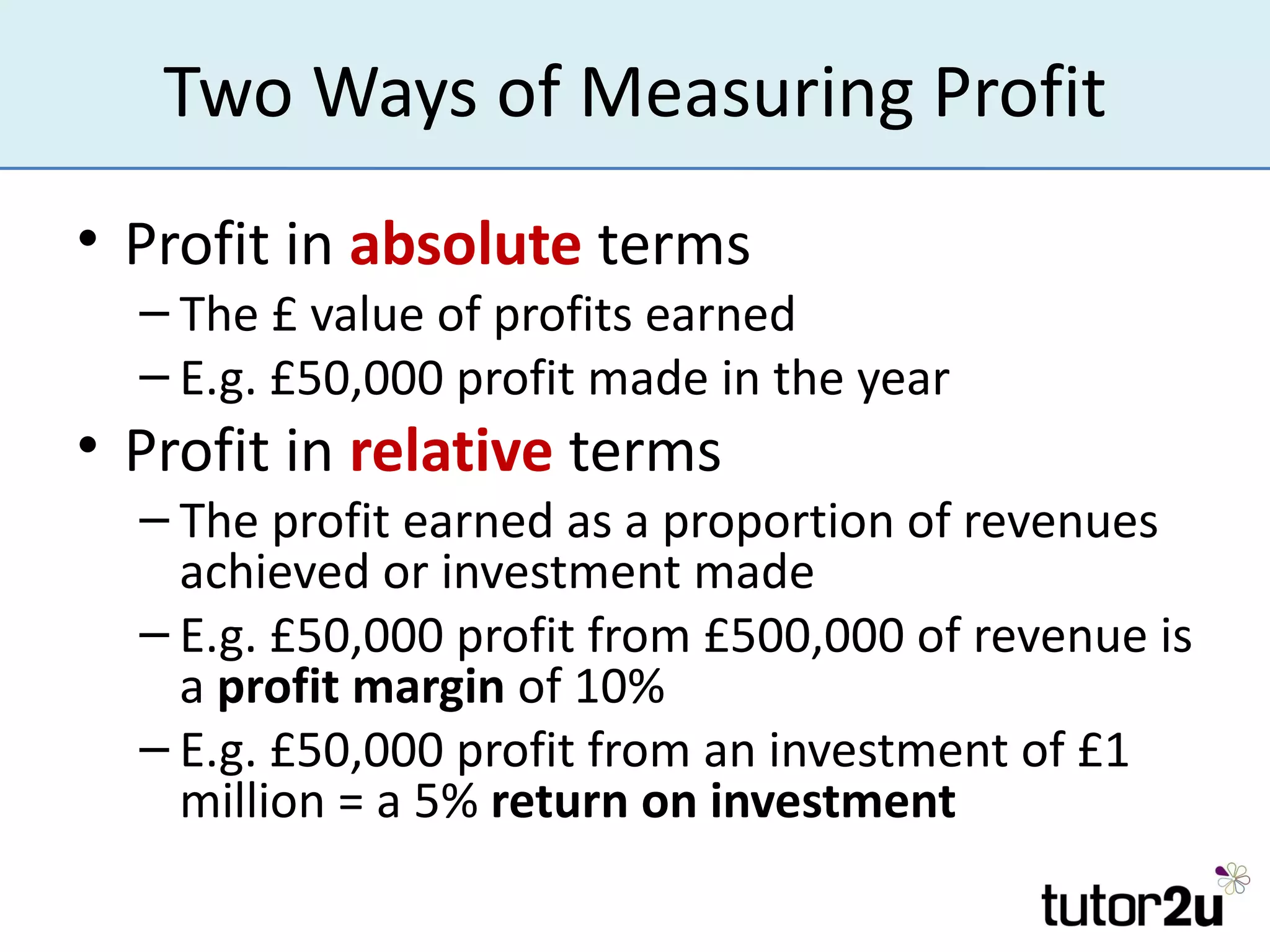

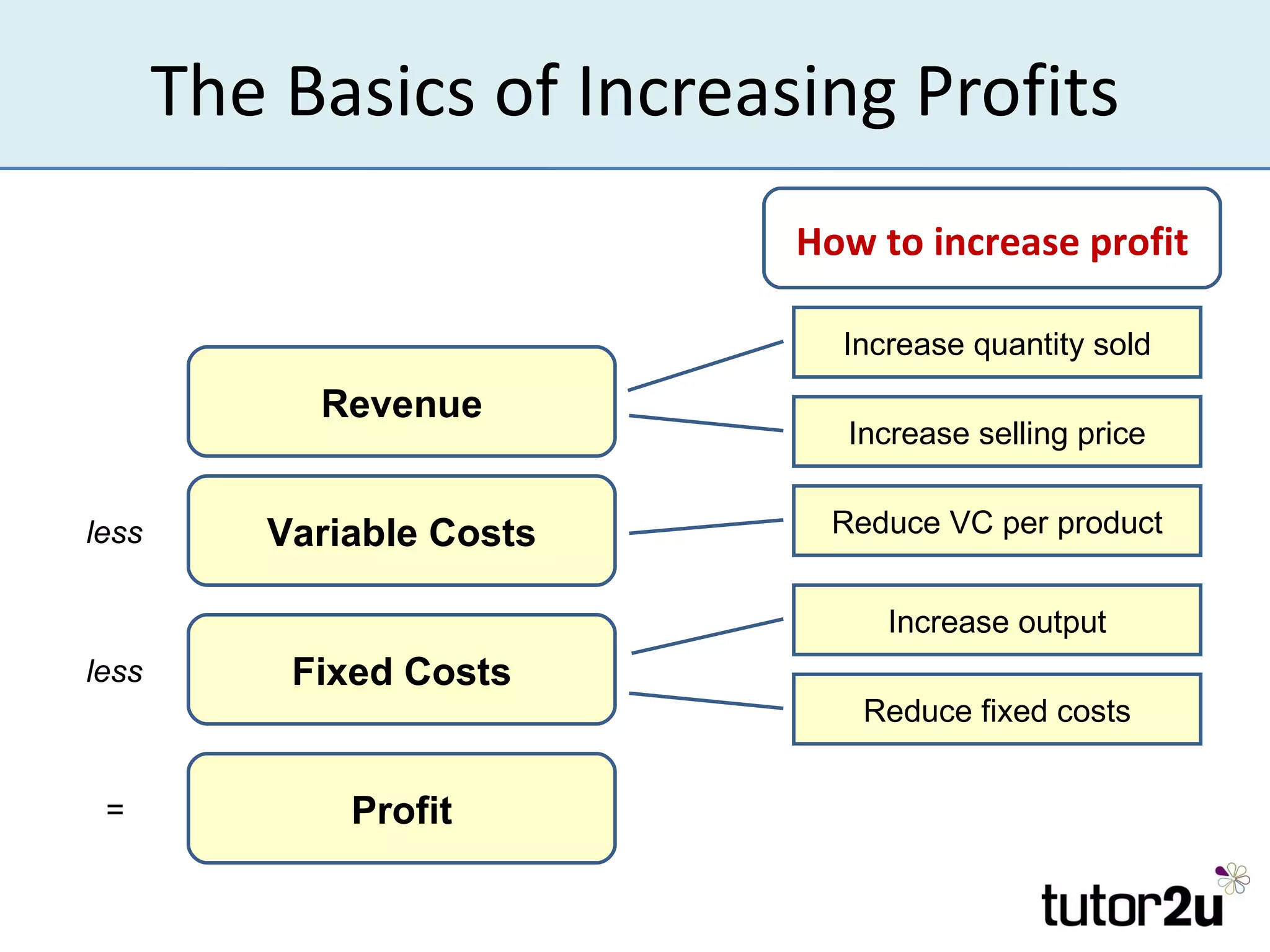

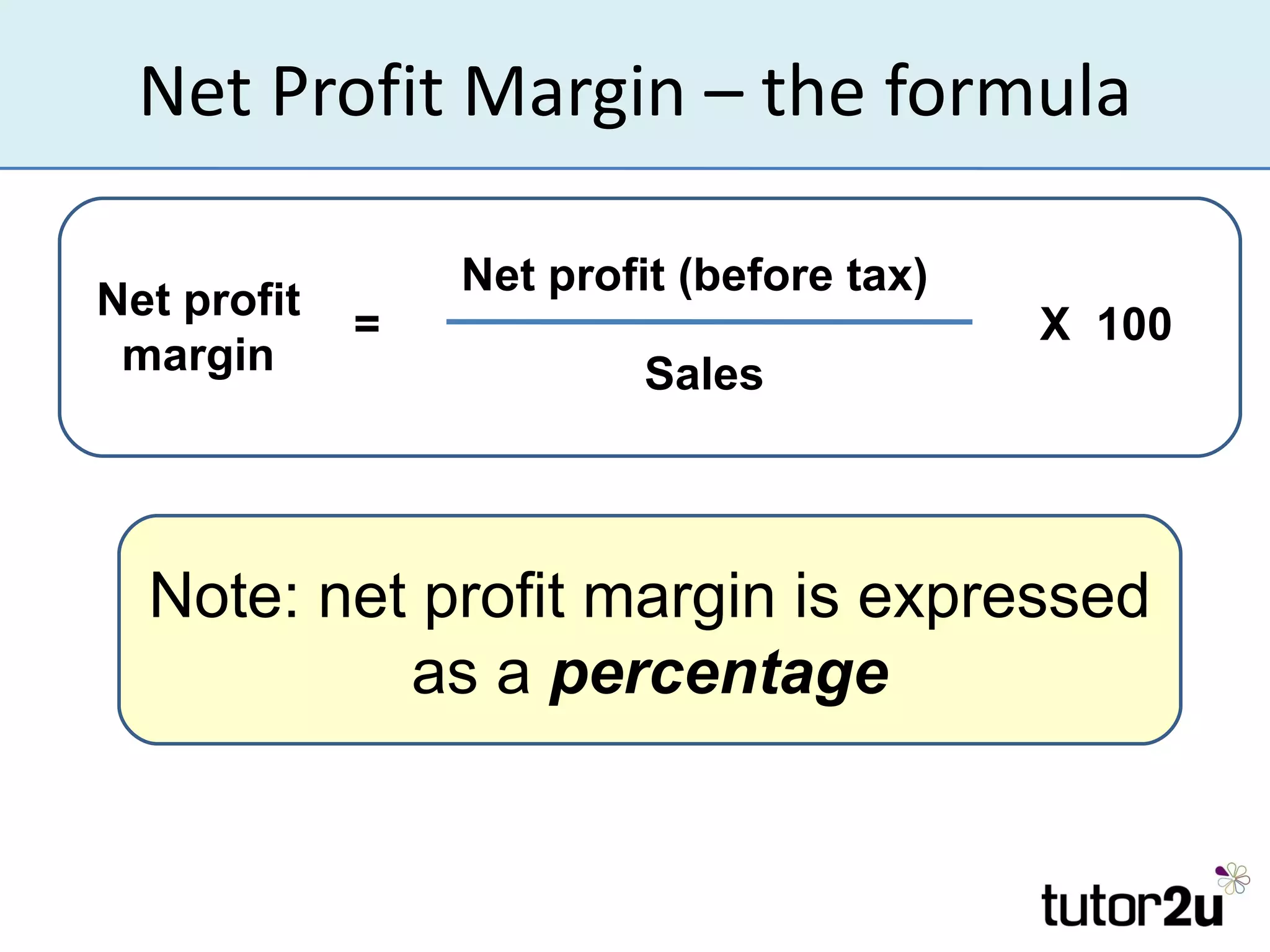

This document discusses calculating and interpreting profit. It explains that profit is the return from taking a risk and measures business success. The profit formula is total revenue minus total costs, with profit occurring when revenue exceeds costs. Methods for measuring profit include absolute profit amounts and relative profit margins. The document also provides strategies for increasing profits such as raising prices or sales volumes while lowering costs.