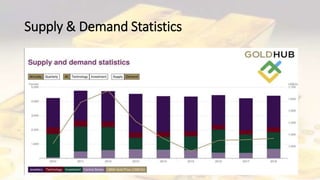

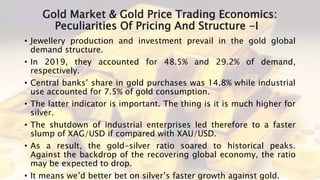

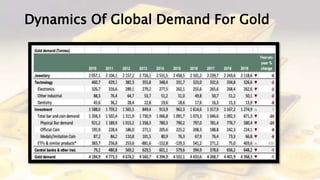

The document discusses factors that affect gold prices. It explores the history of gold as a reserve currency and how the decoupling of the US dollar from gold in the 1970s contributed to gold's growth in value. It analyzes supply and demand statistics, identifying jewelry production, technology, investments, and central banks as key demand sources. The main drivers of gold prices are said to be economic expansion, market risks and uncertainty, alternative prices, and market positioning. The document outlines the peculiarities of gold's pricing structure and trading economics.