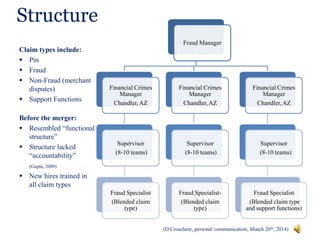

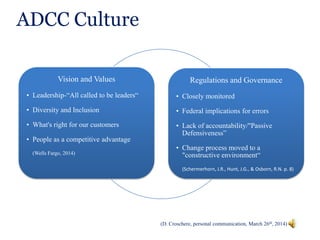

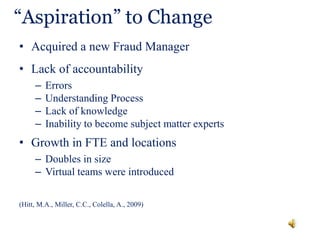

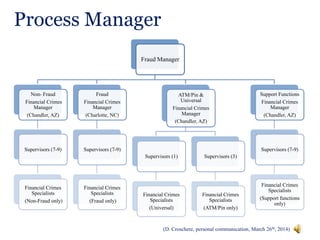

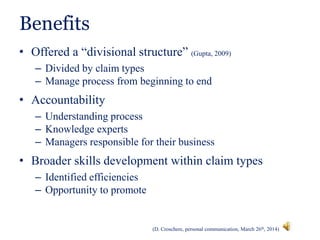

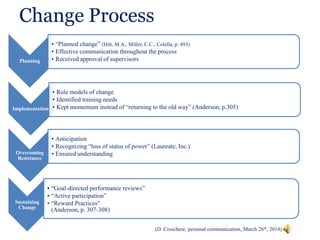

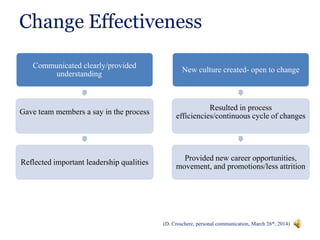

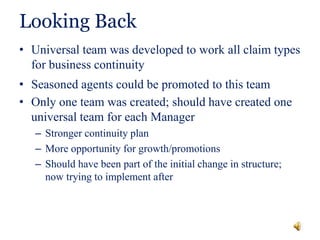

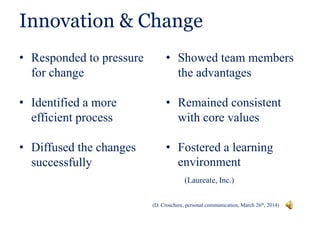

The document summarizes the change process implemented by the ATM & Debit Card Claims (ADCC) department at Wells Fargo after a merger with Wachovia. The department transitioned to a "Process Manager" structure, dividing claim types into separate teams for improved accountability and expertise. The change process involved planning, effective communication, identifying training needs, and overcoming resistance. The new structure provided process efficiencies and career growth opportunities. While largely successful, the department realized it could have better planned continuity by creating additional universal teams to handle all claim types.

![References

Gupta, A. (2009) Functional vs. Divisional Structure. Retrieved from, http://www.practical-management.com/Organization-

Development/Functional-Vs-Divisional-Structure.html

Hitt, M.A., Miller, C.C., Colella. Organizational Behavior. A Strategic Approach. Excerpt from Organizational Change and

Development. Retrieved from,

https://class.waldenu.edu/bbcswebdav/institution/USW1/201440_04/MS_INDT/EDUC_6105/Week%203/Resources/Resources/e

mbedded/Hitt_Ch14OrgChangeDev_OrgBehvr_484_497.pdf

Laureate Education, Inc. (n.d) Introduction to Organizations. [Video File]. Retrieved from

https://class.waldenu.edu/webapps/portal/frameset.jsp?tab_tab_group_id=_2_1&url=%2Fwebapps%2Fblackboard%2Fexecute%

2Flauncher%3Ftype%3DCourse%26id%3D_4775264_1%26url%3D

Laureate, Inc. (n.d) Fostering Innovation. [Video File] Retrieved from,

https://class.waldenu.edu/webapps/portal/frameset.jsp?tab_tab_group_id=_2_1&url=%2Fwebapps%2Fblackboard%2Fexecute%2F

launcher%3Ftype%3DCourse%26id%3D_4775264_1%26url%3D

Schermerhorn, J.R., Hunt, J.G., & Osborn, R.N. (2008). Organizational Behavior: Excerpt from

Chapter 1, “Introducing Organizational Behavior.” Retrieved from

https://class.waldenu.edu/bbcswebdav/institution/USW1/201440_04/MS_INDT/EDUC_6105/Week%201/Resources/Resources/em

bedded/Schermerhorn_Ch1IntroOrgBehav_4_12[1].pdf.

Wells Fargo (2014). News Release: Wells Fargo and Wachovia Merger Completed. Retrieved from,

https://www.wellsfargo.com/press/2009/20090101_Wachovia_Merger.

Wells Fargo (2014). Our Values. Retrieve from, https://www.wellsfargo.com/invest_relations/vision_values/4.](https://image.slidesharecdn.com/wk7assgnpatinoe-140420210040-phpapp01/85/Wk7-assgnpatinoe-doc-13-320.jpg)