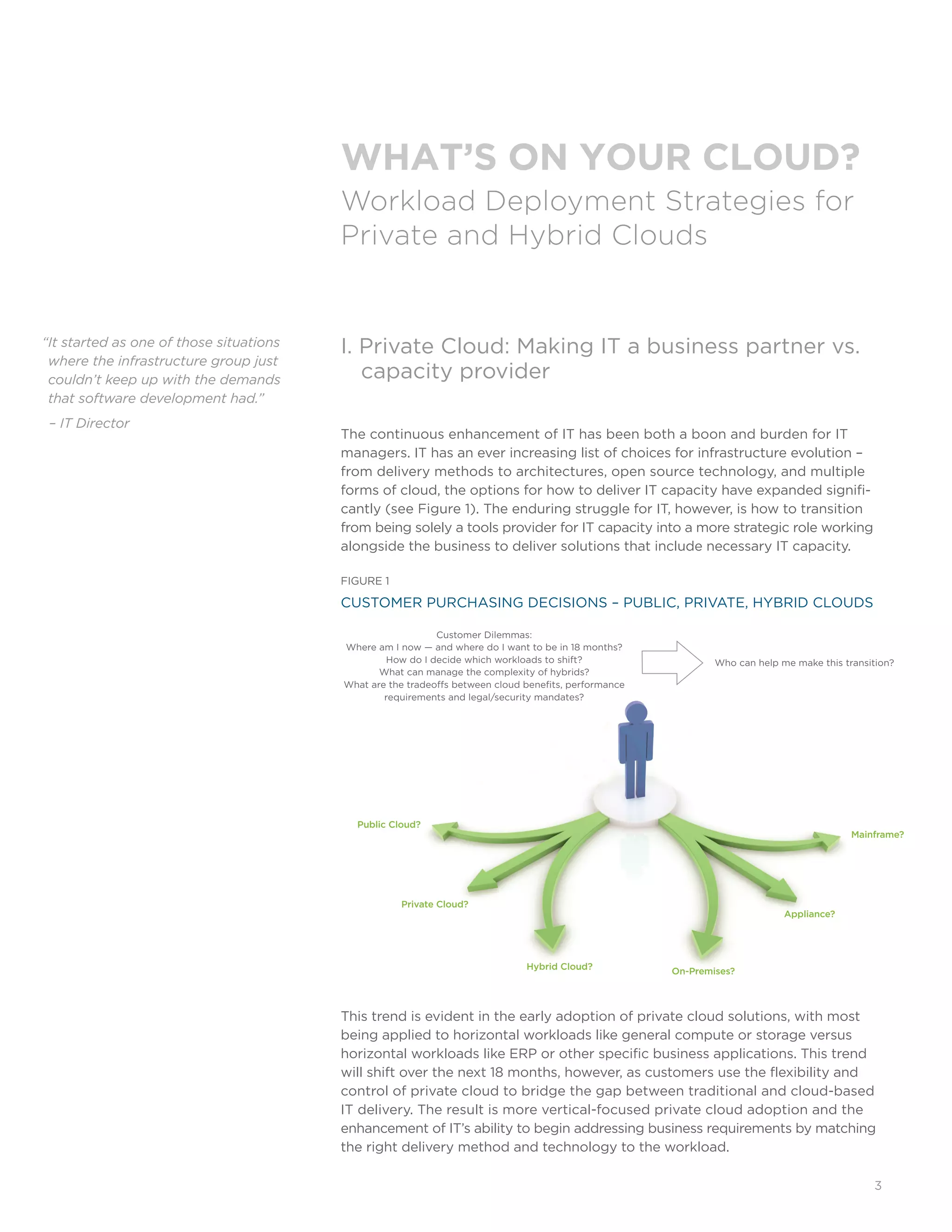

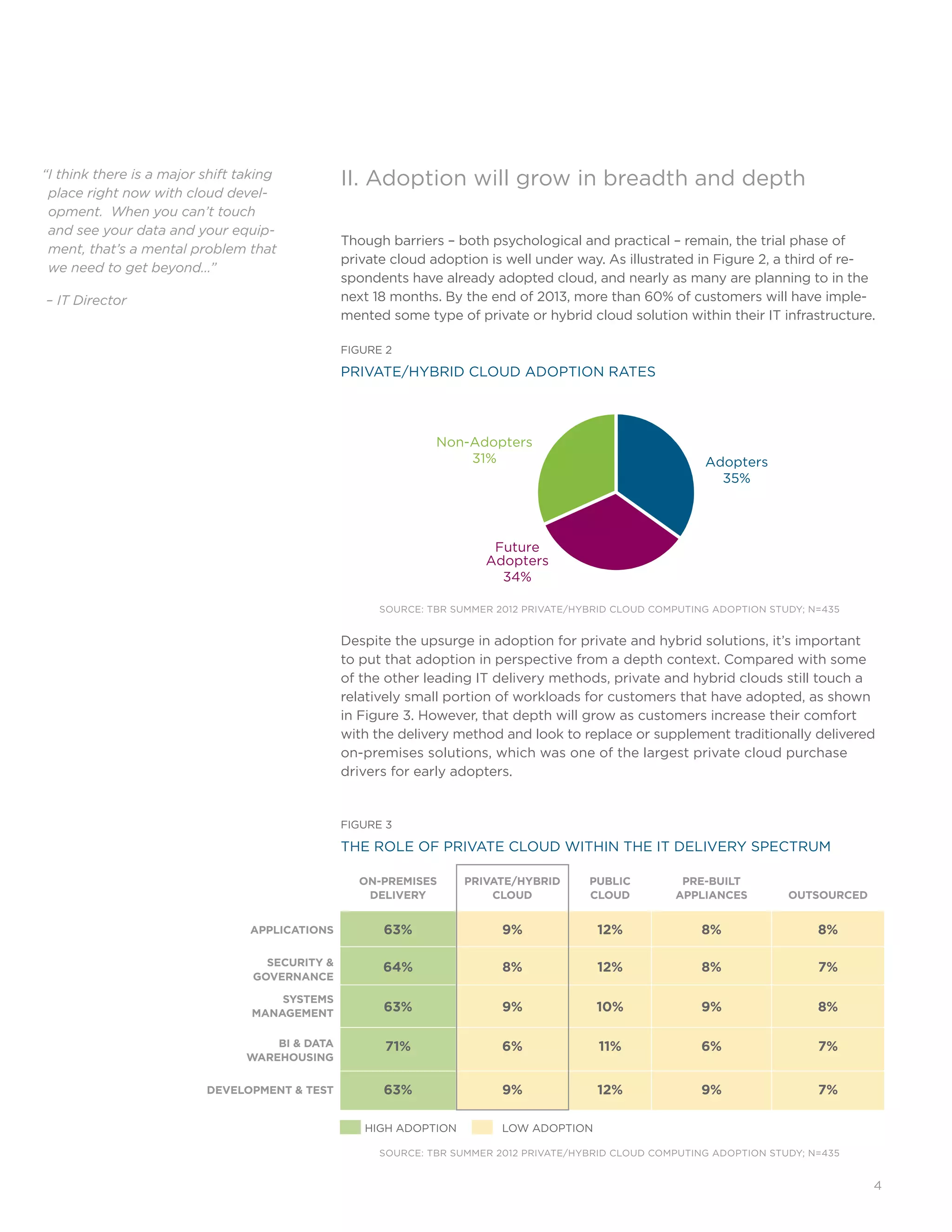

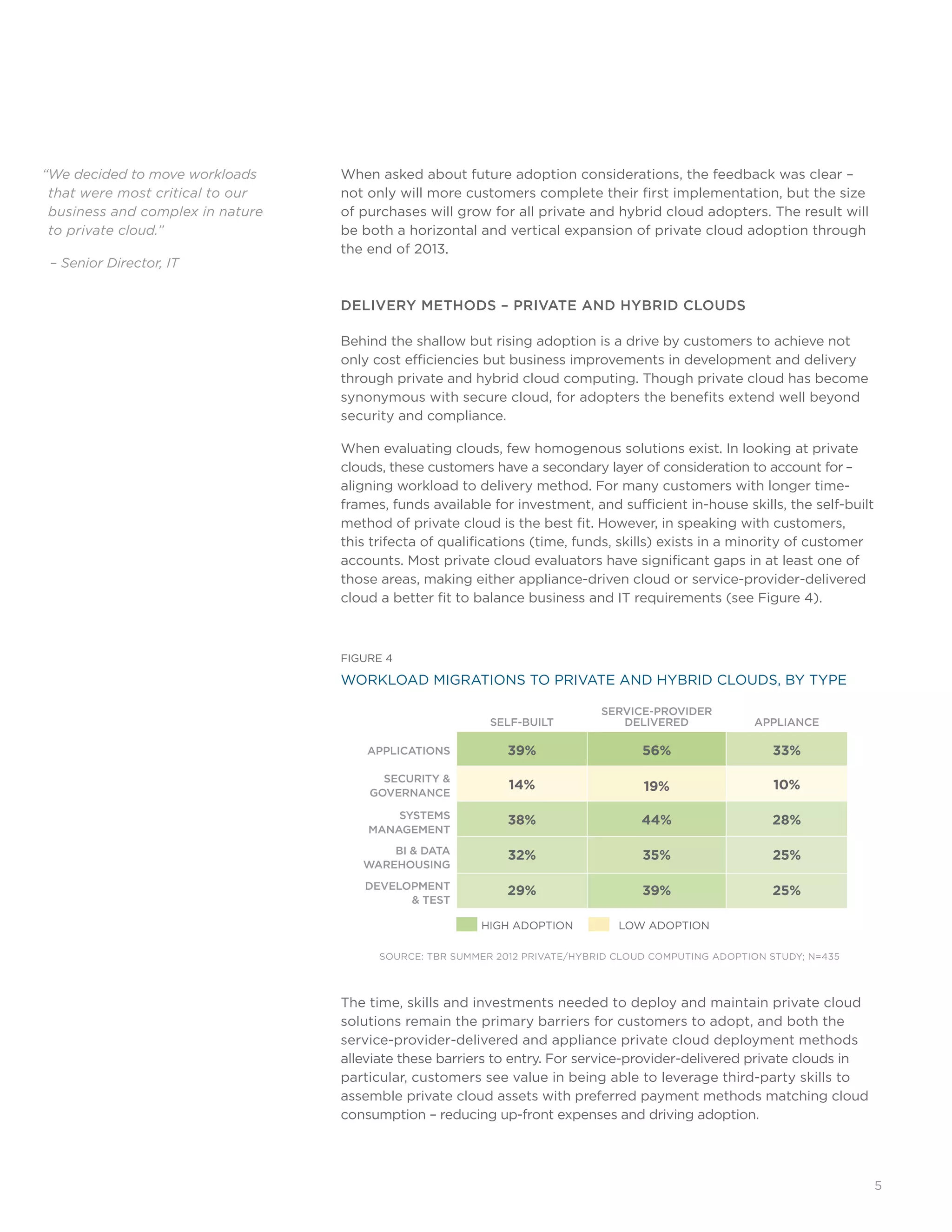

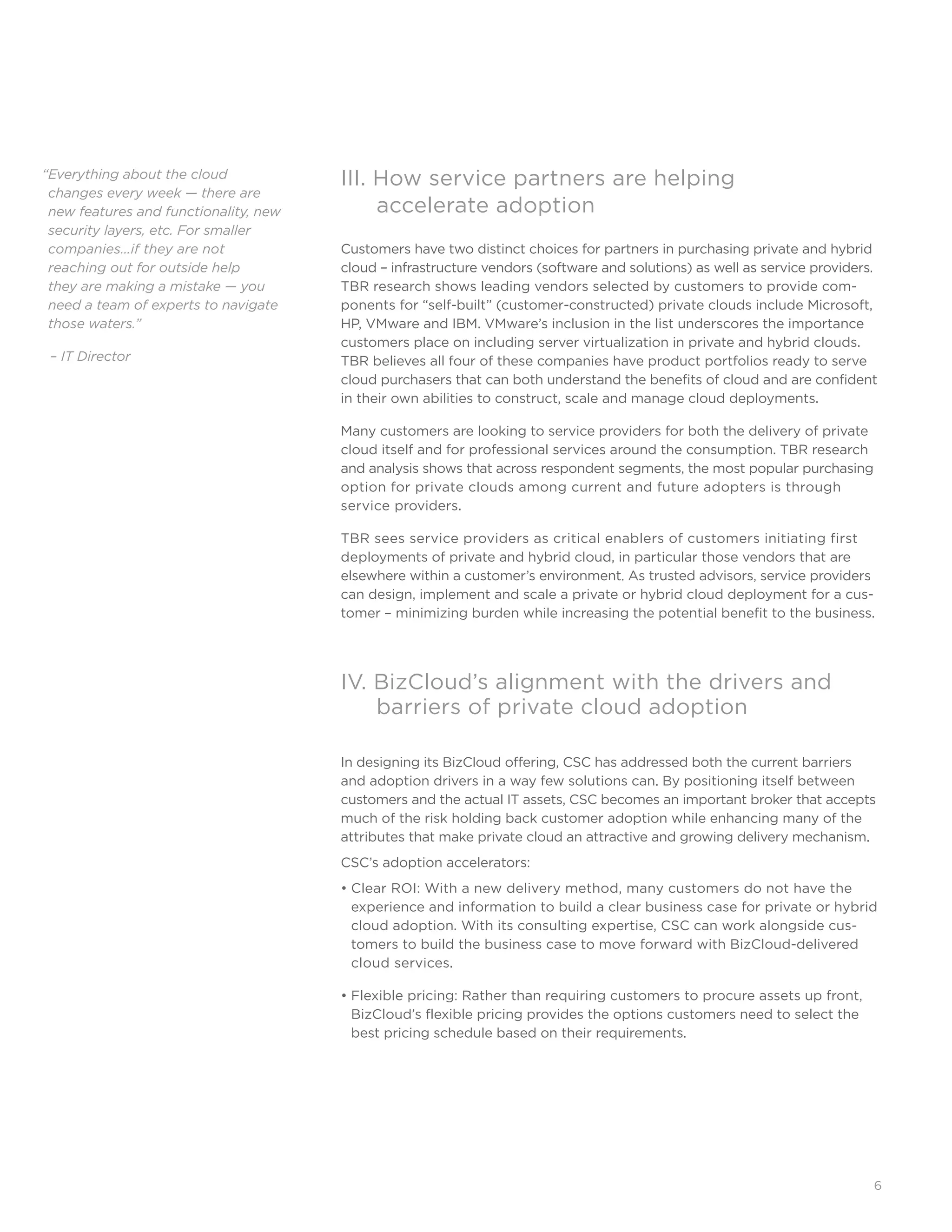

The document analyzes the adoption and strategic role of private and hybrid clouds, highlighting the growth in their usage as organizations transition from traditional IT methods to more cloud-focused solutions. It outlines various workload migration strategies, the importance of partnerships with service providers, and specific challenges faced by businesses in adopting cloud technologies. Additionally, it emphasizes the benefits of flexible offerings like CSC's Bizcloud that help mitigate risks and facilitate integration within existing IT infrastructures.