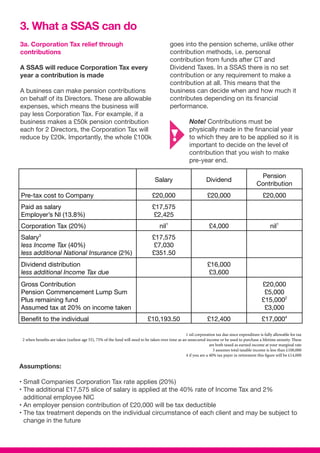

A SSAS (Small Self-Administered Scheme) is a type of UK occupational pension scheme for small businesses. It provides tax benefits such as corporation tax relief on contributions and tax-free growth of investments. Key benefits of a SSAS include allowing business owners to control the scheme as both members and trustees, provide loans to their business, purchase commercial property with tax reliefs, and consolidate all pension funds in one place with lower administration fees than other pension types.