WORKING CAPITAL OF 2 & 3 AUTO WHEELERS

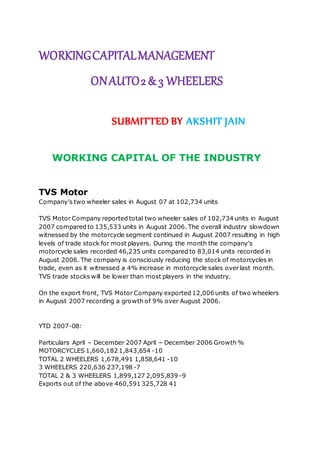

- 1. WORKINGCAPITALMANAGEMENT ONAUTO2 & 3 WHEELERS SUBMITTED BY AKSHIT JAIN WORKING CAPITAL OF THE INDUSTRY TVS Motor Company’s two wheeler sales in August 07 at 102,734 units TVS Motor Company reported total two wheeler sales of 102,734 units in August 2007 compared to 135,533 units in August 2006. The overall industry slowdown witnessed by the motorcycle segment continued in August 2007 resulting in high levels of trade stock for most players. During the month the company’s motorcycle sales recorded 46,235 units compared to 83,014 units recorded in August 2006. The company is consciously reducing the stock of motorcycles in trade, even as it witnessed a 4% increase in motorcycle sales over last month. TVS trade stocks will be lower than most players in the industry. On the export front, TVS Motor Company exported 12,006 units of two wheelers in August 2007 recording a growth of 9% over August 2006. YTD 2007-08: Particulars April – December 2007 April – December 2006 Growth % MOTORCYCLES 1,660,182 1,843,654 -10 TOTAL 2 WHEELERS 1,678,491 1,858,641 -10 3 WHEELERS 220,636 237,198 -7 TOTAL 2 & 3 WHEELERS 1,899,127 2,095,839 -9 Exports out of the above 460,591 325,728 41

- 2. BAJAJ AUTO CONSERVATIVE POLICY AND AGGRESSIVE POLICY the working capital management style adopted in India is both conservative and aggressive. In most of the industry they have fewer amounts of current assets and more amount of fixed assets. This ensures profitability but at the same time when the current assets are less current liabilities may not be met with this. Such style is followed in industry like automobile industry. Whereas in the case of industry like some sensitive industry conservative policy is adopted which is opposite of aggressive policy. OPTIMUM INVENTORY: Every firm likes to keep inventory in stores for the least possible days. In India such policy is achieved by the use of inventory management technique like Just In Time, Supply Chain Management etc. In India much stress is given to convert the inventory in the production. SELF COLLECTION POLICY/AGENCY OR DEALERSHIP SYSTEM: In India the policies followed for debtors are generally the self-collection policy where the company itself collects the amount from its debtors. The other forms to manage debtors is also the discounting of such debtors through bills receivable. In various companies the system followed is Agency, Franchise or the Dealership system. In this system the organization transfers its goods to debtors and receive immediate payment and the dealer later on sells the goods and collect payment from customer. DISTRIBUTED CASH MANAGEMENT SYSTEM: For managing cash most of the organization in India follows distributed cash management system where every branch has its own cash accounts and they manage these cash accounts. In India the centralized cash management system is followed in very few organization because of inadequate resources like in terms of good information and customer system. WORKING CAPITAL OF TVS AND BAJAJ AUTO LTD USE OF CREDIT DEFERRAL POLICY AS FINANCING ALTERNATIVE: In India for financing its current asset is done by various techniques like discounting of bills receivables, obtaining short term bank borrowings etc, but in India use of deferral credit is also a popular technique for financing the current assets of the company. Under the deferral credit system a firm defers the payment to its supplier for a longer period and use that fund to finance its

- 3. current assets. Generally the payment period for the creditor is more than the collection period from debtors and the period for which cash and bank balance is required • USE OF INVENTORY CONTROL TECHNIQUE: in the automobile industry, from the last two years, companies are more inclined toward using of information technologies in maintain their inventory weather it is raw material or the finished goods. Many companies are using JUST IN TIME in controlling their inventory on the shop floors. Using JIT in controlling the inventory, company are able to reduce the handling cost which means when the raw materials are needed for the input at that time only the inventory are brought down on the job floor. Inventory also means the finished stocks, so when the output as the finished goods are produced then using supply chain management system , company directly send it to the customers so again it reduces the handling cost of the finished goods. Using supply chain management system, the company also reduces the time of converting raw material into finished goods and then selling it to end customers. • DEBTORS - DEALERS: companies like TVS, they are more focused in system called DEALERS MANAGEMENT SYSTEM, and this is an online network system through which the companies are directly related to their dealers all over the INDIA. For example when any dealers are shortage of the products then the demand is directly is send to the companies so the time gap is reduced in placing the order and then receiving the order. DMS system also helps in receiving the money from debtors on time, as debtors get aware when they have to pay to the company and it also helps in determining the discounts availed in different order of lots of goods. • DECENTRALISED CASH MANAGEMENT SYSTEM: collection of money from dealers or other debtors is a big problem for the company these days in any industry. In the last two years many companies have decentralized their system in collecting the cash from the debtors. By this system many companies have reduced their cost of collection from their debtors and even they have increased the working capital of the company. • USE OF CREDIT DEFERRAL POLICY AS FINANCING ALTERNATIVE AND ALSO BANK CREDIT: Many companies finance their working capital by the deferral policy of credit or by bank credit. Using deferral policy many companies are able to manage their working capital at very low cost. Use of bank credit is very old

- 4. system but thing which matters is how they use their credit system in managing working capital. Companies try to pay their debts as late as possible through which they can use their credit period in managing working capital which also not affects their goodwill in the industry. HERO MOTORS CORP: The major componentsof the working capital of Hero Motors CORP are Inventory, Debtors, Cash and Bank balance and the Creditors. In this working capital structure there are few interesting things to note and analyse. These are as follows No short term bank borrowings: There are no short term bank borrowings taken by the company to finance the current assets of the company. This is mainly because the current assets of the company are finance by the credit deferral toward its creditors. Negative working capital: The working capital of the company is negative this is because the current liabilities of the company are more than the current assets of the company. The reason behind this is that at any given point of time the amount blocked in creditors is more than the amount blocked in its current assets, mainly in the inventory cash and debtors. Lower current ratio: The current ratio of the company is very low (this is discussed later) which indicates that the company is following aggressive policy. Under this policy the company does not have the short term liquidity but the amount blocked in the net working capital is zero which gives the company more profitability. MAH SCOOTERS The major componentsof the working capital of MAH SCOOTERS LTD are Inventory, Debtors, Cash and Bank balance and the Creditors. In this working capital structure too there are few interesting things to note and analyse. These are as follows Presence of short term borrowing: in order to finance its current assets MAH had to take short term borrowings from the bank. This was the highest in the year 2002-03, followed by the year 2006-07. In the intervening years the borrowings from the bank were minimal and was even nil for the year 2004-05. This trend comes as a consequence of the changes in the net working capital that has been explained next. Net Working Capital: the net working capital of MAH is negative for most of the years except for the year 2002-03 when it was positive. The reason for this has already been given while explaining the negative working capital for Hero Honda. However one interesting thing to note is that the company’s short term borrowing was the maximum in the same year when its net working capital was

- 5. also maximum. We will see an interesting trend regarding this relationship between NWC and short term borrowings when we discuss TVS. Current Ratio: the current ratio for the company is less than 1 for most of the years except for the year 2002 -03. This shows that the company is following an aggressive policy. But again as compared to Hero Honda the company seems less aggressive which can be seen from the higher values of its current ratio. ATUL MOTORS. The components of the working capital are the same as in the earlier two companies discussed. The other things to be noticed are as follows: Presence of short term borrowings: ATUL motors have been taking short term loans to finance its current assets. Hence the relationship between net working capital and the short term borrowing mentioned earlier is more prominent in the case of ATUL motors. Whenever the working capital is positive the company has gone for short term borrowings. This will become apparent from the following data constituents 02-03 03-04 04-05 05-06 06-07 Short term Borrowings 16.13 -10.71 -5.42 34.12 70.02 NET WORKING CAPITAL -9.06 -17.38 4.27 34.6 125.63 Net working capital: the net working capital for ATUL for the first two years i.e. 2002-03 and 2003-04 was negative where as the same for the later years is positive throughout and is constantly increasing. This shows that the company’s current assets were greater than the current liabilities and a part of the net working capital was financed by the short term borrowings. In the year 2005-06 almost the complete gap in the working capital was financed by the short term borrowings. Current ratio The current ratio for the company is constantly increasing and has been greater than one for the past three years i.e. since 2003-04. This is a marked shift from its earlier aggressive policy when the current ratio was less than one. Financial analysis Raw materials conversion period: How much time does it take to convert the raw materials into finished goods? There has been a constant decline in the raw materials conversion period.

- 6. We cited two reasons for this- 1) Good vendor management system 2) just in time (JIT) 3) E-Kanban system Bajaj auto is better in converting raw materials into work in progress because they have better operational efficiency in this aspect. TVS, on the other hand, the raw materials conversion period is constantly decreasing because of poor vendor management system and poor operational efficiency and their conservative approach and they like to keep more of stock for safety purposes. Work in process conversion period: how much time does it take to convert the work in process into finished goods? Hero Honda has a low WIP Conversion period of .72 days due to its high technological know how as it has a collaboration with the Honda company, Japan. Also their operational efficiency and their e-Kanban system is in place. They use the JIT system and all this decreases their wip conversion period. 1) There has been an increase of 11.2% in the sales of hero Honda but the overall figure has changed from 3000751 to 3336756 so the absolute figure is very large so to change the work in process into finished goods at a fast pace was very important in case of hero Honda. 2) In the case of Bajaj auto ltd. There was a sudden jump from 1.49 to 2 and again fallen back to 1.49 the reason cited was that the increase in sales was from 85,498 million to 1,06,060 million so the absolute increase was less and thus the inventory of conversion of work in process to finished goods was high. The tvs is also trying to decrease their wip conversion period and we can see a constant decline in their wip conversion period. Finished goods conversion period: how much time does it take to convert the finished goods into sales? In the case of hero Honda ltd the FGCP is 2.4 which is very less as compared to the industry. The reasons are their better relationship with their dealers, better network and the CRM and SCM in place. Whereas in case of Bajaj auto ltd. They are still trying to reduce their FGCP but it would take time they are having IT and ERP of SAP R/3 but still the maximum use is yet to be seen. Whereas in the case of TVS it’s increasing because they don’t have SAP in place and the industry is becoming competitive day by day. Debtor’s conversion period: it is the time taken to convert the receivables into cash. The trend is the same across all the companies as there has been a sudden increase in the prices of raw materials (steel, nickel and aluminium) and that’s why the receivables are increasing throughout the industry. As they want to have better relationship with their creditors. Creditor’s deferral period: the time taken to pay back our creditors.

- 7. The hero Honda is cashing on the better relationship with their suppliers and the cash discount they give, they are capitalizing on that. Whereas Bajaj auto ltd. And TVS are increasing their creditor’s deferral period as they want to pay their creditors late and keep the money with them as they want to invest this money in other areas. Factors determining the working capital requirements of 2 &3 wheelers auto industry 1. Nature or Character of the Business: The working capital requirements of a firm basically depend upon the nature of the business. For instance, Public utility undertakings require small amount of working capital, while, trading and financial firms require relatively large amounts of working Capital and manufacturing undertakings require sizable amount of working capital 2. Size of the Business/ScaleofOperations: The working capital requirement of a company is directly influenced by its size of the business or scale of the operations. The larger the size of a business unit, greater is the amount of working capital required 3. Production Policy: The amount of working capital required also depends on the production policy of the company. If the policy is to keep steady flow of production by accumulating inventories, then it requires high amount of working capital 4. Manufacturing Process/LengthofProduction Cycle: In a manufacturing business, the amount of working capital increases in direct proportionto length of manufacturing process.Longer the manufacturing process,larger is the amount of working capital required 5. SeasonalVariations: In certain industries raw material is not available throughout the year. Generally, during the peak season, a firm requires larger working capital than in the slack season 6. Working Capital Cycle: The length of the operating cycle determines the working capital of a company. If the operating cycle is lengthy, then the amount of working capital required is large and vice versa

- 8. 7. Rate of Stock Turnover: There is a high degree of inverse co-relationship between the quantum of working capital and the speed with which the sales are affected 8. Credit Policy: A concern that purchases its requirements on credit and sells its products/services on cash requires lesser amount of working capital as there is immediate cashgenerated from sales 9. Business Cycles:During the boomperiod, larger amount of working capital is required due to increase in sales, rise in prices, optimistic expansion of business, etc., and vice versa 10. Earning Capacityand Dividend Policy: Company with good earning capacity requires less working capital cash inflows. In case of high dividend paying firms more working capital is required, as dividends are always paid in cash to the shareholders resulting in cash outflows. WORKING CAPITAL RATIOS Current ratio and quick ratio: it is the ratio of the current assets to current liabilities. In the case of HERO MOTOCORP it is low, showing the aggressive polices the hero Honda is following and the same case is with the Bajaj but in case of TVS it is increasing as they have a conservative approach. Inventory turnover: how many times do you convert your inventory in a year? In the case of hero Honda we see a gradual increase in the inventory turnover whereas in case of Bajaj auto ltd there is a sudden increase the reason cited is the better percentage increase in the sales of hero Honda and also the raw mater costs as a percentage of total sales increase from 69.5% to 72.5% i.e. a increase of 3%. But in the case of TVS it is constantly decreasing because of their aggressive approach. No. of day’s inventory: how many days do we keep the total inventory? There has been a constant decline in hero Honda and bajaj auto ltd. As their conversion of inventory is better because of their efficient operations and their JIT and SAP in place whereas in case of TVS it is increasing because they have a conservative approach and they keep a high level of safety stock. Debtors turnover: the number of times in a year your debtors are converted into cash? What we see here is a trend in the entire industry for the last three years its

- 9. decreasing as hero Honda has implemented dealer management system where they sell their product to the dealers and then the dealers sell it to the consumers. Current assets to fixed assets ratio: this shows what kind of policy we are following a high ratio shows conservative approach whereas a low ratio shows aggressive approach and that’s what we see in the hero Honda and Bajaj auto ltd. A aggressive approach whereas in TVS a conservative approach. MAH SCOOTERS AND ATUL MOTORS: IT has a direct online network with its suppliers to ensure a seamless flow of parts from vendors to its units. Through vendors management system has reduces it manufacturing and processing cost from to 1.74% to 1.64%. To improve the efficiency and inventory cost, it is also using the concept of JUST IN TIME beyond the shop floors. With the help of vendors management uses only the required inventories which is to be processed as to avoid the inventory cost on the shop floors. Through this concept the raw materials can be properly checked on the aspect of quality the company is also able to reduce the handling cost of inventory on the job floor. The implications of vendor management system in MAH & ATUL , has increased the total numbers of vendors to 135 from 46 and in the same time the ordering cost and handling cost have also decreased which in the end affecting the company’s working capital. The company places online order to the suppliers which is reducing the time gap taken in supply of raw materials. ATUL also uses the enterprise resource planning which is SAPR/3 through which it is able to integrate its different functions inside the organization. Using the ERP System, Honda was easily able to implement the new system of VAT when it was implemented by Haryana government, without much investment in its financial system. BAJAJ: Bajaj is one of the companies in automobile sector in India which is using ERP system and supply chain system. Through supply chain management, the company is able to reach the zero defects point in which the cost of selling the products to the end customers is reduced. The supplier also supplies the raw materials to the company at the right time which reduces the idle time cost. TVS: To reduce the working capital cost, TVS uses the concept of dealership management system. TVS is able to manage the entire 280 dealer under them

- 10. and also dealer uses this system. When the dealers face any shortage of product, it directly informs the company which instantly cover up the shortages faced by them. Through DMS, TVS is able to manage its entire dealer with less cost which reduces the working capital of the company. Company is also using the supply chain system in order to manage the entire network from supplier to customers. LIQUIDITY RATIO 1. CURRENT RATIO 2. QUICK RATIO 0.22 0.29 0.04 0.17 0.21 Current Ratio

- 11. TURNOVER RATIO 0.06 0.84 0.01 1.04 1.07 Quick Ratio Quick Ratio

- 12. 1. DEBTORS TURNOVER RATIO 2. EQUITY TURNOVER 0.42 0.39 0.09 0.22 0.35 Debtors Turnover

- 13. 3. INVENTORY TURNOVER RATIO 4. WORKING CAPITAL TURNOVER 4.75 2.53 6.31 0.03 5.50 Equity Turnover Equity Turnover 6.56 3.11 8.90 0.03 332.07 Inventory Turnover

- 14. OTHER FIGURES AND RATIOS ANALYSIS OF 2 & 3 AUTO INDUSTRIES 13.64 11.03 11.85 0.27 31.44 Working Capital Turnover Working Capital Turnover

- 15. Profitability Ratios Returnon Investment 1.02 1.04 0.90 8.01 0.89 Gross Profit Margin Gross profit margin

- 16. Earnings per Share Financial leverage 106.07 105.18 2.44 42.74 23.62 Earnings Per Share Earning per share 1.93 1.31 2.55 1.26 1.65 Financial Leverage Financial Leverage

- 17. Debt equity ratio DividendPay out 0.06 0.01 0.45 0.00 0.00 Debt Equity Ratio Debt Equity Ratio 28.28 4.28 49.18 4.68 2.54 Dividends Payout Dividends payout

- 18. Market share Net profit 58% 39% 2% 1% 0% 0% 0% Market Capital (Rs. Crore) Bajaj Auto Hero Motocorp TVS Motor Mah Scooters Atul Auto -500.00 0.00 500.00 1,000.00 1,500.00 2,000.00 2,500.00 3,000.00 3,500.00 Baj aj Aut o Her o Mot oco rp TVS Mot or Ma h Sco oter s Atul Aut o LML Kin etic Mot or Net Profit 3,043 2,118 116 48.84 25.92 -65.5 1.48 Net Profit