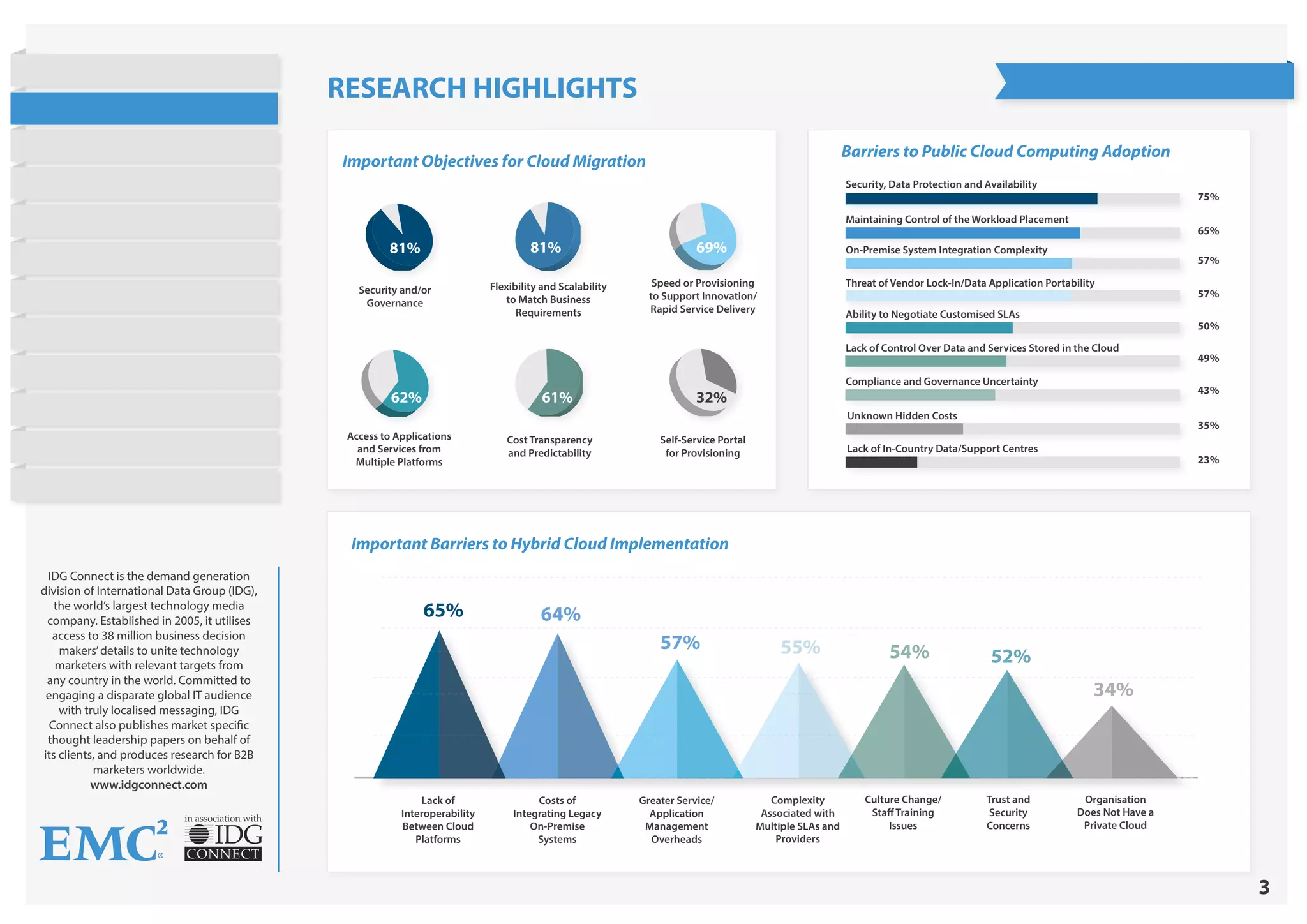

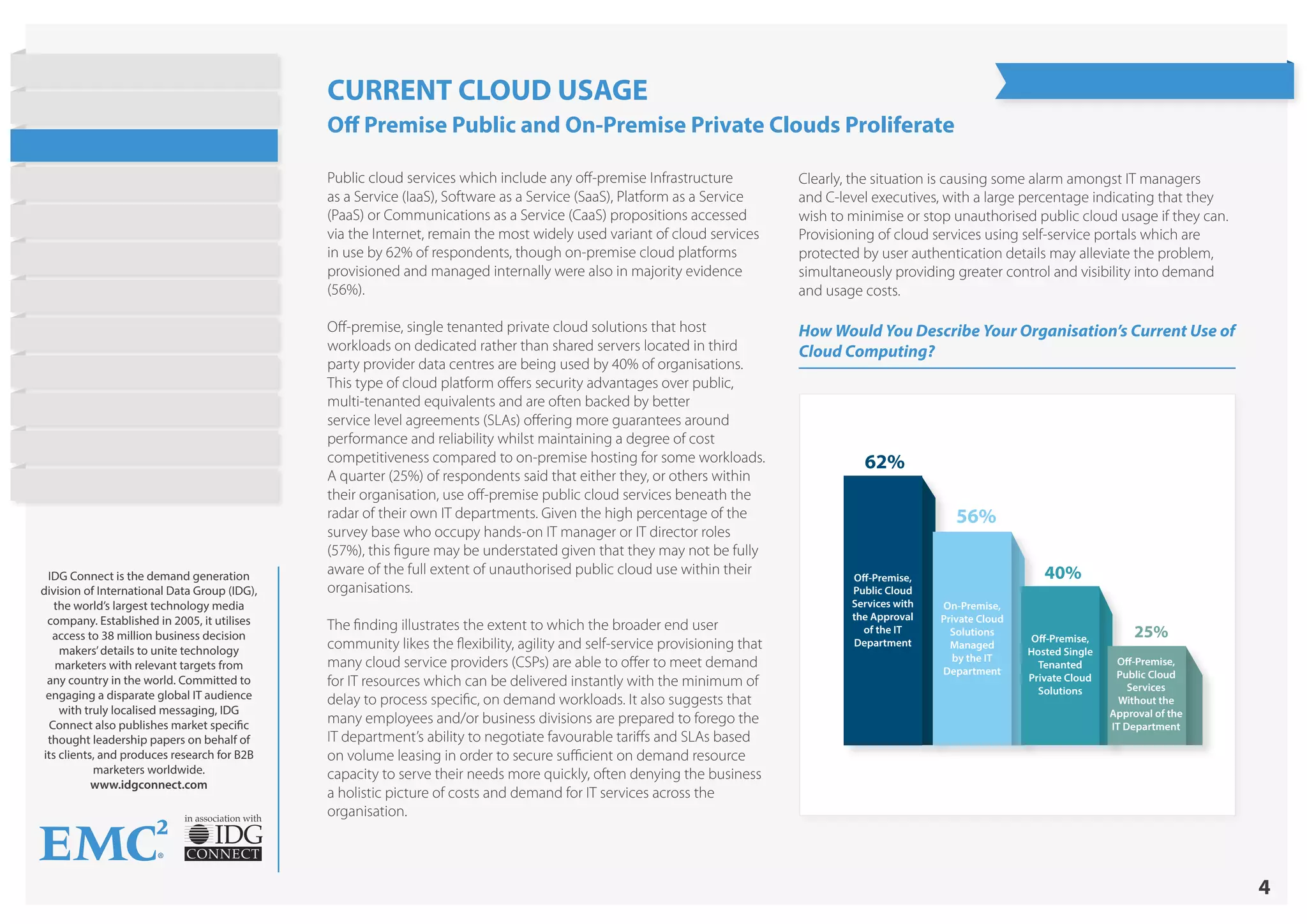

This document summarizes the results of a survey conducted by IDG Connect on hybrid cloud adoption in Asia Pacific. The key findings include:

- Public cloud and private cloud are most widely used currently, with 62% using public cloud and 56% using private cloud.

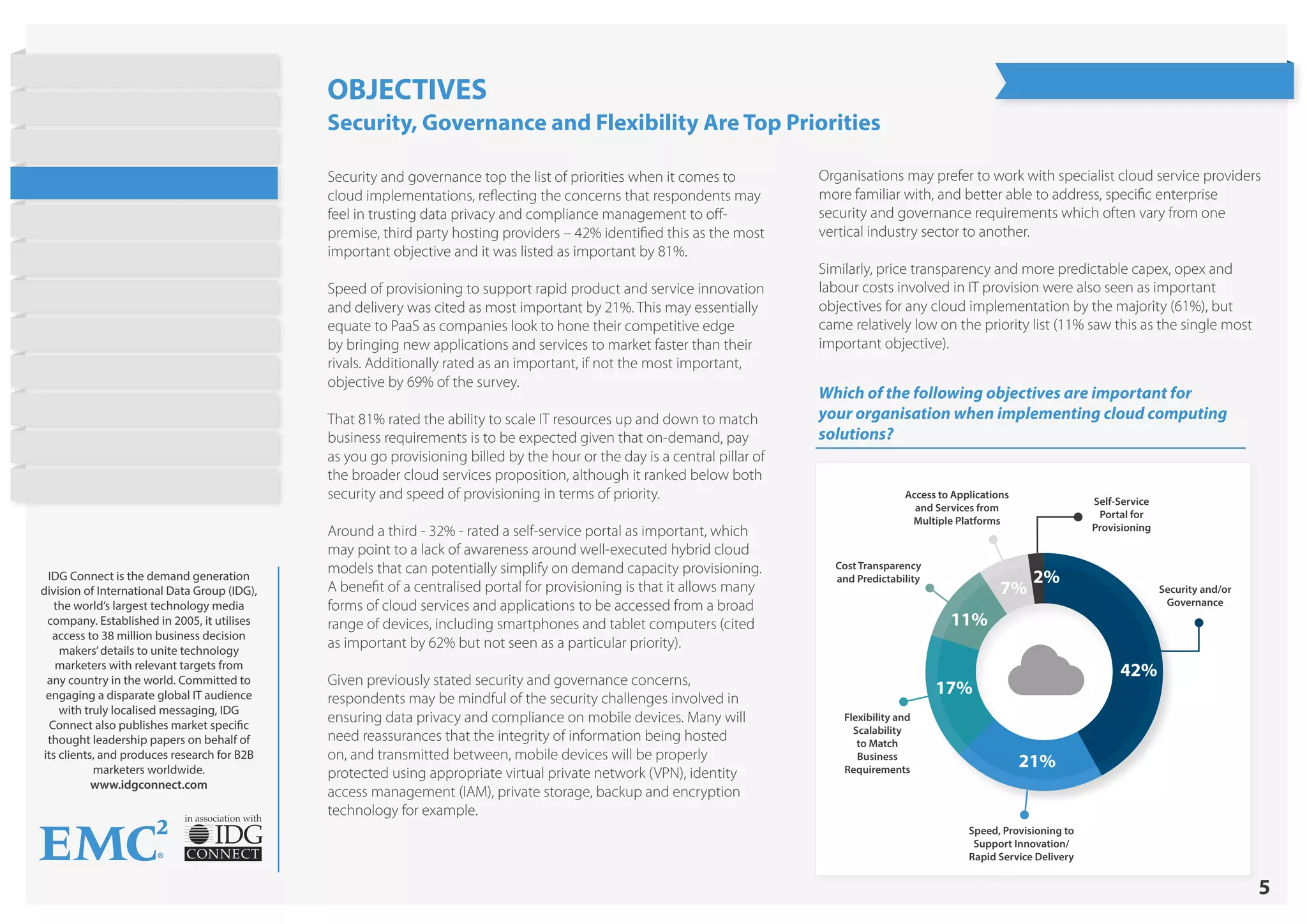

- Top objectives for cloud implementations are security/governance (42%) and speed of provisioning (21%).

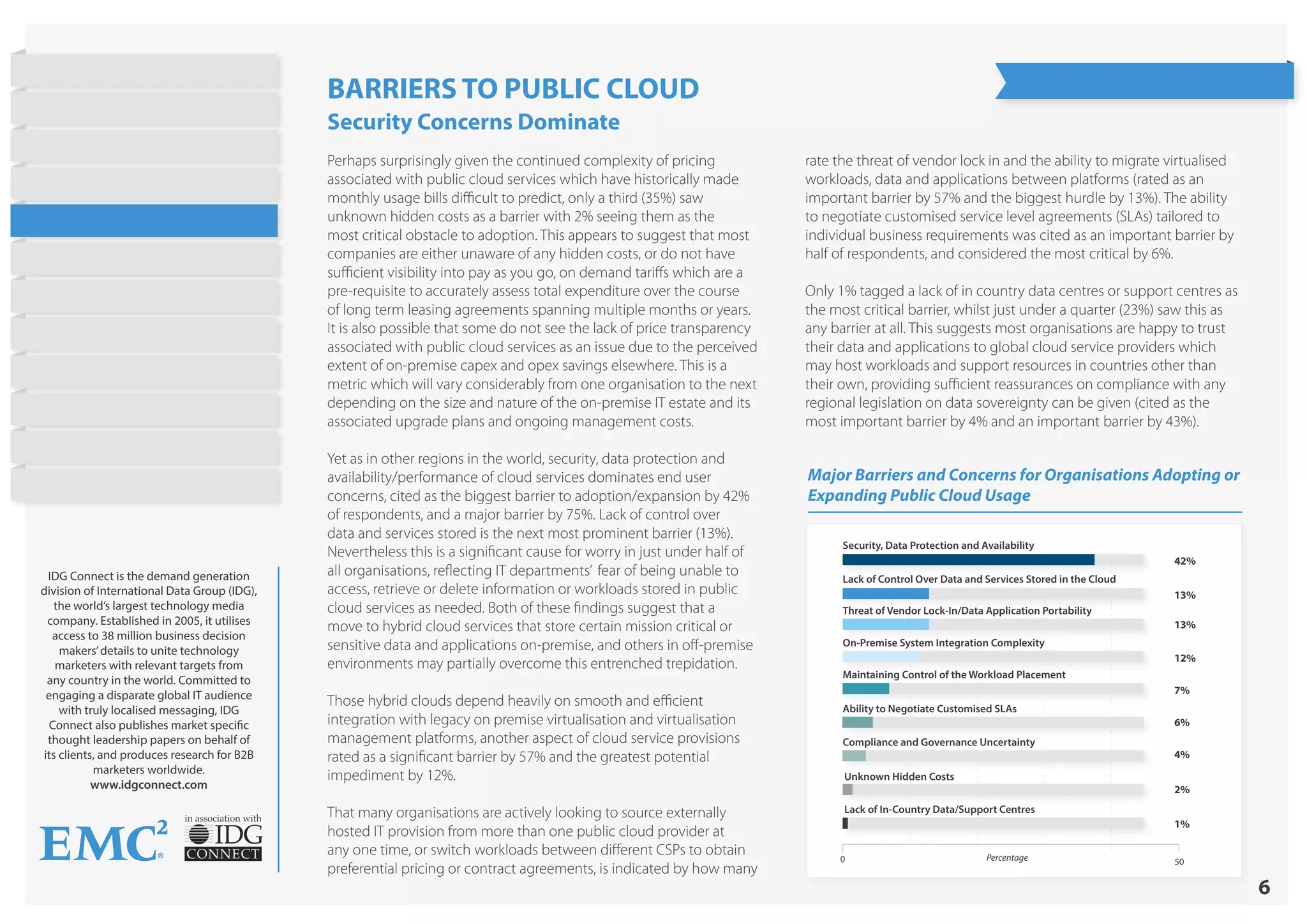

- Biggest barriers to public cloud adoption are security/data protection (42%) and lack of control over cloud data (13%).

- Security, flexibility, and speed of provisioning are the highest priorities for organizations implementing cloud solutions.