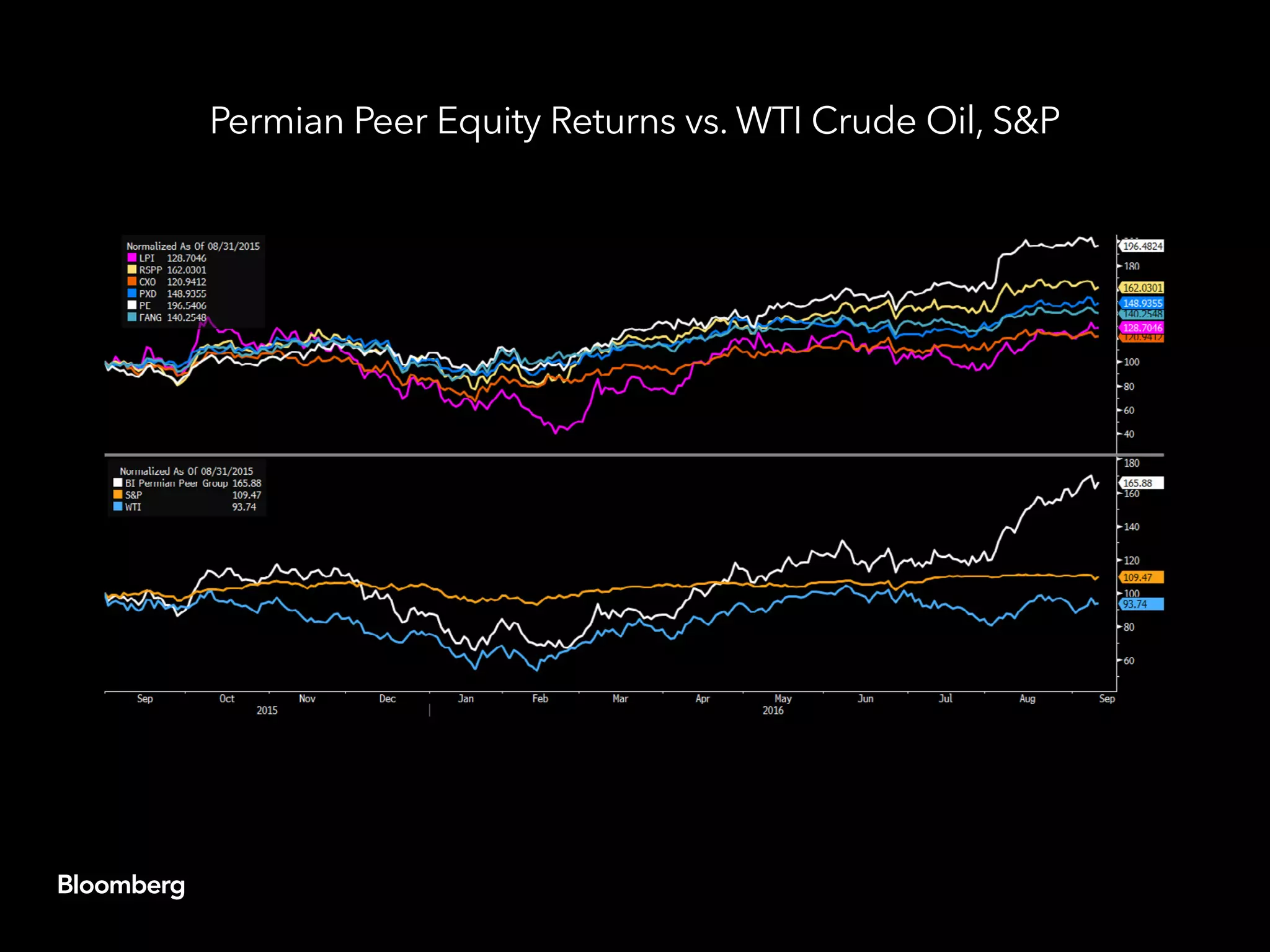

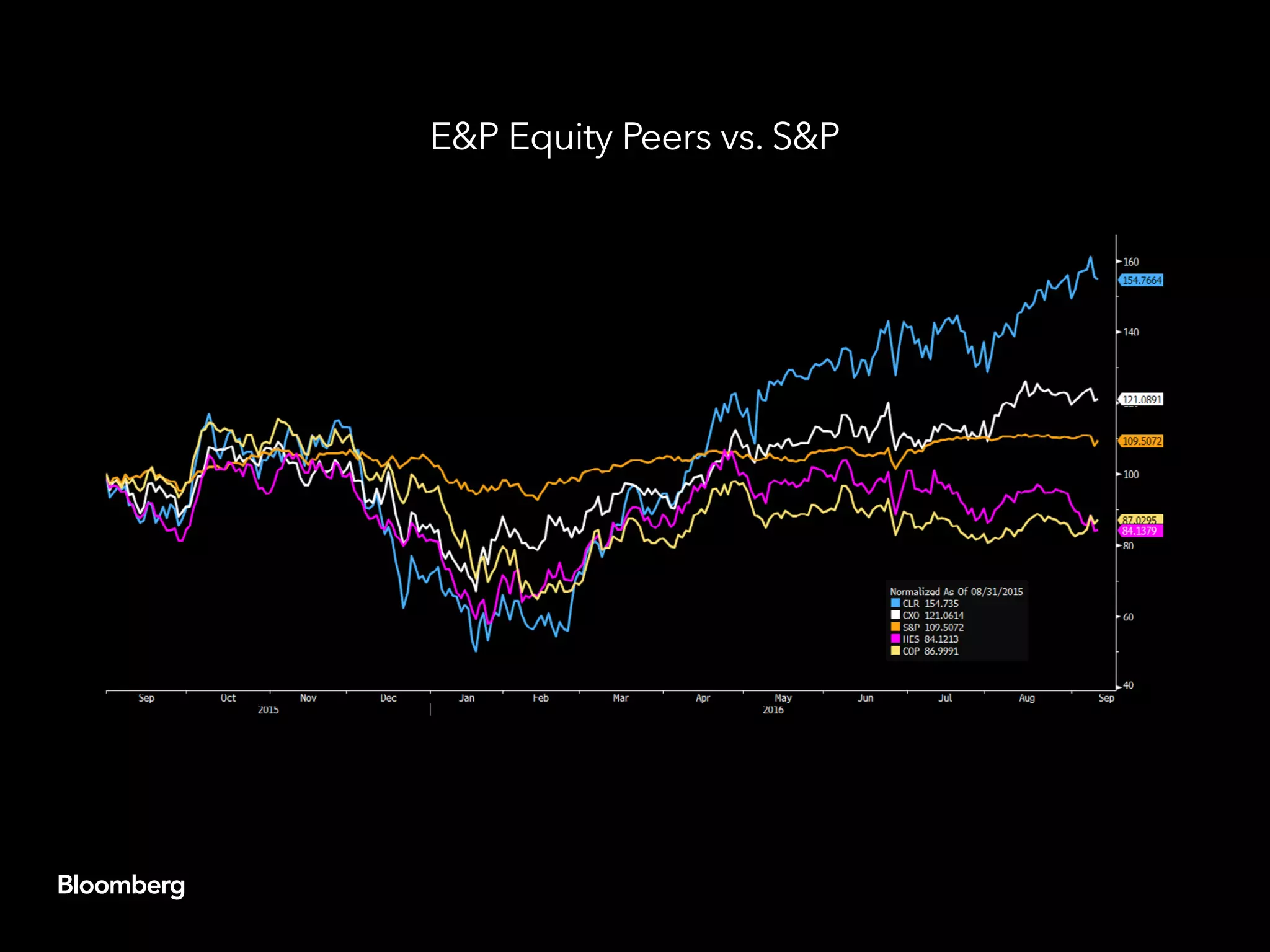

This document discusses trends in the oil and gas exploration and production (E&P) industry. It finds that E&Ps with concentrated assets in major U.S. basins like the Permian have outperformed more diversified companies. Within Appalachia, Rice Energy has done better than peers more exposed to gas. The Permian basin continues to see success driving up acreage prices. Continental Resources, with focus on the Williston basin, has outperformed due to lack of hedging. Broad diversification and operations in sensitive regions have weighed on larger E&Ps relative to peers with U.S. concentration. E&Ps have used equity offerings to strengthen balance sheets and acquire more concentrated acreage positions.