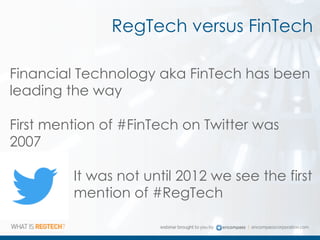

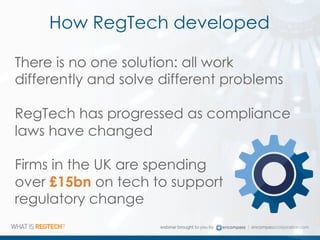

The document discusses the development and significance of regulatory technology (regtech), emphasizing its role in enhancing compliance, governance, and regulatory reporting within financial services. It explains the evolution of regtech from its fintech roots and highlights the various technologies involved, such as blockchain and AI. Furthermore, it predicts that regtech will not only streamline compliance processes but also support informed risk management in the long term.