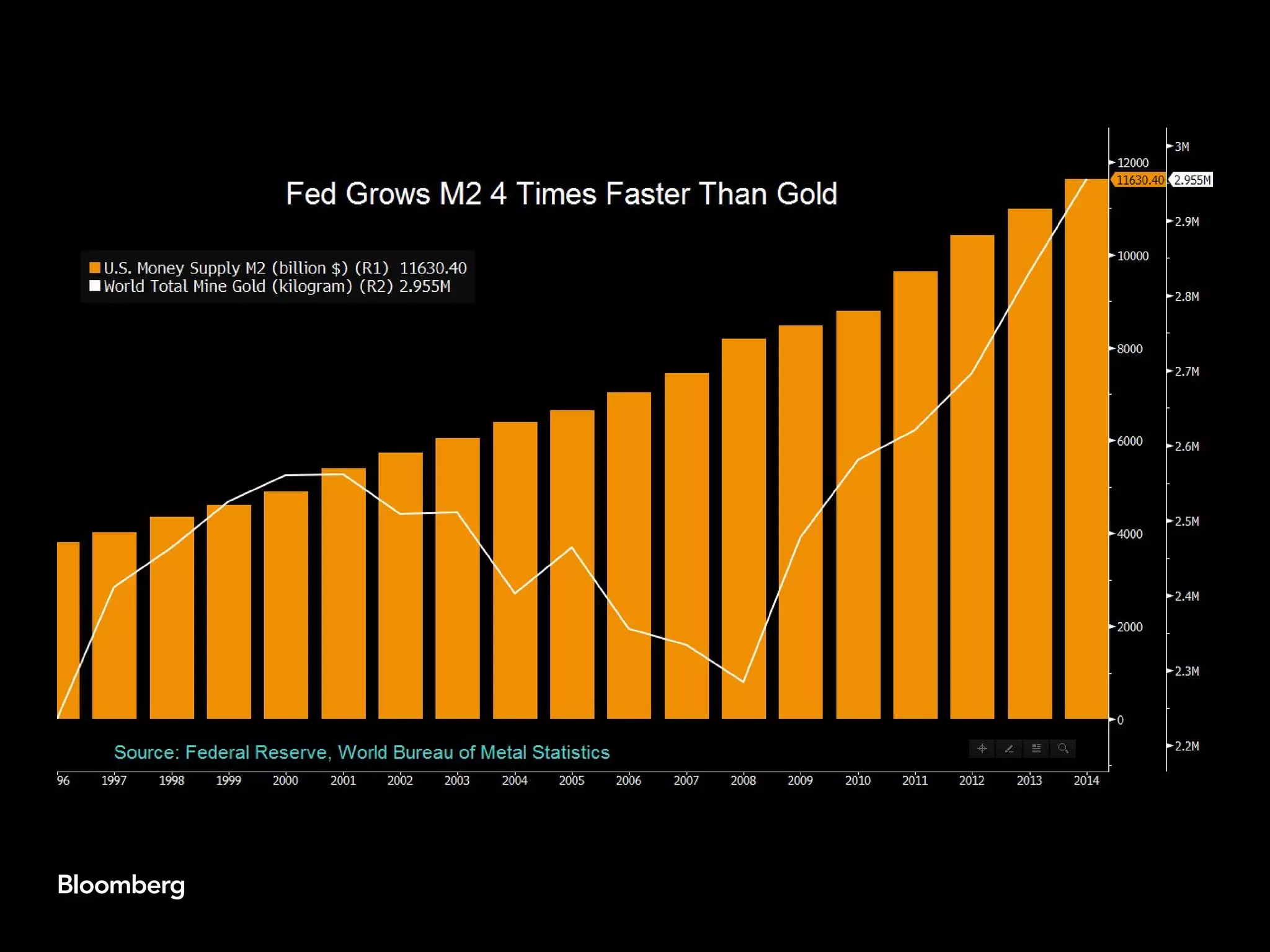

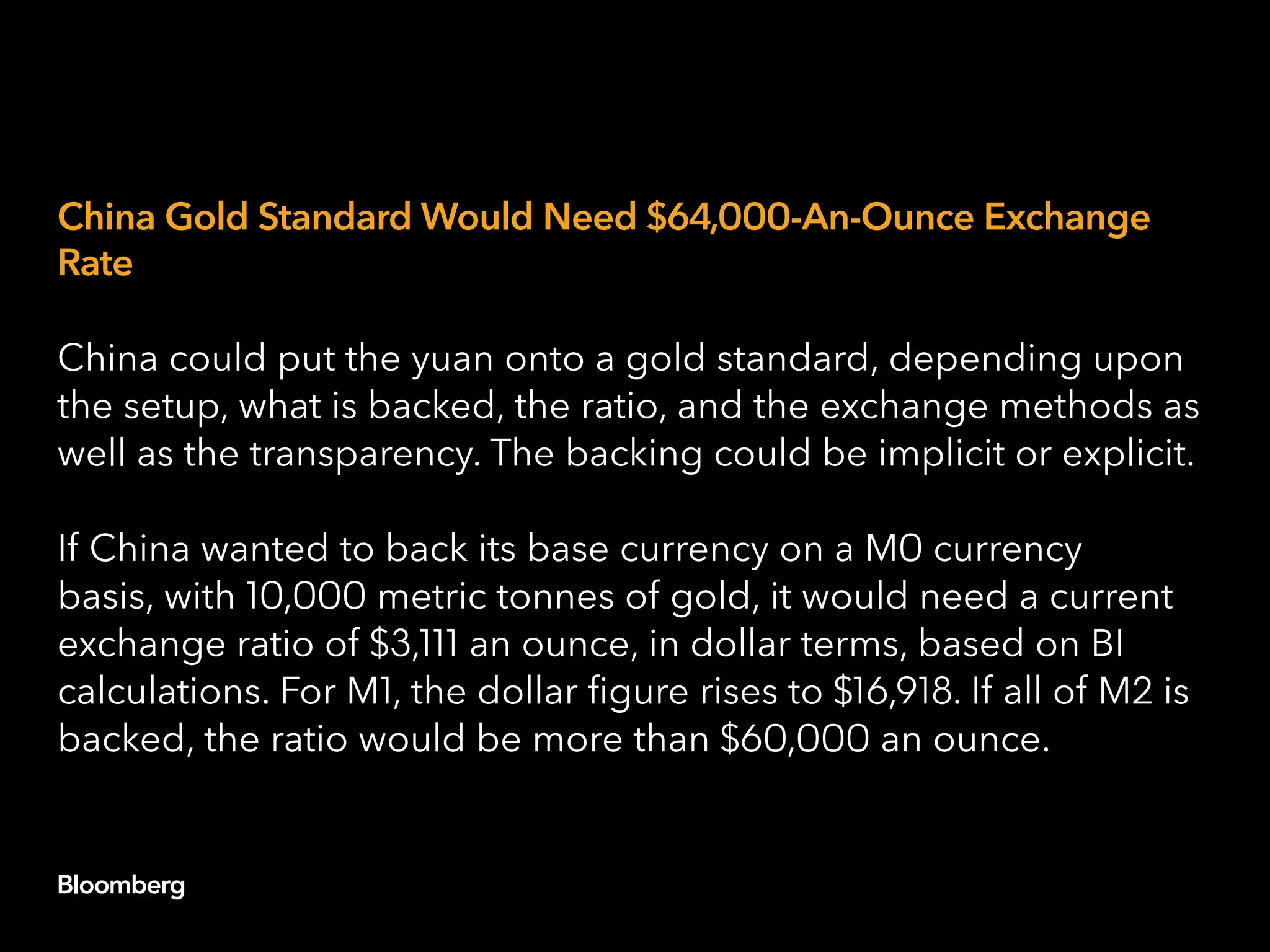

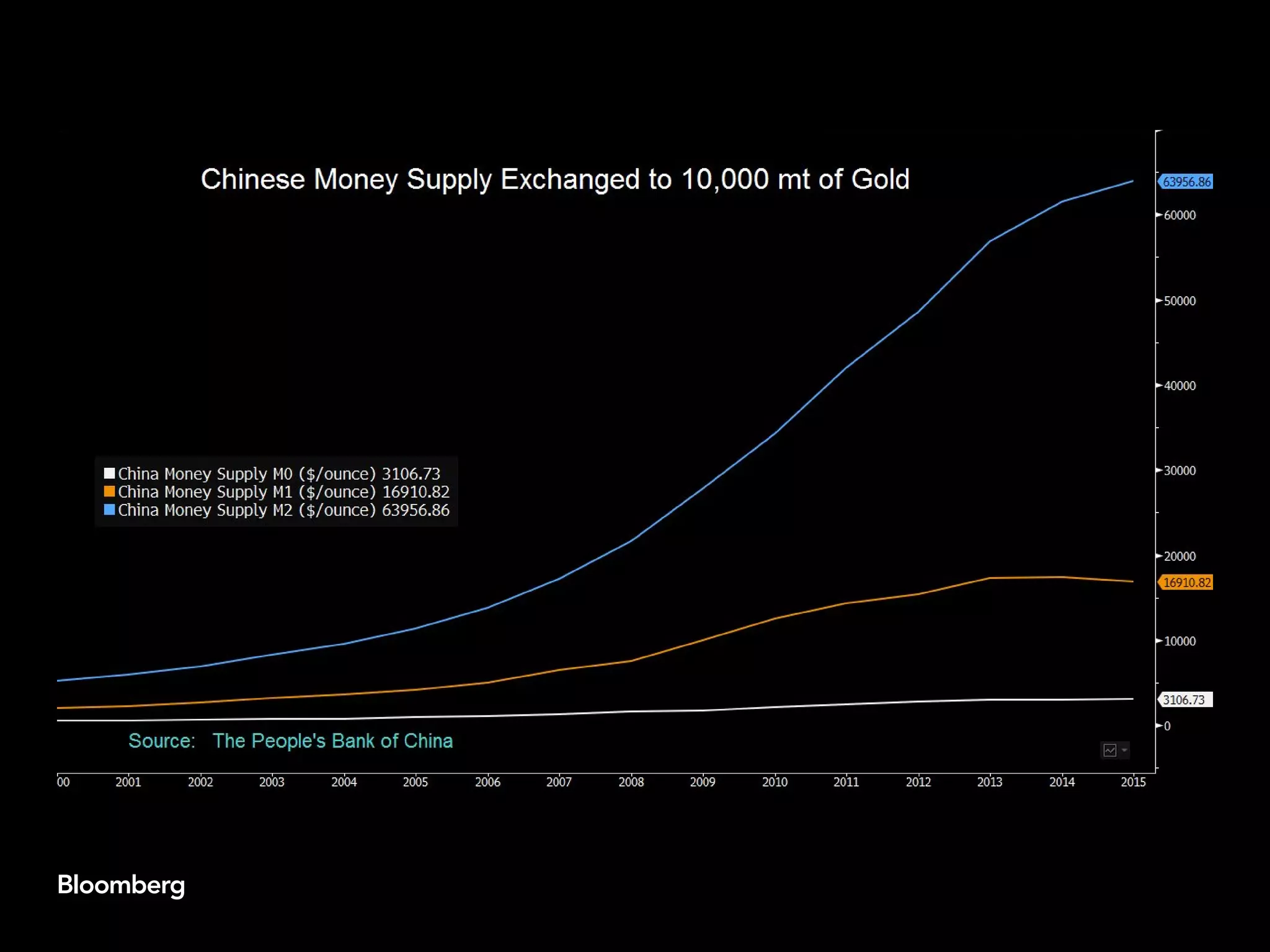

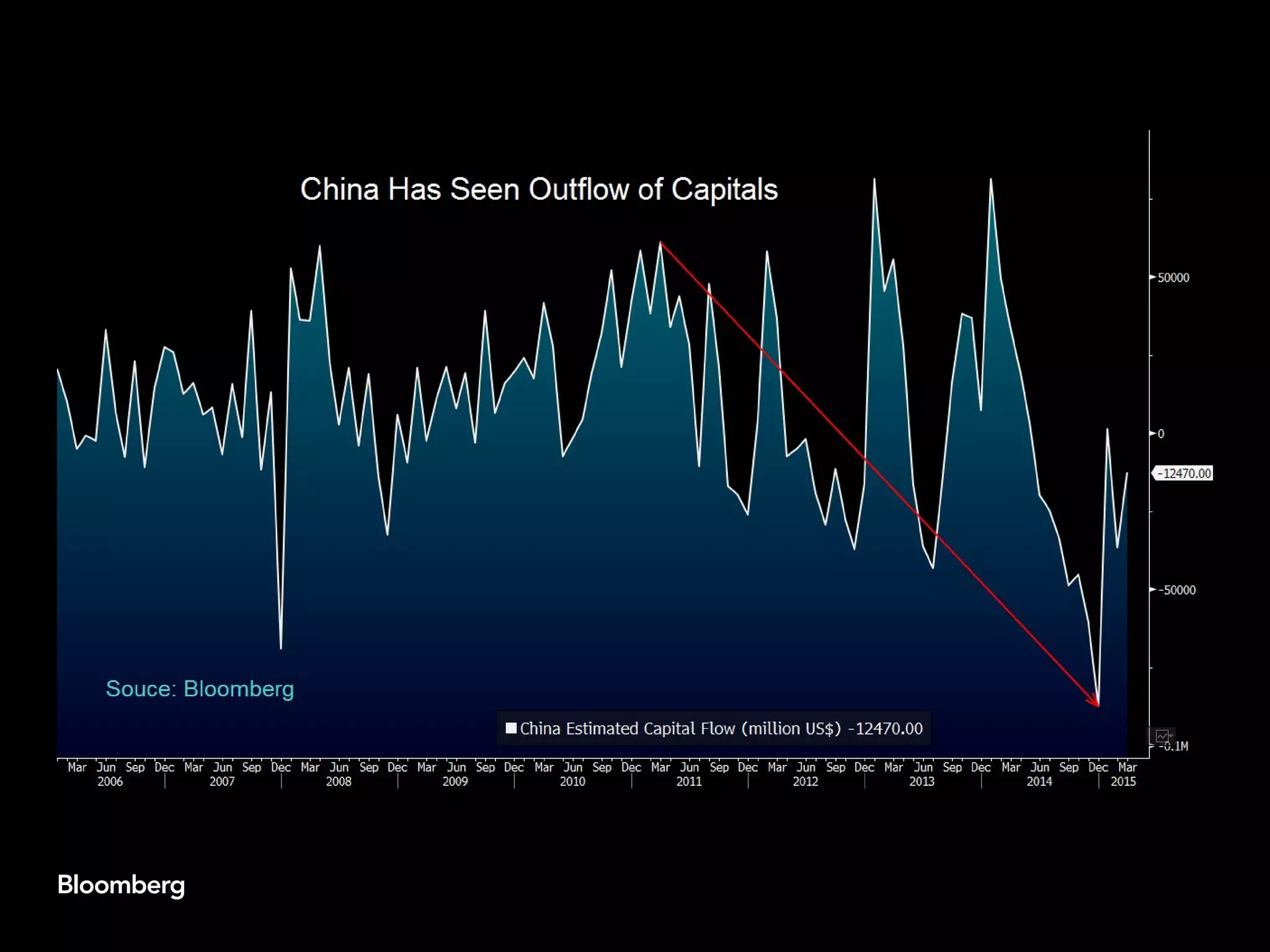

China adopting a gold standard for its currency, the yuan, could help establish the yuan as a globally recognized reserve currency but would also involve complications. Setting the yuan to a gold standard could destabilize the currency and require an exchange rate of $64,000 per ounce of gold based on Bloomberg analysis. China aims to make the yuan a global reserve currency by making it freely convertible, and it may back the yuan with gold to stabilize it. Currently the yuan registers barely as a global reserve currency but is the fifth most traded currency as China opens up its market. Central banks often dislike gold standards as they limit ability to manipulate money supply.