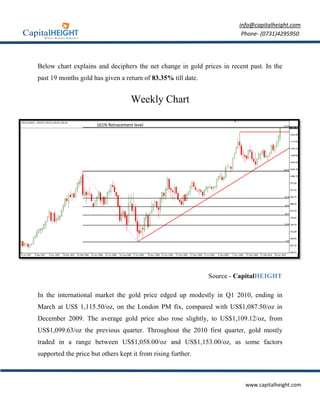

Gold prices have risen significantly in recent years due to concerns about the stability of currencies and as a safe haven investment. The document discusses factors fueling the rise in gold prices, including the European debt crisis weakening confidence in the euro and concerns about inflation. It also notes growing demand from exchange traded funds and countries looking for alternatives to the US dollar. The outlook presented is that gold prices will likely continue rising in the long term due to ongoing volatility and currency issues.