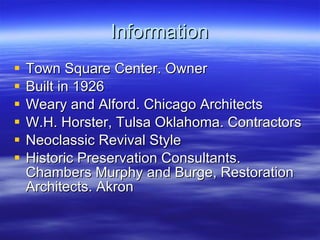

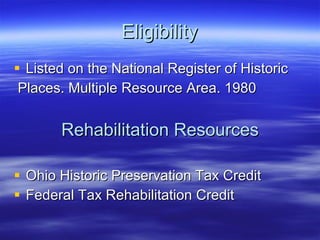

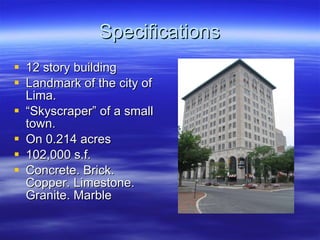

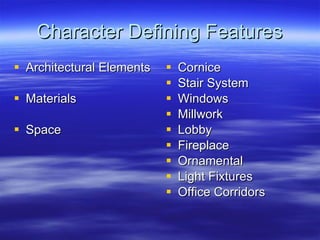

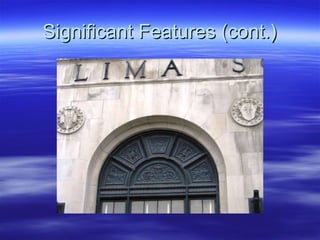

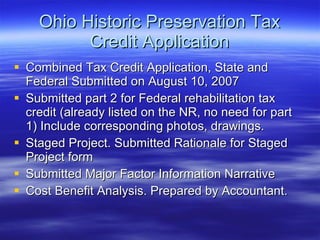

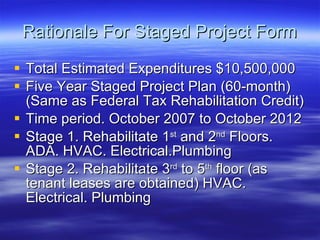

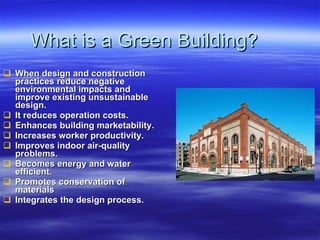

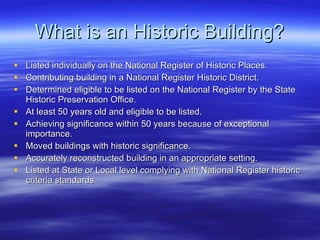

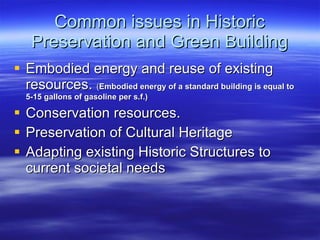

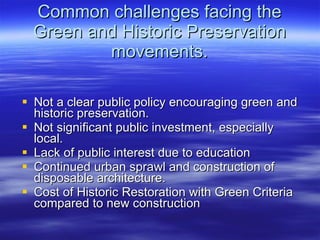

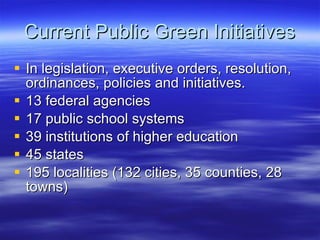

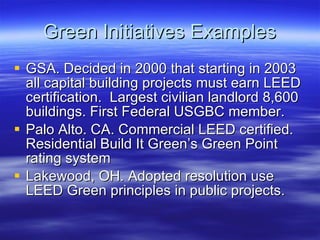

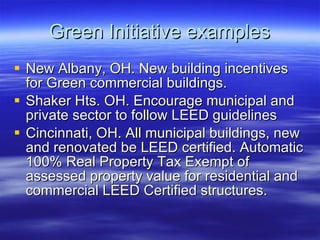

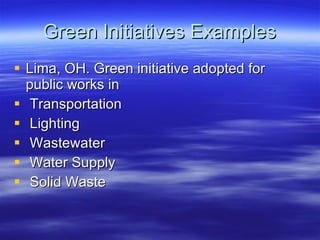

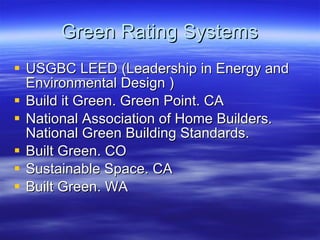

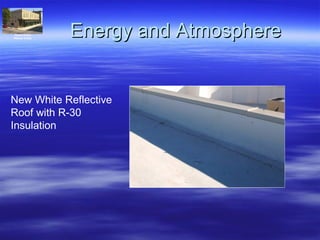

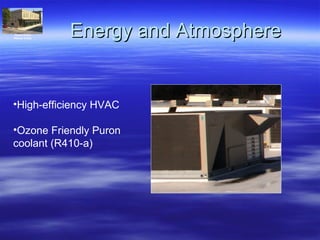

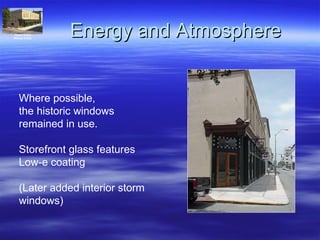

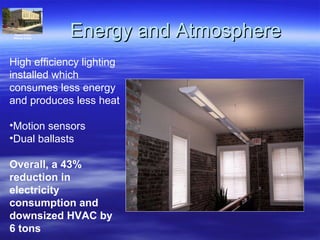

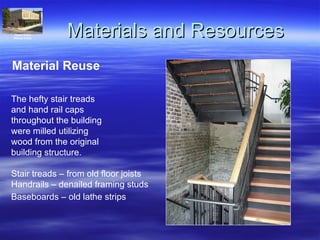

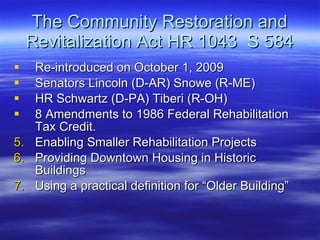

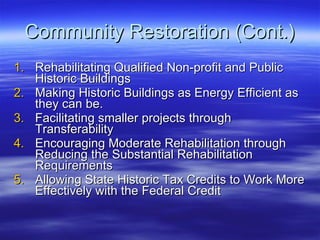

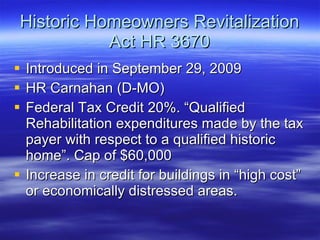

The document summarizes a tax credit workshop held in Lima, Ohio on October 5, 2009. It discusses the historic Lima Trust Company Building, including its architectural details and eligibility for state and federal rehabilitation tax credits. It also covers topics like green building initiatives, integrating historic preservation with green building, and current legislation regarding historic tax credits.

![Presenter Yolita E. Rausche M.Arch HP Historic Preservation Specialist Chambers Murphy & Burge Restoration Architects, Akron, Ohio Heritage Ohio Board Member Email:yrausche@sbcglobal.net [email_address]](https://image.slidesharecdn.com/yr-091105101826-phpapp01/85/Chambers-Murphy-Burge-Restoration-48-320.jpg)